Report of Foreign Issuer (6-k)

August 17 2016 - 12:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2016

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

Buenos Aires, August 10, 2016

Messrs

BUENOS AIRES STOCK EXCHANGE

Messrs

NATIONAL SECURITIES COMMISSION

Issuers Division

Dear Sirs,

As required by section 63 of the Buenos Aires Stock Exchange Regulations, Resolution No. 2/12 and Section 3, caption 35 of Title XII, Chapter I, Part II of the Regulations of the National Securities Commission, I hereby inform you that at the Company Board of Directors meeting held on August 9, 2016, the following documents were approved: Condensed Statement of Financial Position, Condensed Statement of Comprehensive Income, Condensed Statement of Changes in Equity, Condensed Statement of Cash Flows, Notes, Informative Summary and the information required by section 68 of the aforementioned regulations, relating to the six-month interim period ended June 30, 2016.

The amounts disclosed below are stated in thousands of Argentine pesos and arise from the Condensed Interim Financial Statements.

|

Six-month interim period ended June 30, 2016

|

|

|

|

|

|

Loss for the period

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

Loss

|

(1,185,465)

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

Loss

|

(

1,185,465

)

|

|

Other comprehensive income for the

period

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

|

0

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

Total comprehensive loss for the

period

|

|

|

|

|

|

|

|

Attributable to the owners of the parent

|

Loss

|

(1,185,465)

|

|

Attributable to non-controlling interests

|

|

0

|

|

|

Loss

|

(1,185,465)

|

The results of operations for the period have been significantly affected by the granting of different precautionary measures

requested by

customers, both individuals and groups of consumers

, which all together represent approximately 30% of the Company’s sales. Those measures order, for the customers that come within the scope thereof, that the tariff increases granted as from February 1, 2016, be suspended retroactively to that date, that the billing of the increases be interrupted, and that the amounts already collected as a consequence of consumption recorded during that time frame be reimbursed.

Furthermore, on July 15, 2016, the ENRE notified the Company of the granting of a precautionary measure by Division II of the Federal Appellate Court of the City of La Plata, ordering the suspension of such increases in all the Province of Buenos Aires for a period of 3 months to commence as from the date of issuance of such judicial order. This measure impacts 80% of the Company’s billing as from the month of July.

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

Finally, and as described in the Events after the reporting period note to the Financial Statements, on August 3, 2016, in the framework on an action for the protection of a constitutional right that was violated (“

acción de amparo

”) brought against both the Federal Government (PEN and MEyM) and the ENRE in order to have MEyM Resolutions 6/16 and 7/16 and ENRE Resolution 1/16 declared null and void, the Court hearing the case upheld the petition for the granting of a precautionary measure requested therein, with the effects described in our Notice of Relevant Fact dated August 4, 2016. As mentioned therein, this situation would result in the Company having insufficient operating income, which, should it continue over time, would, in the short term, prevent the Company from covering its operating expenses and making electric power payments and/or payments related to the investment plan.

In the

opinion of the Company legal advisors, the previously mentioned precautionary measure would no longer apply due to the filing of the report submitted by the Federal Government, which details the reasons based on which it had taken the decisions whose suspension is sought by the granting of the provisional remedy (“report of Section 4°”);

therefore

, until a new precautionary measure to replace the former one is granted and duly notified to the Company, the initial precautionary measure has no effects on the Company.

The Company estimates that the impact a precautionary measure as the one previously mentioned would have on the financial statements as of June 30, 2016 would amount to an additional net loss of approximately $ 1.3 billion. Furthermore, it would cause a negative equity of approximately $ 900 million, which, should it continue by the end of the current fiscal year, would result in the Company being subject to complying with the provisions of Section 94, sub-section 5 of Argentine Business Organizations Law No. 19,550, which require the dissolution of companies in the event of loss of capital stock.

In spite of this situation, the Company has carried out until June 30, 2016 an ambitious investment plan that amounts to $ 1.3 billion, which could be affected, with the consequent impact on the quality of the distribution public service, if a prompt solution to the judicial measures were not found.

|

Detail of Equity

|

|

|

|

Share Capital– Nominal Value (1)

|

|

906,455

|

|

Share Capital – Adjustment to Capital (2)

|

|

408,063

|

|

Additional paid-in capital

|

|

3,452

|

|

Legal Reserve

|

|

73,275

|

|

Voluntary Reserve

|

|

176,061

|

|

Other Comprehensive Loss

|

|

(42,253)

|

|

Accumulated Deficit

|

|

(1,185,465)

|

|

Total attributable to the owners of the Company

|

|

339,588

|

|

Non-controlling interests

|

|

0

|

|

Total Equity

|

|

339,588

|

(1)

Includes 9,412 relating to treasury shares.

(2)

Includes 10,347 relating to treasury shares.

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

Furthermore, and as required by sub-sections o), p) and q) of section 62, we inform the following:

|

Class of shares

|

Number of shares

|

% on Share Capital

|

|

|

|

|

|

A

|

462,292,111

|

51.00

|

|

B

|

442,210,385

|

48.78

|

|

C

|

1,952,604

|

0.22

|

|

Total

|

906,455,100

|

100.00

|

The class “A” shares are owned by Electricidad Argentina S.A. (EASA), domiciled at 3302 Ortiz de Ocampo Street, Building 4 of the City of Buenos Aires. The class “B” shares are currently traded at the New York Stock Exchange (through American Depositary Shares –“ADSs”) and the Buenos Aires Stock Exchange. As of June 30, 2016, the Company has 9,412,500 treasury shares.

An amount of 1,952,604 class “C” shares, which are held by Banco de la Nación Argentina as trustee of the Company Employee Stock Ownership Program, remains outstanding. Moreover, IEASA S.A., domiciled at 3302 Ortiz de Ocampo Street, Building 4 of the City of Buenos Aires, owns 99.99% of EASA’s voting shares.

The Company does not have debt securities convertible into shares, nor there exist stock options of the Company’s shares.

Yours sincerely,

VICTOR A. RUIZ

|

Officer in charge of Market Relations

|

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5088 / 5113 – Fax: (54-11) 4346-5301

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date: August 17, 2016

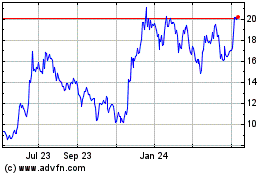

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

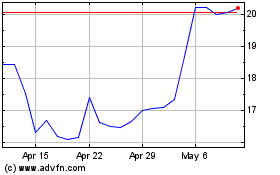

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024