Report of Foreign Issuer (6-k)

June 08 2016 - 9:42AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2016

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

www.edenor.com.ar

FOR IMMEDIATE RELEASE

For more information please contact:

Edenor S.A.

Leandro Montero, Chief Financial Officer

lmontero@edenor.com

Verónica Gysin, Investor Relations Officer

vgysin@edenor.com

(54 - 11) 4346 5000

Edenor announces redemption of all of its outstanding

10.5% Notes Due 2017

BUENOS AIRES, June 8, 2016 – Edenor S.A. (Empresa Distribuidora y Comercializadora Norte S.A.) announces that it has called for redemption all of its outstanding U.S.$220,000,000 10.5% Notes Due 2017(the “Notes Due 2017”). Currently, U.S.$14,760,000 aggregate principal amount of Notes Due 2017 is outstanding. The CUSIP and ISIN numbers for the Notes Due 2017 are detailed below.

|

No. CUSIP:

|

29244AAJ1

|

|

No. ISIN:

|

US29244AAJ16

|

|

|

|

The redemption date is set for July 12, 2016. The redemption price will be 100% of the principal amount of the outstanding Senior Notes Due 2017, plus any unpaid interest accrued on the outstanding principal amount of the Notes Due 2017 to the redemption date.

The Notes Due 2017 must be surrendered to the paying agent at:

The Bank of New York Mellon

Corporate Trust Office -

Attn: Corporate Trust Department

101 Barclay Street, Floor 7 West

New York, NY 10286

Tel: +1 212 815 5619 / Fax: +1 212 815 5802/3

ON THE REDEMPTION DATE THE REDEMPTION PRICE WILL BECOME DUE AND PAYABLE UPON THE NOTES DUE 2017 AND INTEREST THEREON WILL CEASE TO ACCRUE ON AND AFTER SUCH DATE.

*No representation is being made as to the accuracy of the identifying codes listed on this notice or printed on the Notes Due 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date: June 8, 2016

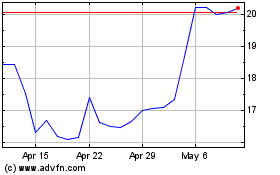

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

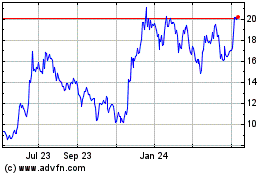

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024