Definitive Materials Filed by Investment Companies. (497)

December 23 2019 - 12:31PM

Edgar (US Regulatory)

EATON

VANCE TAX-ADVANTAGED DIVIDEND INCOME FUND

Supplement to Prospectus dated July 31, 2019 and

Prospectus Supplement dated July 31, 2019

The following replaces

any references, contained either in the Prospectus or the Prospectus Supplement, with respect to the Fund’s: (i) last reported

sale price; (ii) net asset value (“NAV”) per Common Share; (iii) percentage premium to NAV per Common Share; (iv) number

of Common Shares outstanding; and (v) net assets.

On December 20, 2019,

the last reported sale price, NAV per Common Share and percentage premium to NAV per Common Share, were $25.41, $25.73 and (1.24)%,

respectively. As of December 20, 2019, we had 73,393,925 Common Shares outstanding and net assets of approximately $1,888,236,815.

The following replaces

the last sentence in the first paragraph under “Use of Proceeds” in the Prospectus Supplement:

Assuming the sale

of all of the Common Shares offered under this Prospectus Supplement and the accompanying Prospectus, at the last reported sale

price of $25.41 per share for our Common Shares on the NYSE as of December 20, 2019, we estimate that the net proceeds of this

offering will be approximately $137,656,959 after deducting the estimated sales load and the estimated offering expenses payable

by the Fund.

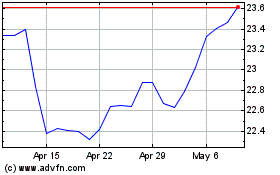

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jul 2023 to Jul 2024