Form 424B3 - Prospectus [Rule 424(b)(3)]

February 20 2024 - 9:29AM

Edgar (US Regulatory)

false

0001281926

424B3

0001281926

2023-03-31

2023-03-31

0001281926

2023-10-31

0001281926

2022-10-31

0001281926

2021-10-31

0001281926

2020-10-31

0001281926

2019-10-31

0001281926

2018-10-31

0001281926

2017-10-31

0001281926

2016-10-31

0001281926

2015-10-31

0001281926

2014-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Filed pursuant to Rule 424(b)(3)

File No. 333-268410

EATON VANCE TAX-ADVANTAGED GLOBAL DIVIDEND

OPPORTUNITIES FUND

Supplement to Prospectus dated March 31, 2023

The following replaces the Financial Highlights contained in the Prospectus:

Selected data for a Common Share outstanding during the periods

stated.

| | |

Year Ended October 31, |

| | |

2023 | |

2022 | |

2021 | |

2020 | |

2019 |

| Net asset value – Beginning of year | |

$ | 21.990 | | |

$ | 31.370 | | |

$ | 22.390 | | |

$ | 23.850 | | |

$ | 22.180 | |

| Income (Loss) From Operations | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income(1) | |

$ | 0.849 | | |

$ | 0.698 | | |

$ | 0.471 | | |

$ | 0.361 | | |

$ | 0.441 | |

| Net realized and unrealized gain (loss) | |

| 1.500 | | |

| (7.943 | ) | |

| 10.303 | | |

| 0.098 | | |

| 3.389 | |

| Total income (loss) from operations | |

$ | 2.349 | | |

$ | (7.245 | ) | |

$ | 10.774 | | |

$ | 0.459 | | |

$ | 3.830 | |

| Less Distributions | |

| | | |

| | | |

| | | |

| | | |

| | |

| From net investment income | |

$ | (0.770 | ) | |

$ | (0.698 | ) | |

$ | (0.846 | ) | |

$ | (0.338 | ) | |

$ | (0.407 | ) |

| From net realized gain | |

| (0.879 | ) | |

| (1.452 | ) | |

| (0.974 | ) | |

| (1.597 | ) | |

| (1.753 | ) |

| Total distributions | |

$ | (1.649 | ) | |

$ | (2.150 | ) | |

$ | (1.820 | ) | |

$ | (1.935 | ) | |

$ | (2.160 | ) |

| Premium from common shares sold through shelf offering(1) | |

$ | — | | |

$ | 0.015 | | |

$ | 0.026 | | |

$ | 0.016 | | |

$ | — | |

| Net asset value – End of year | |

$ | 22.690 | | |

$ | 21.990 | | |

$ | 31.370 | | |

$ | 22.390 | | |

$ | 23.850 | |

| Market value – End of year | |

$ | 20.170 | | |

$ | 22.240 | | |

$ | 32.340 | | |

$ | 19.740 | | |

$ | 26.290 | |

| Total Investment Return on Net Asset Value(2) | |

| 11.13 | % | |

| (23.80 | )% | |

| 49.45 | % | |

| 2.57 | % | |

| 18.21 | % |

| Total Investment Return on Market Value(2) | |

| (2.32 | )% | |

| (25.25 | )% | |

| 74.75 | % | |

| (17.96 | )% | |

| 33.25 | % |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets, end of year (000’s omitted) | |

$ | 371,810 | | |

$ | 360,448 | | |

$ | 503,815 | | |

$ | 351,153 | | |

$ | 359,796 | |

| Ratios (as a percentage of average daily net assets): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expenses excluding interest and fees | |

| 1.22 | % | |

| 1.18 | % | |

| 1.15 | % | |

| 1.24 | % | |

| 1.28 | % |

| Interest and fee expense | |

| 1.45 | % | |

| 0.41 | % | |

| 0.14 | % | |

| 0.50 | % | |

| 1.06 | % |

| Total expenses | |

| 2.67 | %(3) | |

| 1.59 | %(3) | |

| 1.29 | % | |

| 1.74 | % | |

| 2.34 | % |

| Net investment income | |

| 3.54 | % | |

| 2.63 | % | |

| 1.63 | % | |

| 1.58 | % | |

| 1.95 | % |

| Portfolio Turnover | |

| 90 | % | |

| 52 | % | |

| 29 | % | |

| 60 | % | |

| 48 | % |

| Senior Securities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total amount outstanding (in 000’s) | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 118,000 | |

| Asset coverage per $1,000(4) | |

$ | 4,610 | | |

$ | 4,500 | | |

$ | 5,891 | | |

$ | 4,409 | | |

$ | 4,049 | |

(See related

footnotes.)

Financial Highlights (continued)

| | |

Year Ended October 31, |

| | |

2018 | |

2017 | |

2016 | |

2015 | |

2014 |

| Net asset value – Beginning of year | |

$ | 24.600 | | |

$ | 21.790 | | |

$ | 24.050 | | |

$ | 26.150 | | |

$ | 25.880 | |

| Income (Loss) From Operations | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income(1) | |

$ | 0.447 | | |

$ | 0.490 | | |

$ | 0.822 | (5) | |

$ | 0.998 | | |

$ | 1.549 | (5) |

| Net realized and unrealized gain (loss) | |

| (0.724 | ) | |

| 4.480 | | |

| (0.922 | ) | |

| 0.033 | | |

| 1.070 | |

| Total income (loss) from operations | |

$ | (0.277 | ) | |

$ | 4.970 | | |

$ | (0.100 | ) | |

$ | 1.031 | | |

$ | 2.619 | |

| Less Distributions | |

| | | |

| | | |

| | | |

| | | |

| | |

| From net investment income | |

$ | (0.319 | ) | |

$ | (0.475 | ) | |

$ | (0.778 | ) | |

$ | (0.997 | ) | |

$ | (1.527 | ) |

| From net realized gain | |

| (1.841 | ) | |

| (1.685 | ) | |

| (1.382 | ) | |

| (2.134 | ) | |

| — | |

| Tax return of capital | |

| — | | |

$ | (2.160 | ) | |

| — | | |

| — | | |

| (0.822 | ) |

| Total distributions | |

$ | (2.160 | ) | |

$ | — | | |

$ | (2.160 | ) | |

$ | (3.131 | ) | |

$ | (2.349 | ) |

| Premium from common shares sold through shelf offering(1) | |

$ | 0.017 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| Net asset value – End of year | |

$ | 22.180 | | |

$ | 24.600 | | |

$ | 21.790 | | |

$ | 24.050 | | |

$ | 26.150 | |

| Market value – End of year | |

$ | 21.690 | | |

$ | 24.850 | | |

$ | 20.670 | | |

$ | 22.490 | | |

$ | 25.260 | |

| Total Investment Return on Net Asset Value(2) | |

| (1.50 | )% | |

| 23.92 | % | |

| 0.25 | % | |

| 4.80 | % | |

| 11.07 | % |

| Total Investment Return on Market Value(2) | |

| (4.65 | )% | |

| 31.96 | % | |

| 1.69 | % | |

| 1.46 | % | |

| 17.50 | % |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets, end of year (000’s omitted) | |

$ | 333,771 | | |

$ | 357,756 | | |

$ | 316,478 | | |

$ | 349,321 | | |

$ | 379,681 | |

| Ratios (as a percentage of average daily net assets) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expenses excluding interest and fees(6) | |

| 1.27 | % | |

| 1.30 | % | |

| 1.32 | % | |

| 1.28 | % | |

| 1.26 | % |

| Interest and fee expense | |

| 0.82 | % | |

| 0.61 | % | |

| 0.39 | % | |

| 0.26 | % | |

| 0.24 | % |

| Total expenses(6) | |

| 2.09 | % | |

| 1.91 | % | |

| 1.71 | % | |

| 1.54 | % | |

| 1.50 | % |

| Net investment income | |

| 1.83 | % | |

| 2.10 | % | |

| 3.67 | %(5) | |

| 4.03 | % | |

| 5.87 | %(5) |

| Portfolio Turnover | |

| 56 | % | |

| 60 | % | |

| 63 | % | |

| 72 | % | |

| 89 | % |

| Senior Securities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total notes payable outstanding (in 000’s) | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | |

| Asset coverage per $1,000(4) | |

$ | 3,829 | | |

$ | 4,032 | | |

$ | 3,682 | | |

$ | 3,960 | | |

$ | 4,218 | |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions

reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (3) | Includes a reduction by the investment adviser of a portion of its adviser fee due to the Fund’s investment in the Morgan Stanley

Institutional Liquidity Funds – Government Portfolio (equal to less than 0.005% of average daily net assets for the years ended October

31, 2023 and 2022). |

| (4) | |

| (5) | Net investment income per share includes special dividends which amounted to $0.230 and $0.692 per share for the years ended October

31, 2016 and 2014, respectively. Excluding special dividends, the ratio of net investment income to average daily net assets would have

been 2.65% and 3.25% for the years ended October 31, 2016 and 2014, respectively. |

| (6) | Excludes the effect of custody fee credits, if any, of less than 0.005%. Effective September 1, 2015, custody fee credits, which were

earned on cash deposit balances, were discontinued by the custodian. |

February 20, 2024

v3.24.0.1

N-2 - USD ($)

|

Mar. 31, 2023 |

Oct. 31, 2023 |

Oct. 31, 2022 |

Oct. 31, 2021 |

Oct. 31, 2020 |

Oct. 31, 2019 |

Oct. 31, 2018 |

Oct. 31, 2017 |

Oct. 31, 2016 |

Oct. 31, 2015 |

Oct. 31, 2014 |

| Cover [Abstract] |

|

|

|

|

|

|

|

|

|

|

|

|

| Entity Central Index Key |

|

0001281926

|

|

|

|

|

|

|

|

|

|

|

| Amendment Flag |

|

false

|

|

|

|

|

|

|

|

|

|

|

| Document Type |

|

424B3

|

|

|

|

|

|

|

|

|

|

|

| Entity Registrant Name |

|

EATON VANCE TAX-ADVANTAGED GLOBAL DIVIDEND

OPPORTUNITIES FUND

|

|

|

|

|

|

|

|

|

|

|

| Financial Highlights [Abstract] |

|

|

|

|

|

|

|

|

|

|

|

|

| Senior Securities [Table Text Block] |

|

Selected data for a Common Share outstanding during the periods

stated.

| | |

Year Ended October 31, |

| | |

2023 | |

2022 | |

2021 | |

2020 | |

2019 |

| Net asset value – Beginning of year | |

$ | 21.990 | | |

$ | 31.370 | | |

$ | 22.390 | | |

$ | 23.850 | | |

$ | 22.180 | |

| Income (Loss) From Operations | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income(1) | |

$ | 0.849 | | |

$ | 0.698 | | |

$ | 0.471 | | |

$ | 0.361 | | |

$ | 0.441 | |

| Net realized and unrealized gain (loss) | |

| 1.500 | | |

| (7.943 | ) | |

| 10.303 | | |

| 0.098 | | |

| 3.389 | |

| Total income (loss) from operations | |

$ | 2.349 | | |

$ | (7.245 | ) | |

$ | 10.774 | | |

$ | 0.459 | | |

$ | 3.830 | |

| Less Distributions | |

| | | |

| | | |

| | | |

| | | |

| | |

| From net investment income | |

$ | (0.770 | ) | |

$ | (0.698 | ) | |

$ | (0.846 | ) | |

$ | (0.338 | ) | |

$ | (0.407 | ) |

| From net realized gain | |

| (0.879 | ) | |

| (1.452 | ) | |

| (0.974 | ) | |

| (1.597 | ) | |

| (1.753 | ) |

| Total distributions | |

$ | (1.649 | ) | |

$ | (2.150 | ) | |

$ | (1.820 | ) | |

$ | (1.935 | ) | |

$ | (2.160 | ) |

| Premium from common shares sold through shelf offering(1) | |

$ | — | | |

$ | 0.015 | | |

$ | 0.026 | | |

$ | 0.016 | | |

$ | — | |

| Net asset value – End of year | |

$ | 22.690 | | |

$ | 21.990 | | |

$ | 31.370 | | |

$ | 22.390 | | |

$ | 23.850 | |

| Market value – End of year | |

$ | 20.170 | | |

$ | 22.240 | | |

$ | 32.340 | | |

$ | 19.740 | | |

$ | 26.290 | |

| Total Investment Return on Net Asset Value(2) | |

| 11.13 | % | |

| (23.80 | )% | |

| 49.45 | % | |

| 2.57 | % | |

| 18.21 | % |

| Total Investment Return on Market Value(2) | |

| (2.32 | )% | |

| (25.25 | )% | |

| 74.75 | % | |

| (17.96 | )% | |

| 33.25 | % |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets, end of year (000’s omitted) | |

$ | 371,810 | | |

$ | 360,448 | | |

$ | 503,815 | | |

$ | 351,153 | | |

$ | 359,796 | |

| Ratios (as a percentage of average daily net assets): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expenses excluding interest and fees | |

| 1.22 | % | |

| 1.18 | % | |

| 1.15 | % | |

| 1.24 | % | |

| 1.28 | % |

| Interest and fee expense | |

| 1.45 | % | |

| 0.41 | % | |

| 0.14 | % | |

| 0.50 | % | |

| 1.06 | % |

| Total expenses | |

| 2.67 | %(3) | |

| 1.59 | %(3) | |

| 1.29 | % | |

| 1.74 | % | |

| 2.34 | % |

| Net investment income | |

| 3.54 | % | |

| 2.63 | % | |

| 1.63 | % | |

| 1.58 | % | |

| 1.95 | % |

| Portfolio Turnover | |

| 90 | % | |

| 52 | % | |

| 29 | % | |

| 60 | % | |

| 48 | % |

| Senior Securities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total amount outstanding (in 000’s) | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 103,000 | | |

$ | 118,000 | |

| Asset coverage per $1,000(4) | |

$ | 4,610 | | |

$ | 4,500 | | |

$ | 5,891 | | |

$ | 4,409 | | |

$ | 4,049 | |

| | |

Year Ended October 31, |

| | |

2018 | |

2017 | |

2016 | |

2015 | |

2014 |

| Net asset value – Beginning of year | |

$ | 24.600 | | |

$ | 21.790 | | |

$ | 24.050 | | |

$ | 26.150 | | |

$ | 25.880 | |

| Income (Loss) From Operations | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment income(1) | |

$ | 0.447 | | |

$ | 0.490 | | |

$ | 0.822 | (5) | |

$ | 0.998 | | |

$ | 1.549 | (5) |

| Net realized and unrealized gain (loss) | |

| (0.724 | ) | |

| 4.480 | | |

| (0.922 | ) | |

| 0.033 | | |

| 1.070 | |

| Total income (loss) from operations | |

$ | (0.277 | ) | |

$ | 4.970 | | |

$ | (0.100 | ) | |

$ | 1.031 | | |

$ | 2.619 | |

| Less Distributions | |

| | | |

| | | |

| | | |

| | | |

| | |

| From net investment income | |

$ | (0.319 | ) | |

$ | (0.475 | ) | |

$ | (0.778 | ) | |

$ | (0.997 | ) | |

$ | (1.527 | ) |

| From net realized gain | |

| (1.841 | ) | |

| (1.685 | ) | |

| (1.382 | ) | |

| (2.134 | ) | |

| — | |

| Tax return of capital | |

| — | | |

$ | (2.160 | ) | |

| — | | |

| — | | |

| (0.822 | ) |

| Total distributions | |

$ | (2.160 | ) | |

$ | — | | |

$ | (2.160 | ) | |

$ | (3.131 | ) | |

$ | (2.349 | ) |

| Premium from common shares sold through shelf offering(1) | |

$ | 0.017 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| Net asset value – End of year | |

$ | 22.180 | | |

$ | 24.600 | | |

$ | 21.790 | | |

$ | 24.050 | | |

$ | 26.150 | |

| Market value – End of year | |

$ | 21.690 | | |

$ | 24.850 | | |

$ | 20.670 | | |

$ | 22.490 | | |

$ | 25.260 | |

| Total Investment Return on Net Asset Value(2) | |

| (1.50 | )% | |

| 23.92 | % | |

| 0.25 | % | |

| 4.80 | % | |

| 11.07 | % |

| Total Investment Return on Market Value(2) | |

| (4.65 | )% | |

| 31.96 | % | |

| 1.69 | % | |

| 1.46 | % | |

| 17.50 | % |

| Ratios/Supplemental Data | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets, end of year (000’s omitted) | |

$ | 333,771 | | |

$ | 357,756 | | |

$ | 316,478 | | |

$ | 349,321 | | |

$ | 379,681 | |

| Ratios (as a percentage of average daily net assets) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Expenses excluding interest and fees(6) | |

| 1.27 | % | |

| 1.30 | % | |

| 1.32 | % | |

| 1.28 | % | |

| 1.26 | % |

| Interest and fee expense | |

| 0.82 | % | |

| 0.61 | % | |

| 0.39 | % | |

| 0.26 | % | |

| 0.24 | % |

| Total expenses(6) | |

| 2.09 | % | |

| 1.91 | % | |

| 1.71 | % | |

| 1.54 | % | |

| 1.50 | % |

| Net investment income | |

| 1.83 | % | |

| 2.10 | % | |

| 3.67 | %(5) | |

| 4.03 | % | |

| 5.87 | %(5) |

| Portfolio Turnover | |

| 56 | % | |

| 60 | % | |

| 63 | % | |

| 72 | % | |

| 89 | % |

| Senior Securities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total notes payable outstanding (in 000’s) | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | | |

$ | 118,000 | |

| Asset coverage per $1,000(4) | |

$ | 3,829 | | |

$ | 4,032 | | |

$ | 3,682 | | |

$ | 3,960 | | |

$ | 4,218 | |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions

reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (3) | Includes a reduction by the investment adviser of a portion of its adviser fee due to the Fund’s investment in the Morgan Stanley

Institutional Liquidity Funds – Government Portfolio (equal to less than 0.005% of average daily net assets for the years ended October

31, 2023 and 2022). |

| (4) | Calculated by subtracting the Fund’s total liabilities (not including the borrowings payable/notes payable) from the Fund’s

total assets, and dividing the result by the borrowings payable/notes payable balance in thousands. |

| (5) | Net investment income per share includes special dividends which amounted to $0.230 and $0.692 per share for the years ended October

31, 2016 and 2014, respectively. Excluding special dividends, the ratio of net investment income to average daily net assets would have

been 2.65% and 3.25% for the years ended October 31, 2016 and 2014, respectively. |

| (6) | Excludes the effect of custody fee credits, if any, of less than 0.005%. Effective September 1, 2015, custody fee credits, which were

earned on cash deposit balances, were discontinued by the custodian. |

|

|

|

|

|

|

|

|

|

|

|

| Senior Securities Amount |

|

|

$ 103,000

|

$ 103,000

|

$ 103,000

|

$ 103,000

|

$ 118,000

|

$ 118,000

|

$ 118,000

|

$ 118,000

|

$ 118,000

|

$ 118,000

|

| Senior Securities Coverage per Unit |

[1] |

|

$ 4,610

|

$ 4,500

|

$ 5,891

|

$ 4,409

|

$ 4,049

|

$ 3,829

|

$ 4,032

|

$ 3,682

|

$ 3,960

|

$ 4,218

|

|

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 4

| Name: |

cef_FinancialHighlightsAbstract |

| Namespace Prefix: |

cef_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 4

-Subsection 3

-Paragraph 2

| Name: |

cef_SeniorSecuritiesAmt |

| Namespace Prefix: |

cef_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 4

-Subsection 3

-Paragraph 3

-Subparagraph Instruction 2

| Name: |

cef_SeniorSecuritiesCvgPerUnit |

| Namespace Prefix: |

cef_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form N-2

-Section Item 4

-Subsection 3

| Name: |

cef_SeniorSecuritiesTableTextBlock |

| Namespace Prefix: |

cef_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

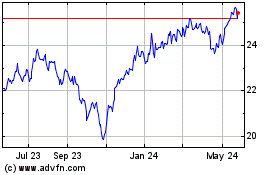

Eaton Vance Tax Advantag... (NYSE:ETO)

Historical Stock Chart

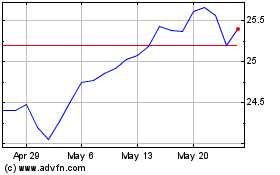

From Jun 2024 to Jul 2024

Eaton Vance Tax Advantag... (NYSE:ETO)

Historical Stock Chart

From Jul 2023 to Jul 2024