Downey Announces Change in Previously Reported Non-Performing Assets

January 14 2008 - 6:00AM

PR Newswire (US)

NEWPORT BEACH, Calif., Jan. 14 /PRNewswire-FirstCall/ -- Downey

Financial Corp. (NYSE:DSL) announced today changes to previously

reported levels of non-performing assets. These changes pertain to

non-performing asset levels since June 30, 2007. Rick McGill,

President, commented, "As previously reported, we implemented at

the beginning of the third quarter of 2007 a borrower retention

program to provide qualified borrowers with a cost effective means

to change from an option ARM to a less costly financing

alternative. We contacted borrowers whose loans were current and we

offered them the opportunity to modify their loans into 5-year

hybrid ARMs or ARMs with interest rates that adjust annually but do

not permit negative amortization. The interest rates associated

with these modifications were the same or no less than those rates

afforded new borrowers but they were below the interest rates on

the original loans. We initially did not consider these

modifications of performing loans to be troubled debt

restructurings, as the modification was only made to those

borrowers who were current with their loan payments and the new

interest rate was no less than those offered new borrowers. KPMG

LLP, our independent registered public accounting firm, did not

object to this assessment during its third quarter review." Mr.

McGill continued, "During December 2007, KPMG advised us that upon

further review of the modification program, it was likely the loan

modifications should be recorded as troubled debt restructurings.

After reassessing our initial analysis, we determined these

modified loans should be accounted for as troubled debt

restructurings. This conclusion was reached because in the current

interpretation of GAAP, especially in the current housing market,

there is a rebuttable presumption that if the interest rate is

lowered in a loan modification, the modification is deemed to be a

troubled debt restructuring unless the modified loan can be proved

to be at a market rate of interest based upon new underwriting,

including an updated property valuation, credit report and income

analysis. We did not perform these additional steps since borrowers

who qualified for our retention program were current and we were

trying to streamline the process for qualified borrowers to modify

their loans at interest rates no less than that being offered to

new borrowers. Inasmuch as we chose not to perform these additional

measures, we are now required to make this reporting change and, as

such, our non- performing assets will increase from what has been

previously reported. While periods prior to the third quarter of

2007 are not impacted by this change, it will result in $99 million

of loans being classified as non-performing at September 30, 2007."

Brian Cote, Chief Financial Officer, commented, "As required for

all loans classified as troubled debt restructurings, loans

modified as part of our borrower retention program must now be

placed on non-accrual status but interest income will be recognized

when paid. If borrowers perform pursuant to the modified loan terms

for six months, the loans will be placed back on accrual status

and, while still reported as troubled debt restructurings, they

will no longer be classified as non-performing assets because the

borrower has demonstrated an ability to perform and the interest

rate was no less than those afforded new borrowers at the time of

the modification." Mr. Cote further commented, "We believe that

when loans modified under our borrower retention program are

current, it is relevant to distinguish them from total

non-performing assets because, unlike other loans classified as

non-performing assets, these loans are effectively performing at

interest rates no less than those afforded new borrowers.

Accordingly, when performing troubled debt restructurings are

excluded from the revised ratio of non- performing assets to total

assets, the revised ratio of all other non- performing assets to

total assets is not materially different from that previously

reported." The table below provides the revised ratio of

non-performing assets to total assets for each affected month of

2007, distinguishing from the total those troubled debt

restructurings associated with Downey's borrower retention plan

wherein the loans are current but have not yet established six

months of successful payment history so that they can be removed

from non-accrual status. Non-Performing Assets as Percent of Total

Assets Jun. 30, Jul. 31, Aug. 31, 2007 2007 2007 Revised Performing

Troubled Debt Restructuring (1) 0.00% 0.04% 0.31% Revised all Other

Non- Performing Assets 1.53% 1.77% 1.96% ----- ----- ----- Revised

Total 1.53% 1.81% 2.27% Previously Reported 1.53% 1.77% 1.96% Sep.

30, Oct. 31, Nov. 30, 2007 2007 2007 Revised Performing Troubled

Debt Restructuring (1) 0.67% 1.09% 2.05% Revised all Other Non-

Performing Assets 2.27% 2.77% 3.72% ----- ----- ----- Revised Total

2.94% 3.86% 5.77% Previously Reported 2.25% 2.74% 3.65% (1) Loans

modified pursuant to borrower retention plan where all loan

payments are current and the interest rate is no less than that

offered new borrowers. Mr. Cote concluded by stating, "As of

year-end 2007, the estimated level of non-performing assets as a

percent of total assets increased to 7.8%. Of this total, about 40%

represented modifications generated from our borrower retention

program, of which an estimated 95% have made all payments due.

Those performing troubled debt restructurings represent about 3.0%

of total assets. As yet, we have not determined the impact this

reporting change may have on previously reported financial

statements, if any, but we expect to complete this analysis soon."

Downey Financial Corp. is the parent company of Downey Savings and

Loan Association, F.A., with assets of $13.5 billion and 168

branches throughout California and four in Arizona. Certain

statements in this release may constitute "forward-looking

statements" under the Private Securities Litigation Reform Act of

1995, which involve risks and uncertainties. Forward-looking

statements do not relate strictly to historical information or

current facts. Some forward-looking statements may be identified by

use of terms such as "expects," "anticipates," "intends," "plans,"

"believes," "seeks," "estimates," or words of similar meaning, or

future or conditional verbs such as "will," "would," "should,"

"could" or "may." Downey's actual results may differ significantly

from the results discussed in such forward-looking statements.

Factors that might cause such a difference include, but are not

limited to, economic conditions, competition in the geographic and

business areas in which Downey conducts its operations,

fluctuations in interest rates, credit quality and government

regulation. Downey does not update forward-looking statements to

reflect the impact of circumstances or events that arise after the

date the forward- looking statements were made. DATASOURCE: Downey

Financial Corp. CONTACT: Brian E. Cote, CFO of Downey Financial

Corp., +1-949-509-4420 Web site: http://www.downeysavings.com/

Copyright

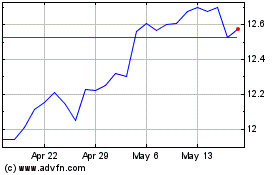

DoubleLine Income Soluti... (NYSE:DSL)

Historical Stock Chart

From Jun 2024 to Jul 2024

DoubleLine Income Soluti... (NYSE:DSL)

Historical Stock Chart

From Jul 2023 to Jul 2024