0000723603false00007236032023-12-042023-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 04, 2023 |

Culp, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

North Carolina |

1-12597 |

56-1001967 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1823 Eastchester Drive |

|

High Point, North Carolina |

|

27265 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 336 889-5161 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

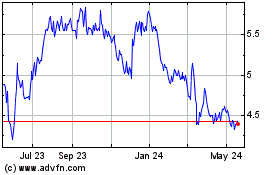

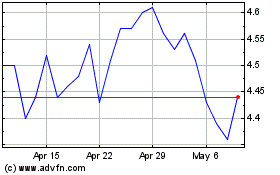

Common stock, par value $0.05 per share |

|

CULP |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This report and the exhibit attached hereto contain “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties that may cause actual events and results to differ materially from such statements. Further, forward looking statements are intended to speak only as of the date on which they are made, and we disclaim any duty to update such statements to reflect any changes in management’s expectations or any change in the assumptions or circumstances on which such statements are based, whether due to new information, future events, or otherwise. Forward-looking statements are statements that include projections, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “anticipate,” “estimate,” “intend,” “plan,” “project,” and their derivatives, and include but are not limited to statements about expectations, projections, or trends for our future operations, strategic initiatives and plans, production levels, new product launches, sales, profit margins, profitability, operating income, capital expenditures, working capital levels, cost savings, income taxes, SG&A or other expenses, pre-tax income, earnings, cash flow, and other performance or liquidity measures, as well as any statements regarding dividends, share repurchases, liquidity, uses of cash and cash requirements, borrowing capacity, investments, potential acquisitions, future economic or industry trends, public health epidemics, or future developments. There can be no assurance that we will realize these expectations or meet our guidance, or that these beliefs will prove correct.

Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect us adversely. The future performance of our business depends in part on our success in conducting and finalizing acquisition negotiations and integrating acquired businesses into our existing operations. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in tariffs or trade policy, including changes in U.S. trade enforcement priorities, or changes in the value of the U.S. dollar versus other currencies, could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currencies in Canada and China can have a negative impact on our sales of products produced in those places. In addition, because our foreign operations use the U.S. dollar as their functional currency, changes in the exchange rate between the local currency of those operations and the U.S dollar can affect our reported profits from those foreign operations. Also, economic or political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. The impact of public health epidemics on employees, customers, suppliers, and the global economy, such as the global coronavirus pandemic currently affecting countries around the world, could also adversely affect our operations and financial performance. In addition, the impact of potential asset impairments, including impairments of property, plant, and equipment, inventory, or intanbile assets, as well as the impact of valuation allowances applied against our net deferred income tax assets, could affect our financial results. Increases in freight costs, labor costs, and raw material prices, including increases in market prices for petrochemical products, can also significantly affect the prices we pay for shipping, labor, and raw materials, respectively, and in turn, increase our operating costs and decrease our profitability. Finally, disruption in our customers’ supply chains for non-fabric components may cause declines in new orders and/or delayed shipping of existing orders while our customers wait for other components, which could adversely affect our financial results. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements, is included in Item 1A “Risk Factors” in our most recent Form 10-K and Form 10-Q reports filed with the Securities and Exchange Commission. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations and financial results.

2

Item 2.02 – Results of Operations and Financial Condition

On December 4, 2023, we issued a news release to announce our financial results for our second quarter ended October 29, 2023. A copy of the news release is attached hereto as Exhibit 99.1.

The information set forth in this Item 2.02 of this Current Report, and in Exhibit 99.1, is intended to be “furnished” under Item 2.02 of Form 8-K. Such information shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The news release contains adjusted income statement information for the three and six-month periods ending October 29, 2023, and October 30, 2022, respectively, which disclose adjusted loss from operations, a non-U.S. GAAP performance measure that eliminates items which are not expected to occur on a recurring or regular basis. For the three and six-month periods ending October 29, 2023, these items include, as applicable for the period presented, a restructuring-related credit, restructuring-related charges, and restructuring expense associated with the discontinued production of cut and sewn upholstery kits in Ouanaminthe, Haiti. For the three and six- month periods ending October 30, 2022, these items include restructuring expense and restructuring-related charges associated with the exit of the company's cut and sew upholstery fabrics operation located in Shanghai, China, during the second quarter of fiscal 2023. The company has included this adjusted information in order to show operational performance excluding the effects of items not expected to occur on a recurring or regular basis. Details of these calculations and a reconciliation to information from our U.S. GAAP financial statements are set forth in the news release. Management believes this presentation aids in the comparison of financial results among comparable financial periods. Management uses adjusted income statement information in evaluating the financial performance of our overall operations and business segments. Also, adjusted income statement information is used as a performance measure in our incentive-based executive compensation program. We note, however, that this adjusted income statement information should not be viewed in isolation or as a substitute for loss from operations calculated in accordance with U.S. GAAP.

The news release contains disclosures about free cash flow, a non-U.S. GAAP liquidity measure that we define as net cash (used in) provided by operating activities, less cash capital expenditures and payments on vendor-financed capital expenditures, plus any proceeds from sale of property, plant, and equipment, plus proceeds from note receivable, plus proceeds from the sale of investments associated with our rabbi trust, less the purchase of investments associated with our rabbi trust, and plus or minus the effects of foreign currency exchange rate changes on cash and cash equivalents, in each case to the extent any such amount is incurred during the period presented. Details of these calculations and a reconciliation to information from our U.S. GAAP financial statements are set forth in the news release. Management believes the disclosure of free cash flow provides useful information to investors because it measures our available cash flow for potential debt repayment, stock repurchases, dividends, additions to cash and investments, or other corporate purposes. We note, however, that not all of the company’s free cash flow is available for discretionary spending, as we may have mandatory debt payments and other cash requirements that must be deducted from our cash available for future use. In operating our business, management uses free cash flow to make decisions about what commitments of cash to make for operations, such as capital expenditures (and possible financing arrangements for these expenditures), purchases of inventory or supplies, SG&A expenditure levels, compensation, and other commitments of cash, while still allowing for adequate cash to meet known future commitments for cash, such as debt repayment, and also for making decisions about dividend payments and share repurchases.

The news release contains disclosures about our Adjusted EBITDA, which is a non-U.S. GAAP performance measure that reflects net (loss) income excluding income tax expense (benefit), net interest income, and restructuring expense and restructuring related charges or credits, as well as depreciation and amortization expense, and stock-based compensation expense. This measure also excludes other non-recurring charges and credits associated with our business, if and to the extent any such amount is incurred during the period presented. Details of these calculations and a reconciliation to information from our U.S. GAAP financial statements are set forth in the news release. We believe presentation of Adjusted EBITDA is useful to investors because earnings before interest income and expense, income taxes, depreciation and amortization, and similar performance measures that exclude certain charges from earnings, are often used by investors and financial analysts in evaluating and comparing companies in our industry. We note, however, that such measures are not defined uniformly by various companies, with differing expenses being excluded from net income to calculate these performance measures. For this reason, Adjusted EBITDA should not be viewed in isolation by investors and should not be used as a substitute for net income (loss) calculated in accordance with GAAP, nor should it be used for direct comparisons with similarly titled performance measures reported by other companies. Use of Adjusted EBITDA as an analytical tool has limitations in that this measure does not reflect all expenses that are necessary to fund and operate our business, including funds required to pay taxes, service our debt,

3

and fund capital expenditures, among others. Management uses Adjusted EBITDA to help it analyze the company’s earnings and operating performance, by excluding the effects of expenses that depend upon capital structure and debt level, tax provisions, and non-cash items such as depreciation, amortization and stock-based compensation expense that do not require immediate uses of cash.

The news release contains disclosures about return on capital for both the entire company and for individual business segments. We define return on capital as adjusted operating income (loss) (measured on a trailing twelve-month basis) divided by average capital employed (excluding intangible assets related to acquisitions at the divisional level only). Adjusted operating income (loss) excludes certain charges or credits that are not expected to occur on a recurring or regular basis, if applicable for the period presented. Average capital employed is calculated over rolling five fiscal periods, depending on which quarter is being presented. Details of these calculations and a reconciliation to information from our U.S. GAAP financial statements are set forth in the news release. We believe return on capital is an accepted measure of earnings efficiency in relation to capital employed, but it is a non-U.S. GAAP performance measure that is not defined or calculated in the same manner by all companies. This measure should not be considered in isolation or as an alternative to net income (loss) or other performance measures, but we believe it provides useful information to investors by comparing the adjusted operating income (loss) we produce to the net asset base used to generate that income (loss). Also, adjusted operating income (loss) on a trailing twelve-months basis does not necessarily indicate results that would be expected for the full fiscal year or for the following twelve months. We note that, particularly for return on capital measured at the segment level, not all assets and expenses are allocated to our operating segments, and there are assets and expenses at the corporate (unallocated) level that may provide support to a segment’s operations and yet are not included in the assets and expenses used to calculate that segment’s return on capital. Thus, the average return on capital for the company’s segments will generally be different from the company’s overall return on capital. Management uses return on capital to evaluate the company’s earnings efficiency and the relative performance of its segments.

Item 9.01 (d) – Exhibits

4

EXHIBIT INDEX

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

CULP, INC. (Registrant) |

|

|

|

|

|

|

By: |

/s/ Kenneth R. Bowling |

|

|

|

Chief Financial Officer |

|

|

|

(principal financial officer and principal accounting officer) |

|

|

|

|

Dated: December 4, 2023

6

Exhibit 99.1

CULP ANNOUNCES RESULTS FOR SECOND QUARTER FISCAL 2024,

WITH CONTINUED SEQUENTIAL AND STRONG YEAR-OVER-YEAR OPERATING IMPROVEMENT AND A SOLID FINANCIAL POSITION

HIGH POINT, N.C. (December 4, 2023) ─ Culp, Inc. (NYSE: CULP) (together with its consolidated subsidiaries, “CULP”) today reported financial and operating results for the second quarter ended October 29, 2023.

Fiscal 2024 Second Quarter Financial Summary

▪Net sales for the second quarter of fiscal 2024 were $58.7 million, up 0.6 percent compared with the prior-year period, with mattress fabrics sales up 19.6 percent, and upholstery fabrics sales down 14.9 percent.

▪Loss from operations was $(2.2) million, compared with a loss from operations of $(11.9) million for the prior-year period (which included $6.7 million relating to certain inventory impairment and other charges and restructuring and related expenses during the period).

▪Net loss was $(2.4) million, or $(0.19) per diluted share, compared with a net loss of $(12.2) million, or $(0.99) per diluted share, for the prior-year period. The effective tax rate for the second quarter was negative (27.0) percent, reflecting the company’s mix of taxable income between its U.S. and foreign jurisdictions during the period.

▪The company maintained a solid financial position, with its balance sheet reflecting $15.2 million of total cash and no outstanding borrowings as of October 29, 2023. Total liquidity as of October 29, 2023, was $41.4 million (consisting of $15.2 million in cash and $26.2 million in borrowing availability under the company's domestic credit facility).

▪Adjusted EBITDA for the period was close to break even at negative $(247,000), as compared to adjusted EBITDA of negative $(8.2) million for the prior-year period.

CEO Commentary

Commenting on the results, Iv Culp, president and chief executive officer of Culp, Inc., said, “We are pleased to report both sequential and year-over-year improvement in our consolidated sales and operating performance for the second quarter, a solid outcome considering the challenging macro environment for furniture and bedding. These results, which were in line with our expectations, reflect the strategic business transformation initiatives underway in both divisions that are focused on driving performance despite ongoing demand softness. In our mattress fabrics segment, we are increasing sales and gaining market position with new fabric and sewn cover placements. This segment also achieved a 90 percent improvement in its operating results as compared to the prior-year period, and a 33 percent improvement as compared sequentially to the prior quarter. This performance was driven by balanced inventory management, higher sales, better pricing and margin, and an ongoing focus by our strengthened leadership team on operational efficiencies across our locations. For our upholstery fabrics segment, as expected, sales for residential fabrics were lower than the prior-year period due to demand softness affecting the home furnishings industry. However, demand remained solid in our hospitality/contract business. The segment also saw a significant improvement in operating performance, driven by better inventory management, fixed cost savings, and other operational improvements.

“Additionally, we continued our focus on prudent financial management, including maintaining a strong balance sheet and ensuring a strategic level of working capital. We ended the quarter with $15.2 million in cash and no outstanding borrowings. We believe we are well positioned, and we are

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 2

December 4, 2023

strategically investing in our business, especially within our mattress fabrics segment, to support future profitable sales growth and further improve operating efficiencies.

“As we enter the third quarter, we acknowledge that the various external headwinds and pressures on consumer spending for furniture and bedding products may remain for some time. However, our market position is strong and growing, and we are diligently focused on internal improvement initiatives that will enable us to withstand these industry conditions and position our business for renewed growth and profitability. Regardless of the current demand backdrop, we expect to continue on a path of sequential and year-over-year operating improvement, including a return to positive adjusted EBITDA in the third quarter. We also believe we are poised to return to consolidated operating profitability by the end of the fiscal year. We are well positioned with our innovative product offerings, creative designs, resilient global manufacturing and sourcing platform, strong leadership teams, and focused financial management. These hallmarks of our business will support us into the future, especially when market conditions improve,” added Culp.

Business Segment Highlights

Mattress Fabrics Segment (“CHF”) Summary

▪Sales for this segment were $31.4 million for the second quarter, up 19.6 percent compared with sales of $26.2 million in the second quarter of fiscal 2023.

▪The higher sales, as compared to the prior-year period, were primarily driven by new fabric and sewn cover placements that are priced in line with current costs. While the domestic mattress industry remains pressured, CHF continues to make gains with customers in a difficult market environment.

▪Operating loss was $(936,000) for the second quarter, a 90 percent improvement compared to the $(9.0) million operating loss in the prior-year period (which included $5.0 million relating to certain inventory impairment charges and losses from inventory close out sales). This substantial reduction in losses was driven by balanced inventory management, higher sales, better pricing and margins, and improvement in operating efficiencies. These factors were partially offset by higher SG&A business investments during the period.

Upholstery Fabrics Segment (“CUF”) Summary

▪Sales for this segment were $27.3 million for the second quarter, down 14.9 percent compared with sales of $32.2 million in the second quarter of fiscal 2023.

▪Sales for CUF's residential fabric business were affected by ongoing softness in the residential home furnishings industry, where demand remains pressured by a challenging macro-economic environment. Demand remained solid for CUF’s hospitality/contract business, with sales for this business accounting for approximately 33 percent of CUF's total sales.

▪Operating income was $1.4 million for the second quarter, up significantly compared with $262,000 in the second quarter of fiscal 2023 (which included approximately $1.0 million in higher-than-normal inventory markdowns). Operating margin for the second quarter was 5.1 percent, again a significant improvement compared to the prior-year period. Operating performance for the second quarter was positively affected by better inventory management; lower fixed costs resulting from the previous restructuring of CUF's cut and sew platforms; lower freight costs; and a more favorable foreign exchange rate associated with CUF's operations in China. These factors were partially offset by lower residential fabric sales and higher SG&A business investments during the period.

Balance Sheet, Cash Flow, and Liquidity

▪As of October 29, 2023, the company reported $15.2 million in total cash and no outstanding debt.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 3

December 4, 2023

▪Cash flow from operations and free cash flow were negative $(4.5) million and negative $(5.6) million, respectively, for the first six months of fiscal 2024. (See reconciliation table at the back of this press release.) As expected, the company’s cash flow from operations and free cash flow during the period were affected by operating losses and planned strategic investments in capital expenditures mostly related to the CHF transformation plan.

▪Capital expenditures for the first six months of fiscal 2024 were $2.0 million. The company continues to manage capital investments, focusing on projects that will increase efficiencies and improve quality, especially for the CHF segment.

▪As of October 29, 2023, the company had approximately $41.4 million in liquidity, consisting of $15.2 million in total cash and $26.2 million in borrowing availability under the company's domestic credit facility.

Share Repurchases

The company did not repurchase any shares during the second quarter of fiscal 2024, leaving approximately $3.2 million available under the current share repurchase program as of October 29, 2023. Despite the current share repurchase authorization, the company does not expect to repurchase any shares during the third quarter of fiscal 2024.

Financial Outlook

▪CULP achieved sequential and year-over-year improvement in its sales and operating results for the second quarter of fiscal 2024. While the current macroeconomic conditions affecting consumer spending and demand trends are likely to continue for some period, the company remains well positioned, especially with the transformation strategy underway in its mattress fabrics division.

▪Due to the uncertainty in the macro-environment, the company is only providing financial guidance for the third quarter of fiscal 2024. The company’s consolidated net sales for the third quarter are expected to be sequentially comparable to second quarter of fiscal 2024 and moderately higher as compared to the third quarter of fiscal 2023, even in the face of ongoing demand headwinds. The company expects a consolidated operating loss (loss from operations) for the third quarter of fiscal 2024 that is in the range of $(1.2) to $(1.6) million, sequentially improved from the previous quarter's results, and a significant improvement compared to the $(7.8) million operating loss for the prior-year period (which included $711,000 in restructuring expense).

▪The company’s expectations are based on information available at the time of this press release and reflect certain assumptions by management regarding the company’s business and trends and the projected impact of the ongoing headwinds.

Conference Call

Culp, Inc. will hold a conference call to discuss financial results for the second quarter of fiscal 2024 on December 5, 2023, at 11:00 a.m. Eastern Time. A live webcast of this call can be accessed on the “Upcoming Events” section on the investor relations page of the company’s website, www.culp.com. A replay of the webcast will be available for 30 days under the “Past Events” section on the investor relations page of the company’s website, beginning at 2:00 p.m. Eastern Time on December 5, 2023.

Investor Relations Contact

Ken Bowling, Executive Vice President, Chief Financial Officer, and Treasurer: (336) 881-5630

krbowling@culp.com

About the Company

Culp, Inc. is one of the world’s largest marketers of mattress fabrics for bedding and upholstery fabrics for residential and commercial furniture. The company markets a variety of fabrics to its global customer base of leading bedding and furniture companies, including fabrics produced at Culp’s manufacturing facilities and fabrics sourced through other suppliers. Culp has manufacturing and sourcing capabilities located in the United States, Canada, China, Haiti, Turkey, and Vietnam.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 4

December 4, 2023

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties that may cause actual events and results to differ materially from such statements. Further, forward looking statements are intended to speak only as of the date on which they are made, and we disclaim any duty to update such statements to reflect any changes in management’s expectations or any change in the assumptions or circumstances on which such statements are based, whether due to new information, future events, or otherwise. Forward-looking statements are statements that include projections, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “anticipate,” “estimate,” “intend,” “plan,” “project,” and their derivatives, and include but are not limited to statements about expectations, projections, or trends for our future operations, strategic initiatives and plans, production levels, new product launches, sales, profit margins, profitability, operating income, capital expenditures, working capital levels, cost savings, income taxes, SG&A or other expenses, pre-tax income, earnings, cash flow, and other performance or liquidity measures, as well as any statements regarding dividends, share repurchases, liquidity, use of cash and cash requirements, borrowing capacity, investments, potential acquisitions, future economic or industry trends, public health epidemics, or future developments. There can be no assurance that we will realize these expectations or meet our guidance, or that these beliefs will prove correct.

Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect us adversely. The future performance of our business depends in part on our success in conducting and finalizing acquisition negotiations and integrating acquired businesses into our existing operations. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in tariffs or trade policy, including changes in U.S. trade enforcement priorities, or changes in the value of the U.S. dollar versus other currencies, could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currencies in Canada and China can have a negative impact on our sales of products produced in those places. In addition, because our foreign operations use the U.S. dollar as their functional currency, changes in the exchange rate between the local currency of those operations and the U.S dollar can affect our reported profits from those foreign operations. Also, economic or political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. The impact of public health epidemics on employees, customers, suppliers, and the global economy, such as the global coronavirus pandemic currently affecting countries around the world, could also adversely affect our operations and financial performance. In addition, the impact of potential asset impairments, including impairments of property, plant, and equipment, inventory, or intangible assets, as well as the impact of valuation allowances applied against our net deferred income tax assets, could affect our financial results. Increases in freight costs, labor costs, and raw material prices, including increases in market prices for petrochemical products, can also significantly affect the prices we pay for shipping, labor, and raw materials, respectively, and in turn, increase our operating costs and decrease our profitability. Finally, disruption in our customers’ supply chains for non-fabric components may cause declines in new orders and/or delayed shipping of existing orders while our customers wait for other components, which could adversely affect our financial results. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements, is included in Item 1A “Risk Factors” in our most recent Form 10-K and Form 10-Q reports filed with the Securities and Exchange Commission. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations and financial results.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 5

December 4, 2023

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR THREE MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THREE MONTHS ENDED |

|

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

October 29, |

|

|

October 30, |

|

|

% Over |

|

|

October 29, |

|

|

October 30, |

|

|

|

2023 |

|

|

2022 |

|

|

(Under) |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

58,725 |

|

|

$ |

58,381 |

|

|

|

0.6 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (2)(3) |

|

|

(50,775 |

) |

|

|

(60,594 |

) |

|

|

(16.2 |

)% |

|

|

86.5 |

% |

|

|

103.8 |

% |

Gross profit (loss) |

|

|

7,950 |

|

|

|

(2,213 |

) |

|

|

(459.2 |

)% |

|

|

13.5 |

% |

|

|

(3.8 |

)% |

Selling, general and administrative

expenses |

|

|

(10,045 |

) |

|

|

(9,103 |

) |

|

|

10.3 |

% |

|

|

17.1 |

% |

|

|

15.6 |

% |

Restructuring expense (4) (5) |

|

|

(144 |

) |

|

|

(615 |

) |

|

|

(76.6 |

)% |

|

|

0.2 |

% |

|

|

1.1 |

% |

Loss from operations |

|

|

(2,239 |

) |

|

|

(11,931 |

) |

|

|

(81.2 |

)% |

|

|

(3.8 |

)% |

|

|

(20.4 |

)% |

Interest income |

|

|

282 |

|

|

|

79 |

|

|

|

257.0 |

% |

|

|

0.5 |

% |

|

|

0.1 |

% |

Other income |

|

|

49 |

|

|

|

829 |

|

|

|

(94.1 |

)% |

|

|

0.1 |

% |

|

|

1.4 |

% |

Loss before income taxes |

|

|

(1,908 |

) |

|

|

(11,023 |

) |

|

|

(82.7 |

)% |

|

|

(3.2 |

)% |

|

|

(18.9 |

)% |

Income tax expense (6) |

|

|

(516 |

) |

|

|

(1,150 |

) |

|

|

(55.1 |

)% |

|

|

(27.0 |

)% |

|

|

(10.4 |

)% |

Net loss |

|

$ |

(2,424 |

) |

|

$ |

(12,173 |

) |

|

|

(80.1 |

)% |

|

|

(4.1 |

)% |

|

|

(20.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic |

|

$ |

(0.19 |

) |

|

$ |

(0.99 |

) |

|

|

(80.4 |

)% |

|

|

|

|

|

|

Net loss per share - diluted |

|

$ |

(0.19 |

) |

|

$ |

(0.99 |

) |

|

|

(80.4 |

)% |

|

|

|

|

|

|

Average shares outstanding-basic |

|

|

12,456 |

|

|

|

12,280 |

|

|

|

1.4 |

% |

|

|

|

|

|

|

Average shares outstanding-diluted |

|

|

12,456 |

|

|

|

12,280 |

|

|

|

1.4 |

% |

|

|

|

|

|

|

Notes

(1) See page 12 for our Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending October 29, 2023, and October 30, 2022.

(2) Cost of sales for the three months ending October 29, 2023, includes a restructuring related credit totaling $78,000 for the gain on disposal inventory related to the discontinuation of production of cut and sewn upholstery kits at our facility in Ouanaminthe, Haiti.

(3) Cost of sales for the three months ending October 30, 2022, includes a restructuring related charge totaling $98,000, which pertains to loss on disposal and markdowns of inventory related to the exit of our cut and sew upholstery fabrics operation located in Shanghai, China.

(4) Restructuring expense for the three months ending October 29, 2023, represents $142,000 for impairment charges related to equipment and $2,000 for employee termination costs related to the discontinuation of production of cut and sewn upholstery kits at our facility in Ouanaminthe, Haiti.

(5) Restructuring expense for the three months ending October 30, 2022, represents $468,000 for employee termination benefits, $80,000 for a loss on disposal of equipment, $47,000 for lease termination costs, and $20,000 of other associated costs related to the exit of our cut and sew upholstery fabrics operation located in Shanghai, China.

(6) Percent of sales column for income tax expense is calculated as a percent of loss before income taxes.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 6

December 4, 2023

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR SIX MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIX MONTHS ENDED |

|

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

October 29, |

|

|

October 30, |

|

|

% Over |

|

|

October 29, |

|

|

October 30, |

|

|

|

2023 |

|

|

2022 |

|

|

(Under) |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

115,387 |

|

|

$ |

120,985 |

|

|

|

(4.6 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (2)(3) |

|

|

(100,352 |

) |

|

|

(119,071 |

) |

|

|

(15.7 |

)% |

|

|

87.0 |

% |

|

|

98.4 |

% |

Gross profit |

|

|

15,035 |

|

|

|

1,914 |

|

|

|

685.5 |

% |

|

|

13.0 |

% |

|

|

1.6 |

% |

Selling, general and administrative

expenses |

|

|

(19,874 |

) |

|

|

(17,968 |

) |

|

|

10.6 |

% |

|

|

17.2 |

% |

|

|

14.9 |

% |

Restructuring expense (4) (5) |

|

|

(482 |

) |

|

|

(615 |

) |

|

|

(21.6 |

)% |

|

|

0.4 |

% |

|

|

0.5 |

% |

Loss from operations |

|

|

(5,321 |

) |

|

|

(16,669 |

) |

|

|

(68.1 |

)% |

|

|

(4.6 |

)% |

|

|

(13.8 |

)% |

Interest income |

|

|

627 |

|

|

|

96 |

|

|

|

553.1 |

% |

|

|

0.5 |

% |

|

|

0.1 |

% |

Other income |

|

|

145 |

|

|

|

747 |

|

|

|

(80.6 |

)% |

|

|

(0.1 |

)% |

|

|

(0.6 |

)% |

Loss before income taxes |

|

|

(4,549 |

) |

|

|

(15,826 |

) |

|

|

(71.3 |

)% |

|

|

(3.9 |

)% |

|

|

(13.1 |

)% |

Income tax expense (6) |

|

|

(1,217 |

) |

|

|

(2,046 |

) |

|

|

(40.5 |

)% |

|

|

(26.8 |

)% |

|

|

(12.9 |

)% |

Net loss |

|

$ |

(5,766 |

) |

|

$ |

(17,872 |

) |

|

|

(67.7 |

)% |

|

|

(5.0 |

)% |

|

|

(14.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic |

|

$ |

(0.47 |

) |

|

$ |

(1.46 |

) |

|

|

(68.1 |

)% |

|

|

|

|

|

|

Net loss per share - diluted |

|

$ |

(0.47 |

) |

|

$ |

(1.46 |

) |

|

|

(68.1 |

)% |

|

|

|

|

|

|

Average shares outstanding-basic |

|

|

12,394 |

|

|

|

12,259 |

|

|

|

1.1 |

% |

|

|

|

|

|

|

Average shares outstanding-diluted |

|

|

12,394 |

|

|

|

12,259 |

|

|

|

1.1 |

% |

|

|

|

|

|

|

Notes

(1) See page 13 for our Reconciliation of Selected Income Statement Information to Adjusted Results for the six months ending October 29, 2023, and October 30, 2022.

(2) Cost of sales for the six months ending October 29, 2023, includes a net restructuring related charge totaling $101,000, which represents the markdown of inventory totaling $179,000 which occurred during the first quarter of fiscal 2024, partially offset by a gain on disposal of inventory totaling $78,000 which occurred during the second quarter of fiscal 2024, related to the discontinuation of production of cut and sewn upholstery kits at our facility in Ouanaminthe, Haiti.

(3) Cost of sales for the six months ending October 30, 2022, includes a restructuring related charge totaling $98,000, which pertains to loss on disposal and markdowns of inventory related to the exit of our cut and sew upholstery fabrics operation located in Shanghai, China.

(4) Restructuring expense for the six months ending October 29, 2023, represents $379,000 for impairment charges related to equipment and $103,000 for employee termination benefits related to the discontinuation of production of cut and sewn upholstery kits at our facility in Ouanaminthe, Haiti.

(5) Restructuring expense for the six months ending October 30, 2022, represents $468,000 for employee termination benefits, $80,000 for a loss on disposal of equipment, $47,000 for lease termination costs, and $20,000 of other associated costs related to the exit of our cut and sew upholstery fabrics operation located in Shanghai, China.

(6) Percent of sales column for income tax expense is calculated as a percent of loss before income taxes.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 7

December 4, 2023

CONSOLIDATED BALANCE SHEETS

OCTOBER 29, 2023, OCTOBER 30, 2022, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

(Condensed) |

|

|

(Condensed) |

|

|

|

|

|

|

|

|

(Condensed) |

|

|

|

October 29, |

|

|

October 30, |

|

|

Increase (Decrease) |

|

|

* April 30, |

|

|

|

2023 |

|

|

2022 |

|

|

Dollars |

|

|

Percent |

|

|

2023 |

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

15,214 |

|

|

|

19,137 |

|

|

|

(3,923 |

) |

|

|

(20.5 |

)% |

|

|

20,964 |

|

Short-term investments - Rabbi Trust |

|

|

937 |

|

|

|

2,237 |

|

|

|

(1,300 |

) |

|

|

(58.1 |

)% |

|

|

1,404 |

|

Accounts receivable |

|

|

23,036 |

|

|

|

22,443 |

|

|

|

593 |

|

|

|

2.6 |

% |

|

|

24,778 |

|

Inventories |

|

|

44,465 |

|

|

|

52,224 |

|

|

|

(7,759 |

) |

|

|

(14.9 |

)% |

|

|

45,080 |

|

Short-term note receivable |

|

|

256 |

|

|

|

— |

|

|

|

256 |

|

|

|

100.0 |

% |

|

|

219 |

|

Current income taxes receivable |

|

|

340 |

|

|

|

510 |

|

|

|

(170 |

) |

|

|

(33.3 |

)% |

|

|

— |

|

Other current assets |

|

|

4,346 |

|

|

|

3,462 |

|

|

|

884 |

|

|

|

25.5 |

% |

|

|

3,071 |

|

Total current assets |

|

|

88,594 |

|

|

|

100,013 |

|

|

|

(11,419 |

) |

|

|

(11.4 |

)% |

|

|

95,516 |

|

Property, plant & equipment, net |

|

|

34,664 |

|

|

|

38,832 |

|

|

|

(4,168 |

) |

|

|

(10.7 |

)% |

|

|

36,111 |

|

Right of use assets |

|

|

6,874 |

|

|

|

11,609 |

|

|

|

(4,735 |

) |

|

|

(40.8 |

)% |

|

|

8,191 |

|

Long-term investments - Rabbi Trust |

|

|

6,995 |

|

|

|

7,526 |

|

|

|

(531 |

) |

|

|

(7.1 |

)% |

|

|

7,067 |

|

Intangible assets |

|

|

2,064 |

|

|

|

2,440 |

|

|

|

(376 |

) |

|

|

(15.4 |

)% |

|

|

2,252 |

|

Long-term note receivable |

|

|

1,596 |

|

|

|

— |

|

|

|

1,596 |

|

|

|

100.0 |

% |

|

|

1,726 |

|

Deferred income taxes |

|

|

472 |

|

|

|

493 |

|

|

|

(21 |

) |

|

|

(4.3 |

)% |

|

|

480 |

|

Other assets |

|

|

901 |

|

|

|

717 |

|

|

|

184 |

|

|

|

25.7 |

% |

|

|

840 |

|

Total assets |

|

$ |

142,160 |

|

|

|

161,630 |

|

|

|

(19,470 |

) |

|

|

(12.0 |

)% |

|

|

152,183 |

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable - trade |

|

|

27,903 |

|

|

|

24,298 |

|

|

|

3,605 |

|

|

|

14.8 |

% |

|

|

29,442 |

|

Accounts payable - capital expenditures |

|

|

298 |

|

|

|

200 |

|

|

|

98 |

|

|

|

49.0 |

% |

|

|

56 |

|

Operating lease liability - current |

|

|

2,540 |

|

|

|

2,655 |

|

|

|

(115 |

) |

|

|

(4.3 |

)% |

|

|

2,640 |

|

Deferred compensation |

|

|

937 |

|

|

|

2,237 |

|

|

|

(1,300 |

) |

|

|

(58.1 |

)% |

|

|

1,404 |

|

Deferred revenue |

|

|

853 |

|

|

|

1,527 |

|

|

|

(674 |

) |

|

|

(44.1 |

)% |

|

|

1,192 |

|

Accrued expenses |

|

|

8,106 |

|

|

|

7,594 |

|

|

|

512 |

|

|

|

6.7 |

% |

|

|

8,533 |

|

Accrued restructuring |

|

|

— |

|

|

|

33 |

|

|

|

(33 |

) |

|

|

100.0 |

% |

|

|

— |

|

Income taxes payable - current |

|

|

998 |

|

|

|

969 |

|

|

|

29 |

|

|

|

3.0 |

% |

|

|

753 |

|

Total current liabilities |

|

|

41,635 |

|

|

|

39,513 |

|

|

|

2,122 |

|

|

|

5.4 |

% |

|

|

44,020 |

|

Operating lease liability - long-term |

|

|

2,431 |

|

|

|

4,194 |

|

|

|

(1,763 |

) |

|

|

(42.0 |

)% |

|

|

3,612 |

|

Income taxes payable - long-term |

|

|

2,055 |

|

|

|

2,629 |

|

|

|

(574 |

) |

|

|

(21.8 |

)% |

|

|

2,675 |

|

Deferred income taxes |

|

|

5,663 |

|

|

|

5,700 |

|

|

|

(37 |

) |

|

|

(0.6 |

)% |

|

|

5,954 |

|

Deferred compensation |

|

|

6,748 |

|

|

|

7,486 |

|

|

|

(738 |

) |

|

|

(9.9 |

)% |

|

|

6,842 |

|

Total liabilities |

|

|

58,532 |

|

|

|

59,522 |

|

|

|

(990 |

) |

|

|

(1.7 |

)% |

|

|

63,103 |

|

Shareholders' equity |

|

|

83,628 |

|

|

|

102,108 |

|

|

|

(18,480 |

) |

|

|

(18.1 |

)% |

|

|

89,080 |

|

Total liabilities and shareholders'

equity |

|

$ |

142,160 |

|

|

|

161,630 |

|

|

|

(19,470 |

) |

|

|

(12.0 |

)% |

|

|

152,183 |

|

Shares outstanding |

|

|

12,470 |

|

|

|

12,294 |

|

|

|

176 |

|

|

|

1.4 |

% |

|

|

12,327 |

|

* Derived from audited financial statements.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 8

December 4, 2023

CULP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

SIX MONTHS ENDED |

|

|

|

Amounts |

|

|

|

October 29, |

|

|

October 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(5,766 |

) |

|

$ |

(17,872 |

) |

Adjustments to reconcile net loss to net cash (used in)

provided by operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

3,251 |

|

|

|

3,489 |

|

Non-cash inventory (credit) charge (1) (2) |

|

|

(2,001 |

) |

|

|

6,439 |

|

Amortization |

|

|

193 |

|

|

|

214 |

|

Stock-based compensation |

|

|

485 |

|

|

|

565 |

|

Deferred income taxes |

|

|

(283 |

) |

|

|

(269 |

) |

Gain on sale of equipment |

|

|

(278 |

) |

|

|

(232 |

) |

Non-cash restructuring expense |

|

|

379 |

|

|

|

— |

|

Foreign currency exchange gain |

|

|

(697 |

) |

|

|

(1,168 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

1,644 |

|

|

|

(443 |

) |

Inventories |

|

|

2,304 |

|

|

|

7,192 |

|

Other current assets |

|

|

(1,355 |

) |

|

|

(728 |

) |

Other assets |

|

|

(123 |

) |

|

|

58 |

|

Accounts payable |

|

|

(495 |

) |

|

|

6,027 |

|

Deferred revenue |

|

|

(339 |

) |

|

|

1,007 |

|

Accrued restructuring |

|

|

— |

|

|

|

33 |

|

Accrued expenses and deferred compensation |

|

|

(762 |

) |

|

|

1,254 |

|

Income taxes |

|

|

(633 |

) |

|

|

601 |

|

Net cash (used in) provided by operating activities |

|

|

(4,476 |

) |

|

|

6,167 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(1,972 |

) |

|

|

(1,051 |

) |

Proceeds from the sale of equipment |

|

|

309 |

|

|

|

465 |

|

Proceeds from note receivable |

|

|

150 |

|

|

|

— |

|

Proceeds from the sale of investments (rabbi trust) |

|

|

986 |

|

|

|

46 |

|

Purchase of investments (rabbi trust) |

|

|

(472 |

) |

|

|

(505 |

) |

Net cash used in investing activities |

|

|

(999 |

) |

|

|

(1,045 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Common stock surrendered for withholding taxes payable |

|

|

(146 |

) |

|

|

(33 |

) |

Payments of debt issuance costs |

|

|

— |

|

|

|

(206 |

) |

Net cash used in financing activities |

|

|

(146 |

) |

|

|

(239 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(129 |

) |

|

|

(296 |

) |

(Decrease) increase in cash and cash equivalents |

|

|

(5,750 |

) |

|

|

4,587 |

|

Cash and cash equivalents at beginning of year |

|

|

20,964 |

|

|

|

14,550 |

|

Cash and cash equivalents at end of period |

|

$ |

15,214 |

|

|

$ |

19,137 |

|

Free Cash Flow (3) |

|

$ |

(5,604 |

) |

|

$ |

4,826 |

|

(1) The non-cash inventory credit of $2.0 million for the six months ending October 29, 2023, represents a $2.1 million credit related to adjustments made to our inventory markdown reserve estimated based on our policy for aged inventory for both our mattress and upholstery segments, partially offset by a net charge of $101,000 which represents the markdown of inventory totaling $179,000 which occurred during the first quarter of fiscal 2024, partially offset by a gain on disposal of inventory totaling $78,000 which occurred during the second quarter of fiscal 2024, related to the discontinuation of production of cut and sewn upholstery kits at our facility in Ouanaminthe, Haiti.

(2) The non-cash inventory charge of $6.4 million for the six months ending October 30, 2022, represents a $2.9 million write down of inventory to its net realizable value associated with our mattress fabrics segment, $3.4 million related to markdowns of inventory estimated based on our policy for aged inventory for both our mattress and uphosltery fabrics segments, and $98,000 for the loss on disposal and markdowns of inventory related to the exit of our cut and sew upholstery fabrics operation located in Shanghai, China.

(3) See next page for Reconciliation of Free Cash Flow for the six-month periods ending October 29, 2023, and October 30, 2022, respectively.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 9

December 4, 2023

CULP, INC.

RECONCILIATION OF FREE CASH FLOW

FOR THE SIX MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

SIX MONTHS ENDED |

|

|

|

Amounts |

|

|

|

October 29, |

|

|

October 30, |

|

|

|

2023 |

|

|

2022 |

|

A) Net cash (used in) provided by operating activities |

|

$ |

(4,476 |

) |

|

$ |

6,167 |

|

B) Minus: Capital expenditures |

|

|

(1,972 |

) |

|

|

(1,051 |

) |

C) Plus: Proceeds from the sale of equipment |

|

|

309 |

|

|

|

465 |

|

D) Plus: Proceeds from note receivable |

|

|

150 |

|

|

|

— |

|

E) Plus: Proceeds from the sale of investments (rabbi trust) |

|

|

986 |

|

|

|

46 |

|

F) Minus: Purchase of investments (rabbi trust) |

|

|

(472 |

) |

|

|

(505 |

) |

G) Effects of exchange rate changes on cash and cash equivalents |

|

|

(129 |

) |

|

|

(296 |

) |

Free Cash Flow |

|

$ |

(5,604 |

) |

|

$ |

4,826 |

|

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 10

December 4, 2023

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE THREE MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THREE MONTHS ENDED |

|

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|

|

October 29, |

|

|

October 30, |

|

|

% Over |

|

|

October 29, |

|

|

October 30, |

|

Net Sales by Segment |

|

2023 |

|

|

2022 |

|

|

(Under) |

|

|

2023 |

|

|

2022 |

|

Mattress Fabrics |

|

$ |

31,377 |

|

|

$ |

26,230 |

|

|

|

19.6 |

% |

|

|

53.4 |

% |

|

|

44.9 |

% |

Upholstery Fabrics |

|

|

27,348 |

|

|

|

32,151 |

|

|

|

(14.9 |

)% |

|

|

46.6 |

% |

|

|

55.1 |

% |

Net Sales |

|

$ |

58,725 |

|

|

$ |

58,381 |

|

|

|

0.6 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit (Loss) |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

Mattress Fabrics |

|

$ |

2,483 |

|

|

$ |

(6,057 |

) |

|

|

(141.0 |

)% |

|

|

7.9 |

% |

|

|

(23.1 |

)% |

Upholstery Fabrics |

|

|

5,389 |

|

|

|

3,942 |

|

|

|

36.7 |

% |

|

|

19.7 |

% |

|

|

12.3 |

% |

Total Segment Gross Profit (Loss) |

|

|

7,872 |

|

|

|

(2,115 |

) |

|

|

(472.2 |

)% |

|

|

13.4 |

% |

|

|

(3.6 |

)% |

Restructuring Related Credit (Charge) (1) |

|

|

78 |

|

|

|

(98 |

) |

|

|

(179.6 |

)% |

|

|

0.1 |

% |

|

|

(0.2 |

)% |

Gross Profit (Loss) |

|

$ |

7,950 |

|

|

$ |

(2,213 |

) |

|

|

(459.2 |

)% |

|

|

13.5 |

% |

|

|

(3.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General and Administrative

Expenses by Segment |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

Mattress Fabrics |

|

$ |

3,419 |

|

|

$ |

2,945 |

|

|

|

16.1 |

% |

|

|

10.9 |

% |

|

|

11.2 |

% |

Upholstery Fabrics |

|

|

3,998 |

|

|

|

3,680 |

|

|

|

8.6 |

% |

|

|

14.6 |

% |

|

|

11.4 |

% |

Unallocated Corporate Expenses |

|

|

2,628 |

|

|

|

2,478 |

|

|

|

6.1 |

% |

|

|

4.5 |

% |

|

|

4.2 |

% |

Selling, General and Administrative

Expenses |

|

$ |

10,045 |

|

|

$ |

9,103 |

|

|

|

10.3 |

% |

|

|

17.1 |

% |

|

|

15.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations

by Segment |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

Mattress Fabrics |

|

$ |

(936 |

) |

|

$ |

(9,002 |

) |

|

|

(89.6 |

)% |

|

|

(3.0 |

)% |

|

|

(34.3 |

)% |

Upholstery Fabrics |

|

|

1,391 |

|

|

|

262 |

|

|

|

430.9 |

% |

|

|

5.1 |

% |

|

|

0.8 |

% |

Unallocated Corporate Expenses |

|

|

(2,628 |

) |

|

|

(2,478 |

) |

|

|

6.1 |

% |

|

|

(4.5 |

)% |

|

|

(4.2 |

)% |

Total Segment Loss from

Operations |

|

|

(2,173 |

) |

|

|

(11,218 |

) |

|

|

(80.6 |

)% |

|

|

(3.7 |

)% |

|

|

(19.2 |

)% |

Restructuring Related Credit (Charge) (1) |

|

|

78 |

|

|

|

(98 |

) |

|

|

(179.6 |

)% |

|

|

0.1 |

% |

|

|

(0.2 |

)% |

Restructuring Expense (1) |

|

|

(144 |

) |

|

|

(615 |

) |

|

|

(76.6 |

)% |

|

|

(0.2 |

)% |

|

|

(1.1 |

)% |

Loss from Operations |

|

$ |

(2,239 |

) |

|

$ |

(11,931 |

) |

|

|

(81.2 |

)% |

|

|

(3.8 |

)% |

|

|

(20.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation Expense by Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mattress Fabrics |

|

$ |

1,468 |

|

|

$ |

1,519 |

|

|

|

(3.4 |

)% |

|

|

|

|

|

|

Upholstery Fabrics |

|

|

149 |

|

|

|

200 |

|

|

|

(25.5 |

)% |

|

|

|

|

|

|

Depreciation Expense |

|

$ |

1,617 |

|

|

$ |

1,719 |

|

|

|

(5.9 |

)% |

|

|

|

|

|

|

Notes

(1) See page 12 for our Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending October 29, 2023, and October 30, 2022.

-MORE-

CULP Announces Results for Second Quarter Fiscal 2024

Page 11

December 4, 2023

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE SIX MONTHS ENDED OCTOBER 29, 2023, AND OCTOBER 30, 2022

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIX MONTHS ENDED |

|

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|

|

October 29, |

|

|

October 30, |

|

|

% Over |

|

|

October 29, |

|

|

October 30, |

|

Net Sales by Segment |

|

2023 |

|

|

2022 |

|

|

(Under) |

|

|

2023 |

|

|

2022 |

|

Mattress Fabrics |

|

$ |

60,599 |

|

|

$ |

55,602 |

|

|

|

9.0 |

% |

|

|

52.5 |

% |

|

|

46.0 |

% |

Upholstery Fabrics |

|

|

54,788 |

|

|

|

65,383 |

|

|

|

(16.2 |

)% |

|

|

47.5 |

% |

|

|

54.0 |

% |

Net Sales |

|

$ |

115,387 |

|

|

$ |

120,985 |

|

|

|

(4.6 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit (Loss) |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

Mattress Fabrics |

|

$ |

4,477 |

|

|

$ |

(6,093 |

) |

|

|

(173.5 |

)% |

|

|

7.4 |

% |

|

|

(11.0 |

)% |

Upholstery Fabrics |

|

|

10,659 |

|

|

|

8,105 |

|

|

|

31.5 |

% |

|

|

19.5 |

% |

|

|

12.4 |

% |

Total Segment Gross Profit |

|

|

15,136 |

|

|

|

2,012 |

|

|

|

652.3 |

% |

|

|

13.1 |

% |

|

|

1.7 |

% |

Restructuring Related Charge (1) |

|

|

(101 |

) |

|

|

(98 |

) |

|

|

3.1 |

% |

|

|

(0.1 |

)% |

|

|

(0.1 |

)% |

Gross Profit |

|

$ |

15,035 |

|

|

$ |

1,914 |

|

|

|

685.5 |

% |

|

|

13.0 |

% |

|

|

1.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General and Administrative

Expenses by Segment |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

Mattress Fabrics |

|

$ |

6,811 |

|

|

$ |

5,829 |

|

|

|

16.8 |

% |

|

|

11.2 |

% |

|

|

10.5 |

% |

Upholstery Fabrics |

|

|

7,939 |

|

|

|

7,302 |

|

|

|

8.7 |

% |

|

|

14.5 |

% |

|

|

11.2 |

% |

Unallocated Corporate Expenses |

|

|

5,124 |

|

|

|

4,837 |

|

|

|

5.9 |

% |

|

|

4.4 |

% |

|

|

4.0 |

% |

Selling, General and Administrative

Expenses |

|

$ |

19,874 |

|

|

$ |

17,968 |

|

|

|

10.6 |

% |

|

|

17.2 |

% |

|

|

14.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations

by Segment |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

Mattress Fabrics |

|

$ |

(2,334 |

) |

|

$ |

(11,922 |

) |

|

|

(80.4 |

)% |

|

|

(3.9 |

)% |

|

|

(21.4 |

)% |

Upholstery Fabrics |

|

|

2,720 |

|

|

|

803 |

|

|

|

238.7 |

% |

|

|

5.0 |

% |

|

|

1.2 |

% |

Unallocated Corporate Expenses |

|

|

(5,124 |

) |

|

|

(4,837 |

) |

|

|

5.9 |

% |

|

|

(4.4 |

)% |

|

|

(4.0 |

)% |

Total Segment Loss from

Operations |

|

|

(4,738 |

) |

|

|

(15,956 |

) |

|

|

(70.3 |

)% |

|

|

(4.1 |

)% |

|

|

(13.2 |

)% |

Restructuring Related Charge (1) |

|

|

(101 |

) |

|

|

(98 |

) |

|

|

3.1 |

% |

|

|

(0.1 |

)% |

|

|

(0.1 |

)% |

Restructuring Expense (1) |

|

|

(482 |

) |

|

|

(615 |

) |

|

|

(21.6 |

)% |

|

|

(0.4 |

)% |

|

|

(0.5 |

)% |

Loss from Operations |

|

$ |

(5,321 |

) |

|

$ |

(16,669 |

) |

|

|

(68.1 |

)% |

|

|

(4.6 |

)% |

|

|

(13.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Capital (2) |

|

|

|

|

|

|

|

|

|