Current Report Filing (8-k)

February 03 2021 - 5:09PM

Edgar (US Regulatory)

false000175567200017556722021-02-012021-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 1, 2021

Corteva, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38710

|

|

82-4979096

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

974 Centre Road, Building 735

Wilmington, Delaware 19805

(Address of principal executive offices)(Zip Code)

(302) 485-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

CTVA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On February 3, 2021, Corteva, Inc. (the "Company") announced its consolidated financial results for the quarter and year ended December 31, 2020. A copy of the Company’s press release and financial statement schedules are furnished herewith on Form 8-K as Exhibits 99.1 and 99.2, respectively. The information contained in this report, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. In addition, the information contained in this report shall not be deemed to be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

Item 2.05 Costs Associated with Exit or Disposal Activities

On February 1, 2021, Corteva, Inc. (“Corteva”) approved restructuring actions designed to right-size and optimize footprint and organizational structure according to the business needs in each region with the focus on driving continued cost improvement and productivity. Corteva expects to record total pre-tax restructuring and asset-related charges of approximately $130 million - $170 million, comprised of approximately $40 million - $50 million of severance and related benefit costs, $40 million - $60 million of asset related charges, $10 million - $15 million of asset retirement obligations and $40 million - $45 million of costs related to contract terminations. Future cash payments related to this charge are anticipated to be approximately $90 million - $110 million, primarily related to the payment of severance and related benefits, asset retirement obligations, and costs related to contract terminations. The restructuring actions associated with this charge are expected to be substantially complete in 2021.

Cautionary Statement About Forward-Looking Statements

This report contains estimates and forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “guidance”, "plans," "expects," "will," "anticipates," "believes," "intends," "projects," "estimates" or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva's strategy for growth, timing of anticipated benefits from restructuring actions, expenditures, and financial results are forward-looking statements. Forward-looking statements and other estimates are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements and other estimates also involve risks and uncertainties, many of which are beyond Corteva's control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in our forward-looking statements and other estimates could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva's business, results of operations and financial condition. Some of the important factors that could cause Corteva's actual results to differ materially from those projected in any such forward-looking statements or estimates include: (i) failure to obtain or maintain the necessary regulatory approvals for some Corteva’s products; (ii) failure to successfully develop and commercialize Corteva’s pipeline; (iii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva’s biotechnology and other agricultural products; (iv) effect of changes in agricultural and related policies of governments and international organizations; (v) effect of competition and consolidation in Corteva’s industry; (vi) effect of competition from manufacturers of generic products; (vii) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (viii) effect of climate change and unpredictable seasonal and weather factors; (ix) risks related to oil and commodity markets; (x) competitor’s establishment of an intermediary platform for distribution of Corteva's products; (xi) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (xii) effect of industrial espionage and other disruptions to Corteva’s supply chain, information technology or network systems; (xiii) effect of volatility in Corteva’s input costs; (xiv) failure to realize the anticipated benefits of the internal reorganizations taken by DowDuPont in connection with the spin-off of Corteva and other cost savings initiatives; (xv) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xvi) failure of Corteva’s customers to pay their debts to Corteva, including customer financing programs; (xvii) increases in pension and other post-employment benefit plan funding obligations; (xviii) risks related to the indemnification obligations of legacy EID liabilities in connection with the separation of Corteva; (xix) effect of compliance with laws and requirements and adverse judgments on litigation; (xx) risks related to Corteva’s global operations; (xxi) failure to effectively manage acquisitions, divestitures, alliances and other portfolio actions; failure to enforce; (xxii) risks related to COVID-19; (xxiii) risks related to activist stockholders; (xxiv) Corteva’s intellectual property rights or defend against intellectual property claims

asserted by others; (xxv) effect of counterfeit products; (xxvi) Corteva’s dependence on intellectual property cross-license agreements; and (xxvii) other risks related to the Separation from DowDuPont.

Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement or other estimate, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva's management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement or other estimate, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements and estimates is included in the "Risk Factors" section of Corteva's Annual Report on Form 10-K, as modified by subsequent quarterly reports on Form 10-Q and Current Reports on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

|

|

Press Release dated February 3, 2021

|

|

|

Financial Statement Schedules dated February 3, 2021

|

|

|

|

|

104

|

The cover page from the Company’s Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

CORTEVA, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

/s/ Brian Titus

|

|

|

Brian Titus

|

|

|

Vice President and Controller

|

February 3, 2021

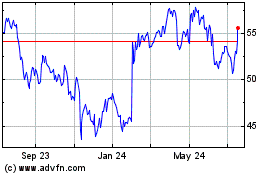

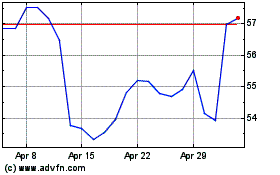

Corteva (NYSE:CTVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Corteva (NYSE:CTVA)

Historical Stock Chart

From Jul 2023 to Jul 2024