Wheat Leads Sinking Grains Down Following Trump Tweet

August 01 2019 - 4:11PM

Dow Jones News

By Kirk Maltais

--Wheat for September delivery fell 2.4% to $ 4.75 3/4 a bushel

on the Chicago Board of Trade on Thursday, with a surprise about a

new 10% tariff on Chinese goods driving trading lower late.

--Soybeans for November delivery fell 1.8% at $8.65 1/4 a

bushel.

--Corn for December delivery fell 1.8% to $4.02 1/2 a

bushel.

HIGHLIGHTS

More Tariffs More Problems: The revelation that the U.S. will

lobby a new tariff of 10% on $300 billion worth of Chinese goods

took its toll on grains in the late stages of trading Thursday.

China's apparent failure to honor promises to buy more U.S.

agriculture appear to be one factor driving President Trump's

decision. "The U.S.-China overall trade relationship is probably at

the worst it's been since early on in the negotiations," said Mike

Zuzolo of Global Commodity Analytics.

Weak Streak: Grain export sales again lagged behind trader

forecasts, according to USDA data - adding fuel to the fire of

concerns about weak grain demand. Corn sales were particularly bad,

with a total of 272,700 metric tons sold, nearly 50% below normal

levels amid numerous sales reductions from "unknown destinations."

Traders told Dow Jones Newswires Wednesday that they expected corn

sales to total 400,000 to 900,000 tons for both the 2018/19 and

2019/20 marketing years.

Not Low Enough: Wheat was down for the whole day, with traders

saying wheat prices need to come down further to be able to compete

with foreign wheat for global business. For most of this year, U.S.

wheat has been losing business to wheat from Russia and the EU

that's more competitively priced.

INSIGHT

Companies Mixed on China: Before President Trump's tweet this

afternoon, Archer Daniels Midland CEO Juan Luciano said that he is

trying to stay optimistic for a resolution to the U.S.-China trade

battle, which has pressured prices of ADM's grain and agricultural

products. "We remain confident in the resumption of significant

food and agricultural trade flows between the U.S. and China, which

will help bolster margins in the U.S. grain export and ethanol

industries," Mr. Luciano said. ADM rival Bunge was much less

certain, earlier this week saying it wasn't counting on a

resolution of the trade dispute in its outlook for the remainder of

2019.

Still Struggling: U.S. farmers, their suppliers and crop traders

continue to grapple with fallout from the wettest 12 months on

record, said seed and pesticide maker Corteva in its earnings call

Thursday. "The events that transpired in North America this year

are without precedent," says CEO Jim Collins. The former

agricultural unit of DowDuPont trimmed its full-year profit

guidance by $250 million to $300 million, as farmers skipped

herbicide sprays and switched to cheaper seeds thanks to the

rain.

AHEAD

-- The CFTC will releases its weekly commitment of traders data

at 3:30 p.m. EDT on Friday.

-- The USDA releases its weekly grain export inspections data at

11 a.m. EDT Monday.

--The USDA provides its weekly update on U.S. crop progress at 4

p.m. EDT Monday.

Jacob Bunge contributed to this article.

(END) Dow Jones Newswires

August 01, 2019 15:56 ET (19:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

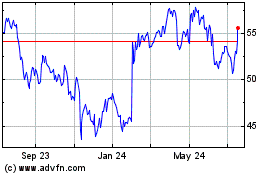

Corteva (NYSE:CTVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

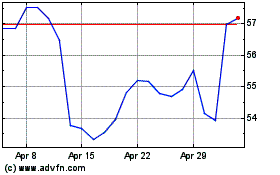

Corteva (NYSE:CTVA)

Historical Stock Chart

From Jul 2023 to Jul 2024