CorEnergy Declares Common and Preferred Dividends, Provides Volume Update and Schedules Results Release for Second Quarter 2022

August 05 2022 - 8:30AM

Business Wire

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA)

("CorEnergy" or the "Company") announced today that its Board of

Directors declared a second quarter 2022 dividend of $0.05 per

share for its common stock, consistent with the preceding quarter.

The dividend is payable on August 31, 2022 to shareholders of

record on August 17, 2022.

The Board of Directors also declared a cash dividend of

$0.4609375 per depositary share for the Company’s 7.375% Series A

Cumulative Redeemable Preferred Stock. The preferred stock

dividend, which equates to an annual dividend payment of $1.84375

per depositary share, is payable on August 31, 2022, to

shareholders of record on August 17, 2022.

California Crude Oil Volume Update

The Company also announced that its joint venture with Crimson

Midstream experienced an unexpected volume decline in the second

quarter, primarily due to supply disruptions in the global oil

market resulting in the California refineries altering their

historical crude oil sourcing patterns. However, the volume loss

has reversed beginning in July due to operational issues in the

crude oil supply chain unrelated to the Crimson assets. As a

result, volumes are expected to remain near first quarter 2022

volumes as long as the third-party operational issues persist.

The level of volume volatility in 2022 is unusual compared to

historical patterns. Based upon the impact of current market

conditions on our customers, and therefore on volumes shipped on

Crimson’s pipelines in any given month, swings in revenue may occur

quarter to quarter, until the global oil markets return to a more

normal state.

Despite the low second quarter volume and uncertainty of the

duration of other supply chain issues, the Company maintains its

revised adjusted EBITDA guidance of $42 to $44 million. The Company

expects to benefit from potential increase in crude oil volume

available to be shipped upon the conversion of the Phillips 66

Rodeo refinery to renewable diesel, scheduled for first quarter

2024.

The Company also announced that Crimson subsidiaries recently

submitted applications for 10% rate increases to the California

Public Utilities Commission. These rate increases mitigate the

adverse earnings impact of long term decline in oil production in

California. The rate increase will become effective in the third

quarter; as always, rate increases are subject to potential refund

if the cost of service impact of lower volume is successfully

challenged.

Second Quarter 2022 Results Release Date

The Company announced that it will report results for its second

quarter ended June 30, 2022, on August 11, 2022.

CorEnergy will host a conference call on Thursday, August 11,

2022, at 10:00 a.m. Central Time to discuss its financial results.

Please dial into the call at +1-973-528-0011 at least five minutes

prior to the scheduled start time. The call will also be webcast in

a listen-only format. A link to the webcast will be accessible at

corenergy.reit.

A webcast replay of the conference call will be available on the

Company’s website at corenergy.reit. A replay of the call will be

available until September 10, 2022, by dialing +1-919-882-2331. The

Conference ID is 46172.

About CorEnergy Infrastructure Trust,

Inc.

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA) is a

real estate investment trust that owns and operates regulated

natural gas transmission and distribution lines and crude oil

gathering, storage and transmission pipelines and associated

rights-of-way. For more information, please visit

corenergy.reit.

Forward-Looking

Statements

This press release contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although CorEnergy believes that the expectations reflected in

these forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Actual results could differ materially from

those anticipated in these forward-looking statements as a result

of a variety of factors, including that oil production in

California faces legal challenges, PSX’s Rodeo refinery may not

shut down as expected, our tariff rate changes might be contested,

customers may switch to competitor pipelines or use other

transportation methods and those discussed in CorEnergy's reports

that are filed with the Securities and Exchange Commission. You

should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Other than as required by law, CorEnergy does not assume a duty to

update any forward-looking statement. In particular, any

distribution paid in the future to our stockholders will depend on

the actual performance of CorEnergy, its costs of leverage and

other operating expenses and will be subject to the approval of

CorEnergy's Board of Directors and compliance with leverage

covenants.

Source: CorEnergy Infrastructure Trust, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220805005088/en/

CorEnergy Infrastructure Trust, Inc. Investor Relations Debbie

Hagen or Matt Kreps 877-699-CORR (2677) info@corenergy.reit

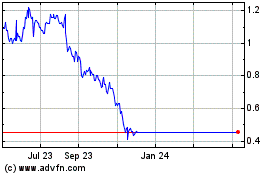

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Nov 2024 to Dec 2024

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Dec 2023 to Dec 2024