Community Financial System, Inc. Reports Second Quarter 2024 Results

July 23 2024 - 6:45AM

Business Wire

Community Financial System, Inc. (the “Company”) (NYSE: CBU)

reported second quarter 2024 results that are included in the

attached supplement. This earnings release, including supporting

financial tables, is also available within the press releases

section of the Company's investor relations website at:

https://ir.communityfinancialsystem.com/news-presentations/press-releases/.

An archived webcast of the earnings call will be available on this

site for one full year.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240723648837/en/

Second Quarter 2024 Performance

Summary

- Net income of $47.9 million, or $0.91 per fully diluted share,

increased $0.02 per fully diluted share from the prior year’s

second quarter and increased $0.15 per fully diluted share from the

first quarter of 2024

- Operating net income, a non-GAAP measure that excludes from net

income the after-tax effects of acquisition expenses,

acquisition-related contingent consideration adjustments,

litigation accrual, loss on sales of investment securities,

unrealized gain (loss) on equity securities and amortization of

intangible assets, of $50.5 million, or $0.95 per fully diluted

share, decreased $0.01 per fully diluted share from the prior

year’s second quarter and increased $0.13 per fully diluted share

from the first quarter of 2024

- Total revenues of $183.8 million, a new quarterly record for

the Company, increased $8.5 million, or 4.9%, from the prior year’s

second quarter and increased $6.5 million, or 3.7%, from the first

quarter of 2024

- Net interest income of $109.4 million increased $0.1 million,

or 0.1%, from the prior year’s second quarter and increased $2.4

million, or 2.3%, from the first quarter of 2024

- Total financial services (employee benefit services, insurance

services and wealth management services) revenues of $54.1 million,

also a new quarterly record for the Company, increased $5.8

million, or 12.1%, from the prior year’s second quarter and

increased $2.1 million, or 4.0%, from the first quarter of

2024

- Operating pre-tax, pre-provision net revenue, a non-GAAP

measure that excludes from income before income taxes the provision

for credit losses, acquisition expenses, acquisition-related

contingent consideration adjustments, litigation accrual, loss on

sales of investment securities, unrealized gain (loss) on equity

securities and amortization of intangible assets, of $68.1 million,

or $1.29 per fully diluted share, increased $0.05 per fully diluted

share from the prior year’s second quarter and increased $0.11 per

fully diluted share from the first quarter of 2024

- Total ending loans of $10.02 billion increased $140.4 million,

or 1.4%, from the end of the first quarter of 2024, marking the

twelfth consecutive quarter of loan growth, and increased $853.1

million, or 9.3%, from the end of the prior year’s second

quarter

- Total ending deposits of $13.14 billion decreased $214.1

million, or 1.6%, from the end of the first quarter of 2024 and

increased $266.1 million, or 2.1%, from the end of the prior year’s

second quarter

- Annualized loan net charge-offs were 0.05% for the quarter

- Tier 1 leverage ratio of 9.07% at the end of the quarter

continues to substantially exceed the regulatory well-capitalized

standard of 5.0%

Company management will conduct an investor call at 11:00 a.m.

(ET) today, July 23, 2024, to discuss the second quarter 2024

results. The conference call can be accessed at 1-833-630-0464

(1-412-317-1809 if outside the United States and Canada). Investors

may also listen live via the Internet at:

https://app.webinar.net/VN97qOvz8pd.

CBU Investor Day – September 6, 2024

Community Financial System, Inc. (NYSE: CBU) will host its

Investor Day on September 6, 2024, which will be available both in

person at the New York Stock Exchange conference facilities and

virtually. The event will provide an opportunity for investors to

engage directly with Company management, gain insights into

strategic initiatives, and explore the Company's future growth

prospects.

Registration Details:

- In-Person Attendance: Register here –

https://edge.media-server.com/mmc/p/ko6picw9

- Virtual Attendance: Register here –

https://edge.media-server.com/mmc/p/77ifdrya

Additional details, including the agenda, will be available on

the Company's website.

About Community Financial System, Inc.

Community Financial System, Inc. is a diversified financial

services company that is focused on four main business lines –

banking, employee benefit services, insurance services and wealth

management services. Its banking subsidiary, Community Bank, N.A.,

is among the country’s 100 largest banking institutions with over

$15 billion in assets and operates approximately 200 customer

facilities across Upstate New York, Northeastern Pennsylvania,

Vermont, and Western Massachusetts. The Company’s Benefit Plans

Administrative Services, Inc. subsidiary is a leading provider of

employee benefits administration, trust services, collective

investment fund administration, and actuarial consulting services

to customers on a national scale. The Company’s OneGroup NY, Inc.

subsidiary is a top 75 U.S. insurance agency. The Company also

offers comprehensive financial planning, trust administration and

wealth management services through its Community Bank Wealth

Management operating unit. The Company is listed on the New York

Stock Exchange and the Company’s stock trades under the symbol CBU.

For more information about the Company visit www.cbna.com or

www.communityfinancialsystem.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723648837/en/

For further information: Joseph E. Sutaris, EVP & Chief

Financial Officer Office: (315) 445-7396

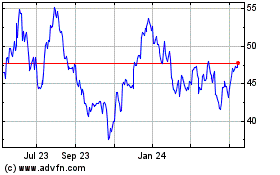

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Jun 2024 to Jul 2024

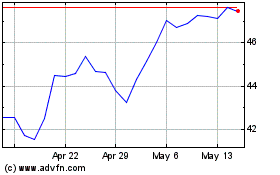

Community Financial System (NYSE:CBU)

Historical Stock Chart

From Jul 2023 to Jul 2024