Statement of Changes in Beneficial Ownership (4)

March 30 2020 - 1:48PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

AMERICAN INTERNATIONAL GROUP INC |

2. Issuer Name and Ticker or Trading Symbol

ClearBridge Energy Midstream Opportunity Fund Inc.

[

EMO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

See Remarks |

|

(Last)

(First)

(Middle)

175 WATER STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/27/2020 |

|

(Street)

NEW YORK, NY 10038

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| 4.51% Series G Senior Secured Notes due October 15, 2023 | 3/27/2020 | | J(1) | | 5099012.11 | D | $5253486.68 | $4097638.25 | I (2) | Held through subsidiaries |

| 4.66% Series H Senior Secured Notes due October 15, 2025 | 3/27/2020 | | J(1) | | 6836985.27 | D | $7048726.72 | $5494298.05 | I (3) | Held through subsidiaries |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | The reported disposition was pursuant to a partial prepayment by the issuer at a price equal to the face value of the prepaid securities, plus accrued and unpaid interest, plus a pro rata portion of the make-whole amount with respect to the principal, calculated in accordance with the note purchase agreement, dated as of October 15, 2013. |

| (2) | American General Life Insurance Company ("AGLIC") and American Home Assurance Company ("AHAC"), each an indirect wholly owned subsidiary of AIG, directly hold $2,796,638.10 principal amount and $1,301,000.15 principal amount, respectively, of the 4.51% Series G Senior Secured Notes due October 15, 2023 (the "Series G Notes"). AIG is an indirect beneficial owner of the Series G Notes. |

| (3) | AGLIC, AHAC, The United States Life Insurance Company in The City of New York ("USLIC") and The Variable Annuity Life Insurance Company ("VALIC"), each an indirect wholly owned subsidiary of AIG, directly held $727,994.49 principal amount, $1,744,439.63 principal amount, $549,429.81 principal amount and $2,472,434.12 principal amount, respectively, of the 4.66% Series H Senior Secured Notes due October 15, 2025 (the "Series H Notes"). AIG is an indirect beneficial owner of the Series H Notes. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

AMERICAN INTERNATIONAL GROUP INC

175 WATER STREET

NEW YORK, NY 10038 |

|

|

| See Remarks |

Signatures

|

| /s/ Geoffrey N. Cornell, Authorized Signatory of American International Group, Inc. | | 3/30/2020 |

| **Signature of Reporting Person | Date |

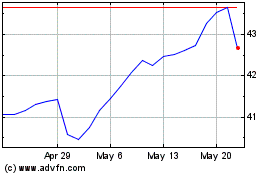

ClearBridge Energy Midst... (NYSE:EMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

ClearBridge Energy Midst... (NYSE:EMO)

Historical Stock Chart

From Jul 2023 to Jul 2024