Brookfield Public Securities Group LLC (“PSG”) has provided an

update for Center Coast Brookfield MLP & Energy Infrastructure

Fund (NYSE: CEN) (the “Fund”).

Registration and Webcast Link:

https://event.webcasts.com/starthere.jsp?ei=1575096&tp_key=202641075b

Shareholders may submit questions about the Fund by sending an

e-mail to publicsecurities.enquiries@brookfield.com.

A transcript of the update is available by calling 855-777-8001

or by sending an e-mail request to the Fund at

publicsecurities.enquiries@brookfield.com.

Brookfield Public Securities Group LLC (“PSG”) is an

SEC-registered investment adviser that represents the Public

Securities platform of Brookfield Asset Management Inc., providing

global listed real assets strategies including real estate

equities, infrastructure equities, energy infrastructure equities,

multi-strategy real asset solutions and real asset debt. With

approximately $22 billion of assets under management as of

September 30, 2022, PSG manages separate accounts, registered funds

and opportunistic strategies for financial institutions, public and

private pension plans, insurance companies, endowments and

foundations, sovereign wealth funds and individual investors. PSG

is a wholly owned subsidiary of Brookfield Asset Management Inc., a

leading global alternative asset manager with approximately $750

billion of assets under management as of June 30, 2022. For more

information, go to www.brookfield.com.

Center Coast Brookfield MLP & Energy Infrastructure Fund is

managed by PSG. The Fund uses its website as a channel of

distribution of material information about the Fund. Financial and

other material information regarding the Fund is routinely posted

on and accessible at https://publicsecurities.brookfield.com/.

COMPANY CONTACTCenter Coast Brookfield MLP

& Energy Infrastructure Fund

Brookfield Place250 Vesey Street, 15th FloorNew York, NY

10281-1023(855)

777-8001publicsecurities.enquiries@brookfield.com

Investing involves risk; principal loss is possible.

Past performance is not a guarantee of future results.

RisksThe outbreak of an infectious respiratory

illness caused by a novel coronavirus known as "COVID-19" is

causing materially reduced consumer demand and economic output,

disrupting supply chains, resulting in market closures, travel

restrictions and quarantines, and adversely impacting local and

global economies. As with other serious economic disruptions,

governmental authorities and regulators are responding to this

crisis with significant fiscal and monetary policy changes,

including by providing direct capital infusions into companies,

introducing new monetary programs and considerably lowering

interest rates, which in some cases resulted in negative interest

rates. These actions, including their possible unexpected or sudden

reversal or potential ineffectiveness, could further increase

volatility in securities and other financial markets, reduce market

liquidity, heighten investor uncertainty and adversely affect the

value of the Fund’s investments and the performance of the Fund.

Markets generally and the energy sector specifically, including

master limited partnerships (“MLPs”) and energy infrastructure

companies in which the Fund invests, have also been adversely

impacted by reduced demand for oil and other energy commodities as

a result of the slowdown in economic activity resulting from the

spread of COVID-19 and by price competition among key oil-producing

countries. While some vaccines have been developed and approved for

use by various governments, the political, social, economic, market

and financial risks of COVID-19 could persist for years to come.

These developments have and may continue to adversely impact the

Fund's NAV and the market price of the Fund's common shares.

The Fund’s investments are concentrated in the energy

infrastructure industry with an emphasis on securities issued by

MLPs, which may increase price fluctuation. The value of

commodity-linked investments such as the MLPs and energy

infrastructure companies (including midstream MLPs and energy

infrastructure companies) in which the Fund invests are subject to

risks specific to the industry they serve, such as fluctuations in

commodity prices, reduced volumes of available natural gas or other

energy commodities, slowdowns in new construction and acquisitions,

a sustained reduced demand for crude oil, natural gas and refined

petroleum products, depletion of the natural gas reserves or other

commodities, changes in the macroeconomic or regulatory

environment, environmental hazards, rising interest rates and

threats of attack by terrorists on energy assets, each of which

could affect the Fund’s profitability.

MLPs are subject to significant regulation and may be adversely

affected by changes in the regulatory environment including the

risk that an MLP could lose its tax status as a partnership. If an

MLP was obligated to pay federal income tax on its income at the

corporate tax rate, the amount of cash available for distribution

would be reduced and such distributions received by the Fund would

be taxed under federal income tax laws applicable to corporate

dividends received (as dividend income, return of capital, or

capital gain).

In addition, investing in MLPs involves additional risks as

compared to the risks of investing in common stock, including risks

related to cash flow, dilution and voting rights. Such companies

may trade less frequently than larger companies due to their

smaller capitalizations which may result in erratic price movement

or difficulty in buying or selling.

The Fund is a non-diversified, closed-end management investment

company. As a result, the Fund’s returns may fluctuate to a greater

extent than those of a diversified investment company. Shares of

closed-end management investment companies, such as the Fund,

frequently trade at a discount to their net asset value, which may

increase investors’ risk of loss. The Fund is not a complete

investment program and you may lose money investing in the

Fund.

Because of the Fund’s concentration in MLP investments, the Fund

is not eligible to be treated as a “regulated investment company”

under the Internal Revenue Code of 1986, as amended. Instead, the

Fund will be treated as a regular corporation, or “C” corporation,

for U.S. federal income tax purposes and, as a result, unlike most

investment companies, will be subject to corporate income tax to

the extent the Fund recognizes taxable income.

An investment in MLP units involves risks that differ from a

similar investment in equity securities, such as common stock, of a

corporation. Holders of MLP units have the rights typically

afforded to limited partners in a limited partnership. As compared

to common shareholders of a corporation, holders of MLP units have

more limited control and limited rights to vote on matters

affecting the partnership. There are certain tax risks associated

with an investment in MLP units. Additionally, conflicts of

interest may exist between common unit holders, subordinated unit

holders and the general partner of an MLP.

The Fund currently seeks to enhance the level of its current

distributions by utilizing financial leverage through borrowing,

including loans from financial institutions, or the issuance of

commercial paper or other forms of debt, through the issuance of

senior securities such as preferred shares, through reverse

repurchase agreements, dollar rolls or similar transactions or

through a combination of the foregoing. Financial leverage is a

speculative technique and investors should note that there are

special risks and costs associated with financial leverage.

Foreside Fund Services, LLC; distributor.

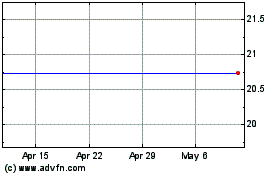

Center Coast Brookfield ... (NYSE:CEN)

Historical Stock Chart

From Feb 2025 to Mar 2025

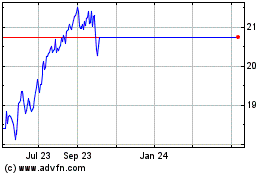

Center Coast Brookfield ... (NYSE:CEN)

Historical Stock Chart

From Mar 2024 to Mar 2025