The Buckle, Inc. (NYSE: BKE) announced today that net income for

the fiscal quarter ended July 30, 2016 was $15.5 million, or

$0.32 per share ($0.32 per share on a diluted basis).

Net sales for the 13-week fiscal quarter ended July 30,

2016 decreased 10.1 percent to $212.2 million from net sales of

$236.1 million for the prior year 13-week fiscal quarter ended

August 1, 2015. Comparable store net sales for the 13-week

period ended July 30, 2016 decreased 10.8 percent from

comparable store net sales for the prior year 13-week period ended

August 1, 2015. Online sales increased 1.4 percent to $20.4

million for the 13-week period ended July 30, 2016, compared

to net sales of $20.1 million for the 13-week period ended

August 1, 2015.

Net sales for the 26-week fiscal period ended July 30, 2016

decreased 10.2 percent to $455.7 million from net sales of $507.4

million for the prior year 26-week fiscal period ended

August 1, 2015. Comparable store net sales for the 26-week

period ended July 30, 2016 decreased 10.9 percent from

comparable store net sales for the prior year 26-week period ended

August 1, 2015. Online sales decreased 0.9 percent to $43.9

million for the 26-week period ended July 30, 2016, compared

to net sales of $44.3 million for the 26-week period ended

August 1, 2015.

Net income for the second quarter of fiscal 2016 was $15.5

million, or $0.32 per share ($0.32 per share on a diluted basis),

compared with $23.5 million, or $0.49 per share ($0.49 per share on

a diluted basis) for the second quarter of fiscal 2015.

Net income for the 26-week fiscal period ended July 30,

2016 was $38.6 million, or $0.80 per share ($0.80 per share on a

diluted basis), compared with $57.1 million, or $1.19 per share

($1.18 per share on a diluted basis) for the 26-week period ended

August 1, 2015.

Please note that net sales for the 13-week and 26-week periods

ended July 30, 2016 are reported net of the impact of both

reward redemptions and accruals for estimated future rewards

related to the Company’s new Guest Loyalty program, which launched

during the fiscal quarter ended April 30, 2016.

Management will hold a conference call at 10:00 a.m. EDT today

to discuss results for the quarter. To participate in the call,

please call (800) 230-1059 for domestic calls or (612) 234-9959 for

international calls and reference the conference code 399570. A

replay of the call will be available for a two-week period

beginning today at 12:00 p.m. EDT by calling (800) 475-6701 for

domestic calls or (320) 365-3844 for international calls and

entering the conference code 399570.

About Buckle

Offering a unique mix of high-quality, on-trend apparel,

accessories, and footwear, Buckle caters to fashion-conscious young

men and women. Known as a denim destination, each store carries a

wide selection of fits, styles, and finishes from leading denim

brands, including the Company’s exclusive brand, BKE. Headquartered

in Kearney, Nebraska, Buckle currently operates 470 retail stores

in 44 states. As of the end of the fiscal quarter, it operated 470

stores in 44 states compared with 464 stores in 44 states at the

end of the second quarter of fiscal 2015.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: All forward-looking statements made by the

Company involve material risks and uncertainties and are subject to

change based on factors which may be beyond the Company’s control.

Accordingly, the Company’s future performance and financial results

may differ materially from those expressed or implied in any such

forward-looking statements. Such factors include, but are not

limited to, those described in the Company’s filings with the

Securities and Exchange Commission. The Company does not undertake

to publicly update or revise any forward-looking statements even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized.

Note: News releases and other information on The Buckle, Inc.

can be accessed at www.buckle.com on the Internet.

THE BUCKLE, INC.

CONSOLIDATED STATEMENTS OF INCOME (Amounts in

Thousands Except Per Share Amounts) (Unaudited)

Thirteen Weeks Ended Twenty-Six Weeks

Ended

July 30,

August 1, July 30,

August 1, 2016 2015 2016 2015

SALES, Net of returns and allowances $ 212,157 $ 236,053 $

455,700 $ 507,398 COST OF SALES (Including buying,

distribution, and occupancy costs) 132,275 141,458

281,089 299,206 Gross profit 79,882

94,595 174,611 208,192 OPERATING

EXPENSES: Selling 46,065 46,358 93,628 95,512 General and

administrative 9,735 11,060 20,471

22,698 55,800 57,418 114,099 118,210

INCOME FROM OPERATIONS 24,082 37,177 60,512 89,982

OTHER INCOME, Net 595 272 1,003 1,008

INCOME BEFORE INCOME TAXES 24,677 37,449 61,515 90,990

PROVISION FOR INCOME TAXES 9,205 13,968

22,946 33,939 NET INCOME $ 15,472 $ 23,481 $ 38,569 $

57,051 EARNINGS PER SHARE: Basic $ 0.32 $ 0.49 $ 0.80

$ 1.19 Diluted $ 0.32 $ 0.49 $ 0.80 $ 1.18 Basic

weighted average shares 48,107 48,074 48,107 48,074 Diluted

weighted average shares 48,227 48,202 48,215 48,195

THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands Except Share and Per Share Amounts)

(Unaudited)

July 30, January 31, August 1,

ASSETS 2016 2016 (1) 2015

CURRENT ASSETS: Cash and cash equivalents $ 168,173 $ 161,185 $

122,458 Short-term investments 38,612 36,465 19,838 Receivables

16,954 9,651 16,037 Inventory 144,267 149,566 150,789 Prepaid

expenses and other assets 5,864 6,030

27,707 Total current assets 373,870

362,897 336,829 PROPERTY AND

EQUIPMENT 459,228 450,762 442,954 Less accumulated depreciation and

amortization (285,701 ) (277,981 ) (265,296 )

173,527 172,781 177,658

LONG-TERM INVESTMENTS 28,080 33,826 48,455 OTHER ASSETS

4,490 3,269 1,978

Total assets $ 579,967 $ 572,773 $ 564,920

LIABILITIES AND STOCKHOLDERS’ EQUITY CURRENT

LIABILITIES: Accounts payable $ 48,764 $ 33,862 $ 59,212 Accrued

employee compensation 15,289 33,126 18,884 Accrued store operating

expenses 14,294 6,639 10,495 Gift certificates redeemable 16,883

22,858 17,662 Income taxes payable - 11,141

- Total current liabilities 95,230

107,626 106,253 DEFERRED

COMPENSATION 14,186 12,849 13,576 DEFERRED RENT LIABILITY 39,825

39,655 40,804 OTHER LIABILITIES - -

9,769 Total liabilities 149,241

160,130 170,402 COMMITMENTS

STOCKHOLDERS’ EQUITY:

Common stock, authorized 100,000,000

shares of $.01 par value; issued and outstanding; 48,623,080 shares

at July 30, 2016, 48,428,110 shares at January 30, 2016, and

48,531,973 shares at August 1, 2015

486 484 485 Additional paid-in capital 138,535 134,864 135,621

Retained earnings 291,883 277,626 258,837 Accumulated other

comprehensive loss (178 ) (331 ) (425 ) Total

stockholders’ equity 430,726 412,643

394,518 Total liabiliites and stockholders’

equity $ 579,967 $ 572,773 $ 564,920

(1) Derived from audited financial statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160819005058/en/

The Buckle, Inc.Karen B. Rhoads, 308-236-8491Chief

Financial Officer

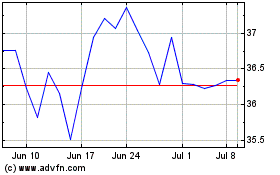

Buckle (NYSE:BKE)

Historical Stock Chart

From Sep 2024 to Oct 2024

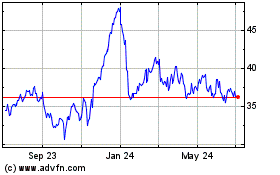

Buckle (NYSE:BKE)

Historical Stock Chart

From Oct 2023 to Oct 2024