Current Report Filing (8-k)

May 26 2021 - 6:04AM

Edgar (US Regulatory)

BOYD GAMING CORP false 0000906553 0000906553 2021-05-25 2021-05-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 25, 2021

Boyd Gaming Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Nevada

|

|

001-12882

|

|

88-0242733

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

3883 Howard Hughes Parkway, Ninth Floor

|

|

Las Vegas, Nevada 89169

|

|

(Address of Principal Executive Offices, Including Zip Code)

|

(702) 792-7200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, $0.01 par value

|

|

BYD

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On May 25, 2021, the Company entered into that certain Amendment No. 5 (the “Amendment”) among the Company, certain direct and indirect subsidiary guarantors of the Company (the “Guarantors”), Bank of America, N.A., as administrative agent, and certain other financial institutions party thereto as lenders. The Amendment modifies that certain Third Amended and Restated Credit Agreement (as amended prior to the execution of the Amendment, the “Existing Credit Agreement,” and as amended by the Amendment, the “Credit Agreement”), dated as of August 14, 2013, among the Company, Bank of America, N.A., as administrative agent and letter of credit issuer, Wells Fargo Bank, National Association, as swing line lender, and certain other financial institutions party thereto as lenders.

The Amendment modifies the Existing Credit Agreement to remove certain of the limitations imposed during the covenant relief period by a prior amendment on (i) the Company’s ability to refinance debt previously incurred under the ratio debt basket and (ii) the Company’s ability to repay junior secured or unsecured indebtedness, such that, during the covenant relief period, subject to certain limitations, including the achievement of a total net leverage ratio of 5.50 to 1.00 on a pro forma basis, the absence of events of default, pro forma compliance with financial covenants (to the extent applicable during the covenant relief period), the use of no more than $200 million of proceeds of borrowings under the revolving credit facility under the Credit Agreement for such purpose and no use of any cash or cash equivalents held in casino cages for such purpose, the Company may repay junior secured or unsecured indebtedness with cash on hand and borrowings under such revolving credit facility.

A copy of the Amendment is attached as Exhibit 10.1 hereto and incorporated herein by reference. The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth in Item 1.01 hereto is incorporated herein by reference.

Item 8.01. Other Events.

On May 25, 2021, Boyd Gaming Corporation (the “Company”) announced the pricing of $900,000,000 aggregate principal amount of 4.750% senior notes due 2031 (the “Notes”) in a private placement transaction (the “Notes Offering”). The Company’s press release announcing the pricing is attached as Exhibit 99.1 and is incorporated herein by reference.

The Company intends to use a portion of the proceeds from the Notes Offering to finance the redemption (the “6.375% Notes Redemption”) of all of its outstanding 6.375% senior notes due 2026 (the “Existing 6.375% Notes”). Concurrent with the Notes Offering, the Company also intends to redeem (the “6.000% Notes Redemption”) all of its outstanding 6.000% senior notes due 2026 (the “Existing 6.000% Notes”) using a combination of a portion of the proceeds from the Notes Offering and cash on hand. The Company plans to use a combination of a portion of the proceeds from the Notes Offering and borrowings under its revolving credit facility to pay the redemption premiums, accrued and unpaid interest, fees (including the initial purchasers’ fees), expenses and commissions related to the Notes Offering and the redemptions. Nothing in this Current Report should be construed as an offer to purchase, notice of redemption or a solicitation of an offer to purchase any of the Existing 6.375% Notes and/or any of the Existing 6.000% Notes, and the closing of Notes Offering is not conditioned on the redemption of the Existing 6.375% Notes and/or the Existing 6.000% Notes. However, each of the 6.375% Notes Redemption and the 6.000% Notes Redemption is expected to be conditioned on the consummation of the Notes Offering. In addition, the consummation of the 6.375% Notes Redemption is not conditioned on the consummation of the 6.000% Notes Redemption, and the 6.000% Notes Redemption is not conditioned on the consummation of the 6.375% Notes Redemption, and we may decide to consummate one of the contemplated note redemptions without also pursuing the other.

The Notes being offered have not been registered under the Securities Act, or applicable state securities laws or blue sky laws, and may not be offered or sold in the United States absent registration under the Securities Act and applicable state securities laws or available exemptions from such registration requirements. This disclosure shall not constitute an offer to sell or the solicitation of an offer to buy the Notes.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

10.1

|

|

Amendment No. 5, dated as of May 25, 2021, among the Company, the Guarantors, Bank of America, N.A., as administrative agent and letter of credit issuer, Wells Fargo Bank, National Association as swing line lender, and certain other financial institutions party thereto as lenders.

|

|

|

|

|

99.1

|

|

Press Release, dated May 25, 2021, announcing the pricing of the Notes Offering.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

1

This Current Report on Form 8-K and the exhibits incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, without limitation, statements regarding our expectations, hopes or intentions regarding the future. These forward looking statements can often be identified by their use of words such as “will”, “predict”, “continue”, “forecast”, “expect”, “believe”, “anticipate”, “outlook”, “could”, “target”, “project”, “intend”, “plan”, “seek”, “estimate”, “should”, “may” and “assume”, as well as variations of such words and similar expressions referring to the future, and may include (without limitation) statements regarding the terms and conditions and timing of the Notes Offering. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in each such statement. Factors that could cause actual results to differ include (without limitation) the possibility that the Notes Offering will not be consummated at the expected time, on the expected terms, or at all; and the Company’s financial performance. Additional factors are discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2021 and in the Company’s other current and periodic reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this document are made based on information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement.

The information furnished pursuant to Item 8.01 of Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and Section 11 of the Securities Act and shall not be otherwise subject to the liabilities of those sections. This Current Report will not be deemed an admission by the Company as to the materiality of any information in this Current Report that is required to be disclosed solely by Item 8.01. The Company does not undertake a duty to update the information in this Current Report and cautions that the information included in this Current Report under Item 8.01 is current only as of the date hereof and may change thereafter.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 25, 2021

|

|

|

|

Boyd Gaming Corporation

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Anthony D. McDuffie

|

|

|

|

|

|

|

|

Anthony D. McDuffie

|

|

|

|

|

|

|

|

Vice President and Chief Accounting Officer

|

3

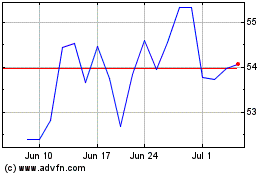

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Jul 2023 to Jul 2024