- Sales up 8%, driven by 7% organic growth in

Nutrition and foreign exchange

- Solid volume growth in Human Nutrition; very

strong volume growth in Animal Nutrition

- Nutrition EBITDA: negative impact of vitamin E

and Swiss franc largely offset

- Performance Materials EBITDA: improved on lower

input costs and cost savings despite soft sales

- Strong operating cash flow of €300 million

- 2015 outlook maintained

| third quarter |

|

|

|

price / |

exch. |

|

| 2015 |

2014 |

yoy |

in

€m |

volume |

mix |

rates |

other |

| |

|

|

Group |

|

|

|

|

| 1,945 |

1,794 |

8% |

Sales |

2% |

-1% |

6% |

1% |

| 287 |

281 |

2% |

EBITDA |

|

|

|

|

| |

|

|

Nutrition |

|

|

|

|

| 1,253 |

1,091 |

15% |

Sales |

6% |

1% |

6% |

2% |

| 213 |

225 |

-5% |

EBITDA |

|

|

|

|

| |

|

|

PM |

|

|

|

|

| 631 |

638 |

-1% |

Sales |

-3% |

-5% |

7% |

0% |

| 102 |

87 |

17% |

EBITDA |

|

|

|

|

Commenting on the results, Feike

Sijbesma, CEO/Chairman of the DSM Managing Board, said:

"DSM continued to make good progress in Q3 in both

EBITDA and cash generation. These results

demonstrate the benefits of our focus on improving our operational

performance. We are starting to implement the

previously announced €125-150 million cost reduction program for

the DSM-wide support functions. Tomorrow at our Capital Markets

Day, we will announce our strategy and targets for the coming

years, as well as an additional efficiency and cost reduction

program in Nutrition.

It is increasingly difficult to

predict macro-economic developments. Assuming

no major changes in current market conditions for the remainder of

this year, we maintain our full year outlook

to deliver an EBITDA in 2015 ahead of 2014, the increase mainly

driven by positive foreign exchange effects."

Sales, EBITDA, operating working capital and cash flow refer to

continuing operations.

Key figures

| third quarter |

|

|

|

|

|

exch.

rates |

|

| 2015 |

2014 |

+/- |

|

in €

million |

volume |

price/mix |

other |

| |

|

|

|

Net sales |

|

|

|

|

| 1,253 |

1,091 |

15% |

|

Nutrition |

6% |

1% |

6% |

2% |

| 631 |

638 |

-1% |

|

Performance Materials |

-3% |

-5% |

7% |

|

| 42 |

40 |

5% |

|

Innovation Center |

-5% |

-1% |

11% |

|

| 19 |

25 |

|

|

Corporate Activities |

|

|

|

|

| 1,945 |

1,794 |

8% |

|

Total continuing operations |

2% |

-1% |

6% |

1% |

| 157 |

529 |

|

|

Discontinued operations |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| third quarter |

|

|

|

January - September |

|

|

| 2015 |

2014 |

+/- |

|

in € million |

2015 |

2014 |

+/- |

|

| |

|

|

|

EBITDA |

|

|

|

|

| 213 |

225 |

-5% |

|

Nutrition |

616 |

650 |

-5% |

|

| 102 |

87 |

17% |

|

Performance Materials |

294 |

243 |

21% |

|

| 0 |

-4 |

|

|

Innovation Center |

-8 |

-15 |

|

|

| -28 |

-27 |

|

|

Corporate Activities |

-88 |

-94 |

|

|

| 287 |

281 |

2% |

|

Total continuing operations |

814 |

784 |

4% |

|

| 3 |

34 |

|

|

Discontinued operations |

94 |

94 |

|

|

| |

|

|

|

|

|

|

|

|

| 123 |

132 |

-7% |

|

Core net profit (continuing operations) |

340 |

360 |

-6% |

|

| 106 |

113 |

-6% |

|

Net

profit before exceptional items, |

285 |

312 |

-9% |

|

| |

continuing operations |

|

| 36 |

93 |

-61% |

|

Net

profit after exceptional items,

total DSM |

65 |

252 |

-74% |

|

| |

|

|

|

|

|

|

|

|

| 0.70 |

0.76 |

-8% |

|

Core EPS (€/share) |

1.95 |

2.08 |

-6% |

|

| 0.59 |

0.64 |

-8% |

|

Net EPS before exceptional items, continuing operations

(€/share) |

1.61 |

1.78 |

-10% |

|

| 0.19 |

0.51 |

-63% |

|

Net EPS

after exceptional items,

total DSM (€/share) |

0.33 |

1.41 |

-77% |

|

| |

|

|

|

|

|

|

|

|

| 300 |

252 |

|

|

Cash flow from continuing operations |

487 |

387 |

|

|

| 113 |

87 |

|

|

Capital expenditures continuing operations

(cash, net of customer funding) |

321 |

269 |

|

|

| |

|

|

|

Net

debt |

2,395 |

2,420 |

* |

|

| |

|

|

|

*

year-end 2014 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In this report:

-

'Organic sales growth' is the

total impact of volume and price/mix;

-

'Discontinued operations'

comprises net sales and operating profit (before depreciation and

amortization) of DSM Pharmaceutical Products up to and including 10

March 2014 as well as DSM Fibre Intermediates and DSM Composite

Resins up to and including 31 July 2015;

-

'Core net profit' is the net

profit from continuing operations before exceptional items and

before acquisition related (intangible) asset

amortization.

Note: all tables are available in the attached

Press release-PDF

Review by cluster

Nutrition

Q3 sales increased 15%, driven by very strong

volume growth in Animal Nutrition & Health and solid volume

developments in Human Nutrition & Health. As a result of higher

prices for some vitamins and other, partly in-sourced, ingredients,

the price/mix-effect was slightly positive despite lower

vitamin E prices.

Q3 EBITDA was 5% lower at €213 million versus Q3 2014. Good volume

growth and overall positive foreign exchange rates largely offset

the negative impact of lower vitamin E prices (of more than €30

million). Positive foreign exchange rates effects mainly associated

with the US dollar were partly offset by the negative impact of the

Swiss franc, the Brazilian real and the Chinese renminbi. The

weakening of the Brazilian real, to which DSM is exposed mainly via

its Tortuga business, had a negative EBITDA impact of ~€5

million.

Animal Nutrition & Health

Volume: Q3 showed very strong volume growth driven

by the premix activities and specialty products in Europe and Latin

America. Although underlying business conditions in the global

animal feed markets are expected to remain favorable, going forward

DSM will face tougher comparative figures for organic growth as

from Q4 2014.

Price: As in the first half of this year, the

price development compared to Q3 2014 was a combination of

significantly lower vitamin E prices and higher prices for a range

of other products. Since a substantial part of these other products

are in-sourced, these increased prices only have limited benefit at

EBITDA level.

Human Nutrition & Health

Volume: DSM delivered solid volume growth in spite

of the continued soft environment in several key market segments.

The dietary supplements businesses continued to show good growth in

Europe and Asia and an ongoing mixed picture in the US where sales

of fish oil and (multi) vitamin based supplements declined in

Q3.

I-Health, DSM's B2C business, continued to deliver double-digit

growth. Conditions in the Food & beverage segment are unchanged

with good sales development in Europe and Asia and ongoing weak

sales in North and South America. Markets for Infant Nutrition are

stable, although DSM's sales were relatively weak in Q3 due to

timing of orders.

Price: Prices were slightly lower versus Q3 2014

mainly as a result of lower vitamin E prices and some mix

effects.

Food Specialties

Q3 showed good volume growth in Enzymes and

Cultures. Also the yeast extract-based savory business is

performing increasingly well.

Performance Materials

Sales in Q3 decreased by 1%

compared to Q3 2014 as a result of overall soft volumes, although

strong in specialties, and lower prices reflecting lower input

costs.

In DSM Engineering Plastics volumes were slightly

down. PA6 polymers sales were weak, amplified by restricted product

availability due to temporary production issues. Compounds and

specialty products showed good volume growth.

In DSM Resins and Functional Materials volumes

declined due to weak demand. Lower prices reflected lower input

costs and a less favorable mix. The market environment for the UV

curable coating resins business of DSM AGI in Asia remained

difficult.

DSM Dyneema delivered

modest organic growth versus Q3 2014 mainly due to timing of orders

in comparison with Q3 2014.

EBITDA in Performance

Materials for the quarter increased by 17% versus Q3 2014. On a

structural base, good margin management and efficiency & cost

savings programs over recent years contributed positively. The

increase in EBITDA was, however, also enhanced by positive foreign

exchange effects as well as temporarily strong margin improvements

due to low input costs.

EBITDA of DSM Engineering Plastics was

substantially up due to higher margins and lower costs.

EBITDA of DSM Resins and Functional Materials was

materially up due to continued good margins and lower costs.

DSM Dyneema showed solid EBITDA growth.

Innovation Center

Sales: DSM Biomedical continues to operate in a

challenging US market.

EBITDA in Q3 improved compared to Q3 2014 driven

by a stronger focus in the innovation activities, cost savings and

positive currency developments.

Corporate Activities

EBITDA in Q3 2015 was in line

with the average quarterly run-rate as well as Q3 2014.

Key joint ventures and associates

DSM Sinochem Pharmaceuticals

(50% DSM) showed a solid financial performance in Q3

supported by favorable exchange rate effects.

DPx holdings (49%

DSM): DPx showed a solid performance. Margin was in line

with previous quarters. On 8 June 2015 DPx, to be renamed Patheon,

has filed a registration statement on Form S-1 with the United

States Securities and Exchange Commission relating to the proposed

initial public offering of its common stock. The timing of the

offering as well as the number of shares to be offered and the

price range for the offering have not yet been determined.

ChemicaInvest (35% DSM): Sales in Q3 were lower

than last year, with lower caprolactam sales coming from a loss in

production following an outage in China and low feedstock

costs.

Discontinued operations

Polymer Intermediates

and Composite Resins

Discontinued operations comprises net sales and

operating profit of DSM Fibre Intermediates and DSM Composite

Resins up to and including 31 July 2015. From that date onwards

their activities have been transferred to ChemicaInvest.

Financial overview Exceptional items

Exceptional items in the

third quarter included non-cash impairment charges of €25 million

related to the obsolescence of certain IT assets as a consequence

of outsourcing and equipment no longer being used. A charge of €15

million was recognized for the devaluation of financial assets in

Venezuela. Restructuring costs and related expenses amounted to €36

million, whilst acquisition related costs and other items were €12

million. Due to these charges a tax benefit of €23 million could be

recognized resulting in a total after tax impact of €65 million.

Associates reported exceptional items of €6 million after tax.

Net profit

Financial income and expense

in Q3 2015 amounted to -€28 million compared to -€26 million in Q3

2014.

The effective tax rate in Q3

2015 remained 18%, equal to the full year 2014.

Net profit from continuing

operations, before exceptional items in Q3 2015 amounted to

€106 million compared to €113 million in Q3 2014.

Net earnings per ordinary share

(continuing operations, before exceptional items) amounted to

€0.59 in Q3 2015 compared to €0.64 in Q3 2014.

Cash flow, capital expenditure and financing

Cash provided by operating

activities from continuing operations in Q3 2015 was €300

million (Q3 2014: €252 million).

Operating working capital

(continuing operations) expressed as a percentage of annualized

sales amounted to 24.9% compared to 26.3% at year-end 2014, in line

with DSM's ambition to further reduce operating working capital. In

Nutrition, operating working capital as a percentage of annualized

sales declined from 34% at year-end 2014 to 32%. The operating

working capital in absolute terms increased by €32 million from

€1,903 million at year-end of 2014 to €1,935 million at the end of

Q3 2015.

Cash used for capital expenditure

net of customer funding (continuing operations) amounted to

€113 million in Q3 2015 compared to €87 million in Q3 2014.

Net debt decreased by €468

million compared to Q2 2015, reflecting the good operating cash

flow and a positive development in mark-to-market value of

financial derivatives held as well as the proceeds from the sale of

the Polymer Intermediates and Composite Resins activities of €282

million.

Outlook 2015

The volatility in currencies, including the

strengthening of the Swiss franc and the US dollar against the

Euro, and the recent weakening of the Brazilian real will have a

mixed effect on DSM's 2015 results compared to 2014. Based on

current exchange rates and the 2015 hedge effects, an overall

annual positive impact on 2015 EBITDA is estimated at approximately

€35 million.

The negative price impact of vitamin E on DSM's

2015 EBITDA is estimated to be approximately €100 million compared

to 2014.

It is increasingly difficult to predict the

macro-economic developments. Assuming current market conditions

will continue for the remainder of the year, DSM maintains its full

year outlook: DSM aims to deliver an EBITDA in 2015 ahead of 2014,

the increase mainly driven by positive foreign exchange

effects.

Additional information

Today DSM will hold a conference call for

investors and analysts from 09.00 to 9.45 CET. Details on how to

access this call can be found on the DSM website, www.dsm.com.

Tomorrow, 4 November 2015, DSM will issue a press

release at 7.15 CET on the information to be discussed at

tomorrow's Capital Markets Day, where DSM will update the markets

on DSM's strategy and targets. DSM will organize a conference call

for the media tomorrow on both the Q3 results and the highlights of

the Capital Markets Day from 09.00 AM to 09.30 AM CET. Details on

how to access this call can be found on the DSM website,

www.dsm.com. The DSM Capital Markets Day can be followed live via

Video webcast from 13.30-19.00 hrs (CET). The presentations can be

found on www.dsm.com as from 13.30 hrs (CET).

Important dates

Capital Markets Day

Wednesday, 4 November

2015

Full year results 2015

Wednesday, 17 February 2016

Report for the first quarter of 2016

Tuesday, 26 April 2016

Annual General Meeting of Shareholders 2016

Friday, 29 April 2016

Report for the second quarter of 2016

Tuesday, 2 August

2016

Report for the third quarter of 2016

Thursday, 3 November 2016

Heerlen, 3 November 2015

The Managing Board

Feike Sijbesma, CEO/Chairman

Geraldine Matchett, CFO

Stephan Tanda

Dimitri de Vreeze

DSM - Bright Science.

Brighter Living.(TM)

Royal DSM is a global science-based company active

in health, nutrition and materials. By connecting its unique

competences in Life Sciences and Materials Sciences DSM is driving

economic prosperity, environmental progress and social advances to

create sustainable value for all stakeholders simultaneously. DSM

delivers innovative solutions that nourish, protect and improve

performance in global markets such as food and dietary supplements,

personal care, feed, medical devices, automotive, paints,

electrical and electronics, life protection, alternative energy and

bio-based materials. DSM and its associated companies deliver

annual net sales of about €10 billion with approximately 25,000

employees. The company is listed on Euronext Amsterdam. More

information can be found at www.dsm.com.

Or find us on:

For more information:

DSM

Corporate Communications

Herman Betten

tel. +31 (0) 45 5782017

e-mail media.contacts@dsm.com |

DSM

Investor Relations

Dave Huizing

tel. +31 (0) 45 5782864

e-mail investor.relations@dsm.com |

Presentation to Investors PDF

Press release-PDF

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: DSM N.V. via Globenewswire

HUG#1963533

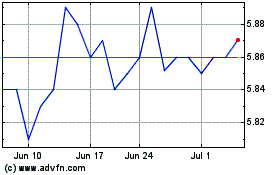

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

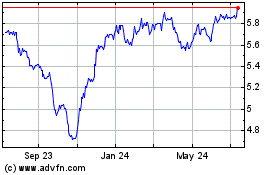

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Jul 2023 to Jul 2024