Blackstone Mortgage Trust Reports Second Quarter 2024 Results

July 24 2024 - 7:00AM

Business Wire

Blackstone Mortgage Trust, Inc. (NYSE: BXMT) today reported its

second quarter 2024 results. The net loss attributable to

Blackstone Mortgage Trust for the quarter was $61 million. Second

quarter EPS, Distributable EPS, Distributable EPS prior to

charge-offs, and dividends paid per basic share were ($0.35),

$0.49, $0.56, and $0.62, respectively.

In addition, BXMT declared a dividend of $0.47 per share of

class A common stock with respect to the third quarter of 2024.

This dividend is payable on October 15, 2024, to stockholders of

record as of September 30, 2024.

BXMT also announced that its Board of Directors has authorized a

share repurchase program for up to $150.0 million of the Company’s

class A common stock.

Katie Keenan, Chief Executive Officer, said, “We believe

stockholder return is well served by balancing current return with

optimization of book value and long-term earnings potential through

our strategic capital allocation decisions. We assess the dividend

with the Board each quarter, prudently considering a variety of

factors, and our Board has declared a third quarter dividend of

$0.47 per share, which we believe reflects a sustainable level

relative to long-term earnings power. With strong liquidity,

accelerating repayments, and an emerging investment pipeline, BXMT

is well positioned to deploy capital accretively in this

environment and continue its forward trajectory through the

cycle.”

Blackstone Mortgage Trust issued a full presentation of its

second quarter 2024 results, which can be viewed at www.bxmt.com.

An updated investor presentation may also be viewed on the

website.

Quarterly Investor Call Details

Blackstone Mortgage Trust will host a conference call today at

9:00 a.m. ET to discuss results. To register for the webcast,

please use the following link:

https://event.webcasts.com/starthere.jsp?ei=1678028&tp_key=56a32bd9f3.

For those unable to listen to the live broadcast, a recorded replay

will be available on the company's website at www.bxmt.com

beginning approximately two hours after the event.

About Blackstone Mortgage Trust

Blackstone Mortgage Trust (NYSE: BXMT) is a real estate finance

company that originates senior loans collateralized by commercial

real estate in North America, Europe, and Australia. Our investment

objective is to preserve and protect shareholder capital while

producing attractive risk-adjusted returns primarily through

dividends generated from current income from our loan portfolio.

Our portfolio is composed primarily of loans secured by

high-quality, institutional assets in major markets, sponsored by

experienced, well-capitalized real estate investment owners and

operators. These senior loans are capitalized by accessing a

variety of financing options, depending on our view of the most

prudent strategy available for each of our investments. We are

externally managed by BXMT Advisors L.L.C., a subsidiary of

Blackstone. Further information is available at www.bxmt.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We

seek to deliver compelling returns for institutional and individual

investors by strengthening the companies in which we invest. Our

more than $1 trillion in assets under management include global

investment strategies focused on real estate, private equity,

infrastructure, life sciences, growth equity, credit, real assets,

secondaries and hedge funds. Further information is available at

www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter),

and Instagram.

Forward-Looking Statements and Other Matters

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which reflect BXMT’s current views with respect to, among

other things, its operations and financial performance, its

business plans and the impact of the current macroeconomic

environment, including interest rate changes. You can identify

these forward-looking statements by the use of words such as

“outlook,” “objective,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “seeks,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. BXMT believes these

factors include but are not limited to those described under the

section entitled “Risk Factors” in its Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, as such factors may be

updated from time to time in its periodic filings with the

Securities and Exchange Commission (“SEC”) which are accessible on

the SEC’s website at www.sec.gov. These factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are included in this release and

in the filings. BXMT assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events or circumstances.

We refer to “Distributable EPS” and “Distributable EPS prior to

charge-offs,” which are non-GAAP financial measures, in this press

release. A reconciliation to net income (loss) attributable to

Blackstone Mortgage Trust, the most directly comparable GAAP

measure, is included in our full detailed presentation of second

quarter 2024 results and is available on our website at

www.bxmt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724885080/en/

Investor Relations Blackstone +1 (888) 756-8443

BlackstoneShareholderRelations@Blackstone.com

Public Affairs Blackstone +1 (212) 583-5263

PressInquiries@Blackstone.com

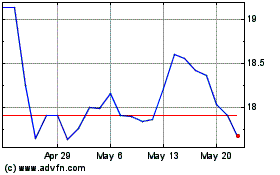

Blackstone Mortgage (NYSE:BXMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

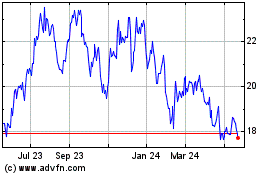

Blackstone Mortgage (NYSE:BXMT)

Historical Stock Chart

From Nov 2023 to Nov 2024