Blackstone Mortgage Trust Declares $0.62 Per Share Dividend

March 15 2024 - 4:16PM

Business Wire

Blackstone Mortgage Trust, Inc. (NYSE: BXMT) declared a dividend

of $0.62 per share of class A common stock with respect to the

first quarter of 2024. This dividend is payable on April 15, 2024

to stockholders of record as of the close of business on March 28,

2024.

About Blackstone Mortgage Trust Blackstone Mortgage Trust

(NYSE: BXMT) is a real estate finance company that originates

senior loans collateralized by commercial real estate in North

America, Europe, and Australia. Our investment objective is to

preserve and protect shareholder capital while producing attractive

risk-adjusted returns primarily through dividends generated from

current income from our loan portfolio. Our portfolio is composed

primarily of loans secured by high-quality, institutional assets in

major markets, sponsored by experienced, well-capitalized real

estate investment owners and operators. These senior loans are

capitalized by accessing a variety of financing options, depending

on our view of the most prudent strategy available for each of our

investments. We are externally managed by BXMT Advisors L.L.C., a

subsidiary of Blackstone. Further information is available at

www.bxmt.com.

About Blackstone Blackstone is the world’s largest

alternative asset manager. We seek to deliver compelling returns

for institutional and individual investors by strengthening the

companies in which we invest. Our more than $1 trillion in assets

under management include global investment strategies focused on

real estate, private equity, infrastructure, life sciences, growth

equity, credit, real assets, secondaries and hedge funds. Further

information is available at www.blackstone.com. Follow @blackstone

on LinkedIn, X (Twitter), and Instagram.

Forward-Looking Statements This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which reflect BXMT’s

current views with respect to, among other things, its operations

and financial performance, its business plans and the impact of the

current macroeconomic environment, including interest rate changes.

You can identify these forward-looking statements by the use of

words such as “outlook,” “objective,” “indicator,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,”

“seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”

or the negative version of these words or other comparable words.

Such forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. BXMT believes these

factors include but are not limited to those described under the

section entitled “Risk Factors” in its Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, as such factors may be

updated from time to time in its periodic filings with the

Securities and Exchange Commission (“SEC”) which are accessible on

the SEC’s website at www.sec.gov. These factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are included in this release and

in the filings. BXMT assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240315038113/en/

Investor Relations Blackstone +1 (888) 756-8443

BlackstoneShareholderRelations@Blackstone.com

Public Affairs Blackstone +1 (212) 583-5263

PressInquiries@Blackstone.com

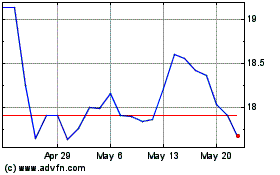

Blackstone Mortgage (NYSE:BXMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

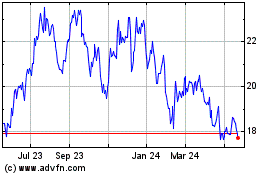

Blackstone Mortgage (NYSE:BXMT)

Historical Stock Chart

From Nov 2023 to Nov 2024