UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21178

| Name of Fund: |

|

BlackRock Municipal Income Quality Trust (BYM) |

| Fund Address: |

|

100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for

service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal Income Quality Trust, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2023

Date of reporting period: 07/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

|

|

|

|

|

|

JULY 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM)

BlackRock Municipal Income Trust II (BLE)

BlackRock MuniVest Fund, Inc.

(MVF)

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

Despite an uncertain economic

landscape during the 12-month reporting period ended July 31, 2023, the resilience of the U.S. economy in the face of ever tighter financial conditions provided an encouraging backdrop for investors. While inflation was near multi-decade highs

at the beginning of the period, it declined precipitously as commodity prices dropped. Labor shortages also moderated, although wages continued to grow and unemployment rates reached the lowest levels in decades. This robust labor market powered

further growth in consumer spending, backstopping the economy.

Equity returns were solid, as the durability of consumer sentiment eased

investors’ concerns about the economy’s trajectory. The U.S. economy resumed growth in the third quarter of 2022 and continued to expand thereafter. Most major classes of equities advanced, including large- and small-capitalization U.S.

stocks and equities from developed and emerging markets.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as

investors reacted to elevated inflation and attempted to anticipate future interest rate changes. The corporate bond market also faced inflationary headwinds, although high-yield corporate bond prices fared significantly better than investment-grade

bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been

more persistent than expected, raised interest rates seven times during the 12-month period ended July 31, 2023. Furthermore, the Fed wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities

that reach maturity. However, the Fed declined to raise interest rates at its June 2023 meeting, the first time it paused its tightening in the current cycle, before again raising rates in July 2023.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase

production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has decelerated the pace of interest

rate hikes and recently opted for a pause, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period to keep inflation under control. Furthermore, ongoing structural changes may mean that the

Fed will be hesitant to cut interest rates in the event of faltering economic activity lest inflation accelerate again. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers

attempt to adapt.

While we favor an overweight position to developed market equities in the long term, we prefer an underweight stance in the

near-term. Expectations for corporate earnings remain elevated, which seems inconsistent with macroeconomic constraints. Nevertheless, we are overweight on emerging market stocks in the near-term as growth trends for emerging markets appear

brighter. We also believe that stocks with an A.I. tilt should benefit from an investment cycle that is set to support revenues and margins. We are neutral on credit overall amid tightening credit and financial conditions; however, there are

selective opportunities in the near term. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. inflation-linked bonds, U.S. mortgage-backed securities, and

hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a

decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

|

|

|

|

|

| Total Returns as of July 31, 2023 |

| |

|

6-Month |

|

12-Month |

| U.S. large cap

equities

(S&P 500® Index) |

|

13.52% |

|

13.02% |

| U.S. small cap

equities

(Russell 2000® Index) |

|

4.51 |

|

7.91 |

| International

equities

(MSCI Europe, Australasia, Far East Index) |

|

6.65 |

|

16.79 |

| Emerging market

equities

(MSCI Emerging Markets Index) |

|

3.26 |

|

8.35 |

| 3-month Treasury

bills

(ICE BofA 3-Month U.S. Treasury Bill Index) |

|

2.34 |

|

3.96 |

| U.S. Treasury

securities

(ICE BofA 10-Year U.S. Treasury Index) |

|

(2.08) |

|

(7.56) |

| U.S. investment

grade bonds

(Bloomberg U.S. Aggregate Bond Index) |

|

(1.02) |

|

(3.37) |

| Tax-exempt

municipal bonds

(Bloomberg Municipal Bond Index) |

|

0.20 |

|

0.93 |

| U.S. high yield

bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

|

2.92 |

|

4.42 |

|

| Past performance is not an indication of future results. Index performance is shown for

illustrative purposes only. You cannot invest directly in an index. |

|

|

|

| 2 |

|

T H I S P A G E

I S N O T P A R T O F Y O U

R F U N D R E P O R T |

Table of Contents

|

|

|

| Municipal Market Overview For the Reporting Period Ended July 31, 2023 |

|

|

Municipal Market Conditions

Municipal bonds posted positive total returns amid heightened volatility. Interest rates rose rapidly early in the period as the Fed continued

its historic hiking cycle but became increasingly rangebound later in the reporting period as economic activity slowed, inflation expectations moderated, and the Fed tempered the magnitude and pace of its policy tightening. Strong credit

fundamentals, bolstered by robust post-pandemic revenue growth and elevated fund balances, drove strong positive excess returns versus comparable U.S. Treasuries. Lower-rated investment grade credits and the 15-year part of the yield curve performed

best.

|

|

|

| During the 12-month period ended July 31, 2023, municipal bond funds experienced net outflows totaling $52

billion (based on data from the Investment Company Institute), transitioning from the largest outflow cycle on record in 2022 to mixed in 2023. At the same time, the market contended with just $324 billion in issuance, well below the $422 billion

issued during the prior 12-months. However, elevated bid-wanted activity filled some of the gap as investors raised cash to meet redemptions, portfolio leverage was repositioned, and the Federal Deposit Insurance Corporation (“FDIC”)

liquidated collapsed bank assets. |

|

Bloomberg Municipal Bond Index(a)

Total Returns as of July 31, 2023

6 months: 0.20%

12 months: 0.93% |

A Closer Look at Yields

|

|

|

|

Source: Thomson

Municipal Market Data. |

|

From July 31, 2022, to July 31, 2023, yields on AAA-rated 30-year municipal bonds increased by 62 basis

points (“bps”) from 2.89% to 3.51%, ten-year yields increased by 36 bps from 2.21% to 2.57%, five-year yields increased by 86 bps from 1.80% to 2.66%, and two-year yields increased by 140 bps from 1.60% to 3.00% (as measured by Refinitiv

Municipal Market Data). As a result, the municipal yield curve flattened over the 12-month period with the spread between two- and 30-year maturities flattening by 78 bps to a slope of 51 bps. Still, the curve remained relatively steep compared to

the deeply inverted U.S. Treasury curve.

Outperformance throughout the period prompted historically rich valuations across the curve. Municipal-to-Treasury ratios tightened

well through their 5-year averages led by short and intermediate maturities. |

Financial Conditions of Municipal Issuers

Buoyed by successive federal aid injections, vaccine distribution, and the re-opening of the economy, states and many local governments experienced

revenue growth above forecasts in 2021 and 2022. However, revenue collections through April 2023, particularly personal income tax receipts, have softened or declined in many states, such as California and New York. A slowing economy could cause

more widespread declines in overall revenue collections. While the inflation rate has slowed, higher wages and interest rates in the post-Covid recovery will pressure state and local government costs. Nevertheless, overall credit fundamentals remain

solid, particularly near-record reserve levels. Other sectors also exhibit strong credit fundamentals. Municipal utilities typically benefit from autonomous rate-setting that allows them to adjust for rising fuel costs. Rising commodity prices over

a prolonged period could test affordability and the political will to raise rates to balance operations. State housing authority bonds, flagship universities, and strong national and regional health systems may also be pressured but are better

poised to absorb the impact of the economic shock. Critical providers (safety net hospitals, mass transit systems, airports) with limited resources may still experience fiscal strain from the economic fallout from high inflation, but aid and demand

in the service sector of the economy will continue to support operating results through 2023. Work-from-home policies remain headwinds for mass transit farebox revenue and commercial real estate values.

The opinions expressed are those of BlackRock as of July 31, 2023 and are subject to change at any time due to changes in market or economic

conditions. The comments should not be construed as a recommendation of any individual holdings or market sectors. Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go down

depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be

able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be

subject to Alternative Minimum Tax (“AMT”). Capital gains distributions, if any, are taxable.

| (a) |

|

The Bloomberg Municipal Bond Index, a broad, market value-weighted index, seeks to measure the performance of the U.S. municipal bond market. All bonds in the index are exempt from U.S. federal income taxes or subject

to the AMT. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index. |

|

|

|

| 4 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

The Benefits and Risks of Leveraging

The Trusts may utilize leverage to seek to enhance the distribution rate on, and

net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is

normally lower than the income earned by a Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Trust (including the assets obtained from leverage) are invested in

higher-yielding portfolio investments, each Trust’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in

the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these

concepts, assume a Trust’s Common Shares capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing

short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Trust’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower

short-term interest rates. At the same time, the securities purchased by a Trust with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Trust’s financing cost of leverage is significantly lower than the

income earned on a Trust’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit Common Shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the

leverage. If interest and other costs of leverage exceed a Trust’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Trust had not used leverage. In such circumstance, the investment adviser may

nevertheless determine to maintain a Trust’s leverage if it deems such action to be appropriate. Furthermore, the value of the Trusts’ portfolio investments generally varies inversely with the direction of long-term interest rates,

although other factors can influence the value of portfolio investments. In contrast, the amount of each Trust’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result,

changes in interest rates can influence the Trusts’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Trust’s intended leveraging

strategy will be successful.

The use of leverage also generally causes greater changes in each Trust’s NAV, market price and dividend rates than

comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Trust’s Common Shares than if the Trust were not leveraged. In addition, each Trust may be required to

sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trust to incur losses.

The use of leverage may limit a Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Trust incurs expenses in connection with the use of leverage, all of which are borne by Common

Shareholders and may reduce income to the Common Shares. Moreover, to the extent the calculation of each Trust’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the

Trusts’ investment adviser will be higher than if the Trusts did not use leverage.

To obtain leverage, each Trust has issued Variable Rate Muni

Term Preferred Shares (“VMTP Shares” or “Preferred Shares”) and/or leveraged its assets through the use of tender option bond trusts (“TOB Trusts”) as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Trust is permitted to borrow money (including through the use of TOB

Trusts) or issue debt securities up to 33 1/3% of its total managed assets or equity securities (e.g., Preferred Shares) up to 50% of its total managed assets. A Trust may voluntarily elect to limit its leverage to less than the maximum amount

permitted under the 1940 Act. In addition, a Trust may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by the Preferred Shares’ governing instruments or by agencies rating the Preferred Shares,

which may be more stringent than those imposed by the 1940 Act.

Derivative Financial Instruments

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market,

and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative

financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Trusts must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund

leverage risk based on value-at-risk. The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these

instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these

instruments, if any, are discussed in detail in the Notes to Financial Statements.

|

|

|

| T H E B E N E F I

T S A N D R I S K S O F L E

V E R A G I N G / D E R I V A

T I V E F I N A N C I A L I N

S T R U M E N T S |

|

5 |

|

|

|

| Trust Summary as of July 31, 2023 |

|

BlackRock Municipal Income Quality Trust (BYM) |

Investment Objective

BlackRock Municipal Income Quality

Trust’s (BYM) (the “Trust”) investment objective is to provide current income exempt from U.S. federal income taxes, including the alternative minimum tax. The Trust seeks to achieve its investment objective by investing, under

normal circumstances, at least 80% of its managed assets in municipal bonds exempt from U.S. federal income taxes, including the U.S. federal alternative minimum tax. The Trust also invests at least 80% of its managed assets in municipal bonds that

are investment grade quality at the time of investment or, if unrated, determined to be of comparable quality by the investment adviser at the time of investment. The Trust may invest up to 20% of its managed assets in securities that are rated

below investment grade, or are considered by BlackRock to be of comparable quality, at the time of purchase. The Trust may invest directly in securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

BYM |

| Initial Offering Date |

|

October 31, 2002 |

| Yield on Closing Market Price as of July 31, 2023 ($

11.23)(a) |

|

4.06% |

| Tax Equivalent Yield(b) |

|

6.86% |

| Current Monthly Distribution per Common

Share(c) |

|

$0.038000 |

| Current Annualized Distribution per Common

Share(c) |

|

$0.456000 |

| Leverage as of July 31, 2023(d) |

|

35% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust,

including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

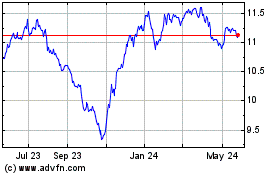

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

| Closing Market Price |

|

$ |

11.23 |

|

|

$ |

13.34 |

|

|

|

(15.82 |

)% |

|

$ |

14.00 |

|

|

$ |

10.18 |

|

| Net Asset Value |

|

|

12.73 |

|

|

|

13.56 |

|

|

|

(6.12 |

) |

|

|

13.65 |

|

|

|

11.41 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation

bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| 6 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Quality Trust (BYM) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| Trust at NAV(a)(b) |

|

|

(1.81 |

)% |

|

|

1.63 |

% |

|

|

4.29 |

% |

| Trust at Market

Price(a)(b) |

|

|

(11.95 |

) |

|

|

1.17 |

|

|

|

3.67 |

|

| Customized Reference Benchmark(c) |

|

|

0.74 |

|

|

|

1.96 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Trust’s use of leverage, if any. |

|

| |

(b) |

The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based

on market price and performance based on NAV. |

|

| |

(c) |

The Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged

(90%) and the Bloomberg Municipal Bond: High Yield ex AMT (non-Investment Grade) Total Return Index (10%). The Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or

more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies,

portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed

End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

High-quality holdings, especially AAA and AA rated bonds in the school district, transportation, state tax backed, and utility sectors, contributed to

performance. Despite the volatility throughout the period, low new issuance led to tighter yield spreads for higher-quality securities. Strong fundamental trends in the transportation sectors, especially airports, also helped fuel positive

performance. Bonds with maturities of 18 to 25 years were especially notable contributors in this area. The Trust’s use of U.S. Treasury futures to manage interest rate risk added value in the rising-rate environment. BBB rated holdings,

especially high-coupon bonds in the tobacco sector, contributed positively due to the high income and low price volatility

On the negative side,

long-dated securities with maturities of 25 years and above—particularly those with lower coupons—detracted from performance due to their higher interest rate sensitivity. Some shorter dated bonds, especially one- to five-year pre-refunded

debt, underperformed modestly due to the increase in short term rates coupled with a decline in price to par as they neared maturity. Bonds in the non-rated, non-investment grade category detracted from performance, driven by some long dated Puerto

Rico debt, workforce housing, and tobacco securities. The adverse effect was most pronounced among the Trust’s holdings in low- to zero-coupon securities.

The healthcare and housing sectors, especially holdings in lower coupon bonds (those with 4% coupons or below) also hurt performance. Within the housing

sector, positions in high yield workforce housing securities were the largest detractors. The Trust’s use of leverage, which amplified the effect of falling prices, was another detractor of note.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or

other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| T R U S T S U M M

A R Y |

|

7 |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Quality Trust (BYM) |

Overview of the Trust’s Total Investments

|

|

|

|

|

| SECTOR ALLOCATION |

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

| County/City/Special District/School District |

|

|

23.2 |

% |

| Transportation |

|

|

16.6 |

|

| Health |

|

|

15.9 |

|

| Utilities |

|

|

12.8 |

|

| State |

|

|

10.6 |

|

| Education |

|

|

6.2 |

|

| Tobacco |

|

|

5.3 |

|

| Corporate |

|

|

5.2 |

|

| Housing |

|

|

4.2 |

|

|

|

|

|

|

| CALL/MATURITY SCHEDULE |

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

| 2023 |

|

|

8.0 |

% |

| 2024 |

|

|

5.7 |

|

| 2025 |

|

|

11.4 |

|

| 2026 |

|

|

3.5 |

|

| 2027 |

|

|

7.3 |

|

|

|

|

|

|

| CREDIT QUALITY ALLOCATION |

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

| AAA/Aaa |

|

|

11.0 |

% |

| AA/Aa |

|

|

43.8 |

|

| A |

|

|

24.3 |

|

| BBB/Baa |

|

|

7.3 |

|

| BB/Ba |

|

|

2.5 |

|

| B |

|

|

0.3 |

|

| N/R(e) |

|

|

10.8 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector

sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector

sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Trust’s total investments. |

|

|

|

| 8 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Trust Summary as of July 31, 2023 |

|

BlackRock Municipal Income Trust II (BLE) |

Investment Objective

BlackRock Municipal Income Trust

II’s (BLE) (the “Trust”) investment objective is to provide current income exempt from regular U.S. federal income tax. The Trust seeks to achieve its investment objective by investing primarily in municipal bonds exempt from U.S.

federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Trust invests, under normal market conditions, at least 80% of its managed assets in municipal bonds that are investment grade quality at

the time of investment or, if unrated, determined to be of comparable quality by the investment adviser at the time of investment. The Trust may invest directly in securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

BLE |

| Initial Offering Date |

|

July 30, 2002 |

| Yield on Closing Market Price as of July 31, 2023 ($

10.45)(a) |

|

3.90% |

| Tax Equivalent Yield(b) |

|

6.59% |

| Current Monthly Distribution per Common

Share(c) |

|

$0.034000 |

| Current Annualized Distribution per Common

Share(c) |

|

$0.408000 |

| Leverage as of July 31, 2023(d) |

|

37% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust,

including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

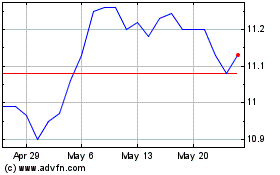

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

| Closing Market Price |

|

$ |

10.45 |

|

|

$ |

11.77 |

|

|

|

(11.21 |

)% |

|

$ |

11.95 |

|

|

$ |

9.43 |

|

| Net Asset Value |

|

|

12.09 |

|

|

|

12.60 |

|

|

|

(4.05 |

) |

|

|

12.72 |

|

|

|

10.62 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation

bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| T R U S T S U M M

A R Y |

|

9 |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Trust II (BLE) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| Trust at NAV(a)(b) |

|

|

0.39 |

% |

|

|

1.11 |

% |

|

|

4.20 |

% |

| Trust at Market

Price(a)(b) |

|

|

(7.11 |

) |

|

|

(0.35 |

) |

|

|

2.97 |

|

| National Customized Reference

Benchmark(c) |

|

|

0.82 |

|

|

|

1.98 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Trust’s use of leverage, if any. |

|

| |

(b) |

The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based

on market price and performance based on NAV. |

|

| |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value

Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or

more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies,

portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed

End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

The

Fund’s use of U.S. Treasury futures to mitigate interest rate risk contributed to results. Security selection in the tobacco sector also helped peformance, as did holdings in the 15- to 20-year maturity range. With respect to credit tiers,

positions in A and BBB rated bonds aided returns.

The Fund’s use of leverage, which amplified the effect of falling prices, detracted from

results. In addition, rising rates have increased the cost of using leverage. Positions in the five- to seven-year maturity range and bonds rated below investment grade also hurt performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or

other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| 10 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Trust II (BLE) |

Overview of the Trust’s Total Investments

|

|

|

|

|

| SECTOR ALLOCATION |

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

| Transportation |

|

|

23.5 |

% |

| County/City/Special District/School District |

|

|

16.2 |

|

| State |

|

|

13.1 |

|

| Health |

|

|

12.8 |

|

| Corporate |

|

|

10.6 |

|

| Utilities |

|

|

8.3 |

|

| Education |

|

|

6.0 |

|

| Housing |

|

|

5.4 |

|

| Tobacco |

|

|

4.1 |

|

|

|

|

|

|

| CALL/MATURITY SCHEDULE |

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

| 2023 |

|

|

10.0 |

% |

| 2024 |

|

|

7.1 |

|

| 2025 |

|

|

3.8 |

|

| 2026 |

|

|

5.7 |

|

| 2027 |

|

|

5.1 |

|

|

|

|

|

|

| CREDIT QUALITY ALLOCATION |

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

| AAA/Aaa |

|

|

4.5 |

% |

| AA/Aa |

|

|

35.6 |

|

| A |

|

|

35.1 |

|

| BBB/Baa |

|

|

12.4 |

|

| BB/Ba |

|

|

2.7 |

|

| B |

|

|

0.9 |

|

| N/R(e) |

|

|

8.8 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector

sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector

sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Trust’s total investments. |

|

|

|

| T R U S T S U M M

A R Y |

|

11 |

|

|

|

| Trust Summary as of July 31, 2023 |

|

BlackRock MuniVest Fund, Inc. (MVF) |

Investment Objective

BlackRock MuniVest Fund, Inc.’s

(MVF) (the “Trust”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Trust

seeks to achieve its investment objective by investing at least 80% of an aggregate of the Trust’s net assets (including proceeds from the issuance of any preferred shares) and the proceeds of any borrowing for investment purposes, in municipal

obligations exempt from U.S. federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). Under normal market conditions, the Trust primarily invests in long term municipal obligations rated investment

grade at the time of investment (or, if unrated, are considered by the Trust’s investment adviser to be of comparable quality at the time of investment) and in long term municipal obligations with maturities of more than ten years at the time

of investment. The Trust may invest up to 20% of its total assets in securities rated below investment grade or deemed equivalent at the time of purchase. The Trust may invest directly in securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

MVF |

| Initial Offering Date |

|

September 29, 1988 |

| Yield on Closing Market Price as of July 31, 2023 ($

6.83)(a) |

|

3.69% |

| Tax Equivalent Yield(b) |

|

6.23% |

| Current Monthly Distribution per Common

Share(c) |

|

$0.021000 |

| Current Annualized Distribution per Common

Share(c) |

|

$0.252000 |

| Leverage as of July 31, 2023(d) |

|

35% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust,

including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

| Closing Market Price |

|

$ |

6.83 |

|

|

$ |

7.81 |

|

|

|

(12.55 |

)% |

|

$ |

7.87 |

|

|

$ |

6.35 |

|

| Net Asset Value |

|

|

7.90 |

|

|

|

8.37 |

|

|

|

(5.62 |

) |

|

|

8.44 |

|

|

|

7.16 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation

bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| 12 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock MuniVest Fund, Inc. (MVF) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

| Trust at NAV(a)(b) |

|

|

(1.57 |

)% |

|

|

1.18 |

% |

|

|

3.73 |

% |

| Trust at Market

Price(a)(b) |

|

|

(8.80 |

) |

|

|

(0.44 |

) |

|

|

2.28 |

|

| National Customized Reference

Benchmark(c) |

|

|

0.82 |

|

|

|

1.98 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Trust’s use of leverage, if any. |

|

| |

(b) |

The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based

on market price and performance based on NAV. |

|

| |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value

Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or

more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies,

portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed

End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

The

Fund’s use of U.S. Treasury futures to manage interest rate risk was a key contributor to performance early in the reporting period when the Fed was aggressively raising rates to combat inflation. The investment adviser closed out this position

before the end of the period given that yields had already risen significantly.

On a sector basis, transportation issues were the largest

contributors. AAA and AA rated bonds were the leading contributors with respect to credit tiers. Holdings with maturities of 20 years and under contributed, as did positions in floating-rate notes and higher-coupon bonds.

On the other hand, healthcare issues with 4% coupons detracted. Holdings in BBB rated debt weighed on results, as well. Additionally, there were a few

individual positions that posted negative returns due to credit concerns or their structures. The Fund was also adversely affected by the investment adviser’s effort to reduce duration at an inopportune time early in the period, which reduced

the benefit of the market’s rebound in early 2023.

The Fund’s cash weighting was above typical levels at the close of the period, which

represented a defensive positioning.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change

based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| T R U S T S U M M

A R Y |

|

13 |

|

|

|

| Trust Summary as of July 31, 2023 (continued) |

|

BlackRock MuniVest Fund, Inc. (MVF) |

Overview of the Trust’s Total Investments

|

|

|

|

|

| SECTOR ALLOCATION |

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

| Health |

|

|

21.5 |

% |

| Transportation |

|

|

20.2 |

|

| County/City/Special District/School District |

|

|

14.3 |

|

| State |

|

|

12.7 |

|

| Education |

|

|

9.2 |

|

| Corporate |

|

|

7.9 |

|

| Housing |

|

|

5.2 |

|

| Utilities |

|

|

4.7 |

|

| Tobacco |

|

|

4.3 |

|

|

|

|

|

|

| CALL/MATURITY SCHEDULE |

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

| 2023 |

|

|

13.9 |

% |

| 2024 |

|

|

7.9 |

|

| 2025 |

|

|

7.1 |

|

| 2026 |

|

|

5.6 |

|

| 2027 |

|

|

16.4 |

|

|

|

|

|

|

| CREDIT QUALITY ALLOCATION |

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

| AAA/Aaa |

|

|

8.1 |

% |

| AA/Aa |

|

|

40.6 |

|

| A |

|

|

22.4 |

|

| BBB/Baa |

|

|

9.1 |

|

| BB/Ba |

|

|

4.3 |

|

| B |

|

|

2.2 |

|

| N/R(e) |

|

|

13.3 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector

sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector

sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Trust’s total investments. |

|

|

|

| 14 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Schedule of Investments

July 31, 2023 |

|

BlackRock Municipal Income Quality Trust (BYM)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Municipal Bonds |

|

|

|

|

|

|

|

|

|

|

|

| Alabama — 4.2% |

|

|

|

|

|

|

| Black Belt Energy Gas District, RB,

4.00%,

10/01/52(a) |

|

$ |

3,830 |

|

|

$ |

3,781,045 |

|

| Black Belt Energy Gas District, Refunding RB, Series D-1, 5.50%, 06/01/49(a)(b) |

|

|

2,875 |

|

|

|

3,026,530 |

|

| City of Birmingham Alabama, GO, CAB, Series A-1, Convertible,

5.00%, 03/01/45(c)(d) |

|

|

1,165 |

|

|

|

1,208,380 |

|

| Southeast Energy Authority A Cooperative District, RB, Series A, 5.25%, 01/01/54(a) |

|

|

5,685 |

|

|

|

6,033,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,048,973 |

|

|

|

|

| Arizona(e) — 0.8% |

|

|

|

|

|

|

| Arizona Industrial Development Authority, RB |

|

|

|

|

|

|

|

|

| 4.38%, 07/01/39 |

|

|

725 |

|

|

|

630,874 |

|

| Series A, 5.00%, 07/01/49 |

|

|

690 |

|

|

|

610,432 |

|

| Series A, 5.00%, 07/01/54 |

|

|

530 |

|

|

|

458,478 |

|

| Industrial Development Authority of the County of Pima, Refunding RB, 5.00%, 06/15/49 |

|

|

685 |

|

|

|

605,180 |

|

| Maricopa County Industrial Development Authority, Refunding RB, 5.00%, 07/01/54 |

|

|

360 |

|

|

|

321,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,626,296 |

|

|

|

|

| California — 14.9% |

|

|

|

|

|

|

| California Community Housing Agency, RB, M/F Housing, 3.00%, 08/01/56(e) |

|

|

155 |

|

|

|

101,805 |

|

| California Enterprise Development Authority, RB, 8.00%,

11/15/62(e) |

|

|

475 |

|

|

|

465,258 |

|

| California Health Facilities Financing Authority, Refunding RB, Sub-Series A-2,

5.00%, 11/01/47 |

|

|

1,465 |

|

|

|

1,664,808 |

|

| California Infrastructure & Economic Development Bank, RB, Series A, 1st Lien, (AMBAC),

5.00%,

01/01/28(c) |

|

|

10,100 |

|

|

|

11,140,371 |

|

| California State Public Works Board, RB, Series I, 5.50%, 11/01/33 |

|

|

1,415 |

|

|

|

1,423,325 |

|

| California Statewide Communities Development Authority, Refunding RB, 4.00%, 03/01/48 |

|

|

3,175 |

|

|

|

2,842,358 |

|

| CSCDA Community Improvement Authority, RB, M/F

Housing(e) |

|

|

|

|

|

|

|

|

| 5.00%, 09/01/37 |

|

|

130 |

|

|

|

127,832 |

|

| 4.00%, 10/01/56 |

|

|

195 |

|

|

|

160,850 |

|

| 4.00%, 12/01/56 |

|

|

230 |

|

|

|

163,142 |

|

| Series A, 4.00%, 06/01/58 |

|

|

1,170 |

|

|

|

911,101 |

|

| Senior Lien, 3.13%, 06/01/57 |

|

|

690 |

|

|

|

472,378 |

|

| Series A, Senior Lien, 4.00%, 12/01/58 |

|

|

955 |

|

|

|

735,350 |

|

| Los Angeles County Facilities, Inc., RB, Series A, 4.00%, 12/01/48 |

|

|

3,370 |

|

|

|

3,294,485 |

|

| Mount San Antonio Community College District, Refunding GO, CAB, CAB, Series A, Convertible, Election 2013,

6.25%, 08/01/28(d) |

|

|

1,580 |

|

|

|

1,471,355 |

|

| Regents of the University of California Medical Center Pooled Revenue, RB, Series P,

4.00%,

05/15/53 |

|

|

4,100 |

|

|

|

3,861,757 |

|

| Riverside County Redevelopment Successor Agency, Refunding TA, Series A, (BAM),

4.00%, 10/01/39 |

|

|

2,650 |

|

|

|

2,679,161 |

|

| San Diego County Regional Airport Authority, ARB, Series A, Subordinate, 4.00%, 07/01/51 |

|

|

2,730 |

|

|

|

2,700,330 |

|

| San Diego Unified School District, GO, Series C, Election 2008, 0.00%, 07/01/38(f) |

|

|

2,000 |

|

|

|

1,120,028 |

|

| San Diego Unified School District, GO, CAB(f) |

|

|

|

|

|

|

|

|

| Series K-2, 0.00%, 07/01/38 |

|

|

1,745 |

|

|

|

939,559 |

|

| Series K-2, 0.00%, 07/01/39 |

|

|

2,115 |

|

|

|

1,081,947 |

|

| Series K-2, 0.00%, 07/01/40 |

|

|

2,715 |

|

|

|

1,324,358 |

|

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| California (continued) |

|

|

|

|

|

|

| San Diego Unified School District, GO,

CAB(f)

(continued) |

|

|

|

|

|

| Series G, Election 2008, 0.00%, 01/01/24(c) |

|

$ |

3,425 |

|

|

$ |

1,761,195 |

|

| San Diego Unified School District, Refunding GO, CAB, Series R-1, 0.00%, 07/01/31(f) |

|

|

1,400 |

|

|

|

1,100,848 |

|

| State of California, Refunding GO,

4.00%, 03/01/46 |

|

|

2,695 |

|

|

|

2,716,549 |

|

| Yosemite Community College District, GO,

Series D, Election 2004, 0.00%, 08/01/37(f) |

|

|

10,000 |

|

|

|

5,653,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49,914,120 |

|

|

|

|

| Colorado — 1.9% |

|

|

|

|

|

|

| City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series B,

5.25%,

11/15/53 |

|

|

5,000 |

|

|

|

5,481,275 |

|

| Sabell Metropolitan District, GO, Series A,

5.00%,

12/01/50(e) |

|

|

1,055 |

|

|

|

909,905 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,391,180 |

|

|

|

|

| Connecticut — 0.3% |

|

|

|

|

|

|

| Connecticut State Health & Educational Facilities Authority, RB, 4.25%, 07/15/53 |

|

|

1,170 |

|

|

|

1,131,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware — 0.8% |

|

|

|

|

|

|

| County of Kent Delaware, RB |

|

|

|

|

|

|

|

|

| Series A, 5.00%, 07/01/40 |

|

|

770 |

|

|

|

752,293 |

|

| Series A, 5.00%, 07/01/48 |

|

|

2,110 |

|

|

|

1,949,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,701,634 |

|

|

|

|

| District of Columbia — 3.2% |

|

|

|

|

|

|

| District of Columbia Tobacco Settlement Financing Corp., Refunding RB, 6.75%, 05/15/40 |

|

|

9,225 |

|

|

|

9,466,953 |

|

| Washington Metropolitan Area Transit Authority, RB, Series B, 5.00%, 07/01/37 |

|

|

1,140 |

|

|

|

1,211,991 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,678,944 |

|

|

|

|

| Florida — 7.2% |

|

|

|

|

|

|

| Brevard County Health Facilities Authority, Refunding RB, 5.00%, 04/01/39 |

|

|

1,795 |

|

|

|

1,814,433 |

|

| Capital Trust Agency, Inc., RB(e) |

|

|

|

|

|

|

|

|

| Series A, 5.00%, 06/01/45 |

|

|

615 |

|

|

|

545,697 |

|

| Series A, 5.50%, 06/01/57 |

|

|

220 |

|

|

|

199,707 |

|

| County of Miami-Dade Florida Water & Sewer System Revenue, Refunding RB, Series B,

4.00%, 10/01/49

.. |

|

|

2,665 |

|

|

|

2,554,458 |

|

| County of Miami-Dade Seaport Department, ARB, Series A, 6.00%, 10/01/23(c) |

|

|

2,770 |

|

|

|

2,781,559 |

|

| County of Pasco Florida, RB, (AGM),

5.00%, 09/01/48 |

|

|

3,090 |

|

|

|

3,297,073 |

|

| Florida Development Finance Corp., RB |

|

|

|

|

|

|

|

|

| 6.50%, 06/30/57(e) |

|

|

420 |

|

|

|

409,763 |

|

| Series A, 5.00%, 06/15/56 |

|

|

580 |

|

|

|

551,050 |

|

| Florida Development Finance Corp., Refunding RB, 5.00%,

09/15/40(e) |

|

|

340 |

|

|

|

307,532 |

|

| Miami-Dade County Educational Facilities Authority, Refunding RB, Series A,

5.00%, 04/01/40 |

|

|

3,910 |

|

|

|

3,980,357 |

|

| Orange County Health Facilities Authority, RB, 4.00%, 10/01/52 |

|

|

4,000 |

|

|

|

3,731,940 |

|

| Orange County Health Facilities Authority, Refunding RB |

|

|

|

|

|

|

|

|

| 5.00%, 08/01/41 |

|

|

630 |

|

|

|

648,900 |

|

| 5.00%, 08/01/47 |

|

|

1,845 |

|

|

|

1,900,350 |

|

| Preserve at South Branch Community Development District, SAB |

|

|

|

|

|

|

|

|

| 4.00%, 11/01/39 |

|

|

300 |

|

|

|

262,760 |

|

|

|

|

| S C H E D U L E

O F I N V E S T M E N T S |

|

15 |

|

|

|

| Schedule of Investments (continued)

July 31, 2023 |

|

BlackRock Municipal Income Quality Trust (BYM)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Florida (continued) |

|

|

|

|

|

|

| Preserve at South Branch Community Development District, SAB (continued) |

|

|

|

|

|

|

|

|

| 4.00%, 11/01/50 |

|

$ |

500 |

|

|

$ |

394,754 |

|

| Village Community Development District No. 15, SAB, 5.25%, 05/01/54(e) |

|

|

280 |

|

|

|

283,455 |

|

| Westside Community Development District, Refunding

SAB(e) |

|

|

|

|

|

|

|

|

| 4.10%, 05/01/37 |

|

|

260 |

|

|

|

235,890 |

|

| 4.13%, 05/01/38 |

|

|

260 |

|

|

|

234,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,134,113 |

|

|

|

|

| Georgia — 2.2% |

|

|

|

|

|

|

| East Point Business & Industrial Development Authority, RB, Series A, 5.25%, 06/15/62(e) |

|

|

245 |

|

|

|

219,481 |

|

| Gainesville & Hall County Hospital Authority, Refunding RB, Series A, (GTD),

5.50%, 02/15/25(c) |

|

|

545 |

|

|

|

563,522 |

|

| Georgia Housing & Finance Authority, RB, S/F Housing |

|

|

|

|

|

|

|

|

| Series A, 3.95%, 12/01/43 |

|

|

275 |

|

|

|

274,945 |

|

| Series A, 4.00%, 12/01/48 |

|

|

410 |

|

|

|

404,525 |

|

| Main Street Natural Gas, Inc., RB |

|

|

|

|

|

|

|

|

| Series A, 5.00%, 05/15/38 |

|

|

595 |

|

|

|

602,586 |

|

| Series A, 5.00%, 05/15/43 |

|

|

775 |

|

|

|

773,134 |

|

| Series B, 5.00%, 12/01/52(a) |

|

|

4,355 |

|

|

|

4,503,384 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,341,577 |

|

|

|

|

| Idaho — 0.5% |

|

|

|

|

|

|

| Idaho Housing & Finance Association, RB, (GTD), 5.50%, 05/01/57 |

|

|

1,510 |

|

|

|

1,604,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Illinois — 12.9% |

|

|

|

|

|

|

| Chicago Board of Education, GO |

|

|

|

|

|

|

|

|

| Series A, 5.00%, 12/01/34 |

|

|

1,620 |

|

|

|

1,686,629 |

|

| Series A, 5.00%, 12/01/40 |

|

|

1,540 |

|

|

|

1,557,105 |

|

| Series A, 5.00%, 12/01/47 |

|

|

450 |

|

|

|

443,551 |

|

| Chicago O’Hare International Airport, ARB, Series D, Senior Lien, 5.25%, 01/01/42 |

|

|

3,300 |

|

|

|

3,452,995 |

|

| Chicago Transit Authority Sales Tax Receipts Fund, RB,

5.25%, 12/01/49 |

|

|

3,500 |

|

|

|

3,545,112 |

|

| City of Chicago Illinois Wastewater Transmission Revenue, RB, Series A, 2nd Lien, (AGM), 5.25%,

01/01/58 |

|

|

4,565 |

|

|

|

4,937,399 |

|

| Cook County Community College District No. 508, GO |

|

|

|

|

|

|

|

|

| 5.13%, 12/01/38 |

|

|

7,700 |

|

|

|

7,715,231 |

|

| 5.50%, 12/01/38 |

|

|

1,000 |

|

|

|

1,003,953 |

|

| Illinois Finance Authority, RB |

|

|

|

|

|

|

|

|

| Series A, 5.00%, 02/15/47 |

|

|

565 |

|

|

|

534,363 |

|

| Series A, 5.00%, 02/15/50 |

|

|

310 |

|

|

|

288,989 |

|

| Illinois Finance Authority, Refunding RB |

|

|

|

|

|

|

|

|

| Series C, 4.13%, 08/15/37 |

|

|

3,130 |

|

|

|

3,068,711 |

|

| Series C, 5.00%, 08/15/44 |

|

|

390 |

|

|

|

394,193 |

|

| Illinois Housing Development Authority, RB, S/F Housing, Series A, (FHLMC, FNMA, GNMA), 3.75%,

10/01/43 |

|

|

3,000 |

|

|

|

2,693,229 |

|

| Illinois Housing Development Authority, Refunding RB, S/F Housing, Series H, (FHLMC, FNMA, GNMA), 4.65%,

10/01/43(b) |

|

|

1,905 |

|

|

|

1,918,093 |

|

| Illinois State Toll Highway Authority, RB, Series A, 5.00%, 01/01/40 |

|

|

7,020 |

|

|

|

7,194,461 |

|

|

|

|

|

|

|

|

|

|

| Security |

|

Par

(000) |

|

|

Value |

|

|

|

|

| Illinois (continued) |

|

|

|

|

|

|

| Metropolitan Pier & Exposition Authority, RB, Series A, 5.00%, 06/15/57 |

|

$ |

670 |

|

|

$ |

680,185 |

|

| State of Illinois, GO, 5.50%, 05/01/39 |

|

|

1,840 |

|

|

|

1,992,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43,107,009 |

|

|

|

|

| Indiana — 0.1% |

|

|

|

|

|

|

| Indiana Finance Authority, RB, Series A,

4.00%, 11/01/51 |

|

|

525 |

|

|

|