UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by

the Registrant ☒

Filed by a Party other than the

Registrant ☐

|

|

|

| Check the appropriate box: |

|

|

|

|

| ☐ Preliminary Proxy Statement |

|

☐ Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2)) |

| ☐ Definitive Proxy Statement |

|

| ☒ Definitive Additional

Materials |

|

| ☐ Soliciting Material Pursuant to

§ 240.14a-12 |

BLACKROCK ESG CAPITAL ALLOCATION TERM TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

On June 15, 2023, representatives of BlackRock ESG Capital Allocation Term Trust (the “Fund”) gave

a presentation to representatives of Institutional Shareholder Services Inc. regarding the Fund. A copy of this presentation is filed herewith.

Presentation to Institutional Shareholder Services

June 2023 BlackRock ESG Capital Allocation Term Trust (ECAT) IPO Date: September 2021

The Boards Nominees are highly qualified and

focused on creating sustainable, long-term value for allECAT shareholders The Board has unanimously approved the following Board Nominees to continue to serve Board Saba Nominees Nominees as Trustees of the Trust: Experience with ECAT, " Cynthia L.

Egan including its investment u " Lorenzo A. Flores objectives and policies " Stayce D. Harris Closed-end fund experienceu " Catherine A. Lynch The Board believes the Board Nominees have Diverse slate of candidatesu the skills, qualifications and

requisite experience in overseeing investment companies to act in the best interests of all Audit Committee Financial Experts u shareholders " The Board Nominees represent a diverse slate of Governance experience professionals, each accomplished in

their respective u fields and knowledgeable about closed-end funds " If the Saba Nominees were elected, the Board would History of service to all lose all gender diversity and two of the Funds three shareholdersu Audit Committee Financial Experts.

Interviewed by a neutral " See complete details in Appendix A 1 professional search firmu (1) Sabas nominees declined an interview proposed to be conducted by neutral professional search firm consistent with standard Board nomination process. 2

The Board is committed to enhancing shareholder

value The Fund was designed to benefit all shareholders NAV pricing: To eliminate high upfront fees for investors of the Fund, BlackRock now pays 100% of the offering costs and the Funds initial NAV equals the initial public offering (IPO) price

Limited term with opportunity for liquidity at NAV: To mitigate any long-term discount issues, the Fund utilizes the new IPO structure with a limited term feature, offering a tender offer for 100% NAV or liquidation in year 12 of the Funds life

Access to private markets: The Fund provides the potential to invest in private investments with no performance fees and 1099 tax reporting These changes help broaden the investor base, potentially lower market price volatility after the IPO 36,325

and offer greater potential for shares to trade at a # of beneficial owners1 premium to NAV in the secondary market (1) As of May 12, 2023 (the annual shareholder meeting record date) 3

BlackRock ESG Capital Allocation Term Trust (ECAT)

IPO Date: September 2021 BlackRock ESG Capital Allocation Term Trusts (ECAT) (the Fund) investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation " The Fund

invests in a portfolio of equity and debt securities. Generally, the Funds portfolio will include both equity and debt securities. At any given time, however, the Fund may emphasize either debt securities or equity securities " The Fund will invest

at least 80% of its total assets in securities that, in the investment advisers assessment, meet certain environmental, social and governance (ESG) criteria as described in the Funds shareholder reports " The Fund utilizes an option writing

(selling) strategy in an effort to generate current gains from options premiums and to enhance the Funds risk-adjusted returns Common shares of closed-end investment companies frequently trade at prices lower than their NAV " The Fund cannot

guarantee that its common shares will trade at a price higher than or equal to NAV " The Funds common shares will trade in the open market at market prices that will be a function of several factors, including distribution levels (which are in turn

affected by expenses), NAV, call protection for portfolio securities, portfolio credit quality, liquidity, distribution stability, relative demand for and supply of the common shares in the market, general market and economic conditions, market

sentiment and other factors The common shares are designed primarily for long-term investors and investors should not purchase common shares of the Fund if they intend to sell them shortly after purchase " The prospectus did NOT state the Fund is

meant for discount arbitrage investors Source: Fund prospectus 4

Rigorous Oversight of ECAT The Board regularly

meets with the portfolio management team led by Rick Rieder to scrutinize performance and fund positioning, including private investments As part of the governance structure, Board Members serve on various committees that thoroughly examine

different aspects of ECATs management " Performance Committee:Reviews information on, and makes recommendations to the full Board of Directors in respect of, the investment objectives, policies and practices of the Fund and reviews information from

BlackRock on the investment performance of the Fund " Audit Committee:Assists the Board in fulfilling its oversight responsibilities relating to the accounting and financial reporting policies and practices of the Fund " Governance and Nominating

Committee:Monitors corporate governance matters and makes recommendations in respect thereof to the Board " Compliance Committee:Provides assistance to Board in fulfilling its responsibility with respect to the oversight of regulatory and fiduciary

compliance matters involving the Fund and fund-related activities of BlackRock, any subadviser and the Funds other third-party service providers The Board established an ad hoc Discount Sub-Committee responsible for studying all aspects of secondary

market discounts, with an emphasis on (i) defining the drivers of discounts, (ii) identifying potential solutions and (iii) implementing remedial action plans " Examples of actions that were derived from this committee and applied to ECAT: r Managed

distribution plan to seek to pay a distribution rate that is consistent with each Funds total returnr Share repurchase plan to enhance shareholder value by repurchasing the Funds shares when trading at a discount to NAV r Exposure to private

investments to utilize the closed structure to seek to enhance income and total return potentialr Enhanced secondary market support initiatives through marketing, education and building client relationships 5

Is change warranted? No, change is not warranted

because ECAT has consistently demonstrated superior results relative to peers since its inception in September 2021 amid heightened market volatility, demonstrating the Boards focus on creating sustainable, long-term value for all ECAT shareholders

ECAT provides unique exposure to shareholders seeking total return and income spanning public and private markets, unconstrained across asset classes and with a focus on ESG factors Total Shareholder Return Distributions NAV Premium / Discount " Top

performing Tactical Allocation " Competitive yield and distribution " Current discount is 3% narrower peer group in 2023 and over the 1 growth relative to the Tactical than Tactical Allocation peers Year period Allocation peers " Traded at a premium

as recently as " Outperformed peers since " Increased distribution rate by 25% the 4th quarter of 2021 inception since inception vs. -22% decline for " Built-in opportunity for liquidity at peers over the same period NAV at year 12 (2033) Fees and

Expenses Corporate Governance Conclusion " Competitive expenses that rank in " Diverse, experienced and qualified " Change is notwarranted the 1st quartile of the Tactical supermajority of independent " The incumbent trustees are the Allocation peer

group trustees most qualified candidates and have " Provides access to private " ECAT has voluntarily repurchased demonstrated their ability to create investments with lower fees $47 million (3.2% of O/S) of its value for all shareholders compared

to private funds and no shares, generating $10 million of carry accretion to its NAV Complete details in ISS Five Factor Framework section 6

ISS Five Factor Framework

Total Shareholder Return Total Return on Market

Price Total Return on Net Asset Value #1 #1 ECAT is the top performing fund in the ECAT is the top performing fund in the Morningstar Tactical Allocation category over Morningstar Tactical Allocation peer category the Year-to-Date and 1 Year periods

over the Year-to-Date and 1 Year periods 19.32 15.00 8.78 5.97 2.82 3.07 -1.76 -3.23 -8.19 -10.27 -9.48 -14.76 Year-to-Date 1 Year Since Inception Year-to-Date 1 Year Since Inception ECAT Tactical Allocation CEFs ECAT Tactical Allocation CEFs

Source: Morningstar data as of 4/30/2023 8

Distributions ECAT pays a higher yield relative to

peers and has grown its monthly distribution rate by 25% since inception over that period, Tactical Allocation CEFs have reduced distributions by -22% Yield on Net Asset Value Distribution Rate Growth 8.53 8.31 25% ECAT Tactical Allocation CEFs -22%

ECAT Tactical Allocation CEFs (ex BlackRock Funds) Source: Morningstar data as of 4/30/2023 9

NAV Premium and DiscountECAT and its Tactical

Allocation peers have experienced a wide range of valuations since ECATs inception in September 2021 due to changes in investor and market sentiment ECAT has previously traded at a premium and currently trades at a narrower discount than its

Tactical Allocation peersHistorical Range of Premium and Discount Since ECAT Inception0.80HIGH BlackRocks Tactical -4.01 Allocation CEFs, including ECAT, are the only funds in the peer CURRENT group with a built-in -11.77 opportunity for

-15.14liquidity at NAV -16.04 in year 12 (2033)LOW-20.10ECAT Tactical Allocation CEFsSource: Morningstar data as of 4/30/20231

Fees and ExpensesECATs total expenses1 are the

lowest in the Tactical Allocation peer group (1st quartile)ECAT is unique from peers given its unconstrained approach and exposure to private marketsECAT reduced its management fee via contractual waiver with approximately $180k in annual savings

for shareholders2Total Expense Ratio12.60%1.28%1.38%ECATTactical Allocation CEF - MedianTactical Allocation CEF - HighSource: Broadridge data as of 12/31/2022Total expenses excluding investment related expenses and taxes (based on net assets); see

Slide 35 for peer groupEstimated based on managed assets as of April 30, 202311

Corporate GovernanceFiduciaries seeking to enhance

value for all shareholdersExperienced, Diverse and Qualified Liquidity at NAVBoard In 2033, all shareholders will have an Current Board Members are committed to opportunity to receive 100% liquidity at ensuring that the Fund operates in a net asset

value via fund liquidation or responsible manner that protects and tender offer advances the interests of the Fund and all of its shareholdersOutperformanceECAT has outperformed Tactical Share Repurchases Allocation peers, global equity and global

The current Board, including the Board fixed income markets since inception Nominees, enhances value for all shareholders. Between March and December 2022, ECAT voluntarily repurchased over Distribution Growth and Stability$47 million of shares

(3.2% of O/S), adding Pays a higher yield than Tactical $10 million to the Funds net asset value with Allocation peers and has grown its approximately -$470k in annual revenue distribution rate by 25%since inception impact to BlackRockIncreased

Demand Management Fee ReductionIn March 2023, ECAT was added to the Reduced management fee through a S-Network Closed-End Fund Index as the 4th contractual with approximately $180k in largest weight, generating an estimated $23 annual savings for

shareholders1, million in demand and helping to narrow the supporting the case for inclusion in the Funds discount by 1.4% on March 31, 2023 S-Network Closed-End Fund Index (the index rebalance date), in our viewSource: BlackRock, VettaFidata as of

March 31, 2023 (1) Estimated based on managed assets as of April 30, 202312

Trustee Nominees

The Boards NomineesExperience Diversity

IndependenceActing for all shareholders Executing for the long termFormer President of Retirement Plan Services at T. Cynthia L. Rowe Price Group Board Chair for The Hanover Insurance Group and EganLead Independent Director for Huntsman

CorporationOver a century of Former Chief Executive Officer and Chief Catherine A. Investment Officer of the National Railroad combined Retirement Investment TrustLynch, CFABoard Directorfor PennyMac Mortgage Investment experience in Trust

investment Former Lieutenant General, Inspector General, U.S. management and StayceD. Air ForceHarris business leadership Board Directorfor The Boeing CompanyLorenzo A. Vice Chairman at Kioxia, Inc.FloresFormer Chief Financial Officer at Xilinx,

Inc.14

Investment companies, including CEFs, are

fundamentally different from operating companies and should be evaluated based on their distinct attributesOperating Company Closed-End FundRun by internal management and employeesu Board has the primary responsibility for oversight of the funds

service providers and management of conflicts of interest u involving the fund, including oversight of the funds investment advisory arrangementSubject to extensive regulation with respect to governance, operations and board independence, including,

but not limited u to, the 1940 Act and rules thereunderMajority independent trustee requirement1u Assets comprised solely of marketable securitiesu Vulnerable to arbitrage plays due to daily publication of net u asset value(1) In order to rely on

certain commonly used rules under the 1940 Act, at least a majority of a closed-end funds trustees must be independent trustees15

Sabas PlaybookSaba is a short-term investor

Saba is a short-term investor Saba may attempt to

claim that it has been a long-term investor in ECAT; however, the fact is that it took advantage of the current market dislocation to acquire an outsized position in the FundSaba net share purchases by quarter92%of current share ownership3,190,120

2,893,125 2,587,130 2,024,327 912,6972,800 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023Source: SEC Filings as of May 23, 202317

Saba has a history of short-term investing and has

never provided a long-term solution to narrow discountsSaba submitted its notice of intent to nominate persons to ECATs Board of Trustees less than one year after initiating a position in the Fund and never reached out to the Board or BlackRock to

discuss a potential solution to narrow the Funds temporary discountSabas weighted-average holding period in ECAT is 160 days and its $174 million position was acquired at an average discount of -15.8%1Saba knows CEFs, even large funds like ECAT,

generally have low trading volumes and therefore may fluctuate between premiums and discounts due to changes in investor and market sentiment nonetheless, it acquires outsized positions to force significant liquidity events as the only means to

realize a quick profit and exit the position without providing any benefit to remaining Fund shareholdersFluctuations in ECATs discount have closely tracked performance of the S&P 500, not Sabas ownership levelFor example, ECATs discount has

narrowed by 7.43% in 2023, with NAV performance and shareholder-focused actions taken by the Funds Board and BlackRock, driving demand for ECAT shares the S&P 500 returned 9.17% and ECATs NAV returned 8.78% through April 2023By comparison, the

Funds discount widened by 271 bps from the date of Sabas initial purchase to the ISS unaffected date of October 31, 2023 during this period, Saba acquired 50% of its shares in ECATECAT Premium and Discount and S&P 500 Return 1,100 -5 $ 1000)

1,000 -10 to Premium / (rebased 900 -15 Discount 500 800 -20 S&P (%) 700 -25Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23Source: BlackRock, Morningstar as of April 30, 2023, unless noted

S&P 500 ECAT (1) As of May 12, 2023 (the annual shareholder meeting record date)18

Saba claims to be focused on governance but

actually focuses its efforts on liquidity, illustrating its true intentions Saba Proxy Campaign HistoryDirector nominee 17 12 5 campaigns Settled / withdrawn Directors not elected Directors seatedGovernance 6 2 5 proposals Settled / withdrawn

Proposal failed Proposal passed, Saba moved on after liquidity eventCampaigns to 10 2 2 fire manager Settled / withdrawn Proposal failed Saba hired itself of fund liquidatedSource: Factset, insightia, SEC Filings data from October 2016 to April

202319

Saba uses the same playbook to enrich itself and

harm the fund and other shareholdersSabas playbook Saba ownership1) Acquire an outsized positionto exert to control when market sentiment is where settlement negative and discounts are temporarily wide reached or Saba 2) Hedge to limit exposure only

to changes in the discount nominees elected3) Petition only the largest shareholders and proxy advisors under the veil of governance4) Seek liquidityat or close to NAV via disruptive tender offers, open-ending or 18.1% fund liquidationsAverage5)

Sell to realize a short-term profit and move on to the next target (without any further advocacy for governance), leaving long-term shareholders to bear (% of outstanding common shares) higher expenses from a smaller asset base (among other

things)Case Study: Delaware Investments National Municipal Income Fund (VFL) Average change in ownership after tender Prior to After Change in tender offer tender offer Ownership offers forced by Saba Saba $37million $0 -100% -83%SabaOther

Institutional $45Shareholders million $16million -65%-59%Retail Shareholders $146million $112million -23% Other InstitutionsSource: Eikon, SEC Filings. Prior to tender offer is based on VFLs closing price on 9/30/2022 and after tender offer is based

on VFLs closing price on 12/29/2022. (1) Shares held based on latest 13D/G or 13F filing prior tender offer expiration (2) Shares held based on latest 13D/G or 13F filing after tender offer expiration20

Tender offers benefit short-term investors like

Saba at the expense of long-term shareholders1Tender offers increase volatility& &and dont add value for long-term shareholders-4.5% -12.0%Current average discount Average change in discount after tender offer expiration2Case Study: Delaware

Investments National Municipal Income Fund (VFL)3Source: Morningstar data as of 5/31/2023Data set includes 14 funds and tender offers forced by Saba between 2017 and 2022Largest discount over 30 days after tender offer expiration minus discount at

tender offer expiration(3) Data as of 4/30/2023; Category discount reflects median premium/discount for the High Yield Muni Morningstar closed-end fund category

Appendix ATrustee Nominee Biographies

Cynthia L. EganCynthia L. Egan brings to the Board

a broad and diverse knowledge of investment companies and the retirement industry as a result of her many years of experience as President, Retirement Plan Services, for T. Rowe Price Group, Inc. and her various senior operating officer positions at

Fidelity Investments, including her service as Executive Vice President of FMR Co., President of Fidelity Institutional Services Company and President of the Fidelity Charitable Gift Fund. Ms. Egan has also served as an advisor to the U.S.

Department of Treasury as an expert in domestic retirement security. Ms. Egan began her professional career at the Board of Governors of the Federal Reserve and the Federal Reserve Bank of New York. Ms. Egan is also a director of UNUM Corporation, a

publicly traded insurance company providing personal risk reinsurance, and a director and Chair of the Board of The Hanover Group, a public property casualty insurance company. Ms. Egan is also the lead independent director and non-executive Vice

Chair of the Board of Huntsman Corporation, a publicly traded manufacturer and marketer of chemical products. Ms. Egans independence from the Fund and the Advisor enhances her service as Chair of the Compliance Committee, and a member of the

Governance Committee and the Performance Oversight Committee.2

Catherine A. Lynch, CFACatherine A. Lynch, who

served as the Chief Executive Officer and Chief Investment Officer of the National Railroad Retirement Investment Fund, benefits the Board by providing business leadership and experience and a diverse knowledge of pensions and endowments. Ms. Lynch

is also a trustee of PennyMac Mortgage Investment Trust, a specialty finance company that invests primarily in mortgage-related assets. Ms. Lynch also holds the designation of Chartered Financial Analyst. Ms. Lynchs knowledge of financial and

accounting matters qualifies her to serve as Chair of the Audit Committee, where she holds financial expert status. Ms. Lynchs independence from the Fund and the Advisor enhances her service as a member of the Governance Committee and the

Performance Oversight Committee.2

Stayce D. HarrisThe Board benefits from StayceD.

Harriss leadership and governance experience gained during her extensive military career, including as a three-star Lieutenant General of the United States Air Force. In her most recent role, Ms. Harris reported to the Secretary and Chief of Staff

of the Air Force on matters concerning Air Force effectiveness, efficiency and the military discipline of active duty, Air Force Reserve and Air National Guard forces. Ms. Harriss experience on governance matters includes oversight of inspection

policy and the inspection and evaluation system for all Air Force nuclear and conventional forces; oversight of Air Force counterintelligence operations and service on the Air Force Intelligence Oversight Panel; investigation of fraud, waste and

abuse; and oversight of criminal investigations and complaints resolution programs. Ms. Harris is also a director of The Boeing Company. Ms. Harriss independence from the Fund and the Advisor enhances her service as a member of the Compliance

Committee and the Performance Oversight Committee.25

Lorenzo A. FloresThe Board benefits from Lorenzo A.

Floress many years of business, leadership and financial experience in his roles at various public and private companies. In particular, Mr. Floress service as Chief Financial Officer and Corporate Controller of Xilinx, Inc. and Vice Chairman of

Kioxia, Inc. and his long experience in the technology industry allow him to provide insight to into financial, business and technology trends. Mr. Floress knowledge of financial and accounting matters qualifies him to serve as a member of the Audit

Committee. Mr. Floress independence from the Fund and the Advisor enhances his service as a member of the Performance Oversight Committee and a financial expert of the Audit Committee.26

Appendix BECAT Overview

BlackRock ESG Capital Allocation Term Trust

(ECAT)Unconstrained investment strategy ESG focus across industriesInvests across all asset classes and Looks at sustainable investments and aims geographies to capitalize on untapped opportunities emerging across industriesAccess to private markets

Risk managementInvests up to 25% in private investments Tactical management of derivatives with no performance fees and simplified to enhance risk-adjusted returns tax reporting1 and generate cash flow(1) Under normal market conditions, ECAT

currently intends to invest up to 25% of its total assets, measured at the time of investment, in illiquid privately placed or restricted securities

8ECAT is managed by a winner of the Morningstar

2023 Outstanding Portfolio Manager Award for Investing ExcellenceRick RiederChief Investment Officer of Global Fixed Income, Head of Fundamental Fixed Income, and Head of the Global Allocation Investment TeamLead Portfolio Manager of ECAT36 years

experienceEric Jacobson, Morningstar Director of Manager Research, Fixed-Income Strategies"Rick leads one of the strongest fixed-income platforms in the industry, guided by his team's thorough research and investor-focused approach. He is a seasoned

veteran who leans on experience and surrounds himself with great people to help drive his success.Tim Strauts, Morningstar Head of Manager Research, North America"Our 2023 winners represent the best of the asset management industry, and their proven

track records show their unwavering focus on serving the best interests of investors. The manager and firm selected ground their strategies in deep fundamental research, which has produced strong results and rewarded investors in the

long-term.MorningstarMorningstars manager research analysts chose the winners from a shortlist of nominees who have distinguished themselves not only by their outstanding long-term returns but also by developing and adhering to sound processes and

shareholder-friendly philosophies that will endure.Rick Rieder manages four Morningstar gold medal rated funds (BSIIX, MAHQX, MAWIX AND MALOX) and one Morningstar silver medalrated fund (BFMCX) data as of 3/31/20232

Experienced and Well-Resourced ECAT PM TeamRick

Rieder is the lead portfolio manager of ECAT, along with Russ Koesterich, David Clayton and Kate Moore. The team leverages ESG expertise across the firm, including Ashley Schulten, who leads ESG investing across the Fixed Income platform. ECAT is

well supported, leveraging all 33 members of the BlackRock Global Allocation Team, over 200 members of BlackRocks Global Multi-Sector Fixed Income Team, along with tapping into expertise across the firm on sourcing private equity and debt

opportunities and sustainable investing. Collectively, this group is experienced in managing global multi-asset portfolios broadly, while also possessing dedicated resources with vast experience in public and private equity and debt investing,

derivatives trading, portfolio construction, and risk management. Lead Portfolio ManagerDavid Clayton, CFA Russ Koesterich, CFA Kate Moore29 years experience 28 years experience 24 years experienceESG Investment TeamAshley Schulten26 years

experienceSource: BlackRock as of 4/30/2023ECAT leverages a global team of 450+ dedicated investment professionals across the globe&United States Europe Asia/Pacific275+ 150+ 45+Investment Investment Investment professionals professionals

professionals&with experience investing across different marketsGlobal stocksSeeking high cash flow growth opportunitiesGlobal bondsLooking across the universe to potentially source income efficientlyPrivatesDedicated investors that specialize

in private investingDerivativesTactical management of options to potentially increase returns and generate cash flow30

Appendix C CEF Market Dynamics

Three structural advantage of CEFsCLIENT

BENEFITStay fully investedClosed structure allows for greater flexibility in the types of Efficient investment strategies that can be used and helps portfolio 1 managers stay invested for the long term without forced selling structureHigher

potential income & returnAccess Access to less liquid and private investments can harvest the 2 private illiquidity premium to seek higher income and return. Unlike private markets funds there are no performance feesLiquidityEnhanced liquidity

vs. Listed on a major exchange (e.g., NYSE) offering intra-day liquidity.3 The contingent limited term feature offers the opportunity for typical private liquidity at net asset value via fund liquidation or tender offerfunds3

CEFs can trade at premiums or discounts to net

asset value NAV, primarily driven by market sentiment20-Year Historical Premiums and Discounts of CEFs5 0 -5-102013 - 2015 2018 2022 Premium/Discount Taper Tantrum Trade Wars Rising Rates-152008 - 2009 2020 Global Financial Crisis COVID-19

Pandemic-202003 2004 2006 2008 2009 2011 2013 2014 2016 2018 2019 2021 2023Overall CEF Average 20-year AverageSource: Morningstar data as of 4/30/202333

Appendix D Morningstar Tactical Allocation category

Tactical Allocation CEF Peer GroupName Ticker

Morningstar Category BlackRock Capital Allocation Term Trust BCAT US CE Tactical Allocation BlackRock ESG Capital Allocation Term Trust ECAT US CE Tactical Allocation Clough Global Dividend and Income Fund GLV US CE Tactical Allocation Clough Global

Opportunities Fund GLO US CE Tactical Allocation Dividend and Income Fund DNIF US CE Tactical Allocation Franklin Universal Trust FT US CE Tactical Allocation RENN Fund, Inc. RCG US CE Tactical Allocation RiverNorthOpportunities Fund, Inc. RIV US CE

Tactical Allocation RiverNorth/ DoubleLine Strategic Opportunity Fund, Inc. OPP US CE Tactical Allocation Special Opportunities Fund, Inc. SPE US CE Tactical AllocationSource: Morningstar data as of 4/30/202335

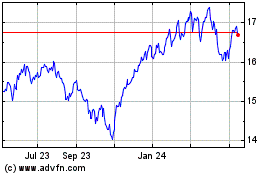

BlackRock ESG Capital Al... (NYSE:ECAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

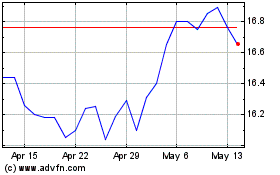

BlackRock ESG Capital Al... (NYSE:ECAT)

Historical Stock Chart

From Jul 2023 to Jul 2024