Current Report Filing (8-k)

December 14 2022 - 9:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 12, 2022

BGSF, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-36704 | 26-0656684 |

(State or Other Jurisdiction of

Incorporation) | (Commission File Number) | (I.R.S. Employer Identification

Number) |

5850 Granite Parkway, Suite 730

Plano, Texas 75024

(Address of principal executive offices, including zip code)

(972) 692-2400

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | BGSF | NYSE |

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

The information set forth under Items 2.01 and 2.03 are incorporated by reference herein.

| | | | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On December 12, 2022, BGSF, Inc. (the “Company”), through its subsidiary BG Professional, LLC, acquired substantially all of the assets, and assumed certain of the liabilities, of Horn Solutions, Inc. and Horn Solutions Dallas, LLC (collectively “Horn Solutions”), pursuant to an Asset Purchase Agreement (the “Purchase Agreement”), dated December 12, 2022, by and between the Company, BG Professional, LLC, Horn Solutions, and Gary Horn (the “Selling Person”).

Horn Solutions, with offices in Houston, Dallas, and Austin, Texas, focuses on Strategic Finance & Accounting, Transactional Accounting & Business Administration, as well as Information Technology. Horn Solutions also offers support services in consulting, loan staff for projects, interim and staff augmentation, direct hire and managed services.

The purchase price of $42.659 million was paid at closing with $33.940 million in cash and $3.351 million of our common stock (254,455 shares of our common stock privately placed under Section 4(a)(2) of the Securities Act of 1933, as amended, based upon the volume weighted average closing price of the Company’s shares for the ten business days prior to closing), as well as a two-year convertible promissory note of $4.368 million with an annual interest rate of 6%, with accrued and unpaid interest to be paid quarterly. The promissory note is convertible into shares of our common stock at any time after the one-year anniversary of the promissory note at a conversion price equal to $17.12 per share. The promissory note is subordinate to the Company’s senior debt. An additional portion of the purchase price, $1 million in cash, was held back as partial security for a post-closing purchase price adjustment, which is expected to fund in March 2023. The cash paid at closing was paid out of funds borrowed under the Term Loan as discussed in Item 2.03.

For the trailing twelve months ended September 30, 2022, Horn Solutions had unaudited revenue of $29.9 million.

The Selling Person has guaranteed certain of Horn Solutions’ obligations under the Purchase Agreement and has agreed to certain noncompetition and nonsolicitation restrictions as set forth in the Purchase Agreement. The Purchase Agreement contains representations and warranties, covenants, and indemnification provisions that are customary for a transaction of this nature.

The Purchase Agreement is filed as Exhibit 2.1 hereto. The above description of the Purchase Agreement is not complete and is qualified in its entirety by reference to Exhibit 2.1, which is incorporated by reference herein.

The information set forth under Item 2.03 is incorporated by reference.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant. |

Second Amendment to the Credit Agreement

In connection with the acquisition of the assets of Horn Solutions described above, on December 12, 2022, the Company entered into a Second Amendment to the Credit Agreement (the “Credit Agreement”) with BMO Harris Bank N.A. (“BMO”), as lead administrative agent, lender, letters of credit issuer, and swing line lender, Citibank, N.A., and Independent Bank, providing for a new $40 million term loan maturing July 16, 2024 (the “Term Loan”) (the initial Term Loan of $30 million having been paid in full). The Term Loan bears interest either at the Base Rate plus the Applicable Margin or Adjusted Term SOFR plus the Applicable Margin (as such terms are defined in the Credit Agreement), with 2.5% of the original principal balance payable on the last business day of each quarter, beginning on March 31, 2023.

The descriptions of the Second Amendment to the Credit Agreement set forth in this Item 2.03 are not complete and are qualified in their entirety by reference to the full text of such agreements. The Second Amendment to the Credit Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and are incorporated herein by reference.

The information set forth under Item 2.01 is incorporated by reference.

| | | | | |

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth under Item 2.01 is incorporated by reference.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On December 12, 2022, the Company issued a press release in connection with the Purchase Agreement, a copy of which is furnished as Exhibit 99.1 to this Current Report. Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(a)Financial statements of businesses acquired. The financial statements required by Item 9.01 with respect to the acquisition described in Item 2.01 are not being filed herewith but will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(b)Pro forma financial information. The pro forma financial information required by Item 9.01 with respect to the acquisition described in Item 2.01 above is not being furnished herewith but will be furnished by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date on which this Current Report on Form 8-K was required to be filed pursuant to Item 2.01.

(c)Exhibits

| | | | | | | | | | | |

| Exhibit No. | Description |

| 2.1* | |

| 10.1* | |

| 99.1 | | December 12, 2022 |

| 104.0 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * | Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and similar attachments have been omitted. The Company hereby agrees to furnish a copy of any omitted schedule or attachment to the Securities and Exchange Commission upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | | BGSF, INC. |

| | | | |

| | | | |

| Date: | December 14, 2022 | | /s/ Dan Hollenbach |

| | | Name:

Title: | Dan Hollenbach

Chief Financial Officer and Secretary

(Principal Financial Officer) |

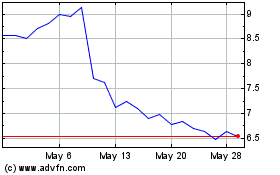

BGSF (NYSE:BGSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

BGSF (NYSE:BGSF)

Historical Stock Chart

From Jul 2023 to Jul 2024