Current Report Filing (8-k)

August 24 2021 - 4:32PM

Edgar (US Regulatory)

0001108134

false

0001108134

2021-08-24

2021-08-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): August 24, 2021

BERKSHIRE

HILLS BANCORP, INC.

(Exact Name of Registrant

as Specified in its Charter)

|

Delaware

|

|

001-15781

|

|

04-3510455

|

|

(State or Other Jurisdiction)

of Incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

60 State Street, Boston, Massachusetts

|

|

02109

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone

number, including area code: (800) 773-5601 ext. 133773

Not Applicable

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

|

BHLB

|

|

New York Stock Exchange

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On August 24, 2021, Berkshire Insurance Group,

Inc., a Massachusetts limited liability company (“BIG”), and subsidiary of Berkshire Hills Bancorp, Inc., a Delaware corporation

(the “Company”), entered into an Asset Purchase Agreement (the “Agreement”) by and among BIG, the Company and

Brown & Brown of Massachusetts, LLC, a Massachusetts limited liability company (“Buyer”), pursuant to which Buyer will

purchase substantially all of the assets of BIG and assume certain liabilities of BIG.

Pursuant to the terms

and subject to the conditions set forth in the Agreement, at the closing of the transaction (the “Closing”), Buyer shall pay

BIG an aggregate purchase price of $41.5 million, minus $1.6 million for executive goodwill purchase price payments payable by Buyer at

the Closing to certain executives of BIG.

The Agreement contains

customary representations and warranties from BIG, the Company and the Buyer, and each party has agreed to customary covenants, including,

among others, BIG has agreed to covenants relating to the conduct of its business during the interim period between the execution of the

Agreement and the Closing. In addition, BIG and the Company have agreed to indemnify and defend the Buyer against losses based upon

or arising out of a breach of any BIG and Company representations, warranties, obligations or covenants, and for the operation of BIG

prior to the closing of the transaction. Buyer has agreed to indemnify and defend BIG and the Company against losses based upon

or arising out a breach of any Buyer representations, warranties, obligations or covenants, and for the operation of the acquired assets

after the closing of the transaction by Buyer.

The consummation of the

transaction is subject to customary conditions, including, among others, no order preventing the consummation of the transaction. Each

party’s obligation to complete the transaction is also subject to certain additional customary conditions, including (i) subject

to certain exceptions, the accuracy of the representations and warranties of the other party, (ii) performance in all material respects

by the other party of its obligations under the Agreement, and (iii) the delivery of certain items pursuant to the Agreement.

The Agreement provides

certain termination rights for the parties, including, among others, mutual consent of the parties.

The foregoing description

of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Asset Purchase

Agreement, which is attached hereto as Exhibit 2.1 and incorporated herein by reference.

On August 24, 2021, the

Company announced that Berkshire Insurance Group, Inc. and the Company had entered into an Asset Purchase Agreement with Brown & Brown

of Massachusetts, LLC, a Massachusetts limited liability company, pursuant to which Brown & Brown of Massachusetts, LLC will purchase

substantially all of the assets of Berkshire Insurance Group, Inc. and assume substantially all of the liabilities of Berkshire Insurance

Group, Inc.. A copy of the related news release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits. The following exhibits are being

filed herewith:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc.

|

|

|

|

|

|

|

|

|

|

DATE: August 24, 2021

|

By:

|

/s/ Nitin J. Mhatre

|

|

|

|

Nitin J. Mhatre

President and Chief Executive Officer

|

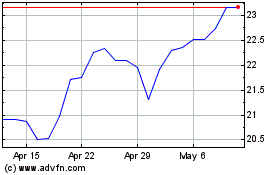

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

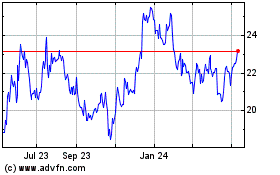

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024