Current Report Filing (8-k)

October 30 2015 - 9:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 27, 2015

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

001-15781 |

|

04-3510455 |

|

(State or Other Jurisdiction)

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

|

24 North Street, Pittsfield, Massachusetts |

|

01201 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (413) 443-5601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On October 27, 2015, Berkshire Hills Bancorp, Inc. (the “Company”), Berkshire Bank, Parke Bank (“Parke”) and 44 Business Capital, LLC (“44 Business Capital”) signed a purchase and assumption agreement under which Berkshire Bank will acquire the business model of 44 Business Capital and certain related assets of Parke’s SBA 7(a) program operations.

The Company’s news release announcing the purchase and assumption agreement is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

News Release dated October 30, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

DATE: October 30, 2015 |

By: |

/s/ Wm. Gordon Prescott |

|

|

|

Wm. Gordon Prescott

Senior Vice President and General Counsel |

3

Exhibit 99.1

Berkshire Welcomes Small Business Team

Pittsfield, MA — October 30, 2015 — Berkshire Bank, a wholly owned subsidiary of Berkshire Hills Bancorp, Inc. (NYSE: BHLB), announced today the signing of an asset purchase agreement with 44 Business Capital, LLC and Parke Bank under which Berkshire will acquire the business model of 44 Business Capital and certain other assets of Parke Bank’s SBA 7(a) loan program operations. As part of the agreement, 44 Business Capital’s entire team, along with its leadership, Greg Poehlmann, Phil Rapone Jeff Sherry and Joe Dreyer will join Berkshire.

44 Business Capital, consistently one of the top U.S. Small Business Administration (SBA) lenders, is a market leading provider and facilitator of SBA guaranteed loans. Headquartered in Blue Bell, PA, the operation was founded in 2009 as a joint venture with Parke Bank to originate, service and sell SBA loans in the Mid-Atlantic region. In 2015, the group was recognized by the National Association of Government Guaranteed Lenders as a champion of veterans small business lending.

Michael P. Daly, Berkshire’s Chief Executive Officer stated, “We are excited to have the team from 44 Business Capital join the Berkshire family. The group has established a strong track record and reputation for small business lending and this partnership complements our existing SBA program extremely well. The combined operation diversifies and expands our SBA focused reach while leveraging our traditional small business and Firestone platforms. We look forward to welcoming them and their customers to America’s Most Exciting Bank®.”

The transaction is subject to receipt of required regulatory approvals and is expected to be completed during the first quarter of 2016.

BACKGROUND

Berkshire Hills Bancorp is the parent of Berkshire Bank — America’s Most Exciting Bank®. The Company has over $7.8 billion in assets and 93 full-service branch offices in Massachusetts, New York, Connecticut, and Vermont providing personal and business banking, insurance and wealth management services.

|

BHLB — Berkshire Hills Bancorp |

|

www.berkshirebank.com |

1

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC’s website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements.

CONTACTS

Investor Relations Contact

Allison O’Rourke; Investor Relations Officer; 413-236-3149

Media Contact

Elizabeth Mach; First Vice President, Marketing Officer; 413-445-8390

2

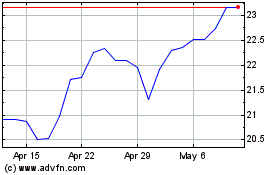

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

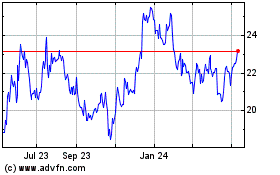

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024