Current Report Filing (8-k)

April 14 2015 - 12:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 14, 2015

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

001-15781 |

|

04-3510455 |

|

(State or Other Jurisdiction)

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

|

24 North Street, Pittsfield, Massachusetts |

|

01201 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (413) 443-5601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

On April 14, 2015, Berkshire Hills Bancorp, Inc. (the “Company”), the holding company for Berkshire Bank (the “Bank”), announced that all regulatory and shareholder approvals have been obtained to complete the Company’s acquisition of Hampden Bancorp, Inc. and the Bank’s acquisition of Hampden Bank. The merger is anticipated to close on or about April 17, 2015.

A copy of the press release announcing the receipt of required approvals to acquire Hampden Bancorp, Inc. and Hampden Bank is being filed herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Joint News Release dated April 14, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

DATE: April 14, 2015 |

By: |

/s/ Michael P. Daly |

|

|

|

Michael P. Daly |

|

|

|

President and Chief Executive Officer |

3

Exhibit 99.1

JOINT NEWS RELEASE

Berkshire Hills and Hampden Bancorp Report Receipt of Regulatory Approvals and Anticipated Merger Closing Date

PITTSFIELD, MA AND SPRINGFIELD, MA — April 14, 2015 — Berkshire Hills Bancorp, Inc. (NYSE: BHLB) and Hampden Bancorp, Inc., (NASDAQ: HBNK) jointly reported that all regulatory approvals relating to the merger of Hampden with and into Berkshire have been received. Hampden shareholders previously approved the merger at a special meeting of shareholders on March 12, 2015. The merger is anticipated to close on or about April 17, 2015.

“We are very pleased to receive regulatory approval for our merger with Hampden as planned,” stated Michael P. Daly, Berkshire’s President and CEO. “Berkshire has a culture of regulatory compliance and strong risk management systems that facilitates merger partnerships. We look forward to completing the merger and integration, and to serving Hampden’s customers and welcoming its employees and shareholders.”

Glenn S. Welsh, Hampden’s President and CEO added, “I’m excited to be joining Berkshire’s team and look forward to continuing to work with Hampden’s community supporters and our valued employees who will be a part of the continued growth of this outstanding banking franchise.”

As previously announced, upon completion of the merger, Hampden shareholders will be entitled to receive 0.81 shares of Berkshire common stock for each share of Hampden common stock. The exchange ratio is fixed and the transaction is expected to qualify as a tax-free exchange for shareholders of Hampden Bancorp, Inc.

BACKGROUND

Berkshire Hills Bancorp is the parent of Berkshire Bank — America’s Most Exciting Bank®. The Company has $6.5 billion in assets and 91 full-service branch offices in Massachusetts, New York, Connecticut, and Vermont providing personal and business banking, insurance, and wealth management services.

Hampden Bancorp, Inc. is the parent of Hampden Bank. Established in 1852, Hampden Bank has $0.7 billion in assets and 10 branch offices providing a full range of community bank service to families and businesses in the Springfield, MA area.

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire’s most recent reports on Forms 10-K and 10-Q and reports related to the merger which have been filed with the Securities and Exchange Commission and which are available on the SEC’s website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements.

CONTACTS

Berkshire Hills Bancorp, Inc.: Allison O’Rourke, SVP and Investor Relations Officer

Telephone: 413-236-3149

Hampden Bancorp, Inc.: Tara Corthell, CFO and Treasurer

Telephone: 413-452-5150

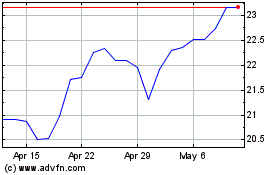

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

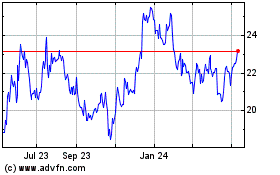

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024