Total Contractual Fleet

|

Aircraft

|

Number of seats

|

4Q19

|

4Q18

|

% ∆

|

3Q19

|

% ∆

|

|

A330

|

242-271

|

8

|

7

|

14.3%

|

8

|

0.0%

|

|

A330neo

|

298

|

2

|

-

|

n.a.

|

1

|

100.0%

|

|

A320neo Family

|

174-214

|

41

|

20

|

105.0%

|

32

|

28.1%

|

|

E195-E2

|

136

|

4

|

-

|

n.a.

|

1

|

300.0%

|

|

E-Jets

|

106-118

|

70

|

72

|

-2.8%

|

70

|

0.0%

|

|

ATRs

|

70

|

39

|

42

|

-7.1%

|

39

|

0.0%

|

|

B737 Freighter

|

-

|

2

|

2

|

0.0%

|

2

|

0.0%

|

|

Total1

|

|

166

|

143

|

16.1%

|

153

|

8.5%

|

|

Aircraft under operating leases

|

147

|

123

|

19.5%

|

134

|

9.7%

|

1 Includes 15 aircraft subleased to TAP.

Total Operating Fleet

|

Aircraft

|

Number of seats

|

4Q19

|

4Q18

|

% ∆

|

3Q19

|

% ∆

|

|

A330

|

242-271

|

8

|

7

|

14.3%

|

8

|

0.0%

|

|

A330neo

|

298

|

2

|

-

|

n.a.

|

1

|

100.0%

|

|

A320neo Family

|

174-214

|

38

|

20

|

90.0%

|

32

|

18.8%

|

|

E195-E2

|

136

|

4

|

-

|

n.a.

|

-

|

n.a.

|

|

E-Jets

|

106-118

|

55

|

63

|

-12.7%

|

57

|

-3.5%

|

|

ATRs

|

70

|

33

|

33

|

0.0%

|

33

|

0.0%

|

|

B737 Freighter

|

-

|

2

|

2

|

0.0%

|

2

|

0.0%

|

|

Total

|

|

142

|

125

|

13.6%

|

133

|

6.8%

|

8

|

|

Fourth Quarter

Results

2019

|

Capex

Cash capital expenditures totaled R$463.9 million in 4Q19, mostly due to the acquisition of spare parts and the capitalization of engine overhaul events, partially offset by resources received from the finance engine maintenance credit facility closed with Overseas Private Investment Corporation (OPIC).

|

(R$ million)

|

4Q19

|

4Q18

|

% ∆

|

2019

|

2018

|

% ∆

|

|

Aircraft related

|

326.7

|

134.7

|

142.4%

|

834.8

|

636.4

|

31.2%

|

|

Maintenance and checks

|

145.1

|

55.1

|

163.3%

|

539.5

|

331.8

|

62.6%

|

|

Pre-delivery payments

|

7.3

|

27.2

|

-73.2%

|

28.8

|

27.2

|

6.0%

|

|

Other

|

70.8

|

52.2

|

35.6%

|

245.9

|

91.0

|

170.2%

|

|

Engine maintenance credit facility (OPIC)

|

(86.0)

|

-

|

n.a.

|

(221.0)

|

-

|

n.a.

|

|

Acquisition of property and equipment

|

463.9

|

269.3

|

72.3%

|

1,427.9

|

1,086.4

|

31.4%

|

|

Net proceeds from sale of property and equipment

|

-

|

-

|

n.a.

|

(59.4)

|

(363.2)

|

-83.6%

|

|

Net CAPEX

|

463.9

|

269.3

|

72.3%

|

1,368.6

|

723.3

|

89.2%

|

9

|

|

Fourth Quarter

Results

2019

|

Environmental, Social and Governance (“ESG”) Responsibility

The table below presents Azul’s key ESG information, according to the Sustainability Accounting Standards Board (SASB) standard for the airline industry.

|

ESG KEY INDICATORS

|

2019

|

2018

|

% ∆

|

|

Environmental

|

|

|

|

|

|

|

|

|

|

Fuel

|

|

|

|

|

Total fuel consumed per ASK (GJ / ASK, million)

|

1,260.6

|

1,325.5

|

-4.9%

|

|

Total fuel consumed (GJ x 1000)

|

45,216

|

38,908

|

16.2%

|

|

Fleet

|

|

|

|

|

Average age of operating fleet

|

5.8

|

5.9

|

-0.9%

|

|

Social

|

|

|

|

|

|

|

|

|

|

Labor Relations

|

|

|

|

|

Employee gender: (%) male

|

59.0

|

58.0

|

1.7%

|

|

(%) female

|

41.0

|

42.0

|

-2.4%

|

|

Employee monthly turnover (%)

|

1.2

|

1.0

|

26.3%

|

|

% of employee covered under collective bargaining agreements

|

100

|

100

|

0.0%

|

|

Number and duration of strikes and lockout (# days)

|

0

|

0

|

n.a.

|

|

Volunteers

|

2,193

|

1,914

|

14.6%

|

|

Customer & Company Behavior

|

|

|

|

|

Amount of legal and regulatory fines and settlements

associated with anti-competitive practices

|

0

|

0

|

n.a.

|

|

Safety

|

|

|

|

|

Number of accidents

|

0

|

0

|

n.a.

|

|

Number of governmental enforcement actions and aviation safety

|

0

|

0

|

n.a.

|

|

Governance

|

|

|

|

|

|

|

|

|

|

Management

|

|

|

|

|

Independent directors (%)

|

82.0

|

82.0

|

0.0%

|

|

Percent of board members that are women

|

9.0

|

9.0

|

0.0%

|

|

Board of directors average age

|

57.1

|

56.1

|

1.8%

|

|

Director meeting attendance (%)

|

87.9

|

99.0

|

-11.2%

|

|

Board size

|

11

|

11

|

0.0%

|

|

Participation of woman in leadership positions (%)

|

39.4

|

32.0

|

23.1%

|

10

|

|

Fourth Quarter

Results

2019

|

2020 Outlook

While we are closely monitoring the potential impact of COVID-19 on our 2020 results, our top priority remains the health and safety of our crewmembers and customers.

Based on the best information available, we are taking measures to reduce any potential impact:

1) Reducing international capacity by 20% to 30% to reflect a lower demand environment

2) Preemptively reducing domestic growth

3) Continuing the replacement of E1s to E2s while putting incremental deliveries on hold

4) Implementing a hiring freeze and launching an unpaid leave of absence program

5) Negotiating new payment terms with commercial partners

Before the outbreak of the virus, our original guidance pointed to continued margin expansion and top line growth. Given the uncertainty related to the impact of the spread of the virus we are suspending our original guidance until we have more visibility.

|

|

2019 Actual

|

2020 Guidance

(Suspended)

|

|

Total ASK growth

|

22.2%

|

20% ± 2p.p.

|

|

CASK

|

0.8%

|

-3% ± 1p.p.

|

|

Operating margin

|

17.8%

|

20% ± 1p.p.

|

11

|

|

Fourth Quarter

Results

2019

|

Non-Recurring Items Reconciliation

Our IFRS results include the impacts of charges that are deemed non-recurring items, which we believe make our results difficult to compare to prior periods as well as future periods and guidance. In 4Q19 we recognized R$3.2 billion of non-recurring items consisted of an impairment charge related to the difference between the book value and expected recoverable amount of our E1s, the write-off of E1 inventory and spare parts, expected aircraft sale losses, delivery expenses, and contractual early termination fees.

The table below provides a reconciliation of our IFRS reported amounts to the non-IFRS amounts excluding non-recurrent items. For more information on the impairment charge see note 1 in our financial statements.

|

4Q19 Non-recurring adjustments

|

As recorded

|

Adjustment

|

Adjusted

|

|

|

|

|

|

|

Operating expenses

|

5,654.9

|

(3,185.8)

|

2,469.1

|

|

Aircraft fuel

|

831.5

|

-

|

831.5

|

|

Salaries, wages and benefits

|

502.2

|

-

|

502.2

|

|

Depreciation and amortization

|

2,501.1

|

(2,054.4)

|

446.8

|

|

Landing fees

|

194.4

|

-

|

194.4

|

|

Traffic and customer servicing

|

129.1

|

-

|

129.1

|

|

Sales and marketing

|

123.3

|

-

|

123.3

|

|

Maintenance materials and repairs

|

142.7

|

(72.5)

|

70.1

|

|

Other operating expenses

|

1,230.6

|

(1,058.9)

|

171.7

|

|

Operating income

|

(2,403.0)

|

3,185.8

|

782.8

|

|

EBITDA

|

98.1

|

1,131.5

|

1,229.6

|

|

Net income

|

(2,313.1)

|

3,185.8

|

872.8

|

|

Basic net income per PN share (R$)

|

2.53

|

-

|

2.53

|

|

Diluted net income per PN share (R$)

|

1.89

|

-

|

1.89

|

IFRS 16 Restated Quarterly Financials

Following the adoption of IFRS 16, Azul revised its aircraft redelivery costs accounting policy in 4Q19 to better adhere to the new standard requirements. The change in policy has resulted in the restatement of the Company’s quarterly results and financial position in 2019 and 2018. For further information see note 3.19 of the Company’s financial statements.

Restated quarterly financials are available at https://ri.voeazul.com.br/en/investor-information/interactive-spreadsheet/

12

|

|

Fourth Quarter

Results

2019

|

Recent Developments

Acquisition of TwoFlex

In February, Azul Linhas Aéreas Brasileiras, a wholly-owned subsidiary of Azul and Two Taxi Aereo, “TwoFlex”, signed a purchase agreement for R$123 million. The closing of this transaction is subject to the approval by the Brazilian Administrative Council for Economic Defense - CADE

TwoFlex offers regular passenger and cargo service to 39 destinations in Brazil, of which only seven destinations are currently being served by Azul. The airline also holds 14 daily departure and arrival slots on the auxiliary runway of Congonhas, São Paulo’s downtown airport. Its fleet is composed of 17 owned Cessna Caravan aircraft, a regional turboprop with a capacity of 9 passengers.

Sublease of 53 Embraer 195s

Also in February, Azul announced the sublease of 53 of its Embraer E195 aircraft E1s to LOT, Poland’s flag carrier, and Breeze Aviation Group, a U.S based start-up airline. The announcement follows Azul’s strategy to replace its entire domestic fleet of E1 jets with larger, next-generation E2 aircraft that are more fuel-efficient due to new engine technology. All E1s are expected to be phased out by the end of 2022 and will be subleased at least until the end of the original operating lease term.

The sublease agreement with Breeze Aviation was submitted for shareholders’ approval on March 2, 2020 and was approved by 97% of the votes received.

13

|

|

Fourth Quarter

Results

2019

|

Conference Call Details

Thursday, March 12th, 2020

11:00 a.m. (EST) | 12:00 p.m. (Brasília time)

USA: +1 412 717-9627

Brazil: +55 11 3181-8565 or +55 11 4210-1803

Verbal Code: Azul

Webcast: www.voeazul.com.br/ir

Replay:

+55 11 3193-1012 or +55 11 2820-4012

Code: 8622178#

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by number of flight departures and cities served, offers 916 daily flights to 116 destinations. With an operating fleet of 142 aircraft and more than 12,000 crewmembers, the Company has a network of 249 non-stop routes as of December 31, 2019. In 2019, Azul was awarded best airline in Latin America by TripAdvisor Travelers’ Choice and also best regional carrier in South America for the ninth consecutive time by Skytrax. Additionally, in 2019, Azul ranked among the top ten most on–time low-cost carriers in the world, according to OAG. For more information visit www.voeazul.com.br/ir.

Contact:

|

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

|

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

|

14

|

|

Fourth Quarter

Results

2019

|

Balance Sheet – IFRS (Unaudited)

|

(R$ million)

|

December 31, 2019

|

December 31, 2018

|

September 30, 2019

|

|

Assets

|

19,197.5

|

16,094.4

|

18,853.1

|

|

Current assets

|

4,138.7

|

3,756.4

|

4,049.0

|

|

Cash and cash equivalents

|

1,647.9

|

1,169.1

|

1,522.1

|

|

Short-term investments

|

62.0

|

517.4

|

41.1

|

|

Trade and other receivables

|

1,165.9

|

1,069.1

|

1,424.1

|

|

Sublease receivables

|

75.1

|

73.7

|

84.8

|

|

Inventories

|

260.9

|

200.1

|

263.9

|

|

Security deposits and maintenance reserves

|

258.2

|

210.4

|

-

|

|

Assets held for sale

|

51.9

|

-

|

-

|

|

Taxes recoverable

|

139.7

|

283.8

|

359.9

|

|

Derivative financial instruments

|

168.1

|

6.7

|

114.8

|

|

Prepaid expenses

|

139.4

|

115.5

|

91.8

|

|

Other current assets

|

169.8

|

110.6

|

146.6

|

|

Non-current assets

|

15,058.8

|

12,338.0

|

14,804.1

|

|

Long-term investments

|

1,397.7

|

1,287.8

|

1,380.2

|

|

Sublease receivables

|

204.5

|

288.1

|

224.4

|

|

Security deposits and maintenance reserves

|

1,393.3

|

1,336.4

|

1,627.8

|

|

Derivative financial instruments

|

657.8

|

588.7

|

750.5

|

|

Prepaid expenses

|

22.2

|

21.7

|

5.9

|

|

Taxes recoverable

|

244.6

|

-

|

-

|

|

Other non-current assets

|

497.6

|

397.4

|

549.7

|

|

Right of use assets - leased aircraft and other assets

|

7,087.4

|

4,926.3

|

6,055.7

|

|

Right of use assets - maintenance of leased aircraft

|

497.4

|

632.9

|

781.0

|

|

Property and equipment

|

1,968.8

|

1,842.2

|

2,378.2

|

|

Intangible assets

|

1,087.5

|

1,016.6

|

1,050.8

|

|

Liabilities and equity

|

19,197.5

|

16,094.4

|

18,853.1

|

|

Current liabilities

|

6,862.0

|

5,275.9

|

6,142.7

|

|

Loans and financing

|

481.2

|

158.8

|

273.6

|

|

Current maturities of lease liabilities

|

1,585.2

|

1,237.9

|

1,493.0

|

|

Accounts payable

|

1,626.6

|

1,450.4

|

1,608.5

|

|

Air traffic liability

|

2,094.3

|

1,672.5

|

1,962.9

|

|

Salaries, wages and benefits

|

357.6

|

244.0

|

382.9

|

|

Insurance premiums payable

|

49.9

|

35.0

|

1.4

|

|

Taxes payable

|

49.1

|

57.0

|

33.0

|

|

Federal tax installment payment program

|

13.5

|

9.7

|

9.7

|

|

Derivative financial instruments

|

81.2

|

181.0

|

129.3

|

|

Provisions

|

323.4

|

36.1

|

56.4

|

|

Other current liabilities

|

200.0

|

193.5

|

191.9

|

|

Non-current liabilities

|

15,854.6

|

11,968.5

|

13,976.6

|

|

Loans and financing

|

3,036.9

|

2,597.3

|

3,121.7

|

|

Long-term obligations under lease liabilities

|

10,521.4

|

7,681.8

|

9,087.2

|

|

Derivative financial instruments

|

229.0

|

260.0

|

302.6

|

|

Deferred income taxes

|

242.5

|

293.2

|

262.5

|

|

Federal tax installment payment program

|

119.3

|

95.7

|

88.4

|

|

Provision

|

1,489.9

|

713.9

|

880.9

|

|

Other non-current liabilities

|

215.6

|

326.5

|

233.4

|

|

Equity

|

(3,519.2)

|

(1,150.0)

|

(1,266.2)

|

|

Issued capital

|

2,243.2

|

2,209.4

|

2,240.6

|

|

Capital reserve

|

1,928.8

|

1,918.4

|

1,921.9

|

|

Treasury shares

|

(15.6)

|

(10.6)

|

(8.1)

|

|

Accumulated other comprehensive income (loss)

|

(159.3)

|

(154.0)

|

(217.3)

|

|

Accumulated losses

|

(7,516.4)

|

(5,113.3)

|

(5,203.3)

|

15

|

|

Fourth Quarter

Results

2019

|

Cash Flow Statement – IFRS (Unaudited)

|

(R$ million)

|

4Q19

|

4Q18

|

% ∆

|

2019

|

2018

|

% ∆

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Income for the period

|

(2,305.6)

|

697.2

|

n.a.

|

(2,403.1)

|

(635.7)

|

278.0%

|

|

Total non-cash adjustments

|

3,198.7

|

58.4

|

5376.6%

|

5,737.4

|

3,608.3

|

59.0%

|

|

Total working capital adjustments

|

271.0

|

86.9

|

211.8%

|

231.8

|

(439.3)

|

n.a.

|

|

Net cash flows provided by operations

|

1,164.1

|

842.5

|

38.2%

|

3,566.1

|

2,533.3

|

40.8%

|

|

Income tax and social contribution paid

|

(0.8)

|

-

|

n.a.

|

(2.4)

|

-

|

n.a.

|

|

Interest paid

|

(271.5)

|

(243.2)

|

11.6%

|

(969.1)

|

(845.3)

|

14.6%

|

|

Net cash provided by operating activities

|

891.7

|

599.3

|

48.8%

|

2,594.6

|

1,688.0

|

53.7%

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Short-term investment

|

(20.6)

|

152.9

|

n.a.

|

461.4

|

544.0

|

-15.2%

|

|

Long-term investment

|

-

|

-

|

n.a.

|

(96.2)

|

-

|

n.a.

|

|

Restricted investments

|

-

|

-

|

n.a.

|

-

|

5.6

|

n.a.

|

|

Cash received on sale of property and equipment

|

-

|

-

|

n.a.

|

59.4

|

363.2

|

-83.6%

|

|

Loan granted to third parties

|

-

|

-

|

n.a.

|

(51.0)

|

-

|

n.a.

|

|

Acquisition of intangible

|

(53.6)

|

(28.0)

|

91.5%

|

(132.5)

|

(100.2)

|

32.2%

|

|

Acquisition of property and equipment

|

(463.9)

|

(269.3)

|

72.3%

|

(1,428.0)

|

(1,086.4)

|

31.4%

|

|

Net cash (used) provided by investing activities

|

(538.2)

|

(144.3)

|

272.9%

|

(1,186.8)

|

(273.8)

|

333.4%

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Loans

|

|

|

|

|

|

|

|

Proceeds

|

184.5

|

-

|

n.a.

|

592.3

|

98.9

|

498.7%

|

|

Repayment

|

(27.6)

|

(44.1)

|

-37.6%

|

(110.0)

|

(747.2)

|

-85.3%

|

|

Debentures

|

|

|

|

|

|

|

|

Proceeds

|

-

|

200.0

|

n.a.

|

-

|

700.0

|

n.a.

|

|

Repayment

|

(24.2)

|

(44.4)

|

-45.5%

|

(64.3)

|

(168.1)

|

-61.7%

|

|

Repayment lease debt

|

(381.2)

|

(283.3)

|

34.6%

|

(1,372.7)

|

(1,082.2)

|

26.8%

|

|

Capital increase

|

5.2

|

16.5

|

-68.6%

|

37.8

|

47.6

|

-20.7%

|

|

Treasury shares

|

(7.7)

|

(1.1)

|

571.7%

|

(12.9)

|

(12.2)

|

5.5%

|

|

Loan to shareholder

|

-

|

-

|

n.a.

|

-

|

76.9

|

n.a.

|

|

Sales and leaseback

|

-

|

-

|

n.a.

|

16.3

|

11.9

|

36.9%

|

|

Net cash (used) provided by financing activities

|

(251.0)

|

(156.5)

|

60.4%

|

(913.5)

|

(1,074.3)

|

-15.0%

|

|

|

|

|

|

|

|

|

|

Exchange gain and (losses) on cash and cash equivalents

|

23.3

|

(23.0)

|

n.a.

|

(15.6)

|

67.0

|

n.a.

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

125.8

|

275.5

|

-54.3%

|

478.7

|

406.8

|

17.7%

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

1,522.1

|

893.7

|

70.3%

|

1,169.1

|

762.3

|

53.4%

|

|

Cash and cash equivalents at the end of the period

|

1,647.9

|

1,169.1

|

40.9%

|

1,647.9

|

1,169.1

|

40.9%

|

16

|

|

Fourth Quarter

Results

2019

|

Glossary

Aircraft Utilization

Average number of block hours per day per aircraft operated.

Available Seat Kilometers (ASK)

Number of aircraft seats multiplied by the number of kilometers flown.

Completion Factor

Percentage of accomplished flights.

Cost per ASK (CASK)

Operating expenses divided by available seat kilometers.

Cost per ASK ex-fuel (CASK ex-fuel)

Operating expenses divided by available seat kilometers excluding fuel expenses.

EBITDA

Earnings before interest, taxes, depreciation, and amortization.

Load Factor

Number of passengers as a percentage of number of seats flown (calculated by dividing RPK by ASK).

Revenue Passenger Kilometers (RPK)

One-fare paying passenger transported one kilometer. RPK is calculated by multiplying the number of revenue passengers by the number of kilometers flown.

Passenger Revenue per Available Seat Kilometer (PRASK)

Passenger revenue divided by available seat kilometers (also equal to load factor multiplied by yield).

Revenue per ASK (RASK)

Operating revenue divided by available seat kilometers.

Stage Length

The average number of kilometers flown per flight.

Trip Cost

Average cost of each flight calculated by dividing total operating expenses by total number of departures.

Yield

Average amount paid per passenger to fly one kilometer. Usually, yield is calculated as average revenue per revenue passenger kilometer, or cents per RPK.

17

|

|

Fourth Quarter

Results

2019

|

This press release includes estimates and forward-looking statements within the meaning of the U.S. federal securities laws. These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our preferred shares, including in the form of ADSs. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us. In addition, in this release, the words “may,” “will,” “estimate,” “anticipate,” “intend,” “expect,” “should” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. Azul is not under the obligation to update publicly or to revise any forward-looking statements after we distribute this press release because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this release might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.

In this press release, we present EBITDA, which is a non-IFRS performance measure and is not a financial performance measure determined in accordance with IFRS and should not be considered in isolation or as alternatives to operating income or net income or loss, or as indications of operating performance, or as alternatives to operating cash flows, or as indicators of liquidity, or as the basis for the distribution of dividends. Accordingly, you are cautioned not to place undue reliance on this information.

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 12, 2020

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

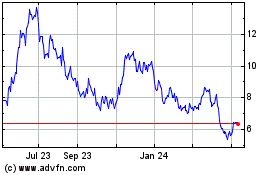

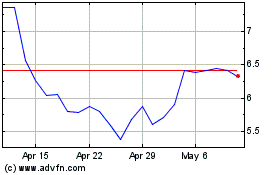

Azul (NYSE:AZUL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Azul (NYSE:AZUL)

Historical Stock Chart

From Jul 2023 to Jul 2024