0001606498falseJuly 31, 202400016064982024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: July 31, 2024

(Date of earliest event reported)

AVANOS MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | 001-36440 | | 46-4987888 |

| (State or other jurisdiction of incorporation) | (Commission file number) | | (I.R.S. Employer Identification No.) |

| 5405 Windward Parkway | |

| Suite 100 South | |

| Alpharetta, | Georgia | 30004 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (844) 428-2667 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock - $0.01 Par Value | AVNS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 31, 2024, Avanos Medical, Inc. (the "Company") issued a press release announcing its results of operations for the three and six months ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained in Item 2.02 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 2.02 of this Current Report or Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | AVANOS MEDICAL, INC. |

| | | | |

| Date: | July 31, 2024 | | By: | /s/ Mojirade James |

| | | | Mojirade James

Senior Vice President and General Counsel |

| | | | | | | | |

| | Investor Contact: Michael Greiner |

| | Avanos Medical, Inc. |

| | 470-562-2692 |

| | Investor.Relations@Avanos.com |

| | |

| | Media Contact: Katrine Kubis |

| | Avanos Medical, Inc. |

| | |

| | CorporateCommunications@Avanos.com |

Avanos Medical, Inc. Announces Second Quarter 2024 Results

ALPHARETTA, Ga., July 31, 2024/PRNewswire/ -- Avanos Medical, Inc. (NYSE: AVNS) today reported second quarter 2024 financial results.

“We are pleased with our second quarter results and the cumulative progress we have made at the mid-year point,” said Joe Woody, Avanos’s chief executive officer. Woody continued, “Digestive Health continues to lead in delivering high-single digit growth while Pain Management and Recovery performance is improving with quarter-over-quarter sequential growth, and we are seeing meaningful progress on our other transformation objectives, all of which are expected to support mid-single digit growth for the remainder of the year. We are proud of these accomplishments and pleased that our solutions have been utilized to treat over 900,000 patients so far this year.”

Second Quarter 2024 Financial Highlights

•Total net sales from continuing operations were $171.7 million, a 1.4% increase from the comparable prior year period.

•Net income from continuing operations for the quarter was $4.3 million, compared to net loss from continuing operations of $4.3 million a year ago.

•Adjusted net income from continuing operations totaled $15.8 million, compared to $11.2 million a year ago.

•Diluted earnings per share from continuing operations was $0.09, compared to diluted loss per share of $0.09 a year ago.

•Adjusted diluted earnings per share from continuing operations was $0.34, compared to $0.24 a year ago.

•Adjusted EBITDA was $26.8 million, compared to $22.9 million a year ago.

Second Quarter 2024 Operating Results From Continuing Operations

For the three months ended June 30, 2024, net sales totaled $171.7 million, an increase of 1.4% compared to the prior year period, due to continued strong demand and volume in our Digestive Health portfolio, primarily from our NeoMed neonatal and pediatric feeding solutions, as well as continued demand for Game Ready. This was partially offset by reduced demand for our hyaluronic acid (“HA”) products. Favorable volume overall was partially offset by pricing and currency translation effects.

Gross margin during the second quarter of 2024 was 55.7%, compared to 57.7% in the prior year period. Adjusted gross margin was 59.6% compared to 59.9% last year. Gross profit margin decreased primarily due to costs related to the priorities of our three-year transformation initiative (the “Transformation Process”) and plant separation costs associated

with the divestiture of our respiratory health (“RH”) business (the “Divestiture”). In addition, lower pricing for our HA products was partially offset by favorable volume and product mix.

Selling and general expenses as a percentage of net sales was 47.1% for the second quarter of 2024, compared to 54.9% for the second quarter of 2023. On an adjusted basis, selling and general expenses as a percentage of net sales was 43.0% for the second quarter of 2024, compared to 45.1% for the second quarter of 2023. Selling and general expenses decreased primarily due to savings realized from the execution on our Transformation Process and disciplined spending.

Operating profit in the second quarter of 2024 was $6.3 million, compared to operating loss of $2.1 million in the prior year period, primarily due to higher sales volume along with lower selling and general expenses related to the execution on Transformation Process and restructuring priorities. On an adjusted basis, operating profit totaled $21.8 million, compared to $18.4 million a year ago.

Adjusted EBITDA from continuing operations was $26.8 million in the three months ended June 30, 2024, compared to $22.9 million in the three months ended June 30, 2023.

First Six Months of 2024 Operating Results

For the six months ended June 30, 2024, net sales were $337.8 million, an increase of 2.8% compared to the prior year period, primarily due to strong demand for our Digestive Health products and Game Ready products. This was partially offset by lower demand and pricing for our HA products.

Gross margin was 56.4%, compared to 57.6% last year. Adjusted gross margin was 59.7% compared to 59.8% last year and was impacted by the same items noted above for the second quarter.

Selling and general expenses as a percentage of net sales were 48.7% for the six months ended June 30, 2024, compared to 55.3% for the prior year period. The decrease was primarily due to disciplined spending, partially offset by non-recurring expenses associated with our ongoing Transformation Process and the Divestiture. On an adjusted basis, selling and general expenses as a percentage of net sales was 44.4% for the first six months of 2024, compared to 46.5% in the prior year period.

Operating profit was $10.3 million, compared to an operating loss of $8.2 million in the prior year period, primarily due to increased demand for our Digestive Health products and lower selling and general costs, partially offset by lower volume and pricing of our HA products. On an adjusted basis, operating profit was $38.1 million compared to $29.6 million a year ago.

Adjusted EBITDA for the six months ended June 30, 2024 was $48.4 million, compared to $39.0 million in the prior year period.

Cash Flow and Balance Sheet

Cash from operations less capital expenditures, or free cash flow, for the second quarter was an inflow of $21.9 million, driven primarily by cash flow provided by operating activities, compared to an outflow of $6.6 million a year ago. The Company’s cash balance at June 30, 2024 was $92.2 million, compared to $87.7 million at year-end 2023.

Total debt outstanding, net of unamortized discounts, was $175.1 million at June 30, 2024, compared to $168.0 million at December 31, 2023.

Discontinued Operations

Net sales from discontinued operations were $13.6 million in the three months ended June 30, 2024, compared to $30.4 million in the three months ended June 30, 2023. Net sales from discontinued operations were $30.5 million in the six months ended June 30, 2024, compared to $62.8 million in the six months ended June 30, 2023.

2024 Outlook

For the year, the Company anticipates revenue from continuing operations of between $685 million and $705 million from continuing operations, adjusted gross margins from continuing operations of between 59.5% and 60.5% and adjusted diluted earnings per share from continuing operations of between $1.30 and $1.45.

Non-GAAP Financial Measures

This press release and the accompanying tables include the following financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S., or GAAP, and are therefore referred to as non-GAAP financial measures:

•Adjusted net income;

•Adjusted diluted earnings per share;

•Adjusted gross and operating profit;

•Adjusted effective tax rate;

•Adjusted EBITDA; and

•Free cash flow.

These non-GAAP financial measures exclude the following items, as applicable, for the relevant time periods as indicated in the accompanying non-GAAP reconciliations to the comparable GAAP financial measures:

•Certain acquisition and integration charges related to acquisitions.

•Expenses associated with restructuring and transformation activities, including the Divestiture in the fourth quarter of 2023.

•Expenses associated with European Union Medical Device Regulation (“EU MDR”) compliance.

•The amortization of intangible assets associated with prior business acquisitions.

•The tax effects of certain adjusting items.

•The benefit associated with the tax effects of the CARES Act.

•The positive or negative effect of changes in currency exchange rates during the year.

The Company provides these non-GAAP financial measures as supplemental information to its GAAP financial measures. Management and the Company’s board of directors use net sales on a constant currency basis, adjusted net income, adjusted diluted earnings per share, adjusted operating profit, adjusted EBITDA, and free cash flow to: (a) evaluate the Company’s historical and prospective financial performance and its performance relative to its competitors, (b) allocate resources and (c) measure the operational performance of the Company’s business units and their managers. Management also believes that the use of an adjusted effective tax rate provides improved insight into the tax effects of the Company’s ongoing business operations.

Additionally, the compensation committee of the Company’s board of directors will use certain of the non-GAAP financial measures when setting and assessing achievement of incentive compensation goals. These goals are based, in part, on the Company’s net sales on a constant currency basis and adjusted EBITDA, which will be determined by excluding certain items that are used in calculating these non-GAAP financial measures.

Our competitors may define these non-GAAP financial measures differently, and as a result, our measure of these non-GAAP financial measures may not be directly comparable to those of other companies. Items excluded from these non-GAAP financial measures are significant components in understanding and assessing financial performance. These non-GAAP financial measures are supplemental measures of operating performance that do not represent, and should not be considered in isolation or as an alternative to, or substitute for, the financial statement data presented in the Company’s consolidated financial statements as indicators of financial performance. These non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of the Company’s results as reported under GAAP. We compensate for these limitations by relying primarily on our GAAP results and using these non-GAAP financial measures as supplemental information.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the attached financial tables.

Conference Call Webcast

Avanos Medical, Inc. will host a conference call today at 9 a.m. ET. The conference call can be accessed live over the internet at https://avanos.investorroom.com or via telephone by dialing 800-836-8184 in the United States. A replay of the call will be available at noon ET today by calling 888-660-6345 in the United States and entering passcode 70891#. A webcast of the call will also be archived in the Investors section on the Avanos website.

About Avanos Medical, Inc.

Avanos Medical (NYSE: AVNS) is a medical technology company focused on delivering clinically superior solutions that will help patients get back to the things that matter. Headquartered in Alpharetta, Georgia, Avanos is committed to addressing some of today’s most important healthcare needs, including providing a vital lifeline for nutrition to patients from hospital to home, and reducing the use of opioids while helping patients move from surgery to recovery. Avanos develops, manufactures and markets its recognized brands globally and holds leading market positions in multiple categories across its portfolio. For more information, visit www.avanos.com and follow Avanos Medical on X (@AvanosMedical), LinkedIn and Facebook.

Forward-Looking Statements

This press release contains information that includes or is based on “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by the use of words such as “may,” “believe,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan” or “continue” and similar expressions. Forward-looking statements are based on the current plans and expectations of management and are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements. Such factors include, but are not limited to: weakening of economic conditions that could adversely affect the level of demand for our products; pricing pressures generally, including cost-containment measures that could adversely affect the price of or demand for our products; shortage in drugs used in our Surgical Pain and Recovery products or other disruptions in our supply chain; the ongoing regional conflicts between Russia and Ukraine and in the Middle East; our ability to successfully execute on or achieve the expected benefits of our transformation initiative or our divestiture, acquisition or merger transactions; inflationary pressures; financial conditions affecting the banking system and the potential threats to the solvency of commercial banks; changes in foreign exchange markets; legislative and regulatory actions; unanticipated issues arising in connection with clinical studies and otherwise that affect U.S. Food and Drug Administration approval of new products; changes in reimbursement levels from third-party payors; a significant increase in product liability claims; the impact of investigative and legal proceedings and compliance risks; the impact of the federal legislation to reform the United States healthcare system; changes in financial markets; and changes in the competitive environment. The information contained herein speaks only as of the date of this release and we undertake no obligation to update forward-looking statements, except as may be required by the securities laws.

Additional information concerning these and other factors that may impact future results is contained in our filings with the U.S. Securities and Exchange Commission, including our most recent Form 10-Q.

AVANOS MEDICAL, INC.

CONDENSED CONSOLIDATED INCOME STATEMENTS

(unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net Sales | $ | 171.7 | | | $ | 169.4 | | | $ | 337.8 | | | $ | 328.7 | |

| Cost of products sold | 76.1 | | | 71.6 | | | 147.4 | | | 139.5 | |

| Gross Profit | 95.6 | | | 97.8 | | | 190.4 | | | 189.2 | |

| Research and development expenses | 6.3 | | | 6.8 | | | 13.3 | | | 14.3 | |

| Selling and general expenses | 80.9 | | | 93.0 | | | 164.5 | | | 181.8 | |

| Other expense, net | 2.1 | | | 0.1 | | | 2.3 | | | 1.3 | |

Operating Income (Loss) | 6.3 | | | (2.1) | | | 10.3 | | | (8.2) | |

| Interest income | 3.0 | | | 0.5 | | | 3.6 | | | 1.0 | |

| Interest expense | (3.1) | | | (3.5) | | | (6.2) | | | (7.0) | |

| Income (Loss) Before Income Taxes | 6.2 | | | (5.1) | | | 7.7 | | | (14.2) | |

Income tax (provision) benefit | (1.9) | | | 0.8 | | | (2.9) | | | 2.1 | |

| Income (Loss) from Continuing Operations | 4.3 | | | (4.3) | | | 4.8 | | | (12.1) | |

| Loss from discontinued operations, net of tax | (2.5) | | | (63.8) | | | (3.9) | | | (56.5) | |

| Net Income (Loss) | $ | 1.8 | | | $ | (68.1) | | | $ | 0.9 | | | $ | (68.6) | |

| | | | | | | |

| Interest expense, net | $ | 0.1 | | | $ | 3.0 | | | $ | 2.6 | | | $ | 6.0 | |

| Income tax provision (benefit) | 1.0 | | | (1.6) | | | 1.5 | | | (1.5) | |

| Depreciation and amortization | 11.3 | | | 11.5 | | | 22.7 | | | 23.6 | |

| EBITDA | $ | 14.2 | | | $ | (55.2) | | | $ | 27.7 | | | $ | (40.5) | |

| | | | | | | |

| Earnings (Loss) Per Share | | | | | | | |

| Basic | | | | | | | |

| Continuing operations | $ | 0.09 | | | $ | (0.09) | | | $ | 0.10 | | | $ | (0.26) | |

| Discontinued operations | (0.05) | | | (1.37) | | | (0.08) | | | (1.21) | |

| Basic Earnings (Loss) Per Share | $ | 0.04 | | | $ | (1.46) | | | $ | 0.02 | | | $ | (1.47) | |

| | | | | | | |

| Diluted | | | | | | | |

| Continuing operations | $ | 0.09 | | | $ | (0.09) | | | $ | 0.10 | | | $ | (0.26) | |

| Discontinued operations | $ | (0.05) | | | (1.37) | | | (0.08) | | | (1.21) | |

| Diluted Earnings (Loss) Per Share | $ | 0.04 | | | $ | (1.46) | | | $ | 0.02 | | | $ | (1.47) | |

| | | | | | | |

| Common Shares Outstanding | | | | | | | |

| Basic | 45.9 | | | 46.8 | | | 46.1 | | | 46.7 | |

| Diluted | 46.3 | | | 46.8 | | 46.6 | | | 46.7 | |

AVANOS MEDICAL, INC.

Discontinued Operations Summary

(unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net Sales | $ | 13.6 | | | $ | 30.4 | | | $ | 30.5 | | | $ | 62.8 | |

| Cost of products sold | 15.6 | | | 18.6 | | | 31.5 | | | 37.9 | |

| Gross Profit | (2.0) | | | 11.8 | | | (1.0) | | | 24.9 | |

| Research and development expenses | — | | | 0.2 | | | — | | | 0.6 | |

| Selling, general and other expenses | — | | | 3.8 | | | — | | | 7.7 |

| Pretax loss on classification as discontinued operations | — | | | 72.3 | | | — | | | 72.3 | |

| Other expense, net | 1.4 | | | 0.1 | | | 4.3 | | | 0.2 | |

| Loss from discontinued operations before income taxes | (3.4) | | | (64.6) | | | (5.3) | | | (55.9) | |

| Income tax benefit (provision) from discontinued operations | 0.9 | | | 0.8 | | | 1.4 | | | (0.6) | |

| (Loss) from discontinued operations, net of tax | $ | (2.5) | | | $ | (63.8) | | | $ | (3.9) | | | $ | (56.5) | |

| | | | | | | |

| (Loss) Per Share | | | | | | | |

| Basic | $ | (0.05) | | | $ | (1.37) | | | $ | (0.08) | | | $ | (1.21) | |

| Diluted | $ | (0.05) | | | $ | (1.37) | | | $ | (0.08) | | | $ | (1.21) | |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Profit |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 95.6 | | | $ | (2.0) | | | $ | 93.6 | | | $ | 97.8 | | | $ | 11.8 | | | $ | 109.6 | |

| Acquisition and integration-related charges | 0.1 | | | — | | | 0.1 | | | — | | | — | | | — | |

| Restructuring and transformation charges | 0.3 | | | — | | | 0.3 | | | 0.1 | | | — | | | 0.1 | |

| Post-RH Divestiture transition charges | 0.4 | | | — | | | 0.4 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 2.2 | | | — | | | 2.2 | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Intangibles amortization | 3.6 | | | — | | | 3.6 | | | 3.6 | | | — | | | 3.6 | |

| As adjusted non-GAAP | $ | 102.2 | | | $ | (2.0) | | | $ | 100.2 | | | $ | 101.5 | | | $ | 11.8 | | | $ | 113.3 | |

| Gross profit margin, as reported | 55.7 | % | | (14.7) | % | | 50.5 | % | | 57.7 | % | | 38.8 | % | | 54.9 | % |

| Gross profit margin, as adjusted | 59.6 | % | | (14.7) | % | | 54.1 | % | | 59.9 | % | | 38.8 | % | | 56.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross Profit |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 190.4 | | | $ | (1.0) | | | $ | 189.4 | | | $ | 189.2 | | | $ | 24.9 | | | $ | 214.1 | |

| Acquisition and integration-related charges | 0.1 | | | — | | | 0.1 | | | — | | | — | | | — | |

| Restructuring and transformation charges | 1.0 | | | — | | | 1.0 | | | 0.1 | | | — | | | 0.1 | |

| Post-RH Divestiture transition charges | 0.8 | | | — | | | 0.8 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 2.2 | | | — | | | 2.2 | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Intangibles amortization | 7.0 | | | — | | | 7.0 | | | 7.2 | | | — | | | 7.2 | |

| As adjusted non-GAAP | $ | 201.5 | | | $ | (1.0) | | | $ | 200.5 | | | $ | 196.5 | | | $ | 24.9 | | | $ | 221.4 | |

| Gross profit margin, as reported | 56.4 | % | | (3.3) | % | | 51.4 | % | | 57.6 | % | | 39.6 | % | | 54.7 | % |

| Gross profit margin, as adjusted | 59.7 | % | | (3.3) | % | | 54.4 | % | | 59.8 | % | | 39.6 | % | | 56.6 | % |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 6.3 | | | $ | (3.4) | | | $ | 2.9 | | | $ | (2.1) | | | $ | 7.7 | | | $ | 5.6 | |

| Acquisition and integration-related charges | 2.2 | | | — | | | 2.2 | | | 0.3 | | | — | | | 0.3 | |

| Restructuring and transformation charges | 1.6 | | | — | | | 1.6 | | | 9.8 | | | — | | | 9.8 | |

| Post-RH Divestiture transition charges | 0.5 | | | — | | | 0.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 3.4 | | | — | | | 3.4 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 1.5 | | | — | | | 1.5 | | | 0.9 | | | — | | | 0.9 | |

| | | | | | | | | | | |

| Intangibles amortization | 6.3 | | | — | | | 6.3 | | | 5.8 | | | 0.3 | | | 6.1 | |

| As adjusted non-GAAP | $ | 21.8 | | | $ | (3.4) | | | $ | 18.4 | | | $ | 18.4 | | | $ | 80.3 | | | $ | 98.7 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 10.3 | | | $ | (5.3) | | | $ | 5.0 | | | $ | (8.2) | | | $ | 16.4 | | | $ | 8.2 | |

| Acquisition and integration-related charges | 2.5 | | | — | | | 2.5 | | | 1.8 | | | — | | | 1.8 | |

| Restructuring and transformation charges | 4.5 | | | — | | | 4.5 | | | 18.7 | | | — | | | 18.7 | |

| Post-RH Divestiture transition charges | 1.5 | | | — | | | 1.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 4.1 | | | — | | | 4.1 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 2.8 | | | — | | | 2.8 | | | 2.0 | | | — | | | 2.0 | |

| | | | | | | | | | | |

| Intangibles amortization | 12.4 | | | — | | | 12.4 | | | 11.6 | | | 0.8 | | | 12.4 | |

| As adjusted non-GAAP | $ | 38.1 | | | $ | (5.3) | | | $ | 32.8 | | | $ | 29.6 | | | $ | 89.5 | | | $ | 119.1 | |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (Loss) Before Taxes |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 6.2 | | | $ | (3.4) | | | $ | 2.8 | | | $ | (5.1) | | | $ | (64.6) | | | $ | (69.7) | |

| Acquisition and integration-related charges | 2.2 | | | — | | | 2.2 | | | 0.3 | | | — | | | 0.3 | |

| Restructuring and transformation charges | 1.6 | | | — | | | 1.6 | | | 9.8 | | | — | | | 9.8 | |

| Post-RH Divestiture transition charges | 0.5 | | | — | | | 0.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 3.4 | | | — | | | 3.4 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 1.5 | | | — | | | 1.5 | | | 0.9 | | | — | | | 0.9 | |

| | | | | | | | | | | |

| Intangibles amortization | 6.3 | | | — | | | 6.3 | | | 5.8 | | | 0.3 | | | 6.1 | |

| As adjusted non-GAAP | $ | 21.7 | | | $ | (3.4) | | | $ | 18.3 | | | $ | 15.4 | | | $ | 8.0 | | | $ | 23.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (Loss) Before Taxes |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 7.7 | | | $ | (5.3) | | | $ | 2.4 | | | $ | (14.2) | | | $ | (55.9) | | | $ | (70.1) | |

| Acquisition and integration-related charges | 2.5 | | | — | | | 2.5 | | | 1.8 | | | — | | | 1.8 | |

| Restructuring and transformation charges | 4.5 | | | — | | | 4.5 | | | 18.7 | | | — | | | 18.7 | |

| Post-RH Divestiture transition charges | 1.5 | | | — | | | 1.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 4.1 | | | — | | | 4.1 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 2.8 | | | — | | | 2.8 | | | 2.0 | | | — | | | 2.0 | |

| | | | | | | | | | | |

| Intangibles amortization | 12.4 | | | — | | | 12.4 | | | 11.6 | | | 0.8 | | | 12.4 | |

| As adjusted non-GAAP | $ | 35.5 | | | $ | (5.3) | | | $ | 30.2 | | | $ | 23.6 | | | $ | 17.2 | | | $ | 40.8 | |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tax (Provision) Benefit |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | (1.9) | | | $ | 0.9 | | | $ | (1.0) | | | $ | 0.8 | | | $ | 0.8 | | | $ | 1.6 | |

| Tax effects of adjusting items | (4.0) | | | — | | | (4.0) | | | (5.0) | | | (2.9) | | | (7.9) | |

| | | | | | | | | | | |

| As adjusted non-GAAP | $ | (5.9) | | | $ | 0.9 | | | $ | (5.0) | | | $ | (4.2) | | | $ | (2.1) | | | $ | (6.3) | |

| Effective tax rate, as reported | 30.6 | % | | 26.5 | % | | 35.7 | % | | 15.7 | % | | 1.2 | % | | 2.3 | % |

| Effective tax rate, as adjusted | 27.2 | % | | 26.5 | % | | 27.3 | % | | 27.0 | % | | 26.3 | % | | 26.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tax (Provision) Benefit |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | (2.9) | | | $ | 1.4 | | | $ | (1.5) | | | $ | 2.1 | | | $ | (0.6) | | | $ | 1.5 | |

| Tax effects of adjusting items | (6.7) | | | — | | | (6.7) | | | (8.5) | | | (4.0) | | | (12.5) | |

| As adjusted non-GAAP | $ | (9.6) | | | $ | 1.4 | | | $ | (8.2) | | | $ | (6.4) | | | $ | (4.6) | | | $ | (11.0) | |

| Effective tax rate, as reported | 37.7 | % | | 26.4 | % | | (62.5) | % | | 14.8 | % | | (1.1) | % | | (2.1) | % |

| Effective tax rate, as adjusted | 27.0 | % | | 26.4 | % | | 27.2 | % | | 27.0 | % | | 27.0 | % | | 27.0 | % |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 4.3 | | | $ | (2.5) | | | $ | 1.8 | | | $ | (4.3) | | | $ | (63.8) | | | $ | (68.1) | |

| Acquisition and integration-related charges | 2.2 | | | — | | | 2.2 | | | 0.3 | | | — | | | 0.3 | |

| Restructuring and transformation charges | 1.6 | | | — | | | 1.6 | | | 9.8 | | | — | | | 9.8 | |

| Post-RH Divestiture transition charges | 0.5 | | | — | | | 0.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 3.4 | | | — | | | 3.4 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 1.5 | | | — | | | 1.5 | | | 0.9 | | | — | | | 0.9 | |

| | | | | | | | | | | |

| Intangibles amortization | 6.3 | | | — | | | 6.3 | | | 5.8 | | | 0.3 | | | 6.1 | |

| Tax effects of adjusting items | (4.0) | | | — | | | (4.0) | | | (5.0) | | | (2.9) | | | (7.9) | |

| | | | | | | | | | | |

| As adjusted non-GAAP | $ | 15.8 | | | $ | (2.5) | | | $ | 13.3 | | | $ | 11.2 | | | $ | 5.9 | | | $ | 17.1 | |

| Diluted earnings (loss) per share, as reported | $ | 0.09 | | | $ | (0.05) | | | $ | 0.04 | | | $ | (0.09) | | | $ | (1.37) | | | $ | (1.46) | |

| Diluted earnings (loss) per share, as adjusted | $ | 0.34 | | | $ | (0.05) | | | $ | 0.29 | | | $ | 0.24 | | | $ | 0.13 | | | $ | 0.37 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 4.8 | | | $ | (3.9) | | | $ | 0.9 | | | $ | (12.1) | | | $ | (56.5) | | | $ | (68.6) | |

| Acquisition and integration-related charges | 2.5 | | | — | | | 2.5 | | | 1.8 | | | — | | | 1.8 | |

| Restructuring and transformation charges | 4.5 | | | — | | | 4.5 | | | 18.7 | | | — | | | 18.7 | |

| Post-RH Divestiture transition charges | 1.5 | | | — | | | 1.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 4.1 | | | — | | | 4.1 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 2.8 | | | — | | | 2.8 | | | 2.0 | | | — | | | 2.0 | |

| | | | | | | | | | | |

| Intangibles amortization | 12.4 | | | — | | | 12.4 | | | 11.6 | | | 0.8 | | | 12.4 | |

| Tax effects of adjusting items | (6.7) | | | — | | | (6.7) | | | (8.5) | | | (4.0) | | | (12.5) | |

| As adjusted non-GAAP | $ | 25.9 | | | $ | (3.9) | | | $ | 22.0 | | | $ | 17.2 | | | $ | 12.6 | | | $ | 29.8 | |

| Diluted earnings (loss) per share, as reported | $ | 0.10 | | | $ | (0.08) | | | $ | 0.03 | | | $ | (0.26) | | | $ | (1.21) | | | $ | (1.47) | |

| Diluted earnings (loss) per share, as adjusted | $ | 0.56 | | | $ | (0.08) | | | $ | 0.48 | | | $ | 0.37 | | | $ | 0.27 | | | $ | 0.64 | |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling, General and Administrative Expenses |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 80.9 | | | $ | — | | | $ | 80.9 | | | $ | 93.0 | | | $ | 3.8 | | | $ | 96.8 | |

| Acquisition and integration-related charges | (0.3) | | | — | | | (0.3) | | | (0.3) | | | — | | | (0.3) | |

| Restructuring and transformation charges | (1.3) | | | — | | | (1.3) | | | (9.5) | | | — | | | (9.5) | |

| Post-RH Divestiture transition charges | (0.1) | | | — | | | (0.1) | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | (1.2) | | | — | | | (1.2) | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | (3.7) | | | — | | | (3.7) | |

| EU MDR Compliance | (1.5) | | | — | | | (1.5) | | | (0.9) | | | — | | | (0.9) | |

| Intangibles amortization | (2.7) | | | — | | | (2.7) | | | (2.2) | | | (0.3) | | | (2.5) | |

| As adjusted non-GAAP | $ | 73.8 | | | $ | — | | | $ | 73.8 | | | $ | 76.4 | | | $ | 3.5 | | | $ | 79.9 | |

SG&A as a percentage of revenue, as reported | 47.1 | % | | — | % | | 43.7 | % | | 54.9 | % | | 12.5 | % | | 48.4 | % |

SG&A as a percentage of revenue, as adjusted | 43.0 | % | | — | % | | 39.8 | % | | 45.1 | % | | 11.5 | % | | 40.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling, General and Administrative Expenses |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| As reported | $ | 164.5 | | | $ | — | | | $ | 164.5 | | | $ | 181.8 | | | $ | 7.7 | | | $ | 189.5 | |

| Acquisition and integration-related charges | (0.6) | | | — | | | (0.6) | | | (0.4) | | | — | | | (0.4) | |

| Restructuring and transformation charges | (3.4) | | | — | | | (3.4) | | | (18.4) | | | — | | | (18.4) | |

| Post-RH Divestiture transition charges | (0.5) | | | — | | | (0.5) | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | (1.9) | | | — | | | (1.9) | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | (3.7) | | | — | | | (3.7) | |

| EU MDR Compliance | (2.8) | | | — | | | (2.8) | | | (2.0) | | | — | | | (2.0) | |

| Intangibles amortization | (5.4) | | | — | | | (5.4) | | | (4.4) | | | (0.8) | | | (5.2) | |

| As adjusted non-GAAP | $ | 149.9 | | | $ | — | | | $ | 149.9 | | | $ | 152.9 | | | $ | 6.9 | | | $ | 159.8 | |

SG&A as a percentage of revenue, as reported | 48.7 | % | | — | % | | 44.7 | % | | 55.3 | % | | 12.3 | % | | 48.4 | % |

SG&A as a percentage of revenue, as adjusted | 44.4 | % | | — | % | | 40.7 | % | | 46.5 | % | | 11.0 | % | | 40.8 | % |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA |

| Three Months Ended June 30, 2024 | | Three Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| Net income (loss) | $ | 4.3 | | | $ | (2.5) | | | $ | 1.8 | | | $ | (4.3) | | | $ | (63.8) | | | $ | (68.1) | |

| Interest expense, net | 0.1 | | | — | | | 0.1 | | | 3.0 | | | — | | | 3.0 | |

| Income tax provision (benefit) | 1.9 | | | (0.9) | | | 1.0 | | | (0.8) | | | (0.8) | | | (1.6) | |

| Depreciation | 5.0 | | | — | | | 5.0 | | | 4.5 | | | 0.9 | | | 5.4 | |

| Amortization | 6.3 | | | — | | | 6.3 | | | 5.8 | | | 0.3 | | | 6.1 | |

| EBITDA | 17.6 | | | (3.4) | | | 14.2 | | | 8.2 | | | (63.4) | | | (55.2) | |

| Acquisition and integration-related charges | 2.2 | | | — | | | 2.2 | | | 0.3 | | | — | | | 0.3 | |

| Restructuring and transformation charges | 1.6 | | | — | | | 1.6 | | | 9.8 | | | — | | | 9.8 | |

| Post-RH Divestiture transition charges | 0.5 | | | — | | | 0.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 3.4 | | | — | | | 3.4 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 1.5 | | | — | | | 1.5 | | | 0.9 | | | — | | | 0.9 | |

| | | | | | | | | | | |

| Adjusted EBITDA | $ | 26.8 | | | $ | (3.4) | | | $ | 23.4 | | | $ | 22.9 | | | $ | 8.9 | | | $ | 31.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA |

| Six Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 |

| Continuing

Operations | | Discontinued

Operations | | Total | | Continuing

Operations | | Discontinued

Operations | | Total |

| Net income (loss) | $ | 4.8 | | | $ | (3.9) | | | $ | 0.9 | | | $ | (12.1) | | | $ | (56.5) | | | $ | (68.6) | |

| Interest expense, net | 2.6 | | | — | | | 2.6 | | | 6.0 | | | — | | | 6.0 | |

| Income tax provision (benefit) | 2.9 | | | (1.4) | | | 1.5 | | | (2.1) | | | 0.6 | | | (1.5) | |

| Depreciation | 10.3 | | | — | | | 10.3 | | | 9.4 | | | 1.8 | | | 11.2 | |

| Amortization | 12.4 | | | — | | | 12.4 | | | 11.6 | | | 0.8 | | | 12.4 | |

| EBITDA | 33.0 | | | (5.3) | | | 27.7 | | | 12.8 | | | (53.3) | | | (40.5) | |

| Acquisition and integration-related charges | 2.5 | | | — | | | 2.5 | | | 1.8 | | | — | | | 1.8 | |

| Restructuring and transformation charges | 4.5 | | | — | | | 4.5 | | | 18.7 | | | — | | | 18.7 | |

| Post-RH Divestiture transition charges | 1.5 | | | — | | | 1.5 | | | — | | | — | | | — | |

| Post-RH Divestiture restructuring | 4.1 | | | — | | | 4.1 | | | — | | | — | | | — | |

| Divestiture related | — | | | — | | | — | | | 3.7 | | | — | | | 3.7 | |

| Estimated loss on Divestiture | — | | | — | | | — | | | — | | | 72.3 | | | 72.3 | |

| EU MDR Compliance | 2.8 | | | — | | | 2.8 | | | 2.0 | | | — | | | 2.0 | |

| | | | | | | | | | | |

| Adjusted EBITDA | $ | 48.4 | | | $ | (5.3) | | | $ | 43.1 | | | $ | 39.0 | | | $ | 19.0 | | | $ | 58.0 | |

AVANOS MEDICAL, INC.

NON-GAAP RECONCILIATIONS

(unaudited)

(in millions except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash provided by (used in) operating activities | $ | 27.8 | | | $ | (2.6) | | | $ | 19.8 | | | $ | (9.4) | |

| Capital expenditures | (5.9) | | | (4.0) | | | (10.0) | | | (8.0) | |

| Free Cash Flow | $ | 21.9 | | | $ | (6.6) | | | $ | 9.8 | | | $ | (17.4) | |

2024 OUTLOOK

| | | | | | | | | | | |

| Estimated Range |

| Diluted earnings per share (GAAP) | $ | 0.63 | | to | $ | 0.87 | |

| Intangibles amortization | 0.37 | | to | 0.34 | |

| Restructuring and transformation charges | 0.08 | | to | 0.06 | |

| Post RH-Divestiture transition charges | 0.12 | | to | 0.10 | |

| Other | 0.10 | | to | 0.08 | |

| Adjusted diluted earnings per share (non-GAAP) | $ | 1.30 | | to | $ | 1.45 | |

AVANOS MEDICAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(in millions)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 92.2 | | | $ | 87.7 | |

| Accounts receivable, net | 123.0 | | | 142.8 | |

| Inventories | 163.9 | | | 163.2 | |

| Prepaid and other current assets | 22.3 | | | 28.8 | |

| Assets held for sale | 72.7 | | | 64.5 | |

| Total Current Assets | 474.1 | | | 487.0 | |

| Property, Plant and Equipment, net | 110.7 | | | 117.2 | |

| Operating Lease Right-of-Use Assets | 29.4 | | | 26.8 | |

| Goodwill | 794.4 | | | 796.1 | |

| Other Intangible Assets, net | 226.2 | | | 239.5 | |

| Deferred Tax Assets | 6.3 | | | 6.5 | |

| Other Assets | 16.7 | | | 19.3 | |

| TOTAL ASSETS | $ | 1,657.8 | | | $ | 1,692.4 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Current portion of long-term debt | $ | 10.2 | | | $ | 8.6 | |

| Current portion of operating lease liabilities | 14.4 | | | 12.8 | |

| Trade accounts payable | 51.4 | | | 56.3 | |

| Accrued expenses | 79.5 | | | 93.2 | |

| Liabilities held for sale | 52.7 | | | 63.7 | |

| Total Current Liabilities | 208.2 | | | 234.6 | |

| Long-Term Debt | 164.9 | | | 159.4 | |

| Operating Lease Liabilities | 28.8 | | | 28.3 | |

| Deferred Tax Liabilities | 23.4 | | | 23.8 | |

| Other Long-Term Liabilities | 10.5 | | | 10.0 | |

| TOTAL LIABILITIES | 435.8 | | | 456.1 | |

| Stockholders’ Equity | 1,222.0 | | | 1,236.3 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 1,657.8 | | | $ | 1,692.4 | |

AVANOS MEDICAL, INC.

CONDENSED CONSOLIDATED CASH FLOW STATEMENTS

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating Activities | | | | | | | |

| Net income (loss) | $ | 1.8 | | | $ | (68.1) | | | $ | 0.9 | | | $ | (68.6) | |

| Depreciation and amortization | 11.3 | | | 11.5 | | | 22.7 | | | 23.6 | |

| Goodwill impairment | — | | | 59.1 | | | — | | | 59.1 | |

| Loss on asset dispositions | — | | | — | | | 0.3 | | | — | |

| Changes in operating assets and liabilities, net of acquisition | 8.3 | | | (13.4) | | | (13.7) | | | (32.7) | |

| Deferred income taxes and other | 6.4 | | | 8.3 | | | 9.6 | | | 9.2 | |

| Cash Provided by (Used in) Operating Activities | 27.8 | | | (2.6) | | | 19.8 | | | (9.4) | |

| Investing Activities | | | | | | | |

| Capital expenditures | (5.9) | | | (4.0) | | | (10.0) | | | (8.0) | |

| Proceeds from RH Divestiture post-closing settlement | — | | | — | | | 2.1 | | | — | |

| Acquisition of assets and investments in businesses | — | | | (2.5) | | | — | | | (2.5) | |

| Cash Used in Investing Activities | (5.9) | | | (6.5) | | | (7.9) | | | (10.5) | |

| Financing Activities | | | | | | | |

| | | | | | | |

| Secured debt repayments | (1.5) | | | (1.5) | | | (3.1) | | | (3.1) | |

| Revolving credit facility proceeds | — | | | — | | | 20.0 | | | — | |

| Revolving credit facility repayments | — | | | — | | | (10.0) | | | (20.0) | |

| | | | | | | |

| Purchase of treasury stock | (3.5) | | | (2.6) | | | (12.6) | | | (3.7) | |

| Proceeds from the exercise of stock options | — | | | — | | | 0.5 | | | 0.6 | |

| Payment of contingent consideration liabilities | — | | | — | | | (0.5) | | | — | |

| Cash Used in Financing Activities | (5.0) | | | (4.1) | | | (5.7) | | | (26.2) | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | (0.5) | | | (0.7) | | | (1.7) | | | 0.2 | |

| Increase (Decrease) in Cash and Cash Equivalents | 16.4 | | | (13.9) | | | 4.5 | | | (45.9) | |

| Cash and Cash Equivalents - Beginning of Period | 75.8 | | | 95.7 | | | 87.7 | | | 127.7 | |

| Cash and Cash Equivalents - End of Period | $ | 92.2 | | | $ | 81.8 | | | $ | 92.2 | | | $ | 81.8 | |

AVANOS MEDICAL, INC.

SELECTED BUSINESS AND PRODUCTS DATA

(unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | | Six Months Ended June 30, | | |

| 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| Digestive Health | $ | 97.7 | | | $ | 93.0 | | | 5.1 | % | | | $ | 192.4 | | | $ | 181.8 | | | 5.8 | % |

| Pain Management and Recovery: | | | | | | | | | | | | |

| Surgical pain and recovery | $ | 32.3 | | | $ | 34.8 | | | (7.2) | % | | | $ | 63.5 | | | $ | 69.5 | | | (8.6) | % |

| Interventional pain | 41.7 | | | 41.6 | | | 0.2 | % | | | 81.9 | | | 77.4 | | | 5.8 | % |

| Total Pain Management and Recovery | 74.0 | | | 76.4 | | | (3.1) | % | | | 145.4 | | | 146.9 | | | (1.0) | % |

| Total Net Sales | $ | 171.7 | | | $ | 169.4 | | | 1.4 | % | | | $ | 337.8 | | | $ | 328.7 | | | 2.8 | % |

| | | | | | | | | | | | |

| | | Total | | Volume | | | Pricing/Mix | | Currency | | |

| Net sales - percentage change | QTD | | 1.4 | % | | 3.5 | % | | | (1.8) | % | | (0.3) | % | | |

| Net sales - percentage change | YTD | | 2.8 | % | | 4.3 | % | | | (1.4) | % | | (0.1) | % | | |

v3.24.2

Cover Page Cover Page

|

Jul. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 31, 2024

|

| Entity File Number |

001-36440

|

| Entity Registrant Name |

AVANOS MEDICAL, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-4987888

|

| Entity Address, Address Line One |

5405 Windward Parkway

|

| Entity Address, Address Line Two |

Suite 100 South

|

| Entity Address, City or Town |

Alpharetta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30004

|

| City Area Code |

844

|

| Local Phone Number |

428-2667

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock - $0.01 Par Value

|

| Trading Symbol |

AVNS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001606498

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

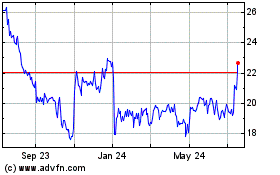

Avanos Medical (NYSE:AVNS)

Historical Stock Chart

From Jul 2024 to Jul 2024

Avanos Medical (NYSE:AVNS)

Historical Stock Chart

From Jul 2023 to Jul 2024