Current Report Filing (8-k)

January 11 2023 - 7:24AM

Edgar (US Regulatory)

0001606498falseJanuary 10, 202300016064982023-01-102023-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: January 10, 2023

(Date of earliest event reported)

Commission file number 001-36440

AVANOS MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | | | 46-4987888 |

| (State or other jurisdiction of incorporation) | | | | (I.R.S. Employer Identification No.) |

| 5405 Windward Parkway | |

| Suite 100 South | |

| Alpharetta, | Georgia | 30004 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (844) 428-2667 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock - $0.01 Par Value | AVNS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 10, 2023, Avanos Medical, Inc. (the “Company”) approved a three-year transformation process (the “Transformation Process”) pursuant to which the Company plans to: (i) combine its Chronic Care and Pain franchises into a single commercial organization focused on the Digestive Health and Orthopedic Pain & Recovery product categories; (ii) exit certain low-margin, low-growth product categories, including through targeted divestitures; (iii) undertake additional cost management activities to enhance the Company’s operating profitability; and (iv) pursue efficient capital allocation strategies, including through acquisitions that meet the Company’s strategic and financial criteria.

As part of the Transformation Process, Kerr W. Holbrook, currently the Company’s Senior Vice President and General Manager, Chronic Care, has been appointed to the position of Senior Vice President and Chief Commercial Officer. In that position, Mr. Holbrook will be responsible for executing on the commercial aspects of the Transformation Process. In addition, Michael C. Greiner, the Company’s Senior Vice President and Chief Financial Officer, will assume the additional role of Chief Transformation Officer. As a result of the combination of the Chronic Care and Pain franchises into a single commercial organization, the position of Senior Vice President and General Manager, Pain Franchise, currently held by William D. Haydon, will be eliminated.

Other than the costs associated with the termination of Mr. Haydon’s employment, which are described in Item 5.02 of this Current Report and incorporated herein by reference, the Company is currently unable in good faith to estimate: (i) the total amount or range of amounts expected to be incurred in connection with each major type of cost associated with the Transformation Process; (ii) the total amount or range of amounts expected to be incurred in connection with the Transformation Process; or (iii) the amount or range of amounts of the charge that will result in future cash expenditures related to the Transformation Process. The Company will file an amended Current Report on Form 8-K within four business days after it makes a determination of such an estimate or range of estimates.

Note Regarding Forward-Looking Statements

This Current Report contains “forward-looking statements” within the meaning of the federal securities laws that are intended to qualify for the Safe Harbor from liability established by the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” generally can be identified by the use of forward-looking terminology such as “plans,” “will,” “expect” (or the negative or other derivatives of each of these terms) or similar terminology. The “forward-looking statements” include statements regarding the expected Transformation Process and the impact and timing of the Transformation Process. These statements represent the Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, general economic and business conditions, and other risks set forth in Item 1A - “Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2021 and in its most recent Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report. Except to the extent required by applicable law, the Company undertakes no obligation to update any forward-looking statement contained in this Current Report, whether as a result of new information, future events, or otherwise.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 10, 2023, the Company and William D. Haydon, the Company’s Senior Vice President and General Manager, Pain Franchise, entered into a Severance and Separation Agreement (the “Severance and Separation Agreement”) pursuant to which: (i) Mr. Haydon’s employment with the Company will terminate effective March 31, 2023 (the “Separation Date”); (ii) the Company will, within 60 days following the Separation Date, pay Mr. Haydon a one-time lump sum cash severance payment equal to $972,000; (iii) the Company will pay 100% of Mr. Haydon’s monthly COBRA premiums for a period of 12 months following the Separation Date; (iv) the Company will provide Mr. Haydon with outplacement services for a period of six months following the Separation Date; and (v) Mr. Haydon will be eligible to receive a bonus (the “Transition Incentive Bonus”) of up to $300,000 based on the extent to which he meets certain performance metrics prior to the Separation Date, as determined in the Company’s sole discretion. The Transition Incentive Bonus will be paid as soon as practicable after the Separation Date, but in no event later than May 31, 2023. Mr. Haydon’s eligibility to receive the benefits described above is conditioned on: (i) his continuing to perform his assigned duties and responsibilities in a satisfactory fashion through the Separation Date, and (ii) his execution of a general release in favor of the Company and its directors, officers, employees and affiliates.

Item 7.01 Regulation FD Disclosure.

On January 11, 2023, the Company will present and discuss during the JP Morgan Healthcare Conference the slide presentation furnished herewith as Exhibit 99.1 to this Current Report and incorporated herein by reference.

On January 11, 2023, the Company issued a press release announcing the appointment of Mr. Holbrook to the position of Senior Vice President and Chief Commercial Officer and the appointment of Mr. Greiner to the additional role of Chief Transformation Officer. A copy of such press release is furnished as Exhibit 99.2 to this Current Report and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | AVANOS MEDICAL, INC. |

| | | | |

| Date: | January 11, 2023 | | By: | /s/ Mojirade James |

| | | | Mojirade James

Senior Vice President and General Counsel |

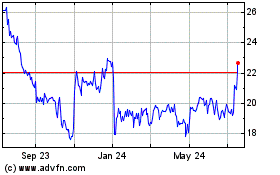

Avanos Medical (NYSE:AVNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avanos Medical (NYSE:AVNS)

Historical Stock Chart

From Jul 2023 to Jul 2024