false000130516800013051682024-08-072024-08-07

| | | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

| FORM | 8-K |

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 |

| | | | | | | | | | | | | | | | | |

| | Date of Report: | August 7, 2024 | | |

| (Date of earliest event reported) |

| ARC Document Solutions, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | |

| Delaware | 001-32407 | 20-1700361 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification Number) |

| | | | | |

| 12657 Alcosta Blvd, Suite 200 | San Ramon | CA | 94583 |

| (Address of principal executive offices) | (Zip Code) |

| | (925) | 949-5100 | | |

| (Registrant's telephone number, including area code) |

Not Applicable (Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ARC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition

On August 7, 2024, ARC Document Solutions, Inc. (the “Company”) issued a press release reporting its financial results for the second quarter of the fiscal year ending December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Dated: August 7, 2024 | ARC DOCUMENT SOLUTIONS, INC. By: /s/ Jorge Avalos Jorge Avalos Chief Financial Officer |

| | | | | | | | |

| Exhibit Index |

| Exhibit No. | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

ARC Reports Growth in Overall Sales and Improvements in Gross Margin for Q2 2024

SAN RAMON, CA – (August 7, 2024) – ARC Document Solutions, Inc. (NYSE: ARC), a leading provider of digital printing and document-related services, today reported its financial results for the second quarter ended June 30, 2024.

| | | | | | | | | | | | | | | | | |

| Financial Highlights: | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| (All dollar amounts in millions, except EPS) | 2024 | 2023 | | 2024 | 2023 |

| Net sales | $ | 75.1 | | $ | 72.4 | | | $ | 145.9 | | $ | 141.3 | |

| Gross margin | 35.1 | % | 34.8 | % | | 33.7 | % | 34.0 | % |

| | | | | |

| Net income attributable to ARC | $ | 3.2 | | $ | 4.0 | | | $ | 5.6 | | $ | 6.0 | |

| Adjusted net income attributable to ARC | $ | 3.3 | | $ | 4.1 | | | $ | 5.9 | | $ | 6.2 | |

| Earnings per share - diluted | $ | 0.07 | | $ | 0.09 | | | $ | 0.13 | | $ | 0.14 | |

| Adjusted earnings per share - diluted | $ | 0.08 | | $ | 0.09 | | | $ | 0.14 | | $ | 0.14 | |

| Cash provided by operating activities | $ | 6.4 | | $ | 10.3 | | | $ | 10.1 | | $ | 14.2 | |

| EBITDA | $ | 9.1 | | $ | 10.6 | | | $ | 17.0 | | $ | 18.8 | |

| Adjusted EBITDA | $ | 9.8 | | $ | 11.1 | | | $ | 18.3 | | $ | 19.8 | |

| Capital expenditures | $ | 3.8 | | $ | 2.2 | | | $ | 6.9 | | $ | 4.5 | |

| Debt & finance leases (including current) | | | | $ | 59.9 | | $ | 62.8 | |

Management Commentary:

“The execution of our strategic objectives were, once again, responsible for our success in the second quarter, despite uncertain business conditions caused by the high interest rates and the weakness in commercial construction due to excess supply,” said Suri Suriyakumar, Chairman and CEO of ARC Document Solutions. “While we expect these conditions to continue in the second half of the year, we remain focused on our long-term objectives during these difficult market conditions.”

“Our digital color print services have been the key drivers of our success in Q2, and we are optimistic about delivering continued strong sales results in the coming quarters,” said Dilo Wijesuriya, President and COO. “The transformation initiatives we implemented several years ago are proving successful, as evidenced by our results.”

“Sales were strong in the period, and we reversed the year-over-year decline in gross margin we experienced in the first quarter,” said Jorge Avalos, Chief Financial Officer. “A number of large projects were completed in the last month of the second quarter, pushing collections into Q3, which temporarily muted our operating cash flow performance. We are confident that cash flows will improve in the third and fourth quarters, just as they did last year.”

2024 Second Quarter Supplemental Information:

Net sales were $75.1 million, a 3.8% increase compared to the second quarter of 2023.

Cash & cash equivalents on the consolidated balance sheet in the second quarter 2024 were $49.9 million.

ARC’s next quarterly cash dividend of $0.05 will be paid on August 30, 2024 with a record date of July 31, 2024.

Days sales outstanding were 50 in Q2 2024 and 48 in Q2 2023.

The number of MPS locations have declined slightly year over year to approximately 10,400 as of June 30, 2024, representing a net decrease of approximately 150 locations compared to June 30, 2023.

Net Revenue

| | | | | | | | | | | | | | | | | | | | |

| In millions | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

| Total net revenue | $ | 75.1 | | $ | 70.8 | | $ | 281.2 | | $ | 68.9 | | $ | 71.1 | | $ | 72.4 | |

In the second quarter 2024, net sales increased 3.8%, compared to the same period in 2023. The increase in net sales was primarily driven by the growth of sales in Digital Printing and Scanning and Digital Imaging sales. Growth for the period was partially offset by a small decline in MPS sales.

Revenue by Business Lines

| | | | | | | | | | | | | | | | | | | | |

| In millions | 2Q 2024 (1) | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 (1) | 2Q 2023 |

| Digital Printing | $ | 46.8 | | $ | 42.7 | | $ | 170.1 | | $ | 40.9 | | $ | 43.5 | | $ | 44.2 | |

| MPS | $ | 18.7 | | $ | 18.6 | | $ | 74.8 | | $ | 18.2 | | $ | 18.6 | | $ | 19.0 | |

| Scanning and Digital Imaging | $ | 5.7 | | $ | 5.7 | | $ | 20.3 | | $ | 5.5 | | $ | 5.0 | | $ | 5.3 | |

| Equipment and supplies | $ | 4.0 | | $ | 3.8 | | $ | 16.0 | | $ | 4.3 | | $ | 3.9 | | $ | 3.9 | |

1.Column does not foot due to rounding.

In the second quarter 2024, Digital Printing sales increased 5.8% compared to prior year. Year-over-year sales saw healthy increases in digital color graphic printing from new and existing customers. This growth was partially offset by a decrease in digital plan printing sales which we continue to attribute to less construction activity and subsequent lower spending due to high interest rates.

In the second quarter 2024, MPS sales decreased 1.2% year-over-year. MPS sales have remained in a narrow band between $18 million to $19 million per quarter for more than two years, strongly implying fewer employees in the workplace will continue to constrain onsite print volumes relative to historical averages.

In the second quarter 2024, Scanning and Digital Imaging sales increased 7.4% year-over-year. The increase in sales of our Scanning and Digital Imaging services continues to be driven by growing demand for paper-to-digital document conversions and digital archives to replace long-term warehoused paper document storage. We believe that demand for our Scanning and Digital Imaging services will continue to grow in the future.

In the second quarter 2024, Equipment and Supplies sales increased 1.4% year-over-year. Equipment and Supplies sales remained relatively flat year-over-year, as buying habits have stabilized as customers have adjusted to a high interest rate environment.

Gross Profit

| | | | | | | | | | | | | | | | | | | | |

| In millions unless otherwise indicated | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

| Gross profit | $ | 26.4 | | $ | 22.8 | | $ | 94.4 | | $ | 22.2 | | $ | 24.1 | | $ | 25.2 | |

| Gross margin | 35.1 | % | 32.2 | % | 33.6 | % | 32.2 | % | 34.0 | % | 34.8 | % |

In the second quarter 2024, gross profit and gross margin were $26.4 million, and 35.1%, respectively, a year-over-year margin increase of 30 basis points driven by the increase in sales, and our ability to leverage our work force and overhead costs.

Selling, General and Administrative Expenses

| | | | | | | | | | | | | | | | | | | | |

| In millions | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

Selling, general and administrative expenses | $ | 21.3 | | $ | 19.1 | | $ | 76.3 | | $ | 18.6 | | $ | 19.3 | | $ | 19.0 | |

Selling, general and administrative expenses increased by $2.3 million or 12.2% year-over-year. The increase is primarily due to greater commissions based on a higher level of sales, as well as continuing investments in sales staff and marketing initiatives. Of note, selling, general and administrative expenses for the three months ended June 30, 2024 also include $0.9 million in costs related to the previously disclosed take-private proposal summarized below under “Non-Binding Proposal.”

Net Income and Earnings Per Share

| | | | | | | | | | | | | | | | | | | | |

| In millions unless otherwise indicated | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

| Net income attributable to ARC – GAAP | $ | 3.2 | | $ | 2.5 | | $ | 8.2 | | $ | (0.9) | | $ | 3.2 | | $ | 4.0 | |

| Adjusted net income attributable to ARC | $ | 3.3 | | $ | 2.6 | | $ | 11.8 | | $ | 2.4 | | $ | 3.2 | | $ | 4.1 | |

| | | | | | |

| Earnings per share attributable to ARC | | | | | | |

| Diluted EPS – GAAP | $ | 0.07 | | $ | 0.06 | | $ | 0.19 | | $ | (0.02) | | $ | 0.07 | | $ | 0.09 | |

| Adjusted diluted EPS | $ | 0.08 | | $ | 0.06 | | $ | 0.27 | | $ | 0.05 | | $ | 0.07 | | $ | 0.09 | |

Year-over-year net income attributable to ARC and earnings per share decreased during the second quarter of 2024. The decrease was driven primarily by higher selling, general and administrative expenses, as described above.

Cash Provided by Operating Activities

| | | | | | | | | | | | | | | | | | | | |

| In millions | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

| Cash provided by operating activities | $ | 6.4 | | $ | 3.7 | | $ | 36.6 | | $ | 13.7 | | $ | 8.7 | | $ | 10.3 | |

The year-over-year decrease in cash flows from operations during the second quarter of 2024 was primarily due to timing of receivable collections resulting from of an increase in sales occurring later in the period.

EBITDA

| | | | | | | | | | | | | | | | | | | | |

| In millions | 2Q 2024 | 1Q 2024 | FYE 2023 | 4Q 2023 | 3Q 2023 | 2Q 2023 |

| EBITDA | $ | 9.1 | | $ | 7.9 | | $ | 31.9 | | $ | 3.7 | | $ | 9.4 | | $ | 10.6 | |

| Adjusted EBITDA | $ | 9.8 | | $ | 8.6 | | $ | 38.1 | | $ | 8.3 | | $ | 10.0 | | $ | 11.1 | |

Year-over-year EBITDA and Adjusted EBITDA decreased due to higher selling, general and administrative expenses, as described above.

| | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| Sales from Services and Product Lines as a Percentage of Net Sales | 2024 | 2023 | 2024 | 2023 |

| Digital Printing | 62.3 | % | 61.1 | % | 61.3 | % | 60.5 | % |

| MPS | 24.9 | % | 26.2 | % | 25.6 | % | 26.9 | % |

| Scanning and Digital Imaging | 7.5 | % | 7.3 | % | 7.8 | % | 7.0 | % |

| Equipment and supplies sales | 5.3 | % | 5.4 | % | 5.3 | % | 5.6 | % |

Non-Binding Proposal

As previously disclosed, we received a non-binding proposal on April 8, 2024 from our Chairman and Chief Executive Officer, Kumarakulasingam Suriyakumar, outlining Mr. Suriyakumar’s intent to explore and evaluate a potential acquisition of all of the outstanding shares of our common stock, $0.001 per share (“common stock”), not already owned by Mr. Suriyakumar in a going-private transaction at a purchase price of $3.25 per share in cash (the “Proposed Transaction”). On June 27, 2024, Mr. Suriyakumar, Dilantha Wijesuriya, our President and Chief Operating Officer, Jorge Avalos, our Chief Financial Officer, Rahul Roy, our Chief Technology Officer, Sujeewa Sean Pathiratne, a private investor, and certain entities affiliated with such persons (collectively, the “Acquisition Group”) agreed in principle that they will work with each other to negotiate and consummate the Proposed Transaction. The Acquisition Group currently beneficially owns approximately 19.6% of our outstanding shares of common stock.

In response to the proposal, on April 8, 2024, a special committee of our board of directors consisting entirely of independent, disinterested directors (the “Special Committee”) was formed to review and evaluate the Proposed Transaction. The Special Committee continues to carefully consider the Proposed Transaction with the assistance of its independent financial and legal advisors. No assurances can be given regarding the terms and details of any transaction, that any proposal made by the Acquisition Group regarding a transaction will be accepted by the Special Committee, that definitive documentation relating to any such transaction will be executed, or that a transaction will be consummated in accordance with that documentation, if at all.

Teleconference and Webcast

ARC Document Solutions will hold a conference call with investors and analysts on Wednesday, August 7, 2024, at 2 P.M. Pacific Time (5 P.M. Eastern Time) to discuss results of the Company’s second quarter of 2024. To access the live conference call outlining ARC’s 2024 second quarter results, dial (800) 715-9871. International callers may join the conference by dialing +1 (646) 307-1963. The conference code is 1511143 and will be required to dial into the call. A live webcast will also be made available at: https://events.q4inc.com/attendee/383771751 or on the Company's investor relations website at http://ir.e-arc.com. A replay of the webcast will be available on the website following the call's conclusion.

About ARC Document Solutions (NYSE: ARC)

ARC partners with top brands around the world to tell their stories through visually compelling graphics. We use advanced digital printing technology, sustainable materials, and innovative techniques to bring their vision to life. ARC also provides other digital printing and scanning services to a wide variety of industries all over North America and in select markets around the world. Follow ARC at www.e-arc.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on current opinions, estimates and assumptions of management regarding future events and the future financial performance of the Company, and on the Company’s operations. Words and phrases such as, “conditions to continue in the second half of the year,” “focused on our long-term objectives” and “optimistic about delivering continued strong sales results in the coming quarters,” and similar expressions identify forward-looking statements and all statements other than statements of historical fact, including, but not limited to, any projections regarding earnings, revenues and financial performance of the Company, could be deemed forward-looking statements. We caution you that such statements are only predictions and are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. In addition to matters affecting the construction, managed print services, digital printing industries, or the economy generally, factors that could cause actual results to differ from expectations stated in forward-looking statements include, among others, the factors described in the section titled "Part I - Item 1A. Risk Factors" of ARC Document Solution's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, Quarterly Reports on Form 10-Q, and other periodic filings and prospectuses. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Contact Information:

David Stickney

VP Corporate Communications & Investor Relations

925-949-5114

| | | | | | | | |

ARC Document Solutions, Inc. | | |

Consolidated Balance Sheets | | |

(In thousands, except per share data) | | |

(Unaudited) | | |

| June 30, | December 31, |

| Current assets: | 2024 | 2023 |

| Cash and cash equivalents | $ | 49,911 | | $ | 56,093 | |

Accounts receivable, net of allowances for accounts receivable of $1,823 and $1,857 | 41,516 | | 35,775 | |

| Inventory | 9,218 | | 8,818 | |

| | |

| Prepaid expenses | 4,943 | | 3,988 | |

| Other current assets | 4,410 | | 3,978 | |

| Total current assets | 109,998 | | 108,652 | |

Property and equipment, net of accumulated depreciation of $226,206 and $229,122 | 42,840 | | 40,925 | |

| Right-of-use assets from operating leases | 34,253 | | 32,838 | |

| Goodwill | 121,051 | | 121,051 | |

| Other intangible assets, net | 138 | | 162 | |

| Deferred income taxes | 2,405 | | 4,383 | |

| Other assets | 1,896 | | 2,113 | |

| Total assets | $ | 312,581 | | $ | 310,124 | |

| Current liabilities: | | |

| Accounts payable | $ | 26,667 | | $ | 24,175 | |

| Accrued payroll and payroll-related expenses | 8,897 | | 9,401 | |

| Accrued expenses | 18,010 | | 18,787 | |

| Current operating lease liabilities | 10,325 | | 9,924 | |

| Current portion of finance leases | 7,431 | | 8,870 | |

| Total current liabilities | 71,330 | | 71,157 | |

| Long-term operating lease liabilities | 28,401 | | 27,357 | |

| Long-term debt and finance leases | 52,457 | | 53,366 | |

| Deferred income taxes | 254 | | 52 | |

| Other long-term liabilities | 2,442 | | 2,467 | |

| Total liabilities | 154,884 | | 154,399 | |

| Commitments and contingencies | | |

| Stockholders’ equity: | | |

| ARC Document Solutions, Inc. stockholders’ equity: | | |

Preferred stock, $0.001 par value, 25,000 shares authorized; 0 shares issued and outstanding | — | | — | |

Common stock, $0.001 par value, 150,000 shares authorized; 53,111 and 52,526 shares issued and 43,248 and 42,783 shares outstanding | 53 | | 52 | |

| Additional paid-in capital | 137,888 | | 136,460 | |

| Retained earnings | 45,522 | | 44,144 | |

| Accumulated other comprehensive loss | (4,514) | | (4,200) | |

| 178,949 | | 176,456 | |

Less cost of common stock in treasury, 9,863 and 9,743 shares | 22,727 | | 22,390 | |

| Total ARC Document Solutions, Inc. stockholders’ equity | 156,222 | | 154,066 | |

| Noncontrolling interest | 1,475 | | 1,659 | |

| Total equity | 157,697 | | 155,725 | |

| Total liabilities and equity | $ | 312,581 | | $ | 310,124 | |

| | | | | | | | | | | | | | |

| ARC Document Solutions, Inc. | | | | |

| Consolidated Statements of Operations | | | | |

| (In thousands, except per share data) | | | | |

| (Unaudited) | Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| | | | |

| | | | |

| Net sales | $ | 75,114 | | $ | 72,350 | | $ | 145,906 | | $ | 141,268 | |

| Cost of sales | 48,726 | | 47,174 | | 96,711 | | 93,167 | |

| Gross profit | 26,388 | | 25,176 | | 49,195 | | 48,101 | |

| Selling, general and administrative expenses | 21,342 | | 19,013 | | 40,413 | | 38,495 | |

| Amortization of intangible assets | 10 | | 10 | | 20 | | 21 | |

| | | | |

| | | | |

| Income from operations | 5,036 | | 6,153 | | 8,762 | | 9,585 | |

| Other income, net | (35) | | (15) | | (71) | | (26) | |

| | | | |

| Interest expense, net | 331 | | 447 | | 641 | | 903 | |

| Income before income tax provision | 4,740 | | 5,721 | | 8,192 | | 8,708 | |

| Income tax provision | 1,605 | | 1,734 | | 2,693 | | 2,894 | |

| Net income | 3,135 | | 3,987 | | 5,499 | | 5,814 | |

| Loss attributable to the noncontrolling interest | 24 | | 31 | | 113 | | 144 | |

| Net income attributable to ARC Document Solutions, Inc. stockholders | $ | 3,159 | | $ | 4,018 | | $ | 5,612 | | $ | 5,958 | |

| Earnings per share attributable to ARC Document Solutions, Inc. stockholders | | | | |

| Basic | $ | 0.07 | | $ | 0.09 | | $ | 0.13 | | $ | 0.14 | |

| Diluted | $ | 0.07 | | $ | 0.09 | | $ | 0.13 | | $ | 0.14 | |

| Weighted average common shares outstanding: | | | | |

| Basic | 42,342 | | 42,801 | | 42,267 | | 42,673 | |

| Diluted | 43,067 | | 43,614 | | 43,061 | | 43,679 | |

| | | | | | | | | | | | | | |

ARC Document Solutions, Inc.

| | | | |

| Consolidated Statements of Cash Flows | | | | |

| (In thousands) | | | | |

| (Unaudited) | Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Cash flows from operating activities | | | | |

| Net income | $ | 3,135 | | $ | 3,987 | | $ | 5,499 | | $ | 5,814 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Allowance for credit losses | 59 | | 131 | | 156 | | 229 | |

| Depreciation | 3,954 | | 4,363 | | 7,994 | | 9,015 | |

| Amortization of intangible assets | 10 | | 10 | | 20 | | 21 | |

| Amortization of deferred financing costs | 18 | | 16 | | 35 | | 32 | |

| | | | |

| | | | |

| Stock-based compensation | 691 | | 529 | | 1,342 | | 1,023 | |

| Deferred income taxes | 1,429 | | 1,583 | | 2,270 | | 2,545 | |

| Deferred tax valuation allowance | (180) | | 6 | | (121) | | 49 | |

| | | | |

| | | | |

| | | | |

| Other non-cash items, net | (280) | | (82) | | (335) | | (157) | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | (3,718) | | 920 | | (6,004) | | 222 | |

| Inventory | 49 | | 260 | | (446) | | (323) | |

| Prepaid expenses and other assets | 1,418 | | 1,284 | | 3,829 | | 4,542 | |

| Accounts payable and accrued expenses | (193) | | (2,678) | | (4,146) | | (8,859) | |

| Net cash provided by operating activities | 6,392 | | 10,329 | | 10,093 | | 14,153 | |

| Cash flows from investing activities | | | | |

| Capital expenditures | (3,844) | | (2,241) | | (6,919) | | (4,496) | |

| | | | |

| Other | 152 | | 99 | | 218 | | 191 | |

| Net cash used in investing activities | (3,692) | | (2,142) | | (6,701) | | (4,305) | |

| Cash flows from financing activities | | | | |

| Proceeds from stock option exercises | 24 | | 45 | | 28 | | 1,081 | |

| Proceeds from issuance of common stock under Employee Stock Purchase Plan | 27 | | 31 | | 59 | | 60 | |

| Share repurchases | (282) | | (1,691) | | (337) | | (1,808) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Payments on finance leases | (2,363) | | (3,011) | | (4,915) | | (6,194) | |

| Borrowings under revolving credit facilities | 40,000 | | 40,000 | | 80,000 | | 82,000 | |

| Payments under revolving credit facilities | (40,000) | | (40,000) | | (80,000) | | (82,000) | |

| Payment of deferred financing costs | — | | (23) | | — | | (23) | |

| | | | |

| Dividends paid | (2,111) | | (2,145) | | (4,219) | | (4,267) | |

| Net cash used in financing activities | (4,705) | | (6,794) | | (9,384) | | (11,151) | |

| Effect of foreign currency translation on cash balances | (113) | | (130) | | (190) | | (192) | |

| Net change in cash and cash equivalents | (2,118) | | 1,263 | | (6,182) | | (1,495) | |

| Cash and cash equivalents at beginning of period | 52,029 | | 49,803 | | 56,093 | | 52,561 | |

| Cash and cash equivalents at end of period | $ | 49,911 | | $ | 51,066 | | $ | 49,911 | | $ | 51,066 | |

| Supplemental disclosure of cash flow information | | | | |

| Noncash investing and financing activities | | | | |

| Finance lease obligations incurred | $ | 1,499 | | $ | 997 | | $ | 2,605 | | $ | 2,482 | |

| Operating lease obligations incurred | $ | 2,228 | | $ | 1,010 | | $ | 6,463 | | $ | 4,375 | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

ARC Document Solutions, Inc.

Net Sales by Product Line

(In thousands)

(Unaudited) | | | | |

| Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Service sales | | | | |

| Digital Printing | $ | 46,766 | | $ | 44,218 | | $ | 89,491 | | $ | 85,597 | |

| MPS | 18,728 | | 18,958 | | 37,312 | | 37,974 | |

| Scanning and Digital Imaging | 5,651 | | 5,260 | | 11,322 | | 9,854 | |

| Total service sales | 71,145 | | 68,436 | | 138,125 | | 133,425 | |

| Equipment and Supplies Sales | 3,969 | | 3,914 | | 7,781 | | 7,843 | |

| Total net sales | $ | 75,114 | | $ | 72,350 | | $ | 145,906 | | $ | 141,268 | |

| | | | | | | | | | | | | | |

ARC Document Solutions, Inc.

Non-GAAP Measures

Reconciliation of cash flows provided by operating activities to EBITDA and Adjusted EBITDA

(In thousands)

(Unaudited) | | |

| Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Cash flows provided by operating activities | $ | 6,392 | | $ | 10,329 | | $ | 10,093 | | $ | 14,153 | |

| Changes in operating assets and liabilities | 2,444 | | 214 | | 6,767 | | 4,418 | |

| Non-cash expenses, including depreciation and amortization | (5,701) | | (6,556) | | (11,361) | | (12,757) | |

| Income tax provision | 1,605 | | 1,734 | | 2,693 | | 2,894 | |

| Interest expense, net | 331 | | 447 | | 641 | | 903 | |

| Loss attributable to the noncontrolling interest | 24 | | 31 | | 113 | | 144 | |

| | | | |

| Depreciation and amortization | 3,964 | | 4,373 | | 8,014 | | 9,036 | |

| EBITDA | 9,059 | | 10,572 | | 16,960 | | 18,791 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Stock-based compensation | 691 | | 529 | | 1,342 | | 1,023 | |

| Adjusted EBITDA | $ | 9,750 | | $ | 11,101 | | $ | 18,302 | | $ | 19,814 | |

See Non-GAAP Financial Measures discussion below.

| | | | | | | | | | | | | | |

ARC Document Solutions, Inc.

Non-GAAP Measures

Reconciliation of net income attributable to ARC Document Solutions, Inc. to EBITDA and Adjusted EBITDA

(In thousands)

(Unaudited) | | |

| Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Net income attributable to ARC Document Solutions, Inc. | $ | 3,159 | | $ | 4,018 | | $ | 5,612 | | $ | 5,958 | |

| Interest expense, net | 331 | | 447 | | 641 | | 903 | |

| Income tax provision | 1,605 | | 1,734 | | 2,693 | | 2,894 | |

| | | | |

| Depreciation and amortization | 3,964 | | 4,373 | | 8,014 | | 9,036 | |

| EBITDA | 9,059 | | 10,572 | | 16,960 | | 18,791 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Stock-based compensation | 691 | | 529 | | 1,342 | | 1,023 | |

| Adjusted EBITDA | $ | 9,750 | | $ | 11,101 | | $ | 18,302 | | $ | 19,814 | |

See Non-GAAP Financial Measures discussion below.

| | | | | | | | | | | | | | |

ARC Document Solutions, Inc.

Non-GAAP Measures

Reconciliation of net income attributable to ARC Document Solutions, Inc. to unaudited adjusted net income attributable to ARC Document Solutions, Inc.

(In thousands, except per share data)

(Unaudited) | | |

| Three Months Ended | Six Months Ended |

| June 30, | June 30, |

| 2024 | 2023 | 2024 | 2023 |

| Net income attributable to ARC Document Solutions, Inc. | $ | 3,159 | | $ | 4,018 | | $ | 5,612 | | $ | 5,958 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Deferred tax valuation allowance and other discrete tax items | 170 | | 33 | | 277 | | 267 | |

| Adjusted net income attributable to ARC Document Solutions, Inc. | $ | 3,329 | | $ | 4,051 | | $ | 5,889 | | $ | 6,225 | |

| | | | |

| Actual: | | | | |

| Earnings per share attributable to ARC Document Solutions, Inc. stockholders: | | | | |

| Basic | $ | 0.07 | | $ | 0.09 | | $ | 0.13 | | $ | 0.14 | |

| Diluted | $ | 0.07 | | $ | 0.09 | | $ | 0.13 | | $ | 0.14 | |

| Weighted average common shares outstanding: | | | | |

| Basic | 42,342 | | 42,801 | | 42,267 | | 42,673 | |

| Diluted | 43,067 | | 43,614 | | 43,061 | | 43,679 | |

| | | | |

| Adjusted: | | | | |

| Earnings per share attributable to ARC Document Solutions, Inc. stockholders: | | | | |

| Basic | $ | 0.08 | | $ | 0.09 | | $ | 0.14 | | $ | 0.15 | |

| Diluted | $ | 0.08 | | $ | 0.09 | | $ | 0.14 | | $ | 0.14 | |

| Weighted average common shares outstanding: | | | | |

| Basic | 42,342 | | 42,801 | | 42,267 | | 42,673 | |

| Diluted | 43,067 | | 43,614 | | 43,061 | | 43,679 | |

See Non-GAAP Financial Measures discussion below.

Non-GAAP Financial Measures

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, adjusted net income and adjusted earnings per share presented in this report are supplemental measures of our performance that are not required by or presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”). These measures are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, income from operations, net income margin, diluted earnings per share or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating, investing or financing activities as a measure of our liquidity. We have presented these measures because we consider them important supplemental measures of our performance and liquidity. We believe investors may also find these measures meaningful, given how our management makes use of them. The following is a discussion of our use of these measures.

EBITDA represents net income before interest, taxes, depreciation and amortization. We calculate EBITDA margin by dividing EBITDA by net sales.

We use EBITDA and EBITDA margin to measure and compare the performance of our operating divisions. Our operating divisions’ financial performance includes all of the operating activities except debt and taxation which are managed at the corporate level for U.S. operating divisions. We use EBITDA and EBITDA margin to compare the performance of our operating divisions and to measure performance for determining consolidated-level compensation. In addition, we use EBITDA and EBITDA margin to evaluate potential acquisitions and potential capital expenditures.

EBITDA and EBITDA margin have limitations as analytical tools, and should not be considered in isolation, or as a substitute for

analysis of our results as reported under GAAP. Some of these limitations are as follows:

•They do not reflect our cash expenditures, or future requirements for capital expenditures and contractual commitments;

•They do not reflect changes in, or cash requirements for, our working capital needs;

•They do not reflect the significant interest expense, or the cash requirements necessary, to service interest or principal payments on our debt;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and

•Other companies, including companies in our industry, may calculate these measures differently than we do, limiting their usefulness as comparative measures.

Because of these limitations, EBITDA and related ratios should not be considered as measures of discretionary cash available to us to invest in business growth or to reduce our indebtedness. We compensate for these limitations by relying primarily on our GAAP results and using EBITDA and EBITDA margin only as supplements.

Our presentation of adjusted net income and adjusted EBITDA is an attempt to provide meaningful comparisons to our historical performance for our existing and future investors. The unprecedented changes in our end markets over the past several years have required us to take measures that are unique in our history and specific to individual circumstances. Comparisons inclusive of these actions make normal financial and other performance patterns difficult to discern under a strict GAAP presentation. Each non-GAAP presentation, however, is explained in detail in the reconciliation tables above.

Specifically, we have presented adjusted net income attributable to ARC and adjusted earnings per share attributable to ARC stockholders for the three and six months ended June 30, 2024 to reflect the exclusion of changes in the valuation allowances related to certain deferred tax assets and other discrete tax items. We believe this presentation helps facilitate our investors understanding of our results of operations and allows them to make meaningful comparisons of our operating results for the three and six months ended June 30, 2024 against the corresponding periods in 2023. We believe these changes were the result of items which are not indicative of our actual operating performance.

We have presented Adjusted EBITDA for the three and six months ended June 30, 2024 to exclude stock-based compensation expense. We calculated Adjusted EBITDA margin by dividing Adjusted EBITDA by net sales. The adjustment to exclude stock-based compensation expense from EBITDA is consistent with the definition of Adjusted EBITDA in our credit agreement; therefore, we believe this information is useful to investors in assessing our financial performance and ability to access our credit facility.

v3.24.2.u1

Cover Page

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

ARC Document Solutions, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32407

|

| Entity Tax Identification Number |

20-1700361

|

| Entity Address, Address Line One |

12657 Alcosta Blvd, Suite 200

|

| Entity Address, City or Town |

San Ramon

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94583

|

| City Area Code |

(925)

|

| Local Phone Number |

949-5100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ARC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001305168

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

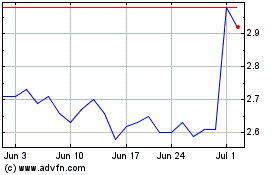

ARC Document Solutions (NYSE:ARC)

Historical Stock Chart

From Aug 2024 to Sep 2024

ARC Document Solutions (NYSE:ARC)

Historical Stock Chart

From Sep 2023 to Sep 2024