January 31, 2014

Dreyfus/STANDISH Intermediate Tax Exempt Bond Fund

Supplement to Summary Prospectus and Statutory Prospectus

dated January 31, 2014

The fund's

b

oard has approved, subject to shareholder approval, changes to the fund's investment objective and investment strategy, effective on or about February 21, 2014 (the Effective Date). These proposed changes are reflected in the revised disclosure below.

As of the Effective Date and subject to shareholder approval, the fund will change its policies of normally investing at least 80% of its net assets in municipal bonds that provide income exempt from federal personal income tax and at least 65% of its net assets in municipal bonds that are general obligation bonds or revenue bonds. As proposed, the fund would invest in a variety of fixed-income securities, normally investing at least 80% of its net assets in bonds (or other instruments with similar economic characteristics) and at least 65% of its net assets in municipal bonds. The fund would have the ability to invest up to 35% of its net assets in taxable bonds. The fund also would have the ability to invest, to a limited extent, in bonds rated below investment grade, or their unrated equivalent, and in foreign bonds, including emerging market bonds. To be consistent with the fund's proposed investment strategy changes, the fund's investment objective would be to seek high after-tax total return. The fund would maintain an effective portfolio duration of seven years or less. The fund's benchmark index would not be changed.

T

he

f

und also

would

change, subject to shareholder approval, from a "diversified" fund to a "non-diversified" fund,

which means that the proportion of

th

e fund's assets that may be invested in the securities of a single issuer is not limited by the Investment Company Act of 1940, as amended

(the

1940 Act

)

.

The fund's

b

oard also has approved, in connection with changing the fund's investment strategy, changing the fund's name to "Dreyfus Tax Sensitive Total Return Bond Fund", and replacing

one

of the fund's current portfolio managers with

two

new portfolio manager

s

. In addition,

the fund's board has approved, subject to shareholder approval, Standish Mellon Asset Management Company LLC (Standish), an affiliate of The Dreyfus Corporation (Dreyfus), the fund's investment adviser, to serve as the fund's sub-adviser. If approved by

shareholder

s

, the fund's portfolio managers who are dual employees of

D

reyfus and Standish

and

who currently serve as portfolio managers of the fund in their capacity as employees of Dreyfus,

and the new portfolio managers,

would

manage the fund

in the future as employees of Standish as the fund's sub-adviser.

Dreyfus, and not the fund, will compensate Standish out of the fee Dreyfus receives from the fund. There will be no increase in the advisory fee paid by the fund to Dreyfus as a consequence of the engagement of Standish.

It is currently contemplated that shareholders of the fund as of December 6, 2013 (the Record Date) will be asked to vote at a special meeting of shareholders, to be held on or about February 13, 2014, on certain matters in connection with the implementation of proposed changes to the fund's investment objective and investment strategy, the engagement

by Dreyfus

of Standish as a sub-adviser to manage the fund's assets, and the implementation of a "manager of managers" arrangement to enable Dreyfus to hire and replace sub-advisers in the future that are either unaffiliated

with Dreyfus

or are wholly-owned subsidiaries (as defined in the

1940

Act) of Dreyfus' ultimate parent company, which is The Bank of New York Mellon Corporation (BNY Mellon), without shareholder approval. A proxy statement with respect to the proposals will be mailed prior to the meeting to fund shareholders as of the Record Date.

If approved by fund shareholders, Dreyfus will seek to implement the changes to the fund's investment strategy in an orderly manner, taking into consideration such factors as market conditions, portfolio transaction costs and the potential tax implications to fund shareholders, Standish would be engaged by Dreyfus to serve as sub-adviser for the fund and the fund would implement a "manager of managers" arrangement on or about the Effective Date, as described below.

******

If approved by shareholders, as of the Effective Date, the fund will seek high after-tax total return. To pursue its goal, the fund normally will invest at least 80% of its net assets, plus any borrowings for investment purposes, in bonds (or other instruments with similar economic characteristics). The fund's objective and the policy with respect to the investment of 80% of its assets may be changed by the fund's board, upon 60 days' prior notice to shareholders. The fund normally will invest at least 65% of its net assets in municipal bonds that provide income exempt from federal personal income tax. The fund may invest up to 35% of its net assets in taxable bonds and may invest, without limitation, in municipal bonds the income from which is subject to the federal alternative minimum tax. The fund also may invest in money market instruments and other short-term debt instruments. The fund's bond investments would include, but not be limited to, the following:

·

municipal bonds

·

bonds issued or guaranteed by the U.S. government or its agencies or instrumentalities

·

corporate bonds

·

mortgage-related securities

·

asset-backed securities

·

bonds of foreign governments and companies (limited to up to 15% of the fund's assets, including emerging market bonds)

·

inflation-indexed securities

·

zero coupon, pay-in-kind and step-up securities

·

euro dollar and yankee dollar investments

The fund will invest principally in bonds rated investment grade (i.e., Baa/BBB or higher) at the time of purchase or, if unrated, deemed of comparable quality by Standish, the fund's sub-adviser.

T

he fund would be permitted to invest up to 25% of its assets in the aggregate in fixed-income securities rated below investment grade ("high yield" or "junk" bonds) or the unrated equivalent as determined by Standish, with up to 15% of the fund's assets in such securities that are taxable and up to 10% of its assets in such securities that are tax exempt.

The fund's portfolio managers will seek to exploit relative value opportunities within the municipal bond market and to selectively invest in taxable securities that may offer the potential to enhance after-tax total return and/or reduce volatility. In selecting securities, the portfolio managers will use a combination of fundamental credit analysis and macro-economic and quantitative inputs, while seeking to exploit relative value opportunities across municipal and taxable securities. A disciplined rigorous active management process will be employed to evaluate on an ongoing basis all fund holdings. A security held by the fund may become a sell candidate if it no longer meets the portfolio managers' strategic or structural objective, if bonds with better after-tax total return characteristics become available, or the issuer's creditworthiness is deteriorating.

The fund generally will maintain an effective portfolio duration of seven years or less. The fund will not have any restrictions on its average effective portfolio maturity or on the maturity or

duration of the individual bonds the fund may purchase. Duration is an estimate of the sensitivity of the price (the value of principal) of a fixed-income security to a change in interest rates. Generally, the longer the duration, the higher the expected volatility. For example, the market price of a fixed-income security with a duration of three years would be expected to decline 3% if interest rates rose 1%. Conversely, the market price of the same security would be expected to increase 3% if interest rates fell 1%.

Although not a principal investment strategy, the fund may, but is not required to, use derivatives as a substitute for investing directly in an underlying asset, to increase returns, to manage credit or interest rate risk, to manage the effective duration or maturity of the fund's portfolio, or as part of a hedging strategy. These

derivative instruments would include

options, futures and options on futures (including those relating to securities, foreign currencies, indexes and interest rates), forward contracts, swaps

(including interest rate, credit default and total return swaps), options on swaps, and other credit derivatives.

To the extent that the fund invests in derivative instruments with economic characteristics similar to bonds, the value of such investments will be included for purposes of the fund's 80% investment policy. Swap agreements can be used to transfer the interest rate or credit risk of a security without actually transferring ownership of the security or to customize exposure to particular corporate credit. The fund may buy securities that pay interest at rates that float inversely with changes in prevailing interest rates (inverse floaters). Inverse floaters are created by depositing municipal bonds in a trust which divides the bond's income stream into two parts: a short term variable rate demand note and a residual interest bond (the inverse floater) which receives interest based on the remaining cash flow of the trust after payment of interest on the note and various trust expenses. Interest on the inverse floater usually moves in the opposite direction as the interest on the variable rate demand note.

To enhance current income, the fund also may engage in a series of purchase and sale contracts or forward roll transactions in which the fund sells a mortgage-related security, for example, to a financial institution and simultaneously agrees to purchase a similar security from the institution at a later date at an agreed upon price.

The fund also may make forward commitments in which the fund agrees to buy or sell a security in the future at

an agreed upon price

. Future rules and regulations of the Securities and Exchange Commission may impact the fund's use of derivatives as described above.

The fund is non-diversified.

******

Investment Risks

In addition to the investment risks applicable to the fund as described in the fund's prospectus, as of the Effective Date, an investment in the fund w

ill

be subject to the following additional principal risks:

·

Credit risk

. Failure of an issuer to make timely interest or principal payments, or a decline or perception of a decline in the credit quality of a bond, can cause a bond's price to fall, potentially lowering the fund's share price. The lower a bond's credit rating, the greater the chance – in the rating agency's opinion – that the bond issuer will default or fail to meet its payment obligations. High yield ("junk") bonds involve greater credit risk, including the risk of default, than investment grade bonds, and are considered predominantly speculative with respect to the issuer's continuing ability to make principal and interest payments. The prices of high yield bonds can fall dramatically in response to bad news about the issuer or its industry, or the economy in general. Bonds rated investment grade when purchased by the fund may subsequently be downgraded.

·

Market risk

. The market value of a security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. A security's market value also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry, or factors that affect a particular company, such as management performance, financial leverage, and reduced demand for the company's products or services.

·

Foreign investment risk

. To the extent the fund invests in foreign securities, the fund's performance will be influenced by political, social and economic factors affecting investments in foreign issuers. Special risks associated with investments in foreign issuers include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political and economic instability and differing auditing and legal standards. Investments denominated in foreign currencies are subject to the risk that such currencies will decline in value relative to the U.S. dollar and affect the value of these investments held by the fund.

Securities of issuers located in emerging markets can be more volatile and less liquid than those of issuers in more developed economies.

·

Mortgage-related securities risk

. Mortgage-related securities are complex derivative instruments, subject to credit, prepayment and extension risk, and may be more volatile and less liquid, and more difficult to price accurately, than more traditional debt securities. The fund is subject to the credit risk associated with these securities, including the market's perception of the creditworthiness of the issuing federal agency, as well as the credit quality of the underlying assets. Although certain mortgage-related securities are guaranteed as to the timely payment of interest and principal by a third party (such as a U.S. government agency or instrumentality with respect to government-related mortgage-backed securities) the market prices for such securities are not guaranteed and will fluctuate. Privately issued mortgage-related securities also are subject to credit risks associated with the performance of the underlying mortgage properties, and may be more volatile and less liquid than more traditional government-backed debt securities. As with other interest-bearing securities, the prices of certain mortgage-related securities are inversely affected by changes in interest rates. However, although the value of a mortgage-related security may decline when interest rates rise, the converse is not necessarily true, since in periods of declining interest rates the mortgages underlying the security are more likely to be prepaid causing the fund to purchase new securities at current market rates, which usually will be lower. The loss of higher yielding underlying mortgages and the reinvestment of proceeds at lower interest rates can reduce the fund's potential price gain in response to falling interest rates, reduce the fund's yield or cause the fund's share price to fall. Moreover, with respect to certain stripped mortgage-backed securities, if the underlying mortgage securities experience greater than anticipated prepayments of principal, the fund may fail to fully recoup its initial investment even if the securities are rated in the highest rating category by a nationally recognized statistical rating organization. When interest rates rise, the effective duration of the fund's mortgage-related and other asset-backed securities may lengthen due to a drop in prepayments of the underlying mortgages or other assets. This is known as extension risk and would increase the fund's sensitivity to rising interest rates and its potential for price declines.

·

Asset-backed securities risk

. General downturns in the economy could cause the value of asset-backed securities to fall. In addition, asset-backed securities present certain risks

that are not presented by mortgage-backed securities. Primarily, these securities may provide the fund with a less effective security interest in the related collateral than do mortgage-backed securities. Therefore, there is the possibility that recoveries on the underlying collateral may not, in some cases, be available to support payments on these securities.

·

Inflation-indexed security risk.

Interest payments on inflation-indexed securities can be unpredictable and will vary as the principal and/or interest is periodically adjusted based on the rate of inflation. If the index measuring inflation falls, the interest payable on these securities will be reduced. The U.S. Treasury has guaranteed that in the event of a drop in prices, it would repay the par amount of its inflation-indexed securities. Inflation-indexed securities issued by corporations generally do not guarantee repayment of principal. Any increase in the principal amount of an inflation-indexed security will be considered taxable ordinary income, even though investors do not receive their principal until maturity. As a result, the fund may be required to make annual distributions to shareholders that exceed the cash the fund received, which may cause the fund to liquidate certain investments when it is not advantageous to do so. Also, if the principal value of an inflation-indexed security is adjusted downward due to deflation, amounts previously distributed may be characterized in some circumstances as a return of capital.

·

Zero coupon, pay-in-kind and step-up securities risk

. Zero coupon securities are debt securities issued or sold at a discount from their face value that do not entitle the holder to any periodic payment of interest prior to maturity or a specified redemption date (or cash payment date). Pay-in-kind securities are bonds that generally pay interest through the issuance of additional bonds. Step-up coupon bonds are debt securities that typically do not pay interest for a specified period of time and then pay interest at a series of different rates. The market prices of these securities generally are more volatile and are likely to respond to a greater degree to changes in interest rates than the market prices of securities that pay cash interest periodically having similar maturities and credit qualities. In addition, unlike bonds which pay cash interest throughout the period to maturity, the fund will realize no cash until the cash payment or maturity date unless a portion of such securities are sold and, if the issuer defaults, the fund may obtain no return at all on its investment. The Internal Revenue Code requires the holder of a zero coupon security or of certain pay-in-kind or step-up bonds to accrue income with respect to these securities prior to the receipt of cash payments. To maintain its qualification as a regulated investment company and avoid liability for Federal income tax, the fund may be required to distribute such income accrued with respect to these securities and may have to dispose of portfolio securities under disadvantageous circumstances in order to generate cash to satisfy this distribution requirement.

·

Liquidity risk.

When there is little or no active trading market for specific types of securities, it can become more difficult to sell the securities at or near their perceived value. In such a market, the value of such securities and the fund's share price may fall dramatically, even during periods of declining interest rates. Investments in foreign securities, particularly those of issuers located in emerging markets, tend to have greater exposure to liquidity risk than domestic securities. Liquidity risk also exists when a particular derivative instrument is difficult to purchase or sell. If a derivative transaction is particularly large or if the relevant market is illiquid (as is the case with many privately negotiated derivatives, including swap agreements), it may not be possible to initiate a transaction or liquidate a position at an advantageous time or price.

·

Non-diversification risk

. The fund is non-diversified, which means that the fund may invest a relatively high percentage of its assets in a limited number of issuers. Therefore,

the fund's performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

******

Portfolio Management

As of the Effective Date and subject to shareholder approval described above, Dreyfus will engage its affiliate, Standish, to serve as the fund's sub-adviser. Standish

, a registered investment adviser

,

is

an indirect wholly-owned subsidiary of BNY Mellon with its principal office at BNY Mellon Center, 201 Washington Street, Suite 2900, Boston, Massachusetts 02108-4408

. Standish

is a dedicated fixed-income manager that traces its roots back to 1933, when its predecessor firm, Standish, Ayer & Wood, Inc., began managing fixed-income portfolios for U.S. financial institutions, banks and insurance companies. Standish offers a wide range of discretionary and non-discretionary credit-based and specialty bond strategies for U.S. and global pension funds, sovereign wealth funds, central banks, endowments, foundations, insurance companies and other institutional investors, as well as for

high net worth

individual investors. As of September 30, 2013, Standish had approximately $163 billion in assets under management. Standish, subject to Dreyfus' supervision and approval, will provide the day-to-day management of the fund's assets allocated to Standish. Christine L. Todd

,

Thomas Casey

,

Daniel Rabasco and Mountaga Aw are the primary portfolio managers of the fund. Ms. Todd,

a

current primary portfolio manager

of the fund

since

Ma

y 20

0

1, is president of Standish, and has served as the director of Standish's tax exempt fixed-income department since December 2001. She also serves as a portfolio manager of tax exempt bond portfolios for Standish's institutional and individual clients. Ms. Todd has been employed at Standish since 1995.

Mr. Casey

,

a

current primary portfolio manager

of the fund

since

April

201

0

,

is a senior portfolio manager for tax sensitive strategies at Standish

,

where he has been employed since July 1993.

Mr. Rabasco is the

c

hief

i

nvestment

o

fficer for

t

ax

s

ensitive

f

ixed-

i

ncome at Standish, where he has been employed since 1998. Mr. Aw is a senior portfolio manager for tax sensitive strategies at Standish, where he has been employed since March 2010. Prior to joining Standish, Mr. Aw worked at Bank of America, where he was head of proprietary tax exempt relative value trading, and previously held positions as a fixed-income strategist at JP Morgan.

******

As of the Effective Date and subject to shareholder approval described above, the fund will implement a "manager of managers" arrangement whereby Dreyfus would be permitted to select one or more sub-advisers to manage the fund's portfolio in the future without obtaining shareholder approval. Dreyfus will evaluate and recommend to the fund's board sub-advisers for the fund. Dreyfus will monitor and evaluate the performance of the sub-advisers for the fund and will advise and recommend to the fund's board any changes to the fund's sub-advisers. Currently, Dreyfus has selected, subject to shareholder approval, Standish to manage all of the fund's assets. Dreyfus has obtained from the Securities and Exchange Commission (SEC) an exemptive order, upon which the fund may rely, that permits Dreyfus, subject to certain conditions and approval by the fund's board, to enter into and materially amend sub-investment advisory agreements with one or more sub-advisers who are either unaffiliated

with Dreyfus

or are wholly-owned subsidiaries (as defined in the

1940

Act) of Dreyfus' ultimate parent company, BNY Mellon, without obtaining shareholder approval. The order also relieves the fund from disclosing the sub-investment advisory fee paid by Dreyfus to an unaffiliated sub-adviser in documents filed with the SEC and provided to shareholders. In addition, pursuant to the order, it is not necessary to disclose the sub-investment advisory fee payable by Dreyfus separately to a sub-adviser that is a wholly-owned subsidiary of BNY Mellon in documents filed with the SEC and provided to shareholders; such fees are to be aggregated with fees payable to Dreyfus. Dreyfus has ultimate

responsibility (subject to oversight by the fund's board) to supervise any sub-adviser and recommend the hiring, termination, and replacement of any sub-adviser to the fund's board. One of the conditions of the order is that the fund's board, including a majority of the "non-interested" board members, must approve each new sub-adviser. In addition, the fund is required to provide shareholders with information about each new sub-adviser within 90 days of the hiring of any new sub-adviser.

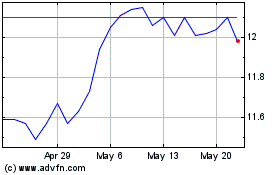

Advent Convertible and I... (NYSE:AVK)

Historical Stock Chart

From Jul 2024 to Aug 2024

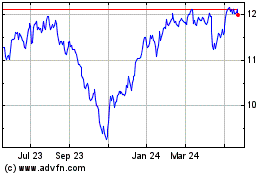

Advent Convertible and I... (NYSE:AVK)

Historical Stock Chart

From Aug 2023 to Aug 2024