UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, Wisconsin 53202

(Address of principal executive offices) (Zip code)

Douglas G. Hess, President

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5

th

Floor

Milwaukee, Wisconsin 53202

(Name and address of agent for service)

(Registrant's telephone number, including area code):

(414) 765-6609

Date of fiscal year end:

October 31, 2012

Date of reporting period:

October 31, 2012

Item 1. Reports to Stockholders.

ANNUAL REPORT

October 31, 2012

FORT PITT CAPITAL TOTAL RETURN FUND

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

1-866-688-8775

Fort Pitt Capital Total Return Fund

Dear Fellow Shareholders,

As of October 31, 2012, the Net Asset Value (NAV) of the Fort Pitt Capital Total Return Fund was $15.88 per share. Total return (including a $0.172 per share dividend) for the fiscal year ended October 31, 2012 was 9.18%. This compares with a total return of 14.30% for the unmanaged Wilshire 5000 Total Market Index and 15.21% for the S&P 500

®

Index for the same period.

Our Fund lagged both the Wilshire 5000 Total Market Index and the S&P 500

®

Index in fiscal 2012 as a result of our general emphasis on less leveraged, more defensive businesses. Large banks were some of the best performing issues in the U.S. stock market during the year, so our limited exposure was a drag on relative returns. The communications group was again our best performing segment in dollar terms, as Comcast Corp., Verizon Communications Inc. and AT&T Inc. were 3 of our top 5 gainers for the year. Amgen, Inc. and General Electric Co. rounded out the top 5. On the downside, SanDisk Corp. and Joy Global Inc. were down 17.5% and 27.6%, respectively. Competitive pressures in the smart-phone market dogged SanDisk, while a tough regulatory environment in the coal industry and concerns about a slowdown in China hurt Joy Global. New purchases during the year included Rockwell Automation, a maker of factory automation equipment and software, and Tempur-Pedic International Inc., a bedding company. The latter announced an earnings shortfall shortly after our purchase, so we sold a portion for tax purposes at year end. Portfolio turnover remained low at 5 percent, and cash holdings are above our long-term average, at just under 13% of the total.

Annualized total return for the three years ended October 31, 2012 was 13.03%, compared to 13.66% for the Wilshire 5000 Total Market Index and 13.21% for the S&P 500

®

Index. Over the five year period ended October 31, 2012, the Fund’s annualized total return was -0.33%, while the Wilshire 5000 Total Market Index’s annualized return was 0.77% and the S&P 500

®

Index’s annualized return was 0.36%. Over the ten year period ended October 31, 2012, the Fund’s annualized total return was 7.54%, while the Wilshire 5000 Total Market Index’s annualized return was 7.79% and the S&P 500

®

Index’s annualized return was 6.91%. Since inception on December 31, 2001, the Fund has produced a total return of 6.28% annualized (93.44% cumulative), compared to 4.87% annualized (67.35% cumulative) for the Wilshire 5000 Total Market Index and 3.97% annualized (52.41% cumulative) for the S&P 500

®

Index. The total annual gross operating expense ratio for the Fund is 1.66%.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-688-8775. The Fund imposes a 2.00% redemption fee on shares held for one hundred and eighty days or less. Performance data quoted does not reflect the redemption fee. If reflected, total returns would be reduced. Performance figures reflect fee waivers in effect. In the absence of waivers, total returns would be lower.

Issues around the U.S. “fiscal cliff” dominated business headlines as we went to press. Previous congressional and administration efforts at reversing outsized deficits and debt came to naught in the fight over the debt ceiling in the summer of 2011. As a result, the fiscal “can” was kicked to midnight December 31st, 2012. This is the deadline for both the Bush tax cuts and large chunks of Federal expenditures totaling more than $500 billion annually. If nothing changes between now and year end, about half the yearly Federal deficit will be plugged in 2013 by big tax increases and spending reductions.

Fort Pitt Capital Total Return Fund

Economists and politicians nearly universally regard this prospect as a bad thing. The stock market has sagged since early October, some say in anticipation of the cliff. Leaders and economic advisors from both political parties cry that a cold-turkey cure (which no one really believed would happen) is worse than the disease itself. Certainly some businesses (defense and other federal contractors in particular) will be hurt by sequestration. But many others may be rejoicing. All along, the stated desire of business leaders has been greater fiscal “certainty”, including a concrete plan to reduce deficits and debt. Just give us a credible, enforceable budget roadmap and we’ll open the investment floodgates, CEOs have said. The fiscal cliff, diabolical as it may be, provides that roadmap.

Over the next year, we’re going to find out if the folks crying “uncertainty” were simply giving us code for “don’t ever raise my taxes.” If true to their word, corporate leaders will emerge from their foxholes in 2013 as the forced truce takes hold. They should then invest some of the nearly $2 trillion in cash stuck on U.S. corporate balance sheets and, presumably, increase hiring. Economic growth should accelerate. If, on the other hand, CEOs didn’t really mean it when they claimed federal budget deficits were hurting investment, then progress on the fiscal front won’t mean much. We’ll be in for more of the same slow growth and grinding deflation we’ve experienced over the past 4 years. Being congenital skeptics, our portfolio has about a 60/40 mix of defensive vs. more cyclical businesses.

Winston Churchill once said that you can always count on Americans to do the right thing - after they’ve tried everything else. Ballooning federal debt is signaling that we’re about out of options. Interest on the debt now consumes more than every dollar of annual economic growth; we’re essentially borrowing to pay the interest on our credit card. Let’s hope the old British Bulldog was right.

Sincerely,

Charlie Smith

Portfolio Manager

Mutual fund investing involves risk; Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Small and medium capitalization companies tend to have limited liquidity and greater price volatility than large capitalization companies. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The opinions expressed are those of Charles A. Smith through the end of the period for this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

The S&P 500

®

Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Wilshire 5000 Total Market Index is a capitalization weighted index of all U.S. headquartered companies which provides the broadest measure of U.S. stock market performance. It is not possible to invest directly in an index.

This information is intended for the shareholders of the Fund and is not for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings please refer to the Schedule of Investment section of this report.

The Fort Pitt Capital Total Return Fund is distributed by Quasar Distributors, LLC.

Fort Pitt Capital Total Return Fund

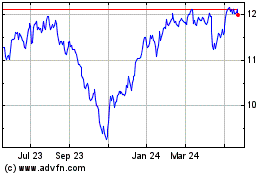

Growth of a Hypothetical $10,000 Investment at October 31, 2012

vs.

Wilshire 5000 Total Market Index & S&P 500

®

Index

|

|

|

Average Annual Total Return

1

|

|

|

|

|

|

Since

|

|

|

One Year

|

Five Year

|

Ten Year

|

Inception

|

|

Fort Pitt Capital Total Return Fund

|

9.18%

|

-0.33%

|

7.54%

|

6.28%

|

|

Wilshire 5000 Total Market Index

|

14.30%

|

0.77%

|

7.79%

|

4.87%

|

|

S&P 500

®

Index

|

15.21%

|

0.36%

|

6.91%

|

3.97%

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-688-8775. The Fund imposes a 2.00% redemption fee on shares held for 180 days or less.

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on dividends, capital gains distributions, or redemption of Fund shares. Indices do not incur expenses and are not available for investment. If it did, total returns would be reduced.

1

Average Annual Total Return represents the average change in account value over the periods indicated.

The Wilshire 5000 Total Market Index is an unmanaged index commonly used to measure performance of over 5,000 U.S. stocks.

The S&P 500

®

Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad domestic economy.

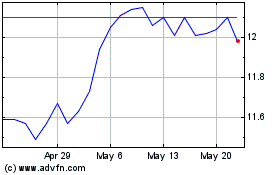

Fort Pitt Capital Total Return Fund

|

ALLOCATION OF PORTFOLIO INVESTMENTS

|

|

at October 31, 2012 (Unaudited)

|

Percentages represent market value as a percentage of total investments.

|

EXPENSE EXAMPLE

|

|

at October 31, 2012 (Unaudited)

|

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (5/1/12 – 10/31/12).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses, with actual net expenses being limited to 1.24% per the operating expenses limitation agreement. Although the Fund charges no sales loads, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The Example below includes, but is not limited to, management fees, fund accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Fort Pitt Capital Total Return Fund

|

EXPENSE EXAMPLE (Continued)

|

|

at October 31, 2012 (Unaudited)

|

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period*

|

|

|

5/1/12

|

10/31/12

|

5/1/12 – 10/31/12

|

|

Actual

|

$1,000.00

|

$1,015.30

|

$6.28

|

|

Hypothetical

|

|

|

|

|

(5% return before expenses)

|

$1,000.00

|

$1,018.90

|

$6.29

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.24%, multiplied by the average account value over the period, multiplied by 184 (days in most recent fiscal half-year)/366 days to reflect the one-half year expense.

|

Fort Pitt Capital Total Return Fund

|

SCHEDULE OF INVESTMENTS

|

|

at October 31, 2012

|

|

COMMON STOCKS – 83.12%

|

|

Shares

|

|

|

Value

|

|

|

Apparel Manufacturing – 2.67%

|

|

|

|

|

|

|

|

VF Corp.

|

|

|

6,800

|

|

|

$

|

1,064,064

|

|

|

Broadcasting (except Internet) – 5.18%

|

|

|

|

|

|

|

|

|

|

Comcast Corp. – Class A

|

|

|

55,000

|

|

|

|

2,063,050

|

|

|

Chemical Manufacturing – 4.89%

|

|

|

|

|

|

|

|

|

|

Allergan, Inc.

|

|

|

12,900

|

|

|

|

1,159,968

|

|

|

Pfizer, Inc.

|

|

|

31,595

|

|

|

|

785,768

|

|

|

|

|

|

|

|

|

|

1,945,736

|

|

|

Computer and Electronic Product Manufacturing – 4.80%

|

|

|

|

|

|

|

|

|

|

Dell, Inc.*

|

|

|

18,000

|

|

|

|

166,140

|

|

|

SanDisk Corp.*

|

|

|

28,350

|

|

|

|

1,183,896

|

|

|

Texas Instruments, Inc.

|

|

|

20,000

|

|

|

|

561,800

|

|

|

|

|

|

|

|

|

|

1,911,836

|

|

|

Credit Intermediation and Related Activities – 5.39%

|

|

|

|

|

|

|

|

|

|

Bank of New York Mellon Corp.

|

|

|

16,300

|

|

|

|

402,773

|

|

|

F.N.B. Corp.

|

|

|

48,700

|

|

|

|

522,551

|

|

|

PNC Financial Services Group, Inc.

|

|

|

21,000

|

|

|

|

1,221,990

|

|

|

|

|

|

|

|

|

|

2,147,314

|

|

|

Fabricated Metal Product Manufacturing – 1.98%

|

|

|

|

|

|

|

|

|

|

Parker Hannifin Corp.

|

|

|

10,000

|

|

|

|

786,600

|

|

|

Furniture and Related Product Manufacturing – 0.27%

|

|

|

|

|

|

|

|

|

|

Tempur-Pedic International, Inc.*

|

|

|

4,000

|

|

|

|

105,760

|

|

|

Insurance Carriers and Related Activities – 6.17%

|

|

|

|

|

|

|

|

|

|

Arthur J. Gallagher & Co.

|

|

|

30,000

|

|

|

|

1,063,200

|

|

|

Erie Indemnity Co. – Class A

|

|

|

6,800

|

|

|

|

423,096

|

|

|

Loews Corp.

|

|

|

23,000

|

|

|

|

972,440

|

|

|

|

|

|

|

|

|

|

2,458,736

|

|

|

Machinery Manufacturing – 4.66%

|

|

|

|

|

|

|

|

|

|

General Electric Co.

|

|

|

61,400

|

|

|

|

1,293,084

|

|

|

Joy Global, Inc.

|

|

|

9,000

|

|

|

|

562,050

|

|

|

|

|

|

|

|

|

|

1,855,134

|

|

|

Miscellaneous Manufacturing – 5.25%

|

|

|

|

|

|

|

|

|

|

Medtronic, Inc.

|

|

|

22,900

|

|

|

|

952,182

|

|

|

Rockwell Automation, Inc.

|

|

|

16,050

|

|

|

|

1,140,513

|

|

|

|

|

|

|

|

|

|

2,092,695

|

|

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at October 31, 2012

|

|

COMMON STOCKS – 83.12% (Continued)

|

|

Shares

|

|

|

Value

|

|

|

Paper Manufacturing – 2.25%

|

|

|

|

|

|

|

|

Kimberly-Clark Corp.

|

|

|

10,750

|

|

|

$

|

897,087

|

|

|

Petroleum and Coal Products Manufacturing – 3.25%

|

|

|

|

|

|

|

|

|

|

BP PLC – ADR

|

|

|

30,200

|

|

|

|

1,295,278

|

|

|

Primary Metal Manufacturing – 0.94%

|

|

|

|

|

|

|

|

|

|

Matthews International Corp. – Class A

|

|

|

13,000

|

|

|

|

374,010

|

|

|

Professional, Scientific, & Technical Services – 2.46%

|

|

|

|

|

|

|

|

|

|

Amgen, Inc.

|

|

|

11,300

|

|

|

|

977,959

|

|

|

Publishing Industries (except Internet) – 9.33%

|

|

|

|

|

|

|

|

|

|

CA, Inc.

|

|

|

49,100

|

|

|

|

1,105,732

|

|

|

Microsoft Corp.

|

|

|

40,600

|

|

|

|

1,158,521

|

|

|

OPNET Technologies, Inc.

|

|

|

34,200

|

|

|

|

1,451,106

|

|

|

|

|

|

|

|

|

|

3,715,359

|

|

|

Securities, Commodity Contracts, and Other Financial

|

|

|

|

|

|

|

|

|

|

Investments and Related Activities – 1.36%

|

|

|

|

|

|

|

|

|

|

The Charles Schwab Corp.

|

|

|

40,000

|

|

|

|

543,200

|

|

|

Telecommunications – 11.58%

|

|

|

|

|

|

|

|

|

|

AT&T, Inc.

|

|

|

55,000

|

|

|

|

1,902,450

|

|

|

Consolidated Communications Holdings, Inc.

|

|

|

33,185

|

|

|

|

512,376

|

|

|

Verizon Communications, Inc.

|

|

|

32,600

|

|

|

|

1,455,264

|

|

|

Windstream Corp.

|

|

|

78,000

|

|

|

|

744,120

|

|

|

|

|

|

|

|

|

|

4,614,210

|

|

|

Transportation Equipment Manufacturing – 6.58%

|

|

|

|

|

|

|

|

|

|

The Boeing Co.

|

|

|

16,650

|

|

|

|

1,172,826

|

|

|

Honeywell International, Inc.

|

|

|

23,650

|

|

|

|

1,448,326

|

|

|

|

|

|

|

|

|

|

2,621,152

|

|

|

Utilities – 4.11%

|

|

|

|

|

|

|

|

|

|

FirstEnergy Corp.

|

|

|

26,200

|

|

|

|

1,197,864

|

|

|

Kinder Morgan, Inc.

|

|

|

12,693

|

|

|

|

440,574

|

|

|

|

|

|

|

|

|

|

1,638,438

|

|

|

TOTAL COMMON STOCKS

|

|

|

|

|

|

|

|

|

|

(Cost $25,809,659)

|

|

|

|

|

|

|

33,107,618

|

|

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

at October 31, 2012

|

|

EXCHANGE-TRADED FUNDS – 3.93%

|

|

Shares

|

|

|

Value

|

|

|

iShares iBoxx $ Investment Grade Corporate Bond Fund

|

|

|

8,300

|

|

|

$

|

1,021,066

|

|

|

iShares MSCI Japan Index Fund

|

|

|

60,000

|

|

|

|

543,000

|

|

|

TOTAL EXCHANGE-TRADED FUNDS

|

|

|

|

|

|

|

|

|

|

(Cost $1,542,549)

|

|

|

|

|

|

|

1,564,066

|

|

|

|

|

|

|

|

|

|

|

|

|

WARRANTS – 0.18%

|

|

|

|

|

|

|

|

|

|

Utilities – 0.18%

|

|

|

|

|

|

|

|

|

|

Kinder Morgan, Inc.*

|

|

|

19,200

|

|

|

|

73,920

|

|

|

TOTAL WARRANTS

|

|

|

|

|

|

|

|

|

|

(Cost $18,481)

|

|

|

|

|

|

|

73,920

|

|

|

|

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS – 12.81%

|

|

|

|

|

|

|

|

|

|

Money Market Funds – 4.02%

|

|

|

|

|

|

|

|

|

|

Invesco STIC – Liquid Assets Portfolio –

|

|

|

|

|

|

|

|

|

|

Institutional Class, 0.18%

†

|

|

|

1,603,621

|

|

|

|

1,603,621

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal

|

|

|

|

|

|

|

|

|

Amount

|

|

|

|

|

|

|

U.S. Treasury Bills – 8.79%

|

|

|

|

|

|

|

|

|

|

United States Treasury Bill, 0.05%, due 12/27/12

+

|

|

$

|

3,500,000

|

|

|

|

3,499,715

|

|

|

TOTAL SHORT-TERM INVESTMENTS

|

|

|

|

|

|

|

|

|

|

(Cost $5,103,336)

|

|

|

|

|

|

|

5,103,336

|

|

|

Total Investments

|

|

|

|

|

|

|

|

|

|

(Cost $32,474,025) – 100.04%

|

|

|

|

|

|

|

39,848,940

|

|

|

Liabilities in Excess of Other Assets – (0.04)%

|

|

|

|

|

|

|

(16,617

|

)

|

|

NET ASSETS – 100.00%

|

|

|

|

|

|

$

|

39,832,323

|

|

|

*

|

Non-income producing security.

|

|

†

|

Rate shown is the 7-day yield at October 31, 2012.

|

|

+

|

Rate shown is the discount rate at October 31, 2012.

|

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

STATEMENT OF ASSETS AND LIABILITIES

|

|

at October 31, 2012

|

|

ASSETS

|

|

|

|

|

Investments, at market value (cost $32,474,025)

|

|

$

|

39,848,940

|

|

|

Receivable for Fund shares sold

|

|

|

3,650

|

|

|

Dividends and interest receivable

|

|

|

73,379

|

|

|

Prepaid expenses

|

|

|

4,699

|

|

|

Total assets

|

|

|

39,930,668

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

Due to advisor

|

|

|

26,025

|

|

|

Fund shares redeemed

|

|

|

20,178

|

|

|

Administration and fund accounting fees

|

|

|

10,596

|

|

|

Audit fees

|

|

|

17,500

|

|

|

Transfer agent fees and expenses

|

|

|

11,382

|

|

|

Pricing fees

|

|

|

329

|

|

|

Legal fees

|

|

|

3,974

|

|

|

Custody fees

|

|

|

767

|

|

|

Shareholder reporting fees

|

|

|

5,483

|

|

|

Chief Compliance Officer fee

|

|

|

1,250

|

|

|

Accrued expenses

|

|

|

861

|

|

|

Total liabilities

|

|

|

98,345

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

$

|

39,832,323

|

|

|

|

|

|

|

|

|

COMPONENTS OF NET ASSETS

|

|

|

|

|

|

Paid-in capital

|

|

$

|

32,017,832

|

|

|

Undistributed net investment income

|

|

|

441,639

|

|

|

Accumulated undistributed net realized loss on investments

|

|

|

(2,063

|

)

|

|

Net unrealized appreciation on investments

|

|

|

7,374,915

|

|

|

Total net assets

|

|

$

|

39,832,323

|

|

|

Shares outstanding

|

|

|

|

|

|

(unlimited number of shares authorized, par value $0.01)

|

|

|

2,507,569

|

|

|

Net Asset Value, Redemption Price and Offering Price Per Share

+

|

|

$

|

15.88

|

|

|

+

|

A charge of 2% is charged on the redemption proceeds of shares held for 180 days or less.

|

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

STATEMENT OF OPERATIONS

|

|

For the year ended October 31, 2012

|

|

INVESTMENT INCOME

|

|

|

|

|

Income

|

|

|

|

|

Dividends

|

|

$

|

992,356

|

|

|

Interest

|

|

|

4,316

|

|

|

Total investment income

|

|

|

996,672

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

Advisory fees (Note 4)

|

|

|

383,229

|

|

|

Administration and fund accounting fees (Note 4)

|

|

|

64,027

|

|

|

Transfer agent fees and expenses (Note 4)

|

|

|

54,768

|

|

|

Registration fees

|

|

|

21,697

|

|

|

Audit fees

|

|

|

17,454

|

|

|

Legal fees

|

|

|

10,845

|

|

|

Custody fees (Note 4)

|

|

|

7,914

|

|

|

Chief Compliance Officer fees (Note 4)

|

|

|

6,317

|

|

|

Trustee fees

|

|

|

6,060

|

|

|

Shareholder reporting

|

|

|

5,197

|

|

|

Other

|

|

|

4,636

|

|

|

Pricing fees

|

|

|

2,301

|

|

|

Insurance fees

|

|

|

1,710

|

|

|

Total expenses before fee waiver

|

|

|

586,155

|

|

|

Less: fee waiver from Advisor (Note 4)

|

|

|

(110,951

|

)

|

|

Net expenses

|

|

|

475,204

|

|

|

Net investment income

|

|

|

521,468

|

|

|

|

|

|

|

|

|

REALIZED AND UNREALIZED GAIN ON INVESTMENTS

|

|

|

|

|

|

Net realized gain on investments

|

|

|

599,371

|

|

|

Change in unrealized appreciation on investments

|

|

|

2,240,236

|

|

|

Net realized and unrealized gain on investments

|

|

|

2,839,607

|

|

|

Net increase in net assets resulting from operations

|

|

$

|

3,361,075

|

|

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

|

For the

|

|

|

For the

|

|

|

|

|

Year Ended

|

|

|

Year Ended

|

|

|

|

|

October 31, 2012

|

|

|

October 31, 2011

|

|

|

OPERATIONS

|

|

|

|

|

|

|

|

Net investment income

|

|

$

|

521,468

|

|

|

$

|

394,894

|

|

|

Net realized gain on investments

|

|

|

599,371

|

|

|

|

499,090

|

|

|

Change in unrealized appreciation on investments

|

|

|

2,240,236

|

|

|

|

3,296,514

|

|

|

Net increase in net assets resulting from operations

|

|

|

3,361,075

|

|

|

|

4,190,498

|

|

|

|

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS TO SHAREHOLDERS

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

(420,337

|

)

|

|

|

(345,322

|

)

|

|

Total distributions

|

|

|

(420,337

|

)

|

|

|

(345,322

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL SHARE TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

Proceeds from shares sold

|

|

|

3,647,534

|

|

|

|

2,084,271

|

|

|

Proceeds from shares issued in reinvestment of dividends

|

|

|

419,309

|

|

|

|

344,371

|

|

|

Cost of shares redeemed*

|

|

|

(2,968,115

|

)

|

|

|

(3,692,544

|

)

|

|

Net increase (decrease) in net assets resulting

|

|

|

|

|

|

|

|

|

|

from capital share transactions

|

|

|

1,098,728

|

|

|

|

(1,263,902

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total increase in net assets

|

|

|

4,039,466

|

|

|

|

2,581,274

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

35,792,857

|

|

|

|

33,211,583

|

|

|

|

|

|

|

|

|

|

|

|

|

End of year

|

|

$

|

39,832,323

|

|

|

$

|

35,792,857

|

|

|

|

|

|

|

|

|

|

|

|

|

Undistributed net investment income

|

|

$

|

441,639

|

|

|

$

|

340,508

|

|

|

|

|

|

|

|

|

|

|

|

|

CHANGES IN SHARES OUTSTANDING

|

|

|

|

|

|

|

|

|

|

Shares sold

|

|

|

239,054

|

|

|

|

146,629

|

|

|

Shares issued in reinvestment of dividends

|

|

|

29,404

|

|

|

|

24,793

|

|

|

Shares redeemed

|

|

|

(193,107

|

)

|

|

|

(259,825

|

)

|

|

Net increase (decrease) in Fund shares outstanding

|

|

|

75,351

|

|

|

|

(88,403

|

)

|

|

Shares outstanding, beginning of year

|

|

|

2,432,218

|

|

|

|

2,520,621

|

|

|

Shares outstanding, end of year

|

|

|

2,507,569

|

|

|

|

2,432,218

|

|

*

Net of redemption fees of $2,687 and $2,769, respectively.

The accompanying notes are an integral part of these financial statements.

Fort Pitt Capital Total Return Fund

For a share outstanding throughout the year

|

|

|

For the Year Ended October 31,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

beginning of year

|

|

$

|

14.72

|

|

|

$

|

13.18

|

|

|

$

|

11.38

|

|

|

$

|

10.48

|

|

|

$

|

17.53

|

|

|

Income (loss) from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

0.21

|

|

|

|

0.16

|

|

|

|

0.13

|

|

|

|

0.16

|

|

|

|

0.15

|

|

|

Net realized and unrealized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

gain (loss) on investments

|

|

|

1.12

|

|

|

|

1.52

|

|

|

|

1.82

|

|

|

|

0.88

|

|

|

|

(6.66

|

)

|

|

Total from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

investment operations

|

|

|

1.33

|

|

|

|

1.68

|

|

|

|

1.95

|

|

|

|

1.04

|

|

|

|

(6.51

|

)

|

|

Less dividends and distributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

net investment income

|

|

|

(0.17

|

)

|

|

|

(0.14

|

)

|

|

|

(0.15

|

)

|

|

|

(0.14

|

)

|

|

|

(0.14

|

)

|

|

Distributions from

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

net realized gains

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(0.40

|

)

|

|

Total dividends and distributions

|

|

|

(0.17

|

)

|

|

|

(0.14

|

)

|

|

|

(0.15

|

)

|

|

|

(0.14

|

)

|

|

|

(0.54

|

)

|

|

Redemption fees:

|

|

|

0.00#

|

|

|

|

0.00#

|

|

|

|

0.00#

|

|

|

|

0.00#

|

|

|

|

0.00#

|

|

|

Net asset value, end of year

|

|

$

|

15.88

|

|

|

$

|

14.72

|

|

|

$

|

13.18

|

|

|

$

|

11.38

|

|

|

$

|

10.48

|

|

|

Total return

1

|

|

|

9.18

|

%

|

|

|

12.80

|

%

|

|

|

17.27

|

%

|

|

|

10.21

|

%

|

|

|

-38.19

|

%

|

|

Supplemental data and ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year

|

|

$

|

39,832,323

|

|

|

$

|

35,792,857

|

|

|

$

|

33,211,583

|

|

|

$

|

30,319,941

|

|

|

$

|

29,759,988

|

|

|

Ratio of net expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reimbursement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and waivers

|

|

|

1.53

|

%

|

|

|

1.96

|

%

|

|

|

2.20

|

%

|

|

|

2.22

|

%

|

|

|

1.88

|

%

|

|

After expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reimbursement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and waivers

|

|

|

1.24

|

%

|

|

|

1.24

|

%

|

|

|

1.24

|

%

|

|

|

1.24

|

%

|

|

|

1.24

|

%

|

|

Ratio of net investment income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to average net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reimbursement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and waivers

|

|

|

1.07

|

%

|

|

|

0.41

|

%

|

|

|

0.09

|

%

|

|

|

0.56

|

%

|

|

|

0.36

|

%

|

|

After expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

reimbursement

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and waivers

|

|

|

1.36

|

%

|

|

|

1.13

|

%

|

|

|

1.05

|

%

|

|

|

1.54

|

%

|

|

|

1.00

|

%

|

|

Portfolio turnover rate

|

|

|

4

|

%

|

|

|

5

|

%

|

|

|

7

|

%

|

|

|

8

|

%

|

|

|

14

|

%

|

|

#

|

Amount is less than $0.01 per share.

|

|

1

|

Total return reflects reinvested dividends but does not reflect the impact of taxes.

|

The accompanying notes are an

integral part of these financial statements.

Fort Pitt Capital Total Return Fund

|

NOTES TO FINANCIAL STATEMENTS

|

|

at October 31, 2012

|

NOTE 1 – ORGANIZATION

The Fort Pitt Capital Total Return Fund (the “Fund”) is a series of Advisors Series Trust (the “Trust”), which is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end management investment company. The Fund began operations on December 31, 2001.

The investment goal of the Fund is to seek to realize a combination of long-term capital appreciation and income that will produce maximum total return. The Fund seeks to achieve its goal by investing primarily in a diversified portfolio of common stocks of domestic (U.S.) companies and fixed income investments.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America.

|

|

A.

|

Security Valuation:

All investments in securities are recorded at their estimated fair value, as described in note 3.

|

|

|

B.

|

Federal Income Taxes:

It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no Federal income or excise tax provision is required.

|

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years 2009-2011, or expected to be taken in the Fund’s 2012 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Wisconsin; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

|

|

C.

|

Securities Transactions, Income and Distributions:

Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date.

|

The Fund distributes substantially all net investment income, if any, and net realized capital gains, if any, annually. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations which differ from accounting principles generally accepted in the United States of America.

|

|

D.

|

Reclassification of Capital Accounts:

Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

|

|

|

E.

|

Use of Estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates.

|

Fort Pitt Capital Total Return Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

|

|

F.

|

Redemption Fee:

The Fund charges a 2.00% redemption fee to shareholders who redeem shares held 180 days or less. Such fees are retained by the Fund and accounted for as an addition to paid-in capital.

|

During the year ending October 31, 2012, the Fund retained $2,687 in redemption fees.

|

|

G.

|

Events Subsequent to the Fiscal Year End:

In preparing the financial statements as of October 31, 2012, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements.

|

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

|

Level 2 –

|

Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities:

The Fund’s investments are carried at fair value. Equity securities, including common stocks, exchange-traded funds and warrants, that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and asked prices. Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities which are not traded in the NASDAQ Global Market System shall be valued at the most recent sales price. Investments in open-end mutual funds are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in level 1 of the fair value hierarchy.

Short-Term Securities:

Short-term securities having a maturity of 60 days or less are valued at amortized cost, which approximates market value. To the extent the inputs are observable and timely, these securities would be classified in level 2 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price doesn’t represent fair value, are valued following procedures approved by the Board of Trustees (“Board”). These procedures consider many factors, including the type of security, size of holding, trading volume and news events. Depending on the relative significance of the valuation inputs, these securities may be classified in either level 2 or level 3 of the fair value hierarchy.

Fort Pitt Capital Total Return Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

The Board has delegated day-to-day valuation issues to a Valuation Committee which is comprised of one or more trustees and representatives from U.S. Bancorp Fund Services, LLC, the Fund’s administrator. The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation Committee are reviewed and ratified by the Board.

The inputs or methodology used for valuing securities is not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of October 31, 2012:

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Common Stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance and Insurance

|

|

$

|

5,149,250

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

5,149,250

|

|

|

Information

|

|

|

10,392,619

|

|

|

|

—

|

|

|

|

—

|

|

|

|

10,392,619

|

|

|

Manufacturing

|

|

|

14,949,352

|

|

|

|

—

|

|

|

|

—

|

|

|

|

14,949,352

|

|

|

Professional, Scientific,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Technical Services

|

|

|

977,959

|

|

|

|

—

|

|

|

|

—

|

|

|

|

977,959

|

|

|

Utilities

|

|

|

1,638,438

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,638,438

|

|

|

Total Common Stocks

|

|

|

33,107,618

|

|

|

|

—

|

|

|

|

—

|

|

|

|

33,107,618

|

|

|

Exchange-Traded Funds

|

|

|

1,564,066

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,564,066

|

|

|

Warrants

|

|

|

73,920

|

|

|

|

—

|

|

|

|

—

|

|

|

|

73,920

|

|

|

Short-Term Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money Market Funds

|

|

|

1,603,621

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,603,621

|

|

|

U.S. Treasury Bills

|

|

|

—

|

|

|

|

3,499,715

|

|

|

|

—

|

|

|

|

3,499,715

|

|

|

Total Short-Term Investments

|

|

|

1,603,621

|

|

|

|

3,499,715

|

|

|

|

—

|

|

|

|

5,103,336

|

|

|

Total Investments

|

|

$

|

36,349,225

|

|

|

$

|

3,499,715

|

|

|

$

|

—

|

|

|

$

|

39,848,940

|

|

Refer to the Fund’s Schedule of Investments for a detailed break-out of common stocks by industry classification. Transfers between levels are recognized at October 31, 2012, the end of the reporting period. The Fund recognized no transfers to/from Level 1 or Level 2. There were no Level 3 securities held in the Fund during the year ended October 31, 2012.

New Accounting Pronouncement:

In December 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented. The Funds are currently evaluating the impact ASU 2011-11 will have on the financial statement disclosures.

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For the year ended October 31, 2012, Fort Pitt Capital Group, Inc. (the “Advisor”) provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnished all investment advice, office space, facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee at the annual rate of 1.00% based upon the average daily net assets of the Fund. For the year ended October 31, 2012, the Fund incurred $383,229 in advisory fees.

Fort Pitt Capital Total Return Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

The Fund is responsible for its own operating expenses. The Advisor has agreed to reduce fees payable to it by the Fund and to pay Fund operating expenses to the extent necessary to limit the Fund’s aggregate annual operating expenses to 1.24% of average daily net assets. Any such reduction made by the Advisor in its fees or payment of expenses which are the Fund’s obligation are subject to reimbursement by the Fund to the Advisor, if so requested by the Advisor, in subsequent fiscal years if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. The Advisor is permitted to be reimbursed only for fee reductions and expense payments made in the previous three fiscal years. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is made. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses. For the year ended October 31, 2012, the Advisor reduced its fees in the amount of $110,951; no amounts were reimbursed to the Advisor. Cumulative expenses subject to recapture pursuant to the aforementioned conditions amounted to $671,126 at October 31, 2012. Cumulative expenses subject to recapture expire as follows:

|

Year

|

|

Amount

|

|

|

2013

|

|

$

|

307,960

|

|

|

2014

|

|

|

252,215

|

|

|

2015

|

|

|

110,951

|

|

|

|

|

$

|

671,126

|

|

U.S. Bancorp Fund Services, LLC (the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals.

U.S. Bancorp Fund Services, LLC (“USBFS”) also serves as the fund accountant and transfer agent to the Fund. U.S. Bank N.A., an affiliate of USBFS, serves as the Fund’s custodian.

For the year ended October 31, 2012, the Fund incurred the following expenses for administration, fund accounting, transfer agency, custody, and Chief Compliance Officer fees:

|

Administration and Fund Accounting

|

|

$

|

64,027

|

|

|

Transfer Agency (a)

|

|

|

19,919

|

|

|

Custody

|

|

|

7,914

|

|

|

Chief Compliance Officer

|

|

|

6,317

|

|

(a) Does not include out-of-pocket expenses

At October 31, 2012, the Fund had payables due to USBFS for administration, fund accounting, transfer agency and Chief Compliance Officer fees and to U.S. Bank N.A. for custody fees in the following amounts:

|

Administration and Fund Accounting

|

|

$

|

10,596

|

|

|

Transfer Agency (a)

|

|

|

7,995

|

|

|

Chief Compliance Officer

|

|

|

1,250

|

|

|

Custody

|

|

|

767

|

|

(a) Does not include out-of-pocket expenses

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of the Administrator.

Certain officers of the Fund are also employees of the Administrator.

Fort Pitt Capital Total Return Fund

|

NOTES TO FINANCIAL STATEMENTS (Continued)

|

NOTE 5 – PURCHASES AND SALES OF SECURITIES

For the year ended October 31, 2012, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were $2,847,669 and $1,457,776, respectively.

NOTE 6 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the year ended October 31, 2012 and the year ended October 31, 2011 were as follows:

|

|

October 31, 2012

|

October 31, 2011

|

|

Ordinary income

|

$420,337

|

$345,322

|

As of October 31, 2012, the components of accumulated earnings/(losses) on a tax basis were as follows:

|

Cost of investments

|

|

$

|

32,474,037

|

|

|

Gross tax unrealized appreciation

|

|

|

9,706,558

|

|

|

Gross tax unrealized depreciation

|

|

|

(2,331,655

|

)

|

|

Net tax unrealized appreciation

|

|

|

7,374,903

|

|

|

Undistributed ordinary income

|

|

|

441,639

|

|

|

Undistributed long-term capital gain

|

|

|

—

|

|

|

Total distributable earnings

|

|

|

441,639

|

|

|

Other accumulated gains/(losses)

|

|

|

(2,051

|

)

|

|

Total accumulated earnings/(losses)

|

|

$

|

7,814,491

|

|

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to the tax deferral of losses on wash sales adjustments.

At October 31, 2012, the Fund had a capital loss carryforward of $2,051, which expires in 2017. The Fund utilized capital loss carryforwards in the amount of $588,576 during the year ended October 31, 2012.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after December 31, 2010, may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Under the law in effect prior to the Act, preenactment net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that postenactment net capital losses be used before pre-enactment net capital losses.

|

NOTICE TO SHAREHOLDERS at October 31, 2012 (Unaudited)

|

For the year ended October 31, 2012, the Fort Pitt Capital Total Return Fund designated $420,337 as ordinary income for purposes of the dividends paid deduction.

For the year ended October 31, 2012, certain dividends paid by the Fort Pitt Capital Total Return Fund may be subject to a maximum tax rate of 15%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income was 100.00%.

For corporate shareholders in the Fort Pitt Capital Total Return Fund, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the year ended October 31, 2012 was 100.00%.

Fort Pitt Capital Total Return Fund

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

To the Board of Trustees

Advisors Series Trust and

Shareholders of

Fort Pitt Capital Total Return Fund

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Fort Pitt Capital Total Return Fund, a series of shares of Advisor Series Trust (the “Trust”), as of October 31, 2012 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2012, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Fort Pitt Capital Total Return Fund as of October 31, 2012 the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

December 27, 2012

Fort Pitt Capital Total Return Fund

|

INFORMATION ABOUT TRUSTEES AND OFFICERS (Unaudited)

|

This chart provides information about the Trustees and Officers who oversee the Fund. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees.

Independent Trustees

1

|

|

|

|

|

Number of

|

|

|

|

|

|

|

Portfolios

|

Other

|

|

|

|

|

|

in Fund

|

Directorships

|

|

|

|

Term of Office

|

|

Complex

|

Held

|

|

Name, Address

|

Position Held

|

and Length of

|

Principal Occupation

|

Overseen by

|

During Past

|

|

and Age

|

with the Trust

|

Time Served

|

During Past Five Years

|

Trustee

2

|

Five Years

|

|

|

|

|

|

|

|

|

Donald E. O’Connor

|

Trustee

|

Indefinite

|

Retired; former Financial

|

1

|

Trustee,

|

|

(age 76)

|

|

term

|

Consultant and former

|

|

Advisors

|

|

615 E. Michigan Street

|

|

since

|

Executive Vice President and

|

|

Series

|

|

Milwaukee, WI 53202

|

|

February

|

Chief Operating Officer of ICI

|

|

Trust (for

|

|

|

|

1997.

|

Mutual Insurance Company

|

|

series not

|

|

|

|

|

(until January 1997).

|

|

affiliated

|

|

|

|

|

|

|

with the

|

|

|

|

|

|

|

Fund);

|

|

|

|

|

|

|

Trustee, The

|

|

|

|

|

|

|

Forward

|

|

|

|

|

|

|

Funds (34

|

|

|

|

|

|

|

portfolios).

|

|

|

|

|

|

|

|

|

George J. Rebhan

|

Trustee

|

Indefinite

|

Retired; formerly President,

|

1

|

Trustee,

|

|

(age 78)

|

|

term

|

Hotchkis and Wiley Funds

|

|

Advisors

|

|

615 E. Michigan Street

|

|

since

|

(mutual funds) (1985 to 1993).

|

|

Series

|

|

Milwaukee, WI 53202

|

|

May

|

|

|

Trust (for

|

|

|

|

2002.

|

|

|

series not

|

|

|

|

|

|

|

affiliated

|

|

|

|

|

|

|

with the

|