Aberdeen

Income Credit Strategies Fund

Rights

Offering

A

Limited Opportunity for Common Shareholders

Highlights of the Rights Offering

dated June 8, 2021

|

|

Fund

|

Aberdeen

Income Credit Strategies Fund (NYSE: ACP) (the “Fund”)

|

|

Subscription

Period

|

May

20, 2021 (record date) to June 16, 2021 (expiration date) (unless extended)

|

|

Offering

Type

|

Transferrable

rights to subscribe for common shares

|

|

Rights

Symbol

|

NYSE:

ACP RT

|

|

Rights

Ratio

|

One

common share for every three rights held (1-for-3)

|

|

|

Ø

|

Opportunity

for investors to buy common shares at a discount to market price

|

|

Subscription

Pricing

|

Ø

|

Subscription

price will be based upon a formula equal to 92.5% of the average of the last reported sales price of a common share on the NYSE on

the expiration date and each of the four immediately preceding trading days (the “Formula Price”). If, however, the Formula

Price is less than 87% of the Fund’s NAV per common share at the close of trading on the NYSE on the expiration date, the subscription

price will be 87% of the Fund’s NAV per common share at the close of trading on the NYSE on that day.

|

|

|

Ø

|

Common

shareholders on the record date will receive one right for each common share owned

|

|

|

Ø

|

Three

rights are required to purchase one common share at the subscription price

|

|

|

Ø

|

The

Fund will not issue fractional shares, so record date shareholders holding fewer than three common shares will be entitled to subscribe

for one full common share

|

|

Subscription

Terms

|

Ø

|

Record

date common shareholders who fully exercise all rights initially issued to them are permitted subscribe for additional common shares

that were not subscribed for by other record date common shareholders at the subscription price (“over-subscription privilege”).

Over-subscription shares may only be acquired if there are unexercised rights. If over-subscription requests exceed the number of

available shares (from unexercised rights), then the available shares will be allocated pro-rata

|

|

|

|

|

|

|

Ø

|

The

proceeds of the offer are anticipated to be invested in attractive opportunities for enhancement of the Fund’s distributions

and/or net asset value (“NAV”) appreciation potential

|

|

Offering

Rationale

|

Ø

|

The Fund

will seek to capitalize on market inefficiencies and to reallocate the portfolio to opportunistically emphasize those investments,

geographies and categories of investments believed to be best suited to the current investment environment

|

|

|

|

|

Contact your financial adviser for more information

PLEASE READ THE ACCOMPANYING

PROSPECTUS SUPPLEMENT AND PROSPECTUS FOR MORE INFORMATION.

These

“Highlights of the Rights Offering” supersede the information contained in any previous “Highlights of the Rights

Offering” relating to the Fund’s current rights offering and are qualified in their entirety by reference to the

information included in the accompanying prospectus supplement, dated May 20, 2021, and prospectus, dated April 27, 2021. Investors

should consider the Fund’s investment objectives, strategies, risks, and expenses before investing. The accompanying

prospectus supplement and prospectus contain this and other information about the Fund, including risk factors that should be

carefully considered before participating in the offer. The prospectus supplement and prospectus should be read

carefully before investing. Although the prospectus supplement and prospectus accompany this brochure, you can also request a

prospectus supplement and prospectus, at no charge, by calling the Information Agent at 1-800-561-2871.

(NOT PART OF THE PROSPECTUS)

Aberdeen

Income Credit Strategies Fund (ACP)

WHY

SHOULD I EXERCISE MY RIGHTS?

|

Ø

|

The

Advisers1 Believe that Global High Yield Credit Continues to Offer Attractive

Investment Opportunities

|

|

|

–

|

Lower

rated credit is likely to continue to outperform as economies re-open post COVID-19

|

|

|

–

|

Thoughtful

security selection may allow the Advisers to potentially enhance risk-adjusted investment

portfolio returns over time

|

|

Ø

|

The

Advisers Believe that Default Rate Expectations are Low and Falling

|

|

|

–

|

Company

earnings are improving, liquidity profiles are strong, and capital markets are functioning

impressively as demonstrated by the record amounts of year-to-date high yield issuance2

|

|

|

–

|

Leverage

multiples are falling and equity cushions are large coupled with extended debt maturity profiles

and lower cost of debt3

|

|

|

–

|

Compensation

for default risk is elevated by historic standards4

|

Issuer-Weighted Default

Rate (%)5

|

Ø

|

The

Advisers Believe the Federal Reserve and European Central Bank (ECB) Policy Continues to

Support Growth

|

|

|

–

|

Dovish

tone of central banks is likely to continue to underpin economic growth; default rates have

been muted by the low interest rate environment globally as borrowers have maintained access

to capital

|

|

|

–

|

Investment

grade corporate bond purchases may create a ripple effect that offers higher yielding investment

opportunities

|

Federal Reserve Balance

Sheet6

|

Ø

|

The

Advisers Believe that Lower Rated Credit is Relatively Insulated from Rising Interest Rates

|

|

|

–

|

The

Fund has an average portfolio duration exposure of 2.4 years,7 and offers an attractive

distribution rate with limited interest rate sensitivity

|

|

Ø

|

Additional

Capital May Allow the Fund to Diversify the Portfolio with New Issues to Help Improve the

Quality of Earnings

|

|

|

–

|

Diversification

will improve downside protection and create a stronger income stream, which the Advisers

believe will also protect the Fund’s distributions

|

|

|

–

|

There

has a been a recent pick up in the amount of lower rated issuance as a percentage of total

issuance

|

|

|

–

|

Emerging

markets are presenting new opportunities for the Fund

|

Economic

and market data and projections contained herein are presented for illustrative purposes only and are not reflective of actual or expected

performance of the Fund. The achievement of the projections is subject to numerous risks and uncertainties. Actual economic results may

vary materially from projections contained herein, which may adversely affect the performance of the Fund and the value of your investment.

Notes:

|

1

|

“Advisers”

collectively refers to Aberdeen Asset Managers Limited (“AAML” or the “Adviser”)

and Aberdeen Standard Investments Inc. (“ASI” or the “Sub-Adviser”)

|

|

2

|

BofA

Global Research, May 7, 2021

|

|

3

|

Credit

Suisse Credit Strategy Daily (HY April Recap), May 3, 2021

|

|

4

|

Deutsche

Bank Research, April 27, 2021

|

|

5

|

Moody's,

Barclays Research. Data as of March 31, 2021

|

|

6

|

Aberdeen

Standard Investments, Haver, December 2020

|

|

7

|

As

of March 31, 2021. The Fund has no set policy regarding duration and may invest in credit

obligations of any maturity or duration.

|

Aberdeen Income

Credit Strategies Fund (ACP)

ABERDEEN INCOME CREDIT STRATEGIES

FUND – GENERAL OVERVIEW

|

Ø

|

Aberdeen

Income Credit Strategies Fund is a diversified, closed end-management investment company

registered under the Investment Company Act of 1940

|

|

Ø

|

The

common shares of the Fund have an aggregate net asset value of ~$202mm and market cap of

~$214mm as of May 17, 2021

|

|

Ø

|

The

Fund seeks to emphasize high current income, with a secondary emphasis on capital appreciation,

by investing generally in senior secured floating rate and fixed rate loans and in second

lien or other subordinated loans or debt instruments, including non-stressed and stressed

credit obligations, and related derivatives

|

|

Ø

|

The

Fund seeks to capitalize on market inefficiencies and reallocate the portfolio of the Fund

to opportunistically emphasize those investments, geographies and categories of investments

believed to be best suited to the current investment and interest rate environment and market

outlook

|

|

Ø

|

The

Fund is advised by Aberdeen Asset Managers Limited and Aberdeen Standard Investments, Inc.

which manages ~$625bn in AUM including $160bn in fixed income assets as of December 31, 2020

|

Annualized Total Returns (%)1

Notes:

|

1

|

Source:

Morningstar. Data as of March 31, 2021. “Since Last Rights Offering” reflects

annualized total return since settlement date on November 15, 2019. Past performance is no

guarantee of future results. Investment return and net asset value and market price of common

shares will fluctuate so that Common Shares, when sold, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance data quoted.

|

|

2

|

Date

as of March 31, 2021. As a percent of Managed Assets of the Fund. “Managed Assets”

are the total assets of the Fund (including any assets attributable to money borrowed for

investment purposes, including proceeds from (and assets subject to) reverse repurchase agreements,

any credit facility and any issuance of preferred shares or notes) minus the sum of the Fund’s

accrued liabilities (other than Fund liabilities incurred for the purpose of leverage). The

Fund’s portfolio is actively managed and the foregoing presents only a “snapshot”

at March 31, 2021. There is no assurance that the composition of the Fund’s portfolio,

either currently or in the future, will resemble the composition of the Fund’s portfolio

at March 31, 2021. The Fund’s current or future portfolio may contain some, all or

none of the referenced sectors or security types in allocations that may be the same, similar

or different from those reflected at March 31, 2021. Past performance and is no guarantee

of future results. Investment return and net asset value and market price of Common Shares

will fluctuate so that Common Shares, when sold, may be worth more or less than their original

cost. Current performance may be lower or higher than the performance data quoted.

|

Aberdeen Income

Credit Strategies Fund (ACP)

HOW

CAN I EXERCISE MY RIGHTS?

To

exercise your rights, contact your broker, custodian or trust officer who can forward your instructions on your behalf. If you do not

have a broker, custodian or trust officer, you should complete the subscription certificate and deliver it to the subscription agent,

together with your payment, at one of the locations indicated on the subscription certificate or in the accompanying prospectus supplement

and prospectus. For more information, contact the Fund’s Information Agent, Georgeson, at 1-800-561-2871. Record date shareholders

that decide not to exercise their rights may sell their rights as discussed below under “May I Sell My Rights?”

MAY

I SELL MY RIGHTS?

Yes.

The rights will be admitted for trading on the NYSE under the symbol “ACP RT.” Contact your broker, custodian or trust officer

who can arrange for the sale of Rights on your behalf. Sellers of Rights through brokers, custodians or trust officers may incur traditional

commissions payable by the seller. If you do not have a broker, custodian or trust officer, indicate your instructions on the subscription

certificate and deliver it to the subscription agent. The rights are expected to trade on the NYSE through June 15, 2021, one business

day prior to the expiration date of the offer, unless extended. The Fund cannot assure record date shareholders that a market for the

rights will develop or that any minimum sale price can be obtained for the rights

PLEASE

READ THE ACCOMPANYING PROSPECTUS SUPPLEMENT AND PROSPECTUS FOR MORE INFORMATION

These

“Highlights of the Rights Offering” are qualified in their entirety by reference to the information included in the accompanying

prospectus supplement and prospectus. Investors should consider the Fund’s investment objective, risks, and charges and expenses

before investing. The accompanying prospectus supplement and prospectus contains this and other information about the Fund, including

risk factors that should be carefully considered before participating in the offer. The common shares may decline in value or even lose

all of their value. The accompanying prospectus supplement and prospectus should be read carefully before investing.

CERTAIN

RISKS. Investing in the Fund involves risks, including the risk that investors may receive little or no return on their investment

or may lose part or all of their investment. Below is a summary of certain principal risks of investing in the Fund. For a more complete

discussion of the risks of investing in the Fund, see “Risks Relating to the Offer“ in the prospectus supplement and “Risk

Factors” in the prospectus. Investors should consider carefully the following principal risks before investing in the Fund. An

investment in the Fund is subject to investment and market risk, including the possible loss of an investor’s entire investment.

Before making an investment decision, a prospective investor should (i) consider the suitability of this investment with respect to his

or her investment objectives and personal situation and (ii) consider factors such as his or her personal net worth, income, age, risk

tolerance and liquidity needs.

TAXATION.

The Fund has elected to be treated and has qualified, and intends to continue to qualify annually to be treated for U.S. federal

income tax purposes, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986,

as amended. Accordingly, the Fund generally will not pay corporate-level federal income taxes on any net ordinary income or capital gains

that it currently distributes to its common shareholders. To qualify and maintain its qualification as a RIC for U.S. federal income

tax purposes, the Fund must meet specified source-of-income and asset diversification requirements and distribute annually at least 90%

of its net ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. See

“U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement and prospectus.

DILUTION

Record date shareholders who do not fully exercise their Rights will, at the completion of the offer, own a smaller proportional

interest in the Fund than owned prior to the offer. The completion of the offer will result in immediate voting dilution for such common

shareholders. Further, both the sales load and the expenses associated with the offer will immediately reduce the net asset value of

each outstanding common share. In addition, if the subscription price is less than the net asset value per common share as of the expiration

date, the completion of this offer will result in an immediate dilution of the net asset value per common share for all existing common

shareholders (i.e., will cause the net asset value per common share of the Fund to decrease). It is anticipated that existing common

shareholders will experience immediate dilution even if they fully exercise their rights. Such dilution is not currently determinable

because it is not known how many common shares will be subscribed for, what the net asset value per common share or market price of the

Fund’s common shares will be on the expiration date or what the subscription price per common share will be. Any such dilution

could be substantial. If the subscription price is substantially less than the current net asset value per common share, this dilution

could be substantial. The Fund will pay expenses associated with the offer, estimated at approximately $2,310,746, in connection with

the offer. In addition, the Fund has agreed to pay a sales load equal to 3.50% of the subscription price per common share for each common

share issued pursuant to the exercise of rights and the over-subscription privilege. The Fund, not investors, pays the sales load, which

is ultimately thus borne by all common shareholders. All of the costs of the offer will be borne by the Fund’s common shareholders.

See “Summary of Fund Expenses” in the accompanying prospectus supplement and prospectus for more information.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained herein constitute forward-looking statements. These statements involve known and unknown risks, uncertainties and

other factors that may cause the Fund’s actual results or level of performance to be materially different from any future results

or level of performance expressed or implied by such forward-looking statements. Such factors include, among others, those listed under

“Risk Relating to the Offer” in the prospectus supplement and “Risk Factors” in the prospectus. As a result of

these and other factors, the Fund cannot give you any assurances as to its future results or level of performance, and neither the Fund

nor any other person assumes responsibility for the accuracy and completeness of such statements. The Fund undertakes no obligation to

publicly update or revise any forward-looking statements made herein.

UBS

Securities LLC is acting as Dealer Manager in connection with the Offer

Information

Agent

Georgeson

1-800-561-2871

(NOT

PART OF THE PROSPECTUS)

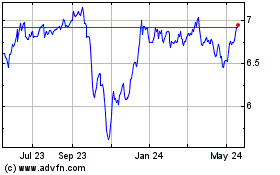

abrdn Income Credit Stra... (NYSE:ACP)

Historical Stock Chart

From Oct 2024 to Nov 2024

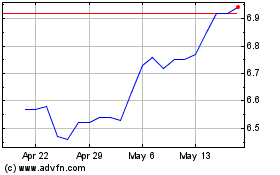

abrdn Income Credit Stra... (NYSE:ACP)

Historical Stock Chart

From Nov 2023 to Nov 2024