SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [x]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[X] Soliciting Material Pursuant to ss. 240.14a-12

CNET NETWORKS, INC.

(Name of Registrant as Specified In Its Charter)

JANA PARTNERS LLC

SPARK MANAGEMENT PARTNERS, L.L.C.

VELOCITY INTERACTIVE MANAGEMENT, LLC

ALEX INTERACTIVE MEDIA, LLC

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

On January 7, 2008, JANA Partners LLC issued a press release announcing that it

had notified CNET Networks, Inc. (the "Issuer") of its intention to nominate

seven people for election to the Issuer's Board of Directors at the next annual

shareholders meeting. Certain of the Potential Participants (as defined below)

also filed a Schedule 13D with the U.S. Securities and Exchange Commission that

included Item 4 stating the following:

"Item 4. Purpose of Transaction.

JANA originally acquired Shares after representatives of JANA met in

October, 2007 with Paul Gardi of AIM, who described what he believed to be

operating issues at the Issuer and stated his belief that addressing such issues

could result in a significant increase in the value of the Shares. Following

subsequent meetings, Gardi introduced JANA's representatives to representatives

of Spark in November, 2007 to discuss working together to propose to the Issuer

how these operating issues could be addressed. On December 3, 2007, JANA,

CT-100, AIM and Gardi entered into a letter agreement (the "Letter Agreement")

setting forth certain terms and conditions of their investment in the Issuer. In

December, 2007, representatives of Spark introduced representatives of JANA to

representatives of Velocity to discuss the same matters. On December 23, 2007,

JANA, CT-100, AIM, Gardi and Velocity entered into an amended and restated

agreement (the "Amended and Restated Agreement") which amended and restated the

terms of the Letter Agreement, in order to, among other things, add Velocity as

a party. The terms of the Amended and Restated Agreement are described in Item 6

of this Schedule 13D. CT-100 and Gardi will acquire Shares from JANA pursuant to

the terms and conditions of the Amended and Restated Agreement. In connection

with becoming a party to the Amended and Restated Agreement, Velocity has

entered into an Option Agreement (the "Option Agreement") with JANA granting it

the option to acquire Shares from JANA. The terms of the Option Agreement are

described in Item 6 of this Schedule 13D.

Representatives of JANA held several calls with representatives of the

Issuer throughout the month of October, 2007 as well as a call on November 1,

2007 with the Issuer's Chief Executive Officer, Neil Ashe. On December 6, 2007,

Santo Politi of Spark met with Jarl Mohn, the Chairman of the Board of Directors

of the Issuer (the "Board"), to inform him of the investment in the Shares by

JANA, CT-100 and Gardi and to discuss proposals for improving the operating

performance of the Issuer. Politi proposed a follow-up discussion with

additional independent directors of the Issuer. In a subsequent conversation,

Mr. Mohn informed Politi that any discussions with members of the Board would

need to be coordinated by Ashe. In further communications with Ashe, it was

communicated to Politi that a meeting with independent Board members would not

be arranged, but rather the investors could meet with Ashe who would communicate

later with the Board.

On December 28, 2007, JANA delivered a notice (the "Notice") to the

Issuer informing the Issuer of its intention (i) to propose two Class III

nominees for election to the Board at the Issuer's 2008 Annual Meeting, (ii) to

propose amendments to the Bylaws of the Issuer to (A) increase the size of the

Board from eight directors to 13 directors, (B) delete a Bylaw provision

providing that in case of any increase in the size of the Board in advance of an

annual meeting of stockholders, additional directors shall be elected by the

directors then in office, (C) delete a Bylaw provision providing that any newly

created directorships resulting from an increase in the size of the Board shall

be apportioned by the Board among the three classes of directors, and (D) add a

Bylaw provision providing that any new directorship created as a result of an

increase in the number of directors may be filled with a person elected by the

stockholders, and (iii) to propose an additional five nominees for election to

the Board to occupy the new directorships created by the adoption of the Bylaw

amendments described in clause (ii) above. The Class III nominees are Paul Gardi

and Santo Politi. The nominees for the new directorships created by the proposed

Bylaw amendments described above are Jonathan Miller, Jaynie Studenmund, Julius

Genachowski, Brian Weinstein and Giorgio Caputo.

The Notice was accompanied by a letter from JANA (the "JANA Letter") to

the Issuer in which JANA stated its view that certain provisions of the Issuer's

Bylaws are either incorrectly interpreted by the Issuer and/or are either

inapplicable or unenforceable under Delaware law. A copy of the JANA Letter is

filed as Exhibit 1 to this Schedule 13D and is incorporated herein by reference.

On January 7, 2008, JANA Master Fund, Ltd. (the "Plaintiff"), an

affiliate of JANA, filed a Verified Complaint for Declaratory and Injunctive

Relief in the Court of Chancery of the State of Delaware (the "Complaint"). The

Complaint alleges that the Issuer is improperly attempting (i) to apply Article

II, Section 3 of the Issuer's By-laws to prohibit the Plaintiff from submitting

its proposals for stockholder approval at the Issuer's 2008 annual meeting and

(ii) to apply Article III, Section 6 of the Issuer's By-laws to prohibit the

Plaintiff from submitting its director candidates for election by the

stockholders at such meeting. In the Complaint, Plaintiff seeks (i) a

declaration that the Issuer's interpretation of Article II, Section 3, and

Article III, Section 6 of the Issuer's By-laws (the "Disputed By-laws") is

invalid as a matter of law and (ii) an order preliminarily and permanently

enjoining the application of the Disputed By-laws to Plaintiff's nomination of

individuals as candidates for director and to Plaintiff's proposals to be

presented for stockholder approval at the Issuer's 2008 Annual Meeting. The

Complaint also alleges that if the Disputed By-laws are interpreted in the

manner the Issuer urges, such By-laws are invalid as a matter of law because,

among other reasons, they (i) impermissibly limit the fundamental right of

stockholders of the Issuer to propose and transact business and to nominate

candidates for director election at an annual meeting, (ii) impermissibly treat

holders of the same class of stock of the Issuer differently and unequally, and

(iii) impose an unreasonable requirement on the stockholders of the Issuer that

does not further a legitimate or proper purpose. In the Complaint, Plaintiff

also seeks an order compelling the Issuer to produce certain requested stocklist

materials pursuant to 8 Del. C. ss. 220. A copy of the Complaint is filed as

Exhibit 2 to this Schedule 13D and is incorporated herein by reference.

On January 7, 2008, JANA issued a press release (the "Press Release")

announcing its intention to nominate seven people for election to the Board at

the Issuer's 2008 Annual Meeting. A copy of the Press Release is filed as

Exhibit 3 to this Schedule 13D and is incorporated herein by reference.

Except as set forth herein or as would occur upon completion of any of

the actions discussed herein, the Reporting Persons have no present plan or

proposal that would relate to or result in any of the matters set forth in

subparagraphs (a)-(j) of Item 4 of Schedule 13D. The Reporting Persons intend to

review their investments in the Issuer on a continuing basis and may engage in

further discussions with management, the Board, other stockholders of the Issuer

and other relevant parties concerning the business, operations, governance,

management, strategy and future plans of the Issuer. Depending on various

factors including, without limitation, the Issuer's financial position and

strategic direction, the outcome of any discussions referenced above, actions

taken by the Board, price levels of the Shares, other investment opportunities

available to the Reporting Persons, conditions in the securities market and

general economic and industry conditions, the Reporting Persons may in the

future take such actions with respect to their investments in the Issuer as they

deem appropriate including, without limitation, purchasing additional Shares or

selling some or all of the Shares held by the Reporting Persons, engaging in

short selling of or any hedging or similar transactions with respect to the

Shares and/or otherwise changing their intention with respect to any and all

matters referred to in Item 4 of Schedule 13D."

A copy of the press release is filed herewith as Exhibit 1.

Information regarding the Potential Participants in a potential solicitation of

proxies with respect to the Issuer's 2008 annual meeting of shareholders is

filed herewith as Exhibit 2.

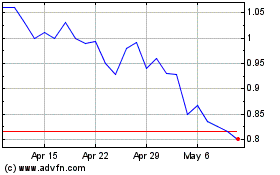

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

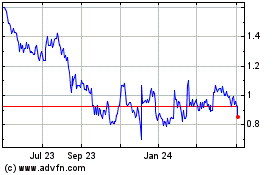

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024