CNET Networks, Inc. (NASDAQ: CNET) today announced that it has

filed with the United States Securities and Exchange Commission

("SEC") an amended annual report on Form 10-K/A for the year ended

December 31, 2005, an amended quarterly report on Form 10-Q/A for

the quarter ended March 31, 2006, and quarterly reports on Form

10-Q for the quarters ended June 30, 2006 and September 30, 2006.

At this time the Company is current with all of its required

filings with the SEC. The Company believes that the filing of these

reports also satisfies the conditions established by The Nasdaq

Listing Qualification panel for continued listing on the Nasdaq

Global Select Market. As discussed below, the Company has restated

its historical financial statements to reflect the results of an

investigation into its historical stock option grant practices, and

has recorded cumulative non-cash, stock compensation charges of

$105.7 million associated with stock options grants made from 1996

through 2005. Background On May 16, 2006, the Center for Financial

Research and Analysis, or CFRA, issued an analysis of stock option

exercise prices relative to stock price ranges for certain

companies during the period 1997 to 2002. The report identified

CNET Networks as having granted stock options between 1998 and 2001

with exercise prices that matched or were close to a forty-day low

for the Company�s stock price. On May 22, 2006, the Company

announced that its Board of Directors appointed a Special Committee

comprised of independent directors to conduct, with the assistance

of legal counsel and outside accounting experts, an internal

investigation relating to past option grants, the timing of such

grants and related accounting matters. On July 10, 2006, CNET

Networks announced that the Special Committee had reached the

preliminary conclusion that the actual measurement dates for the

grants identified in the CFRA report differed from the recorded

measurement dates. Charges related to the change in measurement

dates for these stock options were determined to be material and as

a result, the Company announced that it expected to restate its

financial statements. On October 11, 2006, the Company announced

that the Special Committee reported its findings on the Company's

options granting practices and procedures to the Board of

Directors. The Special Committee concluded that there were

deficiencies with the process by which options were granted at CNET

Networks, including in some instances the backdating of option

grants, during the period from the Company's IPO in July 1996

through at least 2003, which resulted in accounting errors. The

Special Committee report concluded that a number of executives of

the Company, including the former CFO and the recently resigned

CEO, General Counsel and SVP of Human Resources, bore varying

degrees of responsibility for these deficiencies. The report did

not conclude that any current employees of the Company or any

recently resigned employees engaged in intentional wrongdoing. On

December�20, 2006, certain of CNET Networks� executive officers

holding stock options which were granted with per share exercise

prices below the fair market value of a share of CNET Networks

common stock on the date of grant (referred to as discount stock

options) each entered into agreements pursuant to which they agreed

to amend the exercise price of the discount stock options to the

extent not vested as of December 31, 2004 and still outstanding at

December 20, 2006. These executive officers held approximately 1

million discount stock options with a weighted average exercise

price of approximately $9.03 per share which were repriced to their

fair market value. Under these agreements, the amended exercise

prices of such options have been changed to and are equal to the

fair market value of a share of CNET Networks� common stock on the

date of grant of each option. Based on the re-pricing, the 1

million options had a revised weighted average exercise price of

approximately $9.92 per share. The non-executive members of CNET

Networks� Board of Directors each entered into similar agreements

to those entered into by the executive officers described above

except that each non-executive director also agreed to re-price any

discount option, whether or not vested as of December 31, 2004. The

non-executive directors also agreed, with respect to any discount

options which were previously exercised, to repay to the company an

amount equal to the difference between the original exercise price

and the fair market value of CNET Networks� common stock on the

date of grant of such options, net of taxes. Approximately 283,000

discount stock options with a weighted average exercise price of

$9.40 per share held by non-executive members of CNET Networks�

board of directors were repriced to their fair market value. The

weighted average exercise price of these 283,000 shares after the

re-pricing was $10.07 per share. The estimated amount of repayment

to the Company for the difference between the original exercise

price and the fair value of approximately 27,000 options which were

previously exercised by these directors is approximately $16,000

before taxes. The Company�s former Chairman and Chief Executive

Officer and a current member of CNET Networks� board of directors

entered into a similar agreement to those entered into by the

Company�s non-executive directors covering 700,000 discount options

outstanding with a weighted average exercise price of $3.96 per

share and were repriced to their fair market value. This agreement

did not provide for the repayment of amounts related to previously

exercised options because the former Chairman had not exercised any

options. The weighted average exercise price of these 700,000

shares after the repricing was $8.57 per share. In January 2007,

CNET Networks� management completed its review of the Company�s

stock option grant activity. The review conducted by management

covered approximately 97 percent of option grants to all employees,

directors and consultants for all grant dates during the period

from CNET Networks� initial public offering in July 1996 through

May 2006. As a result of the Special Committee�s investigation and

the Company�s internal review of its historical financial

statements, the Company has recorded significant adjustments to its

previously filed financial statements. Restatement Methodology and

Evaluation Process The following describes the methodology and

evaluation process used by management in determining the

appropriate measurement date for various option grants and

reviewing modifications to determine if they were appropriately

accounted for at the date of modification. The measurement date is

the date on which the option is deemed granted under applicable

accounting principles, which for all relevant periods was

Accounting Principles Board Opinion No. 25, �Accounting for Stock

Issued to Employees� and related interpretations (�APB 25�), and is

the first date on which all of the following are known: (1) the

individual who is entitled to receive the option grant; (2) the

number of options that an individual is entitled to receive; and

(3) the option�s exercise price. The majority of the measurement

date determinations were based on objective evidence, such as

minutes from Compensation Committee meetings, unanimous written

consents of the Compensation Committee, Board of Director meeting

minutes, reports filed on Form 4 filed with the SEC,

contemporaneous emails, personnel files, payroll records, and

various records maintained by the Company�s Human Resources

department. Specific information as to when a grant was finalized

was not apparent for certain grants. In these cases, management

considered all available relevant information to form a reasonable

conclusion as to the most likely measurement date for these grants,

and when there was no evidence to indicate which date was more

likely the true measurement date, management calculated

compensation expense utilizing the median price of the stock over

the likely period in which the measurement date occurred.

Management believes that the use of the median price gives a more

reasonable approximation of the compensation expense related to

these options than the amount calculated using either the high or

the low price during the period, as there is no evidence to

indicate that either the date on which the high or the low price

occurred was the true measurement date. A more detailed description

of the methodology used for the objective and subjective

determinations of appropriate measurement dates for these grants

can be found in the amended annual report on Form 10-K/A for the

year ended December 31, 2005 filed today with the SEC. Findings and

Associated Adjustments Based on the separate reviews of management

and the Special Committee, the Company identified instances where

the grant date used as the measurement date for accounting

purposes, differed from the measurement date as defined in APB 25,

for more than the grants identified in the CFRA report. As a

result, the Company corrected the measurement date for

approximately 40.8 million options out of a total of 73.8 million

options granted from July 1996 through December 2005, with nearly

all of these corrections relating to options granted prior to

December 31, 2003. In addition to measurement date corrections,

management also identified instances where the Company incorrectly

accounted for certain option grants that were modified after the

grant date. The restated financial statements also reflect other

adjustments consisting of reclassifications of certain foreign

transactional taxes on the Company�s consolidated statements of

operations and other tax reclassifications on its consolidated

balance sheets, and other adjustments to operating expenses for

previously known errors and corrections to the Company�s provision

for income tax resulting from computational errors. These items

were previously not recorded by the Company because in each case,

and in the aggregate, the underlying errors were not considered by

management to be material to its consolidated financial statements.

The following table sets forth the impact of the non-cash charges

for stock compensation expense and the other adjustments and

reclassifications for the years ended December 31, 2005, 2004,

2003, 2002, 2001, 2000, 1999, 1998, 1997 and 1996: (in thousands)

Year Ended December 31, 2005� 2004� 2003� 2002� 2001� � � Stock

compensation expense adjustments: Stock compensation expense $

6,357� $ 8,991� $ 8,175� $ 22,866� $ 18,909� Capitalized

compensation expense (13) -� (29) (271) (507) Related payroll tax

expense 83� 128� 12� -� -� Total stock compensation expense

adjustments 6,427� 9,119� 8,158� 22,595� 18,402� � Reclassification

of foreign transactional tax: � Revenues (1,258) (887) (651) (681)

(461) Sales and marketing 1,545� 1,075� 738� 681� 548� Income tax

(benefit) (287) (188) (87) -� (87) Total reclassification of

foreign transactional tax -� -� -� -� -� � Other adjustments, net

1,724� 589� (198) (381) (105) � Other income tax adjustments (41)

138� (414) (239) (714) � Total decreases to net income and

increases to net loss from all restatement adjustments � $ 8,110� $

9,846� $ 7,546� $ 21,975� $ 17,583� � � (in thousands) Year Ended

December 31, 2000� 1999� 1998� 1997� 1996� � Stock compensation

expense adjustments: Stock compensation expense $ 23,862� $ 12,940�

$ 3,443� $ 795� $ 151� Capitalized compensation expense -� -� -� -�

-� Related payroll tax expense -� -� -� -� -� Total stock

compensation expense adjustments 23,862� 12,940� 3,443� 795� 151� �

Reclassification of foreign transactional tax: � Revenues -� -� -�

-� -� Sales and marketing -� -� -� -� -� Income tax (benefit) -� -�

-� -� -� Total reclassification of foreign transactional tax -� -�

-� -� -� � Other adjustments, net -� -� -� -� -� � Other income tax

adjustments (2,685) (843) -� -� -� � Total decreases to net income

and increases to net loss from all restatement adjustments � $

21,177� $ 12,097� $ 3,443� $ 795� $ 151� For further explanations

and tables summarizing the impact of the non-cash charges for stock

compensation expense and the other adjustments and

reclassifications on the Company�s historical statements of

operations for years prior to 2003, as well as balance sheet and

cash flow statements adjustments, please see the amended annual

report on Form 10-K/A for the year ended December 31, 2005, filed

today with the SEC. The effects of these restatements are reflected

in the financial statements and other supplemental data, including

the unaudited quarterly data for 2005 and 2004 and selected

financial data, included in the amended Form 10-K/A. CNET Networks

has not amended and does not intend to amend any of its previously

filed annual reports on Form 10-K for the periods affected by the

restatement or adjustments, other than in its 2005 Annual Report on

Form 10-K/A, or any of its previously filed Quarterly Reports on

Form 10-Q for any period prior to December 31, 2005. Evaluation of

Controls and Procedures In connection with the restatement of CNET

Networks� consolidated financial statements, under the supervision

of the Company�s CEO and CFO, CNET Networks reevaluated its

disclosure controls and procedures and internal control over

financial reporting. Based on this reevaluation, the CEO and CFO

concluded that CNET Networks� disclosure controls and procedures

were effective as of December 31, 2005. In management�s and the

Special Committee�s review of the Company�s historical stock option

grants and practices, deficiencies in internal control over

financial reporting with respect to stock option grants were

determined to exist related to options granted prior to January 1,

2004. However, in 2004, the Company changed its practices related

to stock option grants and remediated prior deficiencies. Based on

the results of management�s review of stock option grant activity

during 2005, an evaluation of disclosure controls and procedures

and assessment of internal control over financial reporting as of

December 31, 2005, the Company and its independent auditors

concluded that there was not a material weakness in disclosure

controls and procedures or of internal control over financial

reporting related to accounting for stock options as of such date.

Management also assessed the effectiveness of the Company�s

internal control over financial reporting as of December 31, 2005

based on criteria established in Internal Control�Integrated

Framework issued by the Committee of Sponsoring Organizations of

the Treadway Commission. As a result of this assessment, management

concluded that, as of December 31, 2005, the Company�s internal

control over financial reporting was effective in providing

reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external

purposes in accordance with generally accepted accounting

principles. This press release should be read in conjunction with

the amended 2005 Annual Report on Form 10-K/A, the amended

Quarterly Report on Form 10-Q/A and the Quarterly Reports on Form

10-Q referred to in the release. The Company issued a separate

release today reporting results for the fourth quarter and year

ended December 31, 2006. Safe Harbor This press release contains

forward-looking statements concerning the Company�s satisfaction of

the conditions for continued listing on the Nasdaq Global Select

Market. There can be no assurance that the filing of the amended

annual report on Form 10-K/A, amended quarterly report on Form

10-Q/A and the delinquent form 10-Qs with the Securities and

Exchange Commission will satisfy the Nasdaq Listing Qualifications

Panel�s requirements. Forward-looking statements are made as of the

date of this press release and, except as required by law, the

Company does not undertake an obligation to update its

forward-looking statements to reflect future events or

circumstances. About CNET Networks, Inc. CNET Networks, Inc.

(Nasdaq:CNET - News; www.cnetnetworks.com) is an interactive media

company that builds brands for people and the things they are

passionate about, such as gaming, music, entertainment, technology,

business, food, and parenting. The Company's leading brands include

CNET, GameSpot, TV.com, MP3.com, Webshots, CHOW, ZDNet and

TechRepublic. Founded in 1993, CNET Networks has a strong presence

in the US, Asia, and Europe.

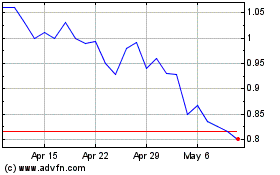

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

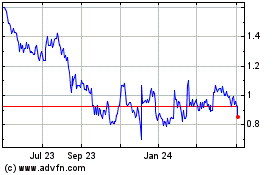

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024