CNET Networks, Inc. (Nasdaq:CNET) today reported revenue results

for the third quarter ended September 30, 2006. �CNET Networks has

proven an ability to add, manage, and monetize multiple brands in

multiple categories,� said Neil Ashe, chief executive officer.

�Although we continue to see the impact of transitions in our

technology and gaming categories, we remain confident in our

long-term position and look forward to CNET Networks� next phase of

growth.� Total revenues for the third quarter were $92.8 million, a

13 percent increase compared to revenues of $81.9 million for the

same period of 2005. Revenues for 2005 and 2006 exclude revenues

related to Computer Shopper magazine, which was sold in the first

quarter of 2006 and consequently has been treated as a discontinued

operation in our financial results in both periods. At the end of

the quarter, cash balances, which includes cash, investments and

restricted cash, were $141.8 million, compared to $143.3 million on

June 30, 2006. As previously announced, the company�s Board of

Directors has established a special committee of independent

directors to review the company�s stock option practices and

related accounting. The company announced that the special

committee reached a conclusion that the actual measurement dates

for certain past stock options granted by the company differ from

the recorded measurement dates. Accordingly, the company

anticipates that it will be required to restate certain previously

issued financial statements to record non-cash charges for

stock-based compensation. The company does not expect that the

anticipated restatement will have any impact on its previously

reported revenues or cash positions. The company will not be in a

position to provide operating expense, operating income, net income

or earnings per share information on a historical basis or as part

of its business outlook pending the completion of the restatement

process. Further information regarding these matters is set forth

in the company�s Current Report on Form 8-K filed July 10, 2006 and

October 11, 2006. Business Review �CNET Networks is known for

building world class brands for people and the things they are

passionate about,� said Ashe. �During the third quarter, we

successfully entered the food category with the launch of CHOW and

look forward to continuing our efforts to extend our existing

brands as well as add new ones.� --� CNET Networks' global network

of Internet properties reached an average of 124.5 million unique

monthly users during the third quarter of 20061, an increase of 13

percent from the third quarter of 2005. Average daily page views

were over 86.3 million during the third quarter1, down 13 percent

from the year-ago quarter. � --� CNET Networks continues to add new

brands and extend its current brands to attract a broader audience

and advertising customers in the US. � --� In September, CNET

Networks launched CHOW (www.chow.com), the new home base for 25- to

40-year-old food enthusiasts designed to engage a passionate

community interested in food, drink and fun. CHOW takes a

refreshingly different approach to food media by combining original

content from its editorial staff and its community. Early

advertiser interest included Sub-Zero and NBC/ Bravo. CHOW

exemplifies CNET Network's ability to identify opportunities and

leverage our expertise of acquisitions and internal development

that build world-class leading brands. � --� CNET recently launched

its new video destination, CNET TV (www.cnettv.com), a single

immersive environment where users can easily find all of CNET's

popular videos online, on television, and on-the-go. � --� Also

during the quarter, CNET Networks continued to enhance its

established brands as part of its ongoing effort to serve its

influential users, with authentic experiences. � --� In August,

Webshots (www.webshots.com) launched a new look, navigation, and

functionality to modernize the user experience for both users and

marketers. Webshots now features 10 community-defined,

editor-programmed channels, organized as "neighborhoods" around the

most popular categories, such as Entertainment, Family, Good Times,

Home and Garden, Sports, and Travel. The redesign introduces

valuable ad units for marketers. Companies such as Energizer,

Suzuki, Chili's, Applebees, Purina, NBC and Fox are taking

advantage of the new opportunities. � --� TV.com's (www.tv.com)

extensive feature on the fall TV season was extremely popular with

users, creating buzz ahead of and during fall season premiers,

which enabled TV.com to provide valuable insight on show trends,

and to forecast hits. The feature balanced rich content such as a

comprehensive program calendar, in-depth show summaries, episode

guides, videos, downloads, news updates, actor bios, and cast

photos, with user engagement features such as viewer reviews,

forums, polls, and blogs. � --� CNET Networks' product excellence

and thought leadership was demonstrated through its partnerships

with other leading companies, its roll-out of youth market research

and its ongoing series of prestigious award wins. � --� This month,

CNET (www.cnet.com) announced partnerships with BestBuy and

Verizon. BestBuy is now featuring CNET reviews content on its

popular shopping Web site to ensure its customers find the right

personal technology products, reviews and buying information. CNET

also entered into a partnership with Verizon to distribute CNET's

video through on-demand television. These partnerships extend the

reach of CNET's content and its original videos to even more people

interested in today's latest tech and consumer electronics. � --�

CNET Networks Entertainment and Starcom MediaVest Group partnered

on an extensive ethnographic youth study aimed at helping marketers

better understand how to engage with the elusive population of

13-to-34-year-olds, a group responsible for $600 billion each year

in consumer spending. The goal was to determine how young people

feel about brands, how they talk about them with friends, and how

they take in, manipulate, and redistribute marketing messages. The

results will help marketers understand and interact effectively

with the youth market. � --� In September, CNET News won two

Excellence in Journalism Awards from the Northern California

Chapter of the Society of Professional Journalists, including

Investigative Reporting for Print, Broadcast and Online, and

Feature Reporting for Online. Business Outlook For the fourth

quarter of 2006, management anticipates total revenues of $108

million to $115 million. For the full-year 2006, management is

estimating total revenues of $376 million to $386 million. The

company will not be in a position to file its Quarterly Report on

Form 10-Q for the quarter ended September 30, 2006 on a timely

basis, pending the completion of its financial restatements related

to its independent investigation of stock option granting practices

and of the requisite audit procedures by the Company�s independent

registered public accountants. Consequently, CNET Networks is not

in a position to provide actual results or guidance regarding

operating expense, operating income, net income or earnings per

share. Convertible Notes As previously announced on October 19,

2006, the Company did not receive a sufficient number of consents

from holders to satisfy the requisite 70 percent consent threshold

in regard to its consent solicitation for its $125.0 million

convertible notes. If the notes are accelerated, the Company

intends to repay them at par value. Conference Call and Webcast

CNET Networks will host a conference call to discuss its third

quarter 2006 the foregoing revenue results and business outlook

beginning at 5:00 pm ET (2:00 pm PT), today, October 23, 2006. To

listen to the discussion, please visit http://ir.cnetnetworks.com

and click on the link provided for the webcast conference call or

dial (800) 344-1035 (international dial-in: (706) 679-3076). A

replay of the conference call will be available via webcast at the

URL listed above or by calling (800) 642-1687 (international

dial-in: (706) 645-9291) and entering the conference ID number

7747781. The company�s past financial news releases, related

financial and operating information, and access to all Securities

and Exchange Commission filings, can also be accessed at

http://ir.cnetnetworks.com. Safe Harbor This press release and its

attachments include forward-looking information and statements that

are subject to risks and uncertainties that could cause actual

results to differ materially. These forward-looking statements

include the statements under the sections entitled �Business

Outlook� which sets forth management�s estimated financial

performance for the fourth quarter and full year of 2006, and

statements regarding our growth prospects and expectations

regarding the future success of our products and services. In

addition, management expects to provide forward-looking information

statements on the conference call to be held shortly following the

issuance of this release, which are also subject to risks and

uncertainties that could cause actual results to differ materially.

The forward-looking statements in this release and on the

conference call are identified by the words �expect,� �estimate,�

�target,� �believe,� �goal,� �anticipate,� �intend� and similar

expressions or are otherwise identified in the context in which

they are made as being forward-looking. These statements are only

effective as of the date of this release and we undertake no duty

to publicly update these forward-looking statements, whether as a

result of new information, future developments or otherwise. The

risks and uncertainties that could cause actual results to differ

materially from those projected include: a lack of growth or a

decrease in marketing spending on the Internet due to failure of

marketers to adopt the Internet as an advertising medium at the

rate that we currently anticipate; a lack of growth or decrease in

marketing spending on CNET Networks� properties in particular,

which could be prompted by competition from other media outlets,

both on and off the Internet, dissatisfaction with CNET Networks�

services, or economic difficulties in our clients� businesses; a

decrease in user activity on our sites due to competition or other

factors, which could reduce advertising revenue generated by such

user activities; reduced consumer activity or manufacturer

marketing due to product lifecycles or product launch delays in the

Company�s content categories; economic conditions such as weakness

in corporate or consumer spending, which could prompt a reduction

in overall advertising expenditures or expenditures specifically on

our properties; the failure of existing advertisers to meet or

renew their advertising commitments as we anticipate; the failure

to attract advertisers outside of our traditional technology and

consumer electronics categories; a continued decline in revenues

from our print publications as advertising dollars shift to other

media and general risks associated with our business. In addition,

the Company anticipates that it will restate its historical

financial statements to record non-cash charges for compensation

expense relating to past stock option grants. The outcome and

timing of the restatement may be impacted by actions that may be

taken or required as a result of the investigation concerning

matters relating to CNET Networks� stock option grants. The Company

and its independent auditors are reviewing recent accounting

guidance published by the SEC, and have not yet determined the

amount of such charges, the resulting tax and accounting impact, or

which periods may require restatement.. For additional information

about risks to CNET Networks� business, see its Annual Form 10-K

for the year ended December 31, 2005 and subsequent Forms 10-Q and

8-K, including disclosures under the captions �Risk Factors� and

�Management�s Discussion and Analysis of Financial Conditions and

Results of Operations,� which are filed with the Securities and

Exchange Commission and are available on the SEC's website at

www.sec.gov.�Forward-looking statements are made as of the date of

this press release and, except as required by law, the Company does

not undertake an obligation to update its forward-looking

statements to reflect future events or circumstances. About CNET

Networks, Inc. CNET Networks, Inc. (Nasdaq: CNET,

www.cnetnetworks.com) is an interactive media company that builds

brands for people and the things they are passionate about, such as

gaming, music, entertainment, technology, business, food, and

parenting. The Company�s leading brands include CNET, GameSpot,

TV.com, MP3.com, Webshots, CHOW, ZDNet and TechRepublic. Founded in

1993, CNET Networks has a strong presence in the US, Asia and

Europe. (1) CNET Networks July 2006 � September 2006 (internal log

data) Quarterly Statistical Highlights (a) Unaudited Q3-06 Q2-06

Q1-06 Q4-05(b) Q3-05(b) � Total Quarterly Revenue ($mm) $ 92.8� $

92.0� $ 83.4� $ 103.3� $ 81.9� � Revenue Distribution (%) (c)

Marketing Services 86% 86% 85% 89% 86% Licensing, Fees and User 14%

14% 15% 11% 14% � Segment Revenue U.S. Media $ 73.5� $ 72.8� $

67.8� $ 82.9� $ 65.9� International Media $ 19.3� $ 19.2� $ 15.6� $

20.4� $ 16.0� � Advertiser Metrics CNET Networks Top 100 US

Advertisers' Renewal Rate (Q-to-Q) 96% 100% 96% 100% 97% CNET

Networks Top 100 US Advertisers' % of Network Revenue 54% 55% 53%

55% 55% � Select Business Metrics Network Unique Users (mm) 124.5�

116.2� 116.8� 116.1� 110.1� Network Average Daily Page Views (mm)

86.3� 92.8� 98.7� 103.6� 99.4� � Balance Sheet Highlights ($mm)

Cash $ 78.7� $ 79.1� $ 74.2� $ 55.9� $ 69.8� Marketable Debt

Securities 60.9� 62.0� 62.1� 54.1� 38.3� Restricted Cash � 2.2� �

2.2� � 2.2� � 2.2� � 4.6� Total Cash and Equivalents $ 141.8� $

143.3� $ 138.5� $ 112.2� $ 112.7� � Total Debt $ 143.3� $ 143.3� $

141.7� $ 141.8� $ 141.3� � Days Sales Outstanding (DSO) 73� 67� 70�

71� 66� � (a) The company will not be in a position to disclose

operating expense, operating income, net income or earnings per

share information pending the completion of the company's financial

statement restatement as described in the company's Current Report

on Form 8-K filed July 10, 2006 and October 11, 2006. (b) Results

for 2005 and 2006 exclude revenue related to Computer Shopper due

to the sale of the Computer Shopper magazine business in Q1 2006

and resulting discontinued operations treatment. (c) Due to the

sale of Computer Shopper magazine on February 2, 2006, CNET

Networks no longer reports publishing revenue. The company's

international publishing revenue is now distributed in the

marketing services and licensing, fee and user lines as described

below: Marketing Services - sales of advertisements on our Internet

network through impression-based and activity-based advertising,

and sales of advertisements in our print publications. Licensing,

Fees and User - licensing our product database, online content,

subscriptions to online services, subscription and newsstand sales

of print publications, and other paid services. CNET Networks, Inc.

(Nasdaq:CNET) today reported revenue results for the third quarter

ended September 30, 2006. "CNET Networks has proven an ability to

add, manage, and monetize multiple brands in multiple categories,"

said Neil Ashe, chief executive officer. "Although we continue to

see the impact of transitions in our technology and gaming

categories, we remain confident in our long-term position and look

forward to CNET Networks' next phase of growth." -- Total revenues

for the third quarter were $92.8 million, a 13 percent increase

compared to revenues of $81.9 million for the same period of 2005.

Revenues for 2005 and 2006 exclude revenues related to Computer

Shopper magazine, which was sold in the first quarter of 2006 and

consequently has been treated as a discontinued operation in our

financial results in both periods. -- At the end of the quarter,

cash balances, which includes cash, investments and restricted

cash, were $141.8 million, compared to $143.3 million on June 30,

2006. -- As previously announced, the company's Board of Directors

has established a special committee of independent directors to

review the company's stock option practices and related accounting.

The company announced that the special committee reached a

conclusion that the actual measurement dates for certain past stock

options granted by the company differ from the recorded measurement

dates. Accordingly, the company anticipates that it will be

required to restate certain previously issued financial statements

to record non-cash charges for stock-based compensation. The

company does not expect that the anticipated restatement will have

any impact on its previously reported revenues or cash positions.

The company will not be in a position to provide operating expense,

operating income, net income or earnings per share information on a

historical basis or as part of its business outlook pending the

completion of the restatement process. Further information

regarding these matters is set forth in the company's Current

Report on Form 8-K filed July 10, 2006 and October 11, 2006.

Business Review "CNET Networks is known for building world class

brands for people and the things they are passionate about," said

Ashe. "During the third quarter, we successfully entered the food

category with the launch of CHOW and look forward to continuing our

efforts to extend our existing brands as well as add new ones." -0-

*T -- CNET Networks' global network of Internet properties reached

an average of 124.5 million unique monthly users during the third

quarter of 2006(1), an increase of 13 percent from the third

quarter of 2005. Average daily page views were over 86.3 million

during the third quarter(1), down 13 percent from the year-ago

quarter. -- CNET Networks continues to add new brands and extend

its current brands to attract a broader audience and advertising

customers in the US. -- In September, CNET Networks launched CHOW

(www.chow.com), the new home base for 25- to 40-year-old food

enthusiasts designed to engage a passionate community interested in

food, drink and fun. CHOW takes a refreshingly different approach

to food media by combining original content from its editorial

staff and its community. Early advertiser interest included

Sub-Zero and NBC/ Bravo. CHOW exemplifies CNET Network's ability to

identify opportunities and leverage our expertise of acquisitions

and internal development that build world-class leading brands. --

CNET recently launched its new video destination, CNET TV

(www.cnettv.com), a single immersive environment where users can

easily find all of CNET's popular videos online, on television, and

on-the-go. -- Also during the quarter, CNET Networks continued to

enhance its established brands as part of its ongoing effort to

serve its influential users, with authentic experiences. -- In

August, Webshots (www.webshots.com) launched a new look,

navigation, and functionality to modernize the user experience for

both users and marketers. Webshots now features 10

community-defined, editor-programmed channels, organized as

"neighborhoods" around the most popular categories, such as

Entertainment, Family, Good Times, Home and Garden, Sports, and

Travel. The redesign introduces valuable ad units for marketers.

Companies such as Energizer, Suzuki, Chili's, Applebees, Purina,

NBC and Fox are taking advantage of the new opportunities. --

TV.com's (www.tv.com) extensive feature on the fall TV season was

extremely popular with users, creating buzz ahead of and during

fall season premiers, which enabled TV.com to provide valuable

insight on show trends, and to forecast hits. The feature balanced

rich content such as a comprehensive program calendar, in-depth

show summaries, episode guides, videos, downloads, news updates,

actor bios, and cast photos, with user engagement features such as

viewer reviews, forums, polls, and blogs. -- CNET Networks' product

excellence and thought leadership was demonstrated through its

partnerships with other leading companies, its roll-out of youth

market research and its ongoing series of prestigious award wins.

-- This month, CNET (www.cnet.com) announced partnerships with

BestBuy and Verizon. BestBuy is now featuring CNET reviews content

on its popular shopping Web site to ensure its customers find the

right personal technology products, reviews and buying information.

CNET also entered into a partnership with Verizon to distribute

CNET's video through on-demand television. These partnerships

extend the reach of CNET's content and its original videos to even

more people interested in today's latest tech and consumer

electronics. -- CNET Networks Entertainment and Starcom MediaVest

Group partnered on an extensive ethnographic youth study aimed at

helping marketers better understand how to engage with the elusive

population of 13-to-34-year-olds, a group responsible for $600

billion each year in consumer spending. The goal was to determine

how young people feel about brands, how they talk about them with

friends, and how they take in, manipulate, and redistribute

marketing messages. The results will help marketers understand and

interact effectively with the youth market. -- In September, CNET

News won two Excellence in Journalism Awards from the Northern

California Chapter of the Society of Professional Journalists,

including Investigative Reporting for Print, Broadcast and Online,

and Feature Reporting for Online. *T Business Outlook -- For the

fourth quarter of 2006, management anticipates total revenues of

$108 million to $115 million. -- For the full-year 2006, management

is estimating total revenues of $376 million to $386 million. The

company will not be in a position to file its Quarterly Report on

Form 10-Q for the quarter ended September 30, 2006 on a timely

basis, pending the completion of its financial restatements related

to its independent investigation of stock option granting practices

and of the requisite audit procedures by the Company's independent

registered public accountants. Consequently, CNET Networks is not

in a position to provide actual results or guidance regarding

operating expense, operating income, net income or earnings per

share. Convertible Notes As previously announced on October 19,

2006, the Company did not receive a sufficient number of consents

from holders to satisfy the requisite 70 percent consent threshold

in regard to its consent solicitation for its $125.0 million

convertible notes. If the notes are accelerated, the Company

intends to repay them at par value. Conference Call and Webcast

CNET Networks will host a conference call to discuss its third

quarter 2006 the foregoing revenue results and business outlook

beginning at 5:00 pm ET (2:00 pm PT), today, October 23, 2006. To

listen to the discussion, please visit http://ir.cnetnetworks.com

and click on the link provided for the webcast conference call or

dial (800) 344-1035 (international dial-in: (706) 679-3076). A

replay of the conference call will be available via webcast at the

URL listed above or by calling (800) 642-1687 (international

dial-in: (706) 645-9291) and entering the conference ID number

7747781. The company's past financial news releases, related

financial and operating information, and access to all Securities

and Exchange Commission filings, can also be accessed at

http://ir.cnetnetworks.com. Safe Harbor This press release and its

attachments include forward-looking information and statements that

are subject to risks and uncertainties that could cause actual

results to differ materially. These forward-looking statements

include the statements under the sections entitled "Business

Outlook" which sets forth management's estimated financial

performance for the fourth quarter and full year of 2006, and

statements regarding our growth prospects and expectations

regarding the future success of our products and services. In

addition, management expects to provide forward-looking information

statements on the conference call to be held shortly following the

issuance of this release, which are also subject to risks and

uncertainties that could cause actual results to differ materially.

The forward-looking statements in this release and on the

conference call are identified by the words "expect," "estimate,"

"target," "believe," "goal," "anticipate," "intend" and similar

expressions or are otherwise identified in the context in which

they are made as being forward-looking. These statements are only

effective as of the date of this release and we undertake no duty

to publicly update these forward-looking statements, whether as a

result of new information, future developments or otherwise. The

risks and uncertainties that could cause actual results to differ

materially from those projected include: a lack of growth or a

decrease in marketing spending on the Internet due to failure of

marketers to adopt the Internet as an advertising medium at the

rate that we currently anticipate; a lack of growth or decrease in

marketing spending on CNET Networks' properties in particular,

which could be prompted by competition from other media outlets,

both on and off the Internet, dissatisfaction with CNET Networks'

services, or economic difficulties in our clients' businesses; a

decrease in user activity on our sites due to competition or other

factors, which could reduce advertising revenue generated by such

user activities; reduced consumer activity or manufacturer

marketing due to product lifecycles or product launch delays in the

Company's content categories; economic conditions such as weakness

in corporate or consumer spending, which could prompt a reduction

in overall advertising expenditures or expenditures specifically on

our properties; the failure of existing advertisers to meet or

renew their advertising commitments as we anticipate; the failure

to attract advertisers outside of our traditional technology and

consumer electronics categories; a continued decline in revenues

from our print publications as advertising dollars shift to other

media and general risks associated with our business. In addition,

the Company anticipates that it will restate its historical

financial statements to record non-cash charges for compensation

expense relating to past stock option grants. The outcome and

timing of the restatement may be impacted by actions that may be

taken or required as a result of the investigation concerning

matters relating to CNET Networks' stock option grants. The Company

and its independent auditors are reviewing recent accounting

guidance published by the SEC, and have not yet determined the

amount of such charges, the resulting tax and accounting impact, or

which periods may require restatement.. For additional information

about risks to CNET Networks' business, see its Annual Form 10-K

for the year ended December 31, 2005 and subsequent Forms 10-Q and

8-K, including disclosures under the captions "Risk Factors" and

"Management's Discussion and Analysis of Financial Conditions and

Results of Operations," which are filed with the Securities and

Exchange Commission and are available on the SEC's website at

www.sec.gov. Forward-looking statements are made as of the date of

this press release and, except as required by law, the Company does

not undertake an obligation to update its forward-looking

statements to reflect future events or circumstances. About CNET

Networks, Inc. CNET Networks, Inc. (Nasdaq: CNET,

www.cnetnetworks.com) is an interactive media company that builds

brands for people and the things they are passionate about, such as

gaming, music, entertainment, technology, business, food, and

parenting. The Company's leading brands include CNET, GameSpot,

TV.com, MP3.com, Webshots, CHOW, ZDNet and TechRepublic. Founded in

1993, CNET Networks has a strong presence in the US, Asia and

Europe. (1) CNET Networks July 2006 - September 2006 (internal log

data) -0- *T Quarterly Statistical Highlights (a) Unaudited Q3-06

Q2-06 Q1-06 Q4-05(b) Q3-05(b) ------- ------- ------- --------

-------- Total Quarterly Revenue ($mm) $ 92.8 $ 92.0 $ 83.4 $ 103.3

$ 81.9 Revenue Distribution (%) (c) Marketing Services 86% 86% 85%

89% 86% Licensing, Fees and User 14% 14% 15% 11% 14% Segment

Revenue U.S. Media $ 73.5 $ 72.8 $ 67.8 $ 82.9 $ 65.9 International

Media $ 19.3 $ 19.2 $ 15.6 $ 20.4 $ 16.0 Advertiser Metrics CNET

Networks Top 100 US Advertisers' Renewal Rate (Q-to-Q) 96% 100% 96%

100% 97% CNET Networks Top 100 US Advertisers' % of Network Revenue

54% 55% 53% 55% 55% Select Business Metrics Network Unique Users

(mm) 124.5 116.2 116.8 116.1 110.1 Network Average Daily Page Views

(mm) 86.3 92.8 98.7 103.6 99.4 Balance Sheet Highlights ($mm) Cash

$ 78.7 $ 79.1 $ 74.2 $ 55.9 $ 69.8 Marketable Debt Securities 60.9

62.0 62.1 54.1 38.3 Restricted Cash 2.2 2.2 2.2 2.2 4.6 -------

------- ------- -------- -------- Total Cash and Equivalents $141.8

$143.3 $138.5 $ 112.2 $ 112.7 Total Debt $143.3 $143.3 $141.7 $

141.8 $ 141.3 Days Sales Outstanding (DSO) 73 67 70 71 66 (a) The

company will not be in a position to disclose operating expense,

operating income, net income or earnings per share information

pending the completion of the company's financial statement

restatement as described in the company's Current Report on Form

8-K filed July 10, 2006 and October 11, 2006. (b) Results for 2005

and 2006 exclude revenue related to Computer Shopper due to the

sale of the Computer Shopper magazine business in Q1 2006 and

resulting discontinued operations treatment. (c) Due to the sale of

Computer Shopper magazine on February 2, 2006, CNET Networks no

longer reports publishing revenue. The company's international

publishing revenue is now distributed in the marketing services and

licensing, fee and user lines as described below: Marketing

Services - sales of advertisements on our Internet network through

impression-based and activity-based advertising, and sales of

advertisements in our print publications. Licensing, Fees and User

- licensing our product database, online content, subscriptions to

online services, subscription and newsstand sales of print

publications, and other paid services. *T

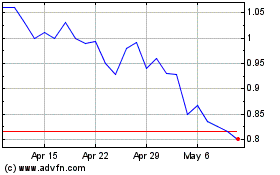

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

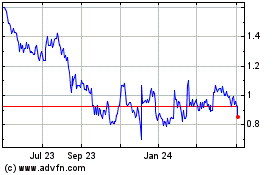

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024