CNET Networks, Inc. Begins Solicitation of Consents From Holders of 0.75% Senior Convertible Notes Due 2024 and Enters Into a $6

September 13 2006 - 4:05PM

Business Wire

CNET Networks, Inc. (NASDAQ:CNET) announced today that it has

commenced a solicitation of consents from holders of record as of

September 12, 2006 of its outstanding $125.0 million principal

amount of 0.75% Senior Convertible Notes due 2024 for the amendment

and waiver of certain reporting requirements in the indenture for

the notes. The amendments and waivers pertain to (i) the company's

previously announced failure to timely file its Quarterly Report on

Form 10-Q for the quarter ended June 30, 2006 and certain future

filing obligations and (ii) possible delisting of the company's

stock that may result from the company's hearing with Nasdaq as

described below. The proposed amendments and waivers to the

indenture would suspend CNET Networks' obligations under the

indenture to transmit to the trustee under the indenture or the

holders of the notes any reports or information CNET Networks is

required to file with the Securities and Exchange Commission on or

prior to the first anniversary of the closing of the consent

solicitation. In addition, the consent solicitation would provide

for a waiver of all related defaults under the indenture's

reporting requirements and, solely with respect to consenting

holders, a waiver of consenting holders' rights to tender notes in

any mandatory offer by CNET Networks to purchase the notes

resulting from the occurrence of any termination of the listing of

the company's common stock on or prior to the first anniversary of

the closing of the consent solicitation. CNET Networks has

requested a hearing before the Nasdaq Listing Qualifications Panel

in response to the receipt of a Nasdaq Staff Determination notice

on Monday, August 14, 2006, stating that the company is not in

compliance with Nasdaq Marketplace Rule 4310c(14). Pending a

decision by the hearing panel, CNET Networks' common stock will

remain listed on The Nasdaq National Market. However, there can be

no assurance that the hearing panel will grant the company's

request for continued listing. CNET Networks previously announced

that it has not timely filed its Quarterly Report on Form 10-Q for

the quarter ended June 30, 2006 in order to address certain

accounting matters. In addition, as previously announced, CNET

Networks anticipates restating the financial statements for 2003,

2004 and 2005 included in its Annual Report on Form 10-K filed with

the SEC on March 16, 2006 and its balance sheet as of March 31,

2006 and may have to restate financial statements for additional

periods. The proposed amendments and waivers require the consent of

holders of 70% of aggregate principal amount of the notes

outstanding. If the required amount of consents are properly

delivered and not revoked prior to the expiration of the consent

solicitation, CNET Networks will pay an additional 7.0% per annum

in special interest on the notes from and after the expiration date

to, but excluding the first anniversary of the closing of the

consent solicitation. The special interest will be paid in the same

manner that regular interest is paid under the indenture. The

consent solicitation will expire at midnight, New York City time,

on October 11, 2006, unless the consent solicitation is extended or

revoked by CNET Networks. The terms and conditions of the consent

solicitation are described in a Consent Solicitation Statement

dated September 13, 2006, which is being sent to all holders of

record as of September 12, 2006. Requests for additional copies of

the Consent Solicitation Statement, the Letter of Consent or other

related documents should be directed to D.F. King & Co., Inc.,

the information and tabulation agent, at (800) 829-6551 (toll-free)

or (212) 269-5550 (collect). Questions regarding the consent

solicitation should be directed to the Convertibles Sales

Department of Banc of America Securities LLC, the solicitation

agent, at 800-654-1666 (toll-free) or 212-583-8206 (collect). CNET

Networks also announced that it has entered into a new $60.0

million, 1-year credit agreement with Bank of America, N.A., which

replaces the company's existing credit facility. The company

intends to satisfy the conditions precedent to any initial drawdown

by September 15, 2006. The borrowings may be drawn down as

revolving loans or as term loans. The borrowings are collateralized

by security interests in most of the company's assets, excluding

goodwill and certain intangible assets. This announcement is not a

solicitation of consents with respect to any securities. The

consent solicitation is being made solely by the Consent

Solicitation Statement dated September 13, 2006. Cautionary

Statement Regarding Forward-Looking Statements The press release

contains forward-looking statements concerning the company's

expected restatement of its historical financial statements, its

anticipated hearing before a Nasdaq Listing Qualifications Panel

and the availability of borrowings under the company's credit

facility. The special committee's review of the company's stock

options practices and related accounting is ongoing, and the

company's expectation that it will restate its financial statements

for 2003, 2004 and 2005 contained in the company's Annual Report on

Form 10-K filed on March 16, 2006 and the company's balance sheet

as of March 31, 2006 is based upon the special committee's

preliminary review of only some of the company's option grants. The

final result of the special committee's review will depend upon a

number of important factors including further analysis of option

grants previously reviewed and a review and analysis of other

option grants not yet reviewed. Additionally, there can be no

assurance concerning the outcomes of the hearing request, the

special committee's review or the effect of the potential

acceleration of the notes or concerning the availability of

borrowings under the company's credit facility. Forward-looking

statements are made as of the date of this press release and,

except as required by law, the company does not undertake an

obligation to update its forward-looking statements to reflect

future events or circumstances. About CNET Networks, Inc. CNET

Networks is a global media company with some of the most important

and valuable brands on the Web targeting passionate audiences. The

company's brands -- such as CNET, GameSpot, TV.com, MP3.com,

Webshots, BNET and ZDNet -- serve the technology, games and

entertainment, business, and community categories. CNET Networks

was founded in 1993 and has always been "a different kind of media

company" creating engaging media experiences through a combination

of world-class content and technology infrastructure.

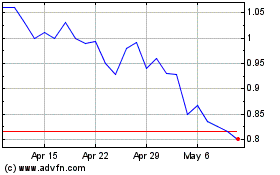

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

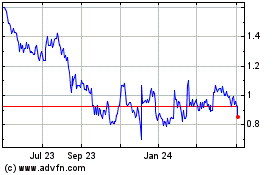

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024