CNET Networks, Inc. (Nasdaq:CNET) today reported results for the

first quarter ended March 31, 2006. "As we start off 2006, we are

pleased with the overall health of the business and believe that

our long-term prospects only continue to improve," said Shelby

Bonnie, chairman and chief executive officer of CNET Networks.

"Although we are seeing more impact from transitions in our endemic

categories in the first half of the year than we originally

expected, we also continue to expand our audience and customer base

as we grow our core brands and add new ones, positioning us well

for the growing opportunity in Internet advertising." -- Total

revenues for the first quarter equaled $83.4 million, a 17 percent

increase compared to revenues of $71.2 million for the same period

of 2005. -- Operating income before depreciation, amortization and

stock compensation expense was $9.2 million, a 47 percent increase

compared to $6.2 million during the first quarter of 2005. -- The

profit margin of operating income before depreciation, amortization

and stock compensation expense increased to 11 percent from 9

percent during the first quarter of 2005. -- Excluding stock

compensation expense in the first quarter of 2006, operating income

equaled $1.7 million compared to $233,000 for the same period of

2005. On a reported basis, which includes $4.7 million of stock

compensation expense in the first quarter of 2006, operating loss

equaled $3.0 million during the quarter. -- Net cash provided by

operating activities for the first quarter of 2006 was $28.3

million, up from $9.5 million in the first quarter of 2005. Free

cash flow for the first quarter of 2006 was $20.0 million compared

to $4.4 million in the year ago quarter. Free cash flow is defined

as net cash provided by operating activities less capital

expenditures. -- Excluding stock compensation expense and $1.3

million of gains on discontinued operations and investments, net

income for the first quarter of 2006 was $2.3 million, or $0.01 per

diluted share compared to a net loss of $365,000, or loss of $0.00

per diluted share, during the same period of 2005. On a reported

basis, net loss for the first quarter of 2006 was $1.1 million, or

a loss of $0.01 per diluted share. This compares with net income of

$383,000, or $0.00 per diluted share during the first quarter of

2005. -- A reconciliation of non-GAAP measures used in this release

to the most comparable GAAP measure and further information

regarding the company's stock compensation expense, discontinued

operations and unusual gains are included in the accompanying

"Operating Income Reconciliation" and "Reconciliation of Net Gain

(Loss) from Unusual Items." Business Review -- CNET Networks'

global network of Internet properties reached an average of 116.8

million unique monthly users during the first quarter of 2006(1),

an increase of 10 percent from the first quarter of 2005. Average

daily page views increased to over 98.7 million during the first

quarter(1), up 4 percent from the year-ago quarter. -- As part of

its effort to expand into new content categories with brands that

engage passionate audiences, CNET Networks has recently added

assets in the food category. The company acquired Chowhound, a

thriving online community focused on the food and dining category.

In addition, the company acquired the assets of Instant Comma,

Inc., operators of Chow Magazine. CNET Networks will leverage the

magazine's editorial expertise, including recipes, how-to's, and

other food-related content to create an online destination for food

enthusiasts, which will replace the magazine. The combination of

Chowhound's passionate community and Chow's editorial expertise

creates a strong platform from which CNET Networks can build a

presence in the food and dining category in the coming months. --

CNET Networks announced several new partnerships this quarter that

bring its original video programming to television viewers

nationwide. The deals illustrate the growing demand for original

video programming that has already proven successful online, and

underscore CNET and GameSpot's positions as the category-defining

brands in technology and gaming, respectively. -0- *T -- CNET

recently announced plans to launch "CNET TV," a video-on-demand

(VOD) offering that packages a selection of CNET's popular video

content for distribution on television and online. CNET TV will

launch initially on TV in early June through partnerships with Cox

Communications, TiVo, Inc., and TVN Entertainment, who will each

offer the content through their own on-demand offerings. Online,

CNET TV will launch in the second half of the year and will provide

users a single destination where they can access all of CNET's

original video content. The new destination will also take

advantage of the interactive nature of the Web, giving users the

ability to program the content based on topics of interest, engage

with CNET's editorial personalities, build custom play lists they

can share with friends, and click to buy products or read full

reviews. -- In March, GameSpot announced that it would produce two

original video series for Gameplay HD, the new gaming channel from

VOOM HD Networks. The programming includes GameSpotting, a

half-hour series of news, reviews and previews, and CinemAddicts,

an hourly series featuring video games in a cohesive cinematic

story. *T -- Webshots launched "Webshots CollegeLive," a feature

that provides students from 4,100 colleges and universities in the

US, UK and Canada a place to plan parties and events, share and

comment on photos after the events, and connect with others.

Webshots members with a .edu email address have access to a special

Webshots-created section dedicated to their college, where students

can share and view photos from students on their campus. Each

college section can only be accessed with a .edu email address from

that school, thereby allowing each college homepage to reflect the

true spirit of its student body. -- CNET Networks continues to

focus on adding a broader segment of advertisers to the networks.

During the first quarter, the company continued to expand its

customer base and add new advertiser segments across the network,

such as Sara Lee, BMW, and Victoria's Secret. In addition,

approximately 80 percent of the general consumer advertisers that

did business with CNET Networks during 2005 continued to advertise

with the company thus far in 2006. -- During the quarter, CNET

Networks maintained momentum in winning prestigious awards and

recognition. -0- *T -- In February, ad agency Avenue A/Razorfish

released its second annual Digital Media Outlook Report with a new

section titled "Best of the Web." CNET Networks was named Publisher

of the Year in the Western Region and its CNET brand was named

Publisher of the Year in the Technology Category. -- CNET was also

nominated for a prestigious National Magazine Award in the General

Excellence Online category. The category recognizes outstanding

magazine Internet sites, as well as online-only magazines and

Weblogs that have a significant amount of original content. -- In

addition, this month award nominations for the 10th annual Webby

Awards were announced by The International Academy of Digital Arts

and Sciences, and CNET Networks picked up a total of 7 nominations

-- more than any other company. *T Business Outlook For the second

quarter of 2006, management anticipates total revenues of $88.5

million to $92 million. Including $5 million to $5.5 million in

stock compensation expense, management estimates operating income

between $900,000 and $4.4 million during the second quarter.

Management expects operating income before depreciation,

amortization and stock compensation expense of between $14 million

and $18 million for the quarter. Excluding stock compensation

expense of $0.03 to $0.04 per diluted share, the company

anticipates second quarter earnings per diluted share to be in the

range of $0.03 to $0.06. Including stock compensation expense,

earnings per share is expected to be in the range of $0.00 to of

$0.02 in the second quarter. For the full-year 2006, management is

revising its expectations. Management is now estimating total

revenues to be in the range of $386 million and $403 million.

Including $22 million to $24 million in stock compensation expense,

management estimates operating income between $30.5 million and

$38.5 million during 2006. Management expects operating income

before depreciation, amortization and stock compensation expense to

be between $86 million and $96 million. Excluding stock

compensation expense of $0.13 to $0.14 per diluted share, earnings

per diluted share is expected to be in the range of $0.31 and $0.37

for the year. Including stock compensation expense, earnings per

share is expected to be in the range of $0.18 to $0.23 for the

year. More detailed guidance, as well as a table that reconciles

operating income (loss) before depreciation, amortization, and

stock compensation guidance to operating income (loss) guidance can

be found on the "Guidance to the Investment Community" sheet that

accompanies this press release. Conference Call and Webcast CNET

Networks will host a conference call to discuss its first quarter

2006 financial results and business outlook beginning at 5:00 pm ET

(2:00 pm PT), today, April 24, 2006. To listen to the discussion,

please visit http://ir.cnetnetworks.com and click on the link

provided for the webcast conference call or dial (800) 344-1035

(international dial-in: (706) 679-3076). A replay of the conference

call will be available via webcast at the URL listed above or by

calling (800) 642-1687 (international dial-in: (706) 645-9291) and

entering the conference ID number 7912752. The company's past

financial news releases, related financial and operating

information, and access to all Securities and Exchange Commission

filings, can also be accessed at http://ir.cnetnetworks.com. Safe

Harbor This press release and its attachments include

forward-looking information and statements that are subject to

risks and uncertainties that could cause actual results to differ

materially. These forward-looking statements include the statements

under the sections entitled "Business Outlook" and "Guidance to the

Investment Community" which sets forth our estimated financial

performance for the second quarter and full year of 2006, and

statements regarding our growth prospects and expectations

regarding the future success of our products and services. In

addition, management expects to provide forward-looking information

statements on the conference call to be held shortly following the

issuance of this release, which are also subject to risks and

uncertainties that could cause actual results to differ materially.

The forward-looking statements in this release and on the

conference call are identified by the words "expect," "estimate,"

"target," "believe," "goal," "anticipate," "intend" and similar

expressions or are otherwise identified in the context in which

they are made as being forward-looking. These statements are only

effective as of the date of this release and we undertake no duty

to publicly update these forward-looking statements, whether as a

result of new information, future developments or otherwise. The

risks and uncertainties that could cause actual results to differ

materially from those projected include: a lack of growth or a

decrease in marketing spending on the Internet due to failure of

marketers to adopt the Internet as an advertising medium at the

rate that we currently anticipate; a lack of growth or decrease in

marketing spending on CNET Networks' properties in particular,

which could be prompted by competition from other media outlets,

both on and off the Internet, dissatisfaction with CNET Networks'

services, or economic difficulties in our clients' businesses; a

decrease in user activity on our sites due to competition or other

factors, which could reduce advertising revenue generated by such

user activities; reduced consumer activity or manufacturer

marketing due to product lifecycles or product launch delays in the

company's content categories, which include technology, games and

entertainment, business and community; economic conditions such as

weakness in corporate or consumer spending, which could prompt a

reduction in overall advertising expenditures or expenditures

specifically on our properties; the failure of existing advertisers

to meet or renew their advertising commitments as we anticipate,

which would cause us to not meet our financial projections; the

failure to attract advertisers outside of our traditional

technology and consumer electronics categories, which would cause

us to not meet our financial projections; a continued decline in

revenues from our print publications as advertising dollars shift

to other media; the acquisition of businesses or the launch of new

lines of business, which could decrease our cash position, increase

operating expense, and dilute operating margins; an increase in

intellectual property licensing fees, which could increase

operating expense, including amortization; the risk of future

impairment of our intangible assets, goodwill or investments based

on a decline in our business or investments; an increase in the

competitiveness of the market for qualified employees or changes in

our stock price or volatility, both of which could increase our

estimated stock compensation expenses for 2006; and general risks

associated with our business. For risks about CNET Networks'

business, see its Annual Form 10-K for the year ended December 31,

2005 and subsequent Forms 10-Q and 8-K, including disclosures under

the captions "Risk Factors" and "Management's Discussion and

Analysis of Financial Conditions and Results of Operations," which

are filed with the Securities and Exchange Commission and are

available on the SEC's website at www.sec.gov. About CNET Networks,

Inc. CNET Networks is a global media company with some of the most

important and valuable brands on the Web targeting passionate

audiences. The company's brands -- such as CNET, GameSpot, TV.com,

MP3.com, Webshots, BNET and ZDNet -- serve the technology, games

and entertainment, business, and community categories. CNET

Networks was founded in 1993 and has always been "a different kind

of media company" creating engaging media experiences through a

combination of world-class content and technology infrastructure.

(1) CNET Networks January 2006 -- March 2006 (internal log data)

-0- *T Consolidated Statements of Operations Unaudited (in

thousands, except share and per share data) Three Months Ended

March 31, --------------------------- 2006 2005 -------------

------------- Revenues $ 83,368 $ 71,224 Operating expenses: Cost

of revenues 41,565 36,316 Sales and marketing 23,174 17,905 General

and administrative 14,178 10,764 Depreciation 4,731 3,915

Amortization of intangible assets 2,721 2,091 -------------

------------- Total operating expenses 86,369 70,991 Operating

income (loss) (3,001) 233 Non-operating income (expense): Realized

gains on investments 882 568 Interest income 1,152 363 Interest

expense (659) (780) Other 140 (85) ------------- -------------

Total non-operating income (expense) 1,515 66 -------------

------------- Income (loss) before income taxes (1,486) 299 Income

tax expense (benefit) 38 96 ------------- ------------- Income

(loss) from continuing operations (1,524) 203 Discontinued

operations Income from operations of discontinued operations 422

180 ------------- ------------- Net income (loss) $ (1,102) $ 383

============= ============= Basic net income per share $ (0.01) $

0.00 ============= ============= Diluted net income per share $

(0.01) $ 0.00 ============= ============= Shares used in

calculating basic net income per share 149,115,657 144,847,388

============= ============= Shares used in calculating diluted net

income per share 149,115,657 151,392,920 =============

============= (a) Stock compensation expense is included in the

above expense categories: Cost of revenues $ 1,897 $ - Sales and

marketing 886 - General and administrative 1,944 - -------------

------------- $ 4,727 $ - ============= ============= (a) On

January 1, 2006, CNET Networks adopted Statement of Financial

Accounting Standards No. 123 (revised 2004), "Share-Based Payment"

("SFAS 123(R)"). CNET Networks' financial statements as of and for

the three months ended March 31, 2006 reflect the impact of SFAS

123(R). Prior to adoption of SFAS 123(R), CNET Networks accounted

for stock compensation under Accounting Principles Board Opinion

No. 25, "Accounting for Stock Issued to Employees" ("APB 25"). In

accordance with APB 25, CNET Networks accounted for stock-based

awards using the intrinsic value method. Since CNET Networks,

adopted the modified prospective transition method, results for

prior period have not been restated under the fair value method.

Therefore, for periods prior to January 1, 2006, no stock-based

compensation expense had been recognized in CNET Networks'

statement of operations as the exercise price of options granted

equaled the estimated fair market value of the underlying stock at

date of grant. Consolidated Balance Sheets Unaudited (in thousands,

except share data) March 31, December 31, 2006 2005 ------------

------------- ASSETS Current Assets: Cash and cash equivalents $

74,158 $ 55,895 Investments in marketable debt securities 52,270

41,591 Accounts receivable, net 64,903 85,312 Other current assets

12,633 13,299 ------------ ------------- Total current assets

203,964 196,097 Restricted cash 2,248 2,248 Investments in

marketable debt securities 9,833 12,432 Property and equipment, net

60,289 56,891 Other assets 16,736 18,465 Intangible assets, net

33,947 37,113 Goodwill 130,187 131,694 ------------ -------------

Total assets $ 457,204 $ 454,940 ============ =============

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable $ 8,113 $ 8,330 Accrued liabilities 45,660 50,887 Current

portion of long-term debt 2,629 2,652 ------------ -------------

Total current liabilities 56,402 61,869 Non-current liabilities:

Long-term debt 139,114 139,114 Other liabilities 761 794

------------ ------------- Total liabilities 196,277 201,777

Stockholders' equity: Common stock; $0.0001 par value; 400,000,000

shares authorized; 149,716,508 outstanding at March 31, 2006 and

149,067,597 outstanding at December 31, 2005 15 15 Additional

paid-in-capital 2,761,226 2,752,208 Accumulated other comprehensive

loss (13,546) (13,394) Treasury stock, at cost (30,453) (30,453)

Accumulated deficit (2,456,315) (2,455,213) ------------

------------- Total stockholders' equity 260,927 253,163

------------ ------------- Total liabilities and stockholders'

equity $ 457,204 $ 454,940 ============ ============= Statements of

Cash Flows Unaudited (in thousands) Three Months Ended March 31,

------------------ 2006 2005 --------- --------- Cash flows from

operating activities: Net Income (Loss) $ (1,102) $ 383 Adjustments

to reconcile net income (loss) to net cash provided by operating

activities: Depreciation and amortization 7,452 6,050 Stock

compensation expense 4,727 - Asset disposals 86 9 Noncash interest

expense (126) 143 Allowance for doubtful accounts 837 529 Equity

losses in investees - 207 Gain on sale of business (507) - Gain on

sale of marketable securities and privately held investments (882)

(568) Changes in operating assets and liabilities, net of

acquisitions: Accounts receivable 19,202 6,361 Other assets 2,339

(148) Accounts payable (217) 170 Accrued liabilities (3,526)

(3,449) Other long-term liabilities (33) (146) --------- ---------

Net cash provided by operating activities 28,250 9,541 ---------

--------- Cash flows from investing activities: Purchase of

marketable debt securities (18,043) (2,403) Proceeds from sale of

marketable debt securities 10,070 4,687 Proceeds from sales of

investments in privately held companies 3,032 568 Investments in

privately held companies (31) (850) Net cash paid for acquisitions

(840) (3,185) Capital expenditures (8,228) (5,164) ---------

--------- Net cash used in investing activities (14,040) (6,347)

--------- --------- Cash flows from financing activities: Net

proceeds from exercise of options 3,895 2,573 Net proceeds from

employee stock purchase plan 398 330 Proceeds from revolver

borrowings - 10,000 Principal payments on borrowings - (10,013)

--------- --------- Net cash provided by financing activities 4,293

2,890 --------- --------- Net increase (decrease) in cash and cash

equivalents 18,503 6,084 Effect of exchange rate changes on cash

and cash equivalents (240) (730) Cash and cash equivalents at the

beginning of the period 55,895 29,560 --------- --------- Cash and

cash equivalents at the end of the period $ 74,158 $ 34,914

========= ========= Business Segments Unaudited (in thousands)

CNET's primary areas of measurement and decision-making include two

principal business segments. CNET has determined that its business

segments are U.S. Media and International Media. U.S. Media

consists of an online network focused on four content categories:

personal technology, games and entertainment, business and

community. International Media includes the delivery of online

technology information and several technology print publications in

non-U.S. markets. Management believes that segment operating income

(loss) before depreciation, amortization and stock compensation

expenses is an appropriate measure of evaluating the operating

performance of the company's segments. However, segment operating

income (loss) before depreciation, amortization and stock

compensation expense should not be considered a substitute for

operating income, cash flows or other measures of financial

performance prepared in accordance with generally accepted

accounting principles. U.S. International Media Media Other(1)

Total -------- ------------- --------- -------- Three Months Ended

March 31, 2006 Revenues $67,783 $15,585 $ - $83,368 Operating

expenses 57,355 16,835 12,179 86,369 -------- -------- ---------

-------- Operating income (loss) $10,428 $(1,250) $(12,179)

$(3,001) ======== ======== ========= ======== Three Months Ended

March 31, 2005 Revenues $58,816 $12,408 $ - $71,224 Operating

expenses 49,467 15,518 6,006 70,991 -------- -------- ---------

-------- Operating income (loss) $ 9,349 $(3,110) $ (6,006) $ 233

======== ======== ========= ======== (1) For the three months ended

March 31, 2006, Other represents operating expenses related to

depreciation of $4,731, amortization of $2,721 and stock

compensation expense of $4,727. For the three months ended March

31, 2005, Other represents operating expenses related to

depreciation of $3,915 and amortization of $2,091. Quarterly

Statistical Highlights Unaudited Q1-06 Q4-05 Q3-05 Q2-05 Q1-05

------- ------- ------- ------- ------- Total Quarterly Revenue

($mm) $ 83.4 $103.3 $ 81.9 $ 80.4 $ 71.2 Revenue Distribution

(%)(a) Marketing Services 85% 89% 86% 86% 84% Licensing, Fees and

User 15% 11% 14% 14% 16% Advertiser Metrics CNET Networks Top 100

US Advertisers' Renewal Rate (Q-to-Q) 96% 100% 97% 95% 97% CNET

Networks Top 100 US Advertisers' % of Network Revenue 53% 55% 55%

55% 56% Select Business Metrics Network Unique Users (mm) 116.8

116.1 110.1 115.1 105.9 Network Average Daily Page Views (mm) 98.7

103.6 99.4 97.7 94.7 Balance Sheet Highlights ($mm) Cash $ 74.2 $

55.9 $ 69.8 $ 42.2 $ 34.9 Marketable Debt Securities 62.1 54.1 38.3

32.1 42.3 Restricted Cash 2.2 2.2 4.6 19.8 19.8 ------- -------

------- ------- ------- Total Cash and Equivalents $138.5 $112.2

$112.7 $ 94.1 $ 97.0 Total Debt $141.7 $141.8 $141.3 $146.4 $146.5

Days Sales Outstanding (DSO) 70 71 66 67 72 (a) Due to the sale of

Computer Shopper magazine on February 2, 2006, CNET Networks no

longer reports publishing revenue. The company's international

publishing revenue is now distributed in the marketing services and

licensing, fee and user lines as described below: Marketing

Services -- sales of advertisements on our Internet network through

impression-based and activity-based advertising, and sales of

advertisements in our print publications. Licensing, Fees and User

-- licensing our product database, online content, subscriptions to

online services, subscription and newsstand sales of print

publications, and other paid services. Guidance to the Investment

Community $ in millions, except Q1-06 Q2-06 estimate FY 2006

estimate per share Actual Low - High Low - High

--------------------- ------- --------------- ----------------

Total Revenues $ 83.4 $88.5 - $ 92.0 $386.0 - $ 403.0 Operating

income before depreciation, amortization and stock compensation

expense $ 9.2 $14.0 - $ 18.0 $ 86.0 - $ 96.0 Depreciation expense

($4.7) ($5.5) ($23.0) Amortization expense ($2.7) ($2.6) ($10.5)

Stock compensation expense ($4.7) ($5.5)- ($5.0) ($24.0)- ($22.0)

Operating income ($3.0) $ 0.9 - $ 4.4 $ 30.5 - $ 38.5 Interest

income (expense), net $ 0.5 $ 0.3 $ 1.2 Other income (expense) $

1.0 ($0.2) $ 0.4 Discontinued operations $ 0.4 - $ 0.4 Tax benefit

(expense) ($0.0) ($0.7) ($2.3) GAAP EPS (including stock

compensation expense) ($0.01) $0.00 - $ 0.02 $ 0.18 - $ 0.23 Pro

forma EPS (excluding stock compensation expense) $ 0.02 $0.03 - $

0.06 $ 0.31 - $ 0.37 Operating Income Reconciliation (in thousands)

Three Months Ended March 31, ------------------- 2006 2005 --------

-------- Operating income (loss) $(3,001) $ 233 Stock compensation

expense 4,727 - Depreciation 4,731 3,915 Amortization of intangible

assets 2,721 2,091 -------- -------- Operating income before

depreciation, amortization and stock compensation expense $ 9,178 $

6,239 ======== ======== (a) Stock compensation expense is included

in the above expense categories: Cost of revenues $ 1,897 $ - Sales

and marketing 886 - General and administrative 1,944 - --------

-------- $ 4,727 $ - ======== ======== (a) On January 1, 2006, CNET

Networks adopted Statement of Financial Accounting Standards No.

123 (revised 2004), "Share-Based Payment" ("SFAS 123(R)"). CNET

Networks' financial statements as of and for the three months ended

March 31, 2006 reflect the impact of SFAS 123(R). Prior to adoption

of SFAS 123(R), CNET Networks accounted for stock compensation

under Accounting Principles Board Opinion No. 25, "Accounting for

Stock Issued to Employees" ("APB 25"). In accordance with APB 25,

CNET Networks accounted for stock-based awards using the intrinsic

value method. Since CNET Networks, adopted the modified prospective

transition method, results for prior period have not been restated

under the fair value method. Therefore, for periods prior to

January 1, 2006, no stock-based compensation expense had been

recognized in CNET Networks' statement of operations as the

exercise price of options granted equaled the estimated fair market

value of the underlying stock at date of grant. We believe that

"operating income before depreciation, amortization and stock

compensation expense" is useful to management and investors as a

supplement to our GAAP (accounting principles generally accepted in

the United States) financial measures for evaluating the ability of

the business to generate cash from operations. Depreciation and

amortization are non-cash items and include within them amounts

related to past transactions and expenditures that are not

necessarily reflective of the current cash or capital requirements

of the business. Stock compensation expense is a non-cash item that

does not reflect upon the ability of the business to generate cash

from operations. Management refers to "operating income before

depreciation, amortization and stock compensation expense" in

making operating decisions and for planning and compensation

purposes. A limitation associated with this measure is that it does

not reflect the costs of certain capitalized tangible and

intangible assets used in generating revenue. Management

compensates for these limitations by relying primarily on our GAAP

financial measures, such as capital expenditures, and using

"operating income before depreciation, amortization and stock

compensation expense" only on a supplemental basis. Although

depreciation and amortization are non-cash charges, the capitalized

assets being depreciated and amortized will often have to be

replaced in the future, and "operating income before depreciation

and amortization" does not reflect any cash requirements for such

replacements. This measure also does not take into account interest

expense, or the cash requirements necessary to service interest or

principal payments on our debt. Nor does the measure reflect

changes in, or cash requirements for, our working capital needs.

"Operating income before depreciation, amortization and stock

compensation expense" should be considered in addition to, and not

as a substitute for, other measures of financial performance

prepared in accordance with GAAP. Reconciliation of Net Gain (Loss)

from Unusual Items (in thousands, except share and per share data)

Three Months Ended March 31, --------------------------- 2006 2005

------------- ------------- Net income (loss) $ (1,102) $ 383

============= ============= Stock compensation expense (1) $ 4,727

$ - Gain on privately held investments (2) (882) (568) Discontinued

Operations (3) (422) (180) ------------- ------------- Effect on

earnings from unusual items 3,423 (748) ------------- -------------

Net income (loss) excluding unusual items $ 2,321 $ (365)

============= ============= Diluted net income (loss) per share

excluding unusual items $ 0.01 $ (0.00) ============= =============

Shares used in calculating diluted net income (loss) per share

155,980,475 151,392,920 ============= ============= (1) During the

three months ended March 31, 2006, the company recorded $4.7

million of stock compensation expense upon the adoption of SFAS

123(R). No amounts were recorded for stock compensation expense in

2005. (2) The company recognized $882,000 and $568,000 of gains on

sales of privately held investments during the three months ended

March 31, 2006 and 2005, respectively. (3) On February 2, 2006, the

company sold its Computer Shopper magazine business. The disposal

of the business qualified for discontinued operations accounting

under the provisions of SFAS 144. As such revenues and expenses of

this business in prior periods has been reclassified to conform to

discontinued operations presentation. The company recognized income

from discontinued operations of $422,000, which includes a $507,000

gain associated with the sale, and $180,000 in the three months

ended March 31, 2006 and 2005, respectively. The company believes

that this information is useful to investors because these items

are infrequent in nature and may affect the comparability of the

current quarter and full year results to other quarter and full

year results. Free Cash Flow Reconciliation (Unaudited) (in

thousands) Three Months Ended March 31, --------------------- 2006

2005 -------- -------- Cash flow from operating activities $28,250

$ 9,541 Capital expenditures (8,228) (5,164) -------- -------- Free

cash flow $20,022 $ 4,377 ======== ======== Free Cash Flow is

defined as net cash provided by operating activities less capital

expenditures. The company believes that free cash flow provides

useful information about the amount of cash generated by the

business after the purchase of property and equipment. A limitation

of free cash flow is that it does not represent the total increase

or decrease in the cash balance for the period. Free cash flow

should be considered in addition to, and not as a substitute for,

other measures of financial performance prepared in accordance with

US GAAP. *T

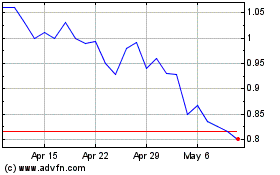

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

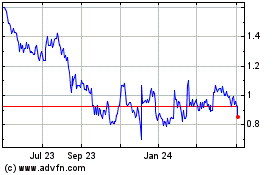

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024