MORNING UPDATE: Mankus-Lavelle Group Issues Alerts for AIG, SIMG, TSM, MNST, and CNET

April 26 2005 - 11:10AM

PR Newswire (US)

MORNING UPDATE: Mankus-Lavelle Group Issues Alerts for AIG, SIMG,

TSM, MNST, and CNET CHICAGO, April 26 /PRNewswire/ --

Mankus-Lavelle Group issues the following Morning Update at 8:30 AM

EDT with new PriceWatch Alerts for key stocks. Before the open...

PriceWatch Alerts for AIG, SIMG, TSM, MNST, and CNET, Market

Overview, Today's Economic Calendar, and the Quote Of The Day.

QUOTE OF THE DAY "The world has changed. It's not that the U.S. has

lost its lead. It's just that the people who are coming up from

behind are coming on real strong." -- Mathew Kazmierczak, director

of research, AeA. New PriceWatch Alerts for AIG, SIMG, TSM, MNST,

and CNET... PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS --

American International Group Inc. (NYSE:AIG) Last Price 51.76 - AUG

50.00 CALL OPTION@ $4.90 -> 6.7 % Return assigned* -- Silicon

Image Inc. (NASDAQ:SIMG) Last Price 9.50 - SEP 7.50 CALL OPTION@

$2.50 -> 7.1 % Return assigned* -- Taiwan Semiconductor

Manufacturing Co. (NYSE:TSM) Last Price 8.16 - OCT 7.50 CALL

OPTION@ $1.05 -> 5.5 % Return assigned* -- Monster Worldwide

Inc. (NASDAQ:MNST) Last Price 25.95 - JUN 25.00 CALL OPTION@ $2.25

-> 5.5 % Return assigned* -- CNET Networks, Inc. (NASDAQ:CNET)

Last Price 9.97 - JUN 10.00 CALL OPTION@ $0.65 -> 7.3 % Return

assigned* * To learn more about how to use these alerts and for our

FREE report, "The 18 Warning Signs That Tell You When To Dump A

Stock", go to: http://www.investorsobserver.com/mu18 (Note: You may

need to copy the link above into your browser then press the

[ENTER] key) ** For the FREE report, "Is Your Investment Portfolio

Disaster Proof? - Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEDP NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. NEWS LEADERS AND LAGGARDS So far today,

Diamond Offshore Drilling Inc., SAP AG, and International Business

Machines Corp. lead the list of companies with the most news

stories while Mittal Steel Co. and FTD Group Inc. are showing a

spike in news. Lockheed Martin Corp., Fording Canadian Coal Trust,

and T Rowe Price Group Inc. have the highest srtIndex scores to top

the list of companies with positive news while Bowater Inc. and

Martha Stewart Living Omnimedia Inc. lead the list of companies

with negative news reports. Schlumberger Ltd. has popped up with a

high positive news sraIndex score. For the FREE article titled,

"Earnings Season Decoded - An Essential 15 Point Checklist For

Finding Winning Stocks." go to:

http://www.wallstreetsecretsplus.com/go/freemu/ MARKET OVERVIEW

Trading overseas is looking extremely weak this morning, with only

two of the 15 markets that we follow in positive territory. The

cumulative average return on the group stands at a -0.311 percent.

Asia finished the trading day mixed, with the Nikkei shedding 0.34

percent while the Hang Seng closed with a 0.8-percent gain.

European stocks are lower today following disappointing earnings

reports from Infineon Technologies and ASM International. However,

strong results from British oil giant BP PLC is providing the U.K.

with some support. The June contract on sweet crude oil eased back

82 cents after four days of gains. As we so often see, round-number

levels often have great significance, and today's high for crude

was 56.00 exactly. But talk on the Street has it that gasoline

rather than crude, is now the vital fluid to watch. Be prepared for

the investing week ahead with Bernie Schaeffer's FREE Monday

Morning Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES Investors suffered an early shock Monday morning,

with the news that crude oil prices are steadily climbing closer to

US$60 amid "a possible squeeze on gasoline supplies this summer."

Having correctly predicted that oil would dip under US$50 per

barrel just a couple of weeks ago, Ian Cooper, investment editor at

Red Zone Profits, EVS, and Doji Master trading services is now

predicting that prices will top US$60 by early May, as demand stays

strong entering the summer driving season. Oil is a subject set to

dominate the financial headlines, with 18 of the industry's biggest

players set to release earnings in the next two weeks. Among them:

Exxon-Mobil and Conoco-Phillips on Wednesday. Exxon alone is

projected to post an impressive 54% growth in earnings-per-share.

Friday sees second biggest US oil producer Chevron-Texaco report

earnings, just one day after the earnings release of the company it

recently agreed to buy out, ninth-ranked Unocal. Since oil prices

heavily affect gasoline prices, the market sits at an important

juncture as the US gears up for the busy summer season. That,

coupled with fresh inflationary pressure, and constant speculation

about the end of the real estate boom has investors concerned.

Among the economic releases: Consumer spending and income data;

durable goods orders; home sales will all contribute to the

market's mood, with the highlight being Thursday when the Commerce

Department releases its initial figure on first quarter US GDP

growth. According to a MarketWatch poll, that figure could hit

3.6%, just a little slower than the 3.8% growth pace posted during

the fourth quarter -- not bad, considering the inflationary

pressures heating up, an inconsistent job market, ballooning oil

prices, and the upward march of interest rates. Read more analysis

from the 247Profits Group every trading day with the FREE

247Profits e-Dispatch, featuring insightful economic commentary,

profitable investment recommendations, and full access to a leading

team of financial experts. Register for free here:

http://www.247profits.com/enter.html TODAY'S ECONOMIC CALENDAR 7:45

A.M. April 23 ICSC Store Sales Index 8:55 A.M. April 23 Redbook

Retail Sales Index 10:00 A.M. March New Home Sales 10:00 A.M. April

Richmond Fed Mfg Index 10:00 A.M. April Conference Board Consumer

Confidence Index 5:00 P.M. April 23 ABC/Washington Post Consumer

Confidence Index The Mankus-Lavelle Group is an independent

brokerage branch of brokersXpress, LLC, a wholly owned subsidiary

of optionsXpress Holdings, Inc. The Mankus-Lavelle Group has some

of the most experienced, respected options professionals in the

industry. Both novice option investors and experienced traders are

attracted to MLG. Less experienced investors appreciate Mankus-

Lavelle Group's friendly expert guidance while more seasoned

investors value Mankus-Lavelle Group's highly trained staff of

option experts. To improve your understanding of options get a free

option kit at: http://www.mlgos.com/. If you are familiar with

stock investing but not sure what options can do for you, call

1-800-230-5570 for a FREE 3-point portfolio check up. Securities

offered through brokersXpress, LLC Member NASD/SPIC. Corporate

Office: 39 South LaSalle Street - Suite 220 - Chicago, Illinois

60603-1608 brokersXpress(SM) is the online broker-dealer for

independent reps and advisors. Powered by the award-winning

technology of optionsXpress(R), its parent company, brokersXpress

provides a leading-edge trading platform particularly powerful for

reps and advisors who employ option strategies. For more

information on how partnering with brokersXpress can empower your

business to new levels, contact us confidentially by e-mail at .

Member NASD/SPIC. CRD# 127081 This Morning Update was prepared with

data and information provided by: InvestorsObserver.com - Better

Strategies for Making Money -> For Investors With a Sense of

Humor. Only $1 for your first month plus seven free bonuses worth

over $420, see: http://www.investorsobserver.com/must Quote.com

QCharts - Real time quotes and streaming technical charts to keep

you up with the market. Analyze, predict, and stay ahead. for a

Free 30 day trial go to: http://www.investorsobserver.com/MUQuote2

247profits.com: You'll get exclusive financial commentary, access

to a global network of experts and undiscovered stock alerts.

Register NOW for the FREE 247profits e-Dispatch. Go to:

http://www.247profits.com/enter.html Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.investorsobserver.com/poweropt All stocks and options

shown are examples only. These are not recommendations to buy or

sell any security and they do not represent in any way a positive

or negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Michael at 800-230-5570 or

at http://www.cboe.com/Resources/Intro.asp. Privacy policy

available upon request. DATASOURCE: Mankus-Lavelle Group CONTACT:

Mike Lavelle of Mankus-Lavelle Group, +1-800-230-5570

Copyright

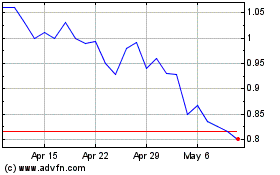

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

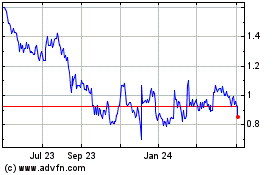

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024