FALSE000132673200013267322025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

FORM 8-K

___________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

___________________________________________________

XENCOR, INC.

(Exact name of registrant as specified in its charter)

___________________________________________________

| | | | | | | | |

Delaware | 001-36182 | 20-1622502 |

| | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | | | | | | |

465 North Halstead Street, Suite 200 Pasadena, California | | 91107 |

| | |

| (Address of principal executive offices) | | (Zip Code) |

(626) 305-5900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

___________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | XNCR | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On February 27, 2025, Xencor, Inc. announced its financial results for the fourth quarter and fiscal year ended December 31, 2024 in the press release furnished as Exhibit 99.1.

In accordance with General Instructions B.2 of Form 8-K, the information in “Item 2.02. Results of Operations and Financial Condition” of this Current Report on Form 8-K and in Exhibit 99.1 attached hereto is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 27, 2025 | XENCOR, INC. |

| | |

| | |

| By: | /s/ Celia Eckert |

| | Celia Eckert |

| | General Counsel & Corporate Secretary |

Exhibit 99.1

Xencor Reports Fourth Quarter and Full Year 2024 Financial Results

PASADENA, Calif.--(BUSINESS WIRE)--Feb. 27, 2025-- Xencor, Inc. (NASDAQ:XNCR), a clinical-stage biopharmaceutical company developing engineered antibodies for the treatment of cancer and autoimmune diseases, today reported financial results for the fourth quarter and full year ended December 31, 2024 and provided clinical updates and priorities for 2025.

“In 2024, we began rebalancing our pipeline to focus on XmAb® drug candidates that leverage our protein engineering strengths and reduce exposure to biological uncertainties—changes we believe increase our overall opportunities for clinical success. We are enthusiastic about ongoing advancement within our oncology portfolio of T-cell engager programs that are nearing important clinical inflection points. We have also introduced several candidates to be developed for patients with autoimmune disease, where there is a great need for new therapeutic agents beyond standard of care, and many of these programs will reach clinical milestones this year,” said Bassil Dahiyat, Ph.D., president and chief executive officer at Xencor.

“In the first half of 2025, we look forward to presenting initial first-in-human healthy volunteer data for XmAb942, our potentially best-in-class, high potency, anti-TL1A antibody with extended half-life, which we are developing for people living with inflammatory bowel disease. In the second half of the year, we plan to present data from our Phase 1 dose-escalation study of XmAb819, our bispecific T-cell engager targeting ENPP3 in ccRCC at a major medical meeting.”

Clinical Program Updates and 2025 Priorities

•XmAb942 (Xtend™ anti-TL1A), a potential best-in-class, high-potency, extended half-life antibody in development for patients with inflammatory bowel disease. In the fourth quarter of 2024, Xencor initiated dosing of healthy volunteers in the first-in-human study of XmAb942. In the first half of 2025, Xencor will present initial data from the single-ascending dose portion of the study. In the second half of 2025, Xencor will present data from the multiple-ascending dose portion of the study and plans to initiate a Phase 2 study in participants with ulcerative colitis.

•XmAb819 (ENPP3 x CD3), a first-in-class, tumor-targeted, T-cell engaging 2+1 bispecific antibody in development for patients with clear cell renal cell carcinoma (ccRCC). XmAb819 engages the immune system and activates T cells for highly potent and targeted lysis of tumor cells expressing ENPP3. Xencor is conducting a Phase 1 study to evaluate XmAb819 in patients with advanced ccRCC and plans to present initial data at a medical conference during the second half of 2025.

•XmAb541 (CLDN6 x CD3), a first-in-class, tumor-targeted, T-cell engaging 2+1 bispecific antibody in development for patients with advanced solid tumors expressing CLDN6. Like XmAb819, XmAb541 engages the immune system and activates T cells for highly potent and targeted lysis of tumor cells expressing CLDN6. The 2+1 multivalent format enables greater selectivity for targeting the tumor-associated antigen CLDN6 over similar Claudin family members, and new preclinical data demonstrating this selectivity were presented in January 2025. A Phase 1 dose-escalation study to evaluate XmAb541 in patients with ovarian cancer and other CLDN6-expressing tumor types is ongoing, with characterization of target dose levels anticipated to begin during 2025.

•XmAb808 (B7-H3 x CD28), a bispecific antibody to provide conditional co-stimulation of T cells when also bound to tumor cells. Dose escalation in an ongoing Phase 1 study combining XmAb808 with pembrolizumab resumed late in the fourth quarter of 2024, and enrollment in the final dose-escalation cohort is complete. To date a maximum tolerated dose has not been reached, and data from the study are expected to inform future development decisions for the program. Xencor does not plan to initiate expansion cohorts in combination with pembrolizumab. Potential combination with CD3 T-cell engaging bispecific antibodies is being evaluated.

•Vudalimab (PD-1 x CTLA-4), a bispecific antibody that targets two immune checkpoint receptors for selective activation of T cells. In the fourth quarter of 2024, we completed enrollment in two studies of vudalimab in patients with metastatic castration-resistant prostate cancer (mCRPC) and in Part 1 of a study in patients with locally advanced or metastatic non-small cell lung cancer. Xencor has paused further development of vudalimab and has prioritized resources to advance other pipeline programs. Safety data from the three studies of vudalimab remain consistent with prior data disclosures.

Upcoming Clinical Study Initiation Plans

•Plamotamab (CD20 x CD3), a clinical stage, B-cell depleting bispecific T-cell engager for development in rheumatoid arthritis (RA). Data demonstrating deep peripheral B-cell depletion observed in patients with lymphoma were presented at a medical meeting in December 2024. Xencor plans to evaluate plamotamab in RA, in which patients have progressed through prior standard-of-care treatment and initiate a Phase 1b/2a proof-of-concept study in the first half of 2025. The Phase 1b portion of the study will select a priming and step-up dose regimen based on the regimen established in oncology and will assess the initial safety, efficacy, and biomarkers of plamotamab in patients with RA. The selected dose regimen will then be evaluated in the randomized Phase 2a portion, with efficacy determined at week 12.

•XmAb657 (CD19 x CD3), a potent, extended half-life B-cell depleting bispecific T-cell engager for development in autoimmune disease. Xencor plans to initiate a first-in-human study in the second half of 2025.

•TL1A x IL23 Program: a bispecific antibody for dual targeting of important inflammatory pathways in autoimmune and inflammatory disease, while avoiding the complexities of dosing and formulary access for two separate TL1A and IL23 targeted drugs. Xencor anticipates selecting a lead candidate in 2025 and initiating first-in-human studies during 2026.

Recent Partnership Developments

•Amgen: Xaluritamig is a STEAP1 x CD3 XmAb 2+1 bispecific T-cell engager that our partner Amgen is advancing for the treatment of patients with prostate cancer. In the fourth quarter of 2024, Amgen initiated a Phase 3 study of xaluritamig in patients with mCRPC who have previously been treated with taxane-based chemotherapy. We earned $30 million in milestone revenue, which we received in 2025. Multiple Phase 1 or Phase 1b studies evaluating xaluritamig as a monotherapy or in combination are enrolling patients with earlier prostate cancer.

•Novartis: In the fourth quarter of 2024, Novartis initiated a Phase 2 study to evaluate an investigational antibody that incorporates an XmAb Fc domain, and Xencor earned $4 million in milestone revenue, which we received in 2025.

Financial Guidance: Based on current operating plans, Xencor expects to end 2025 with between $535 million and $585 million in cash, cash equivalents and marketable debt securities, and to have cash to fund research and development programs and operations into 2028.

Financial Results for the Fourth Quarter and Full Year Ended December 31, 2024

Cash, cash equivalents, and marketable debt securities totaled $706.7 million as of December 31, 2024 compared to $697.0 million as of December 31, 2023.

Total revenue for the fourth quarter ended December 31, 2024 was $52.8 million compared to $51.0 million for the same period in 2023. Revenue earned in the fourth quarter of 2024 was primarily the milestone revenue from Amgen and Novartis, as well as non-cash royalty revenue from Ultomiris and Monjuvi compared to the same period in 2023, which was primarily the research and milestone revenue from the two J&J collaboration agreements and non-cash royalty revenue from Ultomiris and Monjuvi. Revenue for the full year ended December 31, 2024 was $110.5 million compared to $174.6 million for the same period in 2023. Revenue in 2024 was primarily milestone revenue from Amgen and Novartis, licensing revenue, as well as non-cash royalty revenue from Ultomiris and Monjuvi compared to 2023, which was primarily milestone revenue from Alexion, Gilead, J&J, Omeros and Zenas and collaboration revenue from the second J&J collaboration.

Research and development (R&D) expenses for the fourth quarter ended December 31, 2024 were $51.1 million compared to $63.0 million for the same period in 2023. R&D expenses for the full year ended December 31, 2024 were $227.7 million compared to $253.6 million for the same period in 2023. Lower R&D expenses reflect decreased spending on the wind down costs of terminated programs, partially offset by increased spending on programs such as XmAb819, XmAb657 and XmAb942.

General and administrative (G&A) expenses for the fourth quarter ended December 31, 2024 were $14.9 million compared to $15.3 million for the same period in 2023. G&A expenses for the full year ended December 31, 2024 were $61.2 million compared to $53.4 million for the same period in 2023. Increased G&A spending reflects additional compensation costs on general and administrative staffing and spending on professional fees.

Other expense, net for the fourth quarter ended December 31, 2024 was $31.4 million compared to other income, net of $14.7 million for the same period in 2023. Other expense, net for the full year ended December 31, 2024 was $56.5 million compared to other income, net of $12.7 million in the same period in 2023.

Net loss attributable to Xencor for the fourth quarter ended December 31, 2024 was $45.6 million or $(0.62) on a fully diluted per share basis compared to net loss of $26.1 million or $(0.43) on a fully diluted per share basis, for the same period in 2023. For the full year ended December 31, 2024 net loss attributable to Xencor was $232.6 million or $(3.58) on a fully diluted per share basis compared to net loss of $133.1 million or $(2.20) on a fully diluted per share basis, for the same period in 2023.

Upcoming Investor Conferences

Company management will participate at multiple upcoming investor conferences:

•TD Cowen 45th Annual Health Care Conference

Date: Tuesday, March 4, 2025

Presentation Time: 11:10 a.m. ET / 8:10 a.m. PT

•Leerink Partners Global Healthcare Conference

Date: Tuesday, March 11, 2025

Presentation Time: 2:20 p.m. ET / 11:20 a.m. PT

Live webcasts of the presentations will be available under “Events & Presentations” in the Investors section of the Company’s website located at www.xencor.com. Replays of the events will be available on the Xencor website for at least 30 days following the presentations.

About Xencor

Xencor is a clinical-stage biopharmaceutical company developing engineered antibodies for the treatment of patients with cancer and autoimmune diseases. More than 20 candidates engineered with Xencor's XmAb® technology are in clinical development, and multiple XmAb medicines are marketed by partners. Xencor's XmAb engineering technology enables small changes to a protein’s structure that result in new mechanisms of therapeutic action. For more information, please visit www.xencor.com.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include statements that are not purely statements of historical fact, and can generally be identified by the use of words such as “potential,” “can,” “will,” “plan,” “may,” “could,” “would,” “expect,” “anticipate,” “seek,” “look forward,” “believe,” “committed,” “investigational,” and similar terms, or by express or implied discussions relating to Xencor’s business, including, but not limited to, statements regarding expectations and opportunities for clinical progress and success, expectations regarding advancement within Xencor’s portfolio, expectations regarding clinical milestones, planned receipt and presentations of clinical data, including the expected timing thereof, XmAb candidates and programs, planned and ongoing clinical trials, including the expected timing thereof, projected financial resources and financial guidance, including estimated cash, cash equivalents and marketable debt securities at year end and cash runway for research and development programs and operations, the quotations from Xencor's chief executive officer, and other statements that are not purely statements of historical fact. Such statements are made on the basis of the current beliefs, expectations, and assumptions of the management of Xencor and are subject to significant known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements and the timing of events to be materially different from those implied by such statements, and therefore these statements should not be read as guarantees of future performance or results. Such risks include, without limitation, the risks associated with the process of discovering, developing, manufacturing and commercializing drugs that are safe and effective for use as human therapeutics and other risks, including the ability of publicly disclosed preliminary clinical trial data to support continued clinical development and regulatory approval for specific treatments, in each case as described in Xencor's public securities filings. For a discussion of these and other factors, please refer to Xencor's annual report on Form 10-K for the year ended December 31, 2024 as well as Xencor's subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended to date. All forward-looking statements are qualified in their entirety by this cautionary statement and Xencor undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof, except as required by law.

| | | | | | | | | | | |

| Xencor, Inc. |

| Selected Consolidated Balance Sheet Data |

| (in thousands) |

| | | |

| December 31, | | December 31, |

| 2024 | | 2023 |

| | | |

| Cash, cash equivalents and marketable debt securities - current | $ | 449,846 | | | $ | 551,515 | |

| Other current assets | 127,755 | | | 84,088 | |

| Marketable debt securities - long term | 256,833 | | | 145,512 | |

| Other long-term assets | 117,511 | | | 184,020 | |

| Total assets | $ | 951,945 | | | $ | 965,135 | |

| | | |

| Total current liabilities | 87,432 | | | 73,915 | |

| Debt - long term | 115,159 | | | 161,772 | |

| Other long term liabilities | 75,328 | | | 67,361 | |

| Total liabilities | 277,919 | | | 303,048 | |

| Total stockholders' equity | 674,026 | | | 662,087 | |

| Total liabilities and stockholders’ equity | $ | 951,945 | | | $ | 965,135 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Xencor, Inc. |

| Consolidated Statements of Comprehensive Loss |

| (in thousands, except share and per share data) |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (Unaudited) | | | | |

| Revenue | $ | 52,794 | | | $ | 50,966 | | | $ | 110,493 | | | $ | 174,615 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Research and development | 51,056 | | | 63,046 | | | 227,686 | | | 253,598 | |

| General and administrative | 14,916 | | | 15,272 | | | 61,215 | | | 53,379 | |

| Total operating expenses | 65,972 | | | 78,318 | | | 288,901 | | | 306,977 | |

| Loss from operations | (13,178) | | | (27,352) | | | (178,408) | | | (132,362) | |

| | | | | | | |

| Other income (expense), net | (31,404) | | | 14,705 | | | (56,515) | | | 12,728 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss | (46,199) | | | (26,310) | | | (236,540) | | | (133,296) | |

| | | | | | | |

| Net loss attributable to non-controlling interest | (647) | | | (163) | | | (3,922) | | | (163) | |

| Net loss attributable to Xencor, Inc. | (45,552) | | | (26,147) | | | (232,618) | | | (133,133) | |

| | | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| Net unrealized (loss) gain on marketable debt securities available-for-sale | (2,464) | | | 1,999 | | | (1,954) | | | 8,243 | |

| Comprehensive loss attributable to Xencor, Inc. | $ | (48,016) | | | $ | (24,148) | | | $ | (234,572) | | | $ | (124,890) | |

| | | | | | | |

| Net loss per common share attributable to Xencor, Inc.: | | | | | | | |

| Basic and Diluted | $ | (0.62) | | | $ | (0.43) | | | $ | (3.58) | | | $ | (2.20) | |

| Weighted average common shares used to compute net loss per share attributable to Xencor, Inc. | | | | | | | |

| Basic and Diluted | 73,175,549 | | 60,847,854 | | 65,041,265 | | 60,503,283 |

Contacts

For Investors:

Charles Liles

cliles@xencor.com

(626) 737-8118

For Media:

Cassidy McClain

Inizio Evoke

cassidy.mcclain@inizioevoke.com

(619) 694-6291

v3.25.0.1

Cover

|

Feb. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2025

|

| Entity Registrant Name |

XENCOR, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36182

|

| Entity Tax Identification Number |

20-1622502

|

| Entity Address, Address Line One |

465 North Halstead Street, Suite 200

|

| Entity Address, City or Town |

Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91107

|

| City Area Code |

(626)

|

| Local Phone Number |

305-5900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

XNCR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001326732

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

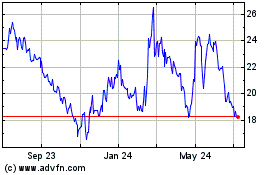

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Feb 2025 to Mar 2025

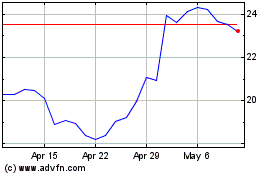

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Mar 2024 to Mar 2025