Xencor Announces Closing of Public Offering Including Full Exercise of Underwriters’ Option to Purchase Additional Shares

September 12 2024 - 4:01PM

Business Wire

Xencor, Inc. (“Xencor”) (Nasdaq: XNCR), a clinical-stage

biopharmaceutical company developing engineered antibodies for the

treatment of cancer and other serious diseases, today announced the

closing of its previously announced underwritten public offering of

8,093,712 shares of its common stock at a price to the public of

$18.00 per share, which includes the exercise in full by the

underwriters of their option to purchase up to 1,458,600 additional

shares of common stock, and pre-funded warrants to purchase up to

an aggregate of 3,088,888 shares of common stock at a price to the

public of $17.99 per pre-funded warrant. The pre-funded warrants

are immediately exercisable and have an exercise price of $0.01 per

share. The gross proceeds to Xencor from this offering were

approximately $201.3 million, before deducting underwriting

discounts and commissions and offering expenses.

Leerink Partners, Raymond James and RBC Capital Markets acted as

joint book-running managers for the offering. Wedbush PacGrow acted

as a co-manager for the offering.

Xencor currently intends to use the net proceeds from the

offering for general corporate purposes, which may include research

and development, capital expenditures, working capital and general

and administrative expenses.

The public offering was made pursuant to an automatic shelf

registration statement on Form S-3 (File No. 333-270030),

previously filed with the Securities and Exchange Commission (the

“SEC”) on February 27, 2023, and which automatically became

effective upon filing. The securities were offered only by means of

a prospectus and prospectus supplement that form a part of the

registration statement. A final prospectus supplement and the

accompanying prospectus relating to and describing the terms of the

offering have been filed with the SEC and are available on the

SEC’s website at www.sec.gov. Copies of the final prospectus

supplement and accompanying prospectus relating to the offering may

also be obtained by contacting Leerink Partners LLC, Attention:

Syndicate Department, 53 State Street, 40th Floor, Boston,

Massachusetts 02109, by telephone at (800) 808-7525, ext. 6105, or

by email at syndicate@leerink.com; from Raymond James &

Associates, Inc., Attention: Equity Syndicate, 880 Carillon

Parkway, St. Petersburg, Florida 33716, by telephone at (800)

248-8863, or by email at prospectus@raymondjames.com; or from RBC

Capital Markets, LLC, Attention: Equity Capital Markets, Brookfield

Place, 200 Vesey Street, 8th Floor, New York, New York 10281, by

telephone at (877) 822-4089 or by email at

equityprospectus@rbccm.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of,

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

About Xencor

Xencor is a clinical-stage biopharmaceutical company developing

engineered antibodies for the treatment of patients with cancer and

other serious diseases. More than 20 candidates engineered with

Xencor’s XmAb® technology are in clinical development, and three

XmAb medicines are marketed by partners. Xencor’s XmAb engineering

technology enables small changes to a proteins structure that

result in new mechanisms of therapeutic action.

Forward-Looking Statements

This press release contains forward-looking statements under the

safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995, including statements regarding Xencor’s

anticipated use of proceeds from the offering. Forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially and adversely and reported

results should not be considered as an indication of future

performance. These risks and uncertainties include, but are not

limited to: risks and uncertainties associated with market and

other conditions and the satisfaction of customary closing

conditions related to the proposed public offering and other risks

that are described in Xencor’s most recent periodic reports filed

with the SEC, including Xencor’s Annual Report on Form 10-K for the

year ended December 31, 2023, including the risk factors set forth

in those filings. These forward-looking statements speak only as of

the date hereof. Xencor disclaims any obligation to update these

forward-looking statements, except as required by applicable

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912235866/en/

Charles Liles cliles@xencor.com (626) 737-8118

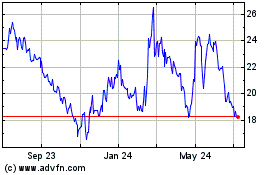

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

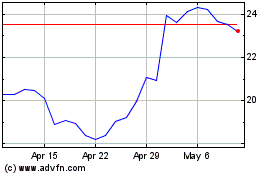

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Jan 2024 to Jan 2025