UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

AERIES TECHNOLOGY, INC.

(Name of Issuer)

Class A Ordinary Shares, $0.0001 par value

(Title of Class of Securities)

G0136H102

(CUSIP Number)

Bhisham

Khare

c/o Aeries Technology, Inc.

60 Paya Lebar Road, #08-13

Paya Lebar Square, Singapore

(919) 228-6404

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

April 5, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

|

* |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP NO. G0136H102

| 1 |

NAME OF REPORTING PERSON

Bhisham Khare |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

1,702,368(1) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

1,702,368(1) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,702,368 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.4% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

| 1 |

Includes

the right to acquire up to 1,702,368 Class A ordinary shares (the “Class A Ordinary Shares”) of Aeries Technology, Inc.

(the “Issuer”) pursuant to that certain Exchange Agreement (see Item 6), of which 851,184 Class A Ordinary Shares are

issuable pursuant to the exercise of exchange rights by the Aeries Employee Stock Option Trust (“ESOP Trust”), for which

the reporting person is a beneficiary, and assumes distribution of the underlying shares by the ESOP Trust to the reporting person

prior to an exchange for Class A Ordinary Shares. |

This Amendment No. 1 to Schedule 13D (this “Amendment

No. 1”), amends and supplements the Schedule 13D filed by the Reporting Person on March 28, 2024 (the “Schedule 13D”)

relating to the Class A ordinary shares (the “Class A Ordinary Shares”) of Aeries Technology, Inc. (the “Issuer”).

This Amendment No. 1 is being filed by Mr. Bhisham Khare (the “Reporting Person”).

The Items below amend and supplement the information disclosed under

the corresponding Items of the Schedule 13D as described below. Except as specifically provided herein, this Amendment No. 1 does not

modify any of the information previously reported in the Schedule 13D.

| Item 4. |

Purpose of Transaction |

Item 4 of the Schedule 13D is hereby amended and

supplemented by adding the following:

On April 5, 2024, a stockholder of the Issuer

exercised his exchange right and received 21,337,000 Class A Ordinary Shares. As a result, the Issuer’s number of outstanding Class

A Ordinary Shares increased to 36,956,004. Given the increase of the number of outstanding shares, the Reporting Person now beneficially

owns 4.4% of the Class A Ordinary Shares.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Schedule 13D is hereby amended and

restated in its entirety as follows:

(a) – (b)

Calculations of the percentage of shares of Class

A Ordinary Shares beneficially owned assumes that there were 36,956,004 Class A Ordinary Shares outstanding as of April 5, 2024, as reported

in the Issuer’s Current Report on Form 8-K filed on April 9, 2024. The aggregate number and percentage of the Class A Ordinary Shares

beneficially owned by the Reporting Person and the number of shares as to which there is sole power to vote or to direct the vote, shares

power to vote or to direct the vote, sole power to dispose or to direct the disposition, or shared power to dispose or to direct the disposition

are set forth on rows 7 through 11 and row 13 of, and the footnotes included on, the cover pages of this Schedule 13D, all of which are

incorporated herein by reference.

(c) Except as described in Item 6, during the

past 60 days, the Reporting Person has not effected any transactions with respect to the Class A Ordinary Shares.

(d) Not applicable.

(e) As of April 5, 2024, the Reporting Person is no longer deemed to

beneficially own more than five percent of the Issuer outstanding shares of Class A Ordinary Shares.

| Item 6. | Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer. |

Item 6 of the Schedule 13D is hereby amended and

restated in its entirety as follows:

Exchange Agreement

Concurrently with the closing of the Business

Combination Agreement, dated as of March 11, 2023, as amended, by and among the Issuer (f/k/a Worldwide Webb Acquisition Corp), WWAC Amalgamation

Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly owned subsidiary of WWAC, and Aark Singapore Pte. Ltd.,

a Singapore private company, Mr. Khare entered into an Exchange Agreement with the Issuer and Aeries (as amended, the “Exchange

Agreement”). Pursuant to the Exchange Agreement, subject to the satisfaction of the exercise conditions specified therein:

| ● | the Issuer has the right to acquire from Mr. Khare the Aeries

Shares held by the Reporting Person (the “Exchanged Shares”) in exchange for the delivery of the Stock Exchange Payment (as

defined below) or, at the election of the Issuer, the Cash Exchange Payment (as defined below). |

| ● | Mr. Khare has the right to exchange Exchanged Shares for the

delivery of the Stock Exchange Payment or, at the election of Mr. Khare, the Cash Exchange Payment. |

| ● | the Cash Exchange Payment may only be elected in the event approval

from the Reserve Bank of India (if such approval is required) is not obtained for a Stock Exchange Payment and provided the Issuer has

reasonable cash flow to be able to pay the Cash Exchange Payment and such Cash Exchange Payment would not be prohibited by any then outstanding

debt agreements or arrangements of the Issuer or any of its subsidiaries. |

| ● | “Stock Exchange Payment” means a number of Class

A Ordinary Shares equal to the product of the number of Exchanged Shares multiplied by the applicable Exchange Rate (as defined below). |

| ● | “Exchange Rate” means, at any time, the number of

Class A Ordinary Shares for which an Exchanged Share is entitled to be exchanged at such time. The Exchange Rate is 14.40, subject to

adjustment. |

| ● | “Cash Exchange Payment” means an amount of cash

equal to the number of Class A Ordinary Shares included in a Stock Exchange Payment multiplied by the volume-weighted average price of

the Class A Ordinary Shares for the five consecutive trading days immediately preceding the date that is two (2) business days after

the reporting person delivers notice of the exercise of the exchange right. |

On March 26, 2024, the Issuer determined that

the exercise conditions with respect to Mr. Khare had been satisfied. Mr. Khare holds 59,110 Aeries Shares and has the right under the

Exchange Agreement to exchange (x) prior to April 1, 2024, up to 20% of the Aeries Shares, and (y) from and after April 1, 2024, 100%

of the Aeries Shares.

An additional 851,184 Class A Ordinary Shares

are issuable pursuant to the exercise of exchange rights pursuant to the Exchange Agreement with respect to 59,110 Aeries Shares held

by the ESOP Trust, for which the reporting person is a beneficiary. This Amendment No. 1 assumes distribution of such Aeries Shares by

the ESOP Trust to the reporting person prior to an exchange for Class A Ordinary Shares.

The foregoing description of the Exchange Agreement

does not purport to be complete and is qualified in its entirety by reference to the Exchange Agreement which is filed as Exhibit 99.1

to the Schedule 13D and incorporated herein by reference.

Except as set forth herein, the Reporting Person

does not have any contracts, arrangements, understandings or relationships (legal or otherwise) with any person with respect to any securities

of the Issuer, including but not limited to any contracts, arrangements, understandings or relationships concerning the transfer or voting

of such securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of

profits or losses, or the giving or withholding of proxies.

SIGNATURE

After reasonable inquiry and to the best of his, her or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: April 9, 2024

|

By: |

/s/ Bhisham Khare |

|

| Name: |

Bhisham Khare |

|

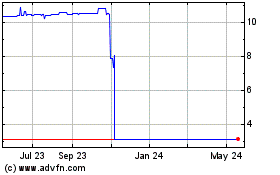

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Dec 2023 to Dec 2024