Virco Mfg. Corporation (NASDAQ: VIRC) reported financial results

for the third quarter ended October 31, 2023, as well as the

reinstatement of a quarterly dividend of $0.02 per share and a

$5,000,000 open market share repurchase program.

For the third quarter ended October 31, 2023, sales increased to

$84,252,000 compared to $77,395,000 in the same period of the prior

year. Gross margin improved to 45.4% from 39.8%. SG&A as a

percent of sales decreased slightly to 27.9% versus 28.4% in the

prior year. Operating Income grew 67.1%, to $14,706,000 versus

$8,800,000 in the same period last year. Interest expense was up

slightly to $765,000 from $567,000. Net income improved 29% to

$10,160,000 from $7,875,000.

For the nine months ended October 31, 2023, sales increased

17.8% to $226,516,000 from $192,276,000 in the same period of the

prior year. YTD Gross margin improved to 44.1% versus 37.6%.

SG&A as a percent of sales declined slightly to 28.8% versus

29.7% in the prior year, despite an increase in the proportion of

orders requiring full service. This improvement was due to

efficiencies of coordination between the Company’s domestic U.S.

factories and its logistics and field service teams. Operating

income for the first nine months more than doubled, from

$15,230,000 last year to $34,648,000 this year. Interest expense

was $2,560,000 or 1.1% of revenue versus $1,692,000 or 0.9% of

revenue in the same period of the prior year, reflecting higher

interest rates and slightly higher financing of inventories and

accounts receivable during the Company’s peak delivery season in

summer.

For the three and nine month periods ended October 31, 2023 the

effective tax rate increased materially due to the recording of a

valuation allowance needed for federal deferred tax assets and

certain state net operating loss carryforwards which commenced in

the fourth quarter of fiscal year ended January 31, 2022 and

continued through the period ended October 31, 2022. The increase

in the effective tax rates was primarily due to the reversal of the

valuation allowance at January 31, 2023.

Management’s preferred measure of business momentum: YTD

shipments + the unshipped backlog (“Shipments + Backlog”), stood at

$268,067,000 on October 31, 2023. This compares to $151,905,000 at

the low point of the pandemic on October 31, 2020. Since that low

point, Shipments + Backlog has grown 76% without additional

borrowing or capital infusion. Management attributes this strong

organically-funded growth to the intrinsic efficiencies of the

Company’s domestically-based, vertically-integrated business model,

as well as the resilience of the markets for public and private

school furniture.

Thanks to these strong results, Virco’s Board of Directors has

re-instated a quarterly dividend of $0.02 per share, payable to

shareholders of record as of December 22, 2023, payable January 10,

2024. In addition, the Board has authorized an open-market share

repurchase program of up to $5,000,000. In combination with share

price appreciation, these actions will re-establish the balanced

portfolio of shareholder returns that allows individual

shareholders to choose the return(s) that allows individual

shareholders to share in the benefits of current income plus

capital appreciation.

Support for in-person education is being reflected in robust

funding across many domains, including state and local funding for

public schools, federal support for particular earmarked activities

such as pre-K programs and expanded foodservice, as well as

continued growth in support for charter schools and

private/parochial schools. Support is also well distributed

geographically, with strong revenue growth in both California and

Florida.

Commenting on the Company’s strong results, Virco CEO and

Chairman Robert Virtue said: “I’m very happy that we are able

restore a dividend and launch an open-market share repurchase

program. This speaks to the strength of our recovery after the

pandemic and speaks as well to the renewed appreciation many people

have for in-person education. We take our role as a supplier of

welcoming and supportive educational environments very seriously.

To be able to share our success in this important work with our

loyal shareholders is very gratifying.”

Virco President Doug Virtue elaborated: “The fact that we’ve

been able to support a 76% expansion in business activity from the

depths of the pandemic, without the need for additional debt or

capital, is a direct reflection of the inherent efficiencies of our

domestically based business model, which includes a full suite of

services from project layout and design to final installation and

clean-up. The expansion of these services across our entire product

line has stabilized our revenue and allowed us to be true partners

with educators. It’s also led to a level of success that has

allowed us to reward our employees for their extraordinary

dedication.”

Contact:Virco Mfg. Corporation (310)

533-0474Robert A. Virtue, Chairman and Chief Executive OfficerDoug

Virtue, PresidentRobert Dose, Chief Financial Officer

Non-GAAP Financial Information

This press release includes a statement of shipments plus

unshipped backlog as of October 31, 2023 compared to the same date

in the prior fiscal years. Shipments represent the dollar amount of

net sales actually shipped during the period presented. Unshipped

backlog represents the dollar amount of net sales that we expect to

recognize in the future from sales orders that have been received

from customers in the ordinary course of business. The Company

considers shipments plus unshipped backlog a relevant and preferred

supplemental measure for production and delivery planning. However,

such measure has inherent limitations, is not required to be

uniformly applied or audited and other companies may use

methodologies to calculate similar measures that are not

comparable. Readers should be aware of these limitations and should

be cautious as to their use of such measure.

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

regarding: our future financial results and growth in our business;

business strategies; market demand and product development;

estimates of unshipped backlog; order rates and trends in

seasonality; product relevance; economic conditions and patterns;

the educational furniture industry generally, including the

domestic market for classroom furniture; cost control initiatives;

absorption rates; declaration of dividends in future periods; and

supply chain challenges. Forward-looking statements are based on

current expectations and beliefs about future events or

circumstances, and you should not place undue reliance on these

statements. Such statements involve known and unknown risks,

uncertainties, assumptions and other factors, many of which are out

of our control and difficult to forecast. These factors may cause

actual results to differ materially from those that are

anticipated. Such factors include, but are not limited to:

uncertainties surrounding the long-term effects of the COVID-19

pandemic; changes in general economic conditions including raw

material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2023, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates. There can be no assurance that the Company will

declare and pay dividends in future periods.

Repurchases of common stock under the share repurchase program

may be made at management’s discretion from time to time through

open market purchases, in privately negotiated transactions, or by

other means, including through the use of trading plans intended to

qualify under Rule 10b5-1 under the Securities Exchange Act of

1934, as amended, in accordance with applicable securities laws and

other restrictions. The timing and total amount of stock

repurchases will depend upon business, economic and market

conditions, corporate, legal and regulatory requirements,

prevailing stock prices, trading volume, and other considerations.

The repurchase program has no time limit and may be suspended for

periods or discontinued at any time. The Company expects to utilize

its existing cash and cash equivalents to fund repurchases under

the share repurchase program.

Financial Tables Follow

|

|

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Balance Sheets |

| |

| |

10/31/2023 |

|

1/31/2023 |

|

10/31/2022 |

|

|

(In thousands) |

| |

|

|

|

|

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash |

$ |

4,887 |

|

$ |

1,057 |

|

$ |

2,175 |

| Trade accounts receivables,

net |

|

33,029 |

|

|

18,435 |

|

|

28,028 |

| Other receivables |

|

27 |

|

|

68 |

|

|

102 |

| Income tax receivable |

|

— |

|

|

19 |

|

|

106 |

| Inventories |

|

58,931 |

|

|

67,406 |

|

|

57,465 |

| Prepaid expenses and other

current assets |

|

1,961 |

|

|

2,083 |

|

|

1,671 |

| Total current assets |

|

98,835 |

|

|

89,068 |

|

|

89,547 |

| Non-current assets |

|

|

|

|

|

| Property, plant and

equipment |

|

|

|

|

|

|

Land |

|

3,731 |

|

|

3,731 |

|

|

3,731 |

|

Land improvements |

|

694 |

|

|

686 |

|

|

686 |

|

Buildings and building improvements |

|

51,498 |

|

|

51,310 |

|

|

51,459 |

|

Machinery and equipment |

|

116,695 |

|

|

113,662 |

|

|

114,762 |

|

Leasehold improvements |

|

976 |

|

|

983 |

|

|

1,012 |

| Total property, plant and

equipment |

|

173,594 |

|

|

170,372 |

|

|

171,650 |

|

Less accumulated depreciation and amortization |

|

138,650 |

|

|

135,810 |

|

|

136,998 |

| Net property, plant and

equipment |

|

34,944 |

|

|

34,562 |

|

|

34,652 |

| Operating lease right-of-use

assets |

|

7,156 |

|

|

10,120 |

|

|

11,116 |

| Deferred tax assets, net |

|

7,031 |

|

|

7,800 |

|

|

160 |

| Other assets, net |

|

9,073 |

|

|

8,576 |

|

|

8,245 |

| Total assets |

$ |

157,039 |

|

$ |

150,126 |

|

$ |

143,720 |

| |

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Balance Sheets |

| |

| |

10/31/2023 |

|

1/31/2023 |

|

10/31/2022 |

| |

(In thousands, except share and par value

data) |

| |

|

|

|

|

|

| Liabilities |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

14,351 |

|

|

$ |

19,448 |

|

|

$ |

18,926 |

|

| Accrued compensation and

employee benefits |

|

11,102 |

|

|

|

9,554 |

|

|

|

9,084 |

|

| Income tax payable |

|

3,130 |

|

|

|

— |

|

|

|

— |

|

| Current portion of long-term

debt |

|

245 |

|

|

|

7,360 |

|

|

|

2,457 |

|

| Current portion operating

lease liability |

|

5,465 |

|

|

|

5,082 |

|

|

|

4,985 |

|

| Other accrued liabilities |

|

7,339 |

|

|

|

7,081 |

|

|

|

7,767 |

|

| Total current liabilities |

|

41,632 |

|

|

|

48,525 |

|

|

|

43,219 |

|

| Non-current liabilities |

|

|

|

|

|

| Accrued self-insurance

retention |

|

748 |

|

|

|

1,050 |

|

|

|

1,454 |

|

| Accrued pension expenses |

|

9,334 |

|

|

|

10,676 |

|

|

|

11,776 |

|

| Long-term debt, less current

portion |

|

7,946 |

|

|

|

14,384 |

|

|

|

14,444 |

|

| Operating lease liability,

less current portion |

|

2,933 |

|

|

|

6,796 |

|

|

|

8,028 |

|

| Other long-term

liabilities |

|

657 |

|

|

|

634 |

|

|

|

771 |

|

| Total non-current

liabilities |

|

21,618 |

|

|

|

33,540 |

|

|

|

36,473 |

|

| Commitments and contingencies

(Notes 6, 7 and 13) |

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

| Preferred stock: |

|

|

|

|

|

| Authorized 3,000,000 shares,

$0.01 par value; none issued or outstanding |

|

— |

|

|

|

— |

|

|

|

— |

|

| Common stock: |

|

|

|

|

|

| Authorized 25,000,000 shares,

$0.01 par value; issued and outstanding 16,347,314 shares at

10/31/2023 and 16,210,985 at 1/31/2023 and 10/31/2022 |

|

164 |

|

|

|

162 |

|

|

|

162 |

|

| Additional paid-in

capital |

|

121,201 |

|

|

|

120,890 |

|

|

|

120,787 |

|

| Accumulated deficit |

|

(26,379 |

) |

|

|

(50,631 |

) |

|

|

(54,707 |

) |

| Accumulated other

comprehensive loss |

|

(1,197 |

) |

|

|

(2,360 |

) |

|

|

(2,214 |

) |

| Total stockholders’

equity |

|

93,789 |

|

|

|

68,061 |

|

|

|

64,028 |

|

| Total liabilities and

stockholders’ equity |

$ |

157,039 |

|

|

$ |

150,126 |

|

|

$ |

143,720 |

|

| |

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Statements of Income |

| |

| |

Three months ended |

| |

10/31/2023 |

|

10/31/2022 |

| |

(In thousands, except per share data) |

|

|

|

|

|

|

|

|

| Net sales |

$ |

84,252 |

|

$ |

77,395 |

|

| Costs of goods sold |

|

46,041 |

|

|

46,618 |

|

| Gross profit |

|

38,211 |

|

|

30,777 |

|

| Selling, general and

administrative expenses |

|

23,505 |

|

|

21,977 |

|

| Operating income |

|

14,706 |

|

|

8,800 |

|

| Unrealized loss (gain) on

investment in trust account |

|

176 |

|

|

(220 |

) |

| Pension expense |

|

301 |

|

|

259 |

|

| Interest expense |

|

765 |

|

|

567 |

|

| Income before income

taxes |

|

13,464 |

|

|

8,194 |

|

| Income tax expense |

|

3,304 |

|

|

319 |

|

| Net income |

$ |

10,160 |

|

$ |

7,875 |

|

| |

|

|

|

| |

|

|

|

| Net income per common

share: |

|

|

|

| Basic |

$ |

0.62 |

|

$ |

0.49 |

|

| Diluted |

$ |

0.62 |

|

$ |

0.48 |

|

| Weighted average shares of

common stock outstanding: |

|

|

|

| Basic |

|

16,347 |

|

|

16,211 |

|

| Diluted |

|

16,428 |

|

|

16,249 |

|

| |

|

|

|

|

|

|

|

Virco Mfg. CorporationUnaudited Condensed

Consolidated Statements of Income |

| |

| |

Nine months ended |

| |

10/31/2023 |

|

10/31/2022 |

| |

(In thousands, except per share data) |

|

|

|

|

|

|

|

| Net sales |

$ |

226,516 |

|

$ |

192,276 |

| Costs of goods sold |

|

126,525 |

|

|

119,947 |

| Gross profit |

|

99,991 |

|

|

72,329 |

| Selling, general and

administrative expenses |

|

65,343 |

|

|

57,099 |

| Operating income |

|

34,648 |

|

|

15,230 |

| Unrealized (gain) loss on

investment in trust account |

|

(448 |

|

|

85 |

| Pension expense |

|

623 |

|

|

650 |

| Interest expense |

|

2,560 |

|

|

1,692 |

| Income before income

taxes |

|

31,913 |

|

|

12,803 |

| Income tax expense |

|

7,661 |

|

|

332 |

| Net income |

$ |

24,252 |

|

$ |

12,471 |

| |

|

|

|

| |

|

|

|

| Net income per common

share: |

|

|

|

| Basic |

$ |

1.49 |

|

$ |

0.77 |

| Diluted |

$ |

1.48 |

|

$ |

0.77 |

| Weighted average shares of

common stock outstanding: |

|

|

|

| Basic |

|

16,277 |

|

|

16,118 |

| Diluted |

|

16,334 |

|

|

16,136 |

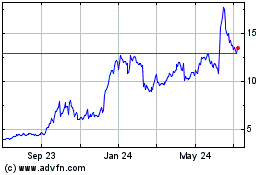

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

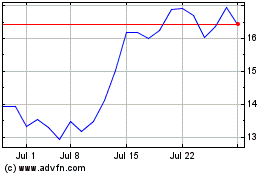

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Nov 2023 to Nov 2024