UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File

Number: 001-39938

Vinci Partners Investments Ltd.

(Exact name of registrant as specified in its

charter)

Av. Bartolomeu Mitre, 336

Leblon – Rio de Janeiro

Brazil 22431-002

+55 (21) 2159-6240

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Vinci Partners Investments Ltd. |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Sergio Passos Ribeiro |

| |

|

|

|

Name: |

Sergio Passos Ribeiro |

| |

|

|

|

Title: |

Chief Financial Officer |

Date: May 9, 2024

Exhibit 99.1

First Quarter 2024 Earnings Presentation May 09, 2024

Disclaimer This presentation contains forward - looking statements that can be identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others . By their nature, forward - looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside of our control . Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward - looking statements and there can be no assurance that such forward - looking statements will prove to be correct . Accordingly, you should not place undue reliance on forward - looking statements . The forward - looking statements included herein speak only as at the date of this presentation and we do not undertake any obligation to update these forward - looking statements . Past performance does not guarantee or predict future performance . Moreover, neither we nor our affiliates, officers, employees and agents undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward - looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation . Further information on these and other factors that could affect our financial results is included in filings we have made and will make with the U . S . Securities and Exchange Commission (the “SEC”) from time to time, including in the section titled “Risk Factors” in our latest fillings with the SEC . These documents are available on the SEC Filings section of the investor relations section of our website at : https : //ir . vincipartners . com/financials/sec - filings . We have prepared this presentation solely for informational purposes . The information in this presentation does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any of our securities or securities of our subsidiaries or affiliates, not should it or any part of it form the basis of, or be relied on, in connection with any contract to purchase or subscribe for any of our securities or securities of any of our subsidiaries or affiliates, nor shall it or any part of it form the basis of, or be relied on, in connection with any contract or commitment whatsoever . This presentation also includes certain non - GAAP financial information . We believe that such information is meaningful and useful in understanding the activities and business metrics of our operations . We also believe that these non - GAAP financial measures reflect an additional way of viewing aspects of our business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting our business . Further, investors regularly rely on non - GAAP financial measures to assess operating performance and such measures may highlight trends in our business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS . We also believe that certain non - GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in our industry, many of which present these measures when reporting their results . The non - GAAP financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements . The non - GAAP measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results . As other companies may determine or calculate this non - GAAP financial information differently, the usefulness of these measures for comparative purposes is limited . A reconciliation of such non - GAAP financial measures to the nearest GAAP measure is included in this presentation . 2

3 Presenters Alessandro Horta Chief Executive Officer Sergio Passos Chief Operating Officer & Chief Financial Officer Bruno Zaremba Private Equity Chairman & Head of Investor Relations

Opening Remarks

5 R$ 4.3 bn Capital Subscriptions 1Q’24 LTM 6 6 6 6 6 Vinci Partners First Quarter 2024 Highlights See notes and definitions at end of document Vinci Partners ended the first quarter with R$69 bn in AUM¹, a 11% growth year - over - year, led by R$4.3 billion in capital subscriptions over the last twelve months across Private Markets funds. Fee Related Earnings (FRE) totaled R$54 million in the quarter, or R$1.01 per share² , up 12% year - over - year on a per share basis . Vinci announced a quarterly distribution of US$0.17 per common share. US$ 0.17 Quarterly Dividend Vinci Partners announced in March the business combination with Compass, creating the gateway to alternative asset management in Latin America. Combined AUM³ of +US$50 bn and strong diversification effect through complementary products and solutions with broader geographic coverage and funding Transaction to expand Vinci’s geographic footprint into a true Pan - regional platform Enhance the distribution of Vinci’s products in Latin America through Compass’ unmatched platform Mindset and cultural alignment between partners and senior management catalyzing superior execution Immediately accretive to FRE/Share R$ 69 bn AUM 1Q’24 + 11 % YoY R$ 54 mm (R$1.01/share) FRE 1Q’24 + 12 % YoY

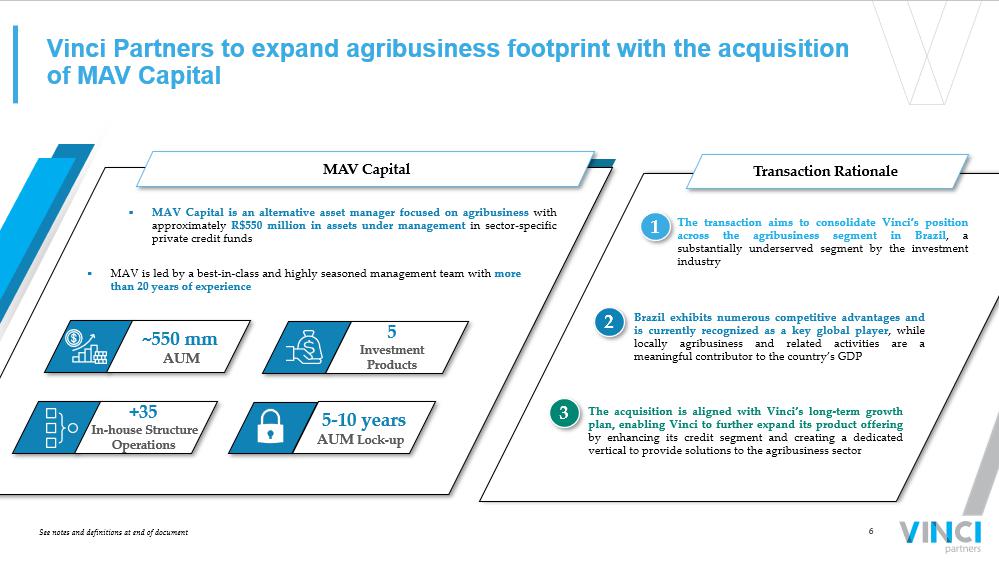

6 Vinci Partners to expand agribusiness footprint with the acquisition of MAV Capital See notes and definitions at end of document Vinci brand recognition MAV Capital Transaction Rationale ▪ MAV Capital is an alternative asset manager focused on agribusiness with approximately R $ 550 million in assets under management in sector - specific private credit funds ▪ MAV is led by a best - in - class and highly seasoned management team with more than 20 years of experience ▪ The transaction aims to consolidate Vinci’s position across the agribusiness segment in Brazil , a substantially underserved segment by the investment industry ▪ Brazil exhibits numerous competitive advantages and is currently recognized as a key global player , while locally agribusiness and related activities are a meaningful contributor to the country’s GDP ▪ The acquisition is aligned with Vinci’s long - term growth plan, enabling Vinci to further expand its product offering by enhancing its credit segment and creating a dedicated vertical to provide solutions to the agribusiness sector 1 2 3 +35 In - house Structure Operations 5 Investment Products ~550 mm AUM 5 - 10 years AUM Lock - up

7 2024 Unlocking Growth: We are focused on delivering growth through strategic partnerships and acquisitions 2021 2022 Acquisition of SPS Capital A new chapter in our product offering capabilities with the expansion into Opportunistic Capital Solutions, a sizable addressable market in Brazil. 2024 + US$ 37 bn AUM¹ 2023 + R$550 mm AUM + R$2 bn AUM Strategic Partnership with Ares Forming a strategic partnership to accelerate growth of Vinci’s platform in Latin America. + US$100 mm Investment Combination with Compass Consolidating Vinci’s position as the gateway to alternative investments in Latin America. A natural step to expand Vinci’s geographic footprint into a Pan - regional platform. 2024 - 2025 What will drive future growth? Vinci continues to explore inorganic growth opportunities, both in Brazil and in Latam , in order to complete its product offering and geographic positioning. Acquisition of MAV Capital The transaction reinforces Vinci's position across the Agribusiness sector, an underserved segment by the Investment Industry in Brazil. Vinci Partners’ IPO

Financial Highlights

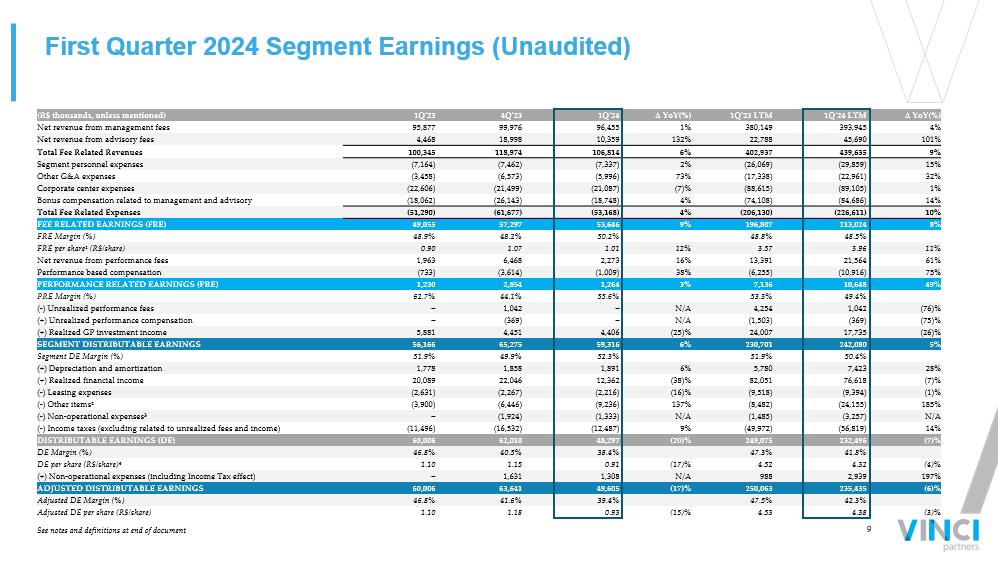

9 First Quarter 2024 Segment Earnings (Unaudited) See notes and definitions at end of document ∆ YoY(%) 1Q'24 LTM 1Q'23 LTM ∆ YoY(%) 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) 4% 393,945 380,149 1% 96,455 99,976 95,877 Net revenue from management fees 101% 45,690 22,788 132% 10,359 18,998 4,468 Net revenue from advisory fees 9% 439,635 402,937 6% 106,814 118,974 100,345 Total Fee Related Revenues 15% (29,859) (26,069) 2% (7,337) (7,462) (7,164) Segment personnel expenses 32% (22,961) (17,338) 73% (5,996) (6,573) (3,458) Other G&A expenses 1% (89,105) (88,615) (7)% (21,087) (21,499) (22,606) Corporate center expenses 14% (84,686) (74,108) 4% (18,748) (26,143) (18,062) Bonus compensation related to management and advisory 10% (226,611) (206,130) 4% (53,168) (61,677) (51,290) Total Fee Related Expenses 8% 213,024 196,807 9% 53,646 57,297 49,055 FEE RELATED EARNINGS (FRE) 48.5% 48.8% 50.2% 48.2% 48.9% FRE Margin (%) 11% 3.96 3.57 12% 1.01 1.07 0.90 FRE per share¹ (R$/share) 61% 21,564 13,391 16% 2,273 6,468 1,963 Net revenue from performance fees 75% (10,916) (6,255) 38% (1,009) (3,614) (733) Performance based compensation 49% 10,648 7,136 3% 1,264 2,854 1,230 PERFORMANCE RELATED EARNINGS (PRE) 49.4% 53.3% 55.6% 44.1% 62.7% PRE Margin (%) (76)% 1,042 4,254 N/A – 1,042 – ( - ) Unrealized performance fees (75)% (369) (1,503) N/A – (369) – (+) Unrealized performance compensation (26)% 17,735 24,007 (25)% 4,406 4,451 5,881 (+) Realized GP investment income 5% 242,080 230,701 6% 59,316 65,275 56,166 SEGMENT DISTRIBUTABLE EARNINGS 50.4% 51.9% 52.3% 49.9% 51.9% Segment DE Margin (%) 28% 7,423 5,780 6% 1,891 1,858 1,778 (+) Depreciation and amortization (7)% 76,618 82,051 (38)% 12,362 22,046 20,089 (+) Realized financial income (1)% (9,394) (9,518) (16)% (2,216) (2,267) (2,631) ( - ) Leasing expenses 185% (24,155) (8,482) 137% (9,236) (6,446) (3,900) ( - ) Other items² N/A (3,257) (1,485) N/A (1,333) (1,924) – ( - ) Non - operational expenses³ 14% (56,819) (49,972) 9% (12,487) (16,532) (11,496) ( - ) Income taxes (excluding related to unrealized fees and income) (7)% 232,496 249,075 (20)% 48,297 62,010 60,006 DISTRIBUTABLE EARNINGS (DE) 41.8% 47.3% 38.4% 40.5% 46.8% DE Margin (%) (4)% 4.32 4.52 (17)% 0.91 1.15 1.10 DE per share (R$/share)⁴ 197% 2,939 988 N/A 1,308 1,631 – (+) Non - operational expenses (including Income Tax effect) (6)% 235,435 250,063 (17)% 49,605 63,641 60,006 ADJUSTED DISTRIBUTABLE EARNINGS 42.3% 47.5% 39.4% 41.6% 46.8% Adjusted DE Margin (%) (3)% 4.38 4.53 (15)% 0.93 1.18 1.10 Adjusted DE per share (R$/share)

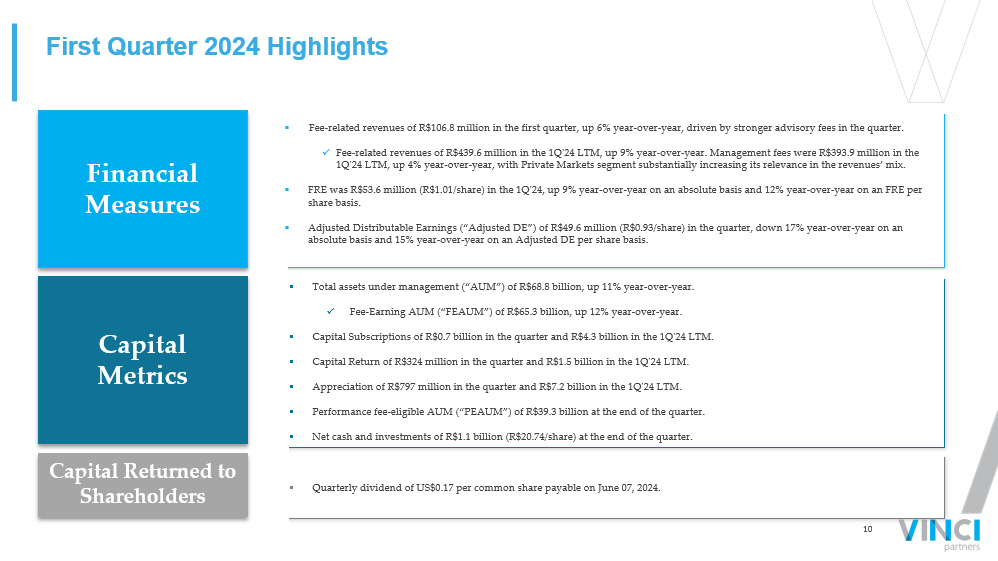

10 ▪ Fee - related revenues of R$1 06 .8 million in the first quarter, up 6 % year - over - year, driven by stronger advisory fees in the quarter. x Fee - related revenues of R$439.6 million in the 1Q'24 LTM, up 9% year - over - year. Management fees were R$393.9 million in the 1Q'24 LTM, up 4% year - over - year, with Private Markets segment substantially increasing its relevance in the revenues’ mix. ▪ FRE was R$ 53 . 6 million (R$1.01/share) in the 1 Q'24, up 9 % year - over - year on an absolute basis and 12% year - over - year on an FRE per share basis. ▪ Adjusted Distributable Earnings (“Adjusted DE”) of R$49.6 million (R$0.93/share) in the quarter, down 17% year - over - year on an absolute basis and 15% year - over - year on an Adjusted DE per share basis. ▪ Total assets under management (“AUM”) of R$68.8 billion, up 11 % year - over - year. x Fee - Earning AUM (“FEAUM”) of R$65.3 billion, up 12% year - over - year. ▪ Capital Subscriptions of R$0.7 billion in the quarter and R$4.3 billion in the 1Q'24 LTM . ▪ Capital Return of R$324 million in the quarter and R$1.5 billion in the 1Q'24 LTM . ▪ Appreciation of R$797 million in the quarter and R$7.2 billion in the 1Q'24 LTM . ▪ Performance fee - eligible AUM (“PEAUM”) of R$39.3 billion at the end of the quarter. ▪ Net cash and investments of R$1.1 billion (R$20.74/share) at the end of the quarter. First Quarter 2024 Highlights Financial Measures Capital Metrics Capital Returned to Shareholders ▪ Quarterly dividend of US$0.17 per common share payable on June 07, 2024.

11 25 30 26 26 7 10 58 65 1Q'23 1Q'24 Private Markets IP&S Public Equities 28 33 27 26 7 10 62 69 1Q'23 1Q'24 Private Markets IP&S Public Equities AUM 1Q’24 vs 1Q’23 ( R$bn ) Long - Term AUM¹ 1Q’24 vs 1Q’23 ( R$bn ) Fee - Earning AUM 1Q’24 vs 1Q’23 ( R$bn ) We continue to see AUM expansion across the platform, with highlight to long - term products ▪ Total assets under management (AUM) of R$69 billion, up 11% year - over - year, driven by a combination of R$4.3 billion of new capi tal subscriptions in Private Markets funds and AUM appreciation across Public Equities and IP&S funds. This growth was partially offset by outflows from our IP&S segment, comin g m ostly from open - ended products in the Pension Plan strategy. ▪ Total Fee - Earning AUM (FEAUM) of R$65.3 billion, up 12% year - over - year. ▪ Total Long - Term AUM of R$37.9 billion in the 1Q’24, up 21% year - over - year. Long - term AUM currently represents 55% of Vinci’s tot al AUM and has been growing at a faster pace, driven by fundraisings across private market funds that carry longer lockups. + 11% + 12% + 21% See notes and definitions at end of document 22 25 3 4 7 9 31 38 1Q'23 1Q'24 5-10 Years 10+ Years Perpetual or quasi-perpetual

12 57% 18% 15% 9% 48% 38% 14% AUM 1Q’24 Our AUM base favors alpha - driven strategies, while our revenue profile is management fee - centric Our platform is highly diversified across different strategies and clients 57 % of net revenues come from private market strategies ² 55 % of AUM is in long term products¹ AUM diversified across five different distribution channels AUM 1Q’24 Net Revenues 1Q'24 LTM See notes and definitions at end of document 4 5 6 7 38% 21% 20% 11% 10% Local Institutional³ HNWI Institutional Offshore Allocators & Distributors Public market vehicles

13 84% 7% 9% Private Equity Infrastructure Vinci SPS Vinci holds a strong long - term upside from realization of performance fees in private market funds Gross Accrued Performance Fees – Private Market Funds ▪ Accrued performance fees receivable of R$294.4 million in the 1Q’24, up 6% quarter - over - quarter. ▪ The VCP strategy¹ in Private Equity accounted for R$240.8 million in accrued performance fees, or 82% of total accrued perfor man ce fees. ▪ Vinci Partners had, as of 1Q’24, R$7 billion in performance eligible AUM coming from Private Markets’ funds still within inve stm ent period. ▪ Accrued performance fees coming from the Infrastructure strategy are the only fees booked as unrealized in the company's bala nce sheet as of the first quarter of 2024, following IFRS 15 rules. The outstanding accrued performance fees balance reflects the funds' most recent mark and are not booked in the company's bal anc e sheet yet. R$294 mm Accrued Performance Fees (R$ mm) Accrued Performance Fees by Strategy (%) Vinci Partners recognizes the performance revenue according to IFRS 15 . Unrealized performance fees are recognized only when is highly probable that the revenue will not be reversed in the Income Statement . The fund FIP Infra Transmissão in Infrastructure had R $ 14 . 4 million as of the end of the first quarter of 2024 booked as unrealized performance fees in the company ´ s balance sheet . Accrued performance fees shown for Private Equity funds of R $ 245 . 7 million and for the Infrastructure fund VIAS, of R $ 6 . 6 million, as of the end of the first quarter of 2024 have not been booked as unrealized performance fees in the company ´ s balance sheet . See notes and definitions at end of document

14 Our GP Commitments are a long - term strong value creator ▪ As of 1Q’24, Vinci Partners had R$1.1 billion in capital commitments signed to proprietary funds mostly across Private Equity , I nfrastructure, Credit and Real Estate. ▪ Realized investment gains are recognized quarterly as GP Investment Income in our Segment Earnings and we believe will be a r ele vant contributor to our Distributable Earnings as the funds enter their divestment periods. ▪ Vinci Partners had R$4.4 million in Realized GP Investment Income in the quarter, or R$0.08 per share, coming from dividend d ist ributions across our GP Commitments in REITs. Fair Value of Investment (R$ mm) GP Commitments Overview See notes and definitions at end of document Per share R$9.30 R$7.94 Total Capital Committed R$1.1 billion Total Capital Called R$495 million Accum. Capital Returned R$81 million ~R$12 million, or R$0.23 per share, after - tax Distributable Earnings Impact if Realized at Fair Value. Fair Value of Investments R$495 million Principal and Capital Gain

15 Fee Related Revenues Management fees remain the main contributor to revenues, accounting for 85% of total revenues over the 1Q'24 LTM. ▪ Fee related revenues totaled R$440 million in the 1Q'24 LTM, up 9% when compared to the 1Q'23 LTM, driven by strong fundraisi ng across Private Markets' products and a higher level of advisory fees. ▪ Management fees for the quarter remained flat on a year - over - year basis. Although Private Markets revenues continue to grow and push FRE for the platform, IP&S have suffered headwinds caused by tougher macro conditions. ▪ Advisory fees accounted for R$10 million in the quarter. Over the past twelve months, advisory fees totaled R$46 million, up 101 % year - over - year, driven by a pickup in deal activity. Fee Related Revenues 1Q’24 vs. 1Q’23 ( R$mm ) Fee Related Revenues 1Q'24 LTM vs. 1Q'23 LTM (R$mm) + 9% + 6% 380 394 23 46 403 440 1Q'23 LTM 1Q'24 LTM Management fees Advisory fees 96 96 4 10 100 107 1Q'23 1Q'24 Management fees Advisory fees

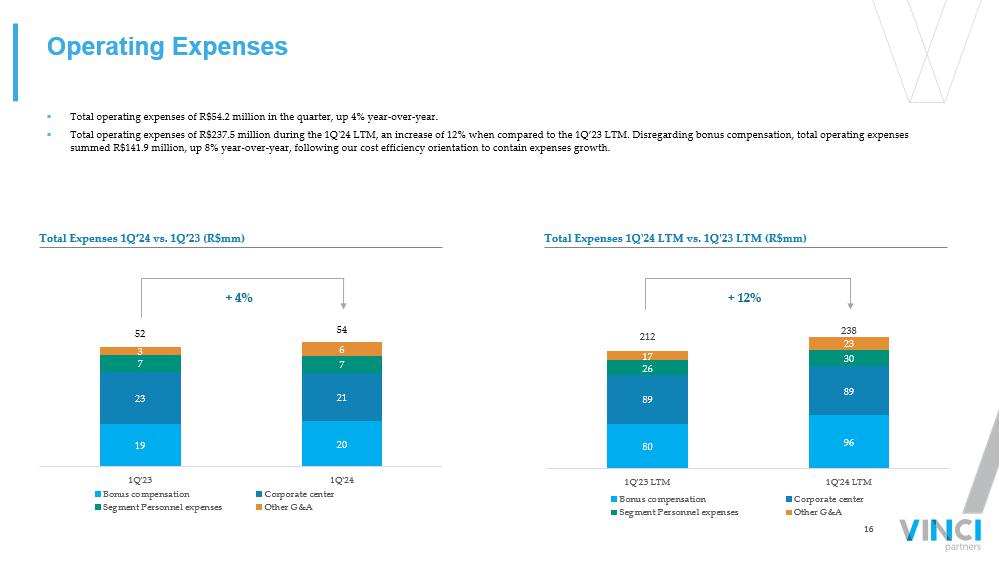

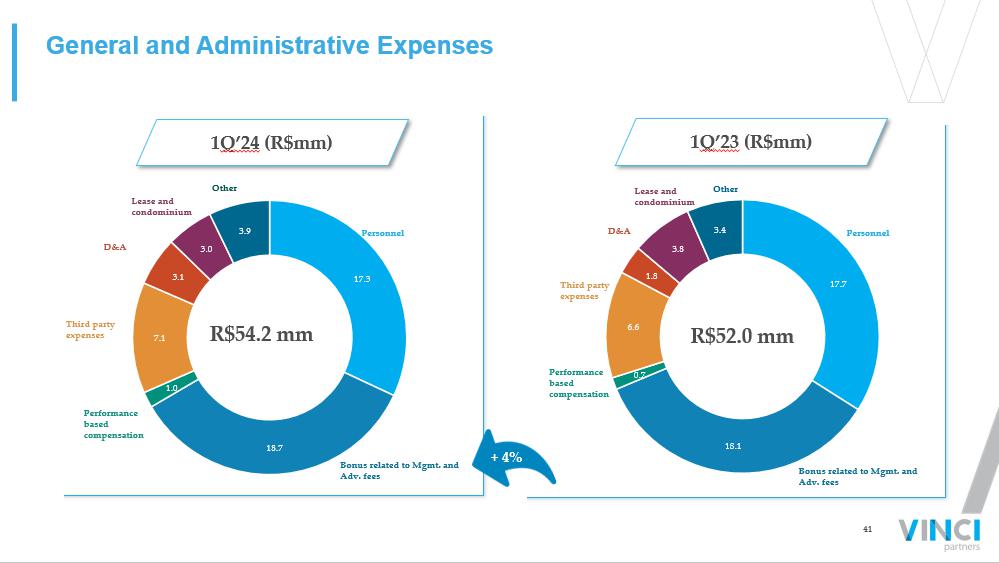

16 Operating Expenses ▪ Total operating expenses of R$54.2 million in the quarter, up 4% year - over - year. ▪ Total operating expenses of R$237.5 million during the 1Q'24 LTM, an increase of 12% when compared to the 1Q’23 LTM. Disregar din g bonus compensation, total operating expenses summed R$141.9 million, up 8% year - over - year, following our cost efficiency orientation to contain expenses growth. Total Expenses 1Q'24 LTM vs. 1Q'23 LTM ( R$mm ) + 12% + 4% Total Expenses 1Q’24 vs. 1Q’23 ( R$mm ) 80 96 89 89 26 30 17 23 212 238 1Q'23 LTM 1Q'24 LTM Bonus compensation Corporate center Segment Personnel expenses Other G&A 19 20 23 21 7 7 3 6 52 54 1Q'23 1Q'24 Bonus compensation Corporate center Segment Personnel expenses Other G&A

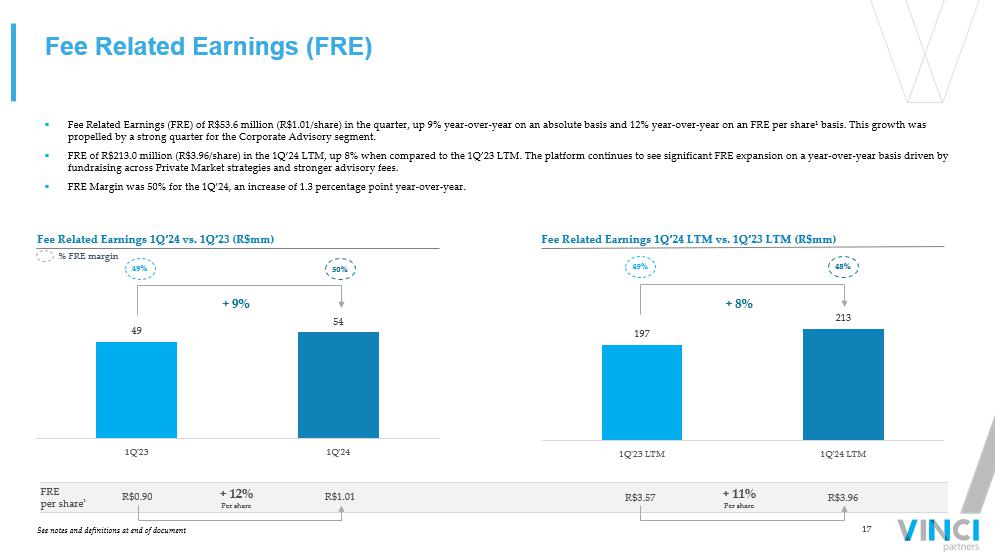

17 Fee Related Earnings (FRE) ▪ Fee Related Earnings (FRE) of R$53.6 million (R$1.01/share) in the quarter, up 9% year - over - year on an absolute basis and 12% ye ar - over - year on an FRE per share¹ basis. This growth was propelled by a strong quarter for the Corporate Advisory segment. ▪ FRE of R$213.0 million (R$3.96/share) in the 1Q’24 LTM, up 8% when compared to the 1Q’23 LTM. The platform continues to see s ign ificant FRE expansion on a year - over - year basis driven by fundraising across Private Market strategies and stronger advisory fees. ▪ FRE Margin was 50% for the 1Q’24, an increase of 1.3 percentage point year - over - year. See notes and definitions at end of document FRE per share ¹ R$1.01 R$0.90 R$3.96 R$3.57 48 % 49% Fee Related Earnings 1Q’24 vs. 1Q’23 ( R$mm ) Fee Related Earnings 1Q’24 LTM vs. 1Q’23 LTM ( R $mm) % FRE margin + 9% 50% 49% + 12% Per share + 11% Per share 49 54 1Q'23 1Q'24 197 213 1Q'23 LTM 1Q'24 LTM + 8%

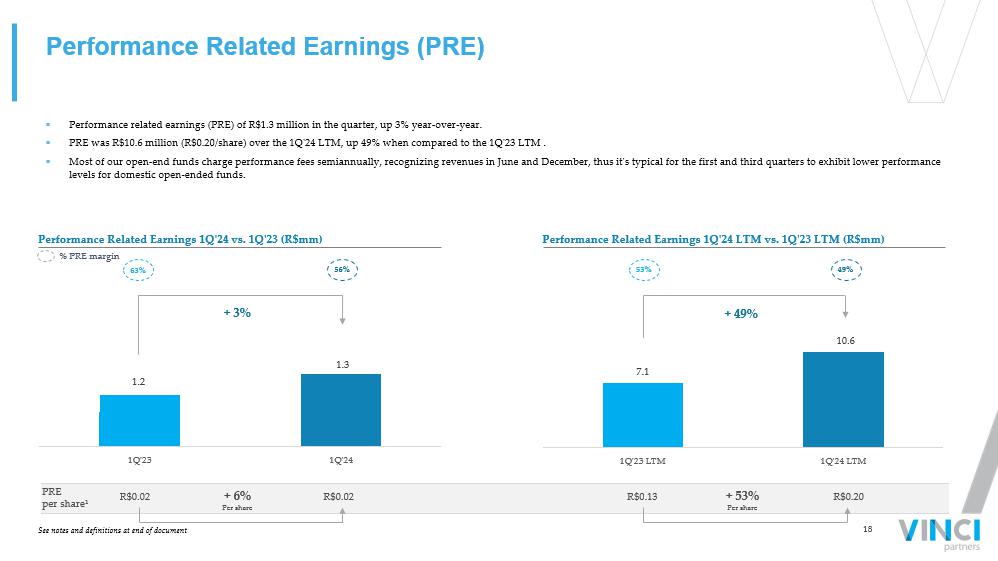

18 Performance Related Earnings (PRE) ▪ Performance related earnings (PRE) of R$1.3 million in the quarter, up 3% year - over - year. ▪ PRE was R$10.6 million (R$0.20/share) over the 1Q'24 LTM, up 49% when compared to the 1Q'23 LTM . ▪ Most of our open - end funds charge performance fees semiannually, recognizing revenues in June and December, thus it's typical fo r the first and third quarters to exhibit lower performance levels for domestic open - ended funds. Performance Related Earnings 1Q'24 vs. 1Q'23 ( R$mm ) Performance Related Earnings 1Q'24 LTM vs. 1Q'23 LTM ( R$mm ) % PRE margin 49% 53% R$0.02 R$0.02 R$0.13 R$0.20 See notes and definitions at end of document 56% 63% + 6% Per share + 53% Per share PRE per share¹ + 3% + 49% 1 .2 1.3 1Q'23 1Q'24 7.1 10.6 1Q'23 LTM 1Q'24 LTM

19 Realized GP Investment and Financial income ▪ Realized GP Investment¹ and Financial income² of R$16.8 million in the 1Q'24, a 35% decrease compared to the previous year. T he global macroeconomic uncertainty adversely affected local markets during the quarter, consequently impacting the portfolio of liquid funds. ▪ Realized GP Investment¹ income of R$4.4 million in the quarter, stemming from dividend distributions of the company’s proprie tar y stake in listed REITs. ▪ Realized GP Investment¹ and Financial income² accounted for R$94.4 million over the 1Q'24 LTM, down 11% when compared to the 1Q' 23 LTM. See notes and definitions at end of document Realized GP Investment¹ and Financial income² 1Q'24 vs. 1Q'23 ( R$mm ) (11)% Realized GP Investment¹ and Financial income² 1Q'24 LTM vs. 1Q'23 LTM ( R$mm ) (35)% 20 12 6 4 26 17 1Q'23 1Q'24 Realized Financial Income Realized GP Investment Income 82 77 24 18 106 94 1Q'23 LTM 1Q'24 LTM Realized Financial Income Realized GP Investment Income

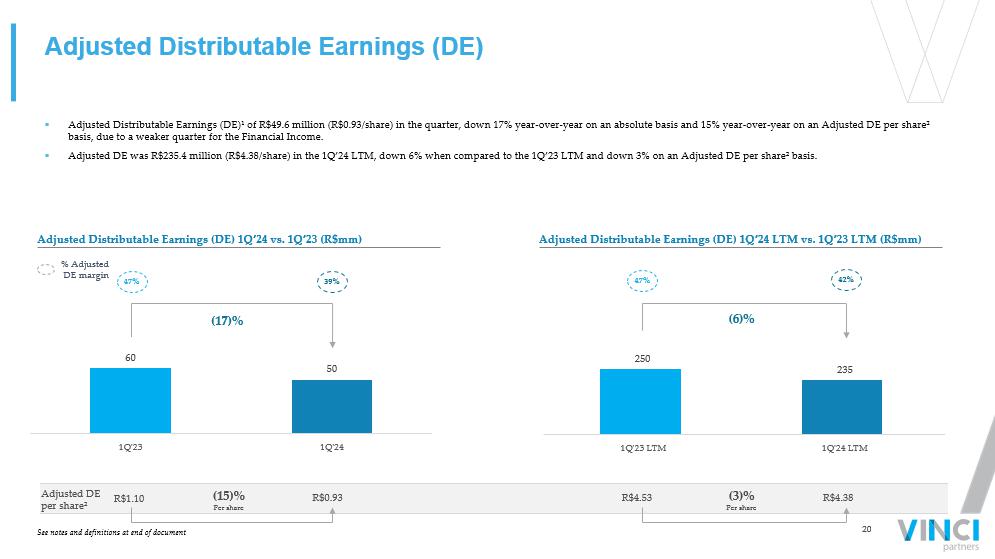

20 Adjusted Distributable Earnings (DE) ▪ Adjusted Distributable Earnings (DE)¹ of R$49.6 million (R$0.93/share) in the quarter, down 17% year - over - year on an absolute ba sis and 15% year - over - year on an Adjusted DE per share² basis, due to a weaker quarter for the Financial Income. ▪ Adjusted DE was R$235.4 million (R$4.38/share) in the 1Q’24 LTM, down 6% when compared to the 1Q’23 LTM and down 3% on an Adj ust ed DE per share² basis. Adjusted Distributable Earnings (DE) 1Q’24 vs. 1Q’23 ( R$mm ) Adjusted Distributable Earnings (DE) 1Q’24 LTM vs. 1Q’23 LTM ( R$mm ) (17)% % Adjusted DE margin R$1.10 R$0.93 (6)% 42 % 47% R$4.53 R$4.38 See notes and definitions at end of document 39% 47% (15)% Per share (3)% Per share Adjusted DE per share² 60 50 1Q'23 1Q'24 250 235 1Q'23 LTM 1Q'24 LTM

21 1Q'24 4Q'23 Share Repurchase Activity (in R$ million, unless mentioned) 533,981 93,249 Total Shares Repurchased (number of shares) 28.0 5.0 Total Capital Used for Share Repurchases 32.0 0.0 Remaining Share Repurchase Plan Authorization 10.6 10.5 Average Price Paid Per Share (US$) 1Q'24 4Q'23 (in R$ millions, unless mentioned) 532.0 660.3 Cash and cash equivalents¹ 1,134.8 1,175.5 Net Investments 639.8 748.5 Liquid funds² 495.0 427.0 GP Fund Investments³ (562.5) (552.7) Debt obligations 4 1,104.4 1,283.1 Net Cash and Investments 20.74 23.86 Net Cash and Net Investments per share⁵ (R$/share) Balance Sheet Highlights ▪ As of March 28, 2024, Vinci Partners had R$1.1 billion (R$20.74/share) in total net cash and investments, that comprise cash, ca sh equivalents and investments (liquid funds and GP fund investments at fair value) net of debt obligations. ▪ The fourth buyback program was approved in February, limited to R$60 million. Vinci Partners repurchased 533,981 shares in th e q uarter with an average share price of US$10.6. See notes and definitions at end of document 23.86 20.74 4Q'23 1Q'24 Net Cash and Investments per share (R$/share)

Segment Highlights

23 61% 14% 15% 9% R$224 mm 62% 14% 15% 8% Private Markets IP&S Public Equities Corporate Advisory Financials by segment ▪ Fee Related Earnings (FRE), disregarding Vinci Retirement Services segment, were R$224.0 million in the 1Q'24 LTM, with 61% o f F RE coming from Private Markets, followed by Public Equities with 15%, IP&S accounting for 14% and Corporate Advisory for 9%. ▪ Segment Distributable Earnings, disregarding Vinci Retirement Services segment, were R$253.1 million in the 1Q’24 LTM, with 6 2% coming from Private Markets’ strategies, followed by Public Equities accounting for 16%, IP&S for 13% and Corporate Advisory for 8%. R$253 mm Fee Related Earnings (FRE) 1Q'24 LTM by Segment Segment Distributable Earnings 1Q'24 LTM by Segment

24 Private Markets R$33 bn AUM ▪ Fee related earnings (FRE) of R$35.0 million in the quarter, up 9% year - over - year. This growth was driven by the strong fundrais ing in 2023 across Private Equity, Infrastructure and Real Estate. ▪ FRE was R$137.1 million in the 1Q'24 LTM, a 18% increase comparing to the 1Q’23 LTM. FRE Margin has been positively impacted by the fundraising environment, demonstrating a consistent increase over the quarters. ▪ Segment Distributable Earnings of R$39.0 million in the quarter, up 4% year - over - year. Segment DE was R$158.2 million in the 1Q' 24 LTM, an increase of 9% comparing to the 1Q’23 LTM. ▪ Total AUM of R$33.0 billion in the quarter, a 17% year - over - year increase propelled by robust fundraising across VCP IV, in Priv ate Equity, VICC, in Infrastructure and VISC, in Real Estate. ∆ YoY (%) 1Q'24 LTM 1Q'23 LTM ∆ YoY (%) 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) 17% 255,046 218,734 7% 62,519 66,363 58,432 Net revenue from management fees (4)% 2,751 2,865 102% 554 1,648 275 Net revenue from advisory fees 16% 257,798 221,598 7% 63,073 68,011 58,706 Total Fee Related Revenues 17% (14,727) (12,630) 6% (3,707) (3,616) (3,509) Segment personnel expenses 23% (10,609) (8,592) 99% (2,856) (2,378) (1,438) Other G&A expenses 14% (54,511) (47,922) (1)% (12,937) (13,502) (13,018) Corporate center expenses 14% (40,867) (35,955) (1)% (8,978) (12,963) (9,111) Bonus compensation related to management and advisory 15% (120,714) (105,100) 5% (28,478) (32,459) (27,076) Total Fee Related Expenses 18% 137,084 116,499 9% 34,595 35,552 31,630 FEE RELATED EARNINGS (FRE) 53.2% 52.6% 54.8% 52.3% 53.9% FRE Margin (%) 76% 4,983 2,826 8% 8 1,983 7 Net revenue from performance fees (15)% 6,024 7,080 8% 8 3,025 7 Realized performance fees (76)% (1,042) (4,254) N/A – (1,042) – Unrealized performance fees 97% (2,297) (1,165) 34% (3) (970) (3) Performance based compensation 62% 2,686 1,661 (7)% 4 1,014 5 PERFORMANCE RELATED EARNINGS (PRE) 53.9% 58.8% 55.8% 51.1% 64.6% PRE Margin (%) (76)% 1,042 4,254 N/A – 1,042 – ( - ) Unrealized performance fees (75)% (369) (1,503) N/A – (369) – (+) Unrealized performance compensation (26)% 17,735 24,007 (25)% 4,406 4,451 5,881 (+) Realized GP investment income 9% 158,178 144,918 4% 39,005 41,689 37,516 SEGMENT DISTRIBUTABLE EARNINGS 56.2% 57.4% 57.8% 55.2% 58.1% Segment DE Margin (%) 17% 33,018 28,198 17% 33,018 32,956 28,198 ASSETS UNDER MANAGEMENT (AUM R$millions) 20% 29,763 24,825 20% 29,763 29,706 24,825 FEE EARNING ASSETS UNDER MANAGEMENT (FEAUM R$millions) 0.88% 0.88% 0.80% 0.89% 0.87% AVERAGE MANAGEMENT FEE RATE (%) Private Equity 44% Real Estate 21% Credit 17% Infrastructure 12% Vinci SPS 6% Private Markets' AUM

25 See notes and definitions at end of document Separate Mandates 73% Pension Plans 11% International 6% Commingled Funds 11% IP&S' AUM ∆ YoY (%) 1Q'24 LTM PF¹ 1Q'23 LTM PF¹ ∆ YoY (%) 1Q'24 4Q'23 PF¹ 1Q'23 PF¹ (R$ thousands, unless mentioned) (18)% 80,451 98,635 (13)% 19,814 19,349 22,817 Net revenue from management fees 14% 32 28 13% 8 8 7 Net revenue from advisory fees (18)% 80,483 98,664 (13)% 19,822 19,357 22,825 Total Fee Related Revenues 10% (7,244) (6,614) (11)% (1,627) (1,801) (1,832) Segment personnel expenses 1% (4,972) (4,916) (22)% (1,008) (1,816) (1,292) Other G&A expenses (21)% (17,241) (21,951) (19)% (4,100) (3,937) (5,084) Corporate center expenses (20)% (17,371) (21,774) (25)% (3,952) (4,011) (5,255) Bonus compensation related to management and advisory (15)% (46,826) (55,253) (21)% (10,687) (11,564) (13,462) Total Fee Related Expenses (22)% 33,657 43,410 (2)% 9,135 7,793 9,362 FEE RELATED EARNINGS (FRE) 41.8% 44.0% 46.1% 40.3% 41.0% FRE Margin (%) (38)% 3,913 6,334 (99)% 9 1,995 790 Net revenue from performance fees (38)% 3,913 6,334 (99)% 9 1,995 790 Realized performance fees N/A – – N/A – – – Unrealized performance fees (40)% (1,948) (3,244) (99)% (4) (994) (316) Performance based compensation (36)% 1,965 3,089 (99)% 4 1,001 474 PERFORMANCE RELATED EARNINGS (PRE) 50.2% 48.8% 50.0% 50.2% 60.0% PRE Margin (%) N/A – – N/A – – – ( - ) Unrealized performance fees N/A – – N/A – – – (+) Unrealized performance compensation (23)% 35,621 46,500 (7)% 9,139 8,793 9,837 SEGMENT DISTRIBUTABLE EARNINGS 42.2% 44.3% 46.1% 41.2% 41.7% Segment DE Margin (%) (3)% 25,756 26,599 (3)% 25,756 25,426 26,599 ASSETS UNDER MANAGEMENT (AUM R$millions) (3)% 25,507 26,288 (3)% 25,507 25,179 26,288 FEE EARNING ASSETS UNDER MANAGEMENT (FEAUM R$millions) 0.34% 0.40% 0.34% 0.33% 0.37% AVERAGE MANAGEMENT FEE RATE (%) Investment Products & Solutions ▪ This quarter, we executed a strategic realignment across our segments. In response to the evolving dynamics of our funds and the strategic vision of our management team, we reassigned a portion of our Hedge Funds business to IP&S (R$2.3 billion). ▪ Fee related earnings (FRE) of R$9.1 million in the quarter, down 2% year - over - year. FRE was R$33.6 million in the 1Q'24 LTM Pro Forma¹, a 22% decrease comparing to the 1Q’23 LTM Pro Forma¹, due to outflows especially within our pension funds strategy, which carries higher fees. ▪ Segment Distributable Earnings of R$9.1 million in the quarter, down 7% year - over - year. Segment DE was R$35.6 million in the 1Q' 24 LTM Pro Forma¹, a decrease of 23% when compared to the 1Q’23 LTM Pro Forma¹, that posted higher contributions from FRE. ▪ Total AUM of R$25.8 billion, down 3% year - over - year. R$26 bn AUM

26 Mosaico Strategy 61% Dividends Strategy 33% Total Return 5% Others 1% Public Equities' AUM ∆ YoY (%) 1Q'24 LTM PF¹ 1Q'23 LTM PF¹ ∆ YoY (%) 1Q'24 4Q'23 PF¹ 1Q'23 PF¹ (R$ thousands, unless mentioned)¹ (7)% 58,124 62,780 (5)% 13,964 14,145 14,628 Net revenue from management fees N/A – – N/A – – – Net revenue from advisory fees (7)% 58,124 62,780 (5)% 13,964 14,145 14,628 Total Fee Related Revenues 5% (3,576) (3,401) (4)% (889) (875) (931) Segment personnel expenses (16)% (1,430) (1,695) 23% (344) (315) (280) Other G&A expenses (11)% (12,454) (13,972) (11)% (2,890) (2,878) (3,259) Corporate center expenses (15)% (8,263) (9,703) (3)% (2,004) (1,798) (2,074) Bonus compensation related to management and advisory (11)% (25,722) (28,771) (6)% (6,126) (5,866) (6,544) Total Fee Related Expenses (5)% 32,403 34,008 (3)% 7,838 8,279 8,084 FEE RELATED EARNINGS (FRE) 55.7% 54.2% 56.1% 58.5% 55.3% FRE Margin (%) 199% 12,670 4,232 94% 2,257 2,491 1,166 Net revenue from performance fees 199% 12,670 4,232 94% 2,257 2,491 1,166 Realized performance fees N/A – – N/A – – – Unrealized performance fees 262% (6,672) (1,845) 141% (1,001) (1,651) (415) Performance based compensation 151% 5,997 2,386 67% 1,255 840 751 PERFORMANCE RELATED EARNINGS (PRE) 47.3% 56.4% 55.6% 33.7% 64.4% PRE Margin (%) N/A – – N/A – – – ( - ) Unrealized performance fees N/A – – N/A – – – (+) Unrealized performance compensation 6% 38,398 36,395 3% 9,093 9,119 8,835 SEGMENT DISTRIBUTABLE EARNINGS 54.2% 54.3% 56.1% 54.8% 55.9% Segment DE Margin (%) 33% 9,910 7,434 33% 9,910 10,055 7,434 ASSETS UNDER MANAGEMENT (AUM R$millions) 34% 9,859 7,374 34% 9,859 10,005 7,374 FEE EARNING ASSETS UNDER MANAGEMENT (FEAUM R$millions) 0.68% 0.84% 0.60% 0.64% 0.83% AVERAGE MANAGEMENT FEE RATE (%) Public Equities ▪ This quarter, we executed a strategic realignment across our segments. In response to the evolving dynamics of our funds and the strategic vision of our management team, we reassigned a portion of our Hedge Funds business to Public Equities (R$ 533.6 million). ▪ Fee related earnings (FRE) of R$7.8 million in the quarter, down 3% year - over - year, following volatile markets across the globe over the last quarters. FRE was R$32.4 million in the 1Q'24 LTM Pro Forma¹, a decrease of 5% compared to the 1Q’23 LTM Pro Forma¹. ▪ Segment Distributable Earnings of R$9.1 million in the quarter, up 3% year - over - year. Segment Distributable Earnings was R$38.4 million in the 1Q'24 LTM Pro Forma¹, an increase of 6% when compared to the 1Q’23 LTM Pro Forma¹, driven by an increase in contributions from realized performance fees. ▪ Total AUM of R$9.9 billion in the quarter, up 33% year - over - year. See notes and definitions at end of document R$10 bn AUM

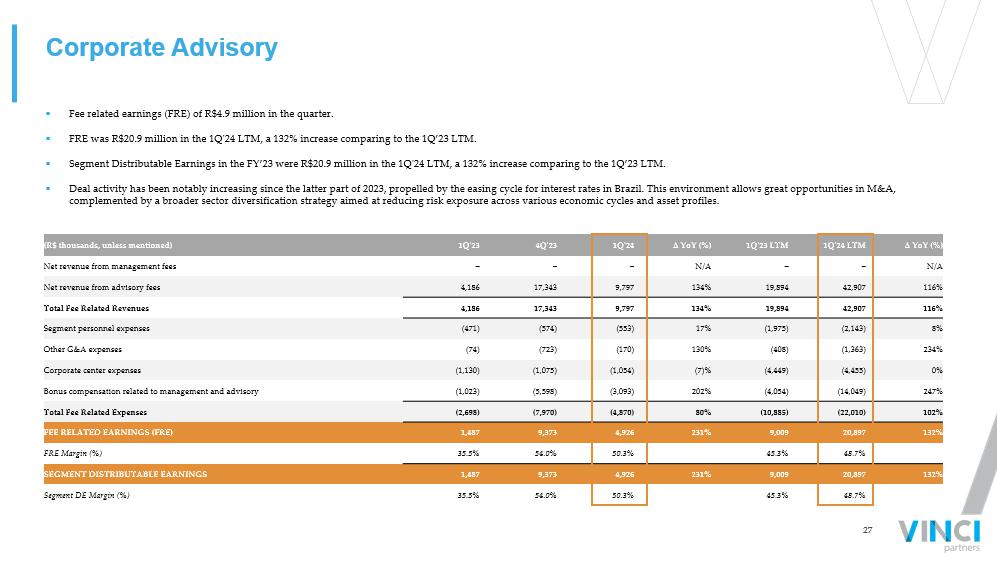

27 ∆ YoY (%) 1Q'24 LTM 1Q'23 LTM ∆ YoY (%) 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) N/A – – N/A – – – Net revenue from management fees 116% 42,907 19,894 134% 9,797 17,343 4,186 Net revenue from advisory fees 116% 42,907 19,894 134% 9,797 17,343 4,186 Total Fee Related Revenues 8% (2,143) (1,975) 17% (553) (574) (471) Segment personnel expenses 234% (1,363) (408) 130% (170) (723) (74) Other G&A expenses 0% (4,455) (4,449) (7)% (1,054) (1,075) (1,130) Corporate center expenses 247% (14,049) (4,054) 202% (3,093) (5,598) (1,023) Bonus compensation related to management and advisory 102% (22,010) (10,885) 80% (4,870) (7,970) (2,698) Total Fee Related Expenses 132% 20,897 9,009 231% 4,926 9,373 1,487 FEE RELATED EARNINGS (FRE) 48.7% 45.3% 50.3% 54.0% 35.5% FRE Margin (%) 132% 20,897 9,009 231% 4,926 9,373 1,487 SEGMENT DISTRIBUTABLE EARNINGS 48.7% 45.3% 50.3% 54.0% 35.5% Segment DE Margin (%) Corporate Advisory ▪ Fee related earnings (FRE) of R$4.9 million in the quarter. ▪ FRE was R$20.9 million in the 1Q'24 LTM, a 132% increase comparing to the 1Q’23 LTM. ▪ Segment Distributable Earnings in the FY’23 were R$20.9 million in the 1Q'24 LTM, a 132% increase comparing to the 1Q’23 LTM. ▪ Deal activity has been notably increasing since the latter part of 2023, propelled by the easing cycle for interest rates in Bra zil. This environment allows great opportunities in M&A, complemented by a broader sector diversification strategy aimed at reducing risk exposure across various economic cycles and ass et profiles.

28 ∆ YoY (%) 1Q'24 LTM 1Q'23 LTM ∆ YoY (%) 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) N/A 324 – N/A 158 119 – Net revenue from management fees N/A – – N/A – – – Net revenue from advisory fees N/A 324 – N/A 158 119 – Total Fee Related Revenues 50% (2,168) (1,450) 33% (561) (596) (422) Segment personnel expenses 166% (4,589) (1,724) 333% (1,618) (1,341) (374) Other G&A expenses 38% (446) (322) (8)% (105) (107) (115) Corporate center expenses 58% (4,136) (2,622) 21% (721) (1,773) (598) Bonus compensation related to management and advisory 85% (11,338) (6,119) 99% (3,006) (3,818) (1,509) Total Fee Related Expenses 80% (11,014) (6,119) 89% (2,847) (3,699) (1,509) FEE RELATED EARNINGS (FRE) N/A N/A N/A N/A N/A FRE Margin (%) N/A – – N/A – – – Net revenue from performance fees N/A – – N/A – – – Realized performance fees N/A – – N/A – – – Unrealized performance fees N/A – – N/A – – – Performance based compensation N/A – – N/A – – – PERFORMANCE RELATED EARNINGS (PRE) N/A N/A N/A N/A N/A PRE Margin (%) N/A – – N/A – – – ( - ) Unrealized performance fees N/A – – N/A – – – (+) Unrealized performance compensation 80% (11,014) (6,119) 89% (2,847) (3,699) (1,509) SEGMENT DISTRIBUTABLE EARNINGS N/A N/A N/A N/A N/A Segment DE Margin (%) N/A 147 – N/A 147 88 – ASSETS UNDER MANAGEMENT (AUM R$millions) N/A 0.86% – N/A 0.58% 0.72% – AVERAGE MANAGEMENT FEE RATE (%) ▪ Fee Related Earnings (FRE) of negative R$2.8 million in the quarter. FRE was negative R$11.0 million in the 1Q'24 LTM. ▪ VRS started to contribute to AUM numbers and management fee revenues in 2023. In February, VRS was officially presented to th e g eneral public with an article in a major newspaper in Brazil. The product is now fully accessible to the public through dedicated apps and website and prepared to accept allocatio ns from all investors through our newly launched platform called Mio. ▪ VRS reached close to R$ 150.0 million in AUM by the end of the first quarter. Retirement Services

Supplement Details

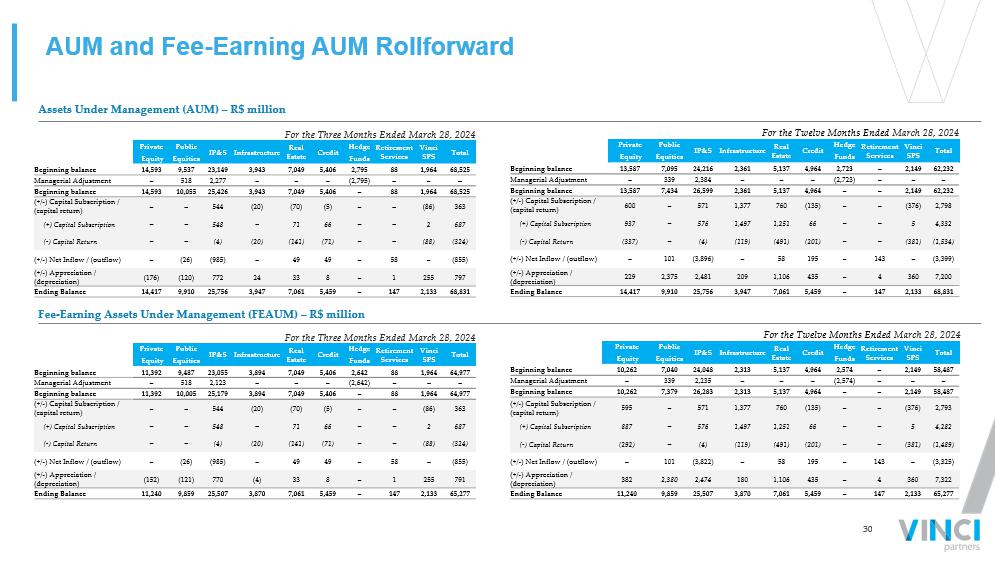

30 Total Vinci SPS Retirement Services Hedge Credit Real Estate Infrastructure IP&S Public Private Funds Equities Equity 58,487 2,149 – 2,574 4,964 5,137 2,313 24,048 7,040 10,262 Beginning balance – – – (2,574) – – – 2,235 339 – Managerial Adjustment 58,487 2,149 – – 4,964 5,137 2,313 26,283 7,379 10,262 Beginning balance 2,793 (376) – – (135) 760 1,377 571 – 595 (+/ - ) Capital Subscription / (capital return) 4,282 5 – – 66 1,251 1,497 576 – 887 (+) Capital Subscription (1,489) (381) – – (201) (491) (119) (4) – (292) ( - ) Capital Return (3,325) – 143 – 195 58 – (3,822) 101 – (+/ - ) Net Inflow / (outflow) 7,322 360 4 – 435 1,106 180 2,474 2,380 382 (+/ - ) Appreciation / (depreciation) 65,277 2,133 147 – 5,459 7,061 3,870 25,507 9,859 11,240 Ending Balance Total Vinci SPS Retirement Services Hedge Credit Real Estate Infrastructure IP&S Public Private Funds Equities Equity 62,232 2,149 – 2,723 4,964 5,137 2,361 24,216 7,095 13,587 Beginning balance – – – (2,723) – – – 2,384 339 – Managerial Adjustment 62,232 2,149 – – 4,964 5,137 2,361 26,599 7,434 13,587 Beginning balance 2,798 (376) – – (135) 760 1,377 571 – 600 (+/ - ) Capital Subscription / (capital return) 4,332 5 – – 66 1,251 1,497 576 – 937 (+) Capital Subscription (1,534) (381) – – (201) (491) (119) (4) – (337) ( - ) Capital Return (3,399) – 143 – 195 58 – (3,896) 101 – (+/ - ) Net Inflow / (outflow) 7,200 360 4 – 435 1,106 209 2,481 2,375 229 (+/ - ) Appreciation / (depreciation) 68,831 2,133 147 – 5,459 7,061 3,947 25,756 9,910 14,417 Ending Balance Total Vinci SPS Retirement Services Hedge Credit Real Estate Infrastructure IP&S Public Private Funds Equities Equity 64,977 1,964 88 2,642 5,406 7,049 3,894 23,055 9,487 11,392 Beginning balance – – – (2,642) – – – 2,123 518 – Managerial Adjustment 64,977 1,964 88 – 5,406 7,049 3,894 25,179 10,005 11,392 Beginning balance 363 (86) – – (5) (70) (20) 544 – – (+/ - ) Capital Subscription / (capital return) 687 2 – – 66 71 – 548 – – (+) Capital Subscription (324) (88) – – (71) (141) (20) (4) – – ( - ) Capital Return (855) – 58 – 49 49 – (985) (26) – (+/ - ) Net Inflow / (outflow) 791 255 1 – 8 33 (4) 770 (121) (152) (+/ - ) Appreciation / (depreciation) 65,277 2,133 147 – 5,459 7,061 3,870 25,507 9,859 11,240 Ending Balance Total Vinci SPS Retirement Services Hedge Credit Real Estate Infrastructure IP&S Public Private Funds Equities Equity 68,525 1,964 88 2,795 5,406 7,049 3,943 23,149 9,537 14,593 Beginning balance – – – (2,795) – – – 2,277 518 – Managerial Adjustment 68,525 1,964 88 – 5,406 7,049 3,943 25,426 10,055 14,593 Beginning balance 363 (86) – – (5) (70) (20) 544 – – (+/ - ) Capital Subscription / (capital return) 687 2 – – 66 71 – 548 – – (+) Capital Subscription (324) (88) – – (71) (141) (20) (4) – – ( - ) Capital Return (855) – 58 – 49 49 – (985) (26) – (+/ - ) Net Inflow / (outflow) 797 255 1 – 8 33 24 772 (120) (176) (+/ - ) Appreciation / (depreciation) 68,831 2,133 147 – 5,459 7,061 3,947 25,756 9,910 14,417 Ending Balance AUM and Fee - Earning AUM Rollforward Assets Under Management (AUM) – R$ million Fee - Earning Assets Under Management (FEAUM) – R$ million For the Three Months Ended March 28, 2024 For the Three Months Ended March 28, 2024 For the Twelve Months Ended March 28, 2024 For the Twelve Months Ended March 28, 2024

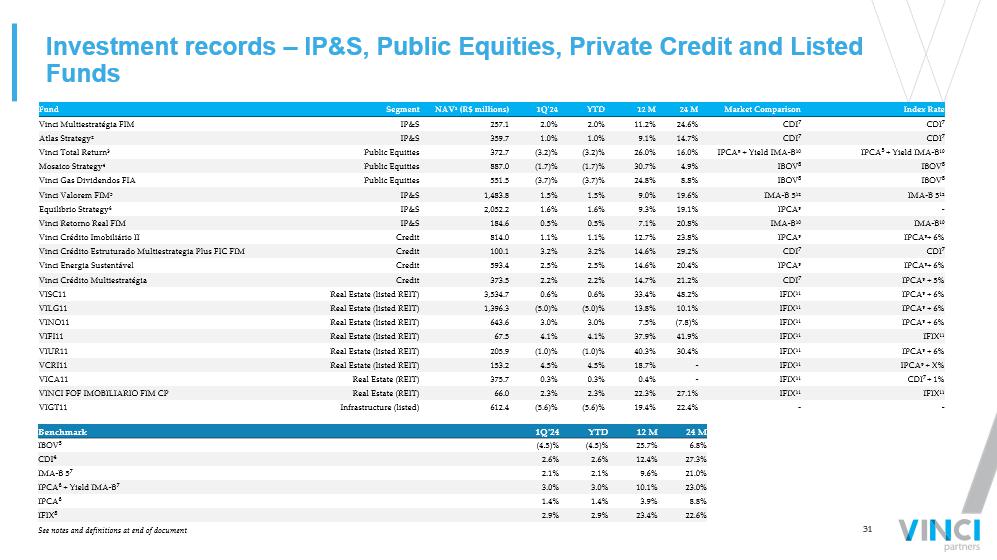

31 Investment records – IP&S, Public Equities, Private Credit and Listed Funds See notes and definitions at end of document Index Rate Market Comparison 24 M 12 M YTD 1Q'24 NAV¹ (R$ millions) Segment Fund CDI 7 CDI 7 24.6% 11.2% 2.0% 2.0% 257.1 IP&S Vinci Multiestratégia FIM CDI 7 CDI 7 14.7% 9.1% 1.0% 1.0% 359.7 IP&S Atlas Strategy² IPCA 5 + Yield IMA - B¹⁰ IPCA⁹ + Yield IMA - B¹⁰ 16.0% 26.0% (3.2)% (3.2)% 372.7 Public Equities Vinci Total Return³ IBOV 8 IBOV 8 4.9% 30.7% (1.7)% (1.7)% 887.0 Public Equities Mosaico Strategy⁴ IBOV 8 IBOV 8 8.8% 24.8% (3.7)% (3.7)% 551.5 Public Equities Vinci Gas Dividendos FIA IMA - B 5¹² IMA - B 5¹² 19.6% 9.0% 1.5% 1.5% 1,483.8 IP&S Vinci Valorem FIM⁵ - IPCA⁹ 19.1% 9.3% 1.6% 1.6% 2,052.2 IP&S Equilibrio Strategy⁶ IMA - B¹⁰ IMA - B¹⁰ 20.8% 7.1% 0.5% 0.5% 184.6 IP&S Vinci Retorno Real FIM IPCA⁹+ 6% IPCA⁹ 23.8% 12.7% 1.1% 1.1% 814.0 Credit Vinci Crédito Imobiliário II CDI 7 CDI 7 29.2% 14.6% 3.2% 3.2% 100.1 Credit Vinci Crédito Estruturado Multiestrategia Plus FIC FIM IPCA⁹+ 6% IPCA⁹ 20.4% 14.6% 2.5% 2.5% 593.4 Credit Vinci Energia Sustentável IPCA⁹ + 5% CDI 7 21.2% 14.7% 2.2% 2.2% 373.5 Credit Vinci Crédito Multiestratégia IPCA⁹ + 6% IFIX¹¹ 48.2% 33.4% 0.6% 0.6% 3,534.7 Real Estate (listed REIT) VISC11 IPCA⁹ + 6% IFIX¹¹ 10.1% 13.8% (5.0)% (5.0)% 1,396.3 Real Estate (listed REIT) VILG11 IPCA⁹ + 6% IFIX¹¹ (7.8)% 7.5% 3.0% 3.0% 643.6 Real Estate (listed REIT) VINO11 IFIX¹¹ IFIX¹¹ 41.9% 37.9% 4.1% 4.1% 67.5 Real Estate (listed REIT) VIFI11 IPCA⁹ + 6% IFIX¹¹ 30.4% 40.3% (1.0)% (1.0)% 205.9 Real Estate (listed REIT) VIUR11 IPCA⁹ + X% IFIX¹¹ - 18.7% 4.5% 4.5% 153.2 Real Estate (listed REIT) VCRI11 CDI 7 + 1% IFIX¹¹ - 0.4% 0.3% 0.3% 375.7 Real Estate (REIT) VICA11 IFIX¹¹ IFIX¹¹ 27.1% 22.3% 2.3% 2.3% 66.0 Real Estate (REIT) VINCI FOF IMOBILIARIO FIM CP - - 22.4% 19.4% (5.6)% (5.6)% 612.4 Infrastructure (listed) VIGT11 24 M 12 M YTD 1Q'24 Benchmark 6.8% 25.7% (4.5)% (4.5)% IBOV 5 27.3% 12.4% 2.6% 2.6% CDI 4 21.0% 9.6% 2.1% 2.1% IMA - B 5 7 23.0% 10.1% 3.0% 3.0% IPCA 6 + Yield IMA - B 7 8.8% 3.9% 1.4% 1.4% IPCA 6 22.6% 23.4% 2.9% 2.9% IFIX 8

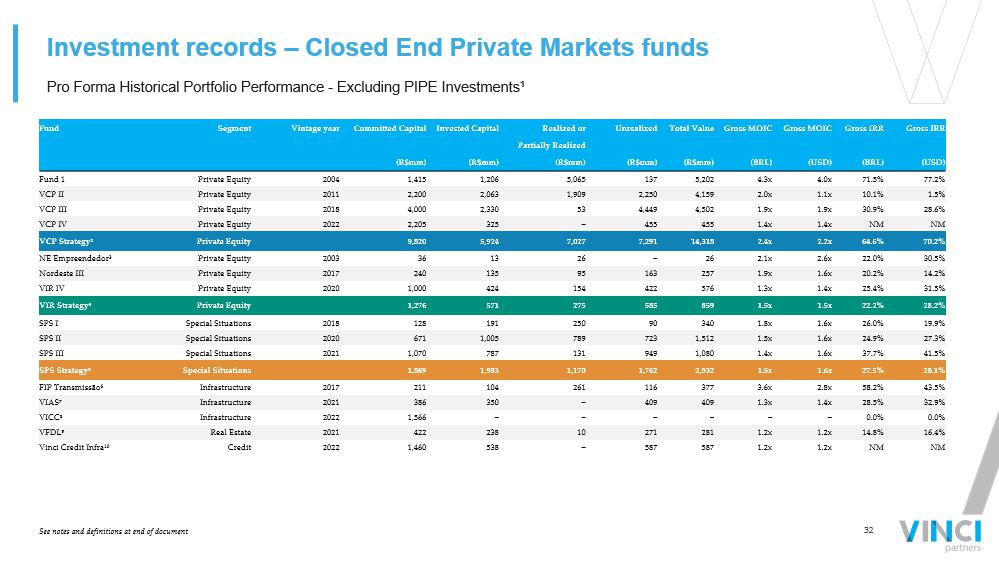

32 Gross IRR Gross IRR Gross MOIC Gross MOIC Total Value Unrealized Realized or Invested Capital Committed Capital Vintage year Segment Fund Partially Realized (USD) (BRL) (USD) (BRL) ( R$mm ) ( R$mm ) ( R$mm ) ( R$mm ) (R$mm) 77.2% 71.5% 4.0x 4.3x 5,202 137 5,065 1,206 1,415 2004 Private Equity Fund 1 1.5% 10.1% 1.1x 2.0x 4,159 2,250 1,909 2,063 2,200 2011 Private Equity VCP II 28.6% 30.9% 1.9x 1.9x 4,502 4,449 53 2,330 4,000 2018 Private Equity VCP III NM NM 1.4x 1.4x 455 455 – 325 2,205 2022 Private Equity VCP IV 70.2% 64.6% 2.2x 2.4x 14,318 7,291 7,027 5,924 9,820 Private Equity VCP Strategy² 30.5% 22.0% 2.6x 2.1x 26 – 26 13 36 2003 Private Equity NE Empreendedor³ 14.2% 20.2% 1.6x 1.9x 257 163 95 135 240 2017 Private Equity Nordeste III 31.5% 25.4% 1.4x 1.3x 576 422 154 424 1,000 2020 Private Equity VIR IV 28.2% 22.2% 1.5x 1.5x 859 585 275 571 1,276 Private Equity VIR Strategy⁴ 19.9% 26.0% 1.6x 1.8x 340 90 250 191 128 2018 Special Situations SPS I 27.3% 24.9% 1.6x 1.5x 1,512 723 789 1,005 671 2020 Special Situations SPS II 41.5% 37.7% 1.6x 1.4x 1,080 949 131 787 1,070 2021 Special Situations SPS III 28.1% 27.5% 1.6x 1.5x 2,932 1,762 1,170 1,983 1,869 Special Situations SPS Strategy⁵ 43.5% 58.2% 2.8x 3.6x 377 116 261 104 211 2017 Infrastructure FIP Transmissão ⁶ 32.9% 28.5% 1.4x 1.3x 409 409 – 350 386 2021 Infrastructure VIAS⁷ 0.0% 0.0% – – – – – – 1,566 2022 Infrastructure VICC⁸ 16.4% 14.8% 1.2x 1.2x 281 271 10 238 422 2021 Real Estate VFDL⁹ NM NM 1.2x 1.2x 587 587 – 538 1,460 2022 Credit Vinci Credit Infra¹⁰ Pro Forma Historical Portfolio Performance - Excluding PIPE Investments¹ Investment records – Closed End Private Markets funds See notes and definitions at end of document

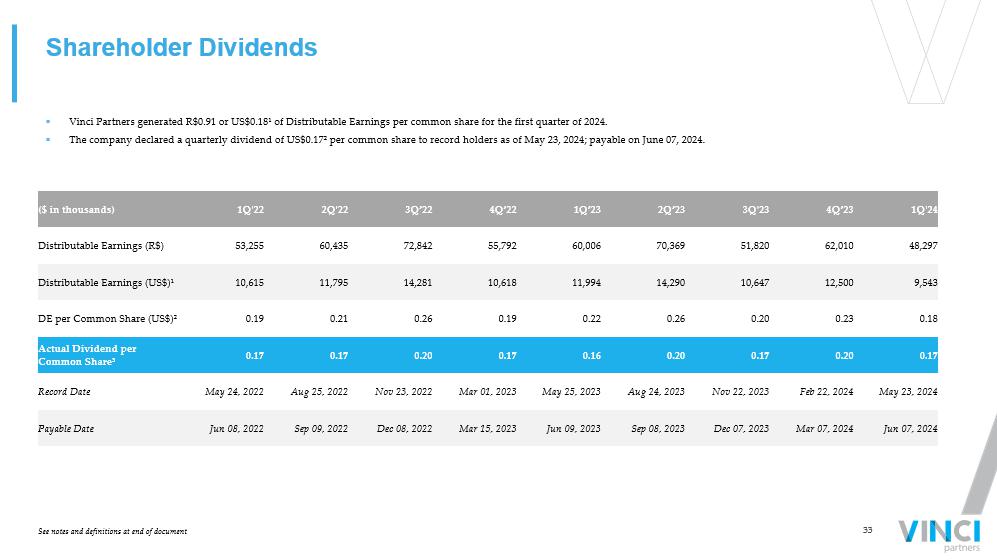

33 Shareholder Dividends 1Q'24 4Q’23 3Q'23 2Q’23 1Q’23 4Q’22 3Q’22 2Q'22 1Q'22 ($ in thousands) 48,297 62,010 51,820 70,369 60,006 55,792 72,842 60,435 53,255 Distributable Earnings (R$) 9,543 12,500 10,647 14,290 11,994 10,618 14,281 11,795 10,615 Distributable Earnings (US$)¹ 0.18 0.23 0.20 0.26 0.22 0.19 0.26 0.21 0.19 DE per Common Share (US$)² 0.17 0.20 0.17 0.20 0.16 0.17 0.20 0.17 0.17 Actual Dividend per Common Share³ May 23, 2024 Feb 22, 2024 Nov 22, 2023 Aug 24, 2023 May 25, 2023 Mar 01, 2023 Nov 23, 2022 Aug 25, 2022 May 24, 2022 Record Date Jun 07, 2024 Mar 07, 2024 Dec 07, 2023 Sep 08, 2023 Jun 09, 2023 Mar 15, 2023 Dec 08, 2022 Sep 09, 2022 Jun 08, 2022 Payable Date ▪ Vinci Partners generated R$0.91 or US$0.18¹ of Distributable Earnings per common share for the first quarter of 2024. ▪ The company declared a quarterly dividend of US$0.17² per common share to record holders as of May 23, 2024; payable on June 07 , 2024. See notes and definitions at end of document

34 Share Summary ▪ Common Shares Outstanding as of quarter end of 53,244,836 shares. x Repurchased 533,981 common shares in the quarter, with an average share price of US$10.6. x Repurchased 4,090,985 common shares since the announcement of the first share repurchase plan, with an average share price of US $10.7. x A new share repurchase plan was approved on February 07, 2024, to buy back up to R$60.0 million of the company’s outstanding sha res. 1Q'24 4Q’23 3Q'23 2Q’23 1Q23 4Q'22 3Q'22 2Q'22 1Q'22 VINP Shares 14,466,239 14,466,239 14,466,239 14,466,239 14,466,239 14,466,239 14,466,239 14,466,239 14,466,239 Class B 38,778,597 39,312,578 39,405,827 39,730,720 40,247,461 40,614,497 40,892,619 41,112,717 41,363,077 Class A¹ 53,244,836 53,778,817 53,872,066 54,196,959 54,713,700 55,080,736 55,358,858 55,578,956 55,829,316 Common Shares See notes and definitions at end of document

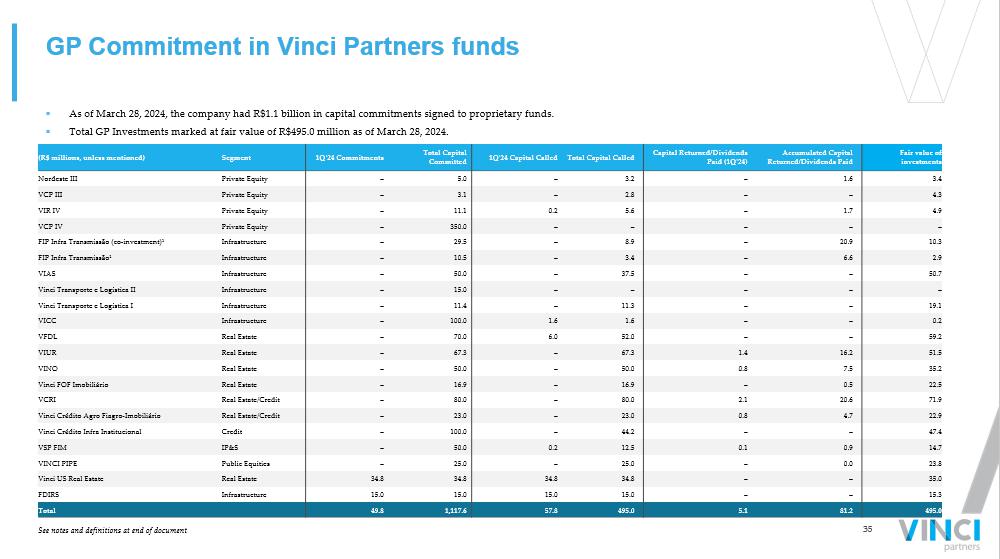

35 GP Commitment in Vinci Partners funds ▪ As of March 28, 2024, the company had R$1.1 billion in capital commitments signed to proprietary funds. ▪ Total GP Investments marked at fair value of R$495.0 million as of March 28, 2024. See notes and definitions at end of document Fair value of investments Accumulated Capital Returned/Dividends Paid Capital Returned/Dividends Paid (1Q'24) Total Capital Called 1Q'24 Capital Called Total Capital Committed 1Q'24 Commitments Segment (R$ millions, unless mentioned) 3.4 1.6 – 3.2 – 5.0 – Private Equity Nordeste III 4.3 – – 2.8 – 3.1 – Private Equity VCP III 4.9 1.7 – 5.6 0.2 11.1 – Private Equity VIR IV – – – – – 350.0 – Private Equity VCP IV 10.3 20.9 – 8.9 – 29.5 – Infrastructure FIP Infra Transmissão ( co - investment )¹ 2.9 6.6 – 3.4 – 10.5 – Infrastructure FIP Infra Transmissão¹ 50.7 – – 37.5 – 50.0 – Infrastructure VIAS – – – – – 15.0 – Infrastructure Vinci Transporte e Logística II 19.1 – – 11.3 – 11.4 – Infrastructure Vinci Transporte e Logística I 0.2 – – 1.6 1.6 100.0 – Infrastructure VICC 59.2 – – 52.0 6.0 70.0 – Real Estate VFDL 51.5 16.2 1.4 67.3 – 67.3 – Real Estate VIUR 35.2 7.5 0.8 50.0 – 50.0 – Real Estate VINO 22.5 0.5 – 16.9 – 16.9 – Real Estate Vinci FOF Imobiliário 71.9 20.6 2.1 80.0 – 80.0 – Real Estate/Credit VCRI 22.9 4.7 0.8 23.0 – 23.0 – Real Estate/Credit Vinci Crédito Agro Fiagro - Imobiliário 47.4 – – 44.2 – 100.0 – Credit Vinci Crédito Infra Institucional 14.7 0.9 0.1 12.5 0.2 50.0 – IP&S VSP FIM 23.8 0.0 – 25.0 – 25.0 – Public Equities VINCI PIPE 35.0 – – 34.8 34.8 34.8 34.8 Real Estate Vinci US Real Estate 15.3 – – 15.0 15.0 15.0 15.0 Infrastructure FDIRS 495.0 81.2 5.1 495.0 57.8 1,117.6 49.8 Total

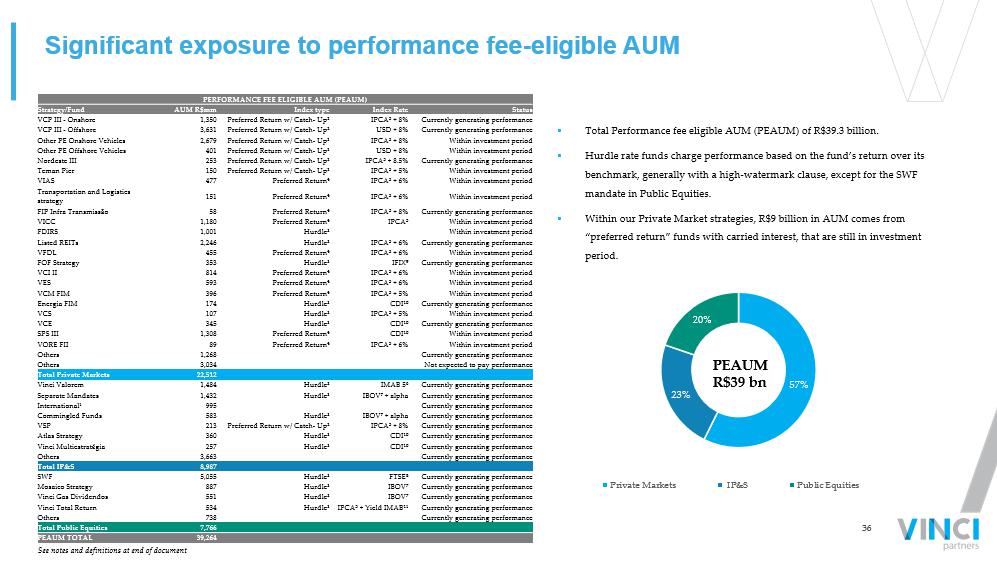

36 57% 23% 20% Private Markets IP&S Public Equities Significant exposure to performance fee - eligible AUM ▪ Total Performance fee eligible AUM (PEAUM) of R$39.3 billion. ▪ Hurdle rate funds charge performance based on the fund’s return over its benchmark, generally with a high - watermark clause, except for the SWF mandate in Public Equities. ▪ Within our Private Market strategies, R$9 billion in AUM comes from “preferred return” funds with carried interest, that are still in investment period. See notes and definitions at end of document PERFORMANCE FEE ELIGIBLE AUM (PEAUM) Status Index Rate Index type AUM R$mm Strategy/Fund Currently generating performance IPCA 5 + 8% Preferred Return w/ Catch - Up² 1,350 VCP III - Onshore Currently generating performance USD + 8% Preferred Return w/ Catch - Up² 3,631 VCP III - Offshore Within investment period IPCA 5 + 8% Preferred Return w/ Catch - Up² 2,679 Other PE Onshore Vehicles Within investment period USD + 8% Preferred Return w/ Catch - Up² 401 Other PE Offshore Vehicles Currently generating performance IPCA 5 + 8.5% Preferred Return w/ Catch - Up² 253 Nordeste III Within investment period IPCA 5 + 5% Preferred Return w/ Catch - Up² 150 Teman Pier Within investment period IPCA 5 + 6% Preferred Return 4 477 VIAS Within investment period IPCA 5 + 6% Preferred Return 4 151 Transportation and Logistics strategy Currently generating performance IPCA 5 + 8% Preferred Return 4 58 FIP Infra Transmissão Within investment period IPCA 5 Preferred Return 4 1,180 VICC Within investment period Hurdle³ 1,001 FDIRS Currently generating performance IPCA 5 + 6% Hurdle³ 2,246 Listed REITs Within investment period IPCA 5 + 6% Preferred Return 4 455 VFDL Currently generating performance IFIX 9 Hurdle³ 353 FOF Strategy Within investment period IPCA 5 + 6% Preferred Return 4 814 VCI II Within investment period IPCA 5 + 6% Preferred Return 4 593 VES Within investment period IPCA 5 + 5% Preferred Return 4 396 VCM FIM Currently generating performance CDI 10 Hurdle³ 174 Energia FIM Within investment period IPCA 5 + 5% Hurdle³ 107 VCS Currently generating performance CDI 10 Hurdle³ 345 VCE Within investment period CDI 10 Preferred Return 4 1,308 SPS III Within investment period IPCA 5 + 6% Preferred Return 4 89 VORE FII Currently generating performance 1,268 Others Not expected to pay performance 3,034 Others 22,512 Total Private Markets Currently generating performance IMAB 5 6 Hurdle³ 1,484 Vinci Valorem Currently generating performance IBOV 7 + alpha Hurdle³ 1,432 Separate Mandates Currently generating performance 995 International¹ Currently generating performance IBOV 7 + alpha Hurdle³ 583 Commingled Funds Currently generating performance IPCA 5 + 8% Preferred Return w/ Catch - Up² 213 VSP Currently generating performance CDI 10 Hurdle³ 360 Atlas Strategy Currently generating performance CDI 10 Hurdle³ 257 Vinci Multiestratégia Currently generating performance 3,663 Others 8,987 Total IP&S Currently generating performance FTSE 8 Hurdle³ 5,055 SWF Currently generating performance IBOV 7 Hurdle³ 887 Mosaico Strategy Currently generating performance IBOV 7 Hurdle³ 551 Vinci Gas Dividendos Currently generating performance IPCA 5 + Yield IMAB 11 Hurdle³ 534 Vinci Total Return Currently generating performance 738 Others 7,766 Total Public Equities 39,264 PEAUM TOTAL PEAUM R$39 bn

Reconciliations and Disclosures

38 Financials - Income Statement See notes and definitions at end of document ∆ LTM (%) 1Q'24 LTM 1Q'23 LTM ∆ YoY (%) 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) REVENUES 4% 393,945 380,149 1% 96,455 99,976 95,877 Net revenue from management fees 61% 21,564 13,391 16% 2,273 6,468 1,963 Net revenue from performance fees 28% 22,606 17,645 16% 2,273 7,510 1,963 Realized performance fees (76)% (1,042) (4,254) N/A – (1,042) – Unrealized performance fees 101% 45,690 22,788 132% 10,359 18,998 4,468 Net revenue from advisory 11% 461,199 416,328 7% 109,087 125,442 102,308 Total net revenues from services rendered EXPENSES 14% (84,686) (74,108) 4% (18,748) (26,143) (18,062) Bonus related to management and advisory 75% (10,916) (6,255) 38% (1,009) (3,614) (733) Performance based compensation 45% (11,285) (7,759) 38% (1,009) (3,983) (733) Realized (75)% 369 1,503 N/A – 369 – Unrealized 19% (95,602) (80,363) 5% (19,757) (29,757) (18,795) Total compensation and benefits 15% (29,859) (26,069) 2% (7,337) (7,462) (7,164) Segment personnel expenses 32% (22,961) (17,338) 73% (5,996) (6,573) (3,458) Other general and administrative expenses 1% (89,106) (88,615) (7)% (21,087) (21,499) (22,606) Corporate center expenses 12% (237,527) (212,385) 4% (54,177) (65,291) (52,023) Total expenses 10% 223,672 203,943 9% 54,910 60,151 50,285 Operating profit OTHER ITEMS N/A 59,727 (9,727) N/A 13,509 14,914 (20,200) GP Investment income (26)% 17,735 24,007 (25)% 4,406 4,451 5,881 Realized gain from GP investment income N/A 41,992 (33,734) N/A 9,103 10,463 (26,081) Unrealized gain from GP investment income (8)% 76,618 83,251 (38)% 12,362 22,046 20,089 Financial income (7)% 76,618 82,051 (38)% 12,362 22,046 20,089 Realized gain from financial income N/A (0) 1,200 N/A – – – Unrealized gain from financial income (1)% (9,394) (9,518) (16)% (2,216) (2,267) (2,631) Leasing expenses N/A (48,468) 9,540 N/A (14,992) (10,461) 151 Other items¹ 21% (19,008) (15,647) 192% (6,148) (4,249) (2,107) Share Based Plan 119% (3,257) (1,485) N/A (1,333) (1,924) – Non - operational expenses² (0)% 56,218 56,414 N/A 1,182 18,059 (4,698) Total Other Items 8% 279,890 260,356 23% 56,092 78,210 45,587 Profit before income taxes (11)% (47,429) (53,555) (19)% (10,384) (14,826) (12,881) ( - ) Income taxes ³ 12% 232,461 206,801 40% 45,708 63,384 32,706 NET INCOME 197% 2,939 988 N/A 1,308 1,631 – (+) Non - operational expenses (including Income Tax effect) N/A 16,949 (11,895) N/A 3,799 2,691 (2,674) ( - ) Contingent consideration adjustment related to acquisitions 4 29% 252,349 195,894 69% 50,815 67,706 30,032 ADJUSTE NET INCOME

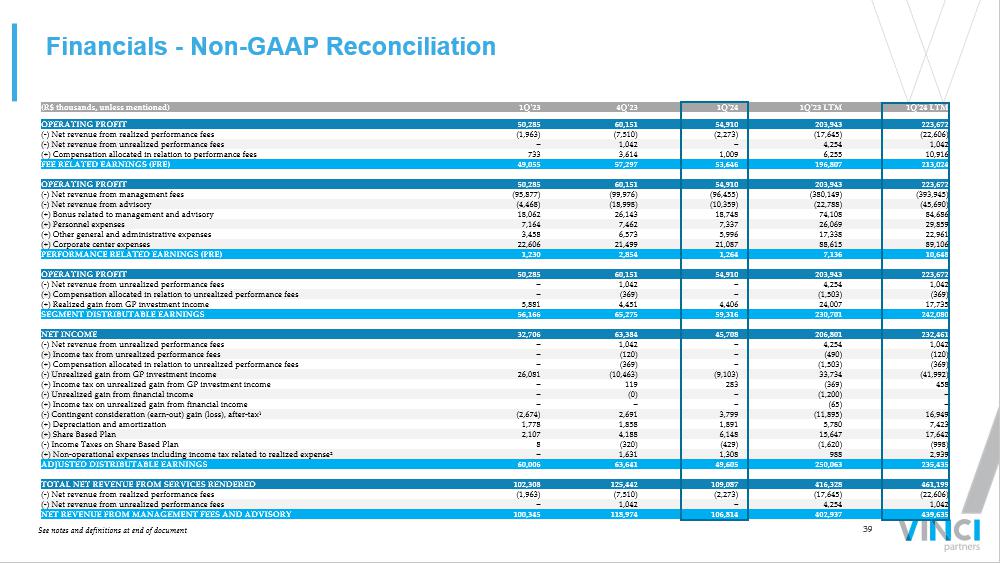

39 Financials - Non - GAAP Reconciliation 1Q'24 LTM 1Q'23 LTM 1Q'24 4Q'23 1Q'23 (R$ thousands, unless mentioned) 223,672 203,943 54,910 60,151 50,285 OPERATING PROFIT (22,606) (17,645) (2,273) (7,510) (1,963) ( - ) Net revenue from realized performance fees 1,042 4,254 – 1,042 – ( - ) Net revenue from unrealized performance fees 10,916 6,255 1,009 3,614 733 (+) Compensation allocated in relation to performance fees 213,024 196,807 53,646 57,297 49,055 FEE RELATED EARNINGS (FRE) 223,672 203,943 54,910 60,151 50,285 OPERATING PROFIT (393,945) (380,149) (96,455) (99,976) (95,877) ( - ) Net revenue from management fees (45,690) (22,788) (10,359) (18,998) (4,468) ( - ) Net revenue from advisory 84,686 74,108 18,748 26,143 18,062 (+) Bonus related to management and advisory 29,859 26,069 7,337 7,462 7,164 (+) Personnel expenses 22,961 17,338 5,996 6,573 3,458 (+) Other general and administrative expenses 89,106 88,615 21,087 21,499 22,606 (+) Corporate center expenses 10,648 7,136 1,264 2,854 1,230 PERFORMANCE RELATED EARNINGS (PRE) 223,672 203,943 54,910 60,151 50,285 OPERATING PROFIT 1,042 4,254 – 1,042 – ( - ) Net revenue from unrealized performance fees (369) (1,503) – (369) – (+) Compensation allocated in relation to unrealized performance fees 17,735 24,007 4,406 4,451 5,881 (+) Realized gain from GP investment income 242,080 230,701 59,316 65,275 56,166 SEGMENT DISTRIBUTABLE EARNINGS 232,461 206,801 45,708 63,384 32,706 NET INCOME 1,042 4,254 – 1,042 – ( - ) Net revenue from unrealized performance fees (120) (490) – (120) – (+) Income tax from unrealized performance fees (369) (1,503) – (369) – (+) Compensation allocated in relation to unrealized performance fees (41,992) 33,734 (9,103) (10,463) 26,081 ( - ) Unrealized gain from GP investment income 458 (369) 283 119 – (+) Income tax on unrealized gain from GP investment income – (1,200) – (0) – ( - ) Unrealized gain from financial income – (65) – – – (+) Income tax on unrealized gain from financial income 16,949 (11,895) 3,799 2,691 (2,674) ( - ) Contingent consideration (earn - out) gain (loss), after - tax¹ 7,423 5,780 1,891 1,858 1,778 (+) Depreciation and amortization 17,642 15,647 6,148 4,188 2,107 (+) Share Based Plan (998) (1,620) (429) (320) 8 ( - ) Income Taxes on Share Based Plan 2,939 988 1,308 1,631 – (+) Non - operational expenses including income tax related to realized expense² 235,435 250,063 49,605 63,641 60,006 ADJUSTED DISTRIBUTABLE EARNINGS 461,199 416,328 109,087 125,442 102,308 TOTAL NET REVENUE FROM SERVICES RENDERED (22,606) (17,645) (2,273) (7,510) (1,963) ( - ) Net revenue from realized performance fees 1,042 4,254 – 1,042 – ( - ) Net revenue from unrealized performance fees 439,635 402,937 106,814 118,974 100,345 NET REVENUE FROM MANAGEMENT FEES AND ADVISORY See notes and definitions at end of document

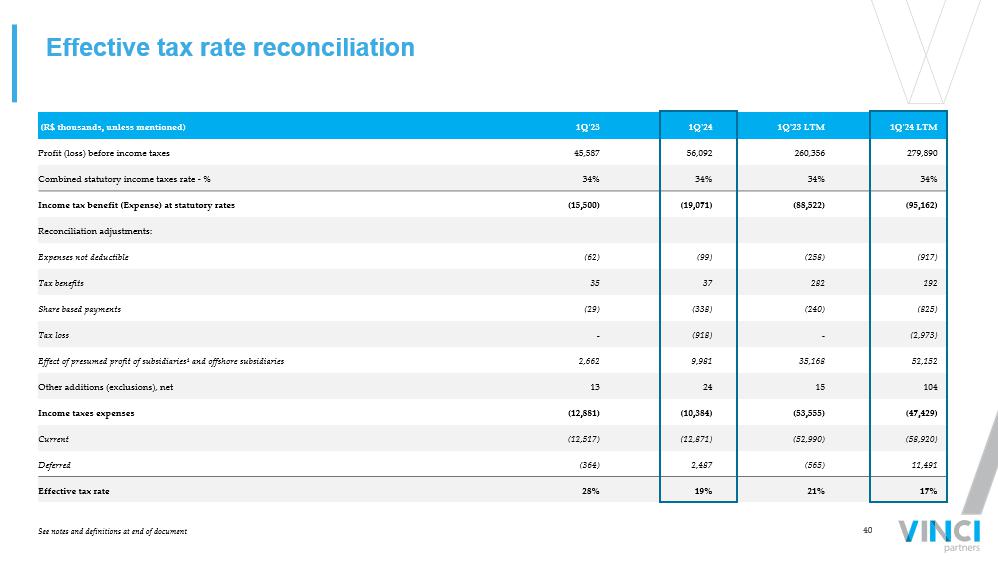

40 1Q'24 LTM 1Q'23 LTM 1Q'24 1Q'23 (R$ thousands, unless mentioned) 279,890 260,356 56,092 45,587 Profit (loss) before income taxes 34% 34% 34% 34% Combined statutory income taxes rate - % (95,162) (88,522) (19,071) (15,500) Income tax benefit (Expense) at statutory rates Reconciliation adjustments: (917) (258) (99) (62) Expenses not deductible 192 282 37 35 Tax benefits (825) (240) (338) (29) Share based payments (2,973) - (918) - Tax loss 52,152 35,168 9,981 2,662 Effect of presumed profit of subsidiaries¹ and offshore subsidiaries 104 15 24 13 Other additions (exclusions), net (47,429) (53,555) (10,384) (12,881) Income taxes expenses (58,920) (52,990) (12,871) (12,517) Current 11,491 (565) 2,487 (364) Deferred 17% 21% 19% 28% Effective tax rate Effective tax rate reconciliation See notes and definitions at end of document

41 General and Administrative Expenses 1 Q’24 ( R$mm ) 1 Q’23 ( R$mm ) Lease and condominium Other Personnel Bonus related to Mgmt. and Adv. fees Performance based compensation Third party expenses D&A Personnel Bonus related to Mgmt. and Adv. fees Performance based compensation Third party expenses D&A Lease and condominium Other R$52.0 mm + 4% R$54.2 mm 17.7 18.1 0.7 6.6 1.8 3.8 3.4 17.3 18.7 1.0 7.1 3.1 3.0 3.9

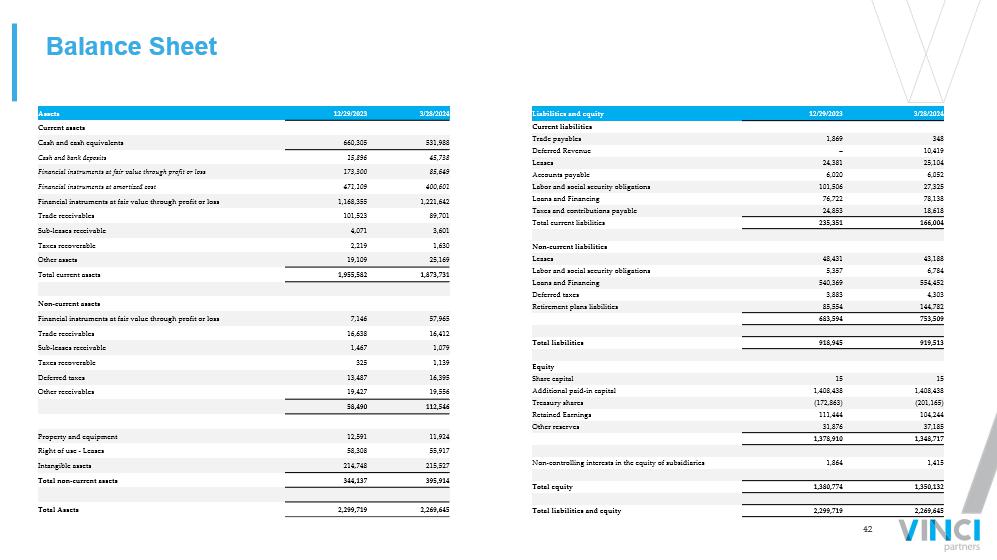

42 3/28/2024 12/29/2023 Assets Current assets 531,988 660,305 Cash and cash equivalents 45,738 15,896 Cash and bank deposits 85,649 173,300 Financial instruments at fair value through profit or loss 400,601 471,109 Financial instruments at amortized cost 1,221,642 1,168,355 Financial instruments at fair value through profit or loss 89,701 101,523 Trade receivables 3,601 4,071 Sub - leases receivable 1,630 2,219 Taxes recoverable 25,169 19,109 Other assets 1,873,731 1,955,582 Total current assets Non - current assets 57,965 7,146 Financial instruments at fair value through profit or loss 16,412 16,638 Trade receivables 1,079 1,467 Sub - leases receivable 1,139 325 Taxes recoverable 16,395 13,487 Deferred taxes 19,556 19,427 Other receivables 112,546 58,490 11,924 12,591 Property and equipment 55,917 58,308 Right of use - Leases 215,527 214,748 Intangible assets 395,914 344,137 Total non - current assets 2,269,645 2,299,719 Total Assets 3/28/2024 12/29/2023 Liabilities and equity Current liabilities 348 1,869 Trade payables 10,419 – Deferred Revenue 25,104 24,381 Leases 6,052 6,020 Accounts payable 27,325 101,506 Labor and social security obligations 78,138 76,722 Loans and Financing 18,618 24,853 Taxes and contributions payable 166,004 235,351 Total current liabilities Non - current liabilities 43,188 48,431 Leases 6,784 5,357 Labor and social security obligations 554,452 540,369 Loans and Financing 4,303 3,883 Deferred taxes 144,782 85,554 Retirement plans liabilities 753,509 683,594 919,513 918,945 Total liabilities Equity 15 15 Share capital 1,408,438 1,408,438 Additional paid - in capital (201,165) (172,863) Treasury shares 104,244 111,444 Retained Earnings 37,185 31,876 Other reserves 1,348,717 1,378,910 1,415 1,864 Non - controlling interests in the equity of subsidiaries 1,350,132 1,380,774 Total equity 2,269,645 2,299,719 Total liabilities and equity Balance Sheet

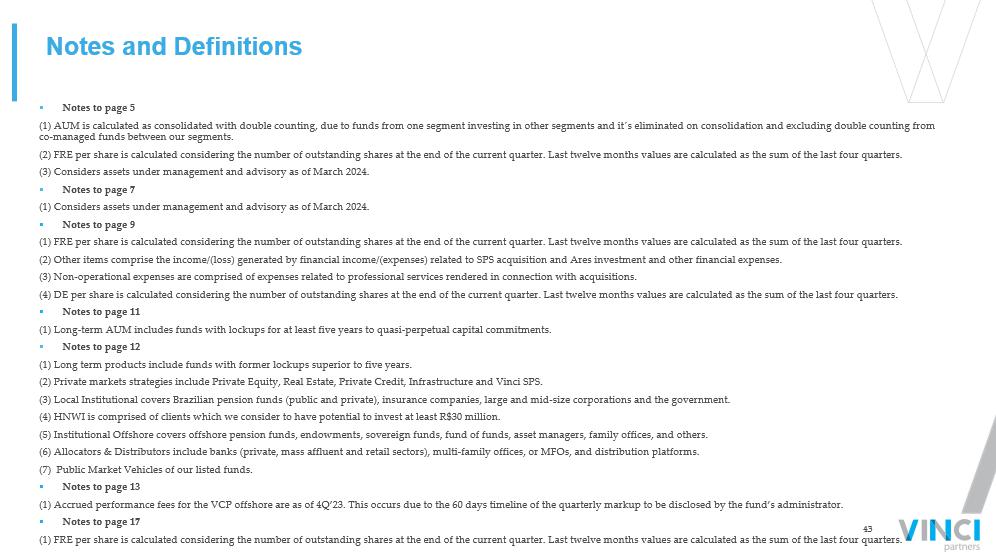

43 Notes and Definitions ▪ Notes to page 5 (1) AUM is calculated as consolidated with double counting, due to funds from one segment investing in other segments and it ´ s eliminated on consolidation and excluding double counting from co - managed funds between our segments. (2) FRE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twelve m ont hs values are calculated as the sum of the last four quarters. (3) Considers assets under management and advisory as of March 2024. ▪ Notes to page 7 (1) Considers assets under management and advisory as of March 2024. ▪ Notes to page 9 (1) FRE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twelve m ont hs values are calculated as the sum of the last four quarters. (2) Other items comprise the income/(loss) generated by financial income/(expenses) related to SPS acquisition and Ares inves tme nt and other financial expenses. (3) Non - operational expenses are comprised of expenses related to professional services rendered in connection with acquisitions . (4) DE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twelve mo nth s values are calculated as the sum of the last four quarters. ▪ Notes to page 11 (1) Long - term AUM includes funds with lockups for at least five years to quasi - perpetual capital commitments. ▪ Notes to page 12 (1) Long term products include funds with former lockups superior to five years. (2) Private markets strategies include Private Equity, Real Estate, Private Credit, Infrastructure and Vinci SPS. (3) Local Institutional covers Brazilian pension funds (public and private), insurance companies, large and mid - size corporation s and the government. (4) HNWI is comprised of clients which we consider to have potential to invest at least R$30 million. (5) Institutional Offshore covers offshore pension funds, endowments, sovereign funds, fund of funds, asset managers, family off ices, and others. (6) Allocators & Distributors include banks (private, mass affluent and retail sectors), multi - family offices, or MFOs, and dist ribution platforms. (7) Public Market Vehicles of our listed funds. ▪ Notes to page 13 (1) Accrued performance fees for the VCP offshore are as of 4Q’23. This occurs due to the 60 days timeline of the quarterly m ark up to be disclosed by the fund’s administrator. ▪ Notes to page 17 (1) FRE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twelve m ont hs values are calculated as the sum of the last four quarters.

44 Notes and Definitions (cont’d.) ▪ Notes to page 18 (1) PRE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twelve m ont hs values are calculated as the sum of the last four quarters. ▪ Notes to page 19 (1) GP investment income comes from proprietary investments made by Vinci Partners in its own Private Markets’ funds and othe r c losed - end funds across Public Equities and IP&S segments with long - term lockups. (2) Financial income is income generated through investments made with our cash and cash equivalents in cash and bank deposit s, certificate of deposits and proprietary investments in Vinci Partners’ Liquid Funds, including funds from Public Equities, IP&S, Real Estate and Private Credit. ▪ Notes to page 20 (1) Adjusted Distributable Earnings is calculated as Distributable Earnings excluding non - operational expenses. (2) Adjusted DE per share is calculated considering the number of outstanding shares at the end of the current quarter. Last twe lve months values are calculated as the sum of the last four quarters. ▪ Notes to page 21 (1) Cash and cash equivalents include cash on hand, bank deposits held with financial institutions, other short - term, highly liq uid investments with original maturities of three months or less, that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. (2) Liquid funds’ value are calculated as investment at fair value as of March 28, 2024, in liquid funds from Vinci Partners’ Pu blic Equities, IP&S, Private Credit and Real Estate. It also comprises the cash and certificate of deposits and federal bonds from Vinci Monalisa FIM. For 1Q24 onwards we are not considering the funds th at refer to financial products as part of the Company’s retirement plans services. For more detail, see 1Q’24 Financial Statements filed within the SEC on May 09, 2024. (3) GP Fund Investments include Vinci Partners’ GP investments in private market funds and other closed - end funds across Public Equities and IP&S segments with long - term lockups and Public REITs, calculated at fair value as of March 28, 2024. For more detail, please see slide 35 and the Financial Statements filed wi thin the SEC on May 09, 2024. (4) Debt obligations include commercial notes, consideration payable and convertible preferred shares. For more detail, see 1 Q’2 4 Financial Statements filed within the SEC on May 09, 2024. (5) Net Cash and Investments per share were calculated considering the number of outstanding shares at the end of each quarte r. ▪ Notes to page 25 (1) In the First Quarter of 2024, Vinci Partners executed a strategic realignment across our segments, reassigning R$2.3 bill ion in AUM from our Hedge Funds business to IP&S, while allocating the remainder R$534 million in AUM to our Public Equities division. Pro Forma numbers for past quarters and last twelve months re fle ct the retroactive adjustment for this managerial reassignment. ▪ Notes to page 26 (1) In the First Quarter of 2024, Vinci Partners executed a strategic realignment across our segments, reassigning R$2.3 bill ion in AUM from our Hedge Funds business to IP&S, while allocating the remainder R$534 million in AUM to our Public Equities division. Pro Forma numbers for past quarters and last twelve months re fle ct the retroactive adjustment for this managerial reassignment. ▪ Notes to page 31 (1) NAV is the net asset value of each fund. For listed vehicles, the NAV represents the Market valuation of the fund.

45 Notes and Definitions (cont’d.) (2) Atlas strategy includes the funds Atlas FIC FIM, Atlas Institucional FIC FIM and Vinci Potenza. (3) Total Return Strategy includes the funds Total Return FIC FIM and Total Return Institucional FIA. (4) Mosaico Strategy includes the funds Mosaico, Mosaico Institucional and Mosaico Advisory FIA. (5) Valorem Strategy includes the funds Valorem FIM and Valorem Advisory. (6) Equilíbrio Strategy incudes the IP&S Family of pension plans. (7) CDI is an average of interbank overnight rates in Brazil (daily average for the period). (8) Brazil stock market most relevant index. (9) IPCA is a broad consumer price index measured by the IBGE. (10) IMAB is composed by government bonds indexed to IPCA. IMAB 5 also includes government bonds indexed to IPCA with up to 5 Ye ars in duration. (11) IFIX is an index composed by listed REITs in the Brazilian stock Market. (12) If IMAB 5 Average is: i. less or equal to 2%, X=3% per year; ii. between 2% - 4%, X= Average IMAB 5+1% per year; iii. Between 4% - 5%, X=5% per year; IV. greater or equal to 5%, X= IMAB 5 Average ▪ Notes to page 32 (1) Track record information is presented throughout this presentation on a pro forma basis and in local currency, excluding PIP E investments, a strategy that will be discontinued in VCP III. (2) Total commitments for VCP III include R$1.3 billion in co - investments. Track record presented for the VCP strategy as of 4Q’ 23, due to fund’s administrator timeline to disclose the quarterly markup of the fund, with the exception of total commitments for VCP IV, which are presented as of 1Q’24. (3) Performance information for Nordeste Empreendedor (“NE I”) comprises only the four (out of seven) investments invested, managed and divested by a team led by Jose Pano (collec ti vely, the ‘”Participating Investments”) while they were employed by NE I’s manager (the “NE I Manager”), an entity not affiliated with the manager or Vinci Partners. Information herein pertaining to any investments made by NE I manager has not been prepared by NE I manager and NE I manager assumes no responsibility for the acc ura cy or completeness of any such information. (4) Track record for VIR strategy is presented as of 4Q’23, due to fund’s administrator timeline to disclose the quarterly ma rku p of the fund. (5) Track record for Vinci SPS strategy is presented as of 1Q’24. (6) Track record for FIP Infra is presented as of 4Q’23. (7) Track record for VIAS is presented as of 4Q’23. (8) Total commitments for VICC are presented as of 1Q’24. (9) Track record for VFDL is presented as of 1Q’24. (10) Track record for Vinci Credit Infra is presented as of 1Q’24.

46 Notes and Definitions (cont’d.) ▪ Notes to page 33 (1) US$ Distributable Earnings was calculated considering the exchange rate from USD to BRL of 5.0610, as of May 07, 2024, wh en dividends were approved by our Board of Directors. (2) Per Share calculations are based on end of period Participating Common Shares. (3) Actual dividends per common share are calculated considering the share count as of the applicable record date. ▪ Notes to page 34 (1) As of March 28, 2024, Public Float was comprised of 12,510,083 Class A common shares. ▪ Notes to page 35 (1) The remaining capital committed in FIP Infra Transmissão and FIP Infra Transmissão co - investment will not be called by the fund, which is already in divestment period. ▪ Notes to page 36 (1) International mandates have several different benchmarks across its vehicles. (2) The preferred return w/ catch - up rule applies to funds for which the vehicle must pay back its limited partners 100% of the invested capital corrected by the preferred return rate so it can charge performance fees. Once the preferred return rate is achieved, due to the catch - up clause, performance fees are charged over the absolute return of the fund instead of the excess return over the preferred rate. (3) Hurdle Rate is the minimum return the fund must achieve before it can charge performance fees. In most cases, funds with hur dle rate also are under a high - water mark clause . (4) Funds with preferred return must return 100% of invested capital corrected by the preferred return rate to its limited pa rtn ers in order to charge performance fees. (5) IPCA is a broad consumer price index measured by the IBGE. (6) IMAB 5 is composed by government bonds indexed to IPCA with up to 5 years in duration. (7) IBOV is the Brazilian stock market's most relevant index; (8) FTSE is London's stock market most relevant index; (9) IFIX is an index composed by listed REITs in the Brazilian stock exchange. (10) The CDI rate is a result of the average interbank overnight rates in Brazil (daily average for the period). (11) IMAB is composed by government bonds indexed to IPCA (inflation rate) plus a fixed interest rate. ▪ Notes to page 38 (1) Other items comprise the income/(loss) generated by contingent consideration adjustment and financial income/(expenses) r ela ted to SPS acquisition and Ares investment. (2) Non - operational expenses are comprised of expenses related to professional services rendered in connection with acquisitions .

47 Notes and Definitions (cont’d.) ( 3) Income taxes are comprised of taxes calculated over our corporate income tax and social contribution taxes. We are taxed o n a n actual taxable profit regime, while part of our subsidiaries are taxed based on deemed profit. (4) Contingent consideration adjustment (after - tax) related to Vinci SPS’ acquisition, reflects the change in the earn out’s fai r value to be paid in 2027. On March 28, 2024, Vinci revaluated the fair value of the obligation based on the economic conditions at the date, resulting in an increase of the contingent consideratio n f air value. The variation was recognized as a loss in the financial result. ▪ Notes to page 39 (1) Contingent consideration adjustment (after - tax) related to Vinci SPS’ acquisition, reflects the change in the earn out’s fai r value to be paid in 2027. On March 28, 2024, Vinci revaluated the fair value of the obligation based on the economic conditions at the date, resulting in an increase of the contingent consideratio n f air value. The variation was recognized as a loss in the financial result. (2) Non - operational expenses are comprised of expenses related to professional services rendered in connection with acquisitions . ▪ Notes to page 40 (1) Brazilian tax law establishes that companies that generate gross revenues of up to R$ 78,000.00 in the prior fiscal year may calculate income taxes as a percentage of gross revenue, using the presumed profit income tax regime. The Entity's subsidiaries adopted this tax regime and the effect of the presumed profit of su bsidiaries represents the difference between the taxation based on this method and the amount that would be due based on the statutory rate applied to the taxable profit of the subsidiaries.

48 Notes and Definitions (cont’d.) ▪ “Fee related earnings”, or “FRE”, is a metric to monitor the baseline performance of, and trends in, our business, in a manne r t hat does not include performance fees, investment income and expenses that do not arise from our normal course of operations. FRE is calculated as operating profit, less (a) net revenue fro m realized performance fees, less (b) net revenue from unrealized performance fees, plus (c) share - based payments, plus (d) compensation allocated in relation to performance fees, plus (e) non - o perational expenses, which are comprised of expenses relating to professional services rendered in connection with acquisitions and our international corporate organization. ▪ “FRE Margin” is calculated as FRE divided by the sum of net revenue from fund management and net revenue from advisory servic es. ▪ “Distributable Earnings”, or “DE”, is used as a reference point by our board of directors to assess our performance and capab ili ties to distribute dividends to our shareholders. Distributable Earnings is calculated as profit for the year, less (a) net revenue from unrealized performance fees, plus (b) income taxes f rom unrealized performance fees, plus (c) compensation allocated in relation to unrealized performance fees, less (d) unrealized gain from investment income, plus (e) income taxes on unrealized ga in from investment income, plus (f) share - based payments, plus (g) income taxes on share - based payments, plus (h) depreciation and amortization, except for depreciation and amortization relat ing to each segment’s investments, less (i) contingent consideration (earn - out) gain (loss) (after tax). ▪ “DE Margin” is calculated as Distributable Earnings divided by sum of net revenue from fund management, net revenue from perf orm ance fees, net revenue from advisory services and realized gain from investment income. ▪ “Performance Related Earnings”, or “PRE”, is a performance measure that we use to assess our ability to generate profits from re venue that relies on outcome from funds above their respective benchmarks. We calculate PRE as operating profit less (a) net revenue from fund management, less (b) net revenue from advisor y s ervices, plus (c) personnel and profit - sharing expenses, plus (d) other general and administrative expenses, less (e) compensation in relation to performance fees. ▪ “Segment Distributable Earnings” is Vinci Partners’ segment profitability measure used to make operating decisions and assess pe rformance across the company’s five segments (Private Markets, Public Equities, Investment Products and Solutions, Retirement Services and Corporate Advisory). Segment Distributab le Earnings is calculated as operating profit less (a) net revenue from unrealized performance fees, plus (b) compensation allocated in relation to unrealized performance fees, plus (c) realiz ed gain from GP investment income. ▪ “AUM” refers to assets under management. Our AUM equals the sum of: (1) the fair market value of all funds and management acc oun ts managed by Vinci Partners, across Private Equity, Real Estate, Infrastructure, Vinci SPS, Credit, IP&S, Public Equities and Retirement Services; (2) the capital that we are en tit led to call from investors in funds pursuant to the terms of their capital commitments to those funds; and (3) the fair market value of co - investments arranged by us that were made or could be ma de by limited partners of our corporate private equity funds and portfolio companies of such funds. AUM includes double counting related to funds from one segment that invest in funds fr om another segment. Those cases occur mainly due to (a) fund, of funds of investment products and solutions segment, and (b) investment funds in general that invest part of their cash in cre dit segment and hedge fund segment funds in order to maintain liquidity and provide for returns on cash. Such amounts are eliminated on consolidation. The bylaws of the relevant funds pro hib it double - charging fees on AUM across segments. Therefore, while our AUM by segment may double - count funds from one segment that invest in funds from another segment, the revenues for any given segment do not include revenue in respect of assets managed by another segment, which means there are no intercompany eliminations on revenues in our results of operation s. ▪ Net Cash and Investments include cash and cash equivalents and the fair value of investments in liquid funds and GP Fund Inve stm ents. Cash and cash equivalents include cash, certificate of deposits, which are issued by Banco Bradesco (credit rating AAA evaluated by Fitch Ratings) with interest rates from 99.5% to 10 1% of CDI.