Village Farms International, Inc. (“Village Farms” or the

“Company”) (NASDAQ: VFF) today announced its financial results for

the fourth quarter and year ended December 31, 2022. All figures

are in U.S. dollars unless otherwise indicated.

Management Commentary

“The fourth quarter of 2022 once again

demonstrated the momentum in our Canadian Cannabis business as

investments in new brands and product innovations contributed to

25% year-over-year growth in retail branded sales and our 17th

consecutive quarter of positive adjusted EBITDA,” said Michael

DeGiglio, Chief Executive Officer, Village Farms. “We achieved a

major milestone in 2022: Our Canadian Cannabis business became the

number two top-selling cannabis company nationally1, growing market

share sequentially every quarter during 2022. We have maintained

this number two position in the first two months of 2023 despite

distressed sales of biomass and ongoing promotional activity in

certain parts of the Canadian market. Our strong brand recognition,

innovation, and low-cost, consistent cultivation are a powerful

combination in a market which is expected to grow steadily over the

next three to five years.”

“During 2023, we expect strong commercial

execution, continuous innovation and sales to export markets will

deliver another year of market-leading results in our Canadian

Cannabis business. At the same time, we are focused on continued

gains in production efficiencies and expense improvements.”

“In our U.S. Cannabis business, Balanced Health

Botanicals continues to perform well in a challenging consumer

market for CBD, based on its leading CBDistillery® brand and

innovative product introductions, including the strong performance

of its hemp-derived THC Synergy+ line of products. This, combined

with prudent cost management, drove positive EBITDA for our U.S.

Cannabis business for the fourth quarter.”

“In our Fresh Produce business, we again reduced

the adjusted EBITDA loss during the fourth quarter, driven by

improvements in our Texas operations. The Fresh Produce business

remains strategic for Village Farms and our customers, and it must

return to profitability. Following a comprehensive review of our

operations, we have initiated a multi-part plan, including

technology and operational enhancements, as well as the decision to

divest our Permian Basin facility, which we view as non-strategic

for our long-term optimized Fresh strategy or a longer-term

Texas-based and national legal cannabis market. We are confident

these initiatives, in aggregate, combined with an improving macro

environment compared with that of 2022, will contribute to

substantially improved financial performance from Fresh Produce in

2023.”

1. Based on estimated retail sales from HiFyre, other third

parties and provincial boards.

Fourth Quarter 2022 Financial

Highlights(All comparable periods are for the

fourth quarter of 2021 unless otherwise stated)

Consolidated

- Consolidated sales were $69.5

million, a decrease of ($3.3 million), or (5%), from $72.8 million,

with the stronger U.S. dollar compared to the Canadian dollar

decreasing reported U.S. sales for our Canadian Cannabis operations

by ($2.4 million). On a constant currency basis, consolidated sales

decreased by (1%);

- Consolidated net loss was ($49.3

million), or ($0.54) per share, compared with net income of $2.1

million, or $0.03 per share;

- Consolidated net loss included an

impairment of $13.5 million related to the acquisition of Balanced

Health Botanicals, a write down in the Canadian Cannabis business

of $11.0 million (C$15.0 million) of lower potency flower inventory

that was more than 12 months old, with the write down partially

attributable to lower pricing in the non-branded market, and

provision for income taxes of $30.4 million;

- Consolidated adjusted EBITDA was

negative ($0.8 million) compared with positive adjusted EBITDA of

$4.8 million; and,

- Completed a registered direct

offering with certain institutional investors for the purchase and

sale of an aggregate of 18,350,000 common shares at US$1.35 per

share, together with accompanying warrants to purchase up to

18,350,000 common shares (exercise price of US$1.65 per share) for

gross proceeds from the sale of the common shares of approximately

US$25 million and potential proceeds from the exercise of all

warrants of approximately US$30 million, with the net proceeds

intended to be used for general working capital purposes.

Cannabis Segment

- Total Cannabis segment net sales

decreased (2.0%) year-over-year to $33.2 million, representing

47.9% of total Village Farms sales; and,

- Total Cannabis segment adjusted

EBITDA was $5.0 million compared with $6.2 million.

Canadian Cannabis (Pure Sunfarms and Rose LifeScience)

- Canadian Cannabis net sales

increased 13.1% to a $27.9 million (C$38.2 million) on a constant

currency basis;

- Canadian Cannabis retail branded

sales increased 25% year-over-year (fourth quarter), and 25% for

the full 2022 year;

- Canadian Cannabis wholesale sales

decreased (35%) due to continued significant erosion in market

pricing as distressed producers liquidate inventories;

- Canadian Cannabis cost of sales

included an inventory write down of $11.0 million (C$15.0 million)

of lower potency flower that was more than 12 months old, with the

write down partially attributable to lower pricing in the

non-branded market. Excluding the write down, gross margin for

Canadian Cannabis was 40%, consistent with its stated target range

of 30% to 40%; and

- Canadian Cannabis adjusted EBITDA

was $4.7 million (C$6.3 million);

U.S. Cannabis (Balanced Health Botanicals and VF Hemp)

- U.S. Cannabis net sales were $5.3

million, with a gross margin of 67.2% and adjusted EBITDA of $0.3

million compared with net sales of $7.5 million, with a gross

margin of 70.1% and adjusted EBITDA of $1.8 million.

Village Farms Fresh

(Produce)

- Sales were $36.2 million compared

with $38.4, primarily due to a smaller growing area in Texas in

fourth quarter of 2022, lower production from our Canadian tomato

greenhouse due to the Brown Rugose virus in the fourth quarter of

2022 and lower third-party supplier volume in the fourth quarter of

2022 due to loss of some contracts in late 2022 that have been

replaced in 2023 with new growers.

- Adjusted EBITDA was negative ($3.0

million) compared with positive $1.2 million. Adjusted EBITDA for

the fourth quarter was a sequential improvement over negative ($4.9

million) reported for the third quarter of 2022. Adjusted EBITDA

for the second half of 2022 improved to negative ($7.9) from

negative ($15.1 million) for the first half of 2022.

Strategic Growth and Operational

Highlights

Canadian Cannabis

- Became the number two ranked cannabis producer in Canada by

market share for the fourth quarter, maintaining the number two

position during the first two months of 2023, and was the

top-selling cannabis producer in Canada across all product

categories in October 20223;

- Continued to expand its number one market share position in the

dried flower category in Canada;

- Rose LifeScience expanded its number two market share position

in Quebec1, which it achieved within the first year of acquisition

by Village Farms, maintaining the number two position during the

first two months of 20233;

- Continued the roll out of a second BC-grown brand, The Original

Fraser Valley Weed Co., focused on the value segment of the market,

with introductions of additional SKUs in British Columbia and

Alberta, as well as launch in Ontario, all of which contributed to

national market share growth;

- Launched Soar, a cannabis brand complementary to its existing

brands, designed to deliver an elevated cannabis experience with

limited quantity batches of exotic and unique genetics that are

hand-harvested, hang-dried, and hand-detailed; and,

- Rose Lifescience established partnerships with three regional

micro-producers, Cannabitibi, Teca Canna and Le Malin Vert,

expanding the number of micro-producers under the brand of the

cannabis collective DLYS to 11.

U.S. Cannabis

- Continued to have success with its Synergy+ line of

hemp-derived, THC products with strong sequential quarterly growth

in sales since launch.

International Cannabis

- Commenced shipping cannabis products (produced by Pure

Sunfarms) to Israel for that country’s medical market under an

exclusive three-year supply agreement with Israel-based Dr.

Samuelov Importing and Marketing Ltd., doing business as Better

Pharma; and,

- Sales to Australia for the fourth quarter increased more than

ten-fold from the first quarter of 2022.

1. Based on estimated retail sales from HiFyre, other third

parties and provincial boards.

Canadian Cannabis Financial Performance

Summary

|

(millions except % metrics) |

Three Months Ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

Change of C$ |

|

|

C$ |

US$ |

C$ |

US$ |

|

|

Total Gross Sales |

$ |

59.9 |

|

$ |

44.1 |

|

$ |

46.3 |

|

$ |

36.7 |

|

+29 |

% |

|

Total Net Sales |

$ |

38.2 |

|

$ |

27.9 |

|

$ |

33.8 |

|

$ |

26.8 |

|

+12 |

% |

|

Total Cost of Sales 1 |

$ |

37.8 |

|

$ |

27.8 |

|

$ |

19.6 |

|

$ |

14.5 |

|

-92 |

% |

|

Cost of Sales Excluding Inventory Write Down |

$ |

22.8 |

|

$ |

16.8 |

|

$ |

19.6 |

|

$ |

14.5 |

|

-16 |

% |

|

Gross Margin 1 |

$ |

0.2 |

|

$ |

0.1 |

|

$ |

14.2 |

|

$ |

11.3 |

|

-99 |

% |

|

Gross Margin % 1 |

|

1 |

% |

|

1 |

% |

|

42 |

% |

|

42 |

% |

-98 |

% |

|

Gross Margin Excluding Inventory Write Down |

$ |

15.1 |

|

$ |

11.1 |

|

N/A |

N/A |

N/A |

|

Gross Margin % Excluding Inventory Write Down |

|

40 |

% |

|

40 |

% |

N/A |

N/A |

N/A |

|

SG&A |

$ |

10.0 |

|

$ |

7.3 |

|

$ |

9.2 |

|

$ |

7.2 |

|

-9 |

% |

|

Share-based compensation |

$ |

0.5 |

|

$ |

0.5 |

|

$ |

1.6 |

|

$ |

1.2 |

|

+69 |

% |

|

Net income |

($ |

3.8 |

) |

($ |

2.8 |

) |

$ |

4.4 |

|

$ |

3.5 |

|

-86 |

% |

|

Adjusted EBITDA 2 |

$ |

6.3 |

|

$ |

4.7 |

|

$ |

6.1 |

|

$ |

4.9 |

|

+3 |

% |

|

Adjusted EBITDA Margin 2 |

|

17 |

% |

|

17 |

% |

|

18 |

% |

|

18 |

% |

-11 |

% |

|

(millions except % metrics) |

Year Ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

Change of C$ |

|

|

C$ |

US$ |

C$ |

US$ |

|

|

Total Gross Sales |

$ |

214.0 |

|

$ |

170.7 |

|

$ |

164.4 |

|

$ |

131.2 |

|

+30 |

% |

|

Total Net Sales |

$ |

143.5 |

|

$ |

109.9 |

|

$ |

120.8 |

|

$ |

96.4 |

|

+19 |

% |

|

Total Cost of Sales 1 |

$ |

104.7 |

|

$ |

80.5 |

|

$ |

72.5 |

|

$ |

57.8 |

|

-44 |

% |

|

Cost of Sales Excluding Inventory Write Down |

$ |

89.7 |

|

$ |

69.5 |

|

$ |

72.5 |

|

$ |

57.8 |

|

-24 |

% |

|

Gross Margin 1 |

$ |

38.3 |

|

$ |

29.4 |

|

$ |

48.3 |

|

$ |

38.6 |

|

-21 |

% |

|

Gross Margin % 1 |

|

27 |

% |

|

27 |

% |

|

40 |

% |

|

40 |

% |

-33 |

% |

|

Gross Margin Excluding Inventory Write Down |

$ |

53.3 |

|

$ |

40.4 |

|

N/A |

N/A |

N/A |

|

Gross Margin % Excluding Inventory Write Down |

|

37 |

% |

|

37 |

% |

N/A |

N/A |

N/A |

|

SG&A |

$ |

39.4 |

|

$ |

30.2 |

|

$ |

26.3 |

|

$ |

20.9 |

|

-50 |

% |

|

Share-based compensation |

$ |

1.7 |

|

$ |

1.4 |

|

$ |

3.5 |

|

$ |

2.7 |

|

+51 |

% |

|

Net income |

$ |

0.2 |

|

$ |

0.1 |

|

$ |

11.5 |

|

$ |

9.2 |

|

-98 |

% |

|

Adjusted EBITDA 2 |

$ |

17.1 |

|

$ |

13.1 |

|

$ |

29.3 |

|

$ |

23.4 |

|

-42 |

% |

|

Adjusted EBITDA Margin 2 |

|

12 |

% |

|

12 |

% |

|

24 |

% |

|

24 |

% |

-50 |

% |

1. Total cost of

sales and gross margin for the three months and twelve months ended

December 31, 2022 include a one-time inventory write down of

C$15,000 (US$11,038). Total cost of sales and gross margin for the

year ended December 31, 2022 excludes a US$1,404 catch-up of

intangible amortization resulting from the finalization of Rose

purchase price accounting in the third quarter of 2022. The year

ended December 31, 2021, cost of sales excludes the C$2,291

(US$1,841) inventory adjustment charge from the revaluation of

inventory to fair value at the acquisition date of November 2,

2020.2. Adjusted EBITDA is a non-GAAP measure, is not a recognized

earnings measure and does not have a standard meaning prescribed in

by GAAP. For a reconciliation of Adjusted EBITDA to net income, see

“Reconciliation of Net Income to Adjusted EBITDA” below.

Canadian Cannabis’ Percent of Sales by

Product Group1

|

|

Three months ended December

31, |

Year ended December 31, |

|

Channel |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Retail, Flower |

83 |

% |

64 |

% |

73 |

% |

64 |

% |

|

Retail, Derivatives |

3 |

% |

11 |

% |

4 |

% |

10 |

% |

|

Wholesale, Flower and Trim |

14 |

% |

25 |

% |

23 |

% |

26 |

% |

- Excludes Rose LifeScience

commission-based revenue.

PRESENTATION OF FINANCIAL RESULTS

The Company’s financial statements for the three and 12 months

ended December 31, 2022, as well as the comparative periods for

2021, have been prepared and presented under United States

Generally Accepted Accounting Principles (“GAAP”). Village Farms

acquired 100% of Balanced Health Botanicals on August 16, 2021 and

their operating results are consolidated in our Consolidated

Statements of Income (Loss) for the three and 12 months ended

December 31, 2022 as well as for August 16, 2021 through December

31, 2021 for the 12 months ended December 31, 2021. The Company

acquired 70% of Rose LifeScience on November 15, 2021 and their

results are presented in the operations of our consolidated

wholly-owned subsidiaries and the minority interest is presented in

Net Income (Loss) Attributable to Non-controlling Interests, Net of

Tax for the three and 12 months ended December 31, 2022.

RESULTS OF OPERATIONS (In thousands of U.S.

dollars, except per share amounts, and unless otherwise noted)

Consolidated Financial Performance

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2022 (1) |

|

|

2021 (1) |

|

|

2022 (1) |

|

|

2021 (1) |

|

|

Sales |

|

$ |

69,457 |

|

|

$ |

72,380 |

|

|

$ |

293,572 |

|

|

$ |

268,020 |

|

| Cost of sales |

|

|

(66,561 |

) |

|

|

(52,664 |

) |

|

|

(266,075 |

) |

|

|

(222,841 |

) |

| Gross margin |

|

|

2,896 |

|

|

|

19,716 |

|

|

|

27,497 |

|

|

|

45,179 |

|

| Selling, general and

administrative expenses |

|

|

(17,037 |

) |

|

|

(16,208 |

) |

|

|

(68,278 |

) |

|

|

(46,384 |

) |

| Share-based compensation |

|

|

(983 |

) |

|

|

(1,828 |

) |

|

|

(3,987 |

) |

|

|

(7,533 |

) |

| Interest expense |

|

|

(914 |

) |

|

|

(923 |

) |

|

|

(3,244 |

) |

|

|

(2,835 |

) |

| Interest income |

|

|

78 |

|

|

|

27 |

|

|

|

207 |

|

|

|

126 |

|

| Foreign exchange loss |

|

|

(84 |

) |

|

|

159 |

|

|

|

(2,255 |

) |

|

|

(476 |

) |

| Other expense, net |

|

|

(109 |

) |

|

|

(26 |

) |

|

|

(115 |

) |

|

|

(420 |

) |

| Impairments (2) |

|

|

(13,500 |

) |

|

|

— |

|

|

|

(43,299 |

) |

|

|

— |

|

| Write-off of joint venture

loan |

|

|

— |

|

|

|

— |

|

|

|

(592 |

) |

|

|

— |

|

| (Provision for) recovery of

income taxes |

|

|

(19,244 |

) |

|

|

983 |

|

|

|

(4,681 |

) |

|

|

3,526 |

|

| (Loss) income from consolidated

entities |

|

|

(48,897 |

) |

|

|

1,900 |

|

|

|

(98,747 |

) |

|

|

(8,817 |

) |

| Less: net loss attributable to

non-controlling interests, net of tax |

|

|

(432 |

) |

|

|

— |

|

|

|

269 |

|

|

|

46 |

|

| Income (loss) from equity method

investments |

|

|

— |

|

|

|

175 |

|

|

|

(2,668 |

) |

|

|

(308 |

) |

| Net (loss) income attributable to

Village Farms International Inc. |

|

$ |

(49,329 |

) |

|

$ |

2,075 |

|

|

$ |

(101,146 |

) |

|

$ |

(9,079 |

) |

| Adjusted EBITDA (3) |

|

$ |

(758 |

) |

|

$ |

4,829 |

|

|

$ |

(21,311 |

) |

|

$ |

14,012 |

|

| Basic (loss) income per

share |

|

$ |

(0.54 |

) |

|

$ |

0.03 |

|

|

$ |

(1.13 |

) |

|

$ |

(0.11 |

) |

| Diluted (loss) income per

share |

|

$ |

(0.54 |

) |

|

$ |

0.03 |

|

|

$ |

(1.13 |

) |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- For the three and twelve months

ended December 31, 2022 and for the period August 16, 2021 through

December 31, 2021, Balanced Health is fully consolidated in the

financial results of the Company. For the three and twelve months

ended December 31, 2022 and for the period November 15, 2021 to

December 31, 2021, Rose LifeScience financial results are fully

consolidated in the financial results of the Company with the

minority non-controlling interest presented in net loss

attributable to non-controlling interests, net of tax.

- Consists of impairments to goodwill

of ($43,299) that were triggered by inflationary effects on

consumer spending, decreases in market capitalization of CBD

companies and the continued federal regulation lack of clarity with

respect to CBD. See Part 2, Item 8 Note 11 “Goodwill and Intangible

Assets” for additional details.

- Adjusted EBITDA is not a recognized

earnings measure and does not have a standardized meaning

prescribed by GAAP. Therefore, Adjusted EBITDA may not be

comparable to similar measures presented by other issuers.

Management believes that Adjusted EBITDA is a useful supplemental

measure in evaluating the performance of the Company because it

excludes non-recurring and other items that do not reflect our

business performance. Adjusted EBITDA includes the Company’s 70%

interest in Rose LifeScience since acquisition and 65% interest in

VFH.

SEGMENTED RESULTS OF OPERATIONS

(In thousands of U.S. dollars, except per share

amounts, and unless otherwise noted)

|

|

For the Three Months Ended December 31, 2022 |

|

|

|

VF Fresh(Produce) |

|

|

Cannabis Canada (1) |

|

|

Cannabis U.S. (1) |

|

|

CleanEnergy |

|

|

Corporate |

|

|

Total |

|

|

Sales |

$ |

36,200 |

|

|

$ |

27,926 |

|

|

$ |

5,331 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

69,457 |

|

| Cost of sales |

|

(37,021 |

) |

|

|

(27,755 |

) |

|

|

(1,744 |

) |

|

|

(41 |

) |

|

|

— |

|

|

|

(66,561 |

) |

| Selling, general and

administrative expenses |

|

(3,279 |

) |

|

|

(7,331 |

) |

|

|

(3,787 |

) |

|

|

(5 |

) |

|

|

(2,635 |

) |

|

|

(17,037 |

) |

| Share-based compensation |

|

— |

|

|

|

(476 |

) |

|

|

(38 |

) |

|

|

— |

|

|

|

(469 |

) |

|

|

(983 |

) |

| Other (expense) income, net |

|

(411 |

) |

|

|

(533 |

) |

|

|

(94 |

) |

|

|

(37 |

) |

|

|

46 |

|

|

|

(1,029 |

) |

| Impairments |

|

— |

|

|

|

— |

|

|

|

(13,500 |

) |

|

|

— |

|

|

|

— |

|

|

|

(13,500 |

) |

| Recovery of (provision for)

income taxes |

|

(16,236 |

) |

|

|

5,759 |

|

|

|

(7,025 |

) |

|

|

— |

|

|

|

(1,742 |

) |

|

|

(19,244 |

) |

| Loss from consolidated

entities |

|

(20,747 |

) |

|

|

(2,410 |

) |

|

|

(20,857 |

) |

|

|

(83 |

) |

|

|

(4,800 |

) |

|

|

(48,897 |

) |

| Less: net loss attributable to

non-controlling interests, net of tax |

|

— |

|

|

|

(432 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(432 |

) |

| Net (loss) income |

|

(20,747 |

) |

|

|

(2,842 |

) |

|

|

(20,857 |

) |

|

|

(83 |

) |

|

|

(4,800 |

) |

|

|

(49,329 |

) |

| Adjusted EBITDA (3) |

$ |

(3,007 |

) |

|

$ |

4,722 |

|

|

$ |

266 |

|

|

$ |

(83 |

) |

|

$ |

(2,656 |

) |

|

$ |

(758 |

) |

| Basic (loss) income per

share |

$ |

(0.22 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.54 |

) |

| Diluted (loss) income per

share |

$ |

(0.22 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.54 |

) |

|

|

For the Three Months Ended December 31, 2021 |

|

|

|

VF Fresh(Produce) |

|

|

Cannabis Canada (1) |

|

|

Cannabis U.S. (1) |

|

|

CleanEnergy |

|

|

Corporate |

|

|

Total |

|

|

Sales |

$ |

38,438 |

|

|

$ |

26,382 |

|

|

$ |

7,517 |

|

|

$ |

43 |

|

|

$ |

— |

|

|

$ |

72,380 |

|

| Cost of sales |

|

(35,819 |

) |

|

|

(14,455 |

) |

|

|

(2,217 |

) |

|

|

(173 |

) |

|

|

— |

|

|

|

(52,664 |

) |

| Selling, general and

administrative expenses |

|

(3,244 |

) |

|

|

(7,131 |

) |

|

|

(3,761 |

) |

|

|

(45 |

) |

|

|

(2,027 |

) |

|

|

(16,208 |

) |

| Share-based compensation |

|

— |

|

|

|

(1,267 |

) |

|

|

(95 |

) |

|

|

— |

|

|

|

(466 |

) |

|

|

(1,828 |

) |

| Other income (expense), net |

|

419 |

|

|

|

(1,400 |

) |

|

|

148 |

|

|

|

(7 |

) |

|

|

77 |

|

|

|

(763 |

) |

| (Provision for) recovery of

income taxes |

|

(597 |

) |

|

|

966 |

|

|

|

— |

|

|

|

— |

|

|

|

614 |

|

|

|

983 |

|

| (Loss) income from consolidated

entities |

|

(803 |

) |

|

|

3,095 |

|

|

|

1,592 |

|

|

|

(182 |

) |

|

|

(1,802 |

) |

|

|

1,900 |

|

| Income from equity method

investments |

|

— |

|

|

|

— |

|

|

|

175 |

|

|

|

— |

|

|

|

— |

|

|

|

175 |

|

| Net (loss) income |

|

(803 |

) |

|

|

3,095 |

|

|

|

1,767 |

|

|

|

(182 |

) |

|

|

(1,802 |

) |

|

|

2,075 |

|

| Adjusted EBITDA (3) |

$ |

1,179 |

|

|

$ |

4,438 |

|

|

$ |

1,832 |

|

|

$ |

(74 |

) |

|

$ |

(2,546 |

) |

|

$ |

4,829 |

|

| Basic (loss) income per

share |

$ |

(0.01 |

) |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

$ |

0.03 |

|

| Diluted (loss) income per

share |

$ |

(0.01 |

) |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

$ |

0.03 |

|

|

|

For the Year Ended December 31, 2022 |

|

|

|

VF Fresh(Produce) |

|

|

Cannabis Canada (1) |

|

|

Cannabis U.S. (1) |

|

|

CleanEnergy |

|

|

Corporate |

|

|

Total |

|

|

Sales |

$ |

160,252 |

|

|

$ |

109,882 |

|

|

$ |

23,302 |

|

|

$ |

136 |

|

|

$ |

— |

|

|

$ |

293,572 |

|

| Cost of sales |

|

(177,634 |

) |

|

|

(80,494 |

) |

|

|

(7,643 |

) |

|

|

(304 |

) |

|

|

— |

|

|

|

(266,075 |

) |

| Selling, general and

administrative expenses |

|

(12,004 |

) |

|

|

(30,235 |

) |

|

|

(16,000 |

) |

|

|

(58 |

) |

|

|

(9,981 |

) |

|

|

(68,278 |

) |

| Share-based compensation |

|

— |

|

|

|

(1,373 |

) |

|

|

(305 |

) |

|

|

— |

|

|

|

(2,309 |

) |

|

|

(3,987 |

) |

| Other expense, net |

|

(1,187 |

) |

|

|

(2,023 |

) |

|

|

(247 |

) |

|

|

(43 |

) |

|

|

(1,907 |

) |

|

|

(5,407 |

) |

| Write-off of joint venture

loan |

|

— |

|

|

|

— |

|

|

|

(592 |

) |

|

|

— |

|

|

|

— |

|

|

|

(592 |

) |

| Impairments (2) |

|

— |

|

|

|

— |

|

|

|

(43,299 |

) |

|

|

— |

|

|

|

— |

|

|

|

(43,299 |

) |

| (Provision for) recovery of

income taxes |

|

(9,914 |

) |

|

|

4,091 |

|

|

|

— |

|

|

|

— |

|

|

|

1,142 |

|

|

|

(4,681 |

) |

| (Loss) income from consolidated

entities |

|

(40,487 |

) |

|

|

(152 |

) |

|

|

(44,784 |

) |

|

|

(269 |

) |

|

|

(13,055 |

) |

|

|

(98,747 |

) |

| Less: net loss attributable to

non-controlling interests, net of tax |

|

— |

|

|

|

269 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

269 |

|

| Loss from equity method

investments |

|

— |

|

|

|

— |

|

|

|

(2,668 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,668 |

) |

| Net (loss) income |

|

(40,487 |

) |

|

|

117 |

|

|

|

(47,452 |

) |

|

|

(269 |

) |

|

|

(13,055 |

) |

|

|

(101,146 |

) |

| Adjusted EBITDA (3) |

$ |

(24,369 |

) |

|

$ |

13,085 |

|

|

$ |

223 |

|

|

$ |

(263 |

) |

|

$ |

(9,987 |

) |

|

$ |

(21,311 |

) |

| Basic (loss) income per

share |

$ |

(0.45 |

) |

|

$ |

0.00 |

|

|

$ |

(0.52 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.16 |

) |

|

$ |

(1.13 |

) |

| Diluted (loss) income per

share |

$ |

(0.45 |

) |

|

$ |

0.00 |

|

|

$ |

(0.52 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.16 |

) |

|

$ |

(1.13 |

) |

|

|

For the Year Ended December 31, 2021 |

|

|

|

VF Fresh(Produce) |

|

|

Cannabis Canada (1) |

|

|

Cannabis U.S. (1) |

|

|

CleanEnergy |

|

|

Corporate |

|

|

Total |

|

|

Sales |

$ |

159,996 |

|

|

$ |

96,434 |

|

|

$ |

11,345 |

|

|

$ |

245 |

|

|

$ |

— |

|

|

$ |

268,020 |

|

| Cost of sales |

|

(158,305 |

) |

|

|

(59,224 |

) |

|

|

(3,398 |

) |

|

|

(1,914 |

) |

|

|

— |

|

|

|

(222,841 |

) |

| Selling, general and

administrative expenses |

|

(10,980 |

) |

|

|

(20,937 |

) |

|

|

(5,605 |

) |

|

|

(188 |

) |

|

|

(8,674 |

) |

|

|

(46,384 |

) |

| Share-based compensation |

|

— |

|

|

|

(2,738 |

) |

|

|

(158 |

) |

|

|

— |

|

|

|

(4,637 |

) |

|

|

(7,533 |

) |

| Other expense, net |

|

(379 |

) |

|

|

(2,946 |

) |

|

|

16 |

|

|

|

(36 |

) |

|

|

(522 |

) |

|

|

(3,867 |

) |

| Recovery of (provision for)

income taxes |

|

2,278 |

|

|

|

(1,688 |

) |

|

|

— |

|

|

|

— |

|

|

|

2,936 |

|

|

|

3,526 |

|

| Net (loss) income |

|

(7,390 |

) |

|

|

8,901 |

|

|

|

2,200 |

|

|

|

(1,893 |

) |

|

|

(10,897 |

) |

|

|

(9,079 |

) |

| Adjusted EBITDA (3) |

$ |

(1,959 |

) |

|

$ |

23,415 |

|

|

$ |

2,364 |

|

|

$ |

(343 |

) |

|

$ |

(9,465 |

) |

|

$ |

14,012 |

|

| Basic (loss) income per

share |

$ |

(0.09 |

) |

|

$ |

0.11 |

|

|

$ |

0.02 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.11 |

) |

| Diluted (loss) income per

share |

$ |

(0.09 |

) |

|

$ |

0.11 |

|

|

$ |

0.02 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- For the three and twelve months

ended December 31, 2022 and for the period August 16, 2021 through

December 31, 2021, Balanced Health is fully consolidated in the

financial results of the Company. For the three and twelve months

ended December 31, 2022 and for the period November 15, 2021 to

December 31, 2021, Rose LifeScience’s financial results are fully

consolidated in the financial results of the Company with the

minority non-controlling interest presented in net loss

attributable to non-controlling interests, net of tax.

- Consists of

impairments to goodwill of ($43,299) that were triggered by

inflationary effects on consumer spending, decreases in market

capitalization of CBD companies and the continued federal

regulation lack of clarity with respect to CBD. See Part 2, Item 8

Note 11 “Goodwill and Intangible Assets” for additional

details.

- Adjusted EBITDA is

not a recognized earnings measure and does not have a standardized

meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be

comparable to similar measures presented by other issuers.

Management believes that Adjusted EBITDA is a useful supplemental

measure in evaluating the performance of the Company because it

excludes non-recurring and other items that do not reflect our

business performance. Adjusted EBITDA includes the Company’s 70%

interest in Rose LifeScience since acquisition and 65% interest in

VFH.

A detailed discussion of our consolidated and segment results

can be found in our Annual Report on Form 10-K for the 12 months

ended December 31, 2022 (the “Annual Report”), which will be filed

with the Securities and Exchange Commission and will be available

at www.sec.gov, and will also be filed in Canada on SEDAR

(www.sedar.com). In addition, the Annual Report can be found on the

Village Farms website under Financial Reports

(https://villagefarms.com/financial-reports/) within the Investors

section.

Reconciliation of Net Income to Adjusted

EBITDA

The following table reflects a reconciliation of net income to

Adjusted EBITDA, as presented by the Company:

|

|

|

Three Months Ended December 31, |

Year Ended December 31, |

|

| (in thousands of

U.S. dollars) |

|

2022 (1) |

|

|

2021 (1) |

|

|

2022 (1) |

|

2021 (1) |

|

|

Net (loss) income |

|

$ |

(49,329 |

) |

|

$ |

2,075 |

|

|

$ |

(101,146 |

) |

|

$ |

(9,079 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

|

2,424 |

|

|

|

2,388 |

|

|

|

10,260 |

|

|

|

13,004 |

|

|

Foreign currency exchange loss (gain) |

|

|

86 |

|

|

|

(192 |

) |

|

|

2,268 |

|

|

|

329 |

|

|

Interest expense, net |

|

|

837 |

|

|

|

849 |

|

|

|

3,038 |

|

|

|

2,709 |

|

|

Recovery of income taxes |

|

|

21,341 |

|

|

|

(983 |

) |

|

|

7,136 |

|

|

|

(3,526 |

) |

|

Share-based compensation |

|

|

872 |

|

|

|

1,828 |

|

|

|

3,808 |

|

|

|

7,533 |

|

|

Interest expense for JV’s |

|

|

— |

|

|

|

13 |

|

|

|

38 |

|

|

|

53 |

|

|

Amortization for JVs |

|

|

241 |

|

|

|

71 |

|

|

|

1,554 |

|

|

|

71 |

|

|

(Recovery of) provision for income taxes for JV’s |

|

|

(1,467 |

) |

|

|

— |

|

|

|

(1,718 |

) |

|

|

— |

|

|

Share-based compensation for JV’s |

|

|

45 |

|

|

|

— |

|

|

|

124 |

|

|

|

— |

|

|

Other expense (income), net |

|

|

45 |

|

|

|

— |

|

|

|

(25 |

) |

|

|

— |

|

|

Deferred financing fees |

|

|

43 |

|

|

|

66 |

|

|

|

214 |

|

|

|

300 |

|

|

Incremental utility costs due to storm |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,400 |

|

|

Impairments (2) |

|

|

13,500 |

|

|

|

— |

|

|

|

43,299 |

|

|

|

— |

|

|

Loss on inventory write-down |

|

|

11,038 |

|

|

|

— |

|

|

|

11,038 |

|

|

|

|

|

|

Purchase price adjustment (3) |

|

|

(731 |

) |

|

|

(861 |

) |

|

|

(4,268 |

) |

|

|

980 |

|

|

Loss (gain) on disposal of assets |

|

|

— |

|

|

|

219 |

|

|

|

(7 |

) |

|

|

254 |

|

|

Share of loss on JV inventory impairment |

|

|

— |

|

|

|

— |

|

|

|

2,284 |

|

|

|

|

|

|

Write-off of note receivable |

|

|

— |

|

|

|

— |

|

|

|

592 |

|

|

|

|

|

|

Other expense (income), net |

|

|

297 |

|

|

|

(197 |

) |

|

|

200 |

|

|

|

(16 |

) |

| Adjusted EBITDA

(4) |

|

$ |

(758 |

) |

|

$ |

5,276 |

|

|

$ |

(21,311 |

) |

|

$ |

14,012 |

|

| Adjusted EBITDA for

JVs |

|

$ |

— |

|

|

$ |

(120 |

) |

|

$ |

(327 |

) |

|

$ |

(260 |

) |

| Adjusted EBITDA

excluding JVs |

|

$ |

(758 |

) |

|

$ |

5,396 |

|

|

$ |

(20,984 |

) |

|

$ |

14,272 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- For the three and twelve months

ended December 31, 2022 and for the period August 16, 2021 through

December 31, 2021, Balanced Health is fully consolidated in the

financial results of the Company. For the three and twelve months

ended December 31, 2022 and for the period November 15, 2021 to

December 31, 2021, Rose LifeScience’s financial results are fully

consolidated in the financial results of the Company with the

minority non-controlling interest presented in net loss

attributable to non-controlling interests, net of tax.

- Consists of

impairments to goodwill of ($43,299) that were triggered by

inflationary effects on consumer spending, decreases in market

capitalization of CBD companies and the continued federal

regulation lack of clarity with respect to CBD. See Part 2, Item 8

Note 11 “Goodwill and Intangible Assets” for additional

details.

- The purchase price adjustment

primarily reflects the non-cash accounting charge resulting from

the revaluation of Pure Sunfarms’ inventory to fair value at the

acquisition date on November 2, 2020 and the catch-up of intangible

amortization resulting from the September 30, 2022 finalization of

the Rose purchase price accounting.

- Adjusted EBITDA is not a recognized

earnings measure and does not have a standardized meaning

prescribed by GAAP. Therefore, Adjusted EBITDA may not be

comparable to similar measures presented by other issuers.

Management believes that Adjusted EBITDA is a useful supplemental

measure in evaluating the performance of the Company because it

excludes non-recurring and other items that do not reflect our

business performance. Adjusted EBITDA includes the 70% interest in

Rose LifeScience since acquisition and 65% interest in VFH.

Conference Call

Village Farms’ management team will have a

conference call to discuss its fourth quarter and year-end

financial results today, Thursday, March 9, 2023, at 8:30 a.m. ET.

Participants wanting to access the conference call by telephone

must register in advance at Village Farms Fourth Quarter 2022

Conference Call to receive the telephone dial-in

information. For those wanting to listen to the

webcast, please visit the Events and Presentations section of

Village Farms’ website here: Events - Village Farms International.

The live question and answer session will be limited to analysts,

however others are invited to submit their questions ahead of the

conference call via email at

investorrelations@villagefarms.com. Management will address

questions received via email as part of the conference call

question and answer session as time permits.

For those unable to participate in the

conference call at the scheduled time, it will be archived for

replay beginning approximately one hour following completion of the

call on Village Farms’ web site at

http://villagefarms.com/investor-relations/investor-calls.

About Village Farms International,

Inc.

Village Farms leverages decades of experience as

a large-scale, Controlled Environment Agriculture-based, vertically

integrated supplier for high-value, high-growth plant-based

Consumer Packaged Goods opportunities, with a strong foundation as

a leading fresh produce supplier to grocery and large-format

retailers throughout the US and Canada, and new high-growth

opportunities in the cannabis and CBD categories in North America

and selected markets internationally.

In Canada, the Company's wholly-owned Canadian

subsidiary, Pure Sunfarms, is one of the single largest cannabis

operations in the world, the lowest-cost greenhouse producer and

one of Canada’s best-selling brands. The Company also owns 70% of

Québec-based, Rose LifeScience, a leading third-party cannabis

products commercialization expert in the Province of Québec.

In the US, wholly-owned Balanced Health

Botanicals is one of the leading CBD brands and e-commerce

platforms in the country. Subject to compliance with all applicable

US federal and state laws and stock exchange rules, Village Farms

plans to enter the US high-THC cannabis market via multiple

strategies, leveraging one of the largest greenhouse operations in

the country (more than 5.5 million square feet in West Texas), as

well as the operational and product expertise gained through Pure

Sunfarms' cannabis success in Canada.

Internationally, Village Farms is targeting

selected, nascent, legal cannabis and CBD opportunities with

significant medium- and long-term potential, with an initial focus

on the Asia-Pacific region, Israel and Europe.

Cautionary Statement Regarding

Forward-Looking Information

As used in this Press Release, the terms

“Village Farms”, “Village Farms International”, the “Company”,

“we”, “us”, “our” and similar references refer to Village Farms

International, Inc. and our consolidated subsidiaries, and the term

“Common Shares” refers to our common shares, no par value. Our

financial information is presented in U.S. dollars and all

references in this Press Release to “$” means U.S. dollars and all

references to “C$” means Canadian dollars.

This Press Release contains forward-looking

statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995, Section 27A of the U.S.

Securities Act of 1933, as amended, (the "Securities Act") and

Section 21E of the Securities Exchange Act of 1934, as amended (the

"Exchange Act"), and is subject to the safe harbor created by those

sections. This Press Release also contains "forward-looking

information" within the meaning of applicable Canadian securities

laws. We refer to such forward-looking statements and

forward-looking information collectively as "forward-looking

statements". Forward-looking statements may relate to the Company's

future outlook or financial position and anticipated events or

results and may include statements regarding the financial

position, business strategy, budgets, expansion plans, litigation,

projected production, projected costs, capital expenditures,

financial results, taxes, plans and objectives of or involving the

Company. Particularly, statements regarding future results,

performance, achievements, prospects or opportunities for the

Company, the greenhouse vegetable or produce industry or the

cannabis industry are forward-looking statements. In some cases,

forward-looking information can be identified by such terms as

"can", "outlook", "may", "might", "will", "could", "should",

"would", "occur", "expect", "plan", "anticipate", "believe",

"intend", "try", "estimate", "predict", "potential", "continue",

"likely", "schedule", "objectives", or the negative or grammatical

variation thereof or other similar expressions concerning matters

that are not historical facts. The forward-looking statements in

this Press Release are subject to risks that may include, but are

not limited to: our limited operating history in the cannabis and

cannabinoids industry, including that of Pure Sunfarms, Inc. (“Pure

Sunfarms”), Rose LifeScience Inc. (“Rose” or “Rose LifeScience”)

and Balanced Health Botanicals, LLC (“Balanced Health”); the legal

status of the cannabis business of Pure Sunfarms and Rose and the

hemp business of Balanced Health; risks relating to the integration

of Balanced Health and Rose into our consolidated business; risks

relating to obtaining additional financing, including our

dependence upon credit facilities; potential difficulties in

achieving and/or maintaining profitability; variability of product

pricing; risks inherent in the cannabis, hemp, CBD, cannabinoids,

and agricultural businesses; market position; ability to leverage

current business relationships for future business involving hemp

and cannabinoids; the ability of Pure Sunfarms and Rose to

cultivate and distribute cannabis in Canada; existing and new

governmental regulations, including risks related to regulatory

compliance and regarding obtaining and maintaining licenses; legal

and operational risks relating to expected conversion of our

greenhouses to cannabis production in Canada and in the United

States; risks related to rules and regulations at the US federal

(Food and Drug Administration and United States Department of

Agriculture), state and municipal rules and regulations with

respect to produce and hemp, cannabidiol-based products

commercialization; retail consolidation, technological advances and

other forms of competition; transportation disruptions; product

liability and other potential litigation; retention of key

executives; labor issues; uninsured and underinsured losses;

vulnerability to rising energy costs; inflationary effects on costs

of cultivation and transportation; recessionary effects on demand

of our products; environmental, health and safety risks, foreign

exchange exposure, risks associated with cross-border trade;

difficulties in managing our growth; restrictive covenants under

our credit facilities; natural catastrophes; the ongoing COVID-19

pandemic; and tax risks.

The Company has based these forward-looking

statements on factors and assumptions about future events and

financial trends that it believes may affect its financial

condition, results of operations, business strategy and financial

needs. Although the forward-looking statements contained in this

Press Release are based upon assumptions that management believes

are reasonable based on information currently available to

management, there can be no assurance that actual results will be

consistent with these forward-looking statements. Forward-looking

statements necessarily involve known and unknown risks and

uncertainties, many of which are beyond the Company's control,

which may cause the Company's or the industry's actual results,

performance, achievements, prospects and opportunities in future

periods to differ materially from those expressed or implied by

such forward-looking statements. These risks and uncertainties

include, among other things, the factors contained in the Company's

filings with securities regulators, including this Press Release.

In particular, we caution you that our forward-looking statements

are subject to the ongoing and developing circumstances related to

the COVID-19 pandemic, which may have a material adverse effect on

our business, operations and future financial results.

When relying on forward-looking statements to

make decisions, the Company cautions readers not to place undue

reliance on these statements, as forward-looking statements involve

significant risks and uncertainties and should not be read as

guarantees of future results, performance, achievements, prospects

and opportunities. The forward-looking statements made in this

Press Release relate only to events or information as of the date

on which the statements are made in this Press Release. Except as

required by law, the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, after the date on

which the statements are made or to reflect the occurrence of

unanticipated events.

Contact Information

| Lawrence ChamberlainInvestor

Relations(416)

519-4196lawrence.chamberlain@loderockadvisors.com |

|

| |

|

|

|

|

|

| Village

Farms International, Inc. |

|

| Consolidated

Statements of Financial Position |

|

| (In

thousands of United States dollars) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

December 31, 2022 |

|

December 31, 2021 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,676 |

|

|

$ |

53,417 |

|

|

Restricted cash |

|

|

5,000 |

|

|

|

5,250 |

|

|

Trade receivables |

|

|

27,558 |

|

|

|

34,360 |

|

|

Inventories |

|

|

70,582 |

|

|

|

68,677 |

|

|

Other receivables |

|

|

309 |

|

|

|

616 |

|

|

Income tax receivable |

|

|

6,900 |

|

|

|

2,430 |

|

|

Prepaid expenses and deposits |

|

|

5,959 |

|

|

|

10,209 |

|

|

Total current assets |

|

|

132,984 |

|

|

|

174,959 |

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment |

|

|

207,701 |

|

|

|

215,704 |

|

|

Investment in in minority interests |

|

|

2,109 |

|

|

|

2,109 |

|

|

Note receivable - joint venture |

|

|

- |

|

|

|

3,256 |

|

|

Goodwill |

|

|

66,225 |

|

|

|

117,533 |

|

|

Intangibles |

|

|

37,157 |

|

|

|

26,394 |

|

|

Deferred tax asset |

|

|

4,201 |

|

|

|

16,766 |

|

|

Right-of-use assets |

|

|

9,132 |

|

|

|

7,609 |

|

|

Other assets |

|

|

5,776 |

|

|

|

2,581 |

|

|

Total assets |

|

$ |

465,285 |

|

|

$ |

566,911 |

|

|

LIABILITIES |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Line of credit |

|

$ |

7,529 |

|

|

$ |

7,760 |

|

|

Trade payables |

|

|

24,894 |

|

|

|

22,597 |

|

|

Current maturities of long-term debt |

|

|

9,646 |

|

|

|

11,416 |

|

|

Accrued sales taxes |

|

|

11,594 |

|

|

|

3,899 |

|

|

Accrued loyalty program |

|

|

2,060 |

|

|

|

2,098 |

|

|

Accrued liabilities |

|

|

13,064 |

|

|

|

14,168 |

|

|

Lease liabilities - current |

|

|

1,970 |

|

|

|

962 |

|

|

Income tax payable |

|

|

- |

|

|

|

- |

|

|

Other current liabilities |

|

|

1,458 |

|

|

|

1,413 |

|

|

Total current liabilities |

|

|

72,215 |

|

|

|

64,313 |

|

|

Non-current liabilities |

|

|

|

|

|

|

Long-term debt |

|

|

43,821 |

|

|

|

50,419 |

|

|

Deferred tax liability |

|

|

19,756 |

|

|

|

18,657 |

|

|

Lease liabilities - non-current |

|

|

7,785 |

|

|

|

6,711 |

|

|

Other liabilities |

|

|

1,714 |

|

|

|

1,973 |

|

|

Total liabilities |

|

|

145,291 |

|

|

|

142,073 |

|

|

Commitments and

contingencies |

|

|

|

|

|

|

MEZZANINE EQUITY |

|

|

|

|

|

|

Redeemable non-controlling interests |

|

|

16,164 |

|

|

|

16,433 |

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Common stock |

|

|

372,429 |

|

|

|

365,561 |

|

|

Additional paid in capital |

|

|

13,372 |

|

|

|

9,369 |

|

|

Accumulated other comprehensive loss |

|

|

(8,371 |

) |

|

|

6,696 |

|

|

Retained earnings |

|

|

(74,367 |

) |

|

|

26,779 |

|

|

Total Village Farm International Inc. shareholders'

equity |

|

|

303,063 |

|

|

|

408,405 |

|

|

Non-controlling

interest |

|

|

767 |

|

|

|

- |

|

|

Total shareholders’ equity |

|

|

303,830 |

|

|

|

408,405 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

465,285 |

|

|

$ |

566,911 |

|

| |

|

|

|

|

|

| Village

Farms International, Inc. |

|

| Condensed

Consolidated Interim Statements of Income (Loss) and Comprehensive

Income (Loss) |

|

| (In

thousands of United States dollars, except per share

data) |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December31, |

|

| |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

69,457 |

|

|

|

$ |

72,808 |

|

|

$ |

293,572 |

|

|

|

$ |

268,020 |

|

|

|

Cost of sales |

|

(66,561 |

) |

|

|

(52,950 |

) |

|

|

(266,075 |

) |

|

|

|

(222,841 |

) |

|

|

Gross margin |

|

2,896 |

|

|

|

19,858 |

|

|

|

27,497 |

|

|

|

45,179 |

|

|

| Selling,

general and administrative expenses |

|

|

(17,037 |

) |

|

|

(16,135 |

) |

|

|

(68,278 |

) |

|

|

(46,384 |

) |

|

| Share-based

compensation |

|

|

(983 |

) |

|

|

(1,828 |

) |

|

|

(3,987 |

) |

|

|

(7,533 |

) |

|

|

Interest expense |

|

(914 |

) |

|

|

(876 |

) |

|

|

(3,244 |

) |

|

|

(2,835 |

) |

|

|

Interest income |

|

78 |

|

|

|

27 |

|

|

|

207 |

|

|

|

126 |

|

|

| Foreign

exchange loss |

|

|

(84 |

) |

|

|

159 |

|

|

|

(2,255 |

) |

|

|

(476 |

) |

|

| Other

expense, net |

|

|

(109 |

) |

|

|

193 |

|

|

|

(707 |

) |

|

|

(1,012 |

) |

|

|

Impairments |

|

(13,500 |

) |

|

|

- |

|

|

|

(43,299 |

) |

|

|

- |

|

|

| Loss on

disposal of assets |

|

|

- |

|

|

|

(219 |

) |

|

|

- |

|

|

|

7 |

|

|

| (Loss)

income before taxes and loss from equity method investments |

|

|

(29,653 |

) |

|

|

1,179 |

|

|

|

(94,066 |

) |

|

|

(12,928 |

) |

|

| Recovery of

(provision for) income taxes |

|

|

(19,244 |

) |

|

|

983 |

|

|

|

(4,681 |

) |

|

|

3,526 |

|

|

| Income

(loss) from equity method investments |

|

|

- |

|

|

|

(133 |

) |

|

|

(2,668 |

) |

|

|

(308 |

) |

|

| (Loss)

income including non-controlling interests |

|

|

(48,897 |

) |

|

|

2,029 |

|

|

|

(101,415 |

) |

|

|

(9,710 |

) |

|

| Less: net

loss attributable to non-controlling interests, net of tax |

|

|

(432 |

) |

|

|

46 |

|

|

|

269 |

|

|

|

46 |

|

|

| Net (loss)

income attributable to Village Farms International Inc. |

|

$ |

(49,329 |

) |

|

$ |

2,075 |

|

|

$ |

(101,146 |

) |

|

$ |

(9,664 |

) |

|

| Basic (loss)

income per share |

|

$ |

(0.54 |

) |

|

|

$ |

0.03 |

|

|

$ |

(1.13 |

) |

|

|

$ |

(0.11 |

) |

|

| Diluted

(loss) income per share |

|

$ |

(0.54 |

) |

|

|

$ |

0.03 |

|

|

$ |

(1.13 |

) |

|

|

$ |

(0.11 |

) |

|

| Weighted

average number of common shares used in the computation of net loss

per share (in thousands): |

|

|

|

|

|

|

|

|

|

| Basic |

|

|

91,350 |

|

|

|

82,161 |

|

|

|

89,127 |

|

|

|

82,161 |

|

|

| Diluted |

|

|

91,350 |

|

|

|

82,161 |

|

|

|

89,127 |

|

|

|

82,161 |

|

|

| Net (loss)

income attributable to Village Farms International Inc. |

|

$ |

(49,329 |

) |

|

$ |

2,075 |

|

|

$ |

(101,146 |

) |

|

$ |

(9,664 |

) |

|

| Other

comprehensive loss: |

|

|

|

|

|

|

|

|

|

| Foreign

currency translation adjustment |

|

|

(260 |

) |

|

|

233 |

|

|

|

(15,460 |

) |

|

|

441 |

|

|

|

Comprehensive loss |

|

$ |

(49,589 |

) |

|

$ |

2,308 |

|

|

$ |

(116,606 |

) |

|

$ |

(9,223 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Village

Farms International, Inc. |

|

| Condensed

Consolidated Interim Statements of Cash Flows |

|

| (In

thousands of United States dollars) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

| Cash

flows used in operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(101,146 |

) |

|

$ |

(9,079 |

) |

|

|

Adjustments to reconcile net (loss) income to net cash used in

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

13,054 |

|

|

|

12,709 |

|

|

|

Amortization of deferred charges |

|

|

214 |

|

|

|

300 |

|

|

|

Share of loss from joint ventures |

|

|

2,668 |

|

|

|

308 |

|

|

|

Net loss attributable to non-controlling interest |

|

|

(269 |

) |

|

|

- |

|

|

|

Interest expense |

|

|

3,244 |

|

|

|

2,835 |

|

|

|

Interest income |

|

|

(207 |

) |

|

|

(126 |

) |

|

|

Interest paid on long-term debt |

|

|

(3,420 |

) |

|

|

(3,306 |

) |

|

|

Unrealized foreign exchange loss |

|

|

83 |

|

|

|

- |

|

|

|

Impairments |

|

|

54,337 |

|

|

|

- |

|

|

|

Write-off of joint venture loan |

|

|

592 |

|

|

|

- |

|

|

|

(Gain) loss on disposal of assets |

|

|

(7 |

) |

|

|

259 |

|

|

|

Non-cash lease expense |

|

|

(604 |

) |

|

|

(1,351 |

) |

|

|

Share-based compensation |

|

|

3,987 |

|

|

|

7,533 |

|

|

|

Deferred income taxes |

|

|

9,831 |

|

|

|

(2,866 |

) |

|

|

Changes in non-cash working capital items |

|

|

(2,246 |

) |

|

|

(46,783 |

) |

|

|

Net cash used in operating activities |

|

|

(19,889 |

) |

|

|

(39,567 |

) |

|

| Cash

flows used in investing activities: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(14,292 |

) |

|

|

(21,656 |

) |

|

|

Acquisitions, net |

|

|

(5,873 |

) |

|

|

(40,685 |

) |

|

|

Advances to joint ventures |

|

|

- |

|

|

|

(20 |

) |

|

|

Notes receivable |

|

|

(734 |

) |

|

|

(1,109 |

) |

|

|

Net cash used in investing activities |

|

|

(20,899 |

) |

|

|

(63,470 |

) |

|

| Cash

flows (used in) provided by financing activities: |

|

|

|

|

|

|

Proceeds from borrowings |

|

|

7,321 |

|

|

|

19,669 |

|

|

|

Repayments on borrowings |

|

|

(9,709 |

) |

|

|

(9,454 |

) |

|

|

Proceeds from issuance of common stock and warrants |

|

|

6,692 |

|

|

|

135,000 |

|

|

|

Issuance costs |

|

|

- |

|

|

|

(7,511 |

) |

|

|

Proceeds from exercise of stock options |

|

|

192 |

|

|

|

199 |

|

|

|

Proceeds from exercise of warrants |

|

|

- |

|

|

|

18,495 |

|

|

|

Share repurchases |

|

|

- |

|

|

|

(5,000 |

) |

|

|

Payments on capital lease obligations |

|

|

- |

|

|

|

(17 |

) |

|

|

Payment of note payable related to acquisition |

|

|

- |

|

|

|

(15,498 |

) |

|

|

Net cash (used in) provided by financing activities |

|

|

4,496 |

|

|

|

135,883 |

|

|

| Effect of

exchange rate changes on cash and cash equivalents |

|

|

(699 |

) |

|

|

142 |

|

|

| Net

(decrease) increase in cash and cash equivalents |

|

|

(36,991 |

) |

|

|

32,988 |

|

|

| Cash

and cash equivalents, beginning of period |

|

|

58,667 |

|

|

|

25,679 |

|

|

| Cash

and cash equivalents, end of period |

|

$ |

21,676 |

|

|

$ |

58,667 |

|

|

| |

|

|

|

|

|

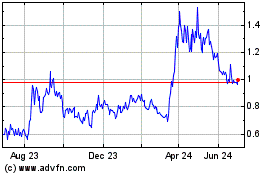

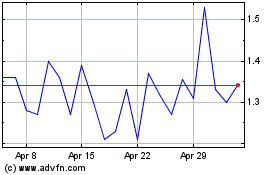

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Jul 2023 to Jul 2024