PRELIMINARY

OFFERING CIRCULAR DATED FEBRUARY 14, 2024

An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular

shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state

in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We

may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion

of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular

was filed may be obtained.

OFFERING

CIRCULAR

Verb

Technology Company, Inc. ®

27,397,260

Shares of Common Stock

By

this offering circular (the “Offering Circular”), Verb Technology Company, Inc., a Nevada corporation, is offering

on a “best-efforts” basis a maximum of 27,397,260 shares of its common stock, par value $0.0001 per share (the “Offered

Shares”), at a fixed price of $0.30 to $1.15 per share (to be fixed by post-qualification supplement), pursuant to Tier

2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). There is no minimum purchase requirement

for investors in this offering.

This

offering is being conducted on a “best-efforts” basis, which means that there is no minimum number of Offered Shares that

must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. None of the proceeds received

will be placed in an escrow or trust account. All proceeds from this offering will become immediately available to us and may be used

as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments. Please

see the “Risk Factors” section, beginning on page 8, for a discussion of the risks associated with a purchase of the Offered

Shares.

We

estimate that this offering will commence within two days of SEC qualification; this offering will terminate at the earliest of (a) the

date on which the maximum offering has been sold, (b) one year from the date of SEC qualification, or (c) the date on which this offering

is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

| | |

Number of

Shares | | |

Price

to Public(1) | | |

Broker-Dealer

Discounts and Commissions(2) | | |

Proceeds

to Company(3) | |

| Per

Share: | |

| - | | |

$ | 0.73 | | |

$ | (0.02 | ) | |

$ | 0.71 | |

| Total

Minimum: | |

| 0 | | |

$ | 0 | | |

$ | 0 | ) | |

$ | 0 | |

| Total

Maximum: | |

| 27,397,260 | | |

$ | 20,000,000 | | |

$ | (600,000 | ) | |

$ | 19,400,000 | |

| (1) |

Assumes

a public offering price of $0.73, which represents the midpoint of the offering price range of $0.30 to $1.15 per share |

| |

|

| (2) |

We

have engaged Dawson James Securities, Inc., member FINRA/SIPC (“the “Placement Agent”), to act as placement agent

for this offering, in exchange for a fee of 3% of the aggregate offering price of the Offered Shares sold. |

| (3) |

Does

not account for the payment of expenses of this offering estimated at $175,450. See

“Plan of Distribution.”

|

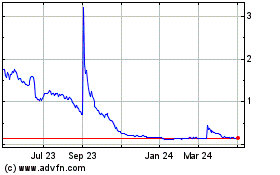

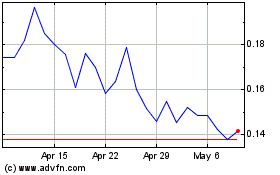

Our

common stock is listed on The Nasdaq Capital Market (“Nasdaq”), under the symbol “VERB.” On February 13,

2024, the last reported sale price of our common stock was $0.147 per share.

Investing

in the Offered Shares is speculative and involves substantial risks. You should purchase Offered Shares only if you can afford a complete

loss of your investment. See “Risk Factors”, beginning on page 8, for a discussion of certain risks that you should

consider before purchasing any of the Offered Shares.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR

THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS.

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN

INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The

use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about

the benefits you will receive from an investment in Offered Shares.

No

sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular

under “Plan of Distribution—State Law Exemption and Offerings to “Qualified Purchasers” on page

22. Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule

251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This

Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The

date of this Offering Circular is _______________, 2024.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking

statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business;

our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities

and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations,

hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipates,” “believes,” “continue,” “could,” “estimates,”

“expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,”

“predicts,” “projects,” “seeks,” “should,” “will,” “would” and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments

that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently

anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other

assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements.

All

forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks

and uncertainties, along with others, are also described below in the section entitled “Risk Factors”. Should one

or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material

respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements

and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required

under applicable securities laws.

OFFERING

CIRCULAR SUMMARY

The

following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information

you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular

carefully, including the section entitled “Risk Factors” and the consolidated financial statements and the

notes thereto. Verb Technology Company, Inc. and its consolidated subsidiaries are referred to herein as “Verb,” “the

Company,” “we,” “us” and “our,” unless the context indicates otherwise.

Overview

All

dollar amounts in this section are in thousands.

Through

June 13, 2023, we operated three distinct lines of business through separate wholly owned subsidiaries. Verb Direct, LLC,

a sales Software-as-a-Service (“SaaS”) platform for the direct sales industry; Verb Acquisition Co., LLC, a sales SaaS platform for the Life Sciences industry and sports teams; and verbMarketplace, LLC, a multi-vendor,

multi-presenter, livestream social shopping platform known as MARKET.live that combines ecommerce and entertainment.

We

determined that by focusing all of our resources solely on the development and operation of MARKET.live, our livestream shopping

platform, over time we could generate greater shareholder value than through the continued operation of our SaaS business platforms.

Accordingly, after an extensive seven-month process, managed by a prominent M&A advisory firm, to identify a buyer willing

to pay the highest price on the most favorable terms for the assets of the SaaS business on June 13, 2023 we disposed of all of the operating

SaaS assets of Verb Direct, LLC and Verb Acquisition Co., LLC pursuant to an asset purchase agreement for aggregate consideration

of $6,500, $4,750 of which was paid in cash by the buyer at the closing of the transaction. Additional payments in the aggregate

of $1,750 will be paid by the buyer if certain profitability and revenue targets are met within the next two years as set forth more

particularly in the asset purchase agreement. During the seven-month period of the sales process, virtually all of our resources were

dedicated to facilitating the sale process and all operating budgets were suspended, including sales and marketing budgets for MARKET.live,

in order to preserve cash and minimize reliance on the capital markets until the asset sale process was complete.

Our

MARKET.live Business

MARKET.live

is a multivendor social shopping platform for retailers, brands, manufacturers, creators, influencers and entrepreneurs who seek

to participate in an open market-style eco-system environment. MARKET.live is akin to a virtual shopping mall, a centralized online destination

where shoppers can explore hundreds, and we believe over time thousands, of shoppable stores for their favorite brands, influencers,

creators and celebrities, all of whom can host livestream shopping events from their virtual stores that can be seen by all shoppers

at the virtual mall. Every store operator can host livestream events, even simultaneously, and over time we believe there could be thousands

of such events, across numerous product and service categories, being hosted by people from all over the world, always on – 24/7

– where shoppers can communicate directly with the hosts in real time to comment or ask questions about products through an on-screen

chat visible to all shoppers. Through the on-screen chat, shoppers can also communicate directly with each other in real time, invite

their friends and family to join them at any of the live shopping events to share the experience, and then simply click on a non-intrusive

in-video overlay to place items in an on-screen shopping cart for purchase – all without interrupting the video. Shoppers can visit

any number of other shoppable events to meet up and chat with friends, old and new, and together watch, shop and chat with the hosts,

discover new products and services, and become part of an immersive entertaining social shopping experience. Throughout the experience,

the shopping cart follows shoppers seamlessly from event to event, shoppable video to shoppable video, host to host, store to store and

product to product.

We

believe the MARKET.live business model is a simple but innovative B-to-B play. It is a multi-vendor platform, with a single follow-me

style unified shopping cart, and robust ecommerce capabilities with the tools for consumer brands, big box brick and mortar stores, boutiques,

influencers and celebrities to connect with their clients, customers, fans, followers, and prospects by providing a unique, interactive

social shopping experience that we believe could keep them coming back and engaged for hours.

Among

the key differentiators for MARKET.live is that it allows anyone that streams on MARKET.live to simultaneously broadcast their stream

(multi-cast or simulcast) over most popular social media sites to reach a substantially larger audience, which can be especially attractive

for creators and influencers that have large number of followers on other social media platforms. All livestream events are recorded

and available to watch in each vendor’s personally branded stores on MARKET.live for those fans, followers and customers to return

after the livestream events, 24/7, to browse and purchase any of the featured products. All the recorded livestream videos are indexed

for easy browsing and remain shoppable.

We

recently completed development work on a new MARKET.live capability that facilitates a deeper integration into the TikTok social media

platform, which could expose MARKET.live shoppable programming to tens of millions of potential viewers/purchasers.

This

new capability allows shoppers watching a MARKET.live stream on TikTok to stay on that site and check out through that site, eliminating

the friction or reluctance of TikTok users to leave their TikTok feed in order to complete their purchase on MARKET.live. Our technology

integration allows the purchase data to flow back through MARKET.live and to the individual vendors and stores on MARKET.live seamlessly

for fulfillment of the orders.

In

fall of 2023 we launched our “Creators on MARKET.live,” a program that allows creators to monetize their content

through livestream shopping and personalized storefronts on MARKET.live. This program is only open to those individuals with a large,

verifiable social media following. Participants selected for the Creators on MARKET.live program (“Creators”) can choose

to feature their favorite products from MARKET.live stores and promote and sell them to their fans, followers and customers. The Company

recently launched a similar program on TikTok for TikTok creators and influencers.

In

the coming weeks, we expect to formally launch a new drop ship program on MARKET.live, offered on a subscription basis, designed

specifically for those individuals interested in starting their own ecommerce business who do not yet have a large base of fans or followers.

Through this new program, entrepreneurs will be able to quickly and easily establish their own virtual storefronts, essentially their

own website, by choosing the products they love from a carefully curated list of products by category (based on their selected subscription

package). They will be able to easily import the products into their storefront and launch their own ecommerce business through livestream

shopping events broadcast live on MARKET.live and simulcast on other social platforms. Subscribers will not have to purchase inventory

and product fulfillment will be handled for them for no additional cost. This program represents a very low cost, low risk option for

those who want to start their own ecommerce business. We are planning a national television commercial campaign to promote this

new program.

Depending

on the products chosen, participants in the Creators on MARKET.live program can earn between 5% and 20% of their gross sales at no cost

and no risk to the Creators selected to participate in the program. Entrepreneurs that participate in the drop ship programs will pay

a fixed monthly fee for access to the products in the program and to maintain their MARKET.live ecommerce storefronts and will also earn

a percentage of the sales they generate, which varies based on the subscription package.

verbTV

will launch as a feature of our MARKET.live platform, serving to draw an audience of people seeking to consume video content that

is also interactive and shoppable. We expect this additional audience will also be exposed to and enhance the eco-system of shoppers

and retailers on MARKET.live. Over time we anticipate that verbTV will feature concerts, game shows, sports, including e-sports, sitcoms,

podcasts, special events, news, including live events, and other forms of video entertainment that is all interactive and shoppable.

verbTV represents an entirely new distribution channel for all forms of content by a new generation of content creators looking for greater

freedom to explore the creative possibilities that a native interactive video platform can provide for their audience. We believe content

creators may also enjoy greater revenue opportunities through the native ecommerce capabilities the platform provides to sponsors and

advertisers who will enjoy real-time monetization, data collection and analytics. Through verbTV, we believe sponsors and advertisers

will be able to accurately measure the ROI from their marketing spend, instead of relying on imprecise viewership information traditionally

offered to television sponsors and advertisers.

Recent

Developments

Nasdaq

Deficiency Notices

August

18, 2023 Notice

On

August 18, 2023, the Company received a notice from The Nasdaq Stock Market LLC (“NASDAQ”) indicating that it did not meet

the minimum of $2,500,000 in stockholders’ equity required by NASDAQ Listing Rule 5550(b)(1) (the “Listing Rule”) for

continued listing, or the alternatives of market value of listed securities or net income from continuing operations. The notice was

based upon the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, which reported that the Company’s

total stockholders’ equity as of June 30, 2023 was ($1,818,000).On October 9, 2023, the Company submitted a plan to regain compliance

with the Listing Rule and was given an extension until February 14, 2024 to evidence compliance through a public filing.

On

February 5, 2024, the Company reported in a Current Report on Form 8-K (the “Form 8-K Filing”) that based on its unaudited

balance sheet as of December 31, 2023, it believed it had regained compliance with the stockholders’ equity requirement of

NASDAQ Listing Rule 5550(b)(1) for continued listing. On February 5, 2023, the Company was informed that based upon the Form 8-K Filing,

the Staff determined that the Company is in compliance with Listing Rule 550(b)(1).

November

2, 2023 Notice

On

November 2, 2023, we received a letter from The NASDAQ Stock Market advising that the Company did not meet the minimum $1.00 per share

bid price requirement for continued inclusion on The NASDAQ Capital Market pursuant to NASDAQ Marketplace Listing Rule 5550(a)(2). To

demonstrate compliance with this requirement, the closing bid price of our common stock needs to be at least $1.00 per share for a minimum

of 10 consecutive business days before April 30, 2024. In order to satisfy this requirement, the Company intends to continue actively

monitoring the bid price for its common stock between now and April 30, 2024, and will consider available options to resolve the deficiency

and regain compliance with the minimum bid price requirement.

Series

C Preferred Stock Offering

On

December 29, 2023, the Company entered into a securities purchase agreement with Streeterville Capital, LLC (the “Streeterville

Purchase Agreement”), pursuant to which the Company sold 3,000 shares of the Company’s newly designated non-convertible

Series C Preferred Stock for proceeds of $3,000,000. The Series C Preferred Stock receives a 10% stated annual dividend, has no voting

rights and has a face value of $1,300 per share. The sale of the Series C Preferred Stock was consummated on December 29, 2023.

ATM

Offerings

On

December 15, 2023, the Company entered into an At-the-Market Issuance Sales Agreement (the “Ascendiant Sales Agreement”)

with Ascendiant Capital Markets, LLC, as sales agent, to sell, from time to time, shares of its common stock having an aggregate

offering price of up to $960,000, through an “at the market” offering pursuant to the Company’s Registration

Statement on Form S-3 (File No. 333-264038), as supplemented by a prospectus supplement. From December 15, 2023 to the date of this

Offering Circular, the Company issued 2,396,247 shares of its common stock and received $0.2 million of aggregate net proceeds in

“at the market” offerings under the Ascendiant Sales Agreement.

On

December 15, 2023, the Company terminated its At-The Market Issuance Sales Agreement, dated as of November 16, 2021, by and between the

Company and Truist Securities, Inc. (the “Truist Sales Agreement”). From September 30, 2023, to December 15, 2023, the Company

issued and sold an aggregate of 8,678,914 shares of common stock for aggregate net proceeds of $2.5 million under the Truist Sales Agreement.

Debt

Financing

On

October 11, 2023, the Company entered into a note purchase agreement with Streeterville Capital, LLC, pursuant to which the Company sold

a promissory note in the aggregate principal amount of $1.0 million (the “Note”). The Note bears interest at 9.0%

per annum compounded daily. The maturity date of the Note is 18 months from the date of its issuance. In connection with the sale of

the Note, verbMarketplace, LLC, a wholly-owned subsidiary of the Company, entered into a Guaranty, dated October 11, 2023, pursuant to

which it guaranteed the obligations of the Company under the Note in exchange for receiving a portion of the proceeds.

Our

Corporate Information

We

are a Nevada corporation that was incorporated in November 2012. Our principal executive and administrative offices are located at 2700

S. Las Vegas Blvd., Suite 2301, Las Vegas, NV 89109, and our telephone number is (855) 250-2300. Our website address is https://www.verb.tech.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and in accordance therewith, we file annual, quarterly and current reports, proxy statements and other information with the SEC. The

SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC. The address of the SEC’s website is www.sec.gov. We make available free of charge on or through our website our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material

with or otherwise furnish it to the SEC. Information on or accessed through our website or the SEC’s website is not incorporated

into this Offering Circular.

Offering

Summary

| Securities

Offered |

|

The

Offered Shares, 27,397,260 shares of common stock, are being offered by the Company in a “best-efforts” offering. |

| |

|

|

| Offering

Price Per Share |

|

$0.30

to $1.15 per Offered Share (to be fixed by post-qualification supplement). |

| |

|

|

| Shares

Outstanding Before This Offering |

|

25,150,074

shares of common stock issued and outstanding as of February 7, 2024. |

| |

|

|

| Shares

Outstanding After This Offering |

|

52,547,334

shares

of common stock issued and outstanding, assuming all of the Offered Shares are sold hereunder.

The number of shares to be outstanding after this offering is based on 25,150,074 shares

outstanding as of February 7, 2024 and excludes:

|

| |

|

|

● |

2,071,465

shares of common stock issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $1.17

per share; |

| |

|

|

● |

148,852

shares of common stock issuable upon vesting of restricted stock unit awards; |

| |

|

|

● |

12,802,279

shares of common stock reserved for future issuance under our 2019 Omnibus Incentive Plan; and |

| |

|

|

● |

919,664

shares of common stock issuable upon exercise of warrants to purchase common stock with a weighted-average exercise price of $33.76

per share. |

| Minimum

Number of Shares to Be Sold in This Offering |

|

None |

| |

|

|

| Investor

Suitability Standards |

|

The

Offered Shares are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities

Act of 1933, as amended (the “Securities Act”). “Qualified purchasers” include any person to whom securities

are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. |

| |

|

|

| Market

for our Common Stock |

|

Our

common stock is listed on Nasdaq under the symbol “VERB.” |

| |

|

|

| Termination

of this Offering |

|

This

offering will terminate at the earliest of (a) the date on which all of the Offered Shares have been sold, (b) the date which is

one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our

sole discretion. (See “Plan of Distribution”). |

| |

|

|

| Use

of Proceeds |

|

We

will use the proceeds of this offering for marketing and advertising expenses and general corporate purposes, including working capital.

See “Use of Proceeds”. |

| |

|

|

| Risk

Factors |

|

An

investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss

of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering

Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding

the Offered Shares. |

Continuing

Reporting Requirements Under Regulation A

We

are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our

continuing reporting obligations under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting

requirements.

RISK

FACTORS

An

investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to

the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the

following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the

only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results,

prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute

forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements”.

Risks

Related to Our Business

We

have incurred significant net losses and cannot assure you that we will achieve or maintain profitable operations.

We

have incurred operating losses and negative cash flows from operations since inception. We incurred a net loss from continuing operations

of $12.0 million during the nine months ended September 30, 2023. We also utilized cash in operations from continuing operations of $6.6

million during the nine months ended September 30, 2023. To date, we have funded our operations through cash collected from sales of

our products and services, offerings of our equity securities, and debt financing. We have devoted substantially all of our resources

to the design, development and commercialization of our products, the scaling of our technology and infrastructure, and our marketing

and sales efforts. We may continue to incur significant losses in the future for a number of reasons, including unforeseen expenses,

difficulties, complications, delays, and other unknown events.

To

implement our business strategy and achieve consistent profitability, we need to, among other things, continue to reduce operating expenses,

increase sales of our products and the gross profit associated with those sales, continue to reduce research and development expenses,

and increase our marketing and sales efforts to drive an increase in the number of customers and clients utilizing our services. These

expenditures may make it more difficult to achieve and maintain profitability. In addition, our efforts to grow our business may be more

expensive than we expect, and we may not be able to generate sufficient revenue to offset operating expenses. If we are forced to reduce

our expenses beyond our planned cost reduction initiatives, our growth strategy could be compromised. To offset our anticipated operating

expenses, we will need to generate and sustain significant revenue levels in future periods in order to become profitable, and even if

we do, we may not be able to maintain or increase our level of profitability.

Accordingly,

we cannot assure you that we will achieve sustainable operating profits as we continue to reduce operating expenses, restructure our

balance sheet, further develop our marketing efforts, and otherwise implement our growth initiatives. Any failure to achieve and maintain

profitability would have a materially adverse effect on our ability to implement our business plan, our results and operations, and our

financial condition, and could cause the value of our common stock, to decline, resulting in a significant or complete loss of your investment.

Our

independent registered public accounting firm’s report for the fiscal year ended December 31, 2022, has raised substantial

doubt as to our ability to continue as a going concern.

Our

independent registered public accounting firm indicated in its report on our audited consolidated financial statements as of and for

the year ended December 31, 2022, that there is substantial doubt about our ability to continue as a going concern. A “going

concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do

not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts

and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our consolidated

balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available

for distribution to stockholders, in the event of liquidation. The presence of the going concern note to our financial statements may

have an adverse impact on the relationships we are developing and plan to develop with third parties as we continue the commercialization

of our products and could make it challenging and difficult for us to raise additional financing, all of which could have a material

adverse impact on our business and prospects and result in a significant or complete loss of your investment.

If

we are unable to generate sufficient cash flow from operations to operate our business and pay our debt obligations as they become due,

we may need to seek to borrow additional funds, dispose of our assets, or reduce or delay capital expenditures. There can be no assurance

that we will ever be profitable or that debt or equity financing will be available to us in the amounts, on terms, and at times deemed

acceptable to us, if at all. The issuance of additional equity securities by us would result in a significant dilution in the equity

interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, would increase our liabilities

and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable

to continue our business, as planned, and as a result may be required to scale back or cease operations for our business, the results

of which would be that our stockholders would lose some or all of their investment. Our audited consolidated financial statements do

not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts

and classifications of liabilities that may result should we be unable to continue as a going concern. For additional information, please

refer to the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations –

Liquidity and Capital Resources – Going Concern,” as well as Note 1 to our audited consolidated financial statements

for the year ended December 31, 2022, included herein.

Public

health threats, such as the COVID-19 pandemic, natural disasters and other events beyond our control, have had and may continue to have

a significant negative impact on our business, sales, results of operations and financial condition.

Public

health threats and other highly communicable diseases and outbreaks could adversely impact our operations, the operations of our customers,

suppliers, distributors and other business partners, as well as the healthcare system in general. For example, the COVID-19 pandemic

has led to severe disruptions in general economic activities, as businesses and federal, state, and local governments take increasingly

broad actions to mitigate this public health crisis. We have experienced disruption to our business, both in terms of disruption of our

operations and the adverse effect on overall economic conditions. These conditions have had significant negative impacts on all aspects

of our business. Our business is dependent on the continued health and productivity of our employees, including our software engineers,

sales staff and corporate management team. Individually and collectively, the consequences of the COVID-19 pandemic have had, and may

continue to have, a material adverse effect on our business, sales, results of operations and financial condition. In addition, our business

operations are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond our control. Although

we maintain crisis management and disaster response plans, such events could make it difficult or impossible for us to deliver our services

to our customers and could decrease demand for our services.

Additionally,

our liquidity could be negatively impacted if these conditions continue for a significant period of time and we may be required to pursue

additional sources of financing to obtain working capital, maintain appropriate inventory levels, and meet our financial obligations.

Capital and credit markets have been disrupted by the crisis and our ability to obtain any required financing is not guaranteed and largely

dependent upon evolving market conditions and other factors. Depending on the continued impact of the crisis, further actions may be

required to improve our cash position and capital structure.

The

extent to which the COVID-19 pandemic, or other public health threats, natural disasters or catastrophic events, ultimately impacts our

business, sales, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot

be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus

or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the COVID-19

pandemic has subsided, we may continue to experience significant impacts to our business as a result of its global economic impact, including

any economic downturn or recession that has occurred or may occur in the future.

Our

ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms

favorable to us.

We

have limited capital resources. We have financed our operations entirely through equity investments by founders and other investors and

the incurrence of debt, and we expect to continue to finance our operations in the same manner in the foreseeable future. Our ability

to continue our normal and planned operations, to grow our business, and to compete in our industry will depend on the availability of

adequate capital. We cannot assure you that we will be able to obtain additional funding from those or other sources when or in the amounts

needed, on acceptable terms, or at all. If we raise capital through the sale of equity, or securities convertible into equity, it would

result in dilution to our then-existing stockholders, which could be significant depending on the price at which we may be able to sell

our securities. If we raise additional capital through the incurrence of additional indebtedness, we would likely become subject to further

covenants restricting our business activities, and holders of debt instruments may have rights and privileges senior to those of our

then-existing stockholders. In addition, servicing the interest and principal repayment obligations under debt facilities could divert

funds that would otherwise be available to support development of new programs and marketing to current and potential new clients. If

we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce, or eliminate development of new

programs or future marketing efforts, or reduce or discontinue our operations. Any of these events could significantly harm our business,

financial condition, and prospects.

Our

indebtedness, and the agreements governing such indebtedness, subject us to required debt service payments, as well as financial restrictions

and operating covenants, any of which may reduce our financial flexibility and affect our ability to operate our business.

From

time to time, we have financed our liquidity needs in part from borrowings made under various credit agreements. As of September 30,

2023, the aggregate outstanding principal balance of our notes payable was $3.3 million.

The

agreements underlying these transactions contain certain financial restrictions, operating covenants, and debt service requirements.

Our failure to comply with obligations under these agreements, or inability to make required debt service payments, could result in an

event of default under the agreements. A default, if not cured or waived, could permit a lender to accelerate payment of the loan, which

could have a material adverse effect on our business, operations, financial condition, and liquidity. Further, if our debt is accelerated,

we cannot be certain that funds will be available to pay the debt or that we will have the ability to refinance the debt on terms satisfactory

to us or at all. If we are unable to repay or refinance the accelerated debt, we could become insolvent and seek to file for bankruptcy

protection, which would have a material adverse impact on our financial condition.

In

addition, the covenants in our credit agreements could limit our ability to engage in transactions that would be in our best interest,

or otherwise respond to changing business and economic conditions, and may therefore have a material impact on our business. For example,

our borrowings will require debt service payments, which could require us to divert funds identified for other purposes to such debt

service payments. Further, if we cannot generate sufficient cash flow from operations to service our debt, we may need to refinance the

debt, dispose of its assets, or reduce or delay expenditures. Alternatively, we may be required to issue equity to obtain necessary funds,

which would be dilutive to our stockholders. We do not know whether we would be able to take any of these actions on a timely basis or

at all.

Our

current or future level of indebtedness could affect our operations in several ways, including the following:

| |

● |

the

covenants contained in current or future agreements governing outstanding indebtedness may limit our ability to borrow additional

funds, refinance debt, dispose of assets, and make certain investments; |

| |

● |

debt

covenants may also affect our flexibility in planning for, and reacting to, changes in the economy and in our industry; |

| |

● |

a

high level of debt would increase our vulnerability to general adverse economic and industry conditions; |

| |

● |

a

significant level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore,

may be able to take advantage of opportunities that our indebtedness would prevent us from pursuing; and |

| |

● |

a

high level of debt may impair our ability to obtain additional financing in the future for working capital, debt service requirements,

acquisitions, or other purposes. |

The

success of our business is dependent upon our ability to maintain and expand our customer base and our ability to convince our customers

to increase the use of our services and/or platform. If we are unable to expand our customer base and/or the use of our services and/or

platform by our customers declines, our business will be harmed.

Our

ability to expand and generate revenue depends, in part, on our ability to maintain and expand our relationships with existing customers

and convince them to increase their use of our platform. If our customers do not increase their use of our platform, then our revenue

may not grow and our results of operations may be harmed. It is difficult to predict customers’ usage levels accurately and the

loss of customers or reductions in their usage levels may have a negative impact on our business, results of operations, and financial

condition. If a significant number of customers cease using, or reduce their usage of, our platform, then we may be required to spend

significantly more on sales and marketing than we currently plan to spend in order to maintain or increase revenue. These additional

expenditures could adversely affect our business, results of operations, and financial condition. Most of our customers do not have long-term

contractual financial commitments to us and, therefore, most of our customers could reduce or cease their use of our platform at any

time without penalty or termination charges.

The

market in which we operate is intensely competitive and, if we do not compete effectively, our operating results could be harmed.

The

market for livestream shopping platforms is intensely competitive and rapidly changing, barriers to entry are relatively low, and many

of our competitors have greater name recognition, longer operating histories, and larger marketing budgets, as well as substantially

greater financial, technical, and other resources, than we do. In addition, many of our potential competitors have established marketing

relationships and access to larger customer bases, and have major distribution agreements with consultants, system integrators, and resellers.

As a result, our competitors may be able to respond more effectively than we can to new or changing opportunities, technologies, standards,

customer requirements, competitive pressures, or challenges within the financial markets. Furthermore, because of these advantages, even

if our products and services are more effective than the products and services that our competitors offer, potential customers might

accept competitive products and services in lieu of purchasing our products and services. If we do not compete effectively against our

current and future competitors, our operating results could be harmed.

We

may not be able to increase the number of our strategic relationships or grow the revenues received from our current strategic relationships.

We

have entered into certain strategic relationships with other individuals and enterprises and are actively seeking additional strategic

relationships. There can be no assurance, however, that these strategic relationships will result in material revenues for us or that

we will be able to generate any other meaningful strategic relationships. If we are not able to increase the number of our strategic

relationships or grow the revenues received from our current strategic relationships, our operating results could be harmed.

We

may not be able to develop enhancements and new features to our existing service or acceptable new services that keep pace with technological

developments.

If

we are unable to develop enhancements to, and new features for, our platform that keep pace with rapid technological developments, our

business will be harmed. The success of enhancements, new features, and services depends on several factors, including the timely completion,

introduction, and market acceptance of the feature or edition. Failure in this regard may significantly impair our revenue growth or

harm our reputation. We may not be successful in either developing these modifications and enhancements or in timely bringing them to

market at a competitive price or at all. Furthermore, uncertainties about the timing and nature of new network platforms or technologies,

or modifications to existing platforms or technologies, could increase our research and development expenses. Any failure of our service

to operate effectively with future network platforms and technologies could reduce the demand for our service, result in customer dissatisfaction,

and harm our business.

Our

ability to deliver our services is dependent on third party Internet providers.

The

Internet’s infrastructure is comprised of many different networks and services that, by design, are highly fragmented and distributed.

This infrastructure is run by a series of independent, third-party organizations that work together to provide the infrastructure and

supporting services of the Internet under the governance of the Internet Corporation for Assigned Numbers and Names (“ICANN”)

and the Internet Assigned Numbers Authority (“IANA”), which is now related to ICANN.

The

Internet has experienced, and will continue to experience, a variety of outages and other delays due to damages to portions of its infrastructure,

denial-of-service attacks, or related cyber incidents. These scenarios are not under our control and could reduce the availability of

the Internet to us or our customers for delivery of our services. Any resulting interruptions in our services or the ability of our customers

to access our services could result in a loss of potential or existing customers and harm our business.

Security

breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation

to suffer.

In

the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information,

proprietary business information of our customers, including, credit card and payment information, and personally identifiable information

of our customers and employees. The secure processing, maintenance, and transmission of this information is critical to our operations

and business strategy.

In

addition, we are subject to numerous federal, state, provincial and foreign laws regarding privacy and protection of data. Some jurisdictions

have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data and our

agreements with certain customers require us to notify them in the event of a security incident. Evolving regulations regarding personal

data and personal information, including the General Data Protection Regulation, the California Consumer Privacy Act of 2018 (“CCPA”),

and the recently passed California Privacy Rights Act, which amends the CCPA and has many provisions that became effective on January

1, 2023, especially relating to classification of IP addresses, machine identification, location data and other information, may limit

or inhibit our ability to operate or expand our business. Such laws and regulations require or may require us or our customers to implement

privacy and security policies, permit consumers to access, correct or delete personal information stored or maintained by us or our customers,

inform individuals of security incidents that affect their personal information, and, in some cases, obtain consent to use personal information

for specified purposes.

We

believe that we take reasonable steps to protect the security, integrity and confidentiality of the information we collect, use, store,

and disclose, and we take steps to strengthen our security protocols and infrastructure, however, our information technology and infrastructure

may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions. We also could be negatively

impacted by software bugs or other technical malfunctions, as well as employee error or malfeasance. Advanced cyber-attacks can be multi-staged,

unfold over time, and utilize a range of attack vectors with military-grade cyber weapons and proven techniques, such as spear phishing

and social engineering, leaving organizations and users at high risk of being compromised. Any such access, disclosure, or other loss

of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory

penalties, a disruption of our operations, damage to our reputation, a loss of confidence in our business, early termination of our contracts

and other business losses, indemnification of our customers, liability for stolen assets or information, increased cybersecurity protection

and insurance costs, financial penalties, litigation, regulatory investigations and other significant liabilities, any of which could

materially harm our business any of which could adversely affect our business, revenues, and competitive position.

Our

success depends, in part, on the capacity, reliability, and security of our information technology hardware and software infrastructure,

as well as our ability to adapt and expand our infrastructure.

The

capacity, reliability, and security of our information technology hardware and software infrastructure are important to the operation

of our current business, which would suffer in the event of system failures. Likewise, our ability to expand and update our information

technology infrastructure in response to our growth and changing needs is important to the continued implementation of our new service

offering initiatives. Our inability to expand or upgrade our technology infrastructure could have adverse consequences, including the

delayed provision of services or implementation of new service offerings, and the diversion of development resources. We rely on third

parties for various aspects of our hardware and software infrastructure. Third parties may experience errors or disruptions that could

adversely impact us and over which we may have limited control. Interruption and/or failure of any of these systems could disrupt our

operations and damage our reputation, thus adversely impacting our ability to provide our products and services, retain our current users,

and attract new users. In addition, our information technology hardware and software infrastructure may be vulnerable to unauthorized

access, misuse, computer viruses, or other events that could have a security impact. If one or more of such events occur, our customer

and other information processed and stored in, and transmitted through, our information technology hardware and software infrastructure,

or otherwise, could be compromised, which could result in significant losses or reputational damage. We may be required to expend significant

additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may

be subject to litigation and financial losses, any of which could substantially harm our business and our results of operations.

We

are dependent on third parties to, among other things, maintain our servers, provide the bandwidth necessary to transmit content, and

utilize the content derived therefrom for the potential generation of revenues.

We

depend on third-party service providers, suppliers, and licensors to supply some of the services, hardware, software, and operational

support necessary to provide some of our products and services. Some of these third parties do not have a long operating history or may

not be able to continue to supply the equipment and services we desire in the future. If demand exceeds these vendors’ capacity,

or if these vendors experience operating or financial difficulties or are otherwise unable to provide the equipment or services we need

in a timely manner, at our specifications and at reasonable prices, our ability to provide some products and services might be materially

adversely affected, or the need to procure or develop alternative sources of the affected materials or services might delay our ability

to serve our users. These events could materially and adversely affect our ability to retain and attract users, and have a material negative

impact on our operations, business, financial results, and financial condition.

We

may not be able to find suitable software developers at an acceptable cost or at all.

We

currently rely on certain key suppliers and vendors in the coding and maintenance of our software. We will continue to require such expertise

in the future. Due to the current demand for skilled software developers, we run the risk of not being able to find or retain suitable

and qualified personnel at an acceptable price, or at all. These risks may be greater now than in the past due to current general labor

shortages in the United States. Without these developers, we may not be able to further develop and maintain our software, which is the

most important aspect of our business development.

The

success of our business is highly correlated to general economic conditions.

Demand

for our products and services is highly correlated with general economic conditions, as a substantial portion of our revenue is derived

from discretionary spending by individuals, which typically declines during times of economic instability. Declines in economic conditions

in the United States or in other countries in which we operate, including declines as a result of the COVID-19 pandemic, and may operate

in the future may adversely impact our financial results. Because such declines in demand are difficult to predict, we or our industry

may have increased excess capacity as a result. An increase in excess capacity may result in declines in prices for our products and

services. Our ability to grow or maintain our business may be adversely affected by sustained economic weakness and uncertainty, including

the effect of wavering consumer confidence, high unemployment, and other factors. The inability to grow or maintain our business would

adversely affect our business, financial conditions, and results of operations, and thereby an investment in our common stock.

Our

failure to adequately protect our intellectual property rights could diminish the value of our products, weaken our competitive position

and reduce our revenue, and infringement claims asserted against us or by us, could have a material adverse effect.

We

regard the protection of our intellectual property, which includes patents, trade secrets, copyrights, trademarks and domain names, as

critical to our success. We strive to protect our intellectual property rights by relying on federal, state and common law rights, as

well as contractual restrictions. We enter into confidentiality and invention assignment agreements with our employees and contractors,

and confidentiality agreements with parties with whom we conduct business in order to limit access to, and disclosure and use of, our

proprietary information. However, these contractual arrangements and the other steps we have taken to protect our intellectual property

may not prevent the misappropriation of our proprietary information or deter independent development of similar technologies by others.

We

have registered domain names and trademarks in the United States and have pursued additional registrations both in and outside the United

States. Effective trade secret, copyright, trademark, domain name and patent protection is expensive to develop and maintain, both in

terms of initial and ongoing registration requirements and the costs of defending our rights. Notwithstanding our efforts, third parties

may independently develop technology that is not covered by our patents, or that is similar to, or competes with, our technology. In

addition, our intellectual property may be infringed or misappropriated by third parties, particularly in foreign countries where the

laws and governmental authorities may not protect our proprietary rights as effectively as those in the United States. We may be required

to protect our intellectual property in an increasing number of jurisdictions, a process that is expensive and may not be successful

or which we may not pursue in every location.

Monitoring

unauthorized use of our intellectual property is difficult and costly. Our efforts to protect our proprietary rights may not be adequate

to prevent misappropriation of our intellectual property. Further, we may not be able to detect unauthorized use of, or take appropriate

steps to enforce, our intellectual property rights. In addition, our competitors may independently develop similar technology. The laws

in the United States and elsewhere change rapidly, and any future changes could adversely affect us and our intellectual property. Our

failure to meaningfully protect our intellectual property could result in competitors offering services that incorporate our most technologically

advanced features, which could seriously reduce demand for our products. In addition, we may in the future need to initiate infringement

claims or litigation. Litigation, whether we are a plaintiff or a defendant, can be expensive, time-consuming and may divert the efforts

of our technical staff and managerial personnel, which could harm our business, whether or not such litigation results in a determination

that is unfavorable to us. In addition, litigation is inherently uncertain, and thus we may not be able to stop its competitors from

infringing upon our intellectual property rights.

Natural

disasters and other events beyond our control could materially adversely affect us.

Natural

disasters or other catastrophic events may cause damage or disruption to our operations, international commerce and the global economy,

and thus could have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power

shortages, pandemics and other events beyond our control. Although we maintain crisis management and disaster response plans, such events

could make it difficult or impossible for us to deliver our services to our customers and could decrease demand for our services.

Our

future success depends on our key executive officers and our ability to attract, retain, and motivate qualified personnel.

Our

future success largely depends upon the continued services of our executive officers and management team, especially our Chief Executive

Officer, Chairman of our board of directors, and President, Mr. Rory J. Cutaia. If one or more of our executive officers are unable or

unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Additionally, we may incur additional

expenses to recruit and retain new executive officers. If any of our executive officers joins a competitor or forms a competing company,

we may lose some or all of our customers. Finally, we do not maintain “key person” life insurance on any of our executive

officers. Because of these factors, the loss of the services of any of these key persons could adversely affect our business, financial

condition, and results of operations, and thereby an investment in our stock.

Our

continuing ability to attract and retain highly qualified personnel will also be critical to our success because we will need to hire

and retain additional personnel as our business grows. There can be no assurance that we will be able to attract or retain highly qualified

personnel. We face significant competition for skilled personnel in our industries. This competition may make it more difficult and expensive

to attract, hire, and retain qualified managers and employees. Because of these factors, we may not be able to effectively manage or

grow our business, which could adversely affect our financial condition or business. As a result, the value of your investment could

be significantly reduced or completely lost.

Risks

Relating to this Offering and Ownership of Our Securities

If

we are not able to comply with the applicable continued listing requirements or standards of The NASDAQ Capital Market, The NASDAQ Capital

Market could delist and adversely affect the market price and liquidity of our common stock.

Our

common stock is currently traded on The NASDAQ Capital Market under the symbol “VERB”. We have in the past been, and may

in the future be, unable to comply with certain of the listing standards that we are required to meet to maintain the listing of our

common stock on The NASDAQ Capital Market. If we fail to meet any of the continued listing standards of The NASDAQ Capital Market,

our common stock will be delisted from The NASDAQ Capital Market.

These

continued listing standards include specifically enumerated criteria, such as a $1.00 minimum closing bid price and a requirement

that we maintain stockholders’ equity of at least $2,500,000. On November 2, 2023, we received a letter from The NASDAQ Stock

Market advising that the Company did not meet the minimum $1.00 per share bid price requirement for continued inclusion on The NASDAQ

Capital Market pursuant to NASDAQ Marketplace Listing Rule 5550(a)(2). To demonstrate compliance with this requirement, the closing bid

price of our common stock needs to be at least $1.00 per share for a minimum of 10 consecutive business days before April 30, 2024. In

order to satisfy this requirement, the Company intends to continue actively monitoring the bid price for its common stock between now

and April 30, 2024 and will consider available options to resolve the deficiency and regain compliance with the minimum bid price requirement.

While

we intend to regain compliance with the minimum bid price rule, there can be no assurance that we will be able to maintain continued

compliance with this rule or the other listing requirements of The NASDAQ Capital Market. If we were unable to meet these requirements,

we would receive another delisting notice from the Nasdaq Capital Market for failure to comply with one or more of the continued listing

requirements. If our common stock were to be delisted from The NASDAQ Capital Market, trading of our common stock most likely will be

conducted in the over-the-counter market on an electronic bulletin board established for unlisted securities such as the OTC Markets

or in the “pink sheets.” Such a downgrading in our listing market may limit our ability to make a market in our common stock

and which may impact purchases or sales of our securities.

Purchasers

in the offering will suffer immediate dilution.

If

you purchase Offered Shares in this offering, the value of your shares based on our pro forma net tangible book value will immediately

be less than the offering price you paid. This reduction in the value of your equity is known as dilution. At an assumed public offering

price of 0.73 per share, which represents the midpoint of the offering price range herein, purchasers of common stock in this offering

will experience immediate dilution of approximately $0.25 per share, representing the difference between the assumed public offering

price per share in this offering and our pro forma as adjusted net tangible book value per share as of September 30, 2023, after giving

effect to the Pro Forma Adjustments (as defined herein), this offering, and after deducting estimated offering expenses, including placement

agent fees, payable by us. See “Dilution.”

You

may experience future dilution as a result of future equity offerings or acquisitions.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or

other securities in any future offering at a price per share that is less than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per

share at which we sell additional shares of our common stock, or securities convertible or exchangeable into our common stock, in future

transactions or acquisitions may be higher or lower than the price per share paid by investors in this offering.

In

addition, we may engage in one or more potential acquisitions in the future, which could involve issuing our common stock as some or

all of the consideration payable by us to complete such acquisitions. If we issue common stock or securities linked to our common stock,

the newly issued securities may have a dilutive effect on the interests of the holders of our common stock. Additionally, future sales

of newly issued shares used to effect an acquisition could depress the market price of our common stock.

This

is a “best efforts” offering; no minimum amount of Offered Shares is required to be sold, and we may not raise the amount

of capital we believe is required for our business.

There

is no required minimum number of Offered Shares that must be sold as a condition to completion of this offering. Because there is no

minimum offering amount required as a condition to the closing of this offering, the actual offering amount, and proceeds to us are not

presently determinable and may be substantially less than the maximum amounts set forth in this Offering Circular. We may sell fewer

than all of the Offered Shares offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in

this offering will not receive a refund in the event that we do not sell an amount of Offered Shares sufficient to pursue the business

goals outlined in this Offering Circular. Thus, we may not raise the amount of capital we believe is required for our business and may

need to raise additional funds, which may not be available or available on terms acceptable to us. Despite this, any proceeds from the

sale of the Offered Shares offered by us will be available for our immediate use, and because there is no escrow account and no minimum

offering amount in this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives

due to a lack of interest in this offering.

Our

management will have broad discretion over the use of the net proceeds from this offering.

We

currently intend to use the net proceeds from the sale of Offered Shares under this offering for marketing and advertising expenses

and general corporate purposes, including working capital. We have not reserved or allocated specific amounts for any of these purposes

and we cannot specify with certainty how we will use the net proceeds. See “Use of Proceeds”. Accordingly,

our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part

of your investment decision, to assess whether the proceeds are being used appropriately. We may use the net proceeds for corporate purposes

that do not increase our operating results or market value.

We

have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to

the value of our common stock, which may decrease in value.

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends

on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as

our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your

investment will only occur if our stock price appreciates.

Our

issuance of additional shares of preferred stock could adversely affect the market value of our common stock, dilute the voting power

of common stockholders and delay or prevent a change of control.

Our

board of directors has the authority to cause us to issue, without any further vote or action by the stockholders, shares of preferred

stock in one or more series, to designate the number of shares constituting any series, and to fix the rights, preferences, privileges

and restrictions thereof, including dividend rights, voting rights, rights and terms of redemption, redemption price or prices and liquidation

preferences of such series.

The

issuance of shares of preferred stock with dividend or conversion rights, liquidation preferences or other economic terms favorable to

the holders of preferred stock could adversely affect the market price for our common stock by making an investment in the common stock

less attractive. For example, investors in the common stock may not wish to purchase common stock at a price above the conversion price

of a series of convertible preferred stock because the holders of the preferred stock would effectively be entitled to purchase common

stock at the lower conversion price causing economic dilution to the holders of common stock.

Further,

the issuance of shares of preferred stock with voting rights may adversely affect the voting power of the holders of our other classes

of voting stock either by diluting the voting power of our other classes of voting stock if they vote together as a single class, or

by giving the holders of any such preferred stock the right to block an action on which they have a separate class vote even if the action

were approved by the holders of our other classes of voting stock. The issuance of shares of preferred stock may also have the effect

of delaying, deferring or preventing a change in control of our company without further action by the stockholders, even where stockholders

are offered a premium for their shares.

The

market price of our common stock has been, and may continue to be, subject to substantial volatility.

The

market price of our common stock may fluctuate significantly in response to numerous factors, many of which are beyond our control, including;

| |

● |

volatility

in the trading markets generally and in our particular market segment; |

| |

|

|

| |

● |

limited

trading of our common stock; |

| |

● |

actual

or anticipated fluctuations in our results of operations; |

| |

|

|

| |

● |

the

financial projections we may provide to the public, any changes in those projections, or our failure to meet those projections; |

| |

|

|

| |

● |

announcements

regarding our business or the business of our customers or competitors; |

| |

|

|

| |

● |

changes

in accounting standards, policies, guidelines, interpretations, or principles; |

| |

|

|

| |

● |

actual

or anticipated developments in our business or our competitors’ businesses or the competitive landscape generally; |

| |

|

|

| |

● |

developments

or disputes concerning our intellectual property or our offerings, or third-party proprietary rights; |

| |

|

|

| |

● |

announced

or completed acquisitions of businesses or technologies by us or our competitors; |

| |

|

|

| |

● |

new

laws or regulations or new interpretations of existing laws or regulations applicable to our business; |

| |

|

|

| |

● |

any

major change in our board of directors or management; |

| |

|

|

| |

● |

sales

of shares of our common stock by us or by our stockholders; |

| |

|

|

| |

● |

lawsuits

threatened or filed against us; and |

| |

|

|

| |

● |

other

events or factors, including those resulting from war, incidents of terrorism, pandemics (such as the COVID-19 pandemic) or responses

to these events. |

Statements

of, or changes in, opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to the markets in which

we operate or expect to operate could have an adverse effect on the market price of our common stock. In addition, the stock market as

a whole, as well as our particular market segment, has from time-to-time experienced extreme price and volume fluctuations, which may

affect the market price for the securities of many companies, and which often have appeared unrelated to the operating performance of

such companies. Any of these factors could negatively affect our stockholders’ ability to sell their shares of common stock at

the time and price they desire.

A

decline in the price of our common stock could affect our ability to raise further working capital, which could adversely impact our

ability to continue operations.

A

prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in

our ability to raise capital. We may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations

through the sale of equity securities; thus, a decline in the price of our common stock could be detrimental to our liquidity and our