- Current report filing (8-K)

March 06 2012 - 12:11PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

March 6, 2012

Date of Report (Date of earliest event reported)

UNITED SECURITY BANCSHARES

(Exact Name of Registrant as Specified in its Charter)

California

(State or Other Jurisdiction of Incorporation)

|

000-32987

|

|

91-2112732

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2126 Inyo Street, Fresno, CA

|

|

93721

|

|

(Address of Principal Executive Office)

|

|

(Zip Code)

|

559-248-4944

(Registrant's Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a12 under the Exchange

Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 5.02(c).

Appointment of Certain Officers

Effective March 2, 2012, Mr. Karlo “Karl” Miller, age 60, was appointed to Senior Vice President and Chief Credit Officer. Mr. Miller joins the Company with over 30 years of banking experience, specializing in credit management in small and middle market institutions in California and the Pacific Northwest. Mr. Miller’s appointment includes a grant of 25,000 shares of incentive stock options to be issued at a later date, not yet determined.

Caution About Forward-Looking Statements

Certain statements made in this Current Report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations, or beliefs about events or results or otherwise are not statements of historical facts, such as statements about the anticipated affects of the restatement on our financial results, regaining compliance with NASDAQ requirements and statements about evaluating strategic alternatives. Although Bancshares believes that its expectations with respect to such forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance Bancshares will be able to regain compliance with the NASDAQ requirements, implement strategic alternatives in a timely manner or that the expected affects of the restatement will be as anticipated, or that actual results, performance or achievements of Bancshares will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual events or results to differ significantly from those described in the forward-looking statements include, but are not limited to those described in the cautionary language included under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and Quarterly Reports on Form 10-Q for the quarter ended September 30, 2011 and other filings made with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

United Security Bancshares

|

|

|

|

|

|

|

|

Date: March 6, 2012

|

By:

|

/s/ Ken Donahue

|

|

|

|

|

Executive Vice President &

|

|

|

|

|

Chief Administrative Officer

|

|

|

|

|

|

|

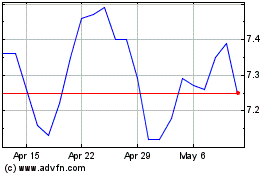

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Oct 2024 to Nov 2024

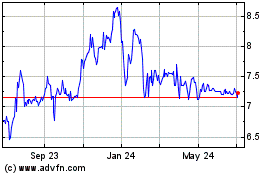

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Nov 2023 to Nov 2024