Issuer Free Writing Prospectus Filed pursuant to Rule 433 Dated November

18, 2020 Registration No. 333-250158 Fixed Income Investor Presentation November 18, 2020Issuer Free Writing Prospectus Filed pursuant to Rule 433 Dated November 18, 2020 Registration No. 333-250158 Fixed Income Investor

Presentation November 18, 2020

Forward–Looking Statements Certain statements contained in this

document constitute forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward‐looking statements by words such as “may,” “hope,”

“will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,”“predict,”“project,” “potential,”

“seek,” “continue,” “could,” “would,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they

discuss our future expectations or state other “forward‐looking” information. These forward‐looking statements include, but are not limited to, statements relating to anticipated future operating and financial performance

measures, including net interest margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of

belief included therein as well as the management assumptions underlying these forward‐looking statements. You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s

filings with the Securities and Exchange Commission (SEC) could have an adverse effect on our business, results of operations and financial condition. Should one or more of these risks materialize, or should any such underlying assumptions prove to

be significantly different, actual results may vary significantly from those anticipated, estimated, projected or expected. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in

the future, be amplified by, the novel coronavirus (COVID‐19) pandemic, and also by the effectiveness of varying governmental responses in ameliorating the impact of the pandemic on our customers and the economies where they operate. Risks

that could cause actual results to differ materially from current expectations of Management include, but are not limited to, changes in the level of nonperforming assets and charge‐offs, an increase in unemployment levels and slowdowns in

economic growth, our ability to manage the impact of the COVID‐19 pandemic on our markets and our customers, aswellasthe effectivenessof actions of federal, state and local governments and agencies (including the Board of Governors of the

Federal Reserve Board (FRB)) to mitigate its spread and economic impact, local, state and national economic and market conditions, conditions in the housing and real estate markets in the regions in which Trustmark operates and the extent and

duration of the current volatility in the credit and financial markets, levels of and volatility in crude oil prices, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility of

market interest rates, the performance and demand for the products and services we offer, including the level and timing of withdrawals from our deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such

litigation, our ability to attract noninterest‐bearing deposits and other low‐cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo expansion and acquisitions,

economic conditions, including the potential impact of issues related to the European financial system and monetary and other governmental actions designed to address credit, securities, and/or commodity markets, the enactment of legislation and

changes in existing regulations or enforcement practices or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing standards, that affect our consolidated financial

statements, changes in consumer spending, borrowings and savings habits, technological changes, changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, greater than expected costs or

difficulties related to the integration of acquisitions or new products and lines of business, cyber‐attacks and other breaches which could affect our information system security, natural disasters, environmental disasters, pandemics or other

health crises, acts of war or terrorism, and other risks described in our filings with the SEC. Although we believe that the expectations reflected in such forward‐looking statements are reasonable, we can give no assurance that such

expectations will prove to be correct. Except as required by law, we undertake no obligation to update or revise any of this information, whether as the result of new information, future events or developments orotherwise. This presentation is not

an offer to sell securities and Trustmark is not soliciting an offer to buy securities in any jurisdiction where such offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities

of Trustmark or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offence. Except as otherwise indicated, this presentation speaks as of the date hereof. Trustmark has filed a registration

statement (including a base prospectus) and a preliminary prospectus supplement with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates. Before you invest in any securities, you

should read the prospectus in that registration statement, the related preliminary prospectus supplement and other documents Trustmark has filed with the SEC for more complete information about Trustmark and this offering. You may obtain these

documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Trustmark, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Morgan Stanley

& Co. LLC, toll‐free at 1‐866‐718‐1649 or by emailing prospectus@morganstanley.com, or Piper Sandler & Co., toll‐free at 1‐866‐805‐4128 or by emailing fsg‐dcm@psc.com. This presentation

includes non‐GAAP financial measures to describe our performance. The calculations of these measures are provided in the Appendix to this presentation. These disclosures should not be viewed as a substitute for operating results determined in

accordance with GAAP, nor are they necessarily comparable to non‐GAAP performance measures that may be presented by other companies. 2Forward–Looking Statements Certain statements contained in this document constitute

forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward‐looking statements by words such as “may,” “hope,” “will,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,”“predict,”“project,” “potential,” “seek,”

“continue,” “could,” “would,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future

expectations or state other “forward‐looking” information. These forward‐looking statements include, but are not limited to, statements relating to anticipated future operating and financial performance measures, including

net interest margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of belief included

therein as well as the management assumptions underlying these forward‐looking statements. You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s filings with the

Securities and Exchange Commission (SEC) could have an adverse effect on our business, results of operations and financial condition. Should one or more of these risks materialize, or should any such underlying assumptions prove to be significantly

different, actual results may vary significantly from those anticipated, estimated, projected or expected. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be

amplified by, the novel coronavirus (COVID‐19) pandemic, and also by the effectiveness of varying governmental responses in ameliorating the impact of the pandemic on our customers and the economies where they operate. Risks that could cause

actual results to differ materially from current expectations of Management include, but are not limited to, changes in the level of nonperforming assets and charge‐offs, an increase in unemployment levels and slowdowns in economic growth, our

ability to manage the impact of the COVID‐19 pandemic on our markets and our customers, aswellasthe effectivenessof actions of federal, state and local governments and agencies (including the Board of Governors of the Federal Reserve Board

(FRB)) to mitigate its spread and economic impact, local, state and national economic and market conditions, conditions in the housing and real estate markets in the regions in which Trustmark operates and the extent and duration of the current

volatility in the credit and financial markets, levels of and volatility in crude oil prices, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility of market interest rates, the

performance and demand for the products and services we offer, including the level and timing of withdrawals from our deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such litigation, our ability to

attract noninterest‐bearing deposits and other low‐cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo expansion and acquisitions, economic conditions, including

the potential impact of issues related to the European financial system and monetary and other governmental actions designed to address credit, securities, and/or commodity markets, the enactment of legislation and changes in existing regulations or

enforcement practices or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing standards, that affect our consolidated financial statements, changes in consumer spending,

borrowings and savings habits, technological changes, changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, greater than expected costs or difficulties related to the integration of

acquisitions or new products and lines of business, cyber‐attacks and other breaches which could affect our information system security, natural disasters, environmental disasters, pandemics or other health crises, acts of war or terrorism,

and other risks described in our filings with the SEC. Although we believe that the expectations reflected in such forward‐looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Except as

required by law, we undertake no obligation to update or revise any of this information, whether as the result of new information, future events or developments orotherwise. This presentation is not an offer to sell securities and Trustmark is not

soliciting an offer to buy securities in any jurisdiction where such offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities of Trustmark or passed upon the accuracy or

adequacy of this presentation. Any representation to the contrary is a criminal offence. Except as otherwise indicated, this presentation speaks as of the date hereof. Trustmark has filed a registration statement (including a base prospectus) and a

preliminary prospectus supplement with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this presentation relates. Before you invest in any securities, you should read the prospectus in that registration

statement, the related preliminary prospectus supplement and other documents Trustmark has filed with the SEC for more complete information about Trustmark and this offering. You may obtain these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, Trustmark, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Morgan Stanley & Co. LLC, toll‐free at

1‐866‐718‐1649 or by emailing prospectus@morganstanley.com, or Piper Sandler & Co., toll‐free at 1‐866‐805‐4128 or by emailing fsg‐dcm@psc.com. This presentation includes non‐GAAP financial

measures to describe our performance. The calculations of these measures are provided in the Appendix to this presentation. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they

necessarily comparable to non‐GAAP performance measures that may be presented by other companies. 2

Offering Summary Issuer:

Trustmark Corporation (NASDAQ: TRMK) Security: 10NC‐5 Fixed‐to‐Floating Rate Subordinated Holding Company Notes Format: SEC Registered Size: $100MM Expected Ratings:

BBB‐ (S&P) / BBB (Fitch) Optional Redemption: Par Call Option After 5 Years and Thereafter Interest Rate:

Fixed‐Rate for 5 Years, Then Floating vs. 3 Month Term SOFR Thereafter Use of Proceeds: General Corporate Purposes Bookrunners:

Morgan Stanley & Co. LLC, Piper Sandler & Co. Launch Date: November 18, 2020 3Offering Summary Issuer: Trustmark Corporation (NASDAQ: TRMK) Security: 10NC‐5

Fixed‐to‐Floating Rate Subordinated Holding Company Notes Format: SEC Registered Size: $100MM Expected Ratings: BBB‐ (S&P) / BBB (Fitch) Optional Redemption: Par Call Option After 5 Years and Thereafter Interest Rate:

Fixed‐Rate for 5 Years, Then Floating vs. 3 Month Term SOFR Thereafter Use of Proceeds: General Corporate Purposes Bookrunners: Morgan Stanley & Co. LLC, Piper Sandler & Co. Launch Date: November 18, 2020 3

Pro Forma Impact of Offering §

Current and pro forma capital well in excess of minimum regulatory requirements §

Tier 2 qualifying subordinated debt being issued will further strengthen regulatory capital ratios Minimum Illustrative Pro Well Capitalized Requirement

Q3‐20 Ratio Increase / Decrease Forma (Including CCB) Common Equity Tier 1 Ratio (%) 6.5 7.0 11.36 11.36 0 bps Tier 1 Risk‐Based Capital Ratio (%) 8.0 8.5 11.86

11.86 0 bps Total Risk‐Based Capital Ratio (%) 10.0 10.5 12.88 13.72 84 bps Tier 1 Leverage Ratio (%) 5.0 4.0 9.20 9.14 (6) bps ‘ (1)

Tangible Equity / Tangible Assets (%) 8.68 8.63 (5) bps ‘ Selected Additional Metrics: CRE Loans / Total Risk‐Based Capital (%) 244.9 230.0 (1,492) bps

Double Leverage Ratio (%) 102.2 102.2 0 bps Source: Company reports (1) See Non‐GAAP financial measures on pages 27‐28 4Pro Forma Impact of Offering § Current

and pro forma capital well in excess of minimum regulatory requirements § Tier 2 qualifying subordinated debt being issued will further strengthen regulatory capital ratios Minimum Illustrative Pro Well Capitalized Requirement Q3‐20 Ratio

Increase / Decrease Forma (Including CCB) Common Equity Tier 1 Ratio (%) 6.5 7.0 11.36 11.36 0 bps Tier 1 Risk‐Based Capital Ratio (%) 8.0 8.5 11.86 11.86 0 bps Total Risk‐Based Capital Ratio (%) 10.0 10.5 12.88 13.72 84 bps Tier 1

Leverage Ratio (%) 5.0 4.0 9.20 9.14 (6) bps ‘ (1) Tangible Equity / Tangible Assets (%) 8.68 8.63 (5) bps ‘ Selected Additional Metrics: CRE Loans / Total Risk‐Based Capital (%) 244.9 230.0 (1,492) bps Double Leverage Ratio (%)

102.2 102.2 0 bps Source: Company reports (1) See Non‐GAAP financial measures on pages 27‐28 4

Today’s Presenters Tom Owens Gerard Jerry Host EVP, Treasurer

Chairman, President & CEO 7 Years at Trustmark, 36 Years at Trustmark, 33 Years of industry experience 48 Years of industry experience Duane Dewey Barry Harvey Director, COO EVP, Chief Credit Officer 17 Years at Trustmark 21 Years at Trustmark

35 Years of industry experience 37 Years of industry experience Louis Greer Granville Tate EVP, Principal Financial Officer EVP, Secretary, Chief Risk Officer & General Counsel 33 Years at Trustmark, 41 Years of industry experience 5 Years at

Trustmark, 34 Years of industry experience 5Today’s Presenters Tom Owens Gerard Jerry Host EVP, Treasurer Chairman, President & CEO 7 Years at Trustmark, 36 Years at Trustmark, 33 Years of industry experience 48 Years of industry

experience Duane Dewey Barry Harvey Director, COO EVP, Chief Credit Officer 17 Years at Trustmark 21 Years at Trustmark 35 Years of industry experience 37 Years of industry experience Louis Greer Granville Tate EVP, Principal Financial Officer EVP,

Secretary, Chief Risk Officer & General Counsel 33 Years at Trustmark, 41 Years of industry experience 5 Years at Trustmark, 34 Years of industry experience 5

Trustmark Corporation Investment Highlights

Who We Are • Attractive diversified business across products • Diversified financial services company headquartered in

Jackson, MS, offering banking, wealth management, and and sectors risk management solutions in 187 locations throughout the Southeast U.S. •

Our vision is to be a premier financial services provider in our • Consistent, through‐the‐cycle, risk‐adjusted marketplace. returns •

Our mission is to achieve outstanding customer satisfaction by providing banking, wealth management, and risk

management solutions through superior sales and service, • Proven track record of strong credit risk

utilizing excellent people, teamwork, and diversity, while management meeting our corporate financial goals. Our Footprint •

Low‐cost core deposit base supported by attractive markets • Leading capital and liquidity position with a long

uninterrupted history of consistent capital return Branches Source: Company reports 6Trustmark Corporation Investment Highlights Who We Are • Attractive diversified business across products •

Diversified financial services company headquartered in Jackson, MS, offering banking, wealth management, and and sectors risk management solutions in 187 locations throughout the Southeast U.S. • Our vision is to be a premier financial

services provider in our • Consistent, through‐the‐cycle, risk‐adjusted marketplace. returns • Our mission is to achieve outstanding customer satisfaction by providing banking, wealth management, and risk management

solutions through superior sales and service, • Proven track record of strong credit risk utilizing excellent people, teamwork, and diversity, while management meeting our corporate financial goals. Our Footprint • Low‐cost core

deposit base supported by attractive markets • Leading capital and liquidity position with a long uninterrupted history of consistent capital return Branches Source: Company reports 6

Leading Market Share Across Attractive Markets

#1 Bank in Mississippi • Leading bank in Mississippi Deposits Mkt Share Bank Dep. Rank Branches • Top 4 market share in 50% of MSAs ($MM) (%) •

Top 3 market share in 55% of counties, top 4 in 66% 9,187 1 14.2 114 Trustmark 8,141 2 12.6 118 Regions Financial •

Focused on markets and communities where relationships are valued and with attractive growth prospects Bancorp South 6,887 3 10.6 94 •

Strategic branch footprint serves a diversified commercial and Renasant Corp. 4,670 4 7.2 70 retail customer base and strengthens brand recognition

Hancock 4,226 5 6.5 39 Whitney Trustmark MSAs of Operation ‐ Top 10 By Deposits Strategic Southeast Branch Footprint Deposits Mkt Share Kansas

Kentucky MSA Dep. Rank Branches Missouri ($MM) (%) Jackson, MS 5,608 1 33.2 45 Tennessee Memphis, TN 834 9 2.1 21 Oklahoma Houston, TX 587 40 0.2 12 Arkansas

Hattiesburg, MS 568 2 15.0 9 Georgia Panama City, FL 567 2 13.4 8 Mississippi Alabama Crestview, FL 485 6 7.6 7 Texas Louisiana Florida Mobile, AL

411 7 4.7 6 Montgomery, AL 310 10 3.3 7 Vicksburg, MS 302 1 24.8 5 187 Branches Tupelo, MS 261 5 6.0 6

Source: SNL Financial (data as of 06/30/2020) 7Leading Market Share Across Attractive Markets #1 Bank in Mississippi • Leading bank in Mississippi Deposits Mkt Share Bank Dep. Rank

Branches • Top 4 market share in 50% of MSAs ($MM) (%) • Top 3 market share in 55% of counties, top 4 in 66% 9,187 1 14.2 114 Trustmark 8,141 2 12.6 118 Regions Financial • Focused on markets and communities where relationships are

valued and with attractive growth prospects Bancorp South 6,887 3 10.6 94 • Strategic branch footprint serves a diversified commercial and Renasant Corp. 4,670 4 7.2 70 retail customer base and strengthens brand recognition Hancock 4,226 5 6.5

39 Whitney Trustmark MSAs of Operation ‐ Top 10 By Deposits Strategic Southeast Branch Footprint Deposits Mkt Share Kansas Kentucky MSA Dep. Rank Branches Missouri ($MM) (%) Jackson, MS 5,608 1 33.2 45 Tennessee Memphis, TN 834 9 2.1 21

Oklahoma Houston, TX 587 40 0.2 12 Arkansas Hattiesburg, MS 568 2 15.0 9 Georgia Panama City, FL 567 2 13.4 8 Mississippi Alabama Crestview, FL 485 6 7.6 7 Texas Louisiana Florida Mobile, AL 411 7 4.7 6 Montgomery, AL 310 10 3.3 7 Vicksburg, MS 302

1 24.8 5 187 Branches Tupelo, MS 261 5 6.0 6 Source: SNL Financial (data as of 06/30/2020) 7

Q3‐20 Financial Highlights

Performance reflects value of diversified financial services businesses • Diversified business model provided stability in challenging economic

At September 30, 2020 Earnings environment; noninterest income increased 6.0% LQ Drivers Total Assets $15.6 billion •

Results reflect lower provision and expense for credit losses due to improved Loans (HFI) $9.8 billion macroeconomic factors PPP Loans $944.3 million •

PPP loans totaled $970.0 million at September 30, 2020, before deferred fees and costs of $25.7 million Total Deposits $13.2 billion

Banking Centers 187 • LHFI (excl. PPP loans) increased $187.9 million, or 1.9%, from the prior quarter Profitable

and $624.1 million, or 6.8%, Y‐o‐Y Q3‐20 Q2‐20 Q3‐19 Revenue (1) • Pre‐tax, pre‐provision (PTPP) income

totaled $62.9 million, up 1.4% LQ and Generation $54.4 $32.2 $41.0 26.0% Y‐o‐Y Net Income million million million (1) EPS – Diluted $0.86 $0.51 $0.64 •

Adjusted noninterest expense totaled $114.6 million in the third quarter of Expense

2020, an increase of 3.2% from the prior quarter, reflecting increases in salaries, Management $62.9 $62.1 $49.9

commissions, and performance‐based incentives (1) PTPP Income million million million •

Allowance for credit losses represented 1.24% of loans held for investment ROAA 1.37% 0.83% 1.21% Credit

and 593.72% of nonperforming loans, excluding individually evaluated loans Quality (1) ROATE 16.82% 10.32% 13.31% •

Maintained strong capital levels with CET1 ratio of 11.36% and total risk‐based Dividends / Capital $0.23 $0.23 $0.23 capital ratio of 12.88% Share

Management • Board of Directors declared quarterly cash dividend of $0.23 per share (1) TCE/TA 8.68% 8.37% 9.53% Source: Company reports

(1) See Non‐GAAP financial measures on pages 27‐28 8Q3‐20 Financial Highlights Performance reflects value of diversified financial services businesses • Diversified business model

provided stability in challenging economic At September 30, 2020 Earnings environment; noninterest income increased 6.0% LQ Drivers Total Assets $15.6 billion • Results reflect lower provision and expense for credit losses due to improved

Loans (HFI) $9.8 billion macroeconomic factors PPP Loans $944.3 million • PPP loans totaled $970.0 million at September 30, 2020, before deferred fees and costs of $25.7 million Total Deposits $13.2 billion Banking Centers 187 • LHFI

(excl. PPP loans) increased $187.9 million, or 1.9%, from the prior quarter Profitable and $624.1 million, or 6.8%, Y‐o‐Y Q3‐20 Q2‐20 Q3‐19 Revenue (1) • Pre‐tax, pre‐provision (PTPP) income totaled

$62.9 million, up 1.4% LQ and Generation $54.4 $32.2 $41.0 26.0% Y‐o‐Y Net Income million million million (1) EPS – Diluted $0.86 $0.51 $0.64 • Adjusted noninterest expense totaled $114.6 million in the third quarter of

Expense 2020, an increase of 3.2% from the prior quarter, reflecting increases in salaries, Management $62.9 $62.1 $49.9 commissions, and performance‐based incentives (1) PTPP Income million million million • Allowance for credit losses

represented 1.24% of loans held for investment ROAA 1.37% 0.83% 1.21% Credit and 593.72% of nonperforming loans, excluding individually evaluated loans Quality (1) ROATE 16.82% 10.32% 13.31% • Maintained strong capital levels with CET1 ratio

of 11.36% and total risk‐based Dividends / Capital $0.23 $0.23 $0.23 capital ratio of 12.88% Share Management • Board of Directors declared quarterly cash dividend of $0.23 per share (1) TCE/TA 8.68% 8.37% 9.53% Source: Company reports

(1) See Non‐GAAP financial measures on pages 27‐28 8

Loans Held for Investment (LHFI) Portfolio

Focused on profitable, credit‐disciplined loan growth LHFI Change (1) ($ in millions) Loan Portfolio Composition 9/30/20 9/30/20 LQ Y‐o‐Y Other RE, 9%

Loans secured by real estate: Nonfarm‐Nonres, 27% C&I, 14% Const., land dev. and other land loans $ 1,386 $ 109 $ 250

Secured by 1‐4 family residential prop. 1,775 (38) (45) Consumer, 2% Secured by nonfarm, nonresidential prop. 2,708 97 265 State & Other

Other real estate secured 888 3 219 Political Sub. , 9% 1‐4 Residential, Commercial and industrial loans 1,398 (15) (93) Other, 6% 18% Consumer loans 161 (1) (16)

Construction, Land Dev, 14% State and other political subdivision loans 935 4 (43) Other loans 596 29 87 Total LHFI $ 9,848 $ 188 $ 624 LHFI by Quarter $9,848

$9,660 $9,568 $9,336 $9,224 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Dollar (2) $112 $160 $92 $188 Change: Source: Company reports

(1) Percentages may not sum to 100% due to rounding.

(2) During Q1‐20, Trustmark reclassified $72.6 million of acquired loans to loans held for investment with the adoption of FASB ASC

Topic 326. Reflects change excluding acquired loan reclass. 9Loans Held for Investment (LHFI) Portfolio Focused on profitable, credit‐disciplined loan growth LHFI Change (1) ($ in millions) Loan Portfolio

Composition 9/30/20 9/30/20 LQ Y‐o‐Y Other RE, 9% Loans secured by real estate: Nonfarm‐Nonres, 27% C&I, 14% Const., land dev. and other land loans $ 1,386 $ 109 $ 250 Secured by 1‐4 family residential prop. 1,775 (38)

(45) Consumer, 2% Secured by nonfarm, nonresidential prop. 2,708 97 265 State & Other Other real estate secured 888 3 219 Political Sub. , 9% 1‐4 Residential, Commercial and industrial loans 1,398 (15) (93) Other, 6% 18% Consumer loans 161

(1) (16) Construction, Land Dev, 14% State and other political subdivision loans 935 4 (43) Other loans 596 29 87 Total LHFI $ 9,848 $ 188 $ 624 LHFI by Quarter $9,848 $9,660 $9,568 $9,336 $9,224 Q3‐19 Q4‐19 Q1‐20 Q2‐20

Q3‐20 Dollar (2) $112 $160 $92 $188 Change: Source: Company reports (1) Percentages may not sum to 100% due to rounding. (2) During Q1‐20, Trustmark reclassified $72.6 million of acquired loans to loans held for investment with the

adoption of FASB ASC Topic 326. Reflects change excluding acquired loan reclass. 9

Real Estate Secured Loan Portfolio Detail CRE Portfolio

As Reported % of CRE Owner‐Occupied NonFarm, % of Owner‐ ($ in millions) Portfolio NonResidential Occupied ($ in millions) As Reported Portfolio 9/30/20 9/30/20

Lots, Development and Unimproved Land $ 253 7% Offices $ 181 16% 1‐4 Family Construction 242 6% Churches 107 9% Other Construction 891 24% Industrial Warehouses 165 14%

Total Construction, Land Development and Other $ 1,386 37% Land Loans Health Care 128 11% Retail 415 11% Convenience Stores 121 10% Offices 257 7% Nursing Homes/Senior Living 182 16%

Hotels/Motels 344 9% Other 281 24% Industrial 216 6% Total Owner‐Occupied $ 1,165 100% Other (including REITs) 353 9% Total Non‐owner Occupied & REITs $ 1,585 42% (1) Multi‐Family

804 21% • Focus on vertical construction with limited exposure to Total CRE $ 3,775 100% unimproved land and development •

Well‐diversified product and geographical mix • Balanced between non‐owner and owner‐occupied portfolios •

Virtually no REIT outstandings ($43 million) Source: Company reports

(1) Multi‐Family is included in Other Real Estate Secured Loans in Financials 10Real Estate Secured Loan Portfolio Detail CRE Portfolio As Reported % of CRE Owner‐Occupied

NonFarm, % of Owner‐ ($ in millions) Portfolio NonResidential Occupied ($ in millions) As Reported Portfolio 9/30/20 9/30/20 Lots, Development and Unimproved Land $ 253 7% Offices $ 181 16% 1‐4 Family Construction 242 6% Churches 107 9%

Other Construction 891 24% Industrial Warehouses 165 14% Total Construction, Land Development and Other $ 1,386 37% Land Loans Health Care 128 11% Retail 415 11% Convenience Stores 121 10% Offices 257 7% Nursing Homes/Senior Living 182 16%

Hotels/Motels 344 9% Other 281 24% Industrial 216 6% Total Owner‐Occupied $ 1,165 100% Other (including REITs) 353 9% Total Non‐owner Occupied & REITs $ 1,585 42% (1) Multi‐Family 804 21% • Focus on vertical construction

with limited exposure to Total CRE $ 3,775 100% unimproved land and development • Well‐diversified product and geographical mix • Balanced between non‐owner and owner‐occupied portfolios • Virtually no REIT

outstandings ($43 million) Source: Company reports (1) Multi‐Family is included in Other Real Estate Secured Loans in Financials 10

Commercial Loan Portfolio Detail

Commercial Portfolio % of Commercial • Portfolio includes commercial, financial intermediaries, ($ in millions) As Reported Portfolio

agriculture production and non‐profits 9/30/20 • Well‐diversified portfolio with no single category exceeding 13% Finance & Insurance $ 256 13% •

Small energy book and has never been an area of focused Manufacturing 201 10% growth Health Care & Social Assistance 200 10% •

Virtually no regulatory defined higher risk commercial and Retail Trade 174 9% industrial outstanding ($11 million) Transportation & Warehousing 155 8%

Real Estate & Rental & Leasing 152 8% Construction 136 7% Wholesale Trade 109 6% Professional, Scientific & Technical Services 84 4% Arts, Entertainment & Recreation 75

4% Information 45 2% All Other 365 19% Total $ 1,952 100% Source: Company reports 11Commercial Loan Portfolio Detail Commercial Portfolio % of Commercial • Portfolio includes commercial, financial intermediaries, ($ in

millions) As Reported Portfolio agriculture production and non‐profits 9/30/20 • Well‐diversified portfolio with no single category exceeding 13% Finance & Insurance $ 256 13% • Small energy book and has never been an

area of focused Manufacturing 201 10% growth Health Care & Social Assistance 200 10% • Virtually no regulatory defined higher risk commercial and Retail Trade 174 9% industrial outstanding ($11 million) Transportation & Warehousing 155

8% Real Estate & Rental & Leasing 152 8% Construction 136 7% Wholesale Trade 109 6% Professional, Scientific & Technical Services 84 4% Arts, Entertainment & Recreation 75 4% Information 45 2% All Other 365 19% Total $ 1,952 100%

Source: Company reports 11

COVID‐19 Impacted Industries

At September 30, 2020 Restaurants Hotels Retail (CRE) Energy Higher Risk C&I •$473 million Outstanding •$110 million Outstanding

•$11 million Outstanding •$119 million •$380 million Outstanding Outstanding •$560 million Exposure •$347 million Exposure

•$14 million Exposure •$442 million Exposure •$131 million Exposure •330 Loans •127 Loans •1 Borrower •97 Loans •337 Loans

•4.8% of Portfolio •1.11% of Portfolio •3.9% of Portfolio Outstandings Outstandings •1.20% of Portfolio Outstandings Outstandings o

21% of book‐ stand‐ o No loans where •99% Real Estate Secured alone buildings with repayment or •85% Real Estate Secured

strong essential underlying security services tenants tied to realization of o Experienced o Full‐Service

value from energy operators & carries Restaurants ‐ 35% reserves o Additional 2% of secondary guarantor book‐ national support o

Limited‐Service grocery store Restaurants – 63% anchored o 91% operate under a o Other – 2% flag o Additional 19% of

book‐investment o 83% operate under grade anchored Marriott, Hilton, IHG centers & Hyatt Flags o Mall exposure in only one borrower‐$5

million outstanding 12COVID‐19 Impacted Industries At September 30, 2020 Restaurants Hotels Retail (CRE) Energy Higher Risk C&I •$473 million Outstanding •$110 million Outstanding •$11 million Outstanding •$119

million •$380 million Outstanding Outstanding •$560 million Exposure •$347 million Exposure •$14 million Exposure •$442 million Exposure •$131 million Exposure •330 Loans •127 Loans •1 Borrower

•97 Loans •337 Loans •4.8% of Portfolio •1.11% of Portfolio •3.9% of Portfolio Outstandings Outstandings •1.20% of Portfolio Outstandings Outstandings o 21% of book‐ stand‐ o No loans where •99%

Real Estate Secured alone buildings with repayment or •85% Real Estate Secured strong essential underlying security services tenants tied to realization of o Experienced o Full‐Service value from energy operators & carries

Restaurants ‐ 35% reserves o Additional 2% of secondary guarantor book‐ national support o Limited‐Service grocery store Restaurants – 63% anchored o 91% operate under a o Other – 2% flag o Additional 19% of

book‐investment o 83% operate under grade anchored Marriott, Hilton, IHG centers & Hyatt Flags o Mall exposure in only one borrower‐$5 million outstanding 12

Strong Consistent History of Credit Risk Management (Loans HFI)

(1) Allowance for Credit Losses / Loans Nonperforming Assets (excl. Acquired Loans) (%) ($ in millions) 1.24% $132 1.23% 1.05% $111 $111 0.95% 0.91% 0.90% 0.90% 0.90% $96

$82 $77 $78 $43 $70 $68 $62 $35 $29 $25 $16 $18 $68 $62 $55 $53 $53 $54 $49 $50 2015 2016 2017 2018 2019 Q1‐20 Q2‐20

Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Allowance NPA / Nonaccrual Loans Other Real Estate / Non‐ Total 122% 145% 114% 129% 158% 190% 238% 226% 1.81% 1.38% 1.26% 1.07%

0.86% 0.78% 0.68% 0.68% accrual Loans + (1) Loans OREO Net Charge‐Offs / Average Loans (excl. Acquired Loans) Criticized & Classified Loans (%) ($ in millions)

$340 0.19% $80 $254 $254 0.15% 0.13% $28 0.11% $42 $191 $187 0.10% $182 $183 $182 0.06% $9 $38 $24 $37 $15 $260 $226 $212 $178

$167 $158 $146 $153 ‐0.02% ‐0.04% 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Substandard & Doubtful Special Mention

Source: Company reports

Note: Unless noted otherwise, credit metrics exclude acquired loans, PPP loans and other real estate covered by FDIC loss‐share agreement

(1) NPAs & NPAs / Total Loans include other real estate 13Strong Consistent History of Credit Risk Management (Loans HFI) (1) Allowance for Credit Losses / Loans Nonperforming Assets (excl.

Acquired Loans) (%) ($ in millions) 1.24% $132 1.23% 1.05% $111 $111 0.95% 0.91% 0.90% 0.90% 0.90% $96 $82 $77 $78 $43 $70 $68 $62 $35 $29 $25 $16 $18 $68 $62 $55 $53 $53 $54 $49 $50 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015

2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Allowance NPA / Nonaccrual Loans Other Real Estate / Non‐ Total 122% 145% 114% 129% 158% 190% 238% 226% 1.81% 1.38% 1.26% 1.07% 0.86% 0.78% 0.68% 0.68% accrual Loans + (1) Loans OREO Net

Charge‐Offs / Average Loans (excl. Acquired Loans) Criticized & Classified Loans (%) ($ in millions) $340 0.19% $80 $254 $254 0.15% 0.13% $28 0.11% $42 $191 $187 0.10% $182 $183 $182 0.06% $9 $38 $24 $37 $15 $260 $226 $212 $178 $167 $158

$146 $153 ‐0.02% ‐0.04% 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Substandard & Doubtful Special Mention Source: Company reports Note: Unless noted

otherwise, credit metrics exclude acquired loans, PPP loans and other real estate covered by FDIC loss‐share agreement (1) NPAs & NPAs / Total Loans include other real estate 13

Disciplined CECL Process

Allowance for Credit Losses ($ in millions) $2 $(6) $16 $122 • Net charge‐ • Other $21 offs changes including • Qualitative individually changes including

analyzed $8 changes due to reserves, $(2) COVID‐19 prepayment $84 • Quantitative portfolio review studies, etc. changes due to • Day 1 •

Changes in the impact of Adjustment loan portfolio COVID‐19 on due to loan the CECL model growth macroeconomic factors ALLL 12/31/19 ACL 9/30/20

Source: Company reports Note: Does not include allowance for off balance sheet credit exposures 14Disciplined CECL Process Allowance for Credit Losses ($ in

millions) $2 $(6) $16 $122 • Net charge‐ • Other $21 offs changes including • Qualitative individually changes including analyzed $8 changes due to reserves, $(2) COVID‐19 prepayment $84 • Quantitative portfolio

review studies, etc. changes due to • Day 1 • Changes in the impact of Adjustment loan portfolio COVID‐19 on due to loan the CECL model growth macroeconomic factors ALLL 12/31/19 ACL 9/30/20 Source: Company reports Note: Does not

include allowance for off balance sheet credit exposures 14

Securities Portfolio

High quality, short duration portfolio provides strong liquidity Available‐for‐Sale & Held‐To‐Maturity Securities

Net Unrealized Gains (losses) on Available for Sale Securities September 30, 2020 ($ in millions) ($ in millions) $45 US Government $42 Agency Obligations $59 RMBS

Pass-Thru $37 CMBS Issued by 2% Guaranteed by GNMA FNMA & FHLC $70 $146 3% 6% RMBS CMO Issued by FNMA $1 and FHLC $‐ $900 35% $(4) $(24) RMBS Pass-Thru Issued by FNMA & FHLC $1,358 54% Total: $2,534 $(43)

Modified Duration of 3.1 Years Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Source: Company reports 15Securities Portfolio High quality, short

duration portfolio provides strong liquidity Available‐for‐Sale & Held‐To‐Maturity Securities Net Unrealized Gains (losses) on Available for Sale Securities September 30, 2020 ($ in millions) ($ in millions) $45 US

Government $42 Agency Obligations $59 RMBS Pass-Thru $37 CMBS Issued by 2% Guaranteed by GNMA FNMA & FHLC $70 $146 3% 6% RMBS CMO Issued by FNMA $1 and FHLC $‐ $900 35% $(4) $(24) RMBS Pass-Thru Issued by FNMA & FHLC $1,358 54% Total:

$2,534 $(43) Modified Duration of 3.1 Years Q4‐18 Q1‐19 Q2‐19 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Source: Company reports 15

Attractive, Low‐Cost Deposit Base Deposit Trends

($ in billions) $13.5 $13.2 $1.5 $1.5 11% $11.6 $11.4 $11.2 $10.6 $10.1 $1.6 $9.9 $9.7 $1.9 $1.6 $9.6 $4.1 $1.8 33% $4.3 $1.6 $2.3 $1.9 $1.7 $7.9 $7.6 $3.6 $7.0

$3.6 $3.9 $3.4 $1.8 $3.6 $2.0 $3.0 $3.3 $3.0 $2.1 $4.0 26% $3.5 $2.3 $3.4 $2.1 $3.1 $2.6 $2.4 $1.8 $1.9 $1.9 Time $1.9 $1.7 $1.5 Savings $1.5 $1.5 $4.0 Interest‐Bearing $3.9 30% $3.0 $3.0 $3.0 $2.9 $2.9 $3.0 $2.7 $2.7 $2.3 $2.0

Noninterest‐Bearing $1.6 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q'2020 2Q'2020 3Q'2020 (1) Core Deposits (%) 70 74 77 77 80 82 84 83 83 86 86 89 89 Brokered Deposits (%) 2 1 1 ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐ Cost of Deposits (%) 0.69 0.48 0.31 0.20 0.16 0.13 0.13 0.21 0.47 0.70 0.52 0.26 0.22 (2) Loans/Deposits (%) 86 78 73 68 71 78 81 83 79 83 83 72 74 Source: Company reports

(1) Core deposits calculated as total deposits excluding time deposits (2) Excludes PPP loans 16Attractive, Low‐Cost Deposit Base Deposit Trends ($ in billions) $13.5 $13.2 $1.5

$1.5 11% $11.6 $11.4 $11.2 $10.6 $10.1 $1.6 $9.9 $9.7 $1.9 $1.6 $9.6 $4.1 $1.8 33% $4.3 $1.6 $2.3 $1.9 $1.7 $7.9 $7.6 $3.6 $7.0 $3.6 $3.9 $3.4 $1.8 $3.6 $2.0 $3.0 $3.3 $3.0 $2.1 $4.0 26% $3.5 $2.3 $3.4 $2.1 $3.1 $2.6 $2.4 $1.8 $1.9 $1.9 Time $1.9

$1.7 $1.5 Savings $1.5 $1.5 $4.0 Interest‐Bearing $3.9 30% $3.0 $3.0 $3.0 $2.9 $2.9 $3.0 $2.7 $2.7 $2.3 $2.0 Noninterest‐Bearing $1.6 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q'2020 2Q'2020 3Q'2020 (1) Core Deposits (%) 70 74

77 77 80 82 84 83 83 86 86 89 89 Brokered Deposits (%) 2 1 1 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Cost of Deposits (%) 0.69 0.48 0.31 0.20 0.16 0.13 0.13 0.21 0.47 0.70 0.52 0.26 0.22 (2) Loans/Deposits (%)

86 78 73 68 71 78 81 83 79 83 83 72 74 Source: Company reports (1) Core deposits calculated as total deposits excluding time deposits (2) Excludes PPP loans 16

Strong Capital Position

Solid capital position reflects consistent profitability, resulting in strong capital return Common Equity Tier 1 Risk‐Based Capital Ratio

Tier 1 Risk‐Based Capital Ratio 12.57% 12.16% 13.21% 11.93% 11.77% 11.77% 12.76% 12.48% 11.42% 11.35% 11.36% 12.33% 12.33% 11.94% 11.88% 11.86% 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017

2018 2019 Q1‐20 Q2‐20 Q3‐20 Total Risk‐Based Capital Ratio Tier 1 Leverage Ratio 10.48% 10.26% 10.21% 14.07% 10.03% 9.90% 9.67% 13.59% 13.25% 9.20% 13.10% 13.07% 9.08% 13.00% 12.88% 12.78% 2015

2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 (1) Tangible Common Equity / Tangible Assets Dividends Per Share 9.72% $0.92

$0.92 $0.92 $0.92 $0.92 9.31% 9.27% 8.79% 8.74% 8.77% 8.68% 8.37% $0.23 $0.23 $0.23 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20

Source: Company reports (1) See Non‐GAAP financial measures on pages 27 ‐28 17Strong Capital Position Solid capital position reflects consistent profitability, resulting in strong capital

return Common Equity Tier 1 Risk‐Based Capital Ratio Tier 1 Risk‐Based Capital Ratio 12.57% 12.16% 13.21% 11.93% 11.77% 11.77% 12.76% 12.48% 11.42% 11.35% 11.36% 12.33% 12.33% 11.94% 11.88% 11.86% 2015 2016 2017 2018 2019 Q1‐20

Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Total Risk‐Based Capital Ratio Tier 1 Leverage Ratio 10.48% 10.26% 10.21% 14.07% 10.03% 9.90% 9.67% 13.59% 13.25% 9.20% 13.10% 13.07% 9.08% 13.00% 12.88%

12.78% 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 (1) Tangible Common Equity / Tangible Assets Dividends Per Share 9.72% $0.92 $0.92 $0.92 $0.92 $0.92 9.31% 9.27% 8.79%

8.74% 8.77% 8.68% 8.37% $0.23 $0.23 $0.23 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 Source: Company reports (1) See Non‐GAAP financial measures on pages 27

‐28 17

Net Interest Income (2) Yields and Costs (1)

Net Interest Income – FTE 4.90% 4.67% 4.54% ($ in millions) 4.03% 3.81% $112 3.61% 3.52% 3.52% $109 $109 $108 3.14% $107 3.05% $2 $2 $7 $5 2.27% 2.28% 2.26% 2.18% 2.05% $109 $107 $107 0.99% 0.88% 0.75% $103 $102 0.39%

0.33% Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Net Interest Income (excl. Int. on Acq. Loans & PPP) NIM Loan Yield

Securities Yield Cost of IBL Interest and Fees on Acq. Loans Interest and Fees on PPP Loans •

Net interest income (FTE), excluding $6.7 million of interest and fees on PPP loans, totaled $102.4 million in the third quarter, resulting

in a net interest margin of 3.05%. •

Including interest and fees on PPP loans, net interest income (FTE) totaled $109.2 million, resulting in a net interest margin of 3.03%. •

Net interest income (FTE) increased $1.2 million relative to the prior quarter, as a $327 thousand reduction in interest income was more

than offset by a $1.5 million reduction in interest expense. Source: Company reports (1) Totals may not foot due to rounding

(2) Loan Yield and NIM exclude acquired loans and PPP 18Net Interest Income (2) Yields and Costs (1) Net Interest Income – FTE 4.90% 4.67% 4.54% ($ in millions) 4.03% 3.81% $112 3.61% 3.52%

3.52% $109 $109 $108 3.14% $107 3.05% $2 $2 $7 $5 2.27% 2.28% 2.26% 2.18% 2.05% $109 $107 $107 0.99% 0.88% 0.75% $103 $102 0.39% 0.33% Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Q3‐19 Q4‐19 Q1‐20 Q2‐20

Q3‐20 Net Interest Income (excl. Int. on Acq. Loans & PPP) NIM Loan Yield Securities Yield Cost of IBL Interest and Fees on Acq. Loans Interest and Fees on PPP Loans • Net interest income (FTE), excluding $6.7 million of interest and

fees on PPP loans, totaled $102.4 million in the third quarter, resulting in a net interest margin of 3.05%. • Including interest and fees on PPP loans, net interest income (FTE) totaled $109.2 million, resulting in a net interest margin of

3.03%. • Net interest income (FTE) increased $1.2 million relative to the prior quarter, as a $327 thousand reduction in interest income was more than offset by a $1.5 million reduction in interest expense. Source: Company reports (1) Totals

may not foot due to rounding (2) Loan Yield and NIM exclude acquired loans and PPP 18

Attractive Diversified Fee Income Business

Noninterest Income – Q3‐20 Noninterest Income Change ($ in millions) Other, net Service Charges on Q3‐20 Q2‐20 Y‐o‐Y 2% Wealth Management Deposit Accounts

Service Charge on Deposit Accounts $ 7.6 $ 1.2 $ (3.5) 10% 10% Bank Card and Other Fees 8.8 1.1 0.5 Insurance Bank Card and Mortgage Banking, net 36.4 2.7 28.3

Commissions Other Fees 16% 12% Insurance Commissions 11.6 (0.3) 0.5 Wealth Management 7.7 0.1 0.0 Other, net 1.6 (0.6) (0.4) Mortgage Banking, net 49% Total Noninterest Income $ 73.7 $ 4.2

$ 25.4 Noninterest Income = 41% of Quarterly Revenue •

Noninterest income totaled $73.7 million, up 6.0% linked‐quarter and up 52.5% year‐over‐year. •

Service charges on deposit accounts increased $1.2 million from the prior quarter. Bank card and other fees increased $1.1 million, reflecting

higher customer derivative revenue and interchange income. •

Insurance revenue totaled $11.6 million in the third quarter, a seasonal decline of 2.6% from the prior quarter. •

Wealth management revenue totaled $7.7 million in the third quarter, in line with the second quarter as increases in brokerage and

investment services were offset by a decline in trust management fees. Source: Company reports 19Attractive Diversified Fee Income Business Noninterest Income – Q3‐20

Noninterest Income Change ($ in millions) Other, net Service Charges on Q3‐20 Q2‐20 Y‐o‐Y 2% Wealth Management Deposit Accounts Service Charge on Deposit Accounts $ 7.6 $ 1.2 $ (3.5) 10% 10% Bank Card and Other Fees 8.8 1.1

0.5 Insurance Bank Card and Mortgage Banking, net 36.4 2.7 28.3 Commissions Other Fees 16% 12% Insurance Commissions 11.6 (0.3) 0.5 Wealth Management 7.7 0.1 0.0 Other, net 1.6 (0.6) (0.4) Mortgage Banking, net 49% Total Noninterest Income $ 73.7 $

4.2 $ 25.4 Noninterest Income = 41% of Quarterly Revenue • Noninterest income totaled $73.7 million, up 6.0% linked‐quarter and up 52.5% year‐over‐year. • Service charges on deposit accounts increased $1.2 million from

the prior quarter. Bank card and other fees increased $1.1 million, reflecting higher customer derivative revenue and interchange income. • Insurance revenue totaled $11.6 million in the third quarter, a seasonal decline of 2.6% from the prior

quarter. • Wealth management revenue totaled $7.7 million in the third quarter, in line with the second quarter as increases in brokerage and investment services were offset by a decline in trust management fees. Source: Company reports

19

AppendixAppendix

Current Ratings Profile Trustmark Corporation

Long‐Term Debt BBB BBB+ Short‐Term Debt A‐2 F2 Outlook Negative Stable Trustmark National Bank Long‐Term Debt BBB+ BBB+ Short‐Term Debt A‐2 F2 Outlook Negative Stable •

S&P – July 24, 2020 o

“Our ratings on Trustmark reflect the company's long history of sound asset quality, above‐peer regulatory capital ratios, large proportion

of noninterest revenues, and focus on organic revenue growth.” o

“Our capital and earnings assessment reflects Trustmark's positive earnings performance through the last economic cycle and our projection

that its RAC ratio will rise back above 10% over the next two years. Trustmark's regulatory capital ratios are at the high end of

peers, supported by consistent earnings, while the common stock dividend payout is relatively modest.” • Fitch – May 4, 2020 o

“In affirming TRMK's ratings with a Stable Outlook, Fitch is signaling its view that the bank enters this pandemic and ensuing sharp

financial downturn

in a position of strength, underpinned by its strong franchise within its operating markets and a conservative risk appetite exhibited by

relatively fewer credit losses through various economic cycles. Moreover, TRMK's solid capital and liquidity levels support today's action.” o

“TRMK has realized a relatively lower level of credit losses compared to peer banks in recent periods despite the company's historically

elevated level of nonperforming assets relative to peers.” Source: S&P Global Ratings Report, Fitch Ratings Report 21Current Ratings

Profile Trustmark Corporation Long‐Term Debt BBB BBB+ Short‐Term Debt A‐2 F2 Outlook Negative Stable Trustmark National Bank Long‐Term Debt BBB+ BBB+ Short‐Term Debt A‐2 F2 Outlook Negative Stable • S&P

– July 24, 2020 o “Our ratings on Trustmark reflect the company's long history of sound asset quality, above‐peer regulatory capital ratios, large proportion of noninterest revenues, and focus on organic revenue growth.” o

“Our capital and earnings assessment reflects Trustmark's positive earnings performance through the last economic cycle and our projection that its RAC ratio will rise back above 10% over the next two years. Trustmark's regulatory capital

ratios are at the high end of peers, supported by consistent earnings, while the common stock dividend payout is relatively modest.” • Fitch – May 4, 2020 o “In affirming TRMK's ratings with a Stable Outlook, Fitch is

signaling its view that the bank enters this pandemic and ensuing sharp financial downturn in a position of strength, underpinned by its strong franchise within its operating markets and a conservative risk appetite exhibited by relatively fewer

credit losses through various economic cycles. Moreover, TRMK's solid capital and liquidity levels support today's action.” o “TRMK has realized a relatively lower level of credit losses compared to peer banks in recent periods despite

the company's historically elevated level of nonperforming assets relative to peers.” Source: S&P Global Ratings Report, Fitch Ratings Report 21

Trustmark Announces Succession Plans

The Boards of Directors of Trustmark Corporation and Trustmark National Bank have overseen a thoughtful and deliberate

succession planning process to ensure a seamless transition of executive leadership. On October 27, 2020, the Boards announced that:

Effective January 1, 2021 · Gerard R. Host will become Executive Chairman of Trustmark Corporation and Trustmark National Bank · Duane A. Dewey, President and Chief Operating Officer of Trustmark National Bank, will succeed

Mr. Host as President and CEO of Trustmark Corporation and CEO of Trustmark National Bank · Granville Tate, Jr., who serves as Executive Vice President, Chief Risk Officer and General Counsel of Trustmark National Bank, will assume additional

responsibilities as the bank’s Chief Administrative Officer effective January 1, 2021. He remains Secretary of the Boards of Directors of Trustmark Corporation and Trustmark National Bank Effective March 1, 2021 · Louis E.

Greer, Treasurer and Principal Financial Officer of Trustmark Corporation and Chief Financial Officer of Trustmark National Bank, announced that he will retire effective March 1, 2021, following a 33‐year career with the organization,

including 13 years as CFO · Thomas C. Owens, who has served as Executive Vice President and Bank Treasurer of Trustmark National Bank since 2013, will succeed Mr. Greer as Treasurer and Principal Financial Officer of Trustmark Corporation and

Chief Financial Officer of Trustmark National Bank · George T. (“Tom”) Chambers, Jr., who has served as Controller of Trustmark National Bank since 2007, will become Principal Accounting Officer of Trustmark Corporation and

Executive Vice President and Chief Accounting Officer of Trustmark National Bank · Maria L. Sugay, who serves as Executive Vice President and Co‐Treasurer of Trustmark National Bank, will succeed Mr. Owens as Bank Treasurer; Ms. Sugay,

with extensive experience in asset liability and treasury management at larger financial institutions, joined Trustmark in June 2020. 22Trustmark Announces Succession Plans The Boards of Directors of Trustmark Corporation and Trustmark National Bank

have overseen a thoughtful and deliberate succession planning process to ensure a seamless transition of executive leadership. On October 27, 2020, the Boards announced that: Effective January 1, 2021 · Gerard R. Host will become Executive

Chairman of Trustmark Corporation and Trustmark National Bank · Duane A. Dewey, President and Chief Operating Officer of Trustmark National Bank, will succeed Mr. Host as President and CEO of Trustmark Corporation and CEO of Trustmark National

Bank · Granville Tate, Jr., who serves as Executive Vice President, Chief Risk Officer and General Counsel of Trustmark National Bank, will assume additional responsibilities as the bank’s Chief Administrative Officer effective January 1,

2021. He remains Secretary of the Boards of Directors of Trustmark Corporation and Trustmark National Bank Effective March 1, 2021 · Louis E. Greer, Treasurer and Principal Financial Officer of Trustmark Corporation and Chief Financial Officer

of Trustmark National Bank, announced that he will retire effective March 1, 2021, following a 33‐year career with the organization, including 13 years as CFO · Thomas C. Owens, who has served as Executive Vice President and Bank

Treasurer of Trustmark National Bank since 2013, will succeed Mr. Greer as Treasurer and Principal Financial Officer of Trustmark Corporation and Chief Financial Officer of Trustmark National Bank · George T. (“Tom”) Chambers, Jr.,

who has served as Controller of Trustmark National Bank since 2007, will become Principal Accounting Officer of Trustmark Corporation and Executive Vice President and Chief Accounting Officer of Trustmark National Bank · Maria L. Sugay, who

serves as Executive Vice President and Co‐Treasurer of Trustmark National Bank, will succeed Mr. Owens as Bank Treasurer; Ms. Sugay, with extensive experience in asset liability and treasury management at larger financial institutions, joined

Trustmark in June 2020. 22

COVID‐19 Loan Portfolio Review •

During the third quarter, Trustmark conducted a review of significantly impacted borrowers who received one or more

payment concessions and other borrowers in industries significantly impacted by COVID‐19. Collectively, the review included

borrowers with $1.8 billion in aggregate outstanding balances. o Approximately 80% of borrowers receiving concessions were reviewed. o

Within the COVID‐19 impacted industries, the review included the following: Category Outstanding Balances % of ($ in millions) Reviewed Category Hotels

$ 366 96% Restaurants 102 86% Retail CRE 443 94% •

The review resulted in approximately $156 million of balances being downgraded to a criticized category. Criticized balances

in COVID‐19 impacted industries are detailed below: Category Balances Moved to ($ in millions) Criticized Hotels $ 68 Restaurants 5 Retail CRE 15 •

Loans receiving a forbearance resulting from impact of COVID‐19 totaled $201 million, or approximately 2% of total loans held

for investment, as of September 30, 2020 23COVID‐19 Loan Portfolio Review • During the third quarter, Trustmark conducted a review of significantly impacted borrowers who received one or more payment

concessions and other borrowers in industries significantly impacted by COVID‐19. Collectively, the review included borrowers with $1.8 billion in aggregate outstanding balances. o Approximately 80% of borrowers receiving concessions were

reviewed. o Within the COVID‐19 impacted industries, the review included the following: Category Outstanding Balances % of ($ in millions) Reviewed Category Hotels $ 366 96% Restaurants 102 86% Retail CRE 443 94% • The review resulted in

approximately $156 million of balances being downgraded to a criticized category. Criticized balances in COVID‐19 impacted industries are detailed below: Category Balances Moved to ($ in millions) Criticized Hotels $ 68 Restaurants 5 Retail

CRE 15 • Loans receiving a forbearance resulting from impact of COVID‐19 totaled $201 million, or approximately 2% of total loans held for investment, as of September 30, 2020 23

Paycheck Protection Program (PPP) 1

At September 30, 2020 ($ in millions) Amount SBA Fee # of Loans Balance $50,000 and less 5% 6,576 $ 117.5 $50,000 ‐ $150,000 5% 1,892 162.7 $150,000 and greater 1‐5%

1,223 689.9 Gross PPP Loans 9,691 $ 970.0 Unamortized Net Loan Fees (25.7) Carrying Amount of PPP Loans $ 944.3 Source: Company reports

(1) Does not include loans that have been funded and paid off at 9/30/20 24Paycheck Protection Program (PPP) 1 At September 30, 2020 ($ in millions) Amount SBA Fee # of Loans

Balance $50,000 and less 5% 6,576 $ 117.5 $50,000 ‐ $150,000 5% 1,892 162.7 $150,000 and greater 1‐5% 1,223 689.9 Gross PPP Loans 9,691 $ 970.0 Unamortized Net Loan Fees (25.7) Carrying Amount of PPP Loans $ 944.3 Source: Company reports

(1) Does not include loans that have been funded and paid off at 9/30/20 24

Income Statement Highlights – Mortgage Banking

Mortgage Banking Income Change • Mortgage loan production in the third quarter totaled ($ in millions)

$885.8 million, an increase of 3.8% from the prior Q3‐20 LQ Y‐o‐Y quarter and a 56.5% increase year‐over‐year

Mortgage servicing income, net $ 5.7 $ (0.2) $ 0.1 • Retail production represented 70.2% of volume, or Change in fair value – MSR from runoff

(4.6) (0.4) (1.0) $621.7 million, in the third quarter Gain on sales of loans, net 34.5 0.4 24.7 •

Gain on sales of loans, net totaled $34.5 million in the third quarter, up $394 thousand from the prior

Mortgage banking income, excl. hedge $ 35.6 $ (0.1) $ 23.7 quarter Net hedge ineffectiveness 0.8 2.8 4.5 • Mortgage banking income, net totaled $36.4 million,

Mortgage Banking Income, net $ 36.4 $ 2.7 $ 28.3 up $2.7 million, or 8.0%, from the prior quarter Mortgage Loan Production ($ in millions) $885.8 $853.3 30%

29% $566.2 $498.5 $457.2 29% 27% 27% 70% 71% 71% 73% 73% Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Retail Wholesale Source: Company reports 25Income Statement Highlights – Mortgage Banking Mortgage Banking

Income Change • Mortgage loan production in the third quarter totaled ($ in millions) $885.8 million, an increase of 3.8% from the prior Q3‐20 LQ Y‐o‐Y quarter and a 56.5% increase year‐over‐year Mortgage

servicing income, net $ 5.7 $ (0.2) $ 0.1 • Retail production represented 70.2% of volume, or Change in fair value – MSR from runoff (4.6) (0.4) (1.0) $621.7 million, in the third quarter Gain on sales of loans, net 34.5 0.4 24.7 •

Gain on sales of loans, net totaled $34.5 million in the third quarter, up $394 thousand from the prior Mortgage banking income, excl. hedge $ 35.6 $ (0.1) $ 23.7 quarter Net hedge ineffectiveness 0.8 2.8 4.5 • Mortgage banking income, net

totaled $36.4 million, Mortgage Banking Income, net $ 36.4 $ 2.7 $ 28.3 up $2.7 million, or 8.0%, from the prior quarter Mortgage Loan Production ($ in millions) $885.8 $853.3 30% 29% $566.2 $498.5 $457.2 29% 27% 27% 70% 71% 71% 73% 73% Q3‐19

Q4‐19 Q1‐20 Q2‐20 Q3‐20 Retail Wholesale Source: Company reports 25

Income Statement Highlights –

Noninterest Expense Noninterest Expense Change 1 ($ in millions) Noninterest Expense Q3‐20 % of Total LQ Y‐o‐Y ($ in millions) Salaries & Benefits $ 67.3 59%

$ 1.2 $ 4.8 $124 $119 Service & Fees 21.0 18% 0.4 2.2 $114 $14 $110 Net Occupancy – premises 7.0 6% 0.4 0.2 $8 $107 $2 Equipment Expense 5.8 5% 0.2 (0.1) $2 FDIC Assessment Expense 1.4 1% 0.2

0.0 $115 $111 $110 $108 $105 Other Expense 12.1 11% 1.5 2.3 (2) Adjusted Noninterest Expense $ 114.6 101% $ 3.6 $ 9.3 Other Noninterest Expense (0.7) ‐1% (8.3) (2.2) Q3‐19 Q4‐19 Q1‐20

Q2‐20 Q3‐20 Total Noninterest Expense $114.0 100% $ (4.7) $ 7.1 Adjusted Noninterest Expense Other Noninterest Expense ( 2) • Adjusted Noninterest Expense –

totaled $114.6 million in the third quarter, up $3.6 million from the prior quarter o

Salaries and benefits increased $1.2 million linked‐quarter, reflecting increases in salaries, commissions, and performance‐based incentives o

Services and fees increased $425 thousand from the prior quarter due to continued investment in technology o Net occupancy –

premises experienced a normal seasonal increase o

Other adjusted noninterest expenses increased $1.5 million primarily due to loan expense related to loan volumes and a non‐cash charge for

the realignment of branch offices • Other Noninterest Expense – declined $8.3 million from the prior quarter o

Credit loss expense related to off‐balance sheet credit exposures declined $9.2 million from the prior quarter, reflecting improvement in the

macroeconomic factors used to determine the necessary reserves for off‐balance sheet exposures o

Other real estate expense, net increased $932 thousand due to write‐downs Source: Company reports (1) Totals may not foot due to rounding

(2) See Non‐GAAP financial measures on pages 27 ‐28 26Income Statement Highlights – Noninterest Expense Noninterest Expense Change 1 ($ in millions) Noninterest Expense Q3‐20 % of Total

LQ Y‐o‐Y ($ in millions) Salaries & Benefits $ 67.3 59% $ 1.2 $ 4.8 $124 $119 Service & Fees 21.0 18% 0.4 2.2 $114 $14 $110 Net Occupancy – premises 7.0 6% 0.4 0.2 $8 $107 $2 Equipment Expense 5.8 5% 0.2 (0.1) $2 FDIC

Assessment Expense 1.4 1% 0.2 0.0 $115 $111 $110 $108 $105 Other Expense 12.1 11% 1.5 2.3 (2) Adjusted Noninterest Expense $ 114.6 101% $ 3.6 $ 9.3 Other Noninterest Expense (0.7) ‐1% (8.3) (2.2) Q3‐19 Q4‐19 Q1‐20 Q2‐20

Q3‐20 Total Noninterest Expense $114.0 100% $ (4.7) $ 7.1 Adjusted Noninterest Expense Other Noninterest Expense ( 2) • Adjusted Noninterest Expense – totaled $114.6 million in the third quarter, up $3.6 million from the prior

quarter o Salaries and benefits increased $1.2 million linked‐quarter, reflecting increases in salaries, commissions, and performance‐based incentives o Services and fees increased $425 thousand from the prior quarter due to continued

investment in technology o Net occupancy – premises experienced a normal seasonal increase o Other adjusted noninterest expenses increased $1.5 million primarily due to loan expense related to loan volumes and a non‐cash charge for the

realignment of branch offices • Other Noninterest Expense – declined $8.3 million from the prior quarter o Credit loss expense related to off‐balance sheet credit exposures declined $9.2 million from the prior quarter, reflecting

improvement in the macroeconomic factors used to determine the necessary reserves for off‐balance sheet exposures o Other real estate expense, net increased $932 thousand due to write‐downs Source: Company reports (1) Totals may not foot

due to rounding (2) See Non‐GAAP financial measures on pages 27 ‐28 26

Non‐GAAP Financial Measures

Pre‐Tax Pre‐Provision (PTPP) Income ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Net Interest Income (GAAP) $ 108,466

$ 105,591 $ 103,952 $ 105,000 $ 106,207 Noninterest Income (GAAP)

48,337 47,578 65,264

69,511 73,701 Pre‐tax pre‐provision revenue a

$ 156,803 $ 153,169 $ 169,216 $ 174,511

$ 179,908 Noninterest expense (GAAP) $ 106,853 $ 110,027 $ 123,810

$ 118,659 $ 113,959 Less: Voluntary early retirement program

‐ ‐

(4,375) ‐

‐

Credit loss expense related to off‐balance sheet exposures

‐ ‐

(6,783) (6,242) 3,004

Adjusted noninterest expense (Non‐GAAP) b $ 106,853 $ 110,027 $ 112,652

$ 112,417 $ 116,963 PPTP income (Non‐GAAP) a‐b $ 49,950

$ 43,142 $ 56,564 $ 62,094

$ 62,945 Return on Average Tangible Equity (ROATE) (1) ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20

NET INCOME ADJUSTED FOR INTANGIBLE AMORTIZATION Net income $ 41,035 $ 33,946

$ 22,218 $ 32,150 $ 54,440

Plus: Intangible amortization net of tax 766

752 609

552 564

Net income adjusted for intangible amortization $ 41,801 $ 34,698

$ 22,827 $ 32,702 $ 55,004 TANGIBLE EQUITY ‐ AVERAGE BALANCES

Total shareholders' equity $ 1,634,646 $ 1,656,605 $ 1,640,070 $ 1,665,716 $ 1,694,903 Less: Goodwill

(379,627) (379,627) (380,671) (383,081)

(385,270) Identifiable intangible assets (8,706)

(7,882) (8,049) (7,834)

(8,550) Total average tangible equity $ 1,246,313 $ 1,269,096 $ 1,251,350

$ 1,274,801 $ 1,301,083 ROATE (Non‐GAAP) 13.31% 10.85% 7.34% 10.32% 16.82%

(1) Calculation = ((net income adjusted for intangible amortization/number of days in period)*number of days in year)/total average tangible equity.

27Non‐GAAP Financial Measures Pre‐Tax Pre‐Provision (PTPP) Income ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Net Interest Income (GAAP) $ 108,466 $ 105,591 $ 103,952 $ 105,000 $ 106,207 Noninterest

Income (GAAP) 48,337 47,578 65,264 69,511 73,701 Pre‐tax pre‐provision revenue a $ 156,803 $ 153,169 $ 169,216 $ 174,511 $ 179,908 Noninterest expense (GAAP) $ 106,853 $ 110,027 $ 123,810 $ 118,659 $ 113,959 Less: Voluntary early

retirement program ‐ ‐ (4,375) ‐ ‐ Credit loss expense related to off‐balance sheet exposures ‐ ‐ (6,783) (6,242) 3,004 Adjusted noninterest expense (Non‐GAAP) b $ 106,853 $ 110,027 $ 112,652 $ 112,417

$ 116,963 PPTP income (Non‐GAAP) a‐b $ 49,950 $ 43,142 $ 56,564 $ 62,094 $ 62,945 Return on Average Tangible Equity (ROATE) (1) ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 NET INCOME ADJUSTED FOR

INTANGIBLE AMORTIZATION Net income $ 41,035 $ 33,946 $ 22,218 $ 32,150 $ 54,440 Plus: Intangible amortization net of tax 766 752 609 552 564 Net income adjusted for intangible amortization $ 41,801 $ 34,698 $ 22,827 $ 32,702 $ 55,004 TANGIBLE EQUITY

‐ AVERAGE BALANCES Total shareholders' equity $ 1,634,646 $ 1,656,605 $ 1,640,070 $ 1,665,716 $ 1,694,903 Less: Goodwill (379,627) (379,627) (380,671) (383,081) (385,270) Identifiable intangible assets (8,706) (7,882) (8,049) (7,834) (8,550)

Total average tangible equity $ 1,246,313 $ 1,269,096 $ 1,251,350 $ 1,274,801 $ 1,301,083 ROATE (Non‐GAAP) 13.31% 10.85% 7.34% 10.32% 16.82% (1) Calculation = ((net income adjusted for intangible amortization/number of days in period)*number

of days in year)/total average tangible equity. 27

Non‐GAAP Financial Measures (Continued)

Adjusted Noninterest Expense ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Total noninterest expense (GAAP) $ 106,853

$ 110,027 $ 123,810 $ 118,659 $ 113,959

Less: Other real estate expense, net (531) (1,491)

(1,294) (271)

(1,203) Amortization of intangibles (1,021)

(1,002) (812)

(736) (752)

Credit loss expense related to off‐balance sheet exposures

‐ ‐

(6,783) (6,242) 3,004

Charitable contributions resulting in state tax credits

‐ ‐

(375) (375)

(375) Voluntary early retirement program

‐ ‐

(4,375) ‐

‐ Adjusted noninterest expense (Non‐GAAP) $ 105,301

$ 107,534 $ 110,171 $ 111,035 $ 114,633

Tangible Common Equity (TCE) / Tangible Assets (TA) ($ in thousands) 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 TANGIBLE EQUITY ‐ PERIOD END BALANCES

Total shareholders' equity $ 1,473,057 $ 1,520,208 $ 1,571,701 $ 1,591,453 $ 1,660,702 $ 1,652,399 $

1,673,944 $ 1,710,041 Less: Goodwill (366,156) (366,156) (379,627)

(379,627) (379,627) (381,717) (385,270)

(385,270) Identifiable intangible assets (27,546)

(20,680) (16,360) (11,112)

(7,343) (7,537) (8,895)

(8,142) Total tangible equity a $ 1,079,355 $ 1,133,372 $ 1,175,714

$ 1,200,714 $ 1,273,732 $ 1,263,145 $ 1,279,779 $ 1,316,629 TANGIBLE EQUITY ‐ PERIOD END BALANCES Total assets $

12,678,896 $ 13,352,333 $ 13,797,953 $ 13,286,460 $ 13,497,877 $ 14,019,829 $ 15,692,079 $ 15,558,162 Less: Goodwill (366,156)

(366,156) (379,627) (379,627) (379,627)

(381,717) (385,270) (385,270)

Identifiable intangible assets (27,546) (20,680)

(16,360) (11,112) (7,343)

(7,537) (8,895) (8,142)

Total tangible assets b $ 12,285,194 $ 12,965,497 $ 13,401,966 $ 12,895,721 $ 13,110,907 $ 13,630,575 $ 15,297,914 $ 15,164,750 TCE/TA (Non‐GAAP) a/b 8.79%

8.74% 8.77% 9.31% 9.72% 9.27% 8.37% 8.68% 28Non‐GAAP Financial Measures (Continued) Adjusted Noninterest Expense ($ in thousands) Q3‐19 Q4‐19 Q1‐20 Q2‐20 Q3‐20 Total noninterest expense (GAAP) $ 106,853 $ 110,027

$ 123,810 $ 118,659 $ 113,959 Less: Other real estate expense, net (531) (1,491) (1,294) (271) (1,203) Amortization of intangibles (1,021) (1,002) (812) (736) (752) Credit loss expense related to off‐balance sheet exposures ‐ ‐

(6,783) (6,242) 3,004 Charitable contributions resulting in state tax credits ‐ ‐ (375) (375) (375) Voluntary early retirement program ‐ ‐ (4,375) ‐ ‐ Adjusted noninterest expense (Non‐GAAP) $ 105,301 $

107,534 $ 110,171 $ 111,035 $ 114,633 Tangible Common Equity (TCE) / Tangible Assets (TA) ($ in thousands) 2015 2016 2017 2018 2019 Q1‐20 Q2‐20 Q3‐20 TANGIBLE EQUITY ‐ PERIOD END BALANCES Total shareholders' equity $

1,473,057 $ 1,520,208 $ 1,571,701 $ 1,591,453 $ 1,660,702 $ 1,652,399 $ 1,673,944 $ 1,710,041 Less: Goodwill (366,156) (366,156) (379,627) (379,627) (379,627) (381,717) (385,270) (385,270) Identifiable intangible assets (27,546) (20,680) (16,360)

(11,112) (7,343) (7,537) (8,895) (8,142) Total tangible equity a $ 1,079,355 $ 1,133,372 $ 1,175,714 $ 1,200,714 $ 1,273,732 $ 1,263,145 $ 1,279,779 $ 1,316,629 TANGIBLE EQUITY ‐ PERIOD END BALANCES Total assets $ 12,678,896 $ 13,352,333 $

13,797,953 $ 13,286,460 $ 13,497,877 $ 14,019,829 $ 15,692,079 $ 15,558,162 Less: Goodwill (366,156) (366,156) (379,627) (379,627) (379,627) (381,717) (385,270) (385,270) Identifiable intangible assets (27,546) (20,680) (16,360) (11,112) (7,343)

(7,537) (8,895) (8,142) Total tangible assets b $ 12,285,194 $ 12,965,497 $ 13,401,966 $ 12,895,721 $ 13,110,907 $ 13,630,575 $ 15,297,914 $ 15,164,750 TCE/TA (Non‐GAAP) a/b 8.79% 8.74% 8.77% 9.31% 9.72% 9.27% 8.37% 8.68% 28

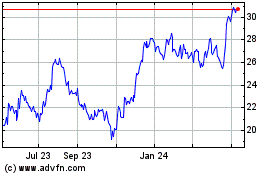

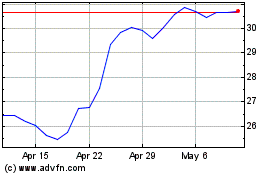

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jul 2023 to Jul 2024