Current Report Filing (8-k)

May 18 2023 - 8:56AM

Edgar (US Regulatory)

0001021096FALSE00010210962022-07-012022-07-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 16, 2023

| | | | | | | | |

| Troika Media Group, Inc. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Nevada | | 001-40329 | | 83-0401552 | |

| (State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

| | | | | | | | | | | | | | |

| 25 West 39th Street New York, NY | | 10018 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant’s telephone number, including area code (212) 213-0111

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares $0.001 par value | TRKA | The NASDAQ Capital Market |

| Redeemable Warrants to acquire Common Shares | TRKAW | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

On May 16, 2023, Troika Media Group, Inc. (the “Company”) received a Staff Delisting Determination (the “Staff Determination”) from the Listing Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”). The Company was notified that Nasdaq has determined to delist the Company’s securities from the Nasdaq Capital Market for failure to maintain a minimum bid price of $1.00 per share for thirty (30) consecutive business days in accordance with Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Rule”). The Company intends to appeal the Staff’s determination by requesting a hearing (the “Hearing”) before a Nasdaq Hearings Panel (the “Panel”) to seek continued listing pending its return to compliance with the Minimum Bid Price Rule. The Hearing request will stay the delisting of the Company’s securities pending the Panel’s decision. According to the Staff Determination, hearings are typically scheduled to occur approximately 30-45 days after the date of a company’s hearing request. There can be no assurance that the Panel will determine to continue to allow the listing of the Company’s securities on the Nasdaq Capital Market or that the Company will be able to evidence compliance with the applicable listing criteria within the period of time, if any, that may be granted by the Panel.

Item 7.01 REGULATION FD DISCLOSURE

The Company issued a press release dated May 18, 2023 announcing its receipt of the Staff Determination and its intention to appeal. The press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The information furnished in Exhibit 99.1 hereto shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filings that such information is to be considered “filed” or incorporated by reference therein.

Forward-Looking Statements

This Report on Form 8-K contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments or events may differ materially from those in the forward-looking statements as a result of various factors, including financial community perceptions of the Company and its business, operations, financial condition and the industries in which it operates, risks and uncertainties regarding the outcome of the appeal of the Nasdaq delisting determination, the risk that the Company will not be able to continue to operate as a going concern, the risk that the Company will not complete a refinancing or other transaction as a result of its ongoing strategic review, the lingering impact of the COVID-19 pandemic and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein, except as required by applicable securities law. There can be no assurance that the Panel will determine to continue to allow the listing of the Company’s securities on the Nasdaq or that the Company will be able to evidence compliance with the applicable listing criteria within the period of time, if any, that may be granted by the Panel.

ITEM 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | | Exhibits |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Troika Media Group, Inc. |

| (Registrant) |

| | |

| Date: May 18, 2023 | By: | /s/ Erica Naidrich |

| | (Signature) |

| | Erica Naidrich

Chief Financial Officer |

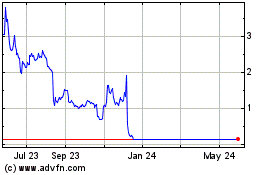

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From Jul 2023 to Jul 2024