0001314727FALSE00013147272025-01-122025-01-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 12, 2025

SONOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38603 | | 03-0479476 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

301 Coromar Drive

Santa Barbara, California 93117

(Address of principal executive offices, including zip code)

(805) 965-3001

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | SONO | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

CEO Transition

On January 12, 2025, Patrick Spence and the Board of Directors (the “Board”) of Sonos, Inc. (the “Company”) agreed that Mr. Spence will step down as Chief Executive Officer (“CEO”) and as a member of the Board, effective as of January 13, 2025.

On January 12, 2025, the Company entered into a Transition Agreement (the “Transition Agreement”) with Mr. Spence pursuant to which Mr. Spence has agreed to continue to remain employed with the Company through June 30, 2025 (the “End Date”) and provide strategic advisory services to the Company during that time in order to facilitate a smooth and orderly transition of the responsibilities of his role as CEO. Pursuant to the Transition Agreement, Mr. Spence will receive a base salary of $7,500 per month during the advisory period. At the End Date, subject to the timely execution of a release of claims in favor of the Company as set forth in the Transition Agreement, Mr. Spence will receive a cash severance payment in the amount of $1,875,000 and 12 months of subsidized COBRA continuation coverage. At the End Date, Mr. Spence will also receive accelerated vesting of the unvested RSUs that would have vested if his employment had continued until June 30, 2026, and Mr. Spence’s stock options will remain exercisable until June 30, 2026. The Transition Agreement also reaffirms the current restrictive covenants to which Mr. Spence is currently subject.

The foregoing description of the Transition Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Transition Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

Appointment of Interim Chief Executive Officer

In connection with Mr. Spence’s departure, on January 12, 2025, the Board appointed Tom Conrad as Interim CEO and President, effective January 13, 2025. Mr. Conrad, 55, has served as a director of the Company since 2017. Mr. Conrad is the outgoing Chief Executive Officer of Zero Longevity Science, Inc. (formerly Big Sky Health), maker of the metabolic health app Zero, a position he has held since November 2021. He previously served as the Chief Product Officer of Quibi, a short form streaming service, from March 2019 to January 2021. Mr. Conrad was the Vice President of Product at Snap Inc., a camera and social media company, from March 2016 to March 2018. Prior to Snap Inc., Mr. Conrad served as the Chief Technology Officer and Executive Vice President of Product of Pandora Media, Inc., a streaming music service company, from July 2004 to July 2014. Mr. Conrad holds a B.S.E in computer science from the University of Michigan.

In connection with his appointment, Mr. Conrad has stepped down from his position as Chair and member of the Compensation, People and Diversity & Inclusion Committee of the Board (the “CPD&I Committee”). Mr. Conrad will remain a member of the Board. The Board appointed current committee member Karen Boone to the position of Chair of the CPD&I Committee and appointed Julius Genachowski as a member of the CPD&I Committee, each effective immediately.

The Company and Mr. Conrad have entered into a letter agreement, dated January 12, 2025, in connection with Mr. Conrad's appointment as Interim CEO (the “Letter Agreement”). Pursuant to the Letter Agreement, Mr. Conrad will receive (i) a base salary at monthly rate of $175,000 and (ii) an award of restricted stock units with a grant date value equal to $2.65 million, which will vest at a rate of one-sixth per month of service as Interim CEO. Vesting will cease when Mr. Conrad’s service as Interim CEO ends. Mr. Conrad will not receive any compensation for his service on the Board while he serves as Interim CEO.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, a copy of which is attached as Exhibit 10.2 hereto and is incorporated herein by reference.

There are no family relationships between Mr. Conrad and any director or executive officer of the Company, and no arrangements or understandings between Mr. Conrad and any other person pursuant to which he was selected as Interim CEO. Mr. Conrad is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

On January 13, 2025, the Company issued a press release announcing the leadership changes described in this Current Report on Form 8-K. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | |

| 10.1 | |

| 10.2 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SONOS, INC. |

| | | |

| Date: January 13, 2025 | By: | /s/ Eddie Lazarus |

| | | Eddie Lazarus Chief Legal and Strategy Officer

|

Sonos, Inc.

301 Coromar Drive,

Santa Barbara, CA 93117

January 12, 2025

Patrick Spence

c/o the confidential email address contained in the records of Sonos, Inc. (the “Company”)

Dear Patrick:

This letter agreement memorializes our recent discussions and sets forth our mutual agreement as to your transition from your role as Chief Executive Officer of the Company, your service as a Special Advisor to the Company’s Board of Directors (the “Board”) and the effect of this transition and your advisor service on your duties, compensation, employee benefits and equity ownership.

1. Transition Date; Advisor Role; End Date. We have agreed that you will continue as Chief Executive Officer of the Company and its subsidiaries and affiliates (the “Company Group”) until January 13, 2025 (the “Transition Date”). Effective as of the Transition Date, you will be deemed to have resigned from all officer and director positions that you hold with the Company Group, including the Board, except that you have agreed to remain as a Special Advisor to the Board until June 30, 2025 (the “End Date”) as provided in this letter agreement (the “Advising Period”).

2. Base Salary through the Transition Date; 2025 Annual Bonus. From the date of this letter agreement through the Transition Date, you will be paid your normal base salary at the same rate of annual base salary as currently in effect ($550,000). You will not be entitled to an annual bonus for the 2025 fiscal year.

3. Duties and Responsibilities during the Advising Period; Compensation.

(a) During the Advising Period, you will serve as Special Advisor to the Board. Your role as Special Advisor will consist of senior executive project-based employment, with duties and responsibilities as are coordinated with the Chairperson as the designee of the Board so as to facilitate a successful transition of your Company Group history and industry experience to the leadership team of the Company (the “Advisory Services”). The details of the Advisory Services, such as the nature of the projects, the location of your performance, and the expected time commitment, will be as determined by the mutual agreement of you and the Chairperson or the Interim CEO.

(b) In consideration of the Advisory Services, the Company will pay you a monthly base salary of $7,500 on regular payroll dates, subject to normal withholdings.

4. Effect of the End Date on Equity Interests. You currently hold incentive equity awards of the Company consisting of the following: (1) 396,293 restricted stock units of the Company, all of which are unvested (the “RSUs”); (2) 405,307 performance share awards of the Company (at target levels of performance), all of which are unvested (the “PSUs”); and (3) 1,226,745 options to purchase common stock of the Company, all of which are vested (the “Options”). The End Date will have the following effect on these equity interests:

(a) RSUs. Subject to your good-faith performance of the Advisory Services and paragraph 6 of this letter agreement, an additional number of unvested RSUs held by you on the End Date shall vest on the End Date equal to the RSUs that would have vested if your employment had continued through June 30, 2026. The Company confirms that the Advising Period will be treated as normal employment for vesting purposes.

(b) PSUs. The End Date will constitute a termination of your employment with the Company Group for purposes of your PSUs.

(c) Options: All of your Options are vested and exercisable. Subject to your good-faith performance of the Advisory Services and paragraph 6 of this letter agreement, the Company has agreed that the post-termination exercise period of your Options will be extended until June 30, 2026. The Company confirms that the Advising Period will be treated as a period of normal employment for purposes of the exercise of your Options.

5. Severance Pay and Termination Benefits.

(a) Subject to paragraph 6 of this letter agreement, following the End Date, you will receive a lump sum cash severance payment of $1,875,000 on the first payroll date following the date on which the Release Agreement (as defined in paragraph 6) has become irrevocable. In addition, subject to paragraph 6 of this letter agreement, if you properly enroll in COBRA continuation coverage following the End Date, you will also be entitled to reimbursement for up to twelve (12) months of COBRA continuation coverage, subject to your paying a portion of the COBRA premium equal to the active employee rate for the coverage level in effect at the End Date.

(b) Following the End Date, no provision of this letter agreement shall affect your right to be provided with the normal rights provided by the Company Group to former employees, such as vested benefits of the Company Group in which you participate, reimbursement of business expenses properly incurred under Company Group policy, and COBRA continuation coverage or other, similar benefits required to be provided to you under applicable law. You agree to obtain prior Company approval for any large reimbursable business expense to be incurred during the Advising Period.

6. Release Requirement. Notwithstanding any other provision of this letter agreement to the contrary, it is expressly agreed the payments and benefits being provided to you pursuant to this letter agreement are of a special and exemplary nature and in recognition of your long service to the Company Group. Accordingly, it is expressly agreed that the equity provisions set forth in paragraph 4 of this letter agreement and the severance pay provisions set forth in paragraph 5 of this letter agreement are all conditioned expressly on (1) your good-faith performance of the Advisory Services during the Advising Period; (2) your entry into and nonrevocation of the attached Release Agreement attached as Exhibit A (the “Release Agreement”) as of the close of business on the End Date, and (3) your compliance in all material respects with the Restrictive Covenants in accordance with the terms thereof; and shall not be paid or provided if these conditions are not met.

7. Reaffirmation of Restrictive Covenants; Nondisparagement.

(a) In consideration for, and as a condition to, the Company’s entry into this letter agreement, you hereby acknowledge and re-affirm those certain restrictive covenants set forth in the Non-Competition and Non-Solicitation Agreement, and the Invention and Non-Disclosure Agreement, each dated as of August 1, 2014, to which you and the Company are parties.

(b) You agree that you will not make any communications, whether written, electronic, oral, or otherwise, to any other person or entity, including, but not limited to any publications and any website postings or blogs, which disparage, denigrate, defame, or otherwise cast aspersions upon any Company Released Party (as defined in Exhibit A). The Company agrees that it will not make any communications, whether written, electronic, oral, or otherwise, to any other person or entity, including, but not limited to any publications and any website postings or blogs, which disparage, denigrate, defame, or otherwise cast aspersions upon you. Notwithstanding the foregoing, the following are excluded from this paragraph 7(b): (1) truthful information and/or testimony provided by any Company Released Party or you in connection with any investigation or proceeding conducted by a governmental agency, or as otherwise required by law; (2) truthful comments by any Company Released Party regarding you, or by you regarding any Company Released Party, as the case may be, narrowly tailored to address disparaging, denigrating, defamatory or untruthful comments made by the other; (3) candid and good faith evaluative statements about individual performance, business performance or strategic direction; or (4) any Permitted Disclosures (as defined in Exhibit A).

8. Indemnification. Following the Transition Date, you shall retain your rights to indemnification and exculpation in respect of your services as a director or officer of the Company Group under any contract or

organizational document of the Company Group, under a policy of insurance maintained by any such person, or under applicable law.

9. Miscellaneous.

(a) Notices under this letter agreement shall be given by email by you to the Company’s Chief Legal Officer, or by the Company to you, to an email address you have separately provided to the Company, and which the Company has separately provided to you, and which each of you agrees to update from time to time as necessary.

(b) The Company and you each agree to cooperate with the other to cause to be executed and delivered all such other instruments and documents, and to take such other actions, as such other parties may reasonably request from time to time to effectuate the provisions and purposes of this letter agreement, including without limitation certificates and other instruments given by you at and following the Transition Date evidencing resignation from your positions with the Company Group.

(c) This letter agreement sets forth the entire understanding of the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, written or oral, between them as to such subject matter. This letter agreement may be amended only by a written amendment entered into by the parties hereto. This letter agreement may be executed and delivered electronically, including by means of emailed .pdf file or electronic signature.

[signature page follows]

Please sign this letter agreement below to evidence our mutual agreement as to the foregoing matters. Please deliver one copy to the Company, keeping another for your records.

Very truly yours,

SONOS, INC.

/s/ Julius Genachowski

By: Julius Genachowski

Title: Authorized Signatory

ACKNOWLEDGED AND AGREED:

/s/ Patrick Spence

Patrick Spence

Exhibit A

Release Agreement

Release of Claims; Exceptions. With the intention of binding the Employee and the Employee’s heirs, executors, administrators and assigns, Patrick Spence (the “Employee”) does hereby release, remise, acquit and forever discharge (1) Sonos, Inc. (the “Company”) and each of its subsidiaries and controlled affiliates (collectively, the “Company Affiliated Group”), (2) the directors, officers, executives, employees, agents, members and stockholders or equity holders of any of the foregoing and (3) the predecessors, successors, and assigns of any of the foregoing ((1)-(3), collectively, the “Company Released Parties”), of and from any and all claims, actions, causes of action, complaints, charges, demands, rights, damages, debts, sums of money, accounts, financial obligations, suits, expenses, attorneys’ fees and liabilities of whatever kind or nature in law, equity or otherwise, whether accrued, absolute, contingent, unliquidated or otherwise and whether now known, unknown, suspected or unsuspected which the Employee, individually or as a member of a class, now has, owns or holds, or has at any time heretofore had, owned or held, against any Company Released Party (an “Action”), including, without limitation, (i) arising out of or in connection with the Employee’s service as an employee and/or officer of the Company Affiliated Group, (ii) for severance or vacation benefits, unpaid wages, salary or incentive payments, (iii) for breach of contract, wrongful discharge, impairment of economic opportunity, defamation, intentional infliction of emotional harm or other tort and (iv) for any violation of applicable state and local labor and employment laws (including, without limitation, all laws concerning harassment, discrimination, retaliation and other unlawful or unfair labor and employment practices), excepting only (1) the rights of the Employee under the letter agreement to which this Exhibit A is attached, (2) rights of the Employee to accrued compensation and expense reimbursement through the End Date, (3) vested benefits under the employee benefit plans of the Company Affiliated Group in which the Employee participates prior to the End Date or to which the Employee is entitled under applicable law, (4) any right or Action which by law the Employee is not permitted to waive (except that, with respect to any such right or Action, the Employee does waive any right to money damages) and the right to make Permitted Disclosures, and (5) the rights of the Employee with respect to the Employee’s ownership of equity interests in the Company, including vested incentive compensation) as of the End Date.

Notwithstanding anything in this Release of Claims to the contrary, nothing in this Release of Claims prohibits the Employee from: (i) voluntarily communicating with, or providing information to, any government agency or other regulator that is responsible for enforcing a law on behalf of the government (including, without limitation, the U.S. Equal Employment Opportunity Commission, the Department of Labor, the National Labor Relations Board, the Department of Justice, the Securities and Exchange Commission, Congress, and any Inspector General of any agency) regarding conduct or action undertaken or omitted to be taken by the Company Affiliated Group that the Employee reasonably believes is illegal or in material non-compliance with any financial disclosure or other regulatory requirement applicable to the Company Affiliated Group; or (ii) providing truthful testimony or accurate information in connection with any investigation being conducted into the business or operations of the Company Affiliated Group by any such government agency or other regulator; nor shall any provision of this Release of Claims be construed to require the Employee to obtain the approval of, or give notice to, the Company Affiliated Group or any of its employees or representatives to take any action permitted under clauses (i) or (ii) (collectively, the “Permitted Disclosures”).

California Residents/Workers Only. Employee expressly waives any and all rights under Section 1542 of the Civil Code of the State of California and any like provision or principle of common law in any foreign jurisdiction. Section 1542 provides as follows:

“A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.”

Acceptance and Revocability. The Employee acknowledges that the Employee has been given a period of 21 days within which to consider this Release of Claims, unless applicable law requires a longer period, in which case the

Employee shall be advised of such longer period and such longer period shall apply. The Employee may accept this Release of Claims at any time within this period of time by signing the Release of Claims and returning it to the Company’s Chief Legal Officer. This Release of Claims shall not become effective or enforceable until seven calendar days after the Employee signs it. The Employee may revoke the Employee’s acceptance of this Release of Claims at any time within that seven calendar day period by sending written notice to the Company. Such notice must be received by the Company within the seven calendar day period in order to be effective and, if so received, would fully void this Release of Claims and the letter agreement to which it is attached for all purposes, except that the termination of the Employee’s employment would still be effective as of the End Date. The Employee also acknowledges that the Employee has been informed of the right to consult with legal counsel and has been advised to do so in considering whether to provide this Release of Claims.

ACCEPTED AND AGREED

__________________________________________________

Patrick Spence

Sonos, Inc.

301 Coromar Drive

Santa Barbara, CA 93117

January 12, 2025

Thomas Conrad

c/o the email address contained in the records of Sonos, Inc. (“Sonos”)

Dear Tom:

This letter agreement sets forth our mutual understandings and agreements with respect to your services as Interim CEO of Sonos.

1.Interim CEO; No Fixed Term. You have agreed to serve as Interim Chief Executive Officer of Sonos. During that time, you will also continue to serve as a member of the Sonos Board of Directors. The term of your service as Interim CEO will commence as of Patrick Spence’s last day of employment and will continue until the appointment of a permanent CEO.

2.Cash Compensation. During your term as Interim CEO, you will be paid a base salary at an annual rate of $2,100,000 ($175,000 per month). You will not receive the compensation paid to Sonos non-employee directors during your period of service as Interim CEO.

3.RSU Grant. Effective as of your appointment, you will receive a grant $2.65 million of Sonos service-vesting restricted stock units (“RSUs”). The RSUs will vest at a rate of one-sixth per month of service as Interim CEO. Vesting will cease when your service as Interim CEO ends.

[signature page follows]

If the foregoing is consistent with your understanding, please sign this letter agreement below to evidence our mutual agreement.

Very truly yours,

SONOS, INC.

/s/ Julius Genachowski

By: Julius Genachowski

ACCEPTED AND AGREED:

/s/ Thomas Conrad

Thomas Conrad

Sonos Announces CEO Transition

Patrick Spence to Step Down as CEO and Board Member

Tom Conrad Appointed Interim CEO

SANTA BARBARA, Calif., January 13, 2025 -- Sonos, Inc. (Nasdaq: SONO) today announced that the Sonos Board of Directors and Patrick Spence have agreed that Mr. Spence will step down as Chief Executive Officer (CEO) and as a member of the Board effective today. The Board has appointed Tom Conrad, an independent member of the Board since 2017, as Interim CEO, also effective as of today. The Board has initiated a search for its next CEO with the assistance of a leading executive search firm, and is committed to identifying a leader who will build on the Sonos legacy of innovation and excellence in serving its customers while also driving profitable growth. This leadership change is unrelated to the Company’s fiscal first quarter results, which will be reported on February 6, 2025, and for which the Company is providing no update at this time.

"On behalf of the Board, I want to thank Patrick for his contributions as CEO," said Julius Genachowski, Chair of the Board of Directors. "During his tenure, Patrick built on our pioneering success in wireless home audio and led the Company's expansion into premium audio for home theater, portables, and headphones. We appreciate Patrick's dedication to Sonos."

Mr. Genachowski continued, "Tom’s mandate is to improve the Sonos core experience for our customers, while optimizing our business to drive innovation and financial performance. With his deep product expertise and long-term relationship with Sonos, Tom is uniquely suited to guide the company forward during the transition and the Board looks forward to partnering with him closely. We are excited about the opportunity ahead."

"I am deeply honored to step into this role at such an important moment for Sonos," said Mr. Conrad. "Nearly two decades ago, when I led the earliest initiative to integrate Pandora and Sonos, I got my first glimpse of the magic that Sonos could bring to millions of lives every day. I am excited to work with our team to restore the reliability and user experience that have defined Sonos, while bringing innovative new products to market. Together, we will focus on delivering extraordinary experiences for our customers and strong results for our shareholders."

About Tom Conrad

Tom Conrad has served on the Sonos Board of Directors since 2017 and is a seasoned leader in consumer technology with over three decades of experience. He is the outgoing Chief Executive Officer of Zero Longevity Science, where he has driven growth for its subscription digital health platform since 2021. He previously served as the Chief Product Officer of Quibi, a short form streaming service where he helped build the team and product from scratch. Mr. Conrad was the Vice President of Product at Snap Inc., where he oversaw numerous product

innovations that solidified Snapchat as a leader in the social media landscape, renowned for its creativity and user engagement. Tom also served as the Chief Technology Officer and Executive Vice President of Product at Pandora, where he was among the original creators of the pioneering music streaming service. During his decade-long tenure, he drove the development of Pandora’s personalized music experience, helping the company scale to tens of millions of users and revolutionizing how the world discovers and listens to music. At the start of his career, Tom worked at Apple building the foundational user interface of the Macintosh. He holds a B.S.E in computer engineering from the University of Michigan.

About Sonos

Sonos (Nasdaq: SONO) is the world’s leading sound experience company. As the inventor of multi-room wireless home audio, Sonos innovation helps the world listen better by giving people access to the content they love and allowing them to control it however and wherever they choose. Known for delivering an unparalleled sound experience, thoughtful design aesthetic, simplicity of use, and an open platform, Sonos makes the breadth of audio content available to anyone. Sonos is headquartered in Santa Barbara, California. Learn more at www.sonos.com.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding the composition of our board of directors, changes to our leadership team, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “expect,” “objective,” “plan,” “potential,” “seek,” “grow,” “target,” “if,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions.

These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors, including, but not limited to: our ability to accurately forecast product demand and effectively forecast and manage owned and channel inventory levels; our ability to introduce software updates to our new app on a timely basis and otherwise deliver on our action plan to address issues caused by our new app and related customer commitments; our ability to maintain, enhance and protect our brand image; the impact of global economic, market and political events, including continued inflationary pressures, high interest rates and, in certain markets, foreign currency exchange rate fluctuations; changes in consumer income and overall consumer spending as a result of economic or political uncertainty or conditions; changes in consumer spending patterns; our ability to successfully introduce new products and services and maintain or expand the success of our existing products; the success of our efforts to expand our direct-to-consumer channel; the success of our financial, growth and business strategies; our ability to compete in the market and maintain or expand market share; our ability to meet product demand and manage any product availability delays; supply chain challenges, including shipping and logistics challenges and component supply-related challenges; our ability to protect our brand and intellectual property; and the other risk factors set forth under the

caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 28, 2024 and our other filings filed with the Securities and Exchange Commission (the “SEC”), copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from our investor relations department.

All forward-looking statements herein reflect our opinions only as of the date of this press release, and we undertake no obligation, and expressly disclaim any obligation, to update forward-looking statements herein in light of new information or future events. Sonos and Sonos product names are trademarks or registered trademarks of Sonos, Inc. All other product names and services may be trademarks or service marks of their respective owners.

Investor Contact

James Baglanis

IR@sonos.com

Press Contact

Erin Pategas

PR@sonos.com

Source: Sonos

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

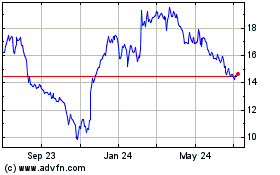

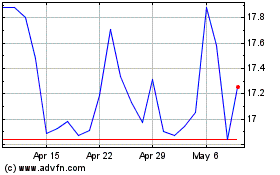

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jan 2024 to Jan 2025