false

--03-31

2025

Q1

0001367083

0001367083

2024-04-01

2024-06-30

0001367083

2024-08-08

0001367083

2024-06-30

0001367083

2024-03-31

0001367083

us-gaap:ConvertiblePreferredStockMember

2024-06-30

0001367083

us-gaap:ConvertiblePreferredStockMember

2024-03-31

0001367083

2023-04-01

2023-06-30

0001367083

2023-03-31

0001367083

2023-06-30

0001367083

us-gaap:CommonStockMember

2024-03-31

0001367083

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001367083

us-gaap:RetainedEarningsMember

2024-03-31

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001367083

us-gaap:CommonStockMember

2023-03-31

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001367083

us-gaap:RetainedEarningsMember

2023-03-31

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001367083

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001367083

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-04-01

2024-06-30

0001367083

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001367083

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001367083

us-gaap:CommonStockMember

2024-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001367083

us-gaap:RetainedEarningsMember

2024-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0001367083

us-gaap:CommonStockMember

2023-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001367083

us-gaap:RetainedEarningsMember

2023-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001367083

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0001367083

us-gaap:RestrictedStockUnitsRSUMember

2023-04-01

2023-06-30

0001367083

us-gaap:StockOptionMember

2024-04-01

2024-06-30

0001367083

us-gaap:StockOptionMember

2023-04-01

2023-06-30

0001367083

us-gaap:WarrantMember

2024-04-01

2024-06-30

0001367083

us-gaap:WarrantMember

2023-04-01

2023-06-30

0001367083

SNOA:CommonStockUnitsMember

2024-04-01

2024-06-30

0001367083

SNOA:CommonStockUnitsMember

2023-04-01

2023-06-30

0001367083

SNOA:InsurancePremiumFinancingMember

2024-02-06

0001367083

SNOA:InsurancePremiumFinancingMember

2024-02-05

2024-02-06

0001367083

SNOA:InsurancePremiumFinancingMember

2024-06-30

0001367083

SNOA:InsurancePremiumFinancingMember

2024-03-31

0001367083

SNOA:EquityDistributionAgreementMember

2024-05-13

2024-05-22

0001367083

us-gaap:StockOptionMember

2024-06-30

0001367083

us-gaap:StockOptionMember

2024-04-01

2024-06-30

0001367083

us-gaap:StockOptionMember

2024-03-31

0001367083

us-gaap:RestrictedStockMember

2024-03-31

0001367083

us-gaap:RestrictedStockMember

2024-04-01

2024-06-30

0001367083

us-gaap:RestrictedStockMember

2024-06-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2024-04-01

2024-06-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2023-04-01

2023-06-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2024-04-01

2024-06-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2023-04-01

2023-06-30

0001367083

us-gaap:ProductMember

2024-04-01

2024-06-30

0001367083

us-gaap:ProductMember

2023-04-01

2023-06-30

0001367083

us-gaap:ServiceMember

SNOA:ServiceAndRoyaltyMember

2024-04-01

2024-06-30

0001367083

us-gaap:ServiceMember

SNOA:ServiceAndRoyaltyMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerAMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerAMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerBMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerBMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerCMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:SalesRevenueNetMember

SNOA:CustomerCMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerAMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerAMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerBMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerBMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerCMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerCMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerDMember

us-gaap:CustomerConcentrationRiskMember

2024-04-01

2024-06-30

0001367083

us-gaap:AccountsReceivableMember

SNOA:CustomerDMember

us-gaap:CustomerConcentrationRiskMember

2023-04-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to

______________

Commission file number: 001-33216

SONOMA PHARMACEUTICALS, INC.

(Name of registrant as specified in its charter)

| Delaware |

68-0423298 |

| (State or other jurisdiction of Incorporation or Organization) |

(I.R.S. Employer identification No.) |

| 5445 Conestoga Court, Suite 150, Boulder, CO |

80301 |

| (Address of principal executive offices) |

(Zip Code) |

(800) 759-9305

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address and former fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

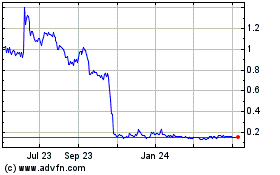

| Common Stock, $0.0001 par value |

SNOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No

☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act:

| Large accelerated Filer ☐ |

Accelerated Filer ☐ |

| Non-accelerated Filer ☒ |

Smaller reporting company ☒ |

| Emerging Growth Company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s

common stock, par value $0.0001 per share, as of August 8, 2024 was 19,149,393.

SONOMA PHARMACEUTICALS, INC.

Index

PART I - FINANCIAL INFORMATION

| Item 1. |

Financial Statements |

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

| | |

| | |

| |

| | |

June 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,589 | | |

$ | 3,128 | |

| Accounts receivable, net | |

| 3,247 | | |

| 2,898 | |

| Inventories, net | |

| 2,658 | | |

| 2,719 | |

| Prepaid expenses and other current assets | |

| 3,196 | | |

| 3,541 | |

| Current portion of deferred consideration, net of discount | |

| 237 | | |

| 262 | |

| Total current assets | |

| 11,927 | | |

| 12,548 | |

| Property and equipment, net | |

| 302 | | |

| 365 | |

| Operating lease, right of use assets | |

| 216 | | |

| 286 | |

| Deferred tax asset | |

| 921 | | |

| 1,145 | |

| Deferred consideration, net of discount, less current portion | |

| 246 | | |

| 330 | |

| Other assets | |

| 61 | | |

| 66 | |

| Total assets | |

$ | 13,673 | | |

$ | 14,740 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 751 | | |

$ | 607 | |

| Accrued expenses and other current liabilities | |

| 2,228 | | |

| 2,113 | |

| Deferred revenue, current portion | |

| 413 | | |

| 478 | |

| Short-term debt | |

| 204 | | |

| 323 | |

| Operating lease liabilities, current portion | |

| 155 | | |

| 198 | |

| Total current liabilities | |

| 3,751 | | |

| 3,719 | |

| Deferred revenue, net of current portion | |

| 64 | | |

| 87 | |

| Withholding tax payable | |

| 4,822 | | |

| 4,710 | |

| Operating lease liabilities, less current portion | |

| 61 | | |

| 87 | |

| Total liabilities | |

| 8,698 | | |

| 8,603 | |

| Commitments and Contingencies (Note 5) | |

| – | | |

| – | |

| Stockholders’ Equity: | |

| | | |

| | |

| Convertible preferred stock, $0.0001 par value; 714,286 shares authorized at June 30, 2024 and March 31, 2024, respectively, no shares issued and outstanding at June 30, 2024 and March 31, 2024, respectively | |

| – | | |

| – | |

| Common stock, $0.0001 par value; 24,000,000 shares authorized at June 30, 2024 and March 31, 2024, respectively, 19,004,393 and 15,607,433 shares issued and outstanding at June 30, 2024 and March 31, 2024, respectively (Note 7) | |

| 2 | | |

| 2 | |

| Additional paid-in capital | |

| 204,069 | | |

| 203,207 | |

| Accumulated deficit | |

| (195,492 | ) | |

| (194,349 | ) |

| Accumulated other comprehensive loss | |

| (3,604 | ) | |

| (2,723 | ) |

| Total stockholders’ equity | |

| 4,975 | | |

| 6,137 | |

| Total liabilities and stockholders’ equity | |

$ | 13,673 | | |

$ | 14,740 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive

Loss

(In thousands, except per share amounts)

(Unaudited)

| | |

| | |

| |

| | |

Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Revenues | |

$ | 3,391 | | |

$ | 3,427 | |

| Cost of revenues | |

| 2,085 | | |

| 2,223 | |

| Gross profit | |

| 1,306 | | |

| 1,204 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 470 | | |

| 325 | |

| Selling, general and administrative | |

| 2,009 | | |

| 2,119 | |

| Total operating expenses | |

| 2,479 | | |

| 2,444 | |

| Loss from operations | |

| (1,173 | ) | |

| (1,240 | ) |

| Other income (expense), net | |

| 176 | | |

| (211 | ) |

| Income tax (expense) benefit | |

| (146 | ) | |

| 33 | |

| Net loss | |

$ | (1,143 | ) | |

$ | (1,418 | ) |

| | |

| | | |

| | |

| Net loss per share: basic and diluted | |

$ | (0.07 | ) | |

$ | (0.29 | ) |

| | |

| | | |

| | |

| Weighted-average shares outstanding: basic and diluted | |

| 17,029 | | |

| 4,936 | |

| | |

| | | |

| | |

| Other comprehensive loss: | |

| | | |

| | |

| Net loss | |

$ | (1,143 | ) | |

$ | (1,418 | ) |

| Foreign currency translation adjustments | |

| (881 | ) | |

| 511 | |

| Comprehensive loss | |

$ | (2,024 | ) | |

$ | (907 | ) |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

| | |

| |

| | |

Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (1,143 | ) | |

$ | (1,418 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 39 | | |

| 45 | |

| Stock-based compensation | |

| 107 | | |

| 177 | |

| Deferred income tax expense | |

| 122 | | |

| 90 | |

| Operating lease right-of-use asset | |

| 55 | | |

| 79 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| (470 | ) | |

| 191 | |

| Inventories, net | |

| (114 | ) | |

| 230 | |

| Prepaid expenses and other current assets | |

| 59 | | |

| (84 | ) |

| Deferred consideration, net of discount | |

| 53 | | |

| 49 | |

| Accounts payable | |

| 182 | | |

| 214 | |

| Accrued expenses and other current liabilities | |

| 186 | | |

| 180 | |

| Withholding tax payable | |

| 112 | | |

| 122 | |

| Operating lease liabilities | |

| (55 | ) | |

| (79 | ) |

| Deferred revenue | |

| (45 | ) | |

| (11 | ) |

| Net cash used in operating activities | |

| (912 | ) | |

| (215 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (5 | ) | |

| (17 | ) |

| Net cash used in investing activities | |

| (5 | ) | |

| (17 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds (costs) from issuance of common stock, net of offering expenses | |

| 748 | | |

| (5 | ) |

| Proceeds from exercise of employee stock options | |

| 7 | | |

| – | |

| Principal payments on short-term debt | |

| (119 | ) | |

| (130 | ) |

| Net cash provided by (used in) financing activities | |

| 636 | | |

| (135 | ) |

| Effect of exchange rate on cash and cash equivalents | |

| (258 | ) | |

| 91 | |

| Net decrease in cash and cash equivalents | |

| (539 | ) | |

| (276 | ) |

| Cash and cash equivalents, beginning of period | |

| 3,128 | | |

| 3,820 | |

| Cash and cash equivalents, end of period | |

$ | 2,589 | | |

$ | 3,544 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 5 | | |

$ | 5 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Changes

in Stockholders’ Equity

For the Three Months ended June 30, 2024 and

2023

(In thousands, except share amounts)

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock

($0.0001 par Value) | | |

Additional

Paid in | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Total | |

| Balance, March 31, 2024 | |

| 15,607,433 | | |

$ | 2 | | |

$ | 203,207 | | |

$ | (194,349 | ) | |

$ | (2,723 | ) | |

$ | 6,137 | |

| Proceeds from At-the-Market sale of common stock, net of offering expenses | |

| 3,166,202 | | |

| – | | |

| 748 | | |

| – | | |

| – | | |

| 748 | |

| Proceeds from exercise of employee stock options | |

| 40,000 | | |

| – | | |

| 7 | | |

| – | | |

| – | | |

| 7 | |

| Employee stock-based compensation expenses | |

| 190,758 | | |

| – | | |

| 107 | | |

| – | | |

| – | | |

| 107 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| (881 | ) | |

| (881 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,143 | ) | |

| – | | |

| (1,143 | ) |

| Balance, June 30, 2024 | |

| 19,004,393 | | |

$ | 2 | | |

$ | 204,069 | | |

$ | (195,492 | ) | |

$ | (3,604 | ) | |

$ | 4,975 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock

($0.0001 par Value) | | |

Additional

Paid in | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Total | |

| Balance, March 31, 2023 | |

| 4,933,550 | | |

$ | 5 | | |

$ | 200,904 | | |

$ | (189,514 | ) | |

$ | (3,418 | ) | |

$ | 7,977 | |

| Cost in connection with ATM | |

| – | | |

| – | | |

| (5 | ) | |

| – | | |

| – | | |

| (5 | ) |

| Employee stock-based compensation expenses | |

| 208,046 | | |

| – | | |

| 177 | | |

| – | | |

| – | | |

| 177 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| 511 | | |

| 511 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,418 | ) | |

| – | | |

| (1,418 | ) |

| Balance, June 30, 2023 | |

| 5,141,596 | | |

$ | 5 | | |

$ | 201,076 | | |

$ | (190,932 | ) | |

$ | (2,907 | ) | |

$ | 7,242 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS,

INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

(Rounded to nearest thousand unless specified)

(Unaudited)

| Note 1. |

Organization and Recent Developments |

Organization

Sonoma Pharmaceuticals, Inc. (the “Company”)

was incorporated under the laws of the State of California in April 1999 and was reincorporated under the laws of the State of Delaware

in December 2006. The Company moved its principal office from Petaluma, California to Woodstock, Georgia in June 2020 and to Boulder,

Colorado in October 2022. The Company is a global healthcare leader for developing and producing stabilized hypochlorous acid (“HOCl”)

products for a wide range of applications, including wound care, eye, oral and nasal care, dermatological conditions, podiatry, animal

health care, and as a non-toxic disinfectant. The Company’s products are clinically proven to reduce itch, pain, scarring, and irritation

safely and without damaging healthy tissue. In-vitro and clinical studies of HOCl show it to safely manage skin abrasions, lacerations,

minor irritations, cuts, and intact skin. The Company sells its products either directly or via partners in 55 countries worldwide.

Basis of Presentation

The accompanying unaudited condensed consolidated

financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”)

for interim financial statements and are in the form prescribed by the Securities and Exchange Commission (the “SEC”) in instructions

to Form 10-Q and Rule 10-01 of Regulation S-X. The accompanying condensed consolidated financial statements reflect all adjustments, consisting

of normal recurring adjustments, considered necessary for a fair statement of the Company’s financial position, results of operations

and cash flows for the periods indicated. All material intercompany accounts and transactions have been eliminated in consolidation. The

accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements for

the year ended March 31, 2024, and notes thereto included in the Company’s annual report on Form 10-K, which was filed with the

SEC on June 17, 2024.

| Note 2. |

Liquidity and Financial Condition |

The Company reported a net loss of $1,143,000

and $1,418,000 for the three months ended June 30, 2024 and 2023, respectively. At June 30, 2024 and March 31, 2024, the Company’s

accumulated deficit amounted to $195,492,000 and $194,349,000, respectively. The Company had working capital of $8,176,000 and $8,829,000

as of June 30, 2024 and March 31, 2024, respectively. During the three months ended June 30, 2024 and 2023, net cash used in operating

activities amounted to $912,000 and $215,000, respectively.

Management believes that the Company has access

to additional capital resources through possible public or private equity offerings, debt financings, corporate collaborations or other

means; however, the Company cannot provide any assurance that other new financings will be available on commercially acceptable terms,

if needed. If the economic climate in the U.S. deteriorates, the Company’s ability to raise additional capital could be negatively

impacted. If the Company is unable to secure additional capital, it may be required to take additional measures to reduce costs in order

to conserve its cash in amounts sufficient to sustain operations and meet its obligations. These measures could cause significant delays

in the Company’s continued efforts to commercialize its products, which is critical to the realization of its business plan and

the future operations of the Company. This uncertainty along with the Company’s history of losses indicates that there is substantial

doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are

issued. The accompanying condensed consolidated financial statements do not include any adjustments that may be necessary should the Company

be unable to continue as a going concern.

| Note 3. |

Summary of Significant Accounting Policies |

Use of Estimates

The preparation of condensed consolidated financial

statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosures of contingent liabilities at the dates of the condensed consolidated financial statements and the reported

amounts of revenues and expenses during the reporting periods. Actual results could differ from these estimates. Significant estimates

and assumptions include reserves and write-downs related to receivables and inventories, the valuation allowance relating to the Company’s

deferred tax assets, valuation of equity and the estimated amortization periods of upfront product licensing fees received from customers.

Periodically, the Company evaluates and adjusts estimates accordingly.

Net Loss per Share

The Company computes basic net loss per share

by dividing net loss per share available to common stockholders by the weighted average number of common shares outstanding for the period

and excludes the effects of any potentially dilutive securities. Diluted earnings per share, if presented, would include the dilution

that would occur upon the exercise or conversion of all potentially dilutive securities into common stock using the “treasury stock”

and/or “if converted” methods as applicable.

The following table provides the net loss for

each period along with the computation of basic and diluted net loss per share:

| Schedule of computation of basic and diluted net loss per share | |

| | |

| |

| | |

For the Three Months Ended June 30, | |

| (In thousands, except per share data) | |

2024 | | |

2023 | |

| Numerator: | |

| | | |

| | |

| Net loss | |

$ | (1,143 | ) | |

$ | (1,418 | ) |

| | |

| | | |

| | |

| Denominator: | |

| | | |

| | |

| Weighted-average number of common shares outstanding: basic and diluted | |

| 17,029 | | |

| 4,936 | |

| | |

| | | |

| | |

| Net loss per share: basic and diluted | |

$ | (0.07 | ) | |

$ | (0.29 | ) |

The computation of basic and diluted loss per

share for the three months ended June 30, 2024 and 2023 excludes the potentially dilutive securities summarized in the table below because

their inclusion would be anti-dilutive.

| Schedule of anti-dilutive shares | |

| | |

| |

| | |

June 30, | |

| (In thousands) | |

2024 | | |

2023 | |

| Common stock to be issued upon vesting of restricted stock units | |

| – | | |

| 31 | |

| Common stock to be issued upon exercise of options | |

| 993 | | |

| 547 | |

| Common stock to be issued upon exercise of warrants | |

| – | | |

| 103 | |

| Common stock to be issued upon exercise of common stock units (1) | |

| – | | |

| 46 | |

| | |

| 993 | | |

| 727 | |

Revenue Recognition

The Company recognizes revenue in accordance with

Accounting Standards Codification (“ASC”), Topic 606 Revenue from Contracts with Customers (“Topic 606”). Revenue

is recognized when the Company transfers promised goods or services to the customer, in an amount that reflects the consideration which

the Company expects to receive in exchange for those goods or services. In determining the appropriate amount of revenue to be recognized

as the Company fulfills its obligations under the agreement, the Company performs the following steps: (i) identification of the

promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations,

including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint

on variable consideration; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue

when (or as) the Company satisfies each performance obligation. The Company only applies the five-step model to contracts when it is probable

that it will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer.

The Company derives the majority of its revenue

through sales of its products directly to end users and to distributors. The Company also sells products to a customer base, including

hospitals, medical centers, doctors, pharmacies, distributors and wholesalers. The Company has also entered into agreements to license

its technology and products.

The Company considers customer purchase orders,

which in some cases are governed by master sales agreements, to be the contracts with a customer. For each contract, the Company considers

the promise to transfer products, each of which are distinct, to be the identified performance obligations. In determining the transaction

price the Company evaluates whether the price is subject to refund or adjustment to determine the net consideration to which it expects

to be entitled.

For all of the Company’s sales to non-consignment

distribution channels, revenue is recognized when control of the product is transferred to the customer (i.e. when its performance obligation

is satisfied), which typically occurs when title passes to the customer upon shipment but could occur when the customer receives the product

based on the terms of the agreement with the customer. For product sales to its value-added resellers, non-stocking distributors and end-user

customers, the Company grants return privileges to its customers, and because the Company has a long history with its customers, the Company

is able to estimate the amount of product that will be returned.

The Company has entered into consignment arrangements,

in which goods are left in the possession of another party to sell. As products are sold from the customer to third parties, the Company

recognizes revenue based on a variable percentage of a fixed price. Revenue recognized varies depending on whether a patient is

covered by insurance or is not covered by insurance. In addition, the Company may incur a revenue deduction related to the use of the

Company’s rebate program.

Sales to stocking distributors are made under

terms with fixed pricing and limited rights of return (known as “stock rotation”) of the Company’s products held in

their inventory. Revenue from sales to distributors is recognized upon the transfer of control to the distributor.

The Company assessed the promised goods and services

in the technical support contract with Invekra for a ten-year period as being a distinct service that Invekra can benefit from on its

own and as separately identifiable from any other promises within the contract. Given that the distinct service is not substantially the

same as other goods and services within the Invekra contract, the Company accounted for the distinct service as a performance obligation.

Accounts Receivable

Trade accounts receivable are recorded net of

allowances for cash discounts for prompt payment, doubtful accounts, and sales returns. Estimates for cash discounts and sales returns

are based on analysis of contractual terms and historical trends.

The Company’s policy is to reserve for uncollectible

accounts based on its best estimate of the amount of probable credit losses in its existing accounts receivable. The Company periodically

reviews its accounts receivable to determine whether an allowance for doubtful accounts is necessary based on an analysis of past due

accounts and other factors that may indicate that the realization of an account may be in doubt. Other factors that the Company considers

include its existing contractual obligations, historical payment patterns of its customers and individual customer circumstances, an analysis

of days sales outstanding by customer and geographic region, and a review of the local economic environment and its potential impact on

government funding and reimbursement practices. Account balances deemed to be uncollectible are charged to the allowance after all means

of collection have been exhausted and the potential for recovery is considered remote. The Company did not deem it necessary to record

an allowance for doubtful accounts for probable credit losses at June 30, 2024 and March 31, 2024. Additionally, at June 30, 2024 and

March 31, 2024, the Company has allowances of $32,000 and $27,000, respectively, related to potential discounts, returns, distributor

fees and rebates. The allowances are included in Accounts Receivable, net in the accompanying condensed consolidated balance sheets.

Inventories

Inventories are stated at the lower of cost, cost

being determined on a standard cost basis (which approximates actual cost on a first-in, first-out basis), or net realizable value.

Due to changing market conditions, estimated future

requirements, age of the inventories on hand and production of new products, the Company regularly reviews inventory quantities on hand

and records a provision to write down excess and obsolete inventory to its estimated net realizable value. At June 30, 2024 and March

31, 2024, the Company recorded provisions to reduce the carrying amounts of inventories to their net realizable value in the amounts of

$262,000 and $296,000, respectively, which is included in Inventories, net in the accompanying condensed consolidated balance sheets.

Recent Accounting Standards

Accounting standards that have been issued or

proposed by the FASB, the SEC or other standard setting bodies that do not require adoption until a future date are not expected to have

a material impact on the condensed consolidated financial statements upon adoption.

| Note 4. |

Condensed Consolidated Balance Sheet |

Inventories, net

Inventories, net consist of the following:

| Schedule of inventories, net | |

| | |

| |

| | |

June 30, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| Raw materials | |

$ | 1,695,000 | | |

$ | 1,802,000 | |

| Finished goods | |

| 1,225,000 | | |

| 1,213,000 | |

| Inventories, gross | |

| 2,920,000 | | |

| 3,015,000 | |

| Less: allowance for obsolete and excess inventory | |

| (262,000 | ) | |

| (296,000 | ) |

| Total inventories, net | |

$ | 2,658,000 | | |

$ | 2,719,000 | |

Leases

The Company’s operating leases are comprised

primarily of facility leases. Balance sheet information related to the Company’s leases is presented below:

| Schedule of lease information | |

| | |

| |

| | |

June 30, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| Operating leases: | |

| | | |

| | |

| Operating lease right-of-use assets | |

$ | 216,000 | | |

$ | 286,000 | |

| Operating lease liabilities – current | |

| 155,000 | | |

| 198,000 | |

| Operating lease liabilities – non-current | |

| 61,000 | | |

| 87,000 | |

Other information related to leases is presented below:

| Three Months Ended June 30, 2024 |

|

|

|

| Operating lease cost |

|

$ |

93,000 |

|

| Other information: |

|

|

|

|

| Operating cash flows from operating leases |

|

|

(55,000 |

) |

| Weighted-average remaining lease term – operating leases (in months) |

|

|

19.0 |

|

| Weighted-average discount rate – operating leases |

|

|

6.00% |

|

As of June 30, 2024, the annual minimum lease payments of our operating

lease liabilities were as follows:

| Schedule of minimum lease payments of operating lease liabilities | |

| |

| For Years Ending March 31, | |

| | |

| 2025 (excluding the three months ended June 30, 2024) | |

$ | 150,000 | |

| 2026 | |

| 67,000 | |

| 2027 | |

| 14,000 | |

| 2028 | |

| 9,000 | |

| Total future minimum lease payments, undiscounted | |

| 240,000 | |

| Less: imputed interest | |

| (24,000 | ) |

| Present value of future minimum lease payments | |

$ | 216,000 | |

| Note 5. |

Commitments and Contingencies |

Legal Matters

The Company may be involved in legal matters arising

in the ordinary course of business including matters involving proprietary technology. While management believes that such matters are

currently insignificant, matters arising in the ordinary course of business for which the Company is or could become involved in litigation

may have a material adverse effect on its business and financial condition of comprehensive loss.

Employment Matters

The Company has employment agreements in place

with two of its key executives. These executive employment agreements provide, among other things, for the payment of up to eighteen months

of severance compensation for terminations under certain circumstances.

As of June 30, 2024, with respect to these agreements,

aggregated annual salaries was $586,000 and potential severance payments to these key executives is $1,300,000, if triggered.

Financing of Insurance Premiums

On February 6, 2024, the Company entered into

a note agreement for $373,000 with an interest rate of 8.42% per annum with final payment on November 1, 2024. This instrument was issued

in connection with financing insurance premiums. The note is payable in nine monthly installment payments of principal and interest of

$42,000, with the first installment beginning March 1, 2024. At June 30, 2024 and March 31, 2024, the outstanding principal on the note

amounted to $204,000 and $323,000, respectively.

| Note 7. |

Stockholders’ Equity |

Authorized Capital

The Company is authorized to issue up to 24,000,000

shares of common stock with a par value of $0.0001 per share and 714,286 shares of convertible preferred stock with a par value of $0.0001

per share.

Sale of Common Stock

In connection with the Equity Distribution Agreement

that the Company entered into on December 15, 2023 with Maxim Group LLC (“Maxim”), as amended, from May 13, 2024 to May 22,

2024 the Company sold 3,166,202 shares of its common stock for gross proceeds of $786,000 and net proceeds of $748,000 after deducting

commissions and other offering expenses paid by the Company.

| Note 8. |

Stock-Based Compensation |

For the three months ended June 30, 2024 and 2023, the Company incurred

$107,000 and $177,000 of stock-based compensation expense, respectively. All stock-based compensation incurred is included in selling,

general and administrative expense in the accompanying condensed consolidated statements of comprehensive loss.

At June 30, 2024, there was unrecognized compensation

costs of $242,000 related to stock options which is expected to be recognized over a weighted-average amortization period of 0.94 years.

Stock

options award activity is as follows:

| Schedule of stock options award

activity | |

| | | |

| | |

| | |

Number of

Shares | | |

Weighted-

Average

Exercise Price | |

| Outstanding at April 1, 2024 | |

| 1,032,999 | | |

$ | 3.13 | |

| Options exercised | |

| (40,000 | ) | |

| 0.18 | |

| Outstanding at June 30, 2024 | |

| 992,999 | | |

$ | 3.25 | |

| Exercisable at June 30, 2024 | |

| 658,453 | | |

$ | 4.30 | |

The aggregate intrinsic value of stock options

is calculated as the difference between the exercise price of the underlying stock options and the fair value of the Company’s common

stock, or $0.21 per share at June 30, 2024.

Restricted stock award activity is as follows:

| Schedule of restricted stock award activity | |

| | |

| |

| | |

Number of Shares | | |

Weighted Average Award Date Fair Value per Share | |

| Unvested restricted stock awards outstanding at April 1, 2024 | |

| – | | |

$ | – | |

| Restricted stock awards granted | |

| 190,758 | | |

| 0.20 | |

| Restricted stock awards vested | |

| (190,758 | ) | |

| 0.20 | |

| Unvested restricted stock awards outstanding at June 30, 2024 | |

| – | | |

$ | – | |

The Company did not capitalize any cost associated

with stock-based compensation.

The Company issues new shares of common stock

upon exercise of stock options or release of restricted stock awards.

At the end of each interim reporting period, the

Company determines the income tax provision by using an estimate of the annual effective tax rate, adjusted for discrete items occurring

in the quarter.

Our effective tax rate for the three months ended

June 30, 2024 was (14.64)%. The Company’s effective tax rate for the three months ended June 30, 2024 differed from the federal

statutory tax rate of 21% primarily due to the valuation allowance recognized against deferred tax assets in the U.S.

Judgment is required in determining whether deferred

tax assets will be realized in full or in part. Management assesses the available positive and negative evidence on a jurisdictional basis

to estimate if deferred tax assets will be recognized and when it is more likely than not that all or some deferred tax assets will not

be realized, and a valuation allowance must be established. As of June 30, 2024, the Company continues to maintain a valuation allowance

in the U.S.

| Note 10. |

Revenue Disaggregation |

The Company generates product revenues from products

which are sold into the human and animal healthcare markets, and the Company generates service revenues from laboratory testing services

which are provided to medical device manufacturers.

The following table presents the Company’s disaggregated revenues

by source:

| Schedule of disaggregated revenue by source | |

| | |

| |

| | |

Three Months Ended June 30, | |

| Product | |

2024 | | |

2023 | |

| Human Care | |

$ | 2,876,000 | | |

$ | 2,750,000 | |

| Animal Care | |

| 399,000 | | |

| 578,000 | |

| Total Product | |

| 3,275,000 | | |

| 3,328,000 | |

| Service and Royalty | |

| 116,000 | | |

| 99,000 | |

| Total | |

$ | 3,391,000 | | |

$ | 3,427,000 | |

The following table shows the Company’s revenues by geographic region:

| Schedule of revenues by geographic region | |

| | |

| |

| | |

Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| United States | |

$ | 642,000 | | |

$ | 806,000 | |

| Europe | |

| 1,288,000 | | |

| 1,070,000 | |

| Asia | |

| 477,000 | | |

| 862,000 | |

| Latin America | |

| 880,000 | | |

| 487,000 | |

| Rest of the World | |

| 104,000 | | |

| 202,000 | |

| Total | |

$ | 3,391,000 | | |

$ | 3,427,000 | |

| Note 11. |

Significant Customer Concentrations |

The following table shows major customers revenues

as a percentage of net revenue:

| Schedule of customer concentrations of risk | |

| | |

| |

| | |

For the Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Customer A | |

| –*% | | |

| 15% | |

| Customer B | |

| 26% | | |

| 14% | |

| Customer C | |

| 18% | | |

| 14% | |

The following table shows major customers accounts

receivable balances as a percentage of net accounts receivables:

| | |

| | |

| |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| Customer A | |

| 16% | | |

| 15% | |

| Customer B | |

| 17% | | |

| –*% | |

| Customer C | |

| 11% | | |

| 11% | |

| Customer D | |

| 17% | | |

| 21% | |

| Note 12. |

Subsequent Events |

Management has evaluated subsequent events or transactions occurring

through the date the condensed consolidated financial statements were issued. The Company does not have subsequent events to report.

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion of our financial condition

and results of operations should be read in conjunction with the condensed consolidated financial statements and notes to those statements

included elsewhere in this Quarterly Report on Form 10-Q as of June 30, 2024 and our audited consolidated financial statements for the

year ended March 31, 2024 included in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on June 17, 2024.

This report contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this report, the words “anticipate,”

“suggest,” “estimate,” “plan,” “aim,” “seek,” “project,” “continue,”

“ongoing,” “potential,” “expect,” “predict,” “believe,” “intend,”

“may,” “will,” “should,” “could,” “would,” “likely,” “proposal,”

and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are subject to risks

and uncertainties that could cause our actual results to differ materially from those projected. These risks and uncertainties include,

but are not limited to the risks described in our Annual Report on Form 10-K including: our ability to become profitable; our dependence

on third-party distributors; certain tax impacts of inter-company loans between us and our Mexican subsidiary; the progress and timing

of our development programs and regulatory approvals for our products; the benefits and effectiveness of our products; the ability of

our products to meet existing or future regulatory standards; the progress and timing of clinical trials and physician studies; our expectations

and capabilities relating to the sales and marketing of our current products and our product candidates; our ability to compete with other

companies that are developing or selling products that are competitive with our products; the establishment of strategic partnerships

for the development or sale of products; the risk our research and development efforts do not lead to new products; the timing of commercializing

our products; our ability to penetrate markets through our sales force, distribution network, and strategic business partners to gain

a foothold in the market and generate attractive margins; the ability to attain specified revenue goals within a specified time frame,

if at all, or to reduce costs; the outcome of discussions with the U.S. Food and Drug Administration, or FDA, and other regulatory agencies;

the content and timing of submissions to, and decisions made by, the FDA and other regulatory agencies, including demonstrating to the

satisfaction of the FDA the safety and efficacy of our products; our ability to manufacture sufficient amounts of our products for commercialization

activities; our ability to protect our intellectual property and operate our business without infringing on the intellectual property

of others; our ability to continue to expand our intellectual property portfolio; the risk we may need to indemnify our distributors or

other third parties; risks attendant with conducting a significant portion of our business outside the United States; our ability to comply

with complex federal and state fraud and abuse laws, including state and federal anti-kickback laws; risks associated with changes to

health care laws; our ability to attract and retain qualified directors, officers and employees; our expectations relating to the concentration

of our revenue from international sales; our ability to expand to and commercialize products in markets outside the wound care market;

our ability to protect our information technology and infrastructure; and the impact of any future changes in accounting regulations or

practices in general with respect to public companies. These forward-looking statements speak only as of the date hereof. We expressly

disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement

is based, except as required by law.

Our Business

We are a global healthcare leader for developing

and producing stabilized hypochlorous acid, or HOCl, products for a wide range of applications, including wound care, eye care, oral care,

dermatological conditions, podiatry, animal health care and non-toxic disinfectants. Our products are clinically proven to reduce itch,

pain, scarring, and irritation safely and without damaging healthy tissue. In-vitro and clinical studies of HOCl show it to safely manage

skin abrasions, lacerations, minor irritations, cuts, and intact skin. We sell our products either directly or via partners in 55 countries

worldwide.

Business Channels

Our core market differentiation is based on being

the leading developer and producer of stabilized hypochlorous acid, or HOCl, solutions. We have been in business for over 20 years, and

in that time, we have developed significant scientific knowledge of how best to develop and manufacture HOCl products backed by decades

of studies and data collection. HOCl is known to be among the safest and most-effective ways to relieve itch, inflammation and burns while

stimulating natural healing through increased oxygenation and eliminating persistent microorganisms and biofilms.

We sell our products into many markets both in

the U.S. and internationally. In international markets, we ship a variety of products to 55 countries. Our core strategy is to work with

partners both in the United States and around the world to market and distribute our products. In some cases, we market and sell our own

products.

Dermatology

We have developed unique, differentiated, prescription-strength

and safe dermatologic products that support paths to healing among various key dermatologic conditions. Our products are primarily targeted

at the treatment of redness and irritation, the management of scars and symptoms of eczema/atopic dermatitis. We are strategically focused

on introducing innovative new products that are supported by human clinical data with applications that address specific dermatological

procedures currently in demand. In addition, we look for markets where we can provide effective product line extensions and pricing to

new product families.

In the United States, we partner with EMC Pharma,

LLC to sell our prescription dermatology products. Pursuant to our March 2021 agreement with EMC Pharma, we manufacture products for EMC

Pharma and EMC Pharma has the right to market, sell and distribute them to patients and customers for an initial term of five years, subject

to meeting minimum purchase and other requirements.

In September

2021, we launched a new over-the-counter product, Regenacyn® Advanced Scar Gel, which is clinically proven to improve the

overall appearance of scars while reducing pain, itch and redness. On the same day, we launched Regenacyn Plus, a prescription-strength

scar gel which is available as an office dispense product through physician offices.

In October

2022, we launched two new over-the-counter dermatology products in the United States, Reliefacyn® Advanced Itch-Burn-Rash-Pain

Relief Hydrogel for the alleviation of red bumps, rashes, shallow skin fissures, peeling, and symptoms of eczema/atopic dermatitis, and

Rejuvacyn® Advanced Skin Repair Cooling Mist for management of minor skin irritations following cosmetic procedures as

well as daily skin health and hydration.

In June 2022, the Natural Products Association

certified Rejuvacyn Advanced as a Natural Personal Care Product. Reliefacyn Advanced received the National Eczema Association Seal of

AcceptanceTM in 2023.

In January 2023, we launched a line of office

dispense products exclusively for skin care professionals, including two new prescription strength dermatology products, Reliefacyn Plus

Advanced Itch-Burn-Rash-Pain Relief Hydrogel and Rejuvacyn Plus Skin

Repair Cooling Mist. These products, along with Regenacyn Plus Scar Gel, are marketed

and sold directly to dermatology practices and medical spas.

In January

2024, we launched LumacynTM Clarifying Mist, a direct-to-consumer skin care product in the United States. Lumacyn is an all-natural

daily toner to soothe skin, reduce redness and irritation, and manage blemishes by reducing infection.

Our consumer products are available

through Amazon.com, our online store and third-party distributors.

We sell dermatology products in Europe and Asia

through distributors. In these international markets, we have a network of partners, ranging from country specific distributors to large

pharmaceutical companies to full-service sales and marketing companies. We work with our international partners to create products they

can market in their home country. Some products we develop and manufacture are custom label while others use branding we have already

developed. We have created or co-developed a wide range of products for international markets using our core HOCl technology.

First Aid and Wound Care

Our HOCl-based wound care products are intended

for the treatment of acute and chronic wounds as well as first- and second-degree burns, and as an intraoperative irrigation treatment.

They work by first removing foreign material and debris from the skin surface and moistening the skin, thereby improving wound healing.

Secondly, our HOCl products assist in the wound healing process by removing microorganisms. HOCl is an important constituent of our innate

immune system, formed and released by the macrophages during phagocytosis. Highly organized cell structures such as human tissue can tolerate

the action of our wound care solution while single-celled microorganisms cannot, making our products advantageous to other wound-irrigation

and antiseptic solutions. Due to its unique chemistry, our wound treatment solution is also much more stable than similar products on

the market and therefore maintains much higher levels of hypochlorous acid over its shelf life.

In the United States, we sell our wound care products

directly to hospitals, physicians, nurses, and other healthcare practitioners and indirectly through non-exclusive distribution arrangements.

In Europe, the Middle East and Asia, we sell our wound care products through a diverse network of distributors.

To respond to market demand for our HOCl technology-based

products, we launched our first direct to consumer over-the-counter product in the United States in February 2021. Microcyn®

OTC Wound and Skin Cleanser is formulated for home use without prescription to help manage and cleanse wounds, minor cuts, and burns,

including sunburns and other skin irritations. Microcyn OTC is available without prescription through Amazon.com, our online store and

third-party distributors.

In March 2021, we received approval to market

and use our HOCl products as biocides under Article 95 of the European Biocidal Products Regulation in France, Germany and Portugal. The

approval applies to our products MucoClyns™ for human hygiene to be marketed and commercialized by us, MicrocynAH®

for animal heath marketed and commercialized through our partner, Petagon Limited, and MicroSafe for disinfectant use to be marketed and

commercialized through our partner, MicroSafe Group DMCC.

In June 2022, the Natural Products Association

certified Microcyn OTC as a Natural Personal Care Product in the United States.

In June 2023, we announced a new application of

our HOCl technology for intraoperative pulse lavage irrigation treatment, which can replace commonly used IV bags in a variety of surgical

procedures. The intraoperative pulse lavage container is designed to be used in combination with a pulse lavage irrigation device, or

flush gun, for abdominal, laparoscopic, orthopedic, and periprosthetic procedures. It is in trial use by hospitals in Europe and launched

in the U.S. in November 2023.

In April 2024, we announced expansion of our Microcyn

Negative Pressure Wound Therapy Solution products line, now available in 250mL, 450mL and 990mL sizes to meet the diverse needs of healthcare

professionals and patients.

In July 2024, we announced an expansion of our

distributor base in Europe through a new partnership with Smart Healthcare Company (SHC) s.r.o. for the distribution of Microdacyn60®

wound care products into Ukraine.

Eye Care

Our prescription product

Acuicyn™ is an antimicrobial prescription solution for the treatment of blepharitis and the daily hygiene of eyelids and lashes

and helps manage red, itchy, crusty and inflamed eyes. It is strong enough to kill the bacteria that causes discomfort, fast enough to

provide near instant relief, and gentle enough to use as often as needed. In the United States, our partner EMC Pharma sells Acuicyn through

its distribution network.

In international markets

we rely on distribution partners to sell our eye products. In May 2020, we entered into an expanded license and distribution agreement

with our existing partner, Brill International S.L., for our Microdacyn60® Eye Care HOCl-based product. Under the license

and distribution agreement, Brill has the right to market and distribute our eye care product under the private label Ocudox™ in

Italy, Germany, Spain, Portugal, France, and the United Kingdom for a period of 10 years, subject to meeting annual minimum sales quantities.

In return, Brill paid us a one-time fee, and the agreed upon supply prices. In parts of Asia, Dyamed Biotech markets our eye product under

the private label Ocucyn.

In September 2021, we

launched Ocucyn® Eyelid & Eyelash Cleanser, which is sold directly to consumers on Amazon.com, through our online store,

and through third party distributors. Ocucyn Eyelid & Eyelash Cleanser, designed for everyday use, is a safe, gentle, and effective

solution for good eyelid and eyelash hygiene.

Oral, Dental and Nasal Care

We sell

a variety of oral, dental, and nasal products around the world.

In international markets, our product Microdacyn60

Oral Care treats mouth and throat infections and thrush. Microdacyn60 assists in reducing inflammation and pain, provides soothing cough

relief and does not contain any harmful chemicals. It does not stain teeth, is non-irritating, non-sensitizing, has no contraindications

and is ready for use with no mixing or dilution.

Our international nasal care product Sinudox™

based on our HOCl technology is an electrolyzed solution intended for nasal irrigation. Sinudox clears and cleans stuffy, runny noses

and blocked or inflamed sinuses by ancillary ingredients that may have a local antimicrobial effect. Sinudox is currently sold through

Amazon in Europe. In other parts of the world, we partner with distributors to sell Sinudox.

Podiatry

Our HOCl-based wound care products are also indicated

for the treatment of diabetic foot ulcers. In the United States, we sell our wound care products directly to podiatrists as well as hospitals,

nurses, and other healthcare practitioners and indirectly through non-exclusive distribution arrangements. In Europe, we sell our wound

care products for podiatric use through a diverse network of distributors.

In April 2023, we launched PodiacynTM

Advanced Everyday Foot Care direct to consumers for over-the-counter use in the United States, intended for management of foot odors,

infections, and irritations, as well as daily foot health and hygiene. Podiacyn is available through Amazon.com, our online store and

third-party distributors.

Animal Health Care

MicrocynAH® is an HOCl-based topical

product that cleans, debrides and treats a wide spectrum of animal wounds and infections. It is intended for the safe and rapid treatment

of a variety of animal afflictions including cuts, burns, lacerations, rashes, hot spots, rain rot, post-surgical sites, pink eye symptoms

and wounds to the outer ear.

For our animal health products sold in the U.S.

and Canada, we partner with Compana Pet Brands. Compana distributes non-prescription products to national pet-store retail chains and

farm animal specialty stores, such as PetSmart, Tractor Supply, Cabela’s, PetExpress, Bass Pro Shops, and Menards. In August 2022,

we announced the launch of a MicrocynVS® line of products exclusively for veterinarians for the management of wound, skin,

ear and eye afflictions in all animal species.

For the

Asian and European markets, in May 2019 we partnered with Petagon an international importer and distributor of quality pet food and products

for an initial term of five years. We supply Petagon with all MicrocynAH products sold by Petagon. In August 2020, Petagon received a

license from the People’s Republic of China for the import of veterinary drug products manufactured by us. This is the highest classification

Petagon and Sonoma can receive for animal health products in China.

Surface Disinfectants

Our HOCl technology has been formulated as a disinfectant

and sanitizer solution for our partner MicroSafe and is sold in numerous countries. It is designed to be used to spray in aerosol format

in areas and environments likely to serve as a breeding ground for the spread of infectious disease, which could result in epidemics or

pandemics. The medical-grade surface disinfectant solution is used in hospitals worldwide to protect doctors and patients. In May 2020,

Nanocyn® Disinfectant & Sanitizer received approval to be entered into the Australian Register of Therapeutic Goods,

or ARTG for use against the coronavirus SARS-CoV-2, or COVID-19, and was also authorized in Canada for use against COVID-19. Nanocyn has

also met the stringent environmental health and social/ethical criteria of Good Environmental Choice Australia, or GECA, becoming one

of the very few eco-certified, all-natural disinfectant solutions in Australia.

Through our partner MicroSafe, we sell hard surface

disinfectant products into Europe, the Middle East and Australia.

In July 2021, we granted MicroSafe the non-exclusive

right to sell and distribute Nanocyn in the United States provided that MicroSafe secure U.S. EPA approval. In April of 2022, MicroSafe

secured the EPA approval for Nanocyn® Disinfectant & Sanitizer, meaning that it can now be sold in the United States as a surface

disinfectant, and it was subsequently added to the EPA’s list N for use against COVID-19. In June 2022, the EPA added Nanocyn to

List Q as a disinfectant for Emerging Viral Pathogens, including Ebola virus, Mpox, and SARS-CoV-2, and in March 2023 the EPA added Nanocyn

to Lists G and H, for use against Methicillin Resistant Staphylococcus Aureus (MRSA), Salmonella, Norovirus, Poliovirus, and as a fungicide.

Nanocyn also received the Green Seal® Certification after surpassing a series of rigorous standards that measure environmental

health, sustainability and product performance. Nanocyn is currently sold by MicroSafe in Europe, the Middle East and Australia.

Additional Information

Investors and others should note that we announce

material financial information using our company website (www.sonomapharma.com), our investor relations website (ir.sonomapharma.com),

SEC filings, press releases, public conference calls and webcasts. The information on, or accessible through, our websites is not incorporated

by reference in this Quarterly Report on Form 10-Q.

Results of Operations

Comparison of the Three Months Ended June 30,

2024 and 2023

Revenue

The following table shows our consolidated total

revenue and revenue by geographic region for the three months ended June 30, 2024 and 2023:

| | |

Three Months Ended June 30, | | |

| | |

| |

| (In thousands) | |

2024 | | |

2023 | | |

$ Change | | |

% Change | |

| United States | |

$ | 642 | | |

$ | 806 | | |

$ | (164 | ) | |

| (20% | ) |

| Europe | |

| 1,288 | | |

| 1,070 | | |

| 218 | | |

| 20% | |

| Asia | |

| 477 | | |

| 862 | | |

| (385 | ) | |

| (45% | ) |

| Latin America | |

| 880 | | |

| 487 | | |

| 393 | | |

| 81% | |

| Rest of the World | |

| 104 | | |

| 202 | | |

| (98 | ) | |

| (49% | ) |

| Total | |

$ | 3,391 | | |

$ | 3,427 | | |

$ | (36 | ) | |

| (1% | ) |

The decrease in United States revenue of $164,000

for the three months ended June 30, 2024, was primarily the result of fluctuations in timing of orders of over-the-counter animal health

care products.

The increase in Europe revenue for the three months

ended June 30, 2024 of $218,000 was the result of a general increase in demand for our products.

The decrease in Asia revenue of $385,000 for the

three months ended June 30, 2024 was primarily due to timing of orders. Revenues from our international distributors tend to fluctuate

from period to period due to customer placement of larger but less frequent orders to benefit from quantity discounts and reduced shipping

costs.

The increase in Latin America revenue for the

three months ended June 30, 2024 of $393,000 was primarily due to timing of customer orders for overflow manufacturing.

The decrease in Rest of World revenue for the

three months ended June 30, 2024 of $98,000 was primarily due to timing of customer orders.

Cost of Revenue and Gross Profit

The cost of revenue and gross profit metrics for

the three months ended June 30, 2024 and 2023 are as follows:

| | |

Three Months Ended June 30, | | |

| | |

| |

| (In thousands, except for percentages) | |

2024 | | |

2023 | | |

$ Change | | |

% Change | |

| Cost of Revenues | |

$ | 2,085 | | |

$ | 2,223 | | |

$ | (138 | ) | |

| (6% | ) |

| Cost of Revenue as a % of Revenues | |

| 61% | | |

| 65% | | |

| | | |

| | |

| Gross Profit | |

$ | 1,306 | | |

$ | 1,204 | | |

$ | 102 | | |

| 8% | |

| Gross Profit as a % of Revenues | |

| 39% | | |

| 35% | | |

| | | |

| | |

The increase in gross profit of $102,000 for the

three months ended June 30, 2024, as compared to the prior period, was primarily due to overall product mix, and higher costs of materials

and transportation in the prior period.

Research and Development Expense

The research and development expense metrics for

the three months ended June 30, 2024 and 2023 are as follows:

| | |

Three Months Ended June 30, | | |

| | |

| |

| (In thousands, except for percentages) | |

2024 | | |

2023 | | |

$ Change | | |

% Change | |

| Research and Development Expense | |

$ | 470 | | |

$ | 325 | | |

$ | 145 | | |

| 45% | |

| Research and Development Expense as a % of Revenues | |

| 14% | | |

| 9% | | |

| | | |

| | |

Increases in research and development expenses

for the three months ended June 30, 2024 of $145,000 was primarily due to increased product development and expanded regulatory efforts

in the U.S. and Europe to support new product releases.

Selling, General and Administrative Expense

The selling, general and administrative expense

metrics for the three months ended June 30, 2024 and 2023 are as follows:

| | |

Three Months Ended June 30, | | |

| | |

| |

| (In thousands, except for percentages) | |

2024 | | |

2023 | | |

Change | | |

% Change | |

| Selling, General and Administrative Expense | |

$ | 2,009 | | |

$ | 2,119 | | |

$ | (110 | ) | |

| (5% | ) |

| Selling, General and Administrative Expense as a % of Revenues | |

| 59% | | |

| 62% | | |

| | | |

| | |

The decline in selling, general and administrative

expenses for the three months ended June 30, 2024 of $110,000 was the result of ongoing efforts to contain expenses across all parts of

the company.

Other Income (Expense), net

Other income (expense), net for the three months

ended June 30, 2024 was $176,000 compared to other income (expense), net of $(211,000) for the three months ended June 30, 2023. The change

in other income (expense), net primarily relates to exchange rate fluctuations.

Income Tax (Expense) Benefit

Income tax (expense) benefit for the three months

ended June 30, 2024 and 2023 was $(146,000) and $33,000, respectively. The expense for the current year is primarily related to

the use of our deferred tax asset in Mexico and, to a lesser extent, our deferred tax asset in Netherlands. The benefit for the

prior year was related to our Mexico deferred tax asset.

Net Loss

The following table provides the net loss for

each period along with the computation of basic and diluted net loss per share:

| | |

Three Months Ended June 30, | |

| (In thousands, except per share data) | |

2024 | | |

2023 | |

| Net loss | |

$ | (1,143 | ) | |

$ | (1,418 | ) |

| | |

| | | |

| | |

| Weighted-average shares outstanding: basic and diluted | |

| 17,029 | | |

| 4,936 | |

| | |

| | | |

| | |

| Net loss per share: basic and diluted | |

$ | (0.07 | ) | |

$ | (0.29 | ) |

Liquidity and Capital Resources

We reported a net loss of $1,143,000 and $1,418,000

for the three months ended June 30, 2024 and June 30, 2023, respectively. At June 30, 2024 and March 31, 2024, our accumulated deficit

amounted to $195,492,000 and $194,349,000, respectively. At June 30, 2024 and March 31, 2024, we had cash and cash equivalents of $2,589,000

and $3,128,000, respectively. At June 30, 2024 and March 31, 2024, we had working capital of $8,176,000 and $8,829,000, respectively.

Sources of Liquidity

Since our inception, substantially all of our

operations have been financed through sales of equity securities. Other sources of financing that we have used to date include our revenues,

as well as various loans and the sale of certain assets to customers.

Since July 1, 2023, substantially all of our operations

have been financed through cash on hand and the following transactions:

| |

· |

Proceeds of $1,446,000, net of offering expenses, from the sale of common stock on October 26, 2023. |

| |

· |

Proceeds of $343,000, net of offering expenses, from the sale of common stock on January 11, 2024. |

| |

· |

Proceeds of $748,000, net of offering expenses, from the sale of common stock in May of 2024. |

Cash Flows

The following table presents a summary of our

consolidated cash flows for operating, investing and financing activities for the three months ended June 30, 2024 and 2023 as well balances

of cash and cash equivalents and working capital:

| | |

Three Months ended June 30, | |

| (In thousands) | |

2024 | | |

2023 | |

| Net cash provided by (used in): | |

| | | |

| | |

| Operating activities | |

$ | (912 | ) | |

$ | (215 | ) |

| Investing activities | |

| (5 | ) | |

| (17 | ) |

| Financing activities | |

| 636 | | |

| (135 | ) |

| Effect of exchange rates on cash | |

| (258 | ) | |

| 91 | |

| Net change in cash and cash equivalents | |

| (539 | ) | |

| (276 | ) |

| Cash and cash equivalents, beginning of the period | |

| 3,128 | | |

| 3,820 | |

| Cash and cash equivalents, end of the period | |

$ | 2,589 | | |

$ | 3,544 | |

| Working capital (1), end of period | |

$ | 8,176 | | |

$ | 9,546 | |

| |

(1) |

Defined as current assets minus current liabilities. |

Net cash used by operating activities during the

three months ended June 30, 2024 was $912,000, primarily due to a net loss of $1,143,000 offset by stock related compensation expense

of $107,000.

Net cash used by operating activities during the

three months ended June 30, 2023 was $215,000, primarily due to a net loss of $1,418,000 offset by stock related compensation expense

of $177,000, decrease in accounts receivable of $191,000, decrease in inventory of $230,000 and a combined increase in accounts payable

and accrued liabilities of $394,000.

Net cash used in investing activities was $5,000

for three months ended June 30, 2024, primarily related to the purchase of equipment.

Net cash used in investing activities was $17,000