Solar Capital Ltd. (the “Company”) (NASDAQ:SLRC), today

reported earnings of $13.8 million, or $0.31 per share for the

quarter ended March 31, 2014. Net investment income was $17.4

million, or $0.40 per average share, for the first quarter. At

March 31, 2014, net asset value (NAV) per share was $22.43.

On May 5, 2014 the Company’s Board of Directors also declared a

second quarter distribution of $0.40 per share payable

on July 1, 2014 to stockholders of record on June

19, 2014. The specific tax characteristics will be reported to

stockholders on Form 1099 after the end of the calendar year.

HIGHLIGHTS:

At March 31, 2014:

Investment Portfolio: $1.03 billionNumber of

Portfolio Companies: 43Net Assets: $972.3 millionNet Asset Value

per share: $22.43

Portfolio Activity for the Quarter Ended March 31,

2014:

Investments made during the quarter: $144.8

millionInvestments prepaid and sold during the quarter: $208.3

million

Operating Results for the Quarter Ended March 31,

2014:

Net investment income: $17.4 millionNet

realized and unrealized losses: $3.7 millionNet increase in net

assets from operations: $13.8 millionNet investment income per

share: $0.40

“We are pleased with our strong originations this quarter. With

the portfolio composition at its highest level of senior secured

and floating rate investments, we believe Solar Capital is

defensively positioned to preserve shareholder value while

delivering strong risk-adjusted returns,” said Michael Gross,

Chairman and CEO of Solar Capital Ltd. “Our objective is to grow

our investment income per share by prudently deploying our

substantial available capital into new investments that meet our

strict underwriting criteria.”

Conference Call and

Webcast

The company will host an earnings conference call and audio

webcast at 10:00 a.m. (Eastern Time) on Tuesday, May 6, 2014.

All interested parties may participate in the conference call by

dialing (866) 953-6856 approximately 5-10 minutes prior to the

call. International callers should dial (617) 399-3480.

Participants should reference Solar Capital Ltd. and the

participant passcode of 17500624 when prompted. This conference

call also can be accessed by all interested parties through Solar

Capital’s website, www.solarcapltd.com. Additionally, a replay

dial-in will be available until May 20, 2014 and can be

accessed by dialing (888) 286-8010 and using the passcode 27264588.

International callers should dial (617) 801-6888 to listen to the

replay.

Portfolio and Investment

Activity

During the three months ended March 31, 2014, we invested

$144.8 million across ten portfolio companies. Investments

sold and prepaid during the quarter ended March 31, 2014 totaled

$208.3 million.

At March 31, 2014, our portfolio consisted of 43 portfolio

companies and was invested 47.0% in senior secured loans, 29.4% in

Crystal Financial whose portfolio is 100% comprised of senior

secured loans, 17.5% in subordinated debt, 2.2% in preferred equity

and 3.9% in common equity and warrants excluding Crystal Financial,

measured at fair value.

Crystal Financial’s $442.7 million of funded senior secured

loans is across 25 issuers with an average balance outstanding of

$17.0 million. All of the commitments from Crystal Financial are

floating-rate, senior-secured loans. During the quarter ended March

31, 2014, Crystal Financial funded new loans totaling $55.9 million

and had $77.4 million of funded loans repaid.

The fair value weighted average yield on our portfolio of

income-producing investments was 10.9% at March 31, 2014.

At March 31, 2014, 69.8% or $689.9 million of our income

producing investment portfolio* is floating rate and 30.2% or

$297.9 million of our income producing portfolio is fixed rate,

measured at fair value.

From inception in 2006 through March 31, 2014, Solar Capital

Ltd. and its predecessor companies have invested approximately $3.4

billion in 107 portfolio companies. Over the same period, Solar

Capital Ltd. has completed transactions with more than 80 different

financial sponsors.

* We have included Crystal Financial as 100% floating rate.

Results of Operations for the Three

Months Ended March 31, 2014 compared to the Three Months Ended

March 31, 2013.

Investment Income

For the three months ended March 31, 2014 and 2013, gross

investment income totaled $32.6 million and $46.1 million,

respectively. The decrease in gross investment income year over

year was primarily due to a smaller income producing portfolio from

the net effect of portfolio repayments, as well as portfolio yield

compression.

Expenses

Expenses totaled $15.2 million and $20.6 million, respectively,

for the three months ended March 31, 2014 and 2013. The decrease in

expenses year over year was primarily due to a decrease in

management and performance-based incentive fees on lower investment

income and portfolio size, as well as decreases in debt expenses

due to lower average borrowings.

Net Investment Income

The Company’s net investment income totaled $17.4 million and

$25.5 million, or $0.40 and $0.58 per average share, for the three

months ended March 31, 2014 and 2013, respectively.

Net Realized and Unrealized Gain (Loss)

Net realized and unrealized gain (loss) for the three months

ended March 31, 2014 and 2013 totaled ($3.7) million and $10.3

million, respectively.

Net Increase in Net Assets Resulting From Operations

For the three months ended March 31, 2014 and 2013, the Company

had a net increase in net assets resulting from operations of $13.8

million and $35.8 million, respectively. For the same periods,

earnings per average share were $0.31 and $0.81, respectively.

Liquidity and Capital Resources

At March 31, 2014, the Company had $198 million of cash and a

total of $490 million of unused credit capacity, subject to

borrowing base limitations.

During the three months ended March 31, 2014, the Company

repurchased $19.6 million of its common stock at an average price

of approximately $22.00 per share, representing a 1.9% discount to

the NAV per share at March 31, 2014. Including additional share

repurchases of $15.6 million since March 31, 2014, the Company has

repurchased a total of $52.7 million out of $100 million authorized

through May 2, 2014.

Financial Statements and

Tables

SOLAR CAPITAL LTD.

CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES

(in thousands, except share

amounts)

March 31, 2014 (unaudited) December 31, 2013

Assets Investments at fair value: Companies less than 5%

owned (cost: $657,796 and $688,685, respectively) $ 647,894 $

680,720 Companies 5% to 25% owned (cost: $8,023 and $7,789,

respectively) 8,023 7,789 Companies more than 25% owned (cost:

$343,525 and $394,285, respectively) 371,848

399,890 Total investments (cost: $1,009,344 and $1,090,759,

respectively) 1,027,765 1,088,399 Cash and cash equivalents 644,890

585,278 Foreign currency (cost: $3,095 and $1,702, respectively)

3,041 1,701 Interest and dividends receivable 14,284 14,228

Deferred financing costs 3,291 3,300 Derivatives — — Receivable for

investments sold 15,531 14,870 Prepaid expenses and other assets

1,207 666

Total assets $

1,710,009 $ 1,708,442

Liabilities

Revolving credit facilities $ — $ — Unsecured senior notes 100,000

100,000 Senior secured notes 75,000 75,000 Term loan 50,000 50,000

Distributions payable 16,662 17,698 Payable for investments and

cash equivalents purchased 479,633 454,887 Management fee payable

6,210 5,780 Performance-based incentive fee payable 3,213 4,633

Payable for common stock repurchased 2,567 — Administrative

services expense payable 552 2,085 Interest payable 2,586 1,499

Other liabilities and accrued expenses 1,257

1,223

Total liabilities $ 737,680 $ 712,805

Net Assets Common stock, par value

$0.01 per share, 200,000,000 and 200,000,000 common shares

authorized, respectively, and 43,354,383 and 44,244,195 shares

issued and outstanding, respectively $ 434 $ 442 Paid-in capital in

excess of par 1,090,979 1,110,545 Distributions in excess of net

investment income (17,404 ) (17,344 ) Accumulated net realized loss

(119,059 ) (92,706 ) Net unrealized appreciation (depreciation)

17,379 (5,300 )

Total net assets $

972,329 $ 995,637

Net Asset Value Per Share $

22.43 $ 22.50

SOLAR CAPITAL LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except share

amounts)

Three months ended March 31, 2014 March 31,

2013 INVESTMENT INCOME: Interest: Companies less than 5%

owned $ 23,015 $ 28,563 Companies 5% to 25% owned 235 7,060

Companies more than 25% owned 964 2,118 Dividends: Companies more

than 25% owned 8,416 8,356 Total

investment income 32,630 46,097

EXPENSES: Management fees $ 6,210 $ 7,134 Performance-based

incentive fees 3,213 6,380 Interest and other credit facility

expenses 3,592 4,823 Administrative services expense 1,169 727

Other general and administrative expenses 1,022

1,514 Total expenses 15,206

20,578 Net investment income $ 17,424 $ 25,519

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, CASH

EQUIVALENTS, FOREIGN CURRENCIES AND DERIVATIVES: Net realized

gain (loss) on investments and cash equivalents: Companies less

than 5% owned $ 8 $ 228 Companies 5% to 25% owned 928 — Companies

more than 25% owned (25,310 ) 472 Net realized

gain (loss) on investments and cash equivalents (24,374 ) 700 Net

realized loss on foreign currencies and derivatives: (1,979

) (11 ) Net realized gain (loss) (26,353 ) 689

Net change in unrealized gain (loss) on investments and cash

equivalents 20,782 8,568 Net change in unrealized gain (loss) on

foreign currencies and derivatives 1,897 1,030

Net change in unrealized gain 22,679

9,598 Net realized and unrealized gain (loss) on

investments, cash equivalents, foreign currencies and derivatives

(3,674 ) 10,287

NET INCREASE IN NET

ASSETS RESULTING FROM OPERATIONS $ 13,750 $ 35,806

EARNINGS PER SHARE $ 0.31 $ 0.81

About Solar Capital Ltd.

Solar Capital Ltd. is a closed-end investment company that has

elected to be treated as a business development company under the

Investment Company Act of 1940. The Company invests primarily in

leveraged, middle market companies in the form of senior secured

loans, mezzanine loans, and equity securities.

Forward-Looking

Statements

Statements included herein may constitute “forward-looking

statements,” which relate to future events or our future

performance or financial condition. These statements are not

guarantees of future performance, conditions or results and involve

a number of risks and uncertainties. Actual results may differ

materially from those in the forward-looking statements as a result

of a number of factors, including those described from time to time

in our filings with the Securities and Exchange Commission. Solar

Capital Ltd. undertakes no duty to update any forward-looking

statements made herein.

Solar Capital Ltd.Investor RelationsRichard Pivirotto,

646-308-8770

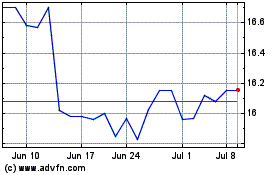

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

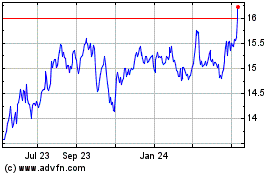

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jul 2023 to Jul 2024