0001680367FALSE00016803672024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Shattuck Labs, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39593 | 81-2575858 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer

Identification Number) |

500 W. 5th Street, Suite 1200

Austin, TX 78701

| | |

| (Address of principal executive offices including zip code) |

(512) 900-4690

| | |

(Registrant’s telephone number, including area code) |

Not Applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuance to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | STTK | The Nasdaq Global Select Market |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

| Emerging Growth Company | ☒ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Shattuck Labs, Inc. issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 2.02 and Exhibit 99.1 incorporated herein shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information or Exhibit 99.1 be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

Exhibits

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | | |

| 99.1 | | |

| | |

| 104 | | The cover page from the Company’s Current Report on Form 8-K formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Shattuck Labs, Inc. |

| | |

| Date: August 1, 2024 | By: | /s/ Dr. Taylor Schreiber |

| | Dr. Taylor Schreiber Chief Executive Officer (principal executive officer) |

Exhibit 99.1

Shattuck Labs Reports Second Quarter 2024 Financial Results and Recent Business Highlights

–Announced updated positive interim data from the Phase 1B dose-expansion clinical trial of SL-172154 in combination with Azacitidine (AZA) in frontline Higher-Risk Myelodysplastic Syndromes (HR-MDS) and TP53 mutant (TP53m) Acute Myeloid Leukemia (AML) patients at the European Society of Hematology (EHA) 2024 Annual Meeting–

–Enrollment ongoing in the randomized, controlled Phase 1B dose-expansion cohort in frontline HR-MDS patients –

–Announced Orphan Drug Designation (ODD) granted by the U.S. Food and Drug Administration (FDA) for SL-172154 for the treatment of AML–

AUSTIN, TX and DURHAM, NC, August 1, 2024 – Shattuck Labs, Inc. (Shattuck) (Nasdaq: STTK), a clinical-stage biotechnology company pioneering the development of bi-functional fusion proteins as a new class of biologic medicine for the treatment of patients with cancer and autoimmune disease, today reported financial results for the quarter ended June 30, 2024 and provided recent business highlights.

“Our data presentation at EHA last quarter included complete remission rates for both HR-MDS and TP53m AML patients treated with SL-172154 in combination with AZA that exceeded the expected complete remission rates for AZA alone. It is encouraging to see in our EHA presentation that our complete remission rate improved as the number of patients in each cohort increased, since our initial data presented at ASH in December of 2023. The next milestone for this program is to see how these response rates translate to an overall survival benefit, and those data will mature over the second half of this year,” said Taylor Schreiber, M.D., Ph.D., Chief Executive Officer of Shattuck. “In parallel, we are pleased that enrollment has begun so swiftly in our randomized, controlled expansion cohort in frontline HR-MDS patients. We look forward to sharing clinical updates from these trials in the months ahead.”

Second Quarter 2024 Business Highlights and Other Recent Developments

SL-172154 (SIRPα-Fc-CD40L)

Phase 1B Trial of SL-172154 in Frontline HR-MDS and TP53m AML

HR-MDS

•Announced updated interim data from the Phase 1B dose expansion clinical trial of SL-172154 in combination with AZA in frontline HR-MDS and TP53m AML patients. These data were featured in a poster presentation during the EHA 2024 Congress.

◦Observed 67% Objective Response Rate (ORR) in frontline HR-MDS patients, primarily with TP53 mutations, and an initial complete remission (CR)/marrow complete remission rate of 58%. As of the data cut-off date on April 23, 2024, median overall survival had not yet been reached.

◦SL-172154 demonstrated a manageable interim safety profile in combination with AZA, with infusion related reactions (IRRs) as the most common drug related adverse event.

•Initiated enrollment of the Part D cohort, a randomized, controlled Phase 1B dose-expansion cohort in frontline HR-MDS patients. Approximately 60 patients will be randomized in a 1:1:1 ratio to receive SL-172154 at 3mg/kg in combination with AZA, SL-172154 at 1mg/kg in combination with AZA, or AZA as monotherapy.

TP53m AML

•Observed 43% ORR in frontline TP53m AML patients and 33% CR/complete remission rate with incomplete hematologic recovery. As of the data cut-off date of June 4, 2024, the median overall survival

had not yet been reached. SL-172154 demonstrated a manageable interim safety profile in combination with AZA.

•In June 2024, the U.S. FDA granted ODD to SL-172154 for the treatment of AML.

Phase 1B Trial of SL-172154 in Platinum-Resistant Ovarian Cancer (PROC)

•Reported data from the Phase 1B clinical trial of SL-172154 in PROC patients, demonstrating an acceptable safety profile in combination with pegylated liposomal doxorubicin (PLD) or mirvetuximab soravtansine (Elahere). IRRs were the most common treatment emergent AE as of the data cutoff.

◦As of April 23, 2024, four of 21 (19%) treated patients in the Phase 1B study of SL-172154 in combination with PLD achieved partial responses. Two additional patients with stable disease showed maximum tumor reductions of 17% and 27%.

◦Completed enrollment for the cohort combining SL-172154 with Elahere. As of the April 23, 2024 data cutoff, ORR benefit beyond Elahere alone was not observed.

◦Shattuck continues to follow patients for progression free survival and overall survival and, should such results mature favorably in either PROC cohort, will evaluate further development in PROC at that time.

Corporate Updates

•On July 1, 2024, Shattuck announced its addition to the Russell 2000® and Russell 3000® Indexes at the conclusion of the 2024 Russell U.S. Indexes annual reconstitution.

Upcoming Events

•Shattuck plans to attend the following investor conferences. Details will be included on the Events & Presentations section of the Company’s website.

◦BTIG Biotechnology Conference (Virtual) August 5-6, 2024

◦Wells Fargo Healthcare Conference (Boston, MA) September 4-6, 2024

◦H.C. Wainwright 26th Annual Global Investment Conference (New York, NY) September 9-11, 2024

Second Quarter 2024 Financial Results

•Cash and Cash Equivalents and Investments: As of June 30, 2024, cash and cash equivalents and investments were $105.3 million, as compared to $117.2 million as of June 30, 2023.

•Research and Development (R&D) Expenses: R&D expenses were $19.2 million for the quarter ended June 30, 2024, as compared to $18.2 million for the quarter ended June 30, 2023.

•General and Administrative (G&A) Expenses: G&A expenses were $5.3 million for the quarter ended June 30, 2024, as compared to $4.7 million for the quarter ended June 30, 2023.

•Net Loss: Net loss was $21.5 million for the quarter ended June 30, 2024, or $0.42 per basic and diluted share, as compared to a net loss of $21.3 million for the quarter ended June 30, 2023, or $0.50 per basic and diluted share.

Financial Guidance

Shattuck believes its cash and cash equivalents and investments will be sufficient to fund its operations into 2026, beyond results from its Phase 1 clinical trials of SL-172154. This cash runway guidance is based on the Company’s current operational plans and excludes any additional capital that may be received, proceeds from business development transactions, and/or additional costs associated with clinical development activities that may be undertaken.

About SL-172154

SL-172154 (SIRPα-Fc-CD40L) is an investigational ARC® fusion protein designed to simultaneously inhibit the CD47/SIRPα checkpoint interaction and activate the CD40 costimulatory receptor to bolster an anti-tumor immune response in patients with advanced cancer. Multiple Phase 1 clinical trials are ongoing for patients with AML, HR-MDS, and PROC.

About Shattuck Labs, Inc.

Shattuck Labs, Inc. (Nasdaq: STTK) is a clinical-stage biotechnology company pioneering the development of bi-functional fusion proteins as a new class of biologic medicine for the treatment of patients with cancer and autoimmune disease. Compounds derived from Shattuck’s proprietary Agonist Redirected Checkpoint, (ARC®), platform are designed to simultaneously inhibit checkpoint molecules and activate costimulatory molecules with a single therapeutic. The company’s lead SL-172154 (SIRPα-Fc-CD40L) program, which is designed to block the CD47 immune checkpoint and simultaneously agonize the CD40 pathway, is being evaluated in multiple Phase 1 trials. Shattuck has offices in both Austin, Texas and Durham, North Carolina. For more information, please visit: www.ShattuckLabs.com.

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the federal securities laws, including, but not limited to, our expectations regarding: plans for our preclinical studies, clinical trials and research and development programs; plans for expansion of clinical trials; the anticipated timing of the results from our clinical trials; the anticipated timing and pace of enrollment in our clinical trials; the clinical benefit, safety and tolerability of SL-172154; and expectations regarding the time period over which our capital resources will be sufficient to fund our anticipated operations. Words such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “develop,” “plan” or the negative of these terms, and similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While we believe these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties (including, without limitation, those set forth in our filings with the U.S. Securities and Exchange Commission (SEC)), many of which are beyond our control and subject to change. Actual results could be materially different. Risks and uncertainties include: global macroeconomic conditions and related volatility, expectations regarding the initiation, progress, and expected results of our preclinical studies, clinical trials and research and development programs; expectations regarding the timing, completion and outcome of our clinical trials; the unpredictable relationship between preclinical study results and clinical study results; the timing or likelihood of regulatory filings and approvals; liquidity and capital resources; and other risks and uncertainties identified in our Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent disclosure documents filed with the SEC. We claim the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or alter any statements whether as a result of new information, future events or otherwise, except as required by law.

The Company intends to use the investor relations portion of its website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD.

Investor & Media Contact:

Conor Richardson

Vice President of Investor Relations

Shattuck Labs, Inc.

InvestorRelations@shattucklabs.com

SHATTUCK LABS, INC.

CONDENSED BALANCE SHEETS

(In thousands)

| | | | | | | | | | | | |

| June 30, 2024 | | December 31,

2023 | |

| (unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | $ | 60,693 | | | $ | 125,626 | | |

| Investments | 44,651 | | | 4,999 | | |

| Prepaid expenses and other current assets | 9,081 | | | 12,595 | | |

| Total current assets | 114,425 | | | 143,220 | | |

| Property and equipment, net | 11,895 | | | 13,804 | | |

| Other assets | 2,294 | | | 2,540 | | |

| Total assets | $ | 128,614 | | | $ | 159,564 | | |

| | | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current Liabilities: | | | | |

| Accounts payable | $ | 2,822 | | | 1,587 | | |

| | | | |

| Deferred revenue | 2,997 | | | 343 | | |

| Total current liabilities | 15,026 | | | 11,453 | | |

| Non-current operating lease liabilities | 2,972 | | | 3,406 | | |

| Total liabilities | $ | 17,998 | | | $ | 14,859 | | |

| Stockholders’ equity: | | | | |

| Common stock | 5 | | | 5 | | |

| Additional paid in capital | 456,982 | | | 451,006 | | |

| Accumulated other comprehensive (loss) income | (5) | | | 4 | | |

| Accumulated deficit | (346,366) | | | (306,310) | | |

| Total stockholders' equity | 110,616 | | | 144,705 | | |

| Total liabilities and stockholders' equity | $ | 128,614 | | | $ | 159,564 | | |

SHATTUCK LABS, INC.

CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Collaboration revenue | $ | 1,609 | | | $ | 200 | | | $ | 2,724 | | | $ | 257 | |

| Operating expenses: | | | | | | | |

| Research and development | 19,239 | | | 18,205 | | | 35,503 | | | 34,872 | |

| General and administrative | 5,332 | | | 4,742 | | | 10,227 | | | 9,793 | |

| Expense from operations | 24,571 | | | 22,947 | | | 45,730 | | | 44,665 | |

| Loss from operations | (22,962) | | | (22,747) | | | (43,006) | | | (44,408) | |

| Other income | 1,410 | | | 1,401 | | | 2,950 | | | 2,338 | |

| Net loss | $ | (21,552) | | | $ | (21,346) | | | $ | (40,056) | | | $ | (42,070) | |

| Unrealized gain (loss) on investments | 9 | | | 265 | | | (9) | | | 803 | |

| Comprehensive loss | $ | (21,543) | | | $ | (21,081) | | | $ | (40,065) | | | $ | (41,267) | |

| | | | | | | |

| Net loss per share – basic and diluted | $ | (0.42) | | | $ | (0.50) | | | $ | (0.79) | | | $ | (0.99) | |

| Weighted-average shares outstanding – basic and diluted | 50,791,241 | | | 42,467,664 | | | 50,678,818 | | | 42,453,513 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

v3.24.2.u1

Cover

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

Shattuck Labs, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39593

|

| Entity Tax Identification Number |

81-2575858

|

| Entity Address, Address Line One |

500 W. 5th Street

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78701

|

| City Area Code |

512

|

| Local Phone Number |

900-4690

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

STTK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001680367

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

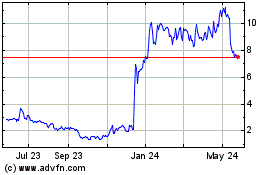

Shattuck Labs (NASDAQ:STTK)

Historical Stock Chart

From Nov 2024 to Dec 2024

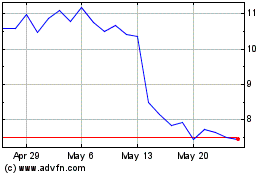

Shattuck Labs (NASDAQ:STTK)

Historical Stock Chart

From Dec 2023 to Dec 2024